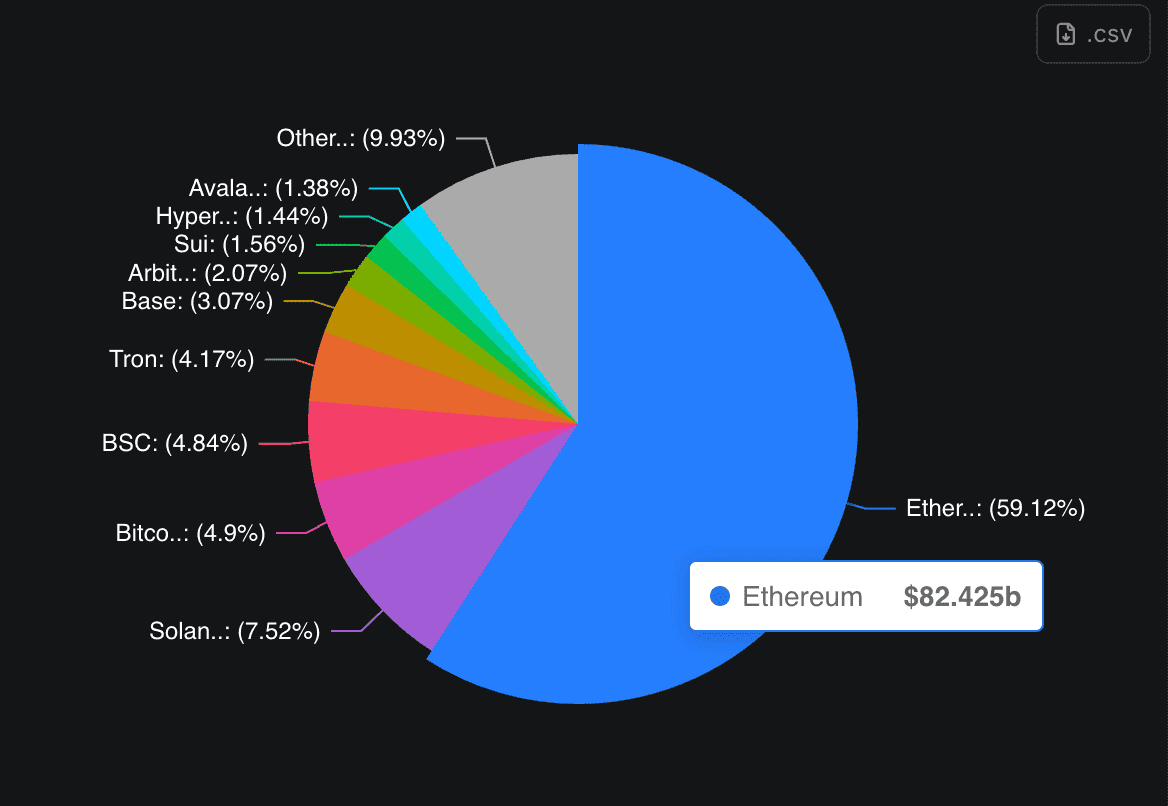

Stablecoin vaults are rapidly transforming the landscape of DAO treasury management in 2025. As decentralized organizations mature, they face mounting pressure to safeguard their capital, generate sustainable yield, and maintain robust liquidity. The latest market data underscores this shift: stablecoins such as Tether (USDT), Circle (USDC), and Ethena Labs (USDe) now dominate on-chain balance sheets, representing over 90% of total stablecoin value in a $230 billion market. This pivot is not just about stability – it’s about unlocking new capital efficiency levers for DAOs navigating volatile DeFi markets.

