Decentralized Autonomous Organizations (DAOs) have entered a new era of treasury management, moving beyond speculative token holdings into robust, risk-managed strategies powered by stablecoin vaults. As DAO treasuries have grown in both size and complexity, the need for capital preservation and sustainable yield has become paramount. In 2025, with regulatory scrutiny intensifying and technical risks evolving, DAOs are leveraging stablecoin vaults to safeguard their assets while maintaining operational agility.

Stablecoin Vaults: The Backbone of Modern DAO Treasury Risk Management

At the core of this transformation is the adoption of on-chain stablecoin vaults. These vaults allow DAOs to convert volatile native tokens into more predictable dollar-pegged assets, dramatically reducing exposure to market swings. By allocating reserves to stablecoins like USDC, USDT, or decentralized options such as LUSD, DAOs can insulate their treasuries from crypto’s notorious volatility.

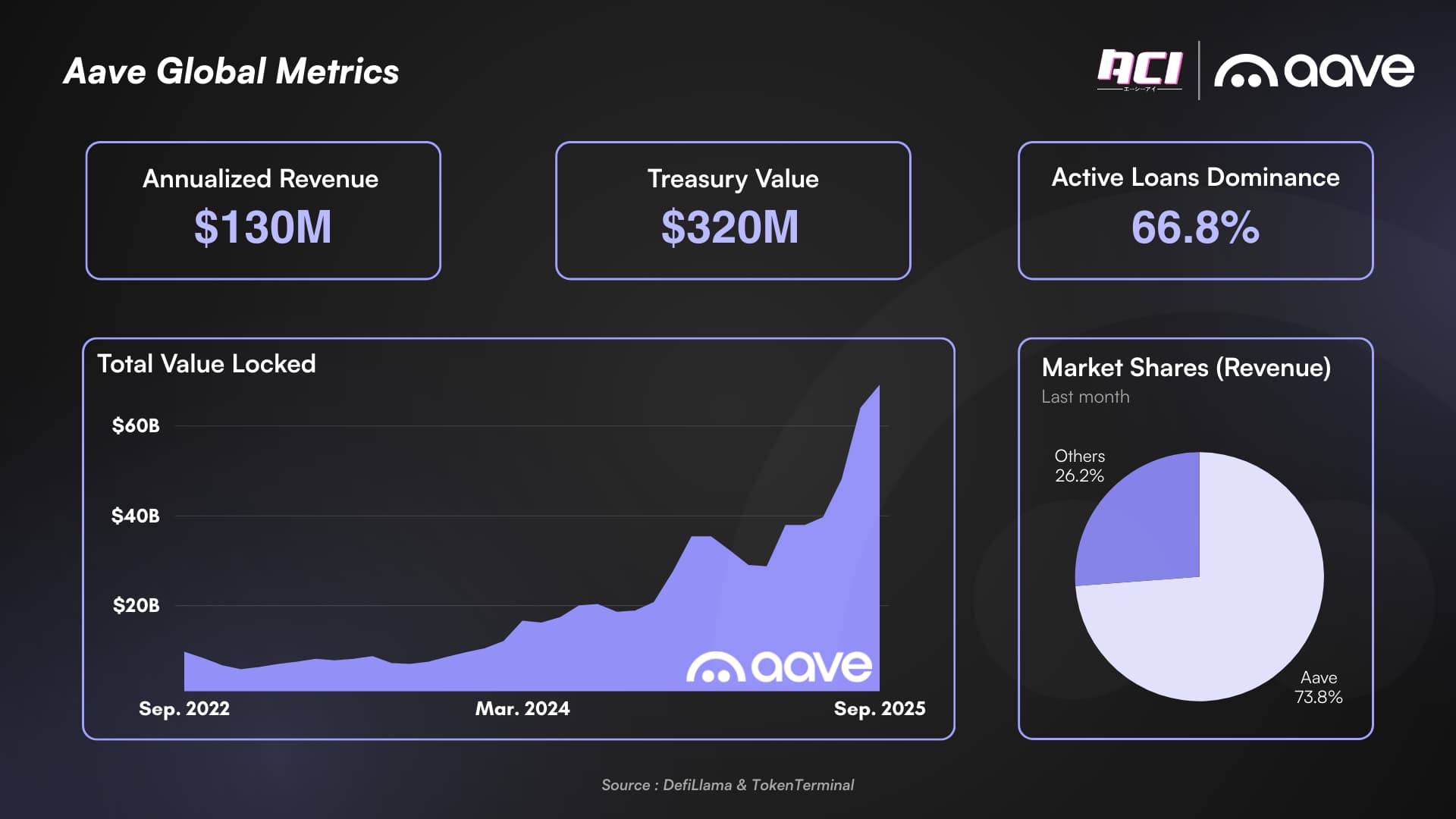

The rationale is quantitative: a 20% drawdown in a native token can instantly erase millions in runway for large DAOs. By contrast, stablecoins provide a volatility buffer and open up additional avenues for low-risk yield generation.

Diversification and Yield Generation Across DeFi Protocols

The leading strategy among DAOs is diversification. Instead of holding only governance tokens or ETH, treasuries now allocate significant portions to stablecoins and deploy them across multiple DeFi protocols. For example, Arbitrum’s Secure Treasury Endowment Program (STEP 2.0) in early 2025 showcased this trend by reallocating assets into stablecoins and spreading risk across lending platforms and Real World Asset (RWA) vaults. The goal: achieve greater financial stability while generating on-chain yield through carefully curated protocols (source).

This approach is not merely about safety; it’s about optimizing capital efficiency without sacrificing risk controls. By tapping into lending pools or RWA-backed products, DAOs earn passive income while keeping principal exposure limited to the stability profile of their chosen collateral.

