For Decentralized Autonomous Organizations (DAOs), market volatility is more than just a headline risk, it’s an existential threat to operational continuity and capital preservation. In 2025, DAO treasuries have become increasingly sophisticated, with stablecoin vaults emerging as a cornerstone of on-chain treasury risk management. These vaults, built atop decentralized finance (DeFi) protocols, allow DAOs to park assets in stablecoins, cryptocurrencies pegged to less volatile assets like the U. S. dollar, while earning yield and maintaining rapid access to funds.

Why Stablecoin Vaults Are Essential for DAO Treasury Protection

Unlike traditional crypto assets such as ETH or BTC, which can swing dramatically in value, stablecoins are engineered to maintain price stability. This is achieved through a combination of collateralization (backing by assets like U. S. Treasuries), algorithmic supply adjustments, and, increasingly, regulatory oversight. For DAOs, this stability is critical. During the early 2025 market downturn, DAO treasuries heavily exposed to volatile tokens saw precipitous declines, while those with robust stablecoin allocations managed to preserve operational runway and avoid forced asset sales at inopportune times.

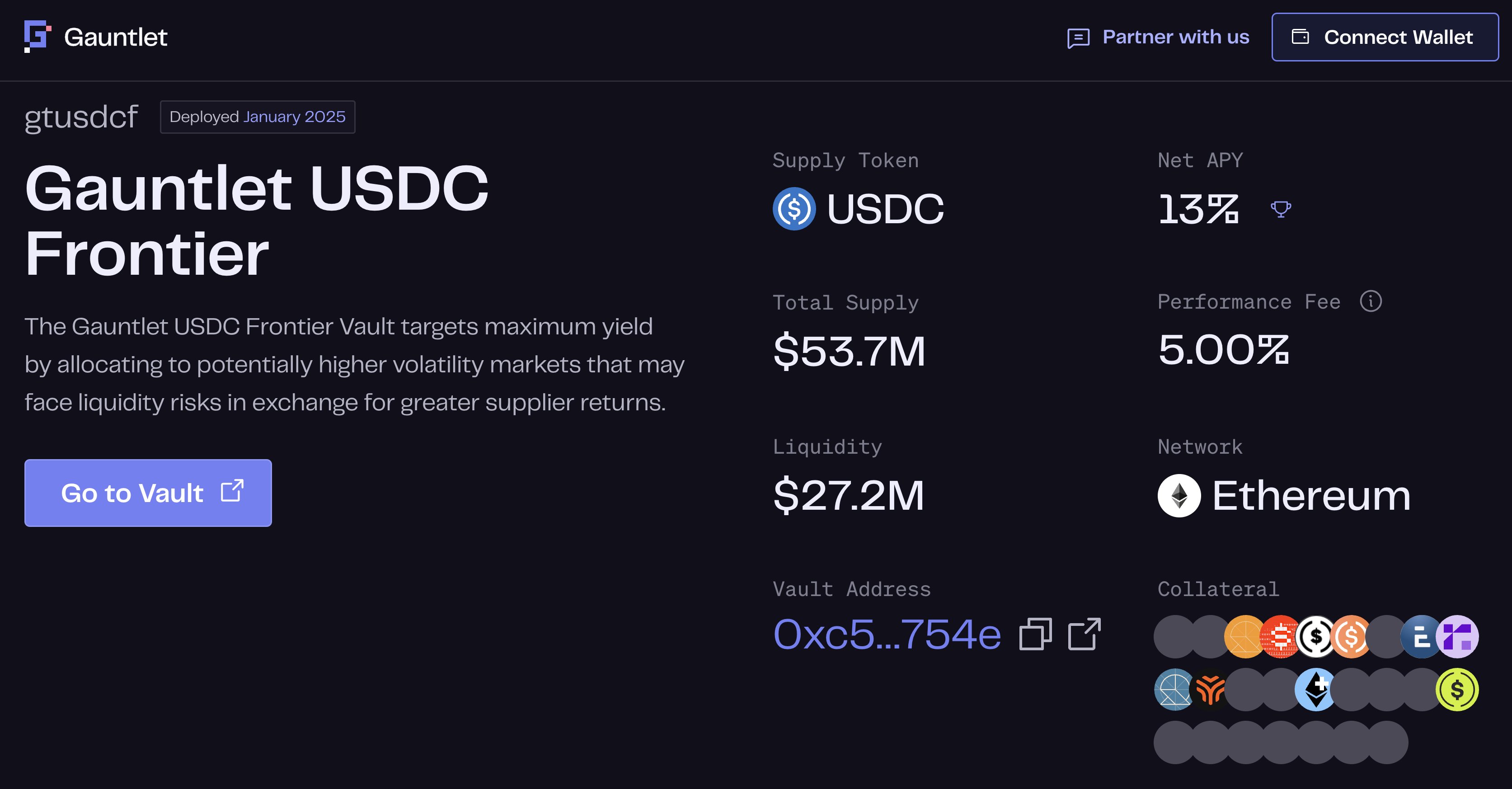

Stablecoin vaults offer a dual advantage: capital protection during market turbulence and yield generation in flat or declining markets. For instance, Gitcoin DAO’s recent proposal to allocate $5 million USDC into a DeFi yield vault managed by Avantgarde targets an annualized return of approximately 10%. This approach not only shields the treasury from crypto market whiplash but also ensures that idle capital is put to productive use. Read more about Gitcoin DAO’s strategy.

Stablecoin Vaults in the Current Macro Environment