Strategic Deployment: From Idle Reserves to Productive Capital

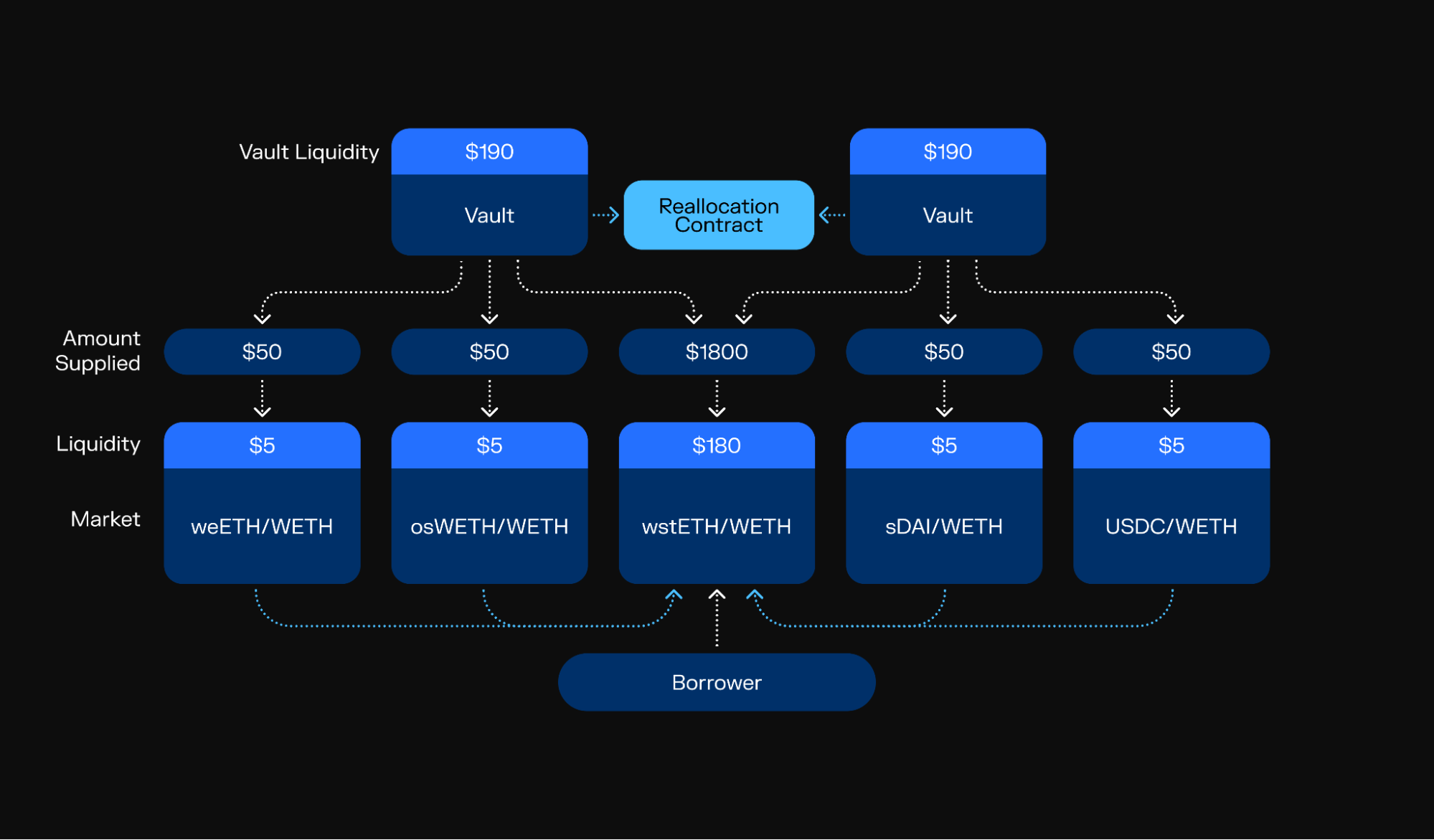

The era of dormant DAO treasuries is over. Leading DAOs are moving billions in stablecoin reserves from cold storage into sophisticated, yield-generating vaults. A prime example: Polygon DAO’s recent proposal to allocate $1.3 billion in stablecoins through Morpho Labs’ vaults with the goal of achieving a 7% annual return. If executed, this strategy could unlock approximately $70 million per year for ecosystem grants and development, without exposing the core treasury to native token price swings.

