Stablecoin vaults have become the backbone of modern DAO treasury management, enabling organizations to optimize yield, preserve liquidity, and automate risk controls on-chain. In 2024, the DeFi landscape offers a curated suite of advanced stablecoin strategies tailored for DAOs that demand both capital efficiency and robust security. This article breaks down the top five stablecoin vault strategies for DAOs to maximize on-chain yield, minimize operational drag, and ensure resilient treasury operations in volatile markets.

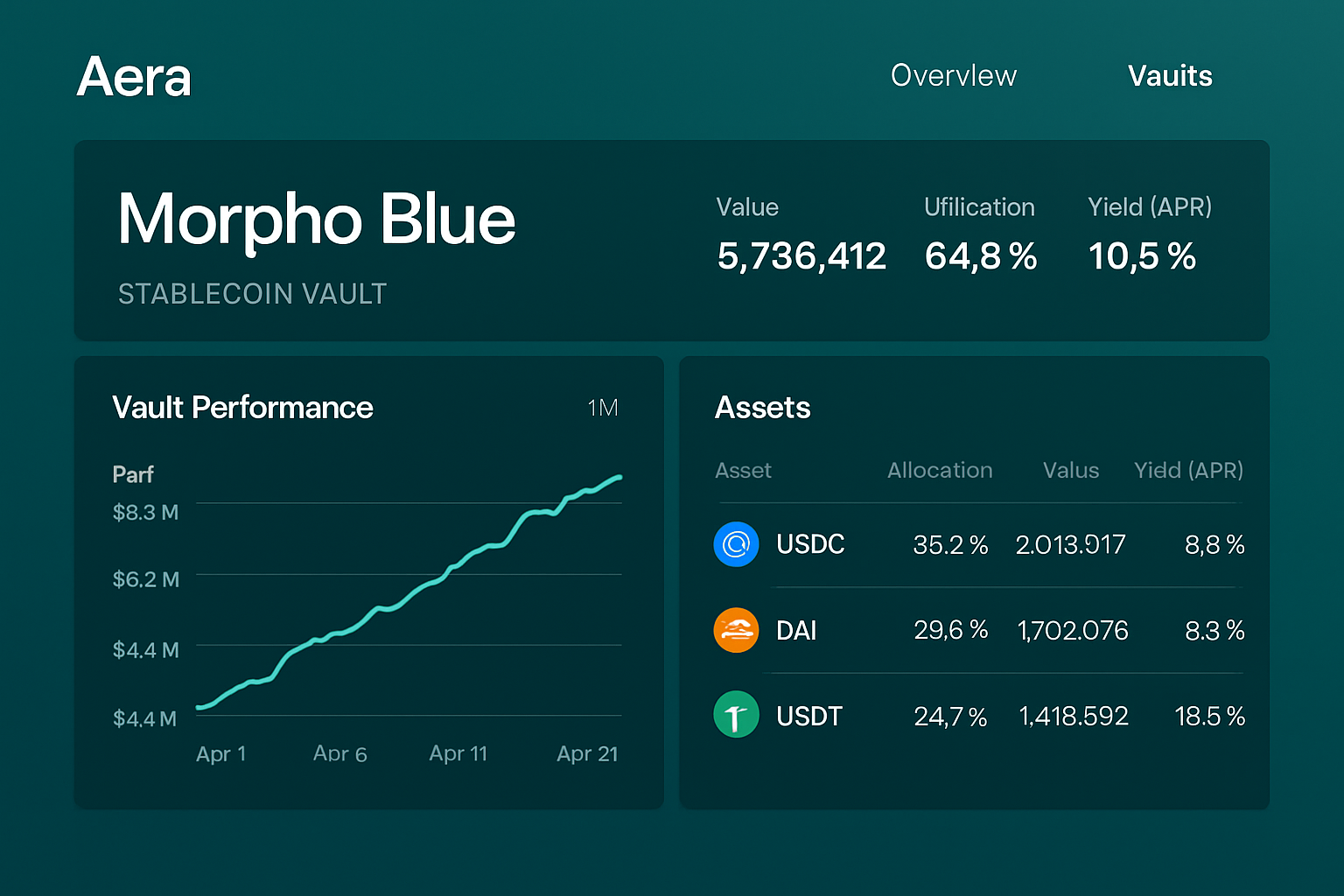

1. Diversified Stablecoin Lending via Aera and Morpho Blue Vaults

