DAO operators are entering a new era of on-chain treasury management, where the optimization of stablecoin vaults is no longer a luxury but a necessity for capital efficiency and risk mitigation. As DAOs mature, the paradigm is shifting from simply holding volatile governance tokens to deploying sophisticated, automated stablecoin strategies that ensure both stability and yield generation. This article unpacks the latest best practices and innovations for optimizing DAO stablecoin vaults, drawing on real-world examples and cutting-edge DeFi infrastructure.

Why Stablecoin Vault Optimization Matters for DAOs

Stablecoin vaults have become the backbone of on-chain treasury management. By integrating assets like USDC and DAI, DAOs can shield their treasuries from the wild price swings that characterize crypto markets. The Decentraland DAO’s recent move to convert a portion of its MANA holdings into stablecoins exemplifies this trend, prioritizing financial stability and sustained funding for long-term initiatives. This approach not only preserves capital but also unlocks new avenues for programmable automation, including payroll, grant disbursements, and liquidity rebalancing via smart contracts.

Modern vault frameworks, particularly those built on the ERC4626 standard, have transformed ad-hoc yield hunting into programmable asset management. This enables DAOs to move beyond manual interventions, leveraging automated strategies that optimize returns while enforcing robust risk controls. For a deep dive into how these vaults are reshaping DAO treasury management in 2025, see this guide.

Key Strategies for DAO Stablecoin Vault Optimization

Top 5 Strategies to Optimize DAO Stablecoin Vaults

-

Diversify Stablecoin Holdings for Stability: Shift treasury assets from volatile native tokens to a mix of established stablecoins like USDC and DAI to reduce market risk and maintain financial stability. For example, the Decentraland DAO has proposed converting MANA to stablecoins for long-term resilience.

-

Automate Treasury Operations with Smart Contracts: Leverage programmable stablecoins to automate payroll, grant disbursements, and real-time liquidity rebalancing across DeFi platforms. This minimizes manual intervention and errors, streamlining DAO financial workflows.

