Stablecoin vaults have rapidly become the cornerstone of DAO treasury management, offering a blend of capital preservation, yield optimization, and operational transparency. As DAOs seek to balance risk and growth, the emergence of automated yield strategies within stablecoin vaults is redefining how decentralized organizations manage and grow their on-chain assets. The latest innovations in vault automation, including dynamic allocation and AI-driven rebalancing, are enabling DAOs to capture market-leading yields while maintaining robust risk controls.

Why Stablecoin Vaults are Essential for Modern DAOs

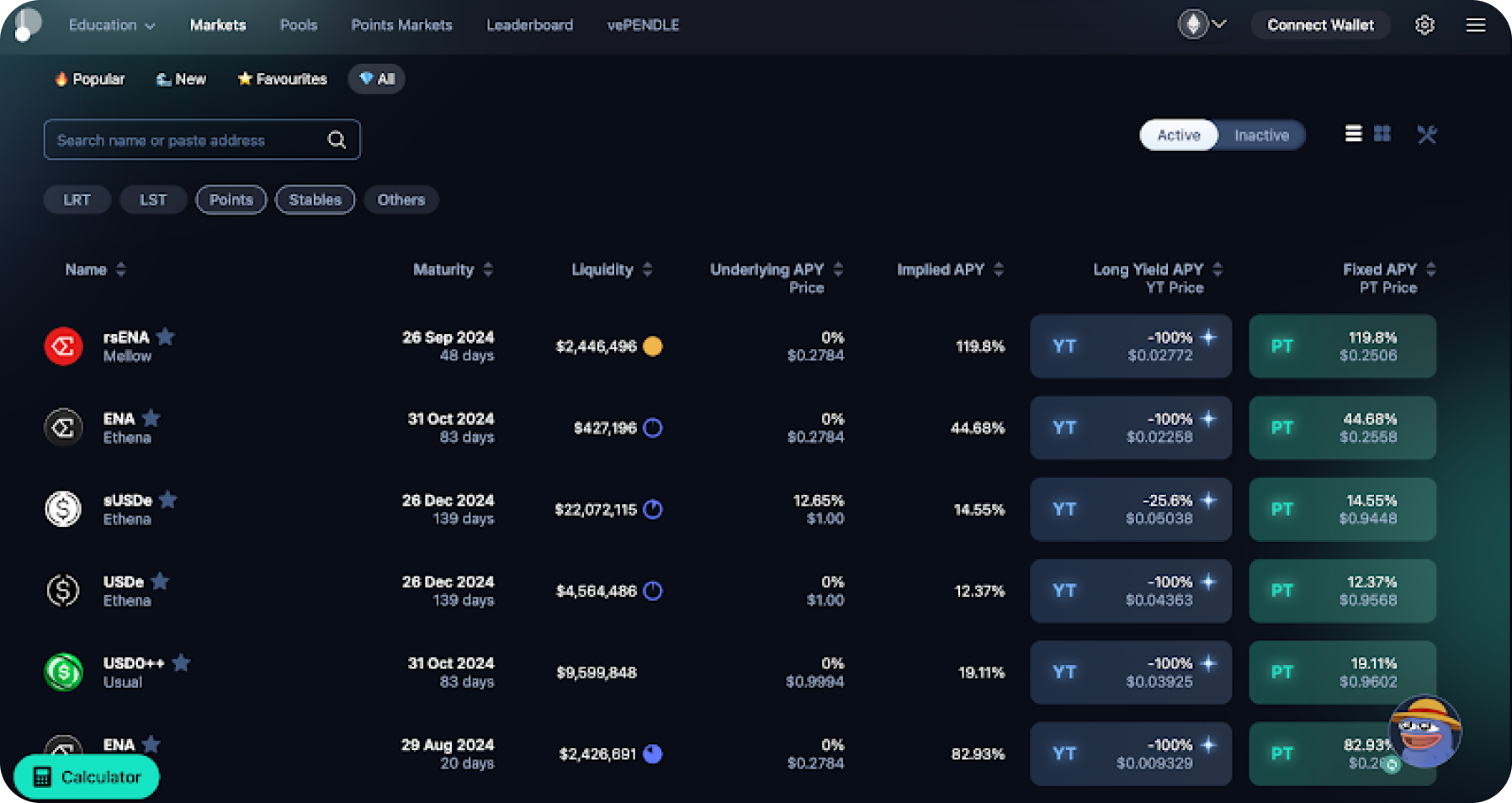

In 2025, the landscape for DeFi stablecoin yield has matured, with platforms like Aave V3, Pendle Finance, and Yearn Finance setting the benchmark for safety and returns. For example, Aave V3 currently offers a 4.67% APY on USDC with the highest safety rating, while Pendle provides up to 13.58% fixed yields through innovative yield trading. These rates are not just attractive, they are accessible at scale thanks to automated vaults that integrate seamlessly with leading protocols.

