Decentralized Autonomous Organizations (DAOs) are rewriting the rules of treasury management, leveraging stablecoin vaults to drive capital efficiency, risk mitigation, and operational transparency. In today’s high-stakes DeFi landscape, the difference between a resilient DAO and one exposed to existential risk often comes down to how intelligently it structures its stablecoin vault strategy. The market is evolving rapidly: DAOs are moving beyond basic multisig wallets and static asset allocations, adopting sophisticated protocols that combine automation, security, and real-time analytics.

Automated Stablecoin Rebalancing Protocols: The New Standard for Asset Optimization

Static allocations are no longer enough. DAOs must dynamically adjust their stablecoin holdings in response to shifting market conditions, protocol risks, and yield opportunities. Implementing automated rebalancing protocols is now best practice for on-chain treasury optimization. Platforms like Aera and TrustStrategy have set the bar by enabling DAOs to delegate rebalancing decisions to decentralized networks or machine learning models. These systems continuously monitor portfolio performance and risk metrics, automatically reallocating assets to maintain target exposures.

This approach not only boosts capital efficiency but also reduces governance overhead – eliminating slow manual interventions that can leave treasuries vulnerable during periods of volatility. For an in-depth look at how automated strategies are transforming DAO vault management, see our dedicated guide.

Security First: Multi-Signature Smart Contracts and Role-Based Access Controls

No matter how advanced your allocation strategy is, it’s only as strong as your security architecture. Utilizing multi-signature smart contracts and robust role-based access controls is non-negotiable for any DAO serious about safeguarding its treasury. Multi-sigs ensure that no single actor can move funds unilaterally – requiring consensus among trusted signers for every transaction.

Role-based access controls add an extra layer of granularity by defining who can propose transactions, approve withdrawals, or adjust vault parameters. This structure helps prevent both external attacks and internal collusion. As highlighted in recent cases of on-chain exploits, even “trustless” systems demand meticulous operational security.

