Stablecoin vaults have emerged as a cornerstone of modern DAO treasury security and operational efficiency, offering decentralized organizations a robust toolkit to navigate the complexities of on-chain asset management. As DAOs grow in size and sophistication, the need for transparent, automated, and risk-mitigated treasury solutions becomes paramount. Stablecoin vaults directly address these demands by combining programmable security features with the capital efficiency of stable digital assets.

Why Stablecoin Vaults Are Essential for DAO Treasuries

The volatility of native crypto assets like ETH and governance tokens has long posed challenges for treasuries seeking to preserve capital while maintaining operational flexibility. Stablecoins, by design, offer price stability, but their true potential is unlocked when managed via smart contract-based vaults. These vaults not only store assets securely but also automate yield generation, risk controls, and reporting.

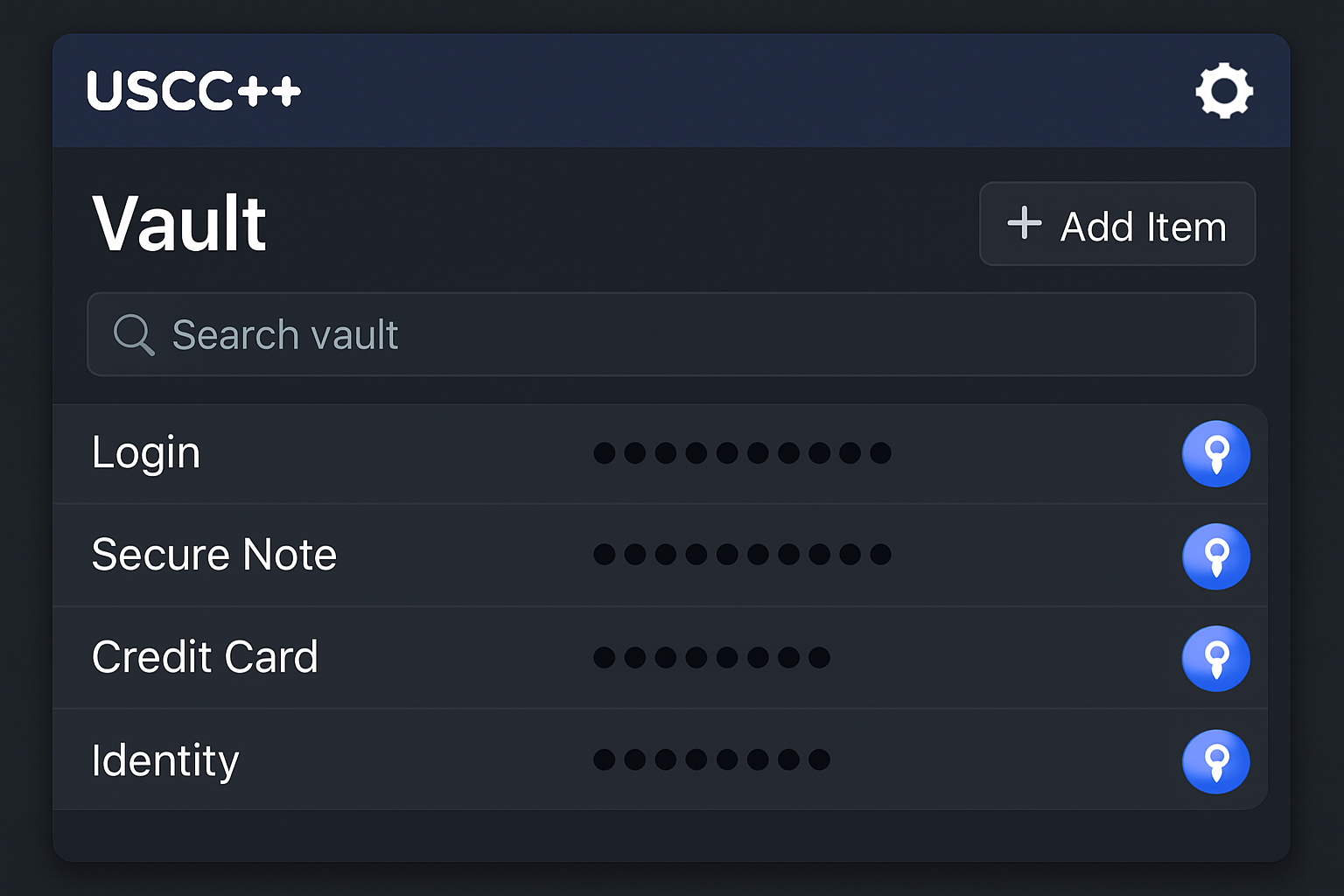

Industry best practices, as outlined by platforms such as OneSafe and Request Finance, emphasize the importance of asset diversification, rigorous wallet safeguards, and transparent record-keeping. Stablecoin vaults naturally embed these principles. For example, vaults can silo risk by designating specific strategies to individual contracts, ensuring that exposure from one yield source does not jeopardize the entire treasury. This modularity is evident in solutions like Usual’s uUSCC and and vault, where deposits remain isolated from the broader ecosystem, with institutional-grade oversight managing tokenized products.