The core advantage of stablecoin vaults lies in their ability to automate complex strategies that would otherwise require continuous manual intervention. By deploying assets into non-custodial, smart contract-driven vaults, DAOs can:

- Auto-compound returns for exponential growth

- Dynamically rebalance between protocols as conditions shift

- Mitigate risk through real-time analytics and AI-powered monitoring

- Maintain liquidity for operational flexibility

This automation is transforming how treasuries operate, shifting the focus from manual yield chasing to strategic, risk-adjusted growth. For a detailed breakdown of top-performing vault strategies, see our dedicated guide.

Automated Yield Strategies: How Do They Work?

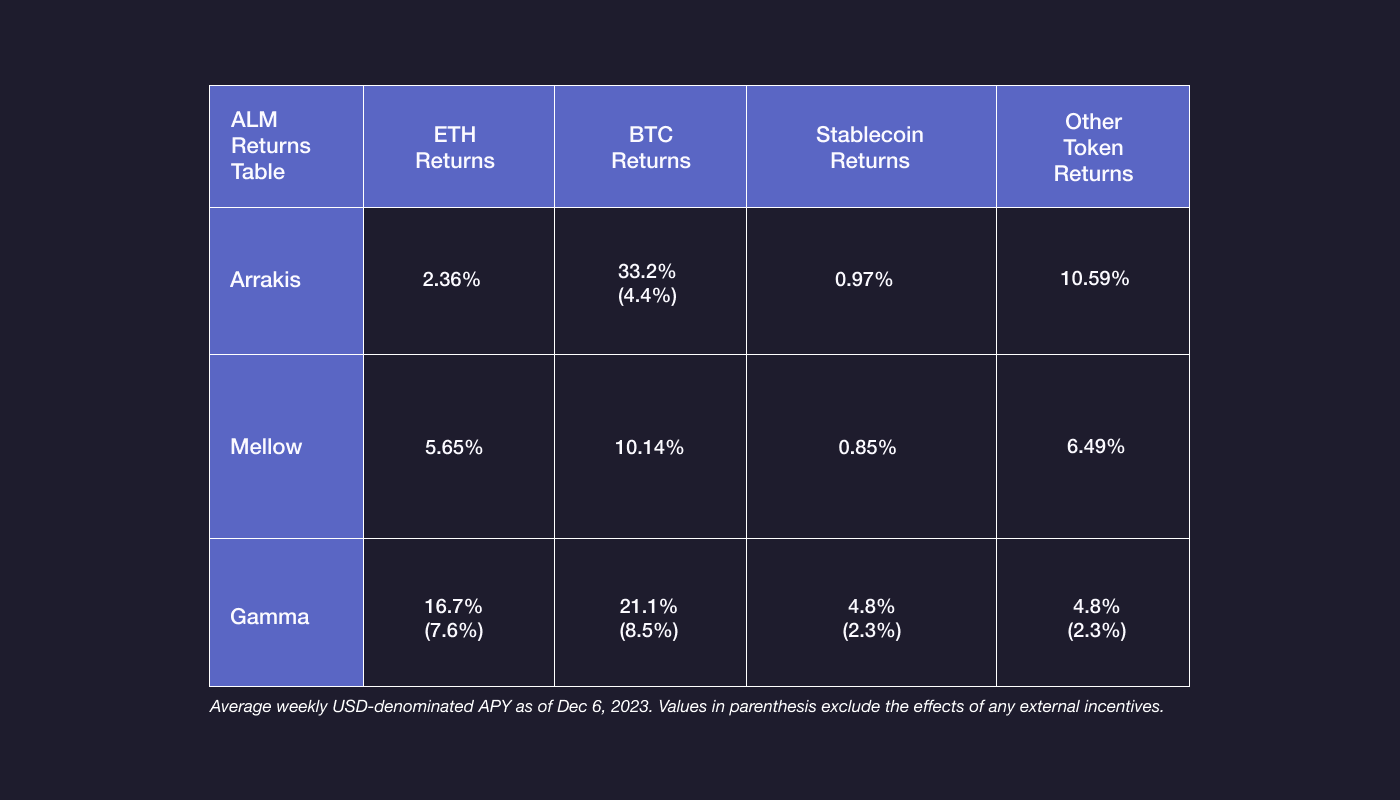

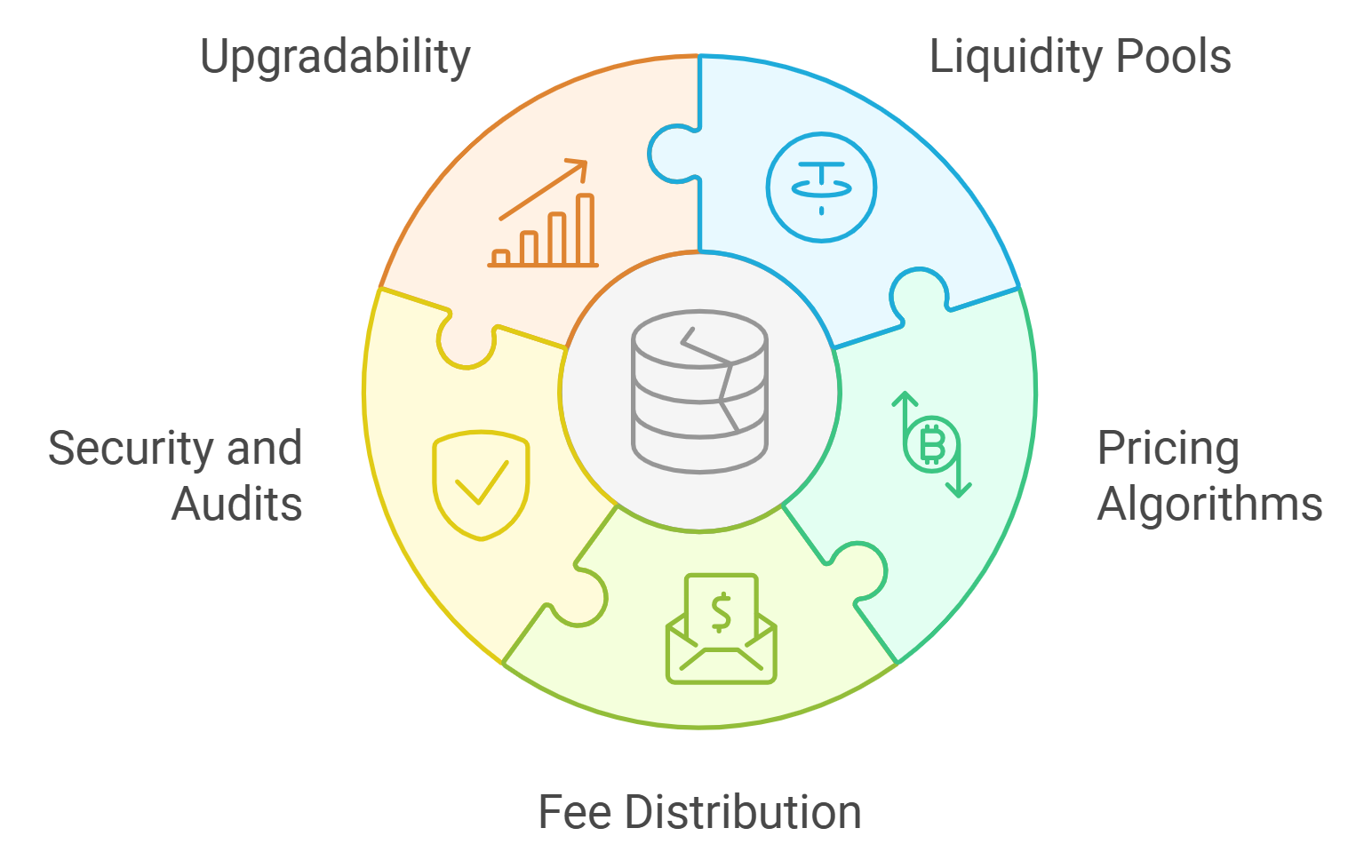

Automated yield strategies in stablecoin vaults leverage smart contracts and advanced algorithms to optimize returns. These systems continuously scan the DeFi landscape for the highest-yielding, safest opportunities, allocating DAO stablecoins accordingly. For instance, Aera’s Stablecoin Yield strategy uses a Guardian mechanism to monitor and rebalance allocations across Compound, Aave, and Morpho, maximizing risk-adjusted yields while ensuring liquidity and asset safety.

