Automated stablecoin vaults are quickly becoming a cornerstone of modern DAO treasury management, enabling on-chain organizations to achieve capital efficiency, reduce manual overhead, and improve risk controls. In today’s volatile DeFi landscape, where DAI is currently priced at $0.9988, DAOs need robust systems that can preserve value while generating reliable yield and maintaining liquidity.

Strategic Foundations: Setting Treasury Objectives and Risk Parameters

The first step in deploying automated stablecoin vaults is to define your DAO’s core treasury objectives. Are you focused on capital preservation, maximizing passive income, or ensuring instant access to funds for operational needs? Each goal will inform your risk tolerance and asset allocation strategy. For example, a DAO prioritizing stability may allocate a higher percentage to stablecoins like USDT, USDC, or DAI (currently at $0.9988), while growth-oriented treasuries might diversify into higher-risk protocols or assets.

Clarity at this stage ensures that all subsequent decisions – from platform selection to automation triggers – align with the DAO’s broader mission and member expectations.

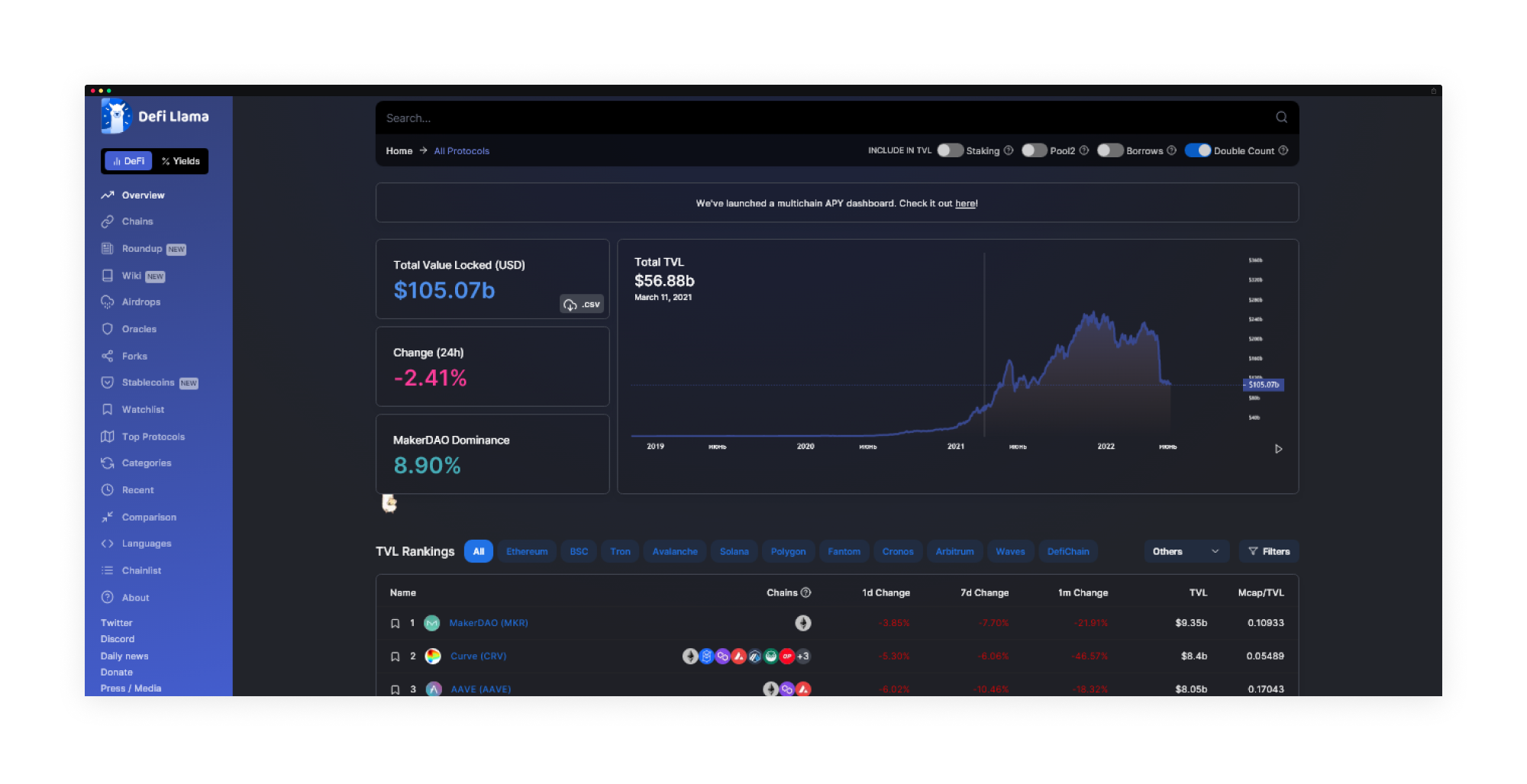

Platform Selection: Evaluating On-Chain Treasury Solutions

With objectives set, the next critical decision is choosing a treasury management platform that supports automated stablecoin vaults. Leading solutions in this space include:

- Factor.fi: Offers modular vaults with programmable automation for rebalancing and yield harvesting.