Enhancing Security Through Automated Risk Management

Security is the foundation of any on-chain treasury management strategy. Stablecoin vaults excel in this regard by leveraging automated mechanisms to limit downside risk. A prime example is Open Dollar’s Treasury Backed Vaults, which utilize a savior module to dynamically add collateral during liquidation events. This automation protects against sudden market shocks, reducing the risk of forced liquidations and safeguarding DAO assets.

Furthermore, the irreversible nature of stablecoin transactions, highlighted by Fireblocks, demands that treasury teams implement rigorous operational controls. Vaults can enforce multi-signature approvals, role-based access, and real-time monitoring, creating a resilient defense against internal errors or malicious actions. By integrating these features, DAOs benefit from both technological safeguards and process discipline.

Driving Operational Efficiency with Automated Yield and Treasury Optimization

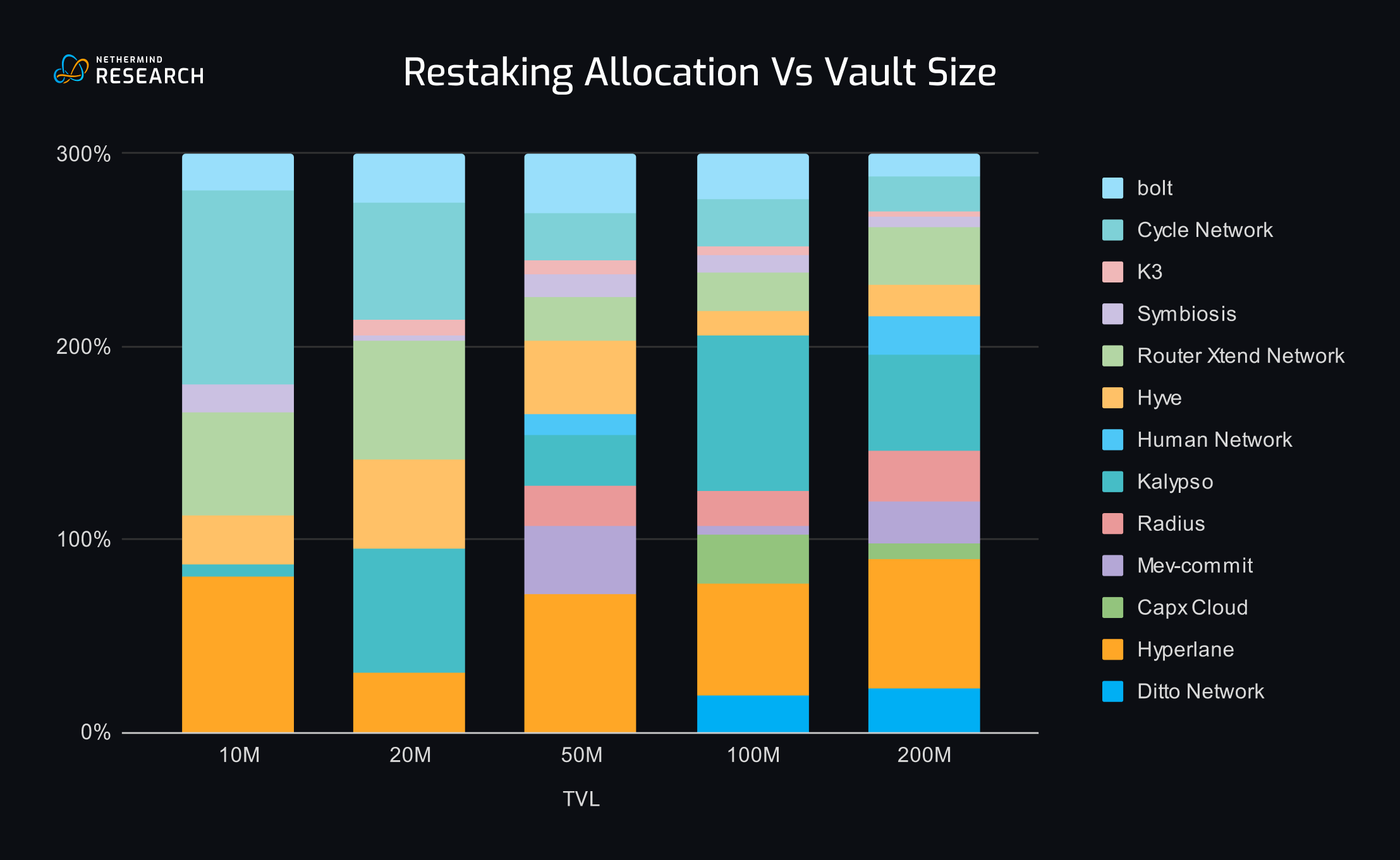

Beyond security, stablecoin strategies for DAOs must also deliver capital productivity. Automated yield generation is one of the most compelling advantages of vault-based treasury management. Platforms like Aera have pioneered vaults that dynamically allocate stablecoin reserves across multiple DeFi protocols to optimize returns while maintaining liquidity. This reduces manual intervention and enables DAOs to capture yields that would otherwise require constant oversight.

Additionally, vaults streamline treasury operations by automating rebalancing and fund distribution. Aera’s model empowers DAOs to delegate asset optimization to decentralized networks of participants, so-called vault guardians, who propose and execute allocation strategies. This delegation not only accelerates decision-making but also enhances capital efficiency by minimizing governance bottlenecks. For a deeper exploration of how these systems are reshaping DAO treasury management in 2025, see our in-depth analysis.

Case Studies: Real-World Impact of Stablecoin Vaults

The practical benefits of stablecoin vaults are best illustrated through real-world deployments:

- Aera’s Treasury Optimizing Vaults: Operating on Polygon, these vaults allow DAOs to deposit reserves into non-custodial contracts. Asset managers compete to optimize allocations, incentivized by performance fees and DAO rewards.