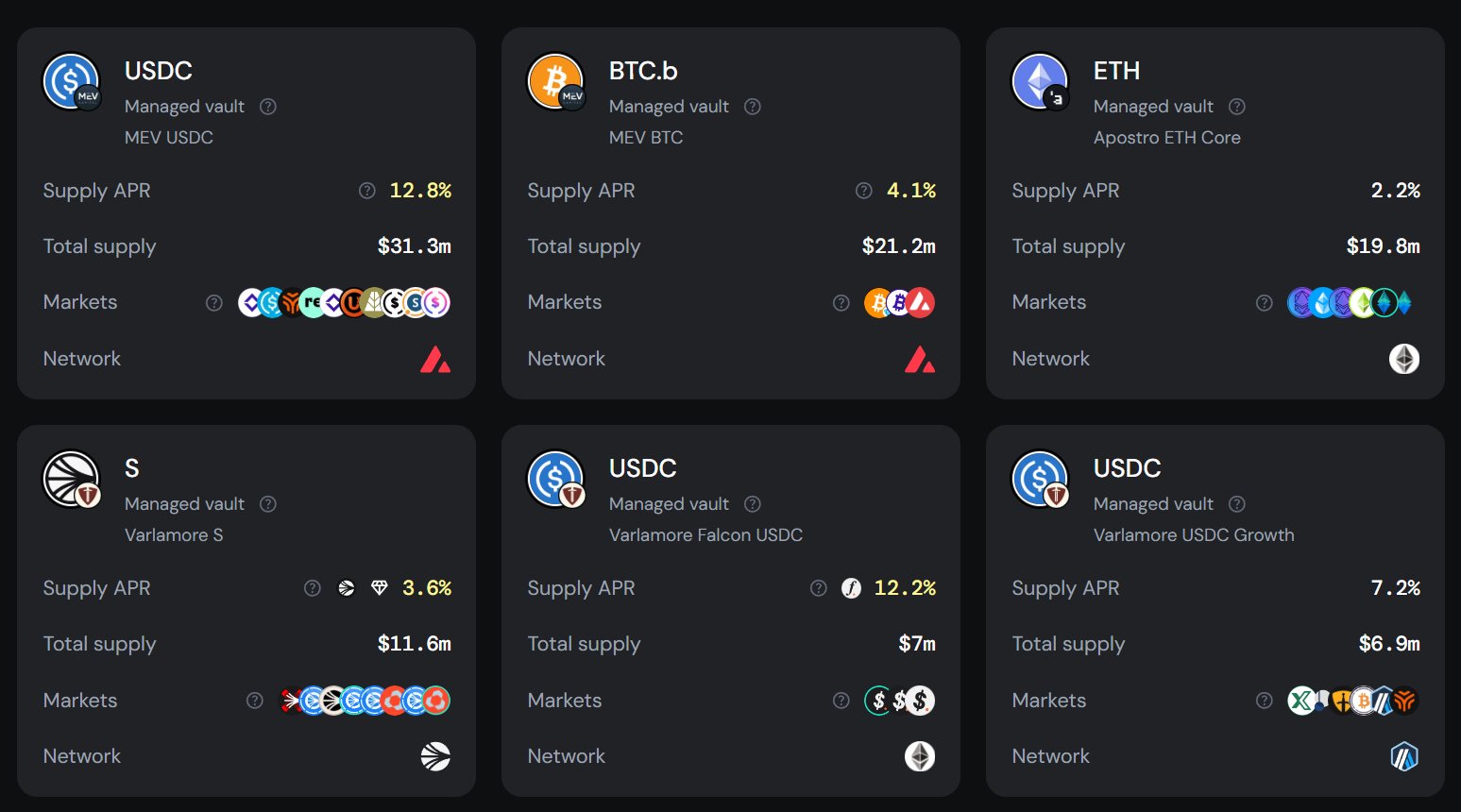

Similarly, Stability DAO’s USDC vault on Silo Finance offers up to 13% APY on USDC deposits, with auto-compounding features powered by Silo V2’s farm strategy. This not only streamlines yield optimization but also reduces operational overhead for DAO treasury managers. By automating farming strategies, DAOs can capture rewards efficiently without needing to manually harvest and reinvest returns, an essential feature for scaling treasury operations.

