DAOs are rapidly evolving into sophisticated financial entities, collectively managing billions in on-chain treasuries. As of September 2025, leading DAOs are driving treasury growth through increased governance participation and agile capital allocation. However, the volatility of crypto assets and the need for transparent, automated risk controls have made stablecoin vaults a cornerstone of modern DAO treasury management.

Why Stablecoin Vaults Matter for DAO Treasury Operations

The rise of stablecoin vaults is fundamentally reshaping how DAOs approach capital efficiency, risk mitigation, and yield generation. Unlike static wallets or legacy multi-sig solutions, these purpose-built smart contracts empower DAOs to automate asset allocation, monitor performance in real time, and enforce on-chain governance rules without human bottlenecks.

Stablecoins such as USDC, USDT, and the emerging GHO have become the preferred medium for treasury reserves due to their price stability and deep liquidity. In 2024-2025, DAOs are leveraging advanced vault protocols not only to safeguard funds but also to unlock programmable strategies tailored to their risk profiles.

Aave GHO Stablecoin Vaults: Earning Yield on Treasury Reserves

One of the most impactful innovations is the integration of Aave GHO stablecoin vaults into DAO treasuries. GHO, designed as a decentralized overcollateralized stablecoin native to Aave’s ecosystem, allows DAOs to deposit idle reserves directly into lending pools. This enables treasuries to earn competitive yields while maintaining liquidity and minimizing exposure to volatile assets.

The automation layer provided by Aave’s vault architecture ensures that treasury managers can set parameters for collateralization ratios and withdrawal limits via on-chain governance proposals. This not only reduces operational overhead but also aligns with community-driven decision-making frameworks that are core to DAO ethos.