- Aera: Delivers autonomous vault management on Polygon with dynamic allocation based on preset objectives.

- dHEDGE: Integrates multi-strategy vaults spanning lending protocols and liquidity pools for diversified yield generation.

When comparing platforms, scrutinize their automation capabilities (such as scheduled rebalancing or auto-yield compounding), security features (multisig support, role-based access), network compatibility (Ethereum mainnet vs L2s like Polygon), and analytics dashboards for real-time monitoring.

Designing Vault Structures: Segmentation for Capital Efficiency

An effective treasury setup typically segments funds across multiple vault types to balance safety, growth potential, and liquidity requirements. A common model looks like this:

- Stablecoin Vaults: Safeguard principal by allocating to assets such as USDC or DAI (current price: $0.9988). These can be deployed into lending protocols or low-risk pools for steady yield.

- Growth Vaults: Allocate a portion of capital to higher-yield DeFi strategies or managed portfolios targeting appreciation beyond stable yields.

- Liquidity Vaults: Maintain an accessible reserve for immediate operational expenses or strategic opportunities without disrupting long-term positions.

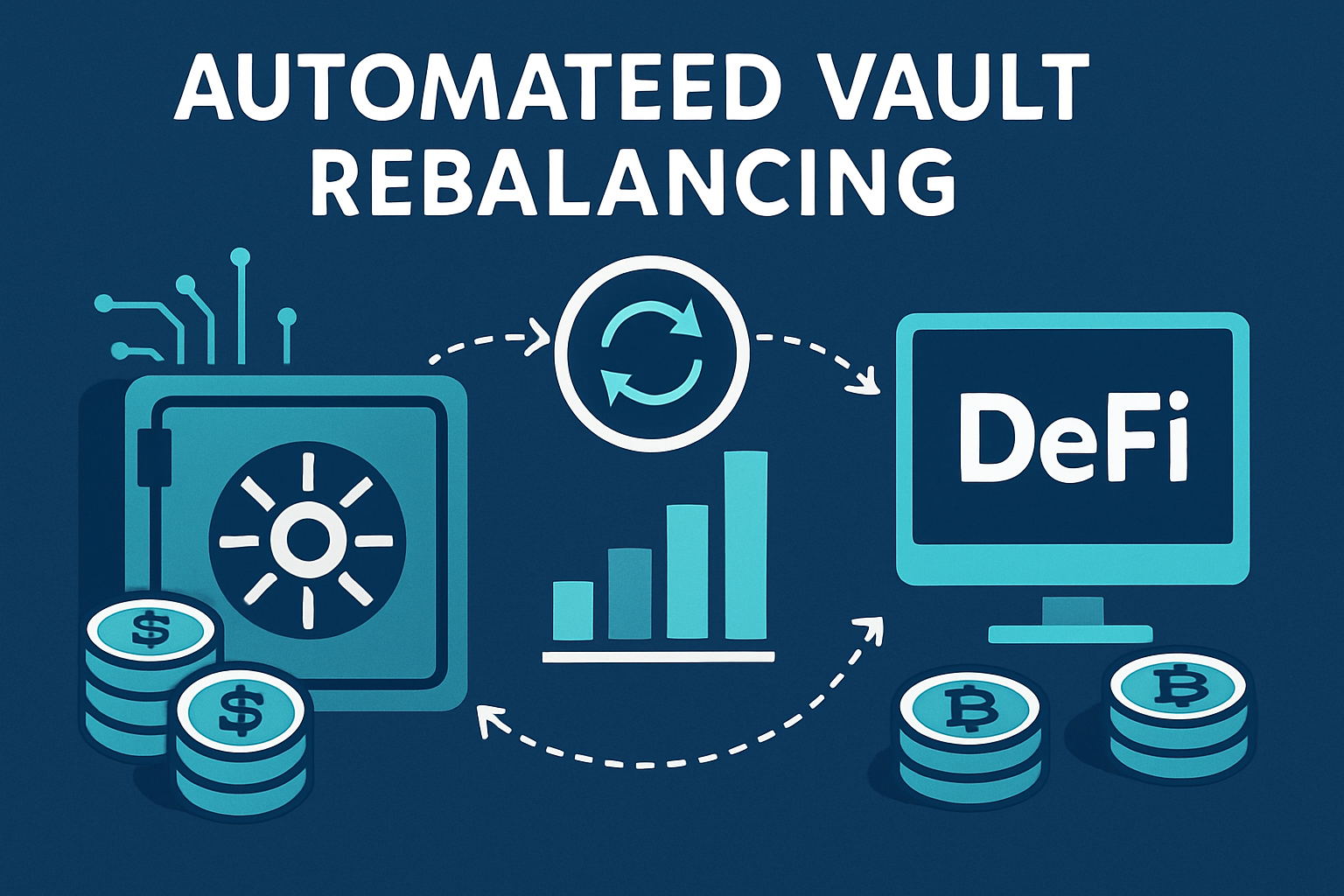

A data-driven approach often uses ratios like 50% stablecoins (for security), 30% growth strategies (for upside), and 20% liquid reserves (for flexibility). Automation tools can enforce these allocations by rebalancing as market conditions change or as yields fluctuate across protocols.

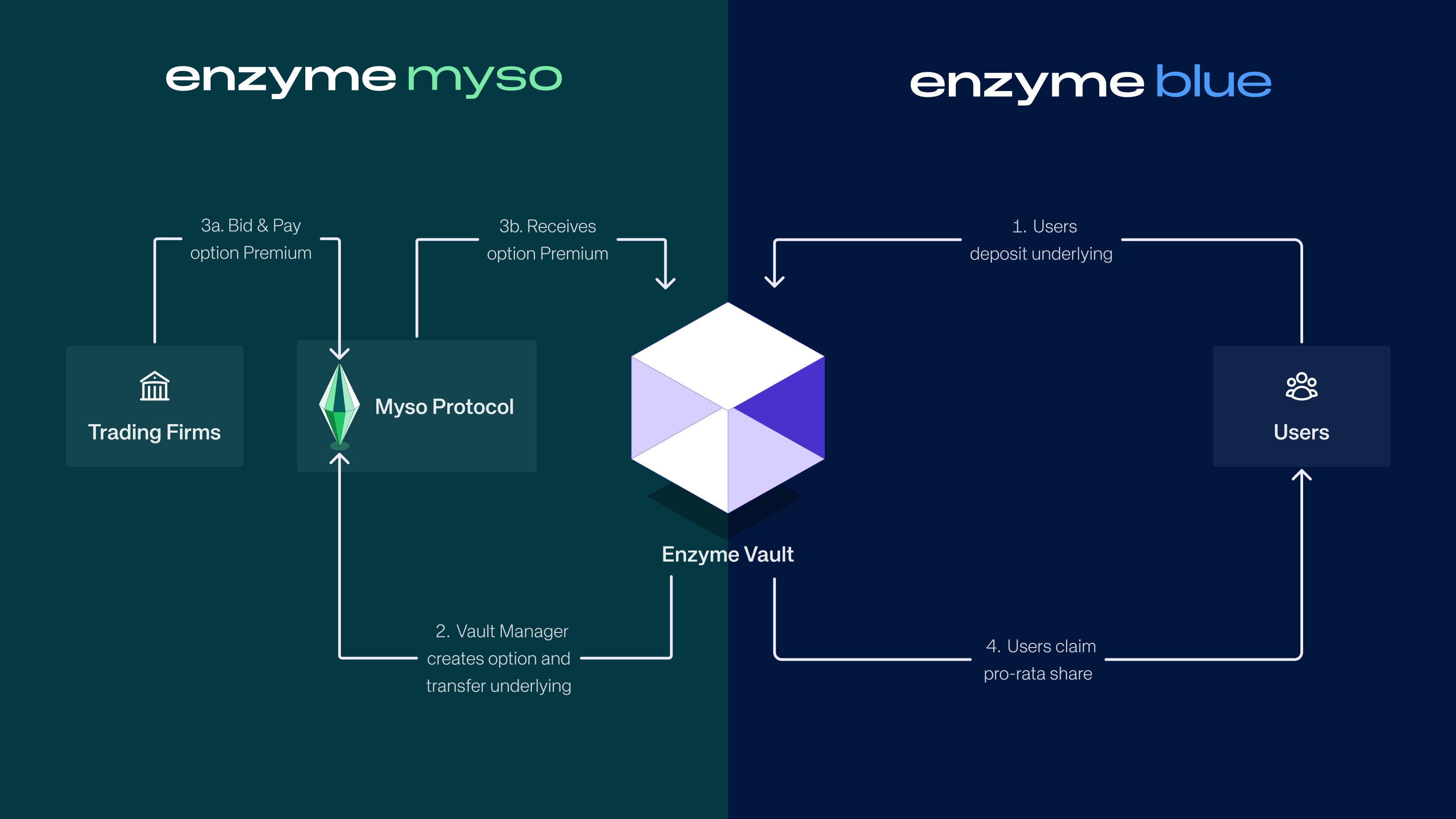

Tactical Automation: Rebalancing and Yield Optimization

The true advantage of automated stablecoin vaults lies in their ability to execute complex strategies without human intervention. Modern platforms allow DAOs to set parameters such as target allocations, minimum acceptable APYs, or maximum drawdown thresholds. The system then automatically reallocates funds between protocols – harvesting yields when rates are favorable or shifting assets back into stables if volatility spikes threaten principal preservation.

