In 2025, on-chain transparency is fundamentally reshaping how DAOs secure and manage their stablecoin vaults. The days of opaque treasury practices are fading fast, replaced by a new era where every transaction, risk parameter adjustment, and governance action is instantly auditable. This transformation is not just a technical upgrade – it’s a cultural shift toward radical accountability and real-time risk management in decentralized finance.

Why On-Chain Transparency Is Now Non-Negotiable for DAO Stablecoin Vaults

The explosive growth of DAO stablecoin vaults has brought both opportunity and scrutiny. In the past, treasury managers faced daunting trade-offs: prioritize security at the expense of agility, or chase yield while exposing funds to hidden risks. Today, transparent smart contracts and automated monitoring tools have changed the calculus.

A modern DAO vault stack typically features:

- Audited, upgradable smart contracts with timelocks: These ensure that every code change or fund movement is visible to all stakeholders before execution. Timelocks act as circuit breakers against rushed or malicious actions.

- Diversification across protocols and chains: By spreading allocations between platforms like Ethereum, Arbitrum, and emerging L2s, DAOs reduce exposure to any single point of failure or exploit.

- Real-time on-chain monitoring: Advanced analytics now track everything from wallet balances to oracle updates. Automated alerts flag suspicious activity before it escalates into disaster.

This transparency isn’t just about optics – it’s about operational resilience. When every community member can verify reserves or audit contract upgrades in real time, trust becomes programmatic rather than aspirational. For an in-depth look at how these mechanisms work in practice, see our guide on securing DAO stablecoin vaults through on-chain best practices.

The Rise of Automated Incident Detection: Real-Time Risk Management for Treasuries