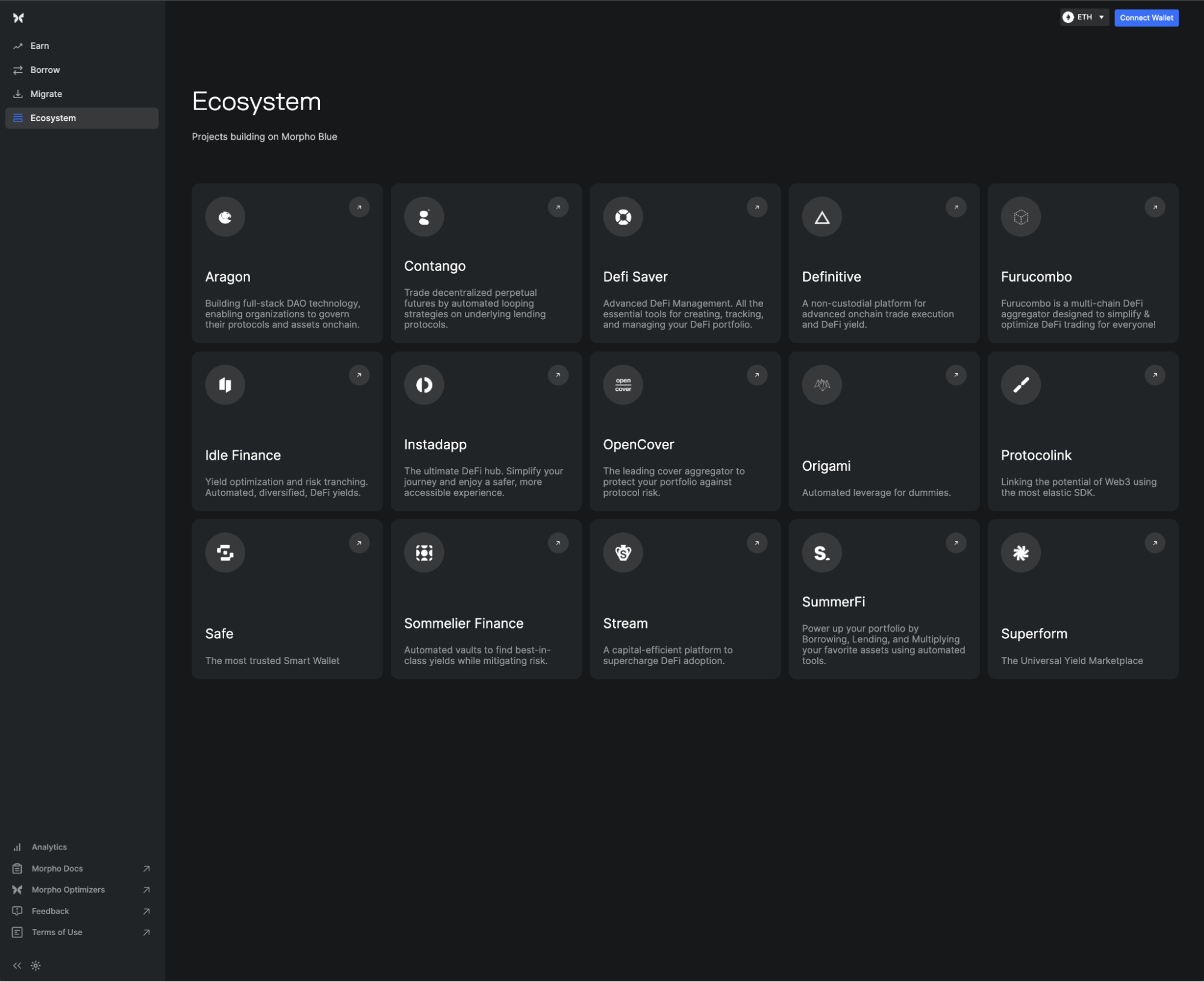

Diversification is fundamental for any DAO treasury seeking to balance returns with risk mitigation. Aera’s autonomous vaults and Morpho Blue’s isolated lending pools provide DAOs with modular exposure across multiple DeFi protocols and counterparties. Aera automates rebalancing between top-tier lending venues like Aave, Compound, and Morpho itself, allocating funds dynamically based on real-time APY spread analysis. Morpho Blue further refines this approach by allowing custom risk parameters and direct peer-to-peer matching, eliminating idle liquidity while enhancing capital efficiency.