-

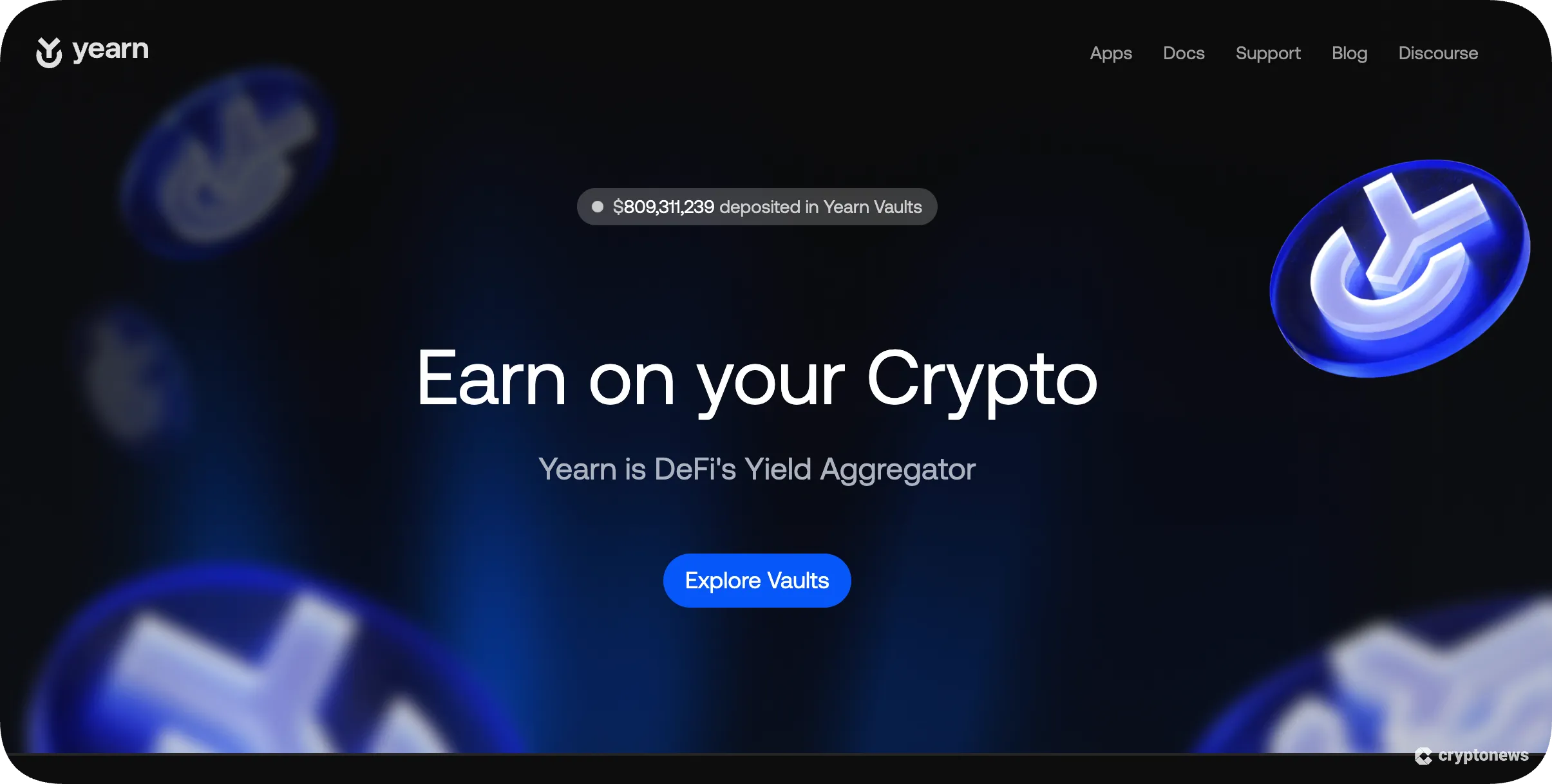

Deploy Stablecoins for Yield Generation: Allocate stablecoins to yield farming and liquidity pools on platforms like Uniswap and Spiral DAO to earn returns while enhancing token liquidity and utility within the DeFi ecosystem.

-

Ensure Transparent and Auditable Treasury Actions: Utilize the inherent transparency of public blockchains to record all treasury transactions, providing an auditable trail that boosts accountability for DAO members and stakeholders.

-

Implement Robust Risk Management and Security: Diversify stablecoin exposure across top-tier assets, use multisig wallet controls, and conduct regular smart contract audits to safeguard treasury assets and minimize vulnerabilities.

Let’s break down the most impactful strategies DAOs are deploying to maximize the utility and safety of their stablecoin reserves:

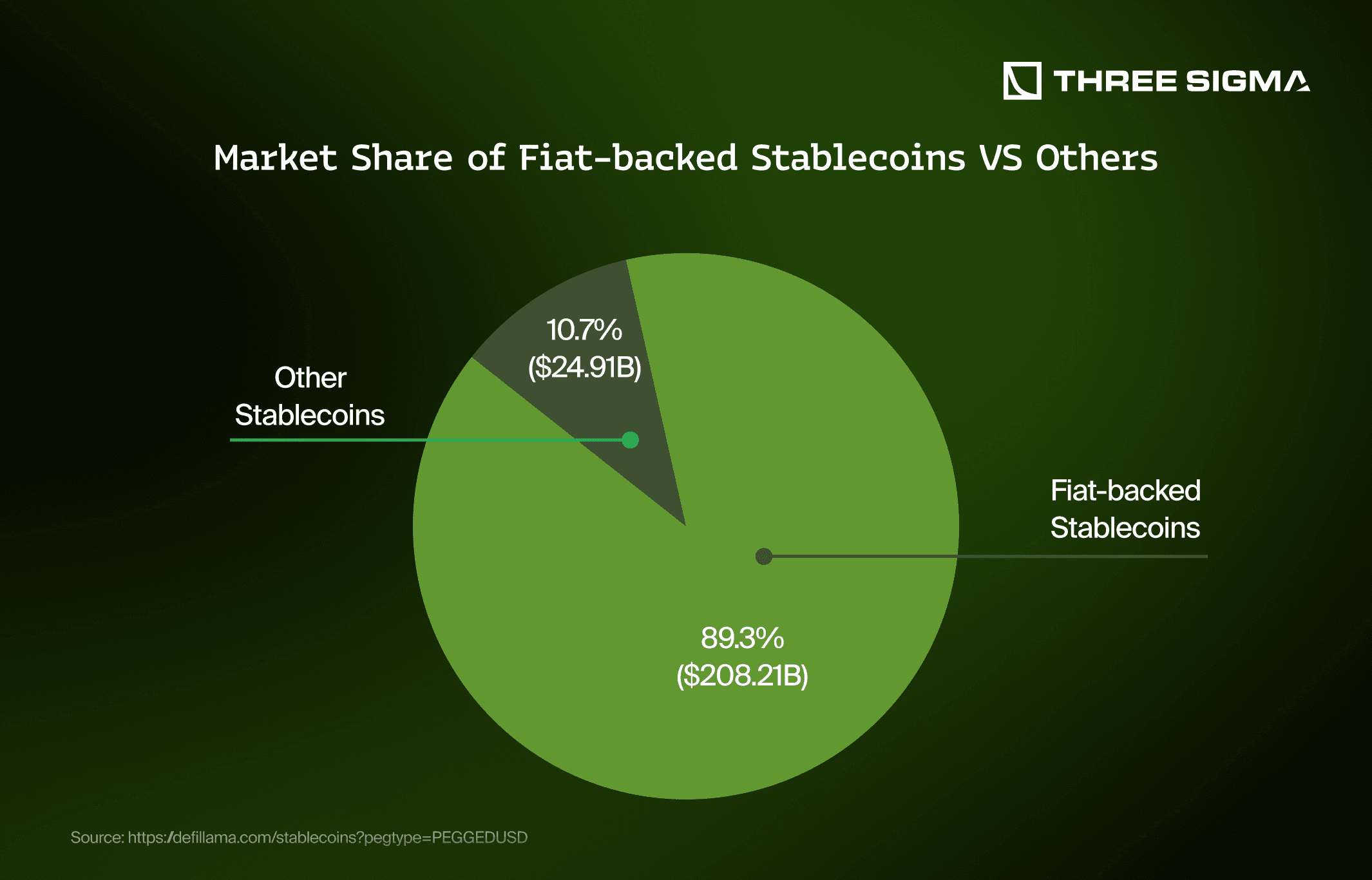

- Diversification across stablecoins: Reduces exposure to single-asset depegs and protocol risk by allocating funds between USDC, DAI, and other top-tier stablecoins.

- Automated yield farming: Deploys stablecoins into vetted DeFi protocols like Spiral DAO or Uniswap to generate predictable yields, all governed by smart contracts with pre-set risk parameters.

- Real-time liquidity management: Uses programmable stablecoins to dynamically rebalance liquidity pools, ensuring DAOs can meet obligations without sacrificing yield opportunities.

- Transparent on-chain reporting: Every treasury action is immutably recorded, providing a clear audit trail for DAO stakeholders and external auditors alike.

- AI-driven portfolio optimization: Machine learning systems such as TrustStrategy’s platform automatically adjust allocations to maximize yield while minimizing risk, adapting in real-time to market changes.

Automating Treasury Operations with Programmable Stablecoins

The integration of programmable stablecoins is revolutionizing how DAOs automate their core treasury functions. Smart contracts now handle routine tasks such as payroll, grant issuance, and liquidity rebalancing, drastically reducing manual workload and the potential for human error. This automation not only streamlines operations but also enforces compliance with DAO governance policies, as every transaction follows pre-approved logic encoded on-chain.

For DAOs seeking to deepen their understanding of automation best practices, our resource on optimizing stablecoin vaults for capital efficiency offers actionable frameworks and protocol comparisons.