Key Benefits of Stablecoin Vaults for DAO Treasuries

-

Reduced Volatility and Capital Preservation: Allocating treasury assets to stablecoins like USDC, USDT, and LUSD shields DAOs from the price swings of native tokens and volatile cryptocurrencies, ensuring greater financial stability.

-

On-Chain Yield Generation: By deploying stablecoins into DeFi lending protocols and real-world asset (RWA) vaults, DAOs can earn sustainable, risk-adjusted yield on idle treasury funds—exemplified by Arbitrum’s STEP 2.0 program.

-

Portfolio Diversification: Stablecoin vaults enable DAOs to diversify away from single-asset exposure, mitigating concentration risk and optimizing risk-return profiles through curated, multi-strategy vaults such as those offered by Coinchange and RootstockLabs.

-

Automated and Efficient Treasury Management: Platforms like Aera provide autonomous, non-custodial vaults where asset allocation and rebalancing are managed by protocol mechanisms and external actors, reducing governance overhead and increasing operational efficiency.

-

Enhanced Security and Decentralization: Utilizing decentralized stablecoins such as Liquity’s LUSD minimizes exposure to centralization and regulatory risks, as these assets are governance-free and resistant to unilateral freezes or interventions.

-

Access to Structured Yield Products: Platforms like Thetanuts Finance offer DAOs customizable structured products, enabling them to generate yield or hedge treasury positions with cash-settled and physically-settled vaults tailored to organizational needs.

Structured Products and Automated Management Solutions

The sophistication does not end at simple lending. Platforms like Thetanuts Finance offer customizable structured products, enabling DAOs to generate yield by selling options on their tokens or diversifying positions through cash-settled and physically-settled vaults (source). This gives treasuries flexibility, if an option is exercised, they can sell tokens at predetermined prices; if not, they collect premium yields.