This approach is gaining traction across the DeFi sector. By leveraging battle-tested protocols and automated vault infrastructure, DAOs are able to optimize idle capital while retaining on-demand liquidity for operational needs or governance-triggered expenditures.

Diversification and Risk Management: The New DAO Mandate

The days when DAOs held treasuries almost exclusively in their own governance tokens are fading fast. Today’s best-practice mandates diversification as a first principle for risk mitigation. Stablecoins have become the backbone of this movement, providing a non-correlated reserve that shields treasuries from crypto market drawdowns.

Arbitrum’s Secure Treasury Endowment Program (STEP 2.0) exemplifies this trend by converting significant portions of its treasury into stablecoins and allocating them across lending protocols and real-world asset (RWA) vaults. The result is a more resilient balance sheet capable of weathering volatility while earning consistent on-chain yield.

Top 5 DAO Treasury Diversification Strategies with Stablecoin Vaults (2025)

-

1. Strategic Deployment of Stablecoin Reserves via Morpho LabsDAOs are allocating significant stablecoin reserves—such as Polygon DAO’s proposed $1.3 billion deployment—into Morpho Labs vaults. This strategy targets competitive annual yields (e.g., 7%), generating sustainable income while maintaining liquidity and minimizing volatility exposure.

-

2. Diversification with Real-World Asset (RWA) VaultsPrograms like Arbitrum’s Secure Treasury Endowment Program (STEP 2.0) diversify DAO treasuries by converting native tokens into stablecoins and allocating them across lending protocols and RWA vaults. This enhances risk management and provides exposure to off-chain yields.

-

3. Automated Treasury Optimization with AeraAera enables DAOs to automate treasury management by depositing reserves into non-custodial, autonomous vaults. Asset managers are incentivized to optimize allocations, reducing manual intervention and improving capital efficiency.

-

4. Customizable Risk Profiles with Factor.fi VaultsFactor.fi offers modular vaults that let DAOs tailor treasury strategies to specific risk appetites. DAOs can create dedicated vaults for operational reserves, yield generation, or directional exposure, enhancing flexibility and resilience.

-

5. Delta-Neutral Yield Farming StrategiesDAOs are leveraging automated, delta-neutral stablecoin vaults—such as those featured on StablecoinInsider—to capture yield without market exposure. These vaults utilize hedged positions across DeFi protocols, providing passive income with minimized risk.