Risk Management: Beyond Simple Diversification

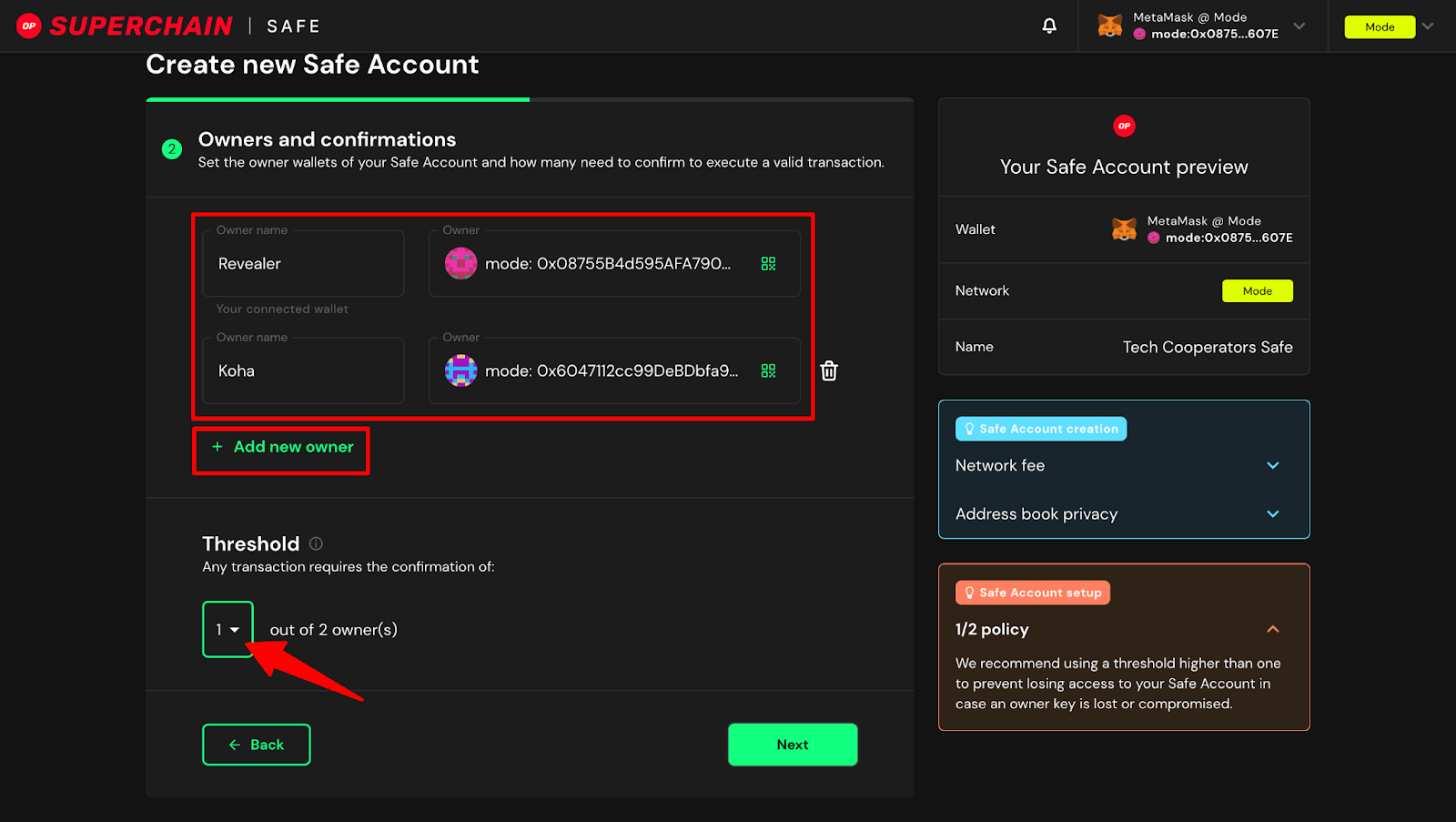

While diversification is a foundational principle, sophisticated DAOs are layering additional risk controls to safeguard their treasuries. This includes deploying multisig wallets, enforcing access controls, and conducting rigorous smart contract audits before allocating funds. Furthermore, DAOs are increasingly using decentralized asset management platforms like dHEDGE to diversify exposure across chains and strategies, ensuring no single point of failure can jeopardize the treasury.

For a technical breakdown of how stablecoin vaults protect DAO treasuries during market volatility, explore our analysis here.