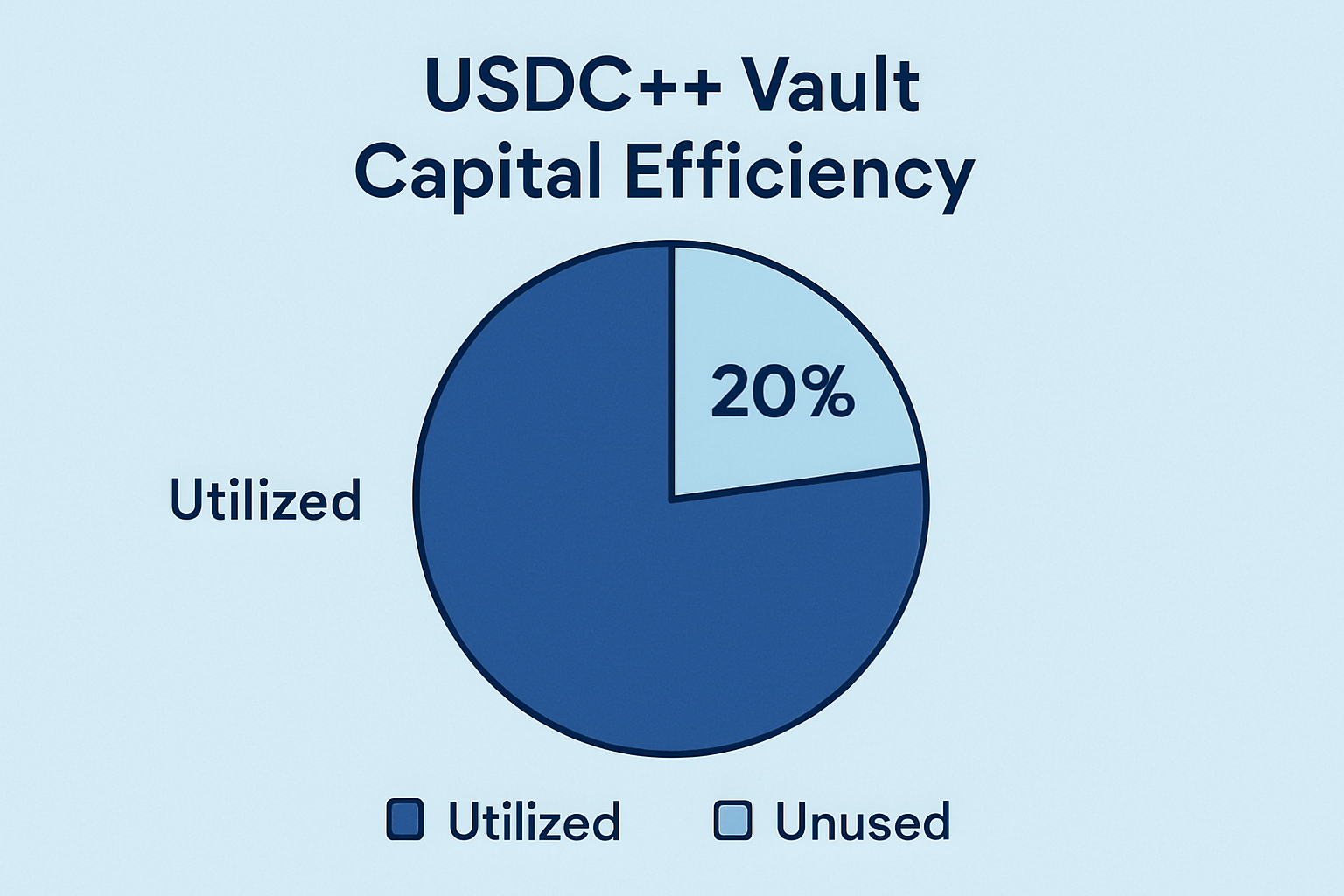

- Usual’s uUSCC and and Vault: Offering layered yield streams and full risk isolation, this vault structure ensures that DAOs can pursue higher capital efficiency without compromising security.

By integrating stablecoin vaults into their treasury frameworks, DAOs can achieve a rare combination of safety, transparency, and operational agility, qualities that are increasingly non-negotiable in the evolving decentralized finance landscape.

As the decentralized finance (DeFi) ecosystem matures, on-chain treasury management is shifting from ad hoc practices to systematic, protocol-driven processes. Stablecoin vaults are at the forefront of this evolution, providing DAOs with a secure, programmable foundation for both capital preservation and growth. The modularity and automation offered by these vaults not only protect against the inherent volatility of digital assets but also reduce the cognitive and operational load on treasury managers.

Integrating Stablecoin Vaults: Best Practices for DAO Operators

Implementing stablecoin vaults requires more than just smart contract deployment. DAO operators should prioritize:

- Comprehensive Due Diligence: Evaluate vault providers for security audits, track records, and transparency in reporting. Regularly review smart contract code and monitor for emerging vulnerabilities.

- Diversification Across Vault Strategies: Avoid concentration risk by allocating stablecoins across multiple vaults with distinct risk-return profiles. This approach mirrors traditional asset allocation but leverages DeFi’s composability.

- Automated Monitoring and Alerts: Use on-chain analytics tools to track vault performance, yield generation, and risk metrics in real time. Automated alerts can flag deviations from expected behavior or signal governance intervention when thresholds are breached.

- Clear Governance Frameworks: Define roles, responsibilities, and escalation paths for treasury actions involving vaults. Multi-signature schemes and role-based access controls are essential for minimizing single points of failure.

For actionable steps on setting up automated stablecoin vaults within your DAO, refer to our comprehensive guide: How to Set Up Automated Stablecoin Vaults for DAO Treasury Management.

The Future of DAO Treasury Security and Efficiency