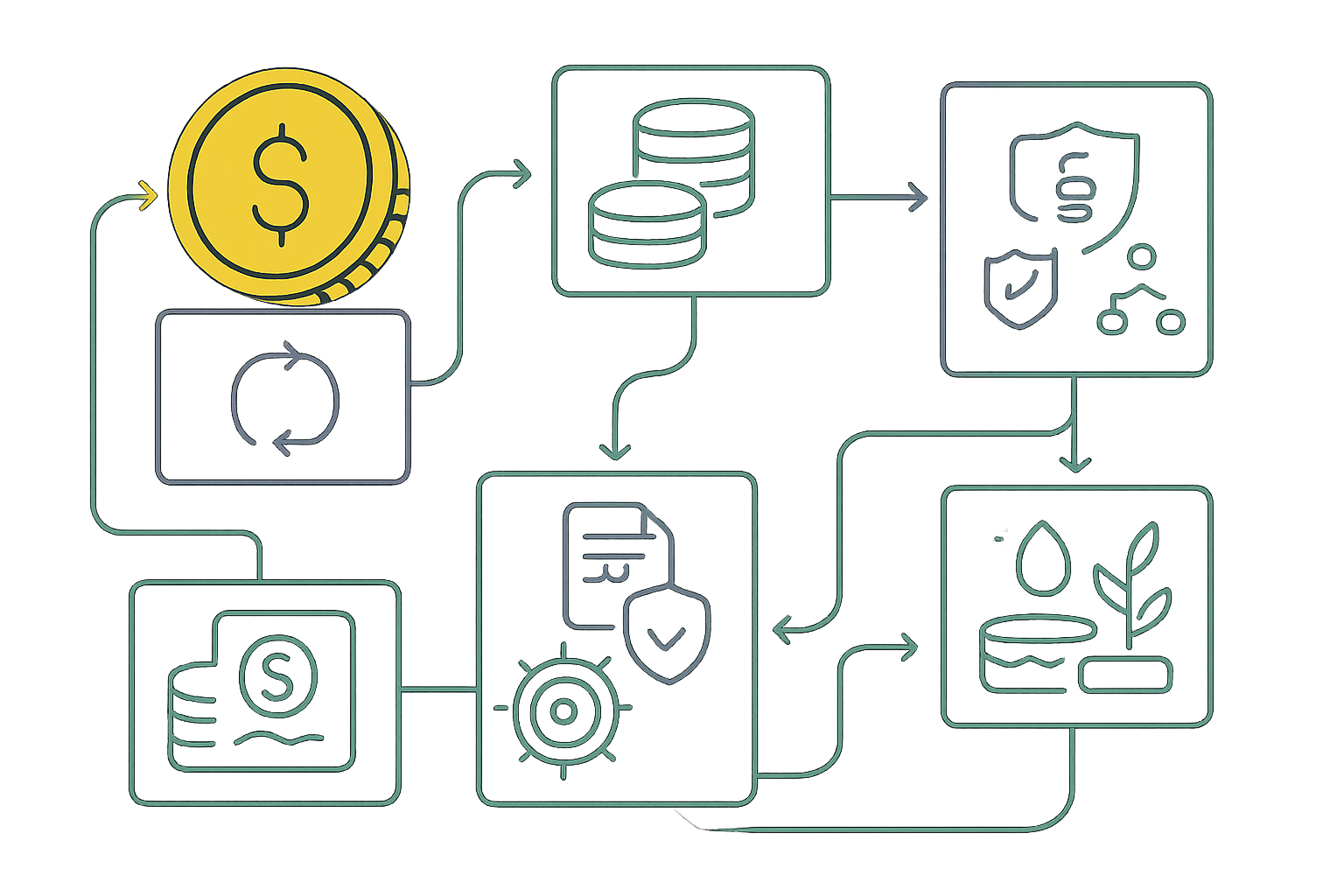

5 Core Strategies for Optimizing DAO Stablecoin Vaults

-

Implement Automated Stablecoin Rebalancing Protocols to Maintain Optimal Asset AllocationLeverage platforms like Aera and TrustStrategy to automate stablecoin rebalancing. These protocols use autonomous or machine learning-driven systems to adjust allocations across stablecoins and DeFi protocols, maximizing capital efficiency while reducing manual governance overhead.

-

Utilize Multi-Signature Smart Contracts and Role-Based Access Controls for Vault SecuritySecure vaults using established multisig solutions like Safe (formerly Gnosis Safe), combined with role-based access controls. This ensures that treasury transactions require multiple approvals and that permissions are clearly defined, significantly reducing the risk of unauthorized access or single points of failure.

-

Diversify Across Multiple Stablecoins and DeFi Yield Platforms to Mitigate Counterparty and Depeg RisksAdopt a diversified approach by allocating assets across stablecoins such as USDC, DAI, and LUSD, and deploying capital to reputable DeFi platforms like Yearn Finance or Avantgarde. This strategy reduces exposure to single-asset failures and enhances yield opportunities.

-

Integrate Real-Time On-Chain Analytics for Treasury Monitoring and Rapid Risk ResponseUtilize analytics tools such as Dune Analytics and Nansen to monitor treasury positions, track protocol health, and receive alerts on abnormal activity. Real-time data empowers DAOs to respond swiftly to market volatility and evolving risks.

-

Establish Transparent, On-Chain Governance for Treasury Allocation and Emergency ActionsImplement governance frameworks using platforms like Aragon or Snapshot to ensure all treasury decisions are transparent, auditable, and community-driven. This approach builds trust and enables rapid, collective action during emergencies.

Diversification Across Stablecoins and Yield Platforms: Managing Counterparty and Depeg Risks

The collapse or depegging of a single stablecoin can devastate an undiversified treasury. That’s why leading DAOs now diversify across multiple stablecoins (USDC, DAI, LUSD) and DeFi yield platforms. This strategy spreads exposure across different issuers and protocols – mitigating counterparty risk while also capturing varied yield streams.

Diversification isn’t just about holding different coins; it’s about deploying assets across lending markets (Aave), liquidity pools (Curve), and managed vaults (Avantgarde) with distinct risk-return profiles. By spreading assets wisely, DAOs can weather market shocks without sacrificing runway or growth potential. For more on diversification frameworks tailored to DAOs, explore our comprehensive analysis.