Leading Platforms and Their Distinct Approaches

The competitive landscape in 2025 is defined by a handful of best-in-class platforms:

Top 5 Stablecoin Vault Platforms for DAOs in 2025

-

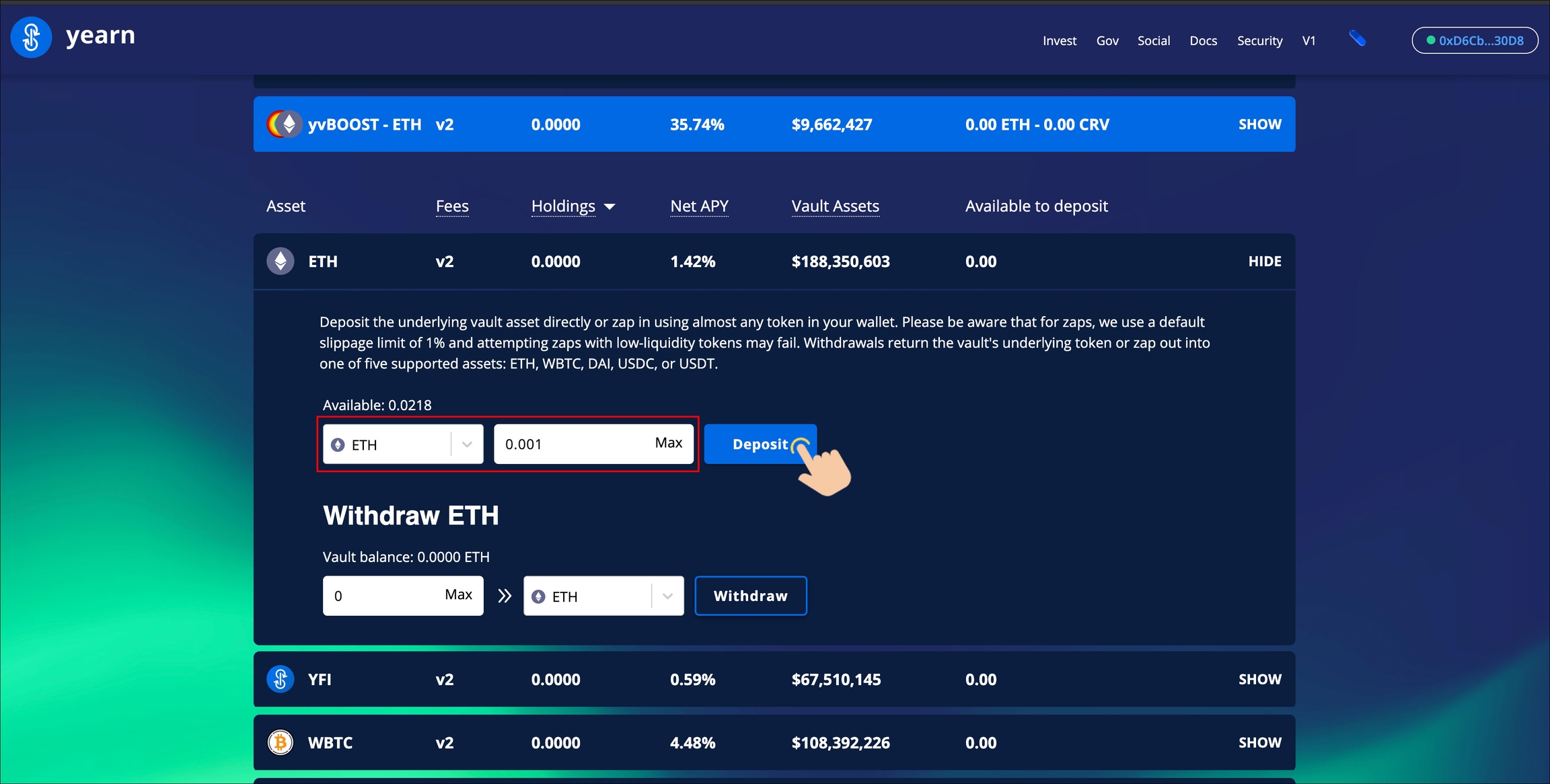

Yearn Finance — Renowned for its blue-chip DeFi auto-compounding vaults, Yearn Finance deploys stablecoins into the highest-yielding strategies using AI-driven optimization. Its automated vaults enable DAOs to maximize passive income while maintaining high liquidity and risk management.