The Rise of Automated and Customizable Vault Solutions

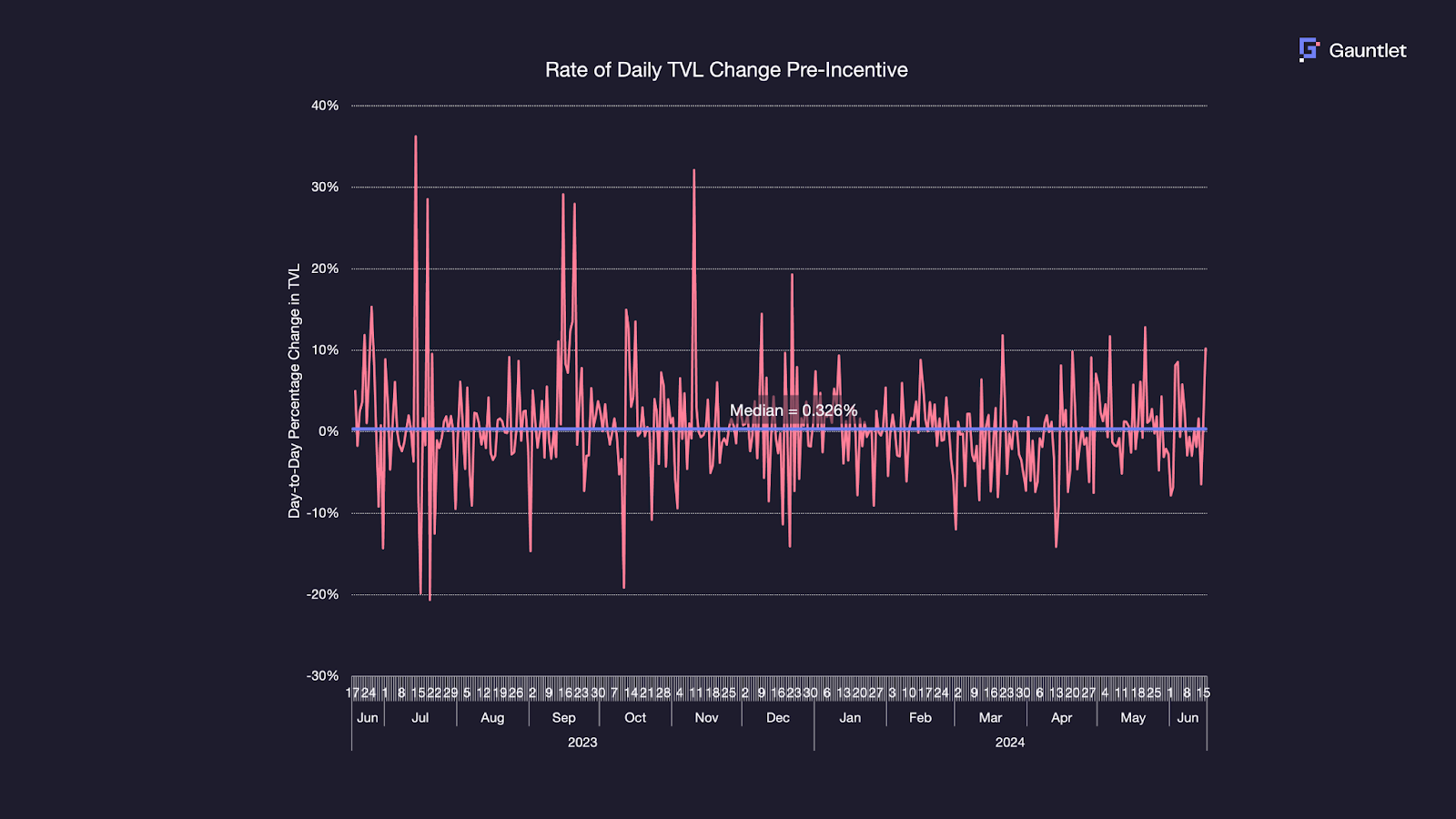

The complexity of managing multi-million dollar treasuries has sparked innovation in automated treasury optimization tools. Platforms like Aera now enable DAOs to delegate asset allocation to decentralized networks of professional managers via non-custodial vaults. This reduces the operational burden on internal governance while ensuring continuous optimization according to pre-set parameters.

Customization is also key: modular solutions such as Factor. fi allow DAOs to program risk profiles directly into their vault strategies, whether prioritizing operational reserves, directional market exposure, or delta-neutral yield generation techniques. This programmability enhances both transparency and accountability within DAO financial operations.

The evolution toward transparent treasury solutions is further supported by backtesting tools, risk dashboards, and performance analytics integrated into modern DeFi vault platforms, empowering DAOs with granular control over their financial destiny while maintaining rigorous oversight for all stakeholders.