But diversification alone isn’t enough in the face of rapidly shifting DeFi risk. DAOs must actively monitor their stablecoin vaults to detect depegs, liquidity crunches, or emerging protocol threats before they turn into existential problems. This is where real-time on-chain analytics become indispensable.

Real-Time On-Chain Analytics: Proactive Treasury Monitoring and Risk Response

With millions of dollars often at stake, leading DAOs now integrate real-time on-chain analytics into their treasury workflows. These systems provide continuous visibility into key metrics: stablecoin peg status, protocol health scores, liquidity depths, and cross-chain flows. When a deviation or anomaly is detected, such as a sudden drop in USDC liquidity or an unexpected spike in smart contract risk, the DAO can respond immediately rather than react after losses are realized.

Automated alerting and dashboarding tools empower treasury managers and governance participants to make informed, timely decisions. The ability to visualize exposures and simulate risk scenarios is quickly becoming a baseline requirement for DAO stablecoin vault management. For a closer look at how analytics tools are reshaping treasury oversight, see our deep dive on on-chain monitoring best practices.

On-Chain Governance: Transparency for Treasury Allocations and Emergency Actions

Finally, no vault optimization strategy is complete without robust governance. Establishing transparent, on-chain governance for all treasury allocations and emergency actions ensures that every move, whether routine rebalancing or crisis intervention, is subject to collective oversight.

This doesn’t mean slow-moving bureaucracy. Modern DAOs use modular frameworks that allow for rapid response when needed (such as freezing transfers during a hack), while maintaining full auditability and community input for all major decisions. Emergency powers can be encoded with clear triggers and limitations, bolstering both security and legitimacy.

The most resilient DAOs publish detailed transaction logs, voting records, and rationale for every allocation or emergency action. This level of transparency builds trust with stakeholders and sets the gold standard for decentralized treasury management. For practical guidance on building transparent governance processes around your vaults, check out this resource.

Key Takeaways: Five Strategies Every DAO Should Adopt Now

Top 5 Strategies to Optimize DAO Stablecoin Vaults

-

Implement Automated Stablecoin Rebalancing Protocols to Maintain Optimal Asset AllocationLeverage autonomous platforms like Aera or TrustStrategy to automate rebalancing of stablecoin holdings. These solutions use decentralized networks and machine learning to dynamically adjust allocations, maximizing capital efficiency and reducing manual intervention.

-

Utilize Multi-Signature Smart Contracts and Role-Based Access Controls for Vault SecurityAdopt established tools such as Gnosis Safe for multi-signature wallets and integrate role-based access controls. This ensures that treasury movements require multiple approvals and specific permissions, significantly mitigating internal and external security risks.

-

Diversify Across Multiple Stablecoins and DeFi Yield Platforms to Mitigate Counterparty and Depeg RisksAllocate assets across leading stablecoins like USDC, DAI, and LUSD, and deploy capital into reputable DeFi protocols such as Yearn or dHEDGE. This strategy reduces exposure to single points of failure and enhances yield generation.

-

Integrate Real-Time On-Chain Analytics for Treasury Monitoring and Rapid Risk ResponseImplement analytics platforms like DeBank or Nansen to monitor treasury assets, track portfolio health, and detect anomalies in real time. This empowers DAOs to respond swiftly to market volatility or protocol risks.

-

Establish Transparent, On-Chain Governance for Treasury Allocation and Emergency ActionsUtilize governance frameworks such as Aragon or Snapshot to enable transparent, community-driven decision-making for treasury allocation and rapid response to emergencies. This ensures accountability and broad stakeholder engagement.

The future of DAO stablecoin vault management lies at the intersection of automation, security, diversification, analytics, and transparent governance. By implementing these five strategies:

- Automated rebalancing protocols

- Multi-signature smart contracts with role-based controls

- Diversification across stablecoins and yield platforms

- Real-time on-chain analytics

- Transparent on-chain governance mechanisms

DAOs can dramatically enhance capital efficiency while minimizing operational risk, even as market conditions evolve unpredictably.

The most successful DAOs treat their stablecoin vaults not as static coffers but as dynamic engines for growth and resilience.