-

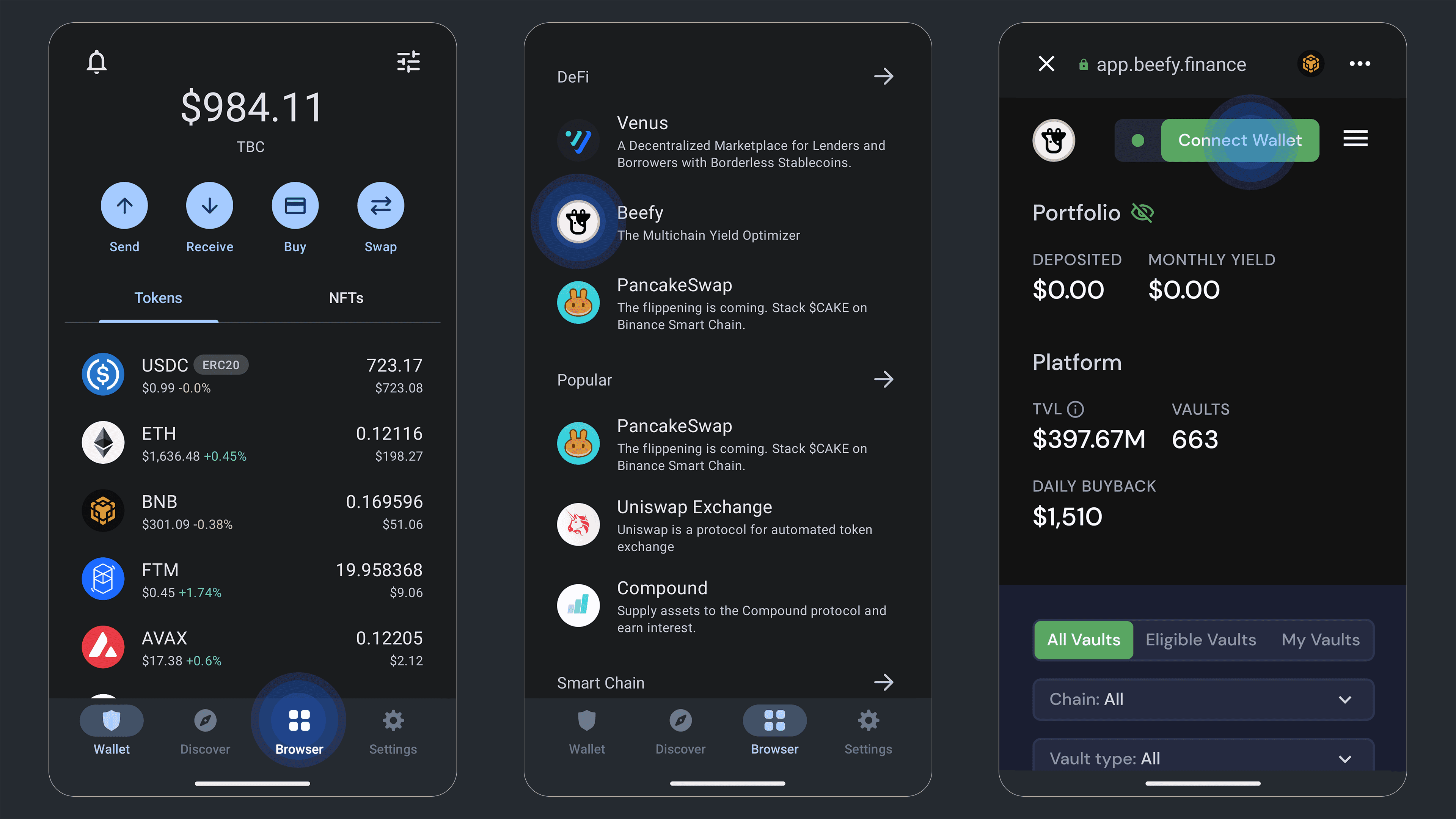

Beefy — As a leading multichain auto-compounder, Beefy offers DAOs access to stablecoin vaults across multiple blockchains. Its smart contracts automatically reinvest yields, optimizing returns and simplifying treasury management for decentralized organizations.

-

Pendle — Pendle specializes in fixed yield and yield trading for stablecoins. DAOs can lock in predictable returns or trade future yield streams, leveraging Pendle’s innovative protocol to manage risk and optimize treasury performance.

-

Aera — Aera’s autonomous vaults dynamically rebalance stablecoin allocations across platforms like Compound, Aave, and Morpho. Its Guardian system continuously monitors risk and adjusts strategies, ensuring DAOs achieve optimal, risk-adjusted yields with high transparency.