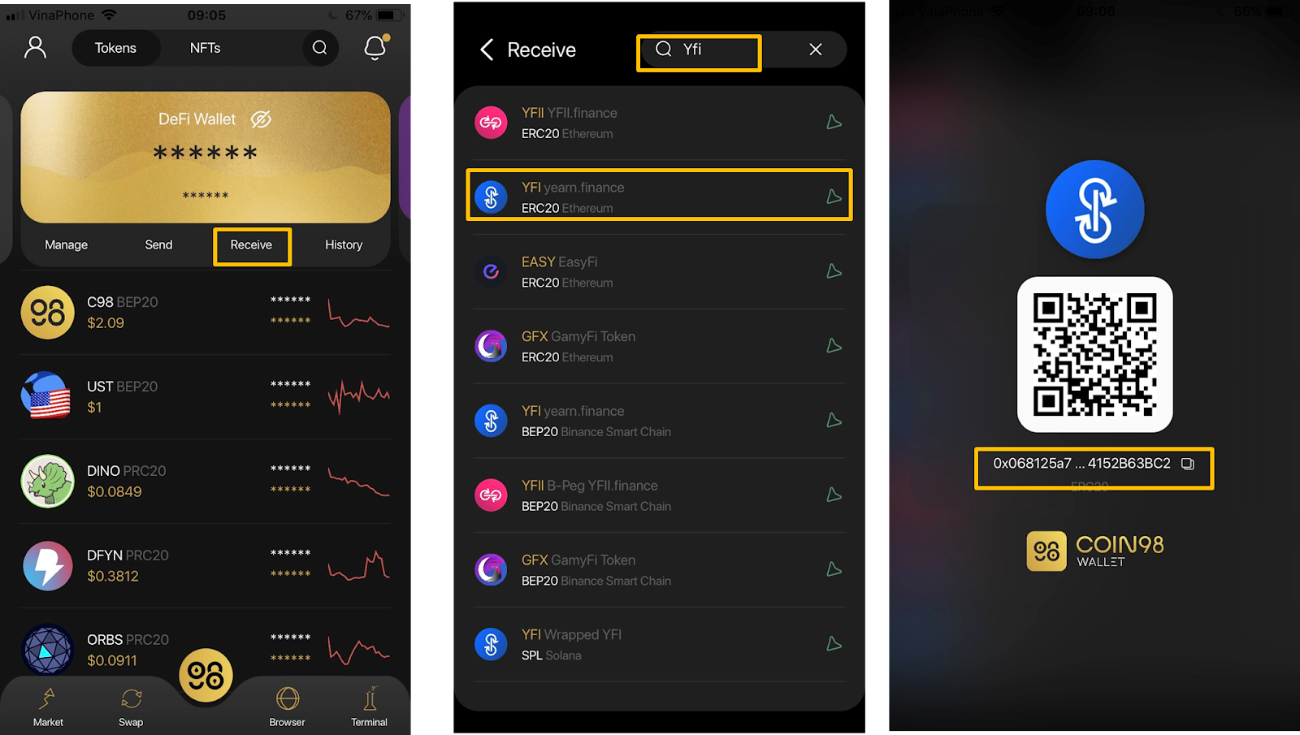

Yearn Finance Stablecoin Vaults: Automated Diversification and Risk Mitigation

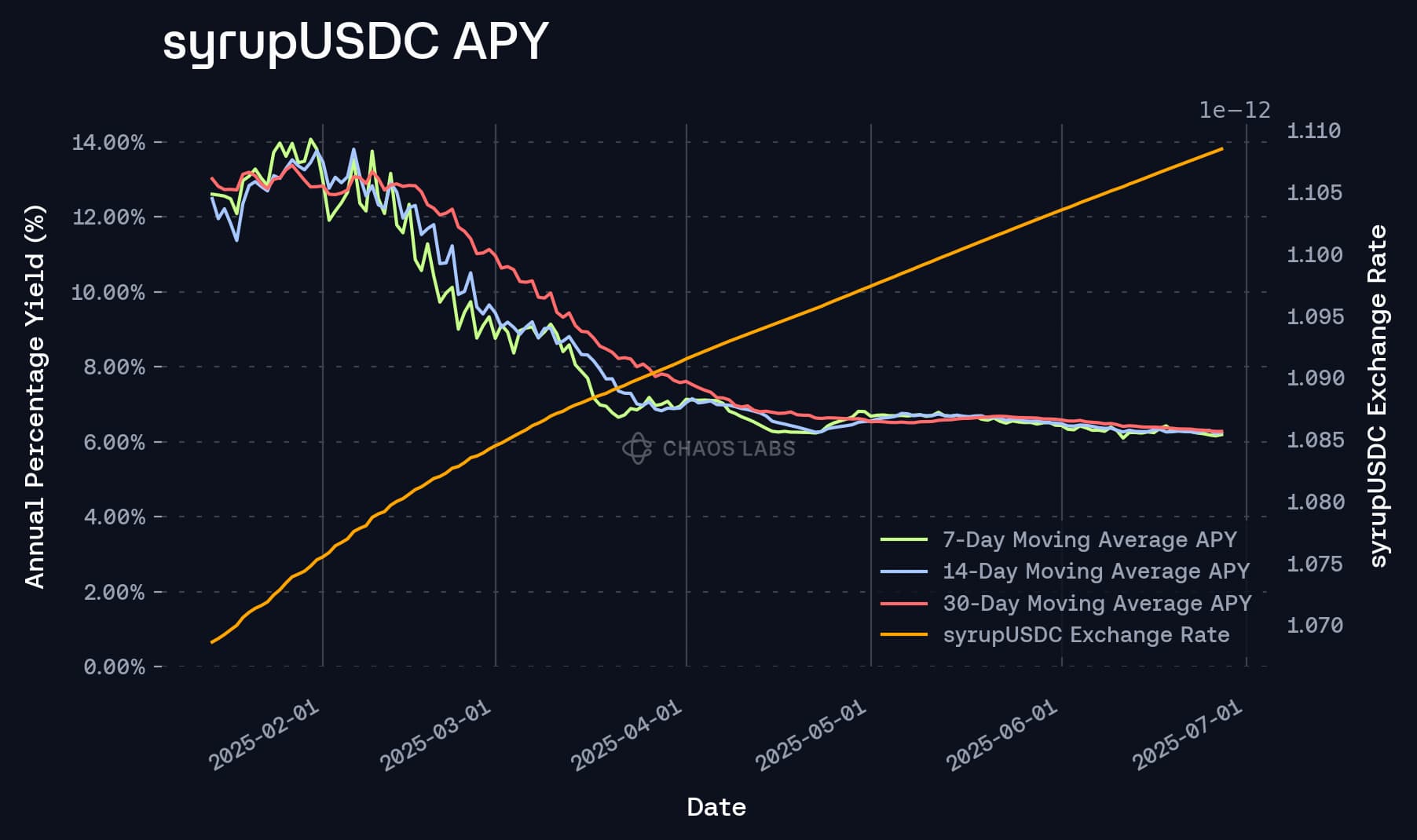

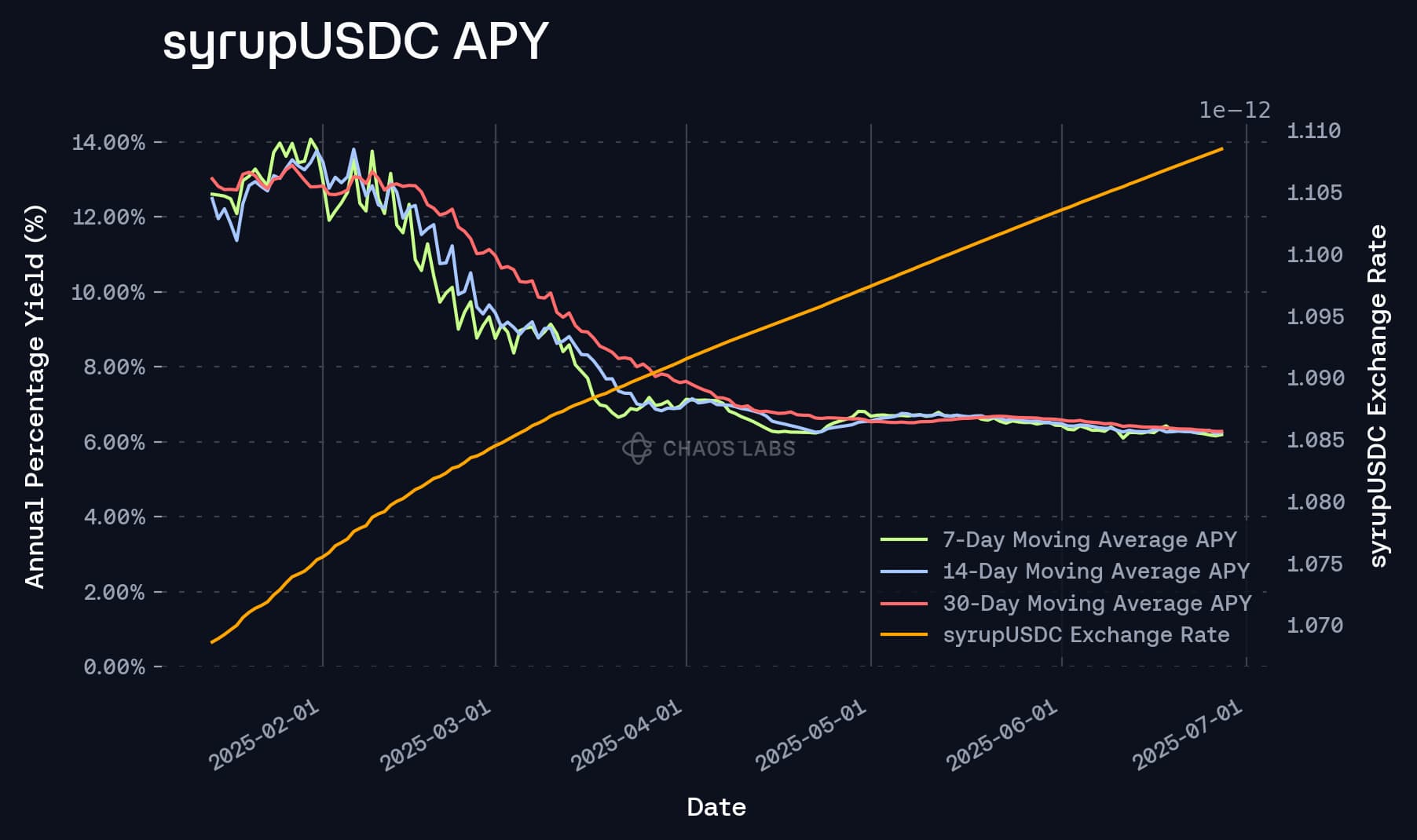

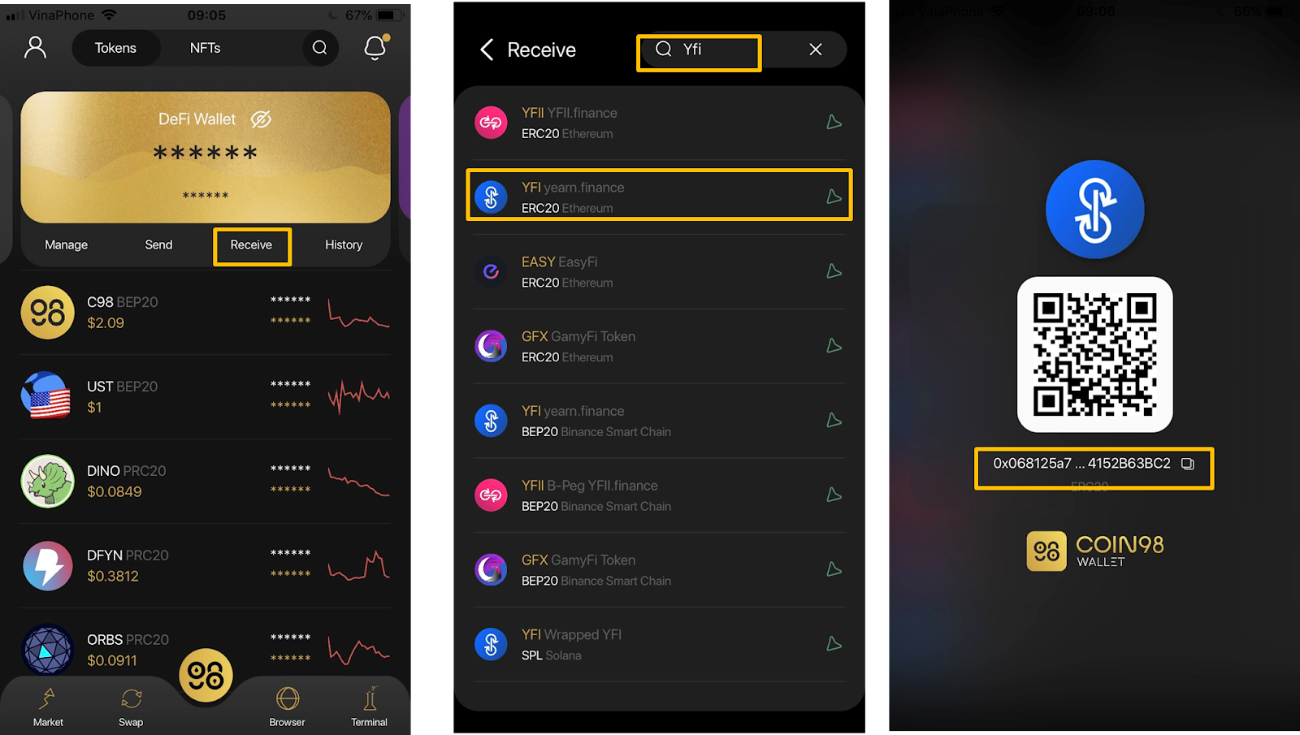

Yearn Finance’s stablecoin vaults have emerged as a best-practice solution for automated diversification within DAO treasuries. By allocating treasury assets across multiple stablecoins (such as USDC, USDT, and DAI) using Yearn’s proven yield strategies, DAOs can mitigate counterparty risk while optimizing returns through aggregation of DeFi lending opportunities.

This diversification is not just theoretical – it is enforced by smart contracts that continuously rebalance allocations based on market conditions and protocol yields. The result is a resilient treasury structure that can weather market drawdowns without sacrificing earning potential or requiring continuous manual intervention from governance participants.

Top Stablecoin Vault Solutions Empowering DAOs

-

Aave GHO Stablecoin Vaults: Enabling DAOs to earn yield on treasury reserves by depositing stablecoins like GHO into Aave’s decentralized lending protocol. These vaults allow DAOs to generate passive income while maintaining liquidity and minimizing volatility risk, leveraging Aave’s robust risk management and transparent on-chain operations.

-

Automated Diversification via Yearn Finance Stablecoin Vaults for Risk Mitigation: Yearn Finance’s stablecoin vaults automatically allocate DAO treasury assets across multiple DeFi protocols, optimizing for yield and reducing exposure to any single platform. This automated diversification enhances risk mitigation and ensures stable returns, supporting DAOs in maintaining capital efficiency and operational resilience.