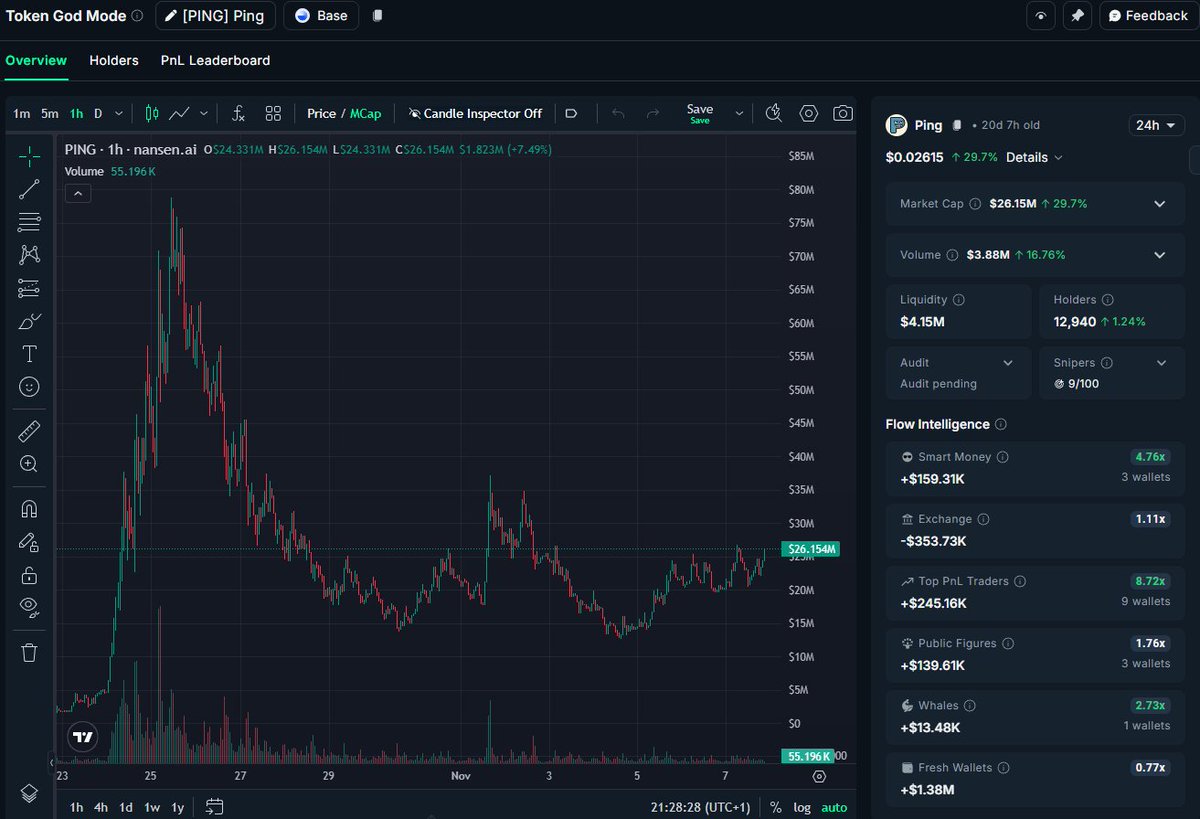

If 2024 was the year of multisig adoption, 2025 is proving to be the year of automated incident response for DAOs. Platforms now integrate real-time monitoring tools that continuously scan for anomalies across vault operations:

- Transaction flow analysis: Detecting unauthorized withdrawals or sudden changes in ownership structure triggers instant alerts to governance participants.

- Contract upgrade tracking: Any attempt to alter critical smart contract logic is flagged well before it can affect assets under management.

- Oracle price feed monitoring: Sudden price discrepancies or oracle outages are identified immediately – essential for vaults holding volatile collateral or managing yield strategies.

This level of automation reduces manual oversight burdens while sharply increasing the speed at which threats are neutralized. It’s a game-changer for DAOs seeking both scale and safety in their treasury operations.

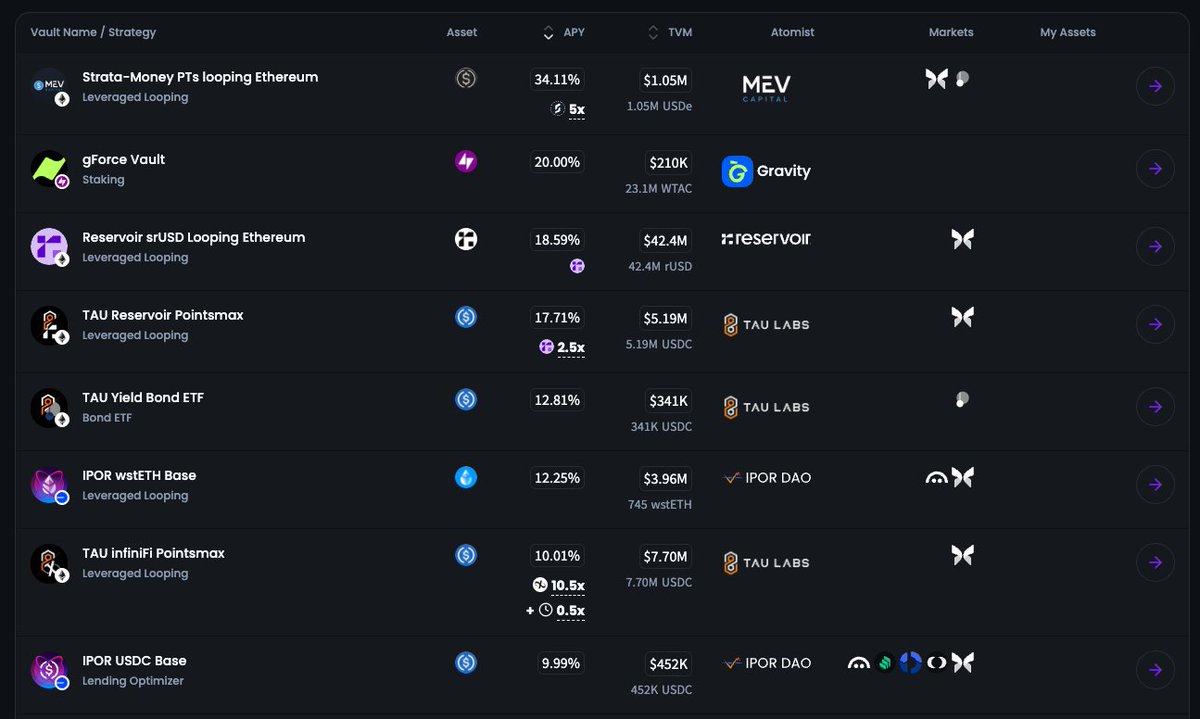

Diversification and Programmable Vaults: The New Pillars of Secure Treasury Management in 2025