-

Silo Finance — Silo Finance’s USDC vaults offer up to 13% APY for DAOs, featuring automated compounding and additional rewards via Silo V2 farm strategies. Its non-custodial design and streamlined automation make it a top choice for treasury yield optimization.

Yearn Finance, for example, remains the go-to for blue-chip DeFi auto-compounding strategies, leveraging AI and real-time analytics for optimal rebalancing. Pendle Finance stands out for offering fixed yields and innovative yield trading opportunities, appealing for DAOs seeking predictable returns on their stablecoin reserves. Meanwhile, Aera’s autonomous vaults dynamically rebalance portfolios based on market conditions and risk exposure, providing a robust layer of security and adaptability.

For a comprehensive analysis of how these platforms are revolutionizing on-chain treasury management, visit this in-depth resource.

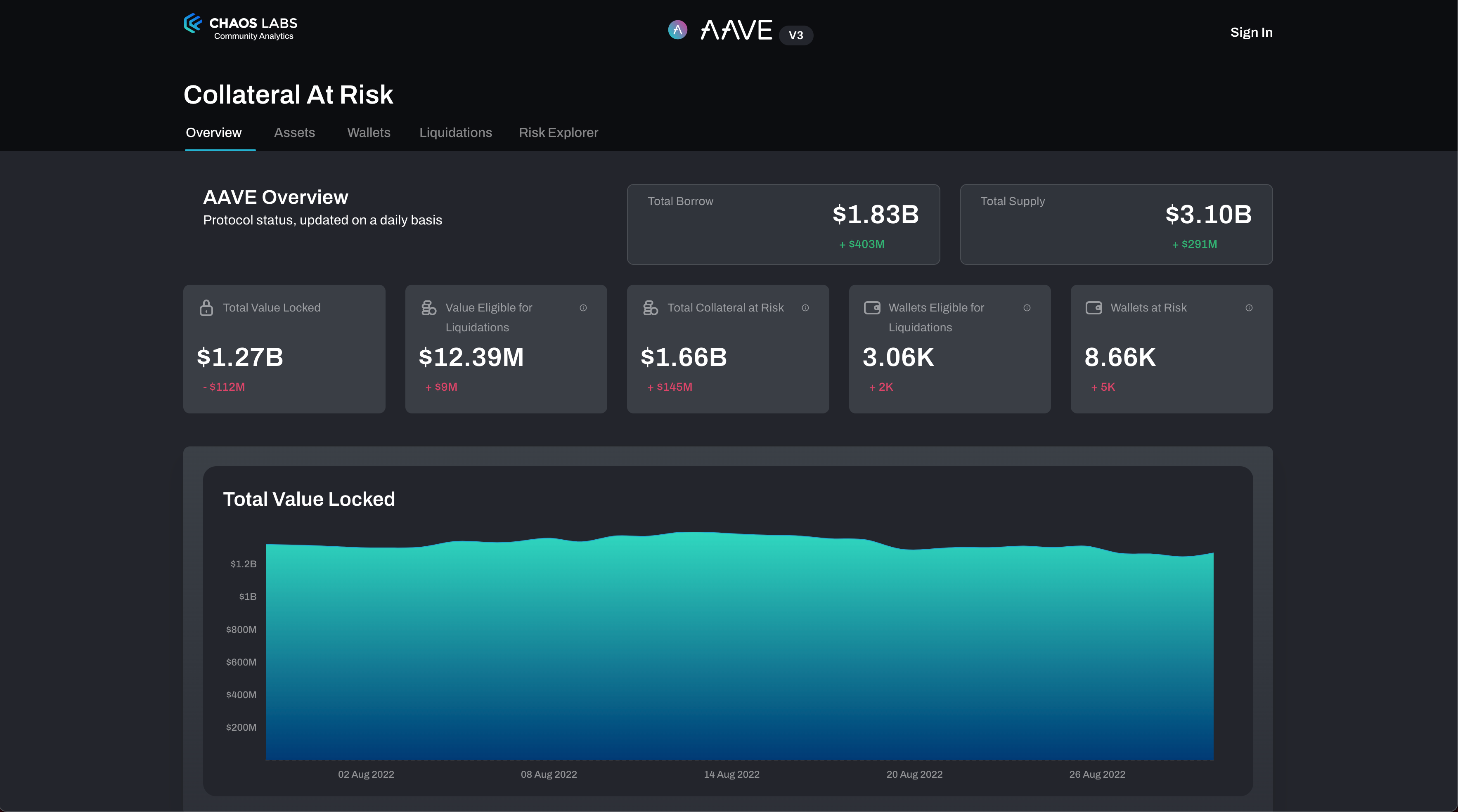

Risk management remains a defining factor in the success of any DAO treasury strategy. Automated stablecoin vaults are engineered with embedded risk controls, such as real-time monitoring of protocol health, collateralization ratios, and liquidity metrics. For instance, Aera’s Guardian system not only reallocates assets for yield but also conducts frequent stress tests and market condition assessments to preemptively flag risks. These features are critical for DAOs seeking to avoid black swan events and ensure uninterrupted capital efficiency.

Transparency is another cornerstone of modern vault automation. Leading protocols publish detailed analytics dashboards, offering DAOs granular visibility into portfolio allocations, yield sources, and real-time APY performance. This transparency fosters trust among DAO members and stakeholders, aligning with the core ethos of decentralized governance. Additionally, open-source smart contracts allow for community audits, further mitigating operational risk. For DAOs prioritizing robust risk controls, this guide explores best practices in on-chain treasury risk management.

Maximizing Yield Without Sacrificing Security

While yield optimization is a primary driver, security cannot be compromised. The most successful DAOs employ a layered approach: distributing stablecoins across multiple vaults, diversifying exposure to different protocols, and setting automated withdrawal triggers based on predefined risk thresholds. This ensures that even in the event of protocol-specific issues, treasury assets remain protected and liquid.

To illustrate, a DAO might allocate a portion of its USDC to Aave V3 for steady 4.67% APY, another tranche to Pendle Finance for up to 13.58% fixed yield, and the remainder to auto-compounding strategies on Yearn Finance. Automated vaults execute these allocations with precision, rebalancing as market conditions evolve or as new opportunities emerge. The result is a resilient, high-performing treasury that can adapt to both bull and bear cycles.