In practice, DAOs leveraging these platforms can capture yields ranging from 2% to 4% APY (for USDC as of Q4 2024) while maintaining granular control over counterparty risk. The result: a diversified lending stack that maximizes yield without sacrificing safety or transparency.

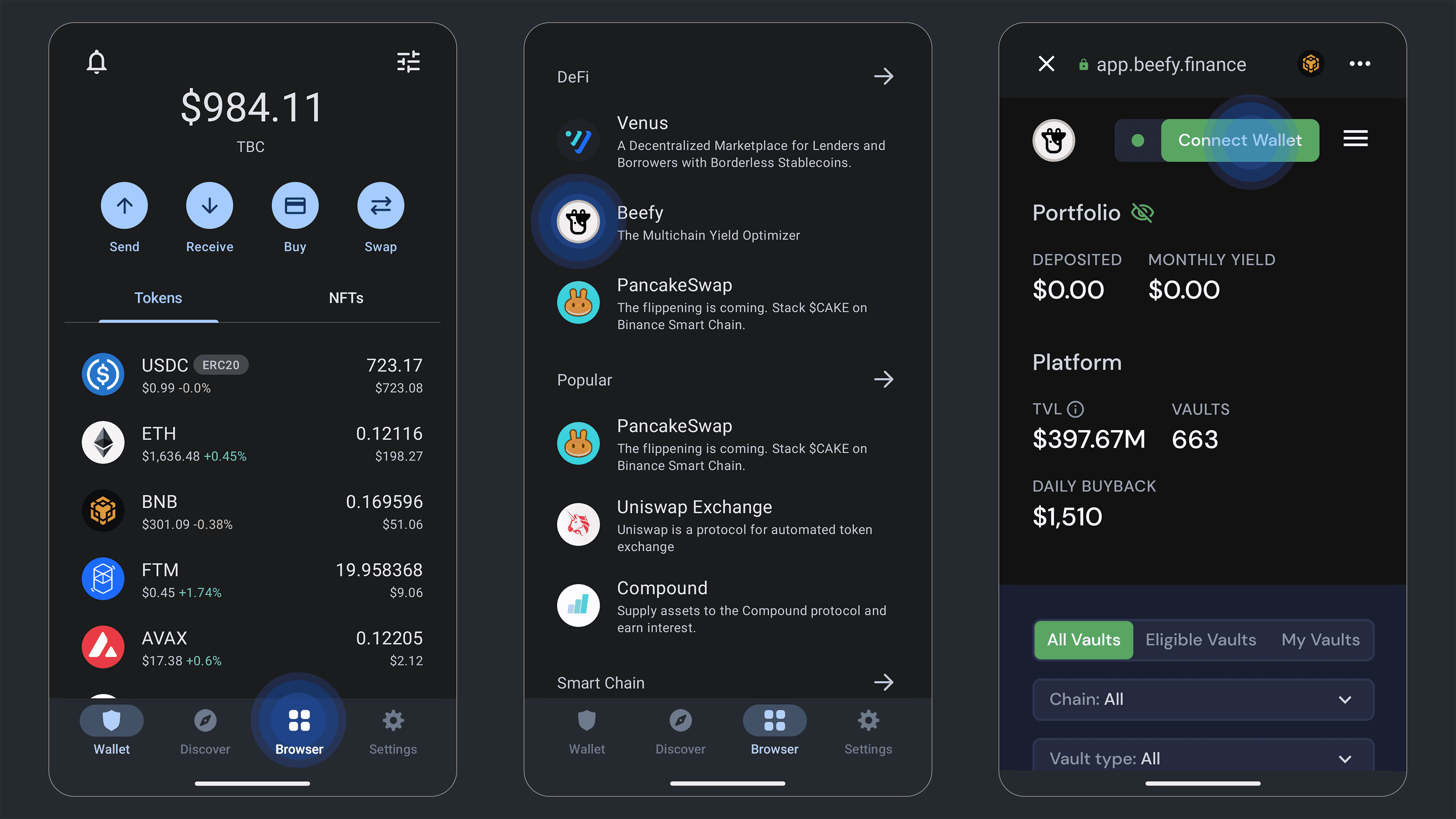

2. Automated Yield Optimization with Yearn and Beefy Stablecoin Vaults

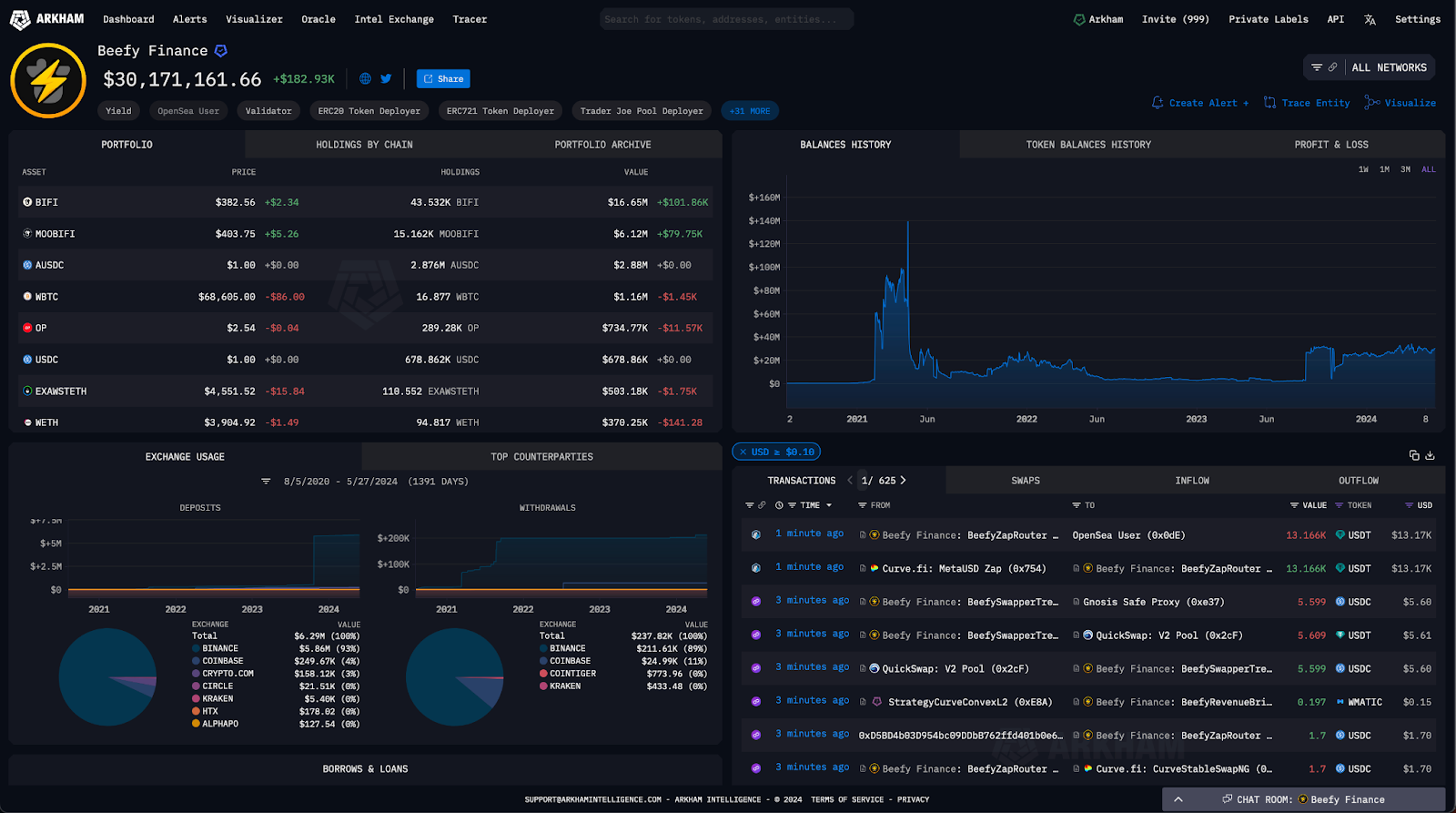

The complexity of modern DeFi means that manual strategy rotation is no longer viable for most DAOs. Automated yield optimizers like Yearn Finance and Beefy Finance are essential tools for DAOs aiming to maximize passive stablecoin returns while minimizing human error and transaction costs.

These protocols aggregate user deposits into smart contract vaults that auto-compound rewards, rebalance allocations across high-performing pools (e. g. , Aave, Curve), and harvest incentives in real time. For example, Yearn’s USDC vault might shift capital between Curve’s stableswap pool and Compound’s lending market based on live APY feeds, ensuring optimal deployment at all times. Beefy extends this automation to multi-chain environments, broadening access to emerging yield sources as they arise.

Top 5 Automated Stablecoin Vault Strategies for DAOs

-