No single protocol or chain can guarantee perfect safety – as recent exploits have shown. That’s why leading DAOs now embrace diversification as a first principle. By distributing stablecoin holdings across multiple vetted protocols (and even different blockchains), treasuries insulate themselves from idiosyncratic risks like smart contract bugs or depegging events.

The rise of programmable vault platforms such as Factor. fi enables automated portfolio rebalancing based on predefined risk parameters. This minimizes manual intervention while ensuring capital efficiency remains high even as market conditions shift rapidly. For more insights into how automated stablecoin vaults are revolutionizing treasury management for DAOs this year, explore our detailed analysis here: How Automated Stablecoin Vaults Are Revolutionizing On-Chain Treasury Management for DAOs.

Yield optimization is another area where on-chain transparency is driving a paradigm shift. DAOs are no longer satisfied with simply parking stablecoins in cold storage; today’s best-in-class treasuries actively deploy capital into risk-managed DeFi vaults, generating sustainable returns while maintaining full auditability. Platforms such as Castle Finance and Gitcoin DAO exemplify this approach, leveraging automated yield strategies that are both visible and verifiable by all governance participants. Every deposit, withdrawal, and rebalance is etched onto the blockchain, leaving zero room for obfuscation or shadow risk-taking.

Top DAO Stablecoin Vault Protocols & Their Transparency Features

-

Safe (formerly Gnosis Safe): The industry-standard multisig wallet for DAOs, Safe offers on-chain transaction transparency, granular access controls, and auditable governance actions. Its integration with automated vaults enables secure, rule-based treasury management and compliance.

-

Factor.fi: This protocol empowers DAOs with programmable, automated stablecoin vaults for portfolio rebalancing and liquidity management. All vault operations and strategies are executed via transparent smart contracts, with real-time monitoring and community oversight.

-

Castle Finance: Castle offers institutional-grade risk-managed vaults designed for DAOs. All treasury actions are on-chain and auditable, with automated risk controls and incident alerts for maximum transparency and security.

-

Gitcoin DAO: A leading DAO that actively deploys stablecoins into DeFi yield vaults with open, on-chain reporting. All treasury allocations and yield strategies are visible to the community, ensuring operational transparency and low-volatility exposure.

-

Aave: As a major DeFi lending protocol, Aave enables DAOs to deposit stablecoins into audited, transparent vaults with real-time, on-chain tracking of deposits, withdrawals, and interest earned. Its open governance ensures protocol upgrades are visible and auditable.