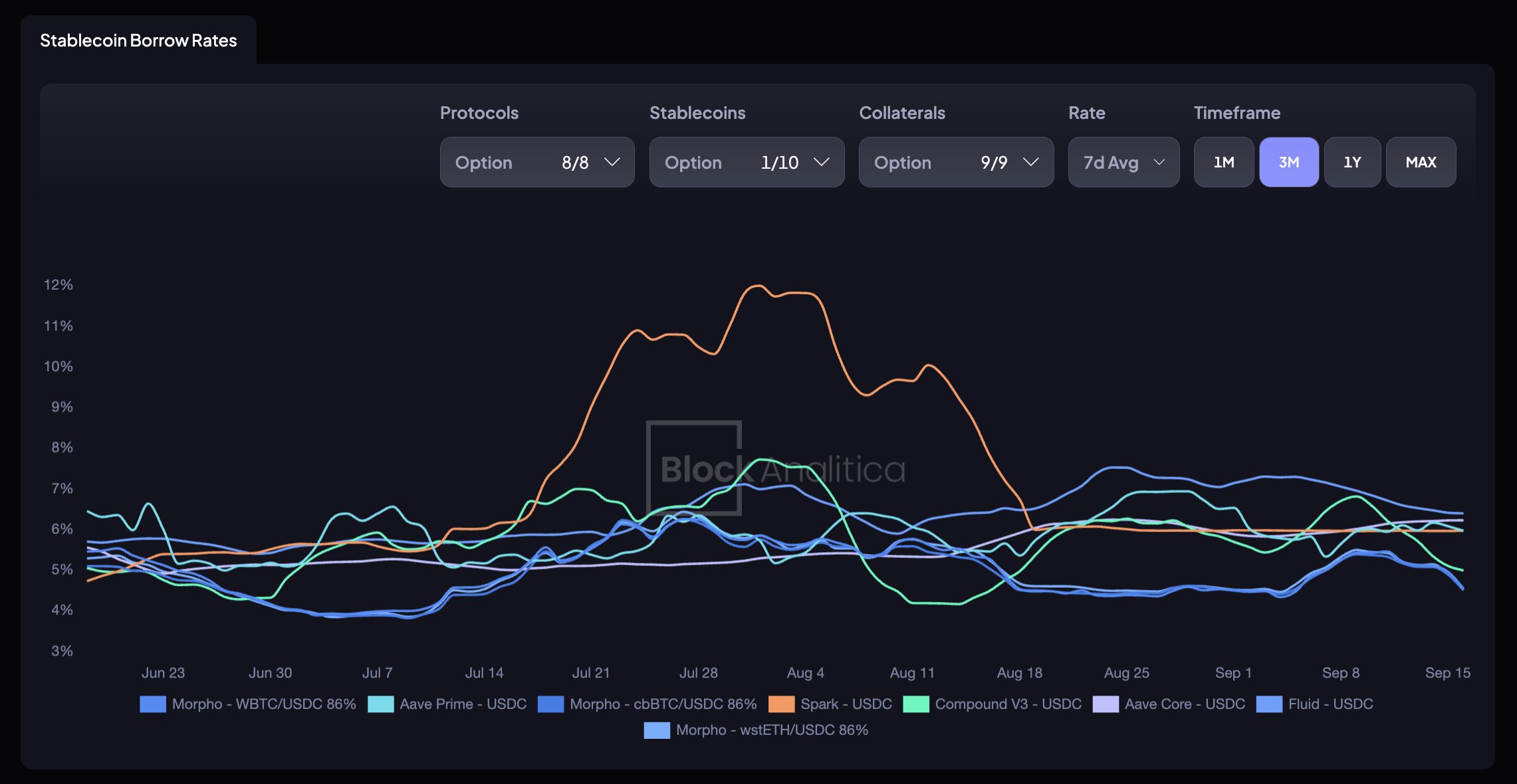

Yield generation is no longer a speculative afterthought for DAOs. In 2025, stablecoin vaults are enabling protocols to pursue sophisticated on-chain stablecoin strategies that balance risk and reward. Delta-neutral yield farming, for example, has emerged as a preferred method for DAOs seeking passive income without directional market exposure. By hedging long and short positions across decentralized exchanges, DAOs can systematically capture yield while minimizing volatility risks traditionally associated with DeFi.

