For decentralized autonomous organizations (DAOs), the stakes of treasury management have never been higher. With volatile markets and the relentless pace of DeFi innovation, DAOs are under pressure to safeguard capital, optimize returns, and uphold transparency for their communities. Enter automated stablecoin vaults: programmable, on-chain solutions that are rapidly redefining how DAOs approach treasury operations.

From Multisig Wallets to Automated Vaults: The Evolution of DAO Treasury Management

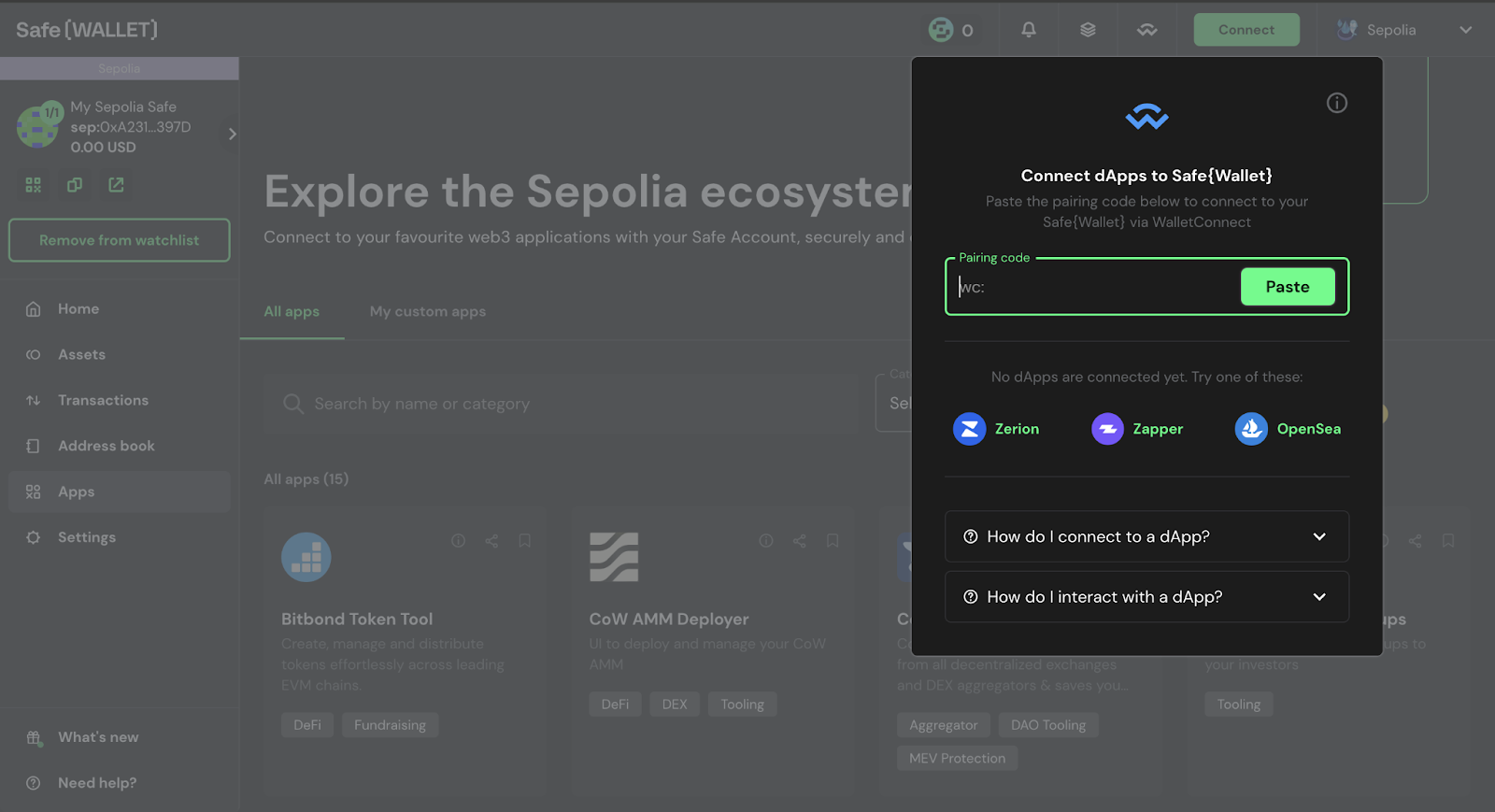

Historically, most DAOs relied on multisig wallets like Safe to custody their treasuries. While multisigs offer baseline security and shared control, they fall short in automating financial workflows or optimizing capital allocation. Manual interventions for rebalancing, yield farming, or risk management not only introduce operational drag but also expose DAOs to human error and governance bottlenecks.

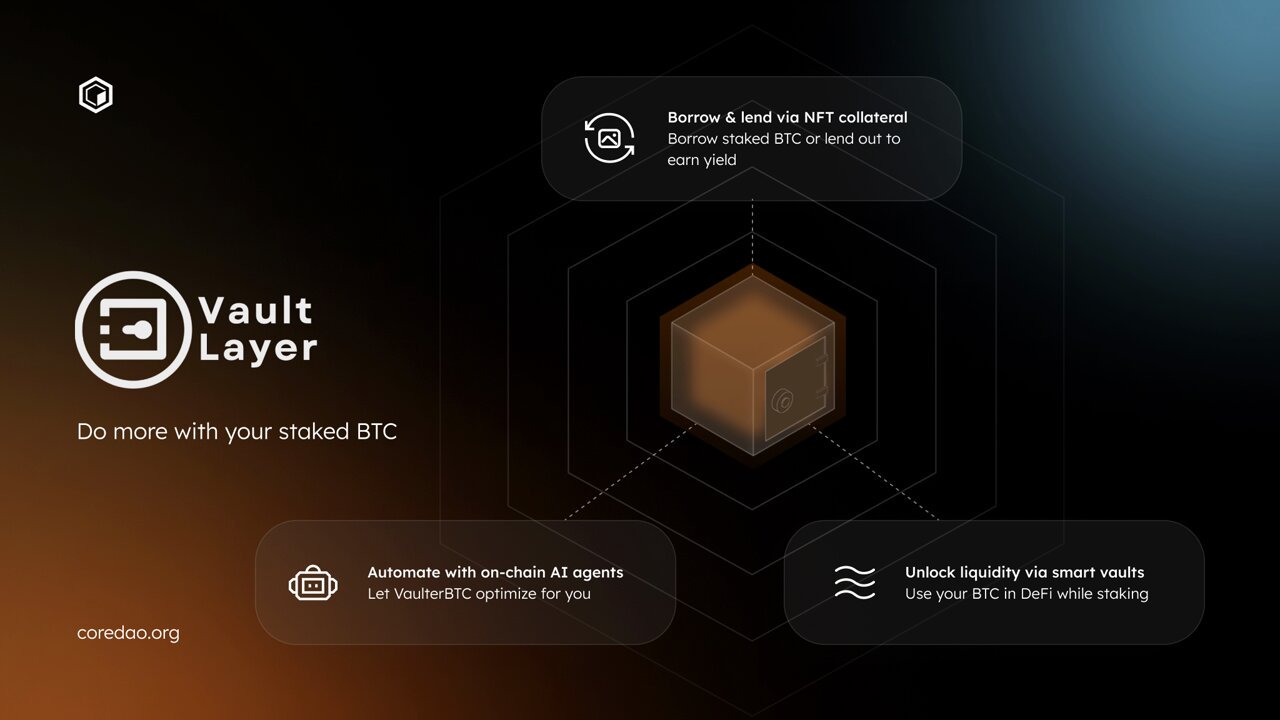