Diversified Stablecoin Lending via Aera and Morpho Blue Vaults: Aera and Morpho Blue enable DAOs to lend stablecoins across isolated pools and dynamically rebalance allocations for optimal yield. These platforms utilize real-time on-chain data and credit scoring, enhancing both capital efficiency and risk management.

-

Automated Yield Optimization with Yearn and Beefy Stablecoin Vaults: Yearn and Beefy automate yield farming by reallocating stablecoin deposits across top DeFi protocols like Aave, Compound, and Curve. Their smart contract vaults continuously seek the highest risk-adjusted returns, minimizing manual oversight for DAOs.

-

Risk-Managed Exposure to Real-World Asset (RWA) Stablecoin Vaults (e.g., Ondo, MakerDAO’s Spark): Platforms like Ondo Finance and MakerDAO’s Spark Protocol offer stablecoin vaults backed by tokenized U.S. Treasury Bills and other real-world assets. These vaults provide DAOs with access to institutional-grade yields (Ondo T-Bills: 5.2%–7.1% APY) while maintaining on-chain transparency and compliance.

-

Liquidity Provision in Low-Impermanent-Loss Stablecoin Pools (Curve, Uniswap v3 Concentrated Liquidity): DAOs can supply stablecoins to pools on Curve and Uniswap v3, benefiting from low impermanent loss and earning swap fees. Curve’s efficient stablecoin pools and Uniswap’s concentrated liquidity model maximize capital efficiency and passive income.

-