The trajectory is clear: as DAOs scale, so too will their reliance on stablecoin vault infrastructure. The next generation of vaults will likely incorporate advanced features such as real-time risk scoring, cross-chain interoperability, and integration with insurance primitives. These innovations will further insulate DAOs from both systemic shocks and idiosyncratic risks.

Moreover, as regulatory frameworks around stablecoins evolve, DAOs must remain agile in adapting their treasury strategies. Vault providers that offer transparent compliance modules and robust audit trails will be best positioned to serve institutional-grade DAOs seeking long-term sustainability.

Key Takeaways for DAO Treasury Managers

Key Benefits of Stablecoin Vaults for DAO Treasuries in 2025

-

Enhanced Risk Isolation: Stablecoin vaults, such as Usual’s uUSCC++ vault, operate independently from the main DAO treasury, ensuring that risks are siloed and do not impact the broader ecosystem. This structure minimizes systemic exposure and protects core assets.

-

Automated Risk Management: Platforms like Open Dollar’s Treasury Backed Vaults utilize automated modules to manage collateral and prevent liquidations, safeguarding DAO assets without requiring manual intervention.

-

Automated Yield Generation: Vaults offered by Aera dynamically allocate stablecoin assets across DeFi protocols, optimizing returns while maintaining liquidity and reducing operational overhead for DAO treasury teams.

-

Streamlined Treasury Operations: Stablecoin vaults automate key treasury functions, such as rebalancing and fund distribution, allowing DAOs to reduce manual processes and focus on governance and growth. Aera’s treasury optimizing vaults exemplify this approach by delegating asset management to a decentralized network, improving efficiency.

-

Increased Capital Efficiency: By leveraging layered yield strategies in vaults like Usual’s uUSCC++, DAOs can unlock higher returns on stablecoin reserves, combining rewards, tokenized treasury income, and crypto carry returns to maximize treasury growth.

The integration of stablecoin vaults is not a panacea but a critical pillar in a holistic treasury management strategy. By combining risk isolation, automated yield generation, and strong governance controls, DAOs can achieve a level of security and efficiency previously unattainable in decentralized finance. For further insights on risk mitigation using stablecoin strategies, explore how DAOs use stablecoin vaults for treasury risk management.