Stablecoin vaults have rapidly become the engine room of DAO treasury management in 2025. As DAOs expand their ambitions and responsibilities, the need for secure, high-yield, and transparent capital management tools has never been more urgent. The evolution of stablecoin vaults is not just a technical upgrade – it is reshaping the very culture of decentralized finance by aligning operational rigor with community values.

Security First: How Vaults Are Fortifying DAO Treasuries

The most immediate concern for any DAO is on-chain treasury security. In 2025, leading DAOs are doubling down on robust access controls. Multi-signature wallets like Gnosis Safe distribute authority among trusted signers, diminishing single points of failure. Automated emergency pause mechanisms and regular third-party audits have become non-negotiable standards. These measures are not just theoretical best practices – they are actively protecting millions in stablecoin reserves across the ecosystem.

For example, when a vulnerability is detected, DAOs can instantly freeze vault interactions via pre-coded smart contract functions. This level of preparedness reflects a new baseline: security must be proactive, not reactive. For an in-depth look at how transparency and automation work together to secure DAO treasuries, see our recent feature on on-chain transparency.

Yield Optimization: Turning Idle Reserves into Productive Capital

The days when DAO treasuries simply parked their stablecoins are over. Today’s stablecoin vaults are programmable engines that allocate assets to a curated mix of DeFi strategies – staking, lending, liquidity provision – all governed by risk parameters set by the DAO itself. Platforms like Aera exemplify this shift by enabling DAOs to leverage decentralized networks of professional asset managers who operate within non-custodial vaults.

This approach offers two critical benefits: first, it minimizes operational overhead for core contributors; second, it ensures that treasury assets are always working to generate sustainable yields without sacrificing safety or flexibility. Vault performance dashboards now provide real-time analytics on APYs and risk exposures, empowering communities to make informed decisions and pivot strategies as market conditions evolve.