-

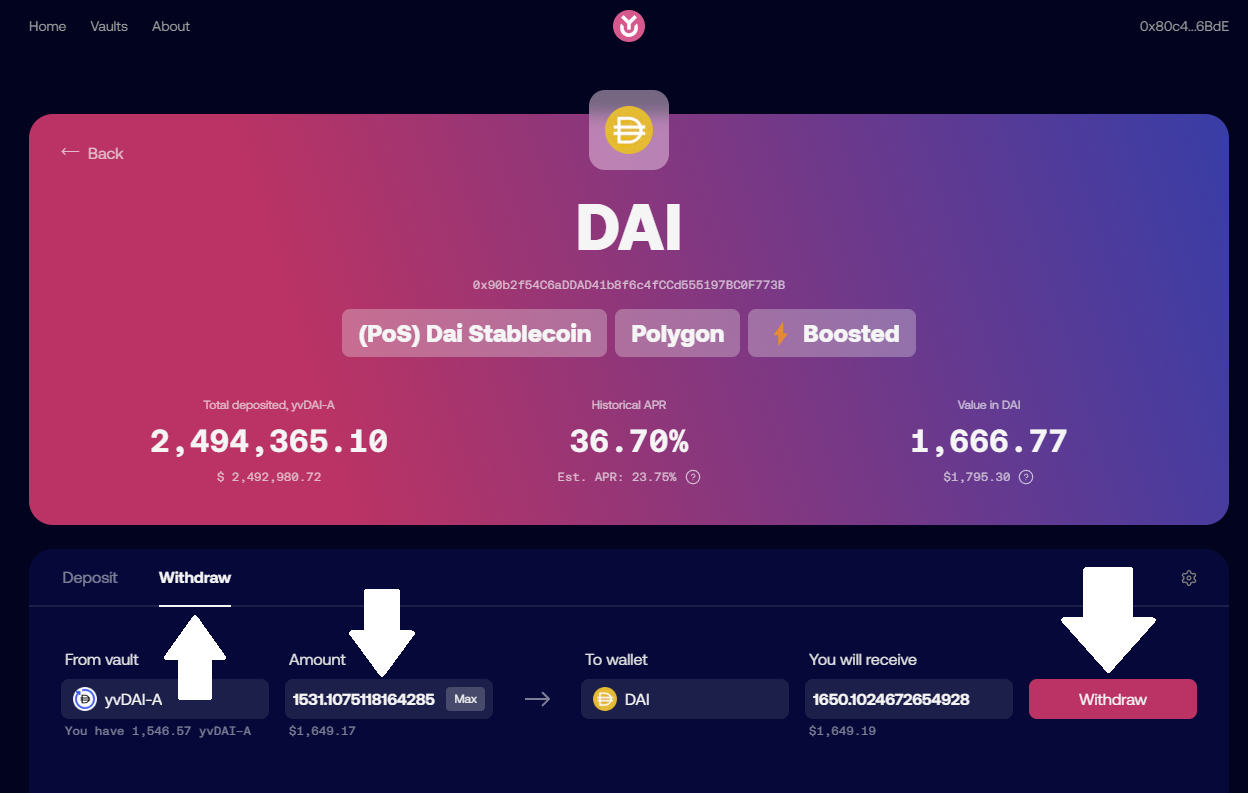

Yearn Finance: Yearn’s automated stablecoin vaults are widely used by DAOs for yield optimization. All vault strategies, performance data, and contract upgrades are transparently published on-chain, supporting full community oversight.

Compliance pressures are also mounting in 2025. Regulatory frameworks like the GENIUS Act and evolving global standards increasingly require DAOs to prove that their stablecoin reserves are fully backed, secure, and transparent. On-chain attestation mechanisms, such as publishing Merkle proofs of reserves or integrating with real-time audit APIs, are quickly becoming baseline requirements for any DAO wishing to interact with institutional partners or remain competitive in a tightening market environment.

This regulatory convergence is not a threat but an opportunity. By adopting on-chain transparency tools proactively, DAOs can demonstrate robust compliance without sacrificing decentralization or operational agility. The result: greater access to capital, stronger community trust, and improved resilience against external shocks.

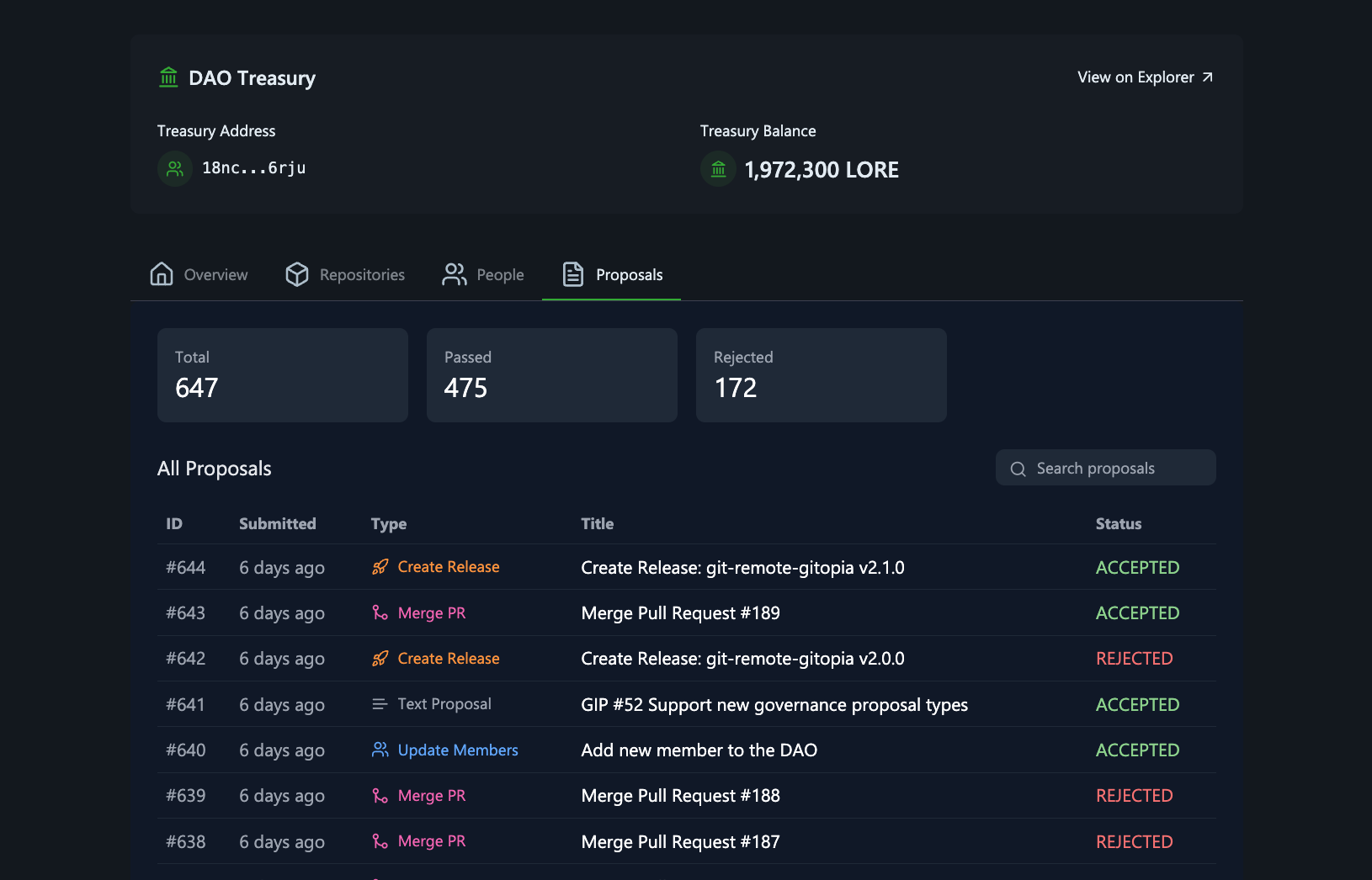

Building Trust Through Radical Auditability

The ultimate promise of on-chain transparency is radical auditability. When every treasury action, from multi-sig approvals to yield farming allocations, is instantly accessible via block explorers and analytics dashboards, the entire community becomes an active participant in risk oversight. This collective vigilance dramatically reduces the likelihood of catastrophic mismanagement or insider exploitation.

Moreover, transparent vaults foster a culture of shared responsibility within DAOs. Treasury managers can focus on strategy rather than firefighting, knowing that automated controls and real-time monitoring will catch most anomalies before they escalate. For practical steps on implementing these frameworks in your organization, see our hands-on guide: How to Build Secure Stablecoin Vaults for DAO Treasury Management.

The bottom line? On-chain transparency has moved from a nice-to-have to an existential necessity for DAOs managing significant stablecoin treasuries in 2025. The organizations leading this charge aren’t just safer, they’re setting new benchmarks for what’s possible in decentralized finance.