Utilizing Automated Rebalancing Protocols for Dynamic Treasury Allocation (Balancer Smart Vaults, Enzyme Finance): Balancer Smart Vaults and Enzyme Finance allow DAOs to automate portfolio rebalancing based on predefined rules or market triggers. This dynamic allocation helps maintain target risk/yield profiles and reduces operational overhead.

3. Risk-Managed Exposure to Real-World Asset (RWA) Stablecoin Vaults

The integration of real-world assets (RWAs) into DeFi has unlocked new frontiers in risk-adjusted yield for DAOs holding significant stablecoin reserves. Platforms such as Ondo Finance offer tokenized U. S. Treasury Bill vaults with yields currently ranging from 5.2% to 7.1% APY, providing a compelling alternative to purely crypto-native strategies.

Ondo’s institutional-grade approach, complete with audited statements and KYC-compliant access points, makes it attractive for larger treasuries prioritizing regulatory clarity alongside performance. Meanwhile, MakerDAO’s Spark Protocol delivers sDAI, a passive savings solution accruing interest from DAI Savings Rate (DSR) mechanics, offering seamless integration with both DeFi-native and RWA-backed strategies.

Together, these RWA-focused solutions enable DAOs to diversify into off-chain yield streams without leaving the programmable security of Ethereum-based infrastructure.