The growing prevalence of stablecoins is now intertwined with global financial markets. According to recent research, stablecoin issuers collectively hold $166 billion in U. S. Treasuries, effectively tokenizing money market exposure for crypto-native organizations. This means that DAO treasuries using stablecoin vaults are indirectly benefiting from the same safe-haven assets that anchor traditional finance. However, this linkage is not without its fragilities. As highlighted by the CFA Institute, sudden outflows from stablecoins or collateral sales during high volatility could impact the perceived safety of Treasuries themselves, underscoring the importance of diversified and automated treasury strategies.

Key Benefits and Risks of Stablecoin Vaults for DAO Treasuries

-

Mitigating Market Volatility: Stablecoin vaults allow DAOs to hold assets in stablecoins like USDC or DAI, protecting treasury value from the extreme price swings seen in cryptocurrencies such as ETH or BTC. This stability was crucial during the 2025 crypto downturn, when volatile assets led to significant treasury losses.

-

Generating Yield on Treasury Assets: By depositing stablecoins into DeFi protocols such as Aave or Avantgarde, DAOs can earn interest on their holdings. For example, Gitcoin DAO proposed allocating $5 million USDC to a yield vault targeting an annualized yield of 10%.

-

Enhancing Liquidity and Flexibility: Stablecoin vaults provide DAOs with quick access to funds for operational costs or new investments, without the risk of sudden value drops. This liquidity ensures DAOs can act swiftly in changing market conditions.

-

Smart Contract Vulnerabilities: DeFi vaults rely on smart contracts, which can be exploited if not properly secured. High-profile platforms like Aave and Compound undergo regular audits, but risk remains, making due diligence essential.

-

Stablecoin Depegging Risk: Even established stablecoins such as USDT or DAI can lose their peg to the U.S. dollar under stress. DAOs should diversify among reputable stablecoins and monitor market stability to mitigate this risk.

-

Regulatory Uncertainty: The regulatory landscape for stablecoins is evolving rapidly. Changes in U.S. or global regulations could impact the usability or legality of certain stablecoins, directly affecting DAO treasury strategies.