Transparency and Trust: Every Transaction On-Chain

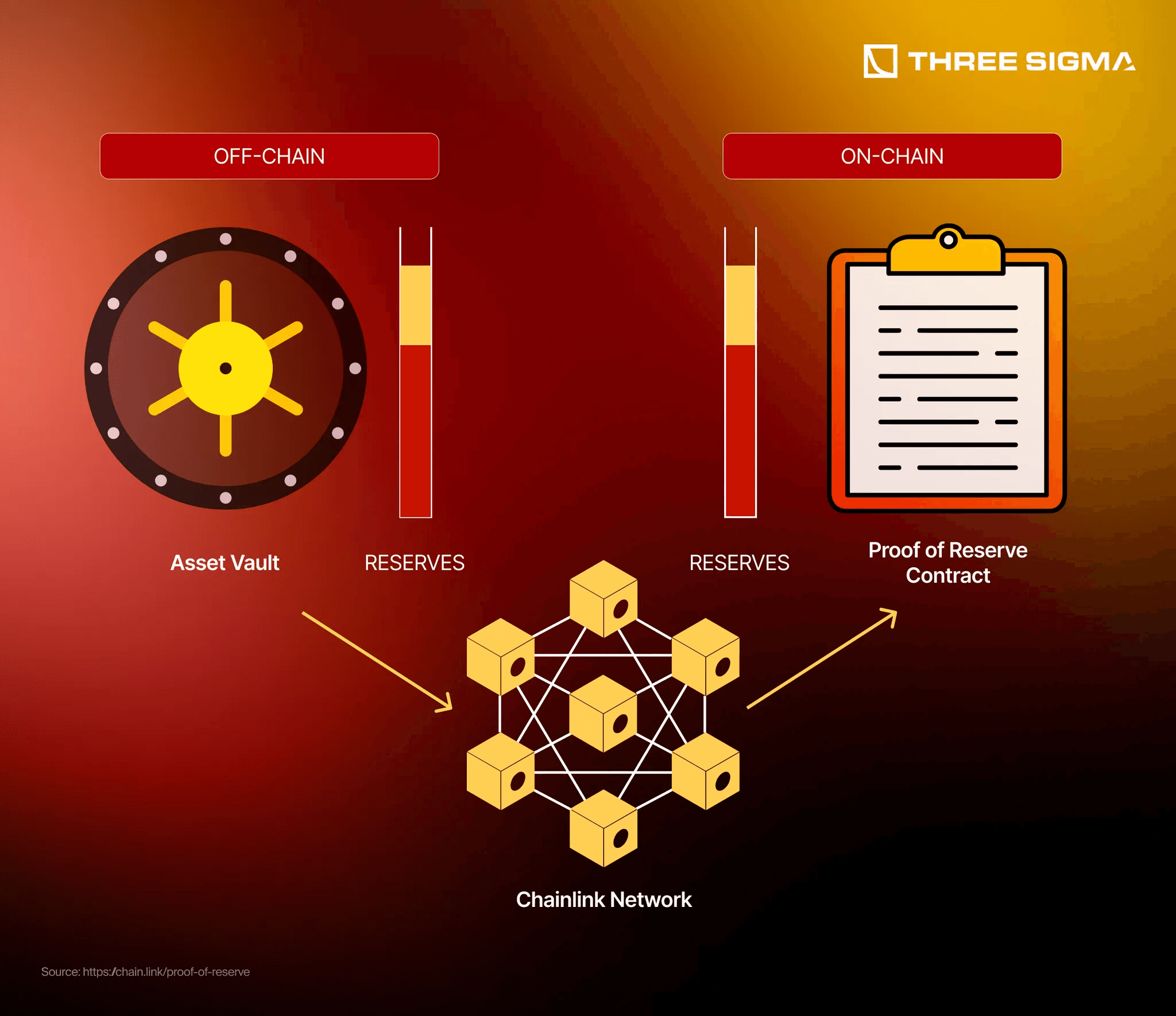

Decentralized finance transparency has moved from aspiration to expectation. Modern stablecoin vaults come equipped with real-time dashboards and open APIs that allow anyone – from token holders to external auditors – to verify every transaction as it happens. Automated governance modules let DAOs set pre-approved withdrawal limits or risk thresholds directly within smart contracts, maintaining continuous oversight without bottlenecking operations.

This radical openness builds trust both internally and externally. When every action is visible on-chain and every policy encoded transparently in smart contracts, communities can hold their leadership accountable while ensuring that capital remains safe yet productive. For practical guidance on integrating these practices into your own organization’s workflow, explore our article on reshaping DAO treasury management with vault technology.

Transparency is not just a compliance checkbox for DAOs in 2025, it is the core of community legitimacy and long-term resilience. The ability to trace every stablecoin movement, audit vault balances, and monitor strategy performance in real time has dramatically reduced the risk of mismanagement or fraud. These advances mean treasury managers can focus on optimizing yield and supporting protocol growth, while members enjoy unprecedented visibility into how collective assets are stewarded.

Moreover, the integration of automated governance within stablecoin vaults has enabled DAOs to react swiftly to market volatility or evolving risk profiles. For example, if a particular DeFi protocol’s risk score increases, smart contracts can automatically rebalance allocations toward safer venues or trigger community votes for more significant changes. This blend of transparency and automation is what sets the leading DAO treasuries apart in 2025.

Choosing the Right Vault: Balancing Security, Yield, and Transparency

The proliferation of stablecoin vault solutions means that DAO operators must be discerning when evaluating their options. Key criteria include:

- Security infrastructure: Does the vault use multisig controls, regular audits, and emergency pause features?

- Yield strategy: Are allocations diversified across audited protocols? Is there an option for dynamic rebalancing?

- Transparency tools: Are real-time dashboards available? Can all transactions be independently verified?

The best-in-class solutions offer a blend of these features, delivering capital efficiency without sacrificing trust or safety. For DAOs seeking further insight into evaluation frameworks and best practices, see our detailed guide on how to evaluate stablecoin vaults.

The Road Ahead: Stablecoin Vaults as Catalysts for DAO Evolution

The rapid adoption of stablecoin vaults in 2025 marks a turning point for decentralized finance. Secure by design, yield-optimized by default, and radically transparent, these tools are empowering DAOs to unlock new levels of agility and capital efficiency. As more organizations embrace these standards, we are witnessing not just technical progress but also cultural transformation: accountability is embedded in code, opportunity is democratized through automation.

This momentum will only accelerate as innovations like automated rebalancing networks and cross-chain vault integrations mature. The most forward-thinking DAOs are already leveraging these advancements to align treasury management with their mission, whether that means funding public goods, supporting ecosystem growth, or building long-term endowments that reflect shared values.

If you’re ready to future-proof your DAO’s financial operations with robust stablecoin vaults, or simply want to stay ahead of the next wave in on-chain treasury management, continue exploring our latest research on vault-powered DAO evolution.