4. Liquidity Provision in Low-Impermanent-Loss Stablecoin Pools

For DAOs prioritizing both yield and capital preservation, providing liquidity to stablecoin pools with minimal impermanent loss is a proven strategy. Protocols like Curve Finance and Uniswap v3 (with concentrated liquidity) have set the industry standard for efficient, low-risk stablecoin swaps. Curve’s stableswap model allows DAOs to earn swap fees and protocol incentives by supplying liquidity to pools such as USDC/DAI or FRAX/sDAI, with historical yields often surpassing 3% APY in optimal market conditions.

Uniswap v3 takes this further by letting DAOs define tight price ranges for their stablecoin pairs, concentrating capital where most trades occur and minimizing exposure to volatility. This targeted approach reduces impermanent loss and boosts fee income per dollar deployed, especially during periods of high on-chain volume.

Top 5 Stablecoin Vault Strategies for DAO Treasuries (2024)

-

Diversified Stablecoin Lending via Aera and Morpho Blue Vaults: Deploy treasury assets into Aera and Morpho Blue lending vaults to access dynamic, cross-protocol yield and isolated lending markets. These platforms enable automated rebalancing and risk-adjusted returns, optimizing stablecoin allocation for maximum on-chain yield.

-

Automated Yield Optimization with Yearn and Beefy Stablecoin Vaults: Leverage Yearn and Beefy vaults to automate stablecoin yield farming. These protocols route funds across top DeFi platforms (like Aave, Compound, and Curve) to capture the best rates, reducing manual overhead for treasury managers.

-

Risk-Managed Exposure to Real-World Asset (RWA) Stablecoin Vaults (e.g., Ondo, MakerDAO’s Spark): Allocate stablecoins to tokenized RWA vaults such as Ondo Finance and MakerDAO’s Spark Protocol. These strategies offer exposure to U.S. Treasury Bills and other real-world assets, providing yield (Ondo T-Bills: 5.2%–7.1% APY) with robust compliance and transparency.

-

Liquidity Provision in Low-Impermanent-Loss Stablecoin Pools (Curve, Uniswap v3 Concentrated Liquidity): Provide liquidity to stablecoin pools on Curve Finance and Uniswap v3. These pools are engineered for minimal impermanent loss and high capital efficiency, making them ideal for DAOs seeking stable, fee-driven returns.

-

Utilizing Automated Rebalancing Protocols for Dynamic Treasury Allocation (Balancer Smart Vaults, Enzyme Finance): Employ Balancer Smart Vaults and Enzyme Finance to automate treasury allocation across multiple stablecoin strategies. These protocols enable customizable rebalancing rules and real-time portfolio management for risk mitigation and yield optimization.

The result is a robust foundation for DAO treasuries seeking predictable cash flow while maintaining 24/7 access to their assets.