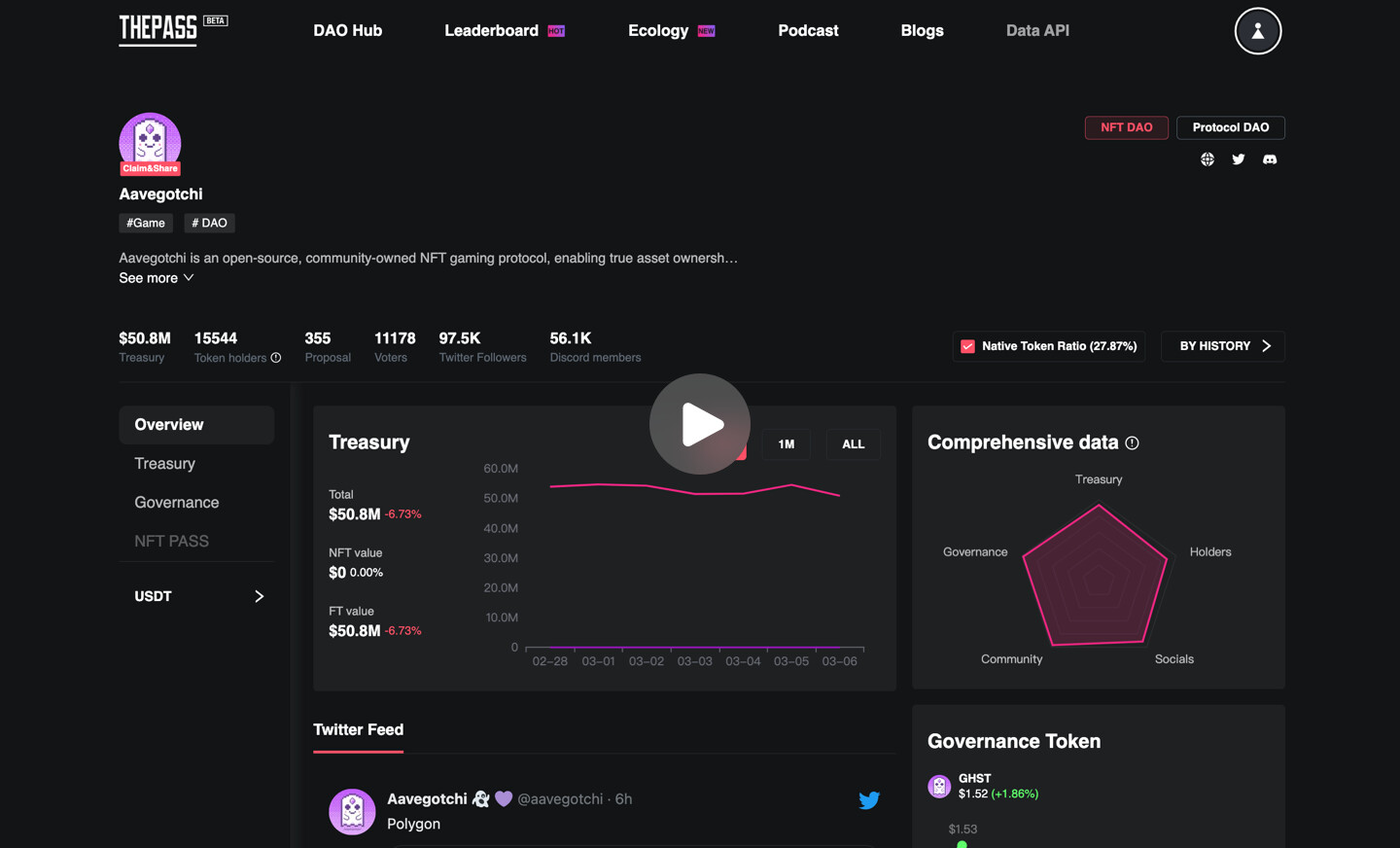

Meanwhile, autonomous solutions like Aera are emerging as non-custodial managers for DAO treasuries. Their model introduces ‘vault guardians’ who propose allocation strategies based on quantitative risk profiles and ‘arbitrageurs’ who execute trades to maintain targets (source). This automation reduces reliance on slow-moving governance votes while enhancing capital efficiency, a critical advantage as treasuries scale into hundreds of millions of dollars.

Navigating Stablecoin Risks: Centralized vs Decentralized Options

No discussion about DAO treasury management is complete without addressing the risks inherent in different types of stablecoins. Centralized options like USDC or USDT carry counterparty and regulatory risks, issuer blacklisting or government action can freeze funds unexpectedly (source). Decentralized alternatives such as LUSD from Liquity provide immutability and governance-resistance but may introduce smart contract or market liquidity risks instead.