This level of automation not only streamlines treasury operations but also reduces governance fatigue by minimizing the need for frequent manual votes on routine asset movements. As highlighted in recent market research, DAOs leveraging these tools consistently outperform those relying solely on manual processes in terms of both yield generation and risk mitigation.

Security remains non-negotiable in DAO treasury management, especially as vault automation increases. Every transaction and allocation adjustment should pass through rigorous controls. Multi-signature wallets are industry standard, requiring multiple approvals before funds move. Combine this with role-based access policies, only designated contributors can initiate or approve certain actions, to mitigate the risk of internal compromise or external attack.

Platforms like Factor. fi and Aera natively support these security layers, allowing DAOs to define custom approval thresholds and permission sets. For example, a 3-of-5 multisig structure ensures that no single member can unilaterally drain the treasury, while role-based restrictions prevent accidental misallocations by less experienced operators. This layered approach is essential for safeguarding assets like DAI, which currently trades at $0.9988, as well as other stablecoins and growth tokens.

“Automated vaults have transformed our treasury operations, governance now focuses on strategy rather than micromanagement. “

Performance Monitoring: Continuous Analytics and Responsive Adjustments

Once vaults are deployed and automation is live, continuous performance monitoring is critical. Top-tier platforms offer real-time dashboards displaying metrics such as yield rates, portfolio allocations, risk exposure, and liquidity coverage ratios. Set up automated alerts for deviations from target allocations or unexpected drawdowns so your team can react promptly to market shifts.

Regularly review analytics to answer key questions: Is your stablecoin yield meeting expectations given the current DAI price of $0.9988? Are growth vaults outperforming or underperforming relative to benchmarks? Do liquidity reserves cover projected operational needs for the next quarter? Use these insights to iterate on your allocation models and automation triggers.

Best Practices: DAO Stablecoin Security and Capital Efficiency

Best Practices for DAO Stablecoin Vault Security & Efficiency

-

Use Multi-Signature Wallets for All Vault TransactionsRequire multiple approvals (e.g., 3-of-5 signatures) for every transaction to prevent unilateral fund movement and reduce risk of compromise.

-

Segment Treasury Funds by StrategyAllocate assets into distinct vaults—such as stablecoin, growth, and liquidity vaults—to balance capital preservation, yield, and operational flexibility.

-

Automate Rebalancing and Yield HarvestingSet smart contracts or platform rules to automatically rebalance vault allocations and reinvest yields, maintaining alignment with DAO objectives.

-

Enforce Role-Based Access ControlsAssign permissions based on roles (e.g., proposer, approver, executor) to minimize unauthorized actions and improve operational security.

-

Continuously Monitor Vault PerformanceUse analytics dashboards to track yield, risk, and liquidity. Adjust strategies proactively based on real-time data and market shifts.

-

Prioritize Stable, Liquid AssetsFavor major stablecoins like USDC and DAI (current DAI price: $0.9988) for core vault allocations to ensure capital stability and easy access.

To maximize both security and efficiency in automated stablecoin vaults:

- Diversify across protocols: Spread deposits among reputable lending markets and pools to reduce counterparty risk.

- Automate but verify: Schedule periodic audits of automated strategies, ensure smart contracts are up-to-date and free from known vulnerabilities.

- Document governance processes: Maintain transparent records of all vault parameters, signatory roles, and emergency procedures so new members can quickly onboard.

- Centralize analytics: Use unified dashboards for holistic oversight of all treasury segments, avoid data silos that obscure true risk exposure.

Community Pulse: Are Automated Vaults Now Essential?

Are automated stablecoin vaults essential for modern DAO treasury management?

With DAOs increasingly using automated stablecoin vaults to optimize yield, ensure liquidity, and mitigate risks, do you believe these tools are now a must-have for effective treasury management?

The landscape is clear: DAOs that leverage automated stablecoin vaults achieve superior capital efficiency while minimizing operational risks. With DAI holding steady at $0.9988, robust automation frameworks allow organizations to preserve value even during periods of heightened volatility, and to capture sustainable yields without overexposing themselves to DeFi’s inherent risks.

If your DAO isn’t yet using an on-chain solution for treasury management, now is the time to assess available platforms, define your objectives with precision, and implement battle-tested automation protocols. The future of decentralized finance will be won by those who combine data-driven strategy with unyielding security discipline.