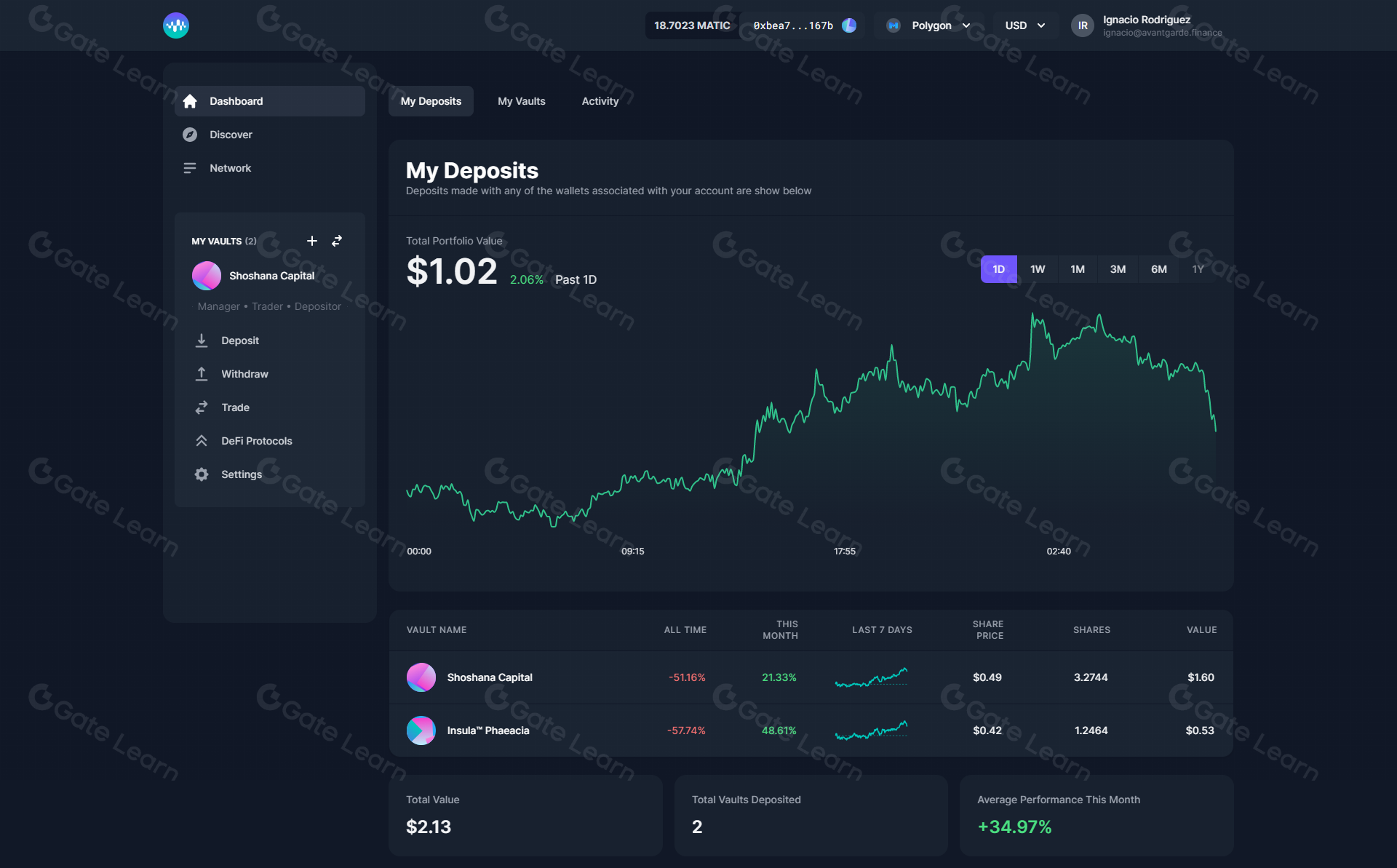

5. Utilizing Automated Rebalancing Protocols for Dynamic Treasury Allocation

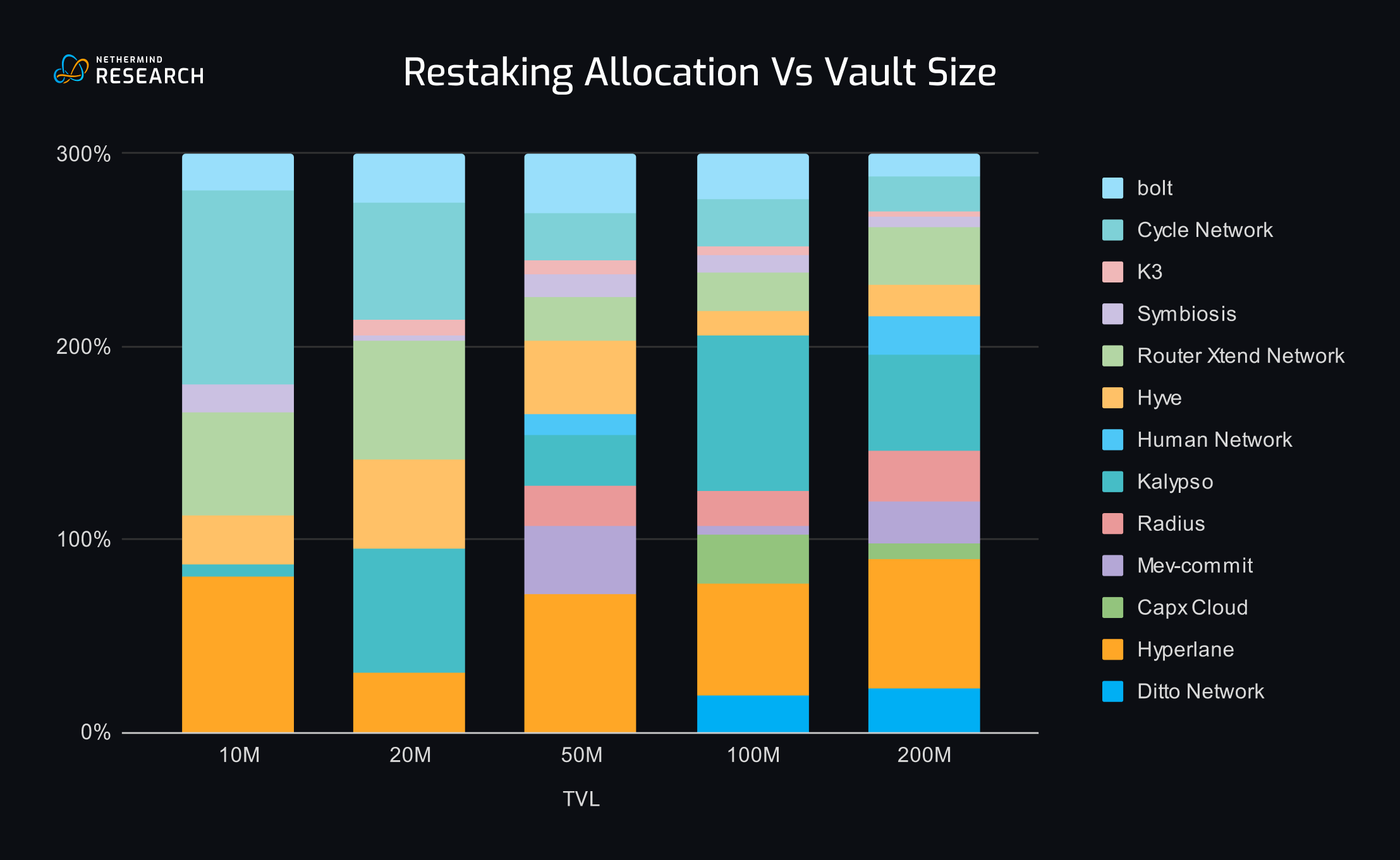

Automated rebalancing protocols have emerged as critical infrastructure for DAOs managing complex multi-asset treasuries. Tools like Balancer Smart Vaults and Enzyme Finance enable programmable portfolio management, allowing DAOs to set target allocations across multiple stablecoins or yield strategies and let smart contracts handle ongoing rebalancing based on pre-set rules or market triggers.

This automation not only reduces operational overhead but also removes emotional bias from treasury decisions. For example, a DAO can programmatically maintain a 40/30/30 split between USDC lending (via Morpho/Aera), RWA exposure (Ondo/Spark), and Curve LP positions, automatically shifting capital as yields fluctuate or risk parameters change.

Learn more about dynamic allocation frameworks here.

This dynamic approach helps DAOs maximize yield while staying responsive to evolving DeFi market conditions, critical in an environment where opportunity cost can quickly erode returns.

Strategic Takeaways for DAO Treasury Managers in 2024

The most resilient DAOs are those that treat their treasury like an actively managed portfolio, diversifying across lending markets, integrating real-world assets, optimizing liquidity provision, and leveraging automation wherever possible. By deploying capital using the five strategies outlined above provides Diversified Stablecoin Lending via Aera/Morpho Blue Vaults; Automated Yield Optimization with Yearn/Beefy; Risk-Managed RWA Vaults; Low-Impermanent-Loss Pooling on Curve and Uniswap v3; Automated Rebalancing with Balancer and Enzyme: treasury managers can capture higher yields without compromising security or liquidity.

The DeFi landscape will continue evolving rapidly throughout 2024. Staying ahead requires not just adopting best practices but continuously monitoring protocol risk, APY trends, and new integrations that could further optimize your DAO’s cash flow engine.

If you’re ready to level up your treasury operations or want deeper insights into protocol selection and risk frameworks, explore our detailed guides on how stablecoin vaults are revolutionizing on-chain treasury management for DAOs.