DAOs must weigh these trade-offs with quantitative rigor. The optimal treasury blend often includes a mix of centralized and decentralized stablecoins, each sized according to risk tolerance, regulatory exposure, and operational needs. For example, a DAO with significant U. S. -based contributors may prefer a larger USDC allocation for compliance clarity, while another focused on censorship resistance might tilt toward LUSD or similar decentralized assets.

Beyond asset selection, DAOs are increasingly adopting automated rebalancing strategies. By leveraging smart contract-based vaults that monitor market conditions and adjust allocations in real time, treasuries can maintain target risk profiles with minimal manual intervention. This is particularly valuable during periods of heightened volatility or when regulatory developments threaten certain stablecoin issuers. Automated vaults also enable DAOs to capture yield opportunities dynamically, shifting capital across protocols as rates fluctuate.

Quantitative Risk Frameworks and Best Practices

The discipline of quantitative risk management is fast becoming table stakes for DAOs managing sizable treasuries. Leading organizations now implement robust frameworks to score counterparty risks, smart contract vulnerabilities, and yield sustainability across their stablecoin vault allocations. These frameworks are informed by both traditional financial models (e. g. , Value-at-Risk) and crypto-native analytics such as protocol audits and on-chain liquidity metrics.

Best practices emerging in 2025 include:

Best Practices for DAO Treasury Managers Using Stablecoin Vaults

-

Diversify Treasury Across Multiple Stablecoins and Vaults: Allocate assets into a mix of centralized (e.g., USDC, USDT) and decentralized stablecoins (e.g., LUSD by Liquity) across various vault protocols to mitigate single-asset and counterparty risks.

-

Utilize Automated Treasury Management Protocols: Leverage platforms like Aera for autonomous, non-custodial treasury optimization, reducing manual intervention and enhancing capital efficiency through algorithmic rebalancing.

-

Implement Multisig and Smart Contract Security: Store vault access keys in a multisignature wallet (e.g., Gnosis Safe) and conduct regular smart contract audits to minimize operational and technical risks.

-

Incorporate Structured Products for Yield and Flexibility: Use platforms like Thetanuts Finance to access customizable structured vaults, enabling both yield generation and flexible asset management via cash- or physically-settled options.

-

Monitor Regulatory and Compliance Risks: Stay updated on evolving stablecoin regulations and ensure all vault activities comply with relevant jurisdictions to avoid legal pitfalls.

-

Regularly Assess Vault and Stablecoin Risks: Continuously evaluate technical, credit, and governance risks associated with each stablecoin and vault provider, referencing frameworks such as those from Elliptic and Galaxy.

-

Establish Transparent Onchain Reporting: Use onchain analytics tools (e.g., Dune Analytics) to provide transparent, real-time reporting on vault allocations and performance for DAO stakeholders.

One major innovation is the use of modular vault structures, where assets are split across multiple protocols and strategies. This diversification not only limits losses from any single protocol failure but also smooths out yield variability over time. Platforms like Aera exemplify this modular approach by enabling DAOs to customize their allocation logic while maintaining non-custodial security guarantees (source).

The Future: From Passive Vaults to Active On-Chain Treasury Optimization

The next frontier in DAO treasury management is the transition from passive stablecoin storage to active on-chain optimization. We’re seeing the rise of real-time analytics dashboards that give operators granular insight into yield sources, risk exposures, and scenario analysis, empowering data-driven decisions at DAO scale.

This evolution supports not just capital preservation but also strategic growth initiatives. With automated governance tools layered atop these systems, DAOs can pre-program responses to specific triggers, such as regulatory events or sudden price shocks, further reducing human error and response lag.

The bottom line: Stablecoin vaults are no longer just a defensive tool; they have become an engine for sustainable growth in the DAO ecosystem. As best practices converge around quantitative analysis, modular architecture, and automation-first design, expect leading DAOs to set new standards in transparency, resilience, and capital efficiency throughout 2025, and beyond.