Emerging best practices also emphasize the strategic use of permissioned vaults and non-custodial frameworks. These models allow DAOs to retain full control over treasury assets while accessing professional-grade yield strategies and risk management tools. For example, Compound DAO’s permissioned vault architecture enables access to curated DeFi yields without relinquishing custody, ensuring both compliance and operational security.

On the security front, DAOs are adopting layered defense models. These include multisig wallet governance, time-locked contract upgrades, and continuous monitoring for protocol exploits or depeg events. Leveraging a mix of on-chain analytics and off-chain alerts, treasury managers can respond to threats proactively, minimizing loss potential from smart contract vulnerabilities or stablecoin instability.

Capital Efficiency and Yield: Striking the Right Balance

Optimizing for capital efficiency means more than just chasing the highest APY. DAOs are increasingly prioritizing risk-adjusted returns, allocating stablecoins to protocols with proven track records, deep liquidity, and transparent governance. Automated rebalancing powered by AI ensures that idle capital is continuously deployed to the most productive venues, while maintaining sufficient liquidity buffers for operational needs.

Integrating real-time analytics dashboards provides DAO members with granular visibility into vault performance, yield sources, and risk exposures. This transparency fosters trust and enables data-driven governance decisions. For those interested in a comprehensive review of how stablecoin vaults are revolutionizing on-chain treasury management, see this in-depth analysis.

Top Risk Mitigation Tools for DAO Stablecoin Vaults

-

Diversified Stablecoin Holdings: DAOs commonly allocate treasury funds across multiple leading stablecoins such as USDC, DAI, and USDT to minimize exposure to any single asset’s depegging or systemic risk.

-

Multisig Wallets: Platforms like Gnosis Safe require multiple DAO signers to authorize transactions, reducing single-point-of-failure risk and enhancing treasury security.

-

Smart Contract Audits: Regular third-party audits by firms such as OpenZeppelin and Trail of Bits help DAOs identify and patch vulnerabilities in vault and treasury management contracts.

-

Automated Risk Monitoring: Tools like Gauntlet provide continuous risk assessment and on-chain analytics, alerting DAOs to protocol risks or abnormal treasury activity in real time.

-

Decentralized Asset Management Platforms: Solutions such as dHEDGE and Enzyme enable DAOs to implement diversified, rules-based strategies and delegate management to vetted professionals with transparent on-chain performance.

-

Insurance Protocols: DAOs often use decentralized coverage providers like Nexus Mutual or InsurAce to insure stablecoin vaults against smart contract exploits or protocol failures.

-

Programmable Treasury Automation: Leveraging programmable stablecoins and platforms such as Superfluid allows DAOs to automate recurring payouts, liquidity rebalancing, and risk controls directly on-chain.

-

AI-Driven Portfolio Optimization: Advanced systems like TrustStrategy use machine learning to dynamically rebalance DAO stablecoin allocations, optimizing yield while maintaining risk-adjusted exposure.

As DAOs scale, the use of structured stablecoin products is on the rise. These products bundle risk-managed yield strategies, insurance coverage, and automated rebalancing, catering to treasuries that demand both capital preservation and reliable growth. Platforms like dHEDGE and TrustStrategy are leading this wave, offering modular vaults that can be tailored to each DAO’s unique risk appetite and mission objectives.

Future-Proofing DAO Treasuries

The next frontier for DAO stablecoin vault optimization lies in cross-chain asset management and AI-driven treasury orchestration. As DAOs expand to new L2s and alternative blockchains, interoperable vaults will enable seamless capital flows and unified risk controls across ecosystems. Machine learning algorithms will further refine portfolio allocation, adapting to market shifts in real-time and unlocking new efficiencies previously unattainable through manual management.

Ultimately, the most successful DAOs will be those that treat treasury management as a living, evolving discipline. By continually iterating on vault strategies, embracing automation, and prioritizing security, DAOs can transform their stablecoin treasuries from passive reserves into dynamic engines of growth and resilience.

For actionable playbooks and protocol comparisons, explore our deep dive on automated yield optimization for DAO treasuries.