Mitigating Crypto Market Volatility with Automated Treasury Management

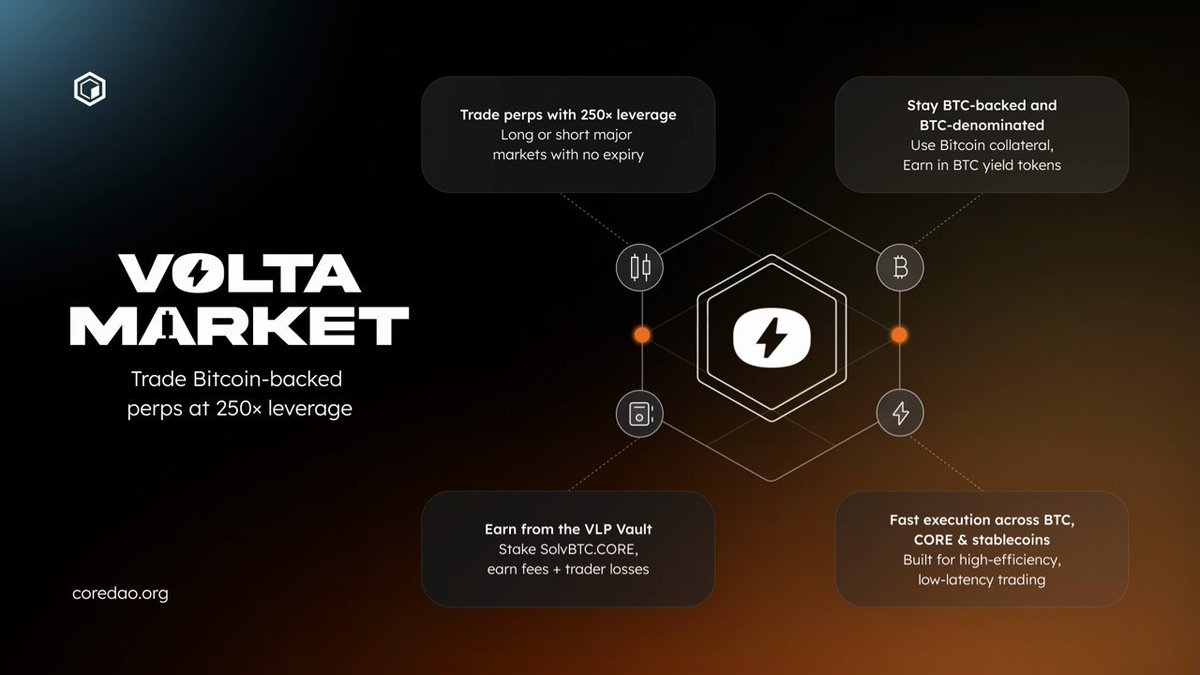

On-chain treasury automation is a game-changer for DAOs seeking to balance risk and opportunity. Automated vaults can rebalance allocations, respond to market signals, and execute governance-approved strategies without manual intervention. This reduces operational overhead and ensures that treasury policies are executed with precision, even during periods of extreme volatility.

Yet, automation is only as strong as the underlying protocols. Smart contract vulnerabilities remain a persistent risk. DAOs must prioritize due diligence, selecting only audited and battle-tested DeFi platforms for their stablecoin vaults. Additionally, no stablecoin is immune to depegging events, as seen in isolated incidents where algorithmic or collateral-backed stablecoins briefly lost their $1 value. Treasury managers should diversify across multiple stablecoins and set automated alerts to monitor peg stability in real time.

By combining stablecoin vaults with on-chain automation, DAOs can achieve a resilient treasury posture, one that preserves value during downturns while remaining agile enough to capitalize on new opportunities as markets recover.

As the digital asset landscape matures, DAOs are learning that treasury diversification strategies are as crucial as ever. Relying solely on a single stablecoin or protocol can expose treasuries to concentration risk. By spreading assets across multiple stablecoins, such as USDC, DAI, and Tether, and leveraging different audited DeFi platforms, DAOs can mitigate the impact of a single-point failure, regulatory event, or depeg scenario. This approach not only strengthens risk management but also enables DAOs to optimize yield by selecting the most competitive and secure vaults available at any given time.

Real-World Lessons and Evolving Best Practices

Recent market events have underscored the need for proactive DeFi risk mitigation. During the early 2025 volatility spike, DAOs with automated on-chain treasury systems were able to swiftly rotate out of riskier assets, preserving capital and avoiding panic-driven losses. Meanwhile, treasuries that lagged in automation or relied on manual intervention often faced delays that proved costly. This real-world stress test has accelerated the adoption of governance frameworks that prioritize automation, risk monitoring, and emergency protocols.

Transparency is another pillar of robust DAO treasury management. On-chain analytics offer real-time visibility into vault balances, yield performance, and protocol exposures, empowering communities to hold treasury managers accountable. This openness builds trust, a critical asset during periods of uncertainty when members want assurance that the organization’s runway and mission are protected.

Checklist: Building a Resilient DAO Treasury with Stablecoin Vaults

Looking ahead, regulatory developments will play a defining role in shaping the stablecoin landscape. As policymakers scrutinize the link between stablecoins and U. S. Treasuries, DAOs must remain agile, ready to adapt their treasury strategies in response to new compliance requirements or market shifts. Staying informed and regularly reviewing protocol risk will be essential to maintaining both security and growth.

Ultimately, stablecoin vaults are more than just a defensive tool against crypto market volatility. When combined with automation, diversification, and rigorous oversight, they become a foundation for sustainable growth and innovation in the DAO ecosystem. By embracing these best practices, DAOs can transform market turbulence from a threat into an opportunity for disciplined, transparent, and efficient treasury management.