Operational Considerations for DAO Treasury Managers

Implementing automated stablecoin vaults is not a set-and-forget process. Treasury managers must regularly review vault performance, audit smart contract updates, and stay informed about evolving DeFi risks. Many DAOs now form dedicated treasury committees or engage third-party security auditors to oversee these processes. The combination of automation and human oversight creates a feedback loop that enhances both yield and safety.

Looking ahead, the integration of AI-driven analytics, cross-chain yield strategies, and modular automation tools will further empower DAOs to optimize capital allocation. As stablecoin vault infrastructure matures, expect to see more sophisticated features such as automated insurance coverage, dynamic fee optimization, and real-time governance triggers that respond instantly to market volatility.

Best Practices for Managing Automated Stablecoin Vaults

-

Prioritize Risk Assessment and Diversification: Regularly evaluate the risk profiles of integrated protocols (such as Aave V3, Compound, and Morpho) and diversify stablecoin allocations across multiple platforms to mitigate exposure to smart contract or liquidity risks.

-

Leverage Automated Yield Aggregators: Utilize established platforms like Yearn Finance and Pendle for auto-compounding and dynamic rebalancing, ensuring stablecoins are always deployed in the highest-yielding, risk-adjusted strategies.

-

Implement Transparent Reporting and Monitoring: Adopt real-time analytics tools and on-chain dashboards to track vault performance, APYs (e.g., 13% APY on USDC via Silo Finance), and strategy allocations, enhancing transparency for DAO stakeholders.

-

Maintain High Liquidity and Withdrawal Flexibility: Select vaults and protocols that offer high liquidity and flexible withdrawal terms, such as Stability DAO’s USDC vault on Silo Finance, to ensure treasury funds remain accessible for operational needs.

-

Regularly Update and Audit Smart Contracts: Schedule frequent audits and updates for all vault-related smart contracts, leveraging third-party security services to safeguard DAO assets against vulnerabilities.

The Road Ahead: Evolving Standards for On-Chain Treasury Optimization

The convergence of automation, transparency, and advanced risk management in stablecoin vaults is setting new standards for on-chain treasury optimization. DAOs that embrace these innovations are not only securing higher yields but also establishing resilient financial frameworks capable of withstanding market shocks. For organizations seeking to future-proof their treasuries, staying at the forefront of vault automation is essential.

To explore more about how stablecoin vaults are reshaping DAO treasury management and discover actionable strategies, visit our comprehensive analysis.