This shift is underscored by the proliferation of automated vault products offering built-in risk indicators and robust backtesting capabilities. These tools empower treasury managers to make data-driven decisions, dynamically rebalancing allocations in response to changing market conditions or governance directives. As a result, DAOs are not only safeguarding their capital but actively compounding it, fueling further innovation and ecosystem growth.

Transparency and Governance: Raising the Bar for Accountability

The maturation of DAO treasury management is tightly linked to advancements in transparency and reporting standards. Today’s leading vault protocols provide real-time dashboards, on-chain audit trails, and open APIs, ensuring that every transaction is verifiable by token holders or external auditors at any time. This level of visibility is critical not just for trust but for regulatory alignment as DAOs scale their operations globally.

Moreover, the integration of automated governance modules enables continuous oversight without bottlenecking operational agility. For example, DAOs can set pre-approved risk thresholds or withdrawal limits within their vault smart contracts, reducing governance overhead while maintaining rigorous checks against misuse or misallocation of funds.

The Competitive Landscape: Stablecoin Vaults Fueling DAO Innovation

The rise of stablecoin vaults has also intensified competition among both stablecoin issuers and DeFi infrastructure providers. Tether (USDT), Circle (USDC), and Ethena Labs (USDe) remain dominant in terms of market share, collectively representing over 90% of total stablecoin value in 2025’s $230 billion market, but new entrants like Sky Protocol (USDS/DAI) are gaining traction through innovative collateral models and enhanced compliance features.

This rapidly evolving ecosystem creates a virtuous cycle: as more DAOs adopt advanced treasury solutions, demand grows for transparent, high-performance stablecoins, and vice versa. The best DAO projects now treat treasury strategy as a core competency rather than an afterthought, investing in dedicated teams or partnering with specialized asset managers to maximize capital efficiency.

Top 5 Metrics for Evaluating DeFi Vaults in 2025

-

Annual Percentage Yield (APY): DAOs closely monitor the APY delivered by stablecoin vaults, seeking consistent, competitive returns. For example, Polygon DAO targets a 7% annual return on its stablecoin deployment via Morpho Labs vaults.

-

Risk-Adjusted Return (Sharpe Ratio): Evaluating risk-adjusted returns is essential for DAOs to ensure that yield is not achieved at the expense of excessive risk. Platforms like Factor.fi provide programmable vaults with built-in risk metrics, enabling DAOs to compare vault performance on a risk-adjusted basis.

-

Liquidity and Withdrawal Flexibility: DAOs prioritize vaults that offer high liquidity and flexible withdrawal terms, ensuring operational agility. For instance, Aera enables non-custodial vaults with rapid, on-chain withdrawal capabilities.

-

Protocol Security and Audit Status: Security remains paramount; DAOs assess whether vaults are audited by reputable firms such as OpenZeppelin and maintain robust on-chain protections against exploits.

-

Vault Diversification and Asset Allocation: Effective diversification across stablecoins (e.g., USDT, USDC, USDe, DAI) and real-world asset vaults is a key metric. Programs like Arbitrum’s STEP 2.0 exemplify this by allocating treasury across multiple protocols and asset classes to enhance stability.

What Lies Ahead: Sustainable Growth Through Robust Treasury Infrastructure

The integration of stablecoin vaults marks a watershed moment for decentralized organizations. With programmable risk controls, automated optimization engines, and real-time analytics at their disposal, DAOs are finally equipped to deliver on the promise of sustainable on-chain finance, balancing liquidity needs with long-term capital appreciation.

For operators seeking actionable guidance on implementation frameworks or best practices in this new era of transparent treasury solutions, our comprehensive resource covers practical steps from policy design to protocol selection: How DAOs Use Stablecoin Vaults for Treasury Risk Management.

The next generation of DAO treasuries won’t just weather market cycles, they’ll set the standard for financial discipline across all of Web3.