-

Real-Time Treasury Reporting and Governance Integration Using Coinshift with USDC/USDT Vaults: Coinshift provides DAOs with integrated treasury management tools, enabling real-time reporting and analytics for stablecoin vaults (e.g., USDC, USDT). These features streamline governance processes, support transparent decision-making, and allow for seamless allocation, tracking, and auditing of DAO funds.

Coinshift: Real-Time Treasury Reporting and Governance Integration with USDC/USDT Vaults

The next leap in DAO treasury management is real-time reporting combined with seamless governance integration. Coinshift’s platform, which supports both USDC and USDT vault management, offers DAOs an intuitive dashboard for tracking balances, yield generation metrics, payments history, and multi-sig activity – all updated live on-chain.

This transparency isn’t just about compliance – it empowers token holders with actionable insights during governance votes. Coinshift’s modular design allows DAOs to automate recurring payments (such as contributor salaries or grants), while granular permission controls ensure that only authorized signers can initiate transfers or adjust strategy parameters.

Together, these solutions represent a new paradigm in on-chain treasury optimization for DAOs. By leveraging programmable stablecoin-native applications like Aave GHO vaults for yield generation, Yearn Finance for risk-managed diversification, and Coinshift for transparent reporting and automation workflows. . .

. . . DAOs are unlocking a toolkit that is both resilient and agile. The result is a treasury stack that not only preserves capital but also amplifies it through secure, automated DeFi primitives. Let’s examine how these three innovations are setting the standard for DAO treasury management in 2025.

Best Practices: Building a Future-Proof DAO Treasury Stack

To maximize the value of stablecoin vaults, DAOs should adopt a layered approach that combines yield generation, risk mitigation, and transparent governance. Here’s how the most forward-thinking organizations are putting these principles into practice:

Top Stablecoin Vault Solutions Empowering DAOs

-

Aave GHO Stablecoin Vaults: Enabling DAOs to earn yield on treasury reserves by depositing stablecoins like GHO into Aave’s secure, on-chain lending markets. These vaults provide programmable yield strategies, transparent risk parameters, and deep liquidity for stablecoin assets.

-

Automated Diversification via Yearn Finance Stablecoin Vaults for Risk Mitigation: Yearn Finance offers automated stablecoin vaults that diversify DAO treasuries across multiple yield strategies. This reduces exposure to single protocol risks and optimizes returns by leveraging Yearn’s battle-tested aggregation and rebalancing mechanisms.

-

Real-Time Treasury Reporting and Governance Integration Using Coinshift with USDC/USDT Vaults: Coinshift empowers DAOs with advanced treasury management, integrating real-time reporting, multi-signature controls, and governance workflows for USDC/USDT vaults. This enables transparent financial oversight and seamless on-chain decision-making.

1. Earn Yield Without Sacrificing Liquidity

Aave GHO vaults let DAOs earn passive income on reserves while retaining rapid access to funds. Automated lending strategies mean treasuries can respond to market shifts or funding needs without unwinding complex positions or facing slippage risk.

2. Automate Diversification to Minimize Risk

Yearn Finance’s vault architecture allows DAOs to split stablecoin allocations across multiple protocols and assets. This not only shields treasuries from single-point failures but also delivers consistent returns even in volatile DeFi cycles.

3. Prioritize Transparency with Real-Time Reporting

Coinshift’s platform closes the loop between treasury operations and DAO governance. With live dashboards and granular permissions, every stakeholder can monitor performance, approve transactions, and participate in strategic decisions based on up-to-date financial data.

The Road Ahead: Stablecoin Vaults as Core Infrastructure

The adoption of stablecoin vaults is rapidly becoming non-negotiable for any DAO seeking long-term sustainability. As regulatory scrutiny increases and stakeholders demand greater accountability, these programmable vault solutions offer an auditable trail of every action – from yield harvesting to grant disbursement.

This isn’t just theoretical: leading DAOs are already reporting improved capital efficiency metrics and higher governance participation rates after integrating these tools. With the continued evolution of smart contract standards and cross-chain composability, expect stablecoin-native treasury management to become even more robust – supporting everything from real-time audits to automated insurance triggers.

If you’re ready to future-proof your organization’s capital reserves, now is the time to explore how programmable stablecoin vaults can redefine your treasury stack. For deeper technical breakdowns on risk management frameworks or hands-on guides for implementation, check out our dedicated resource hub or read more at How DAOs Use Stablecoin Vaults for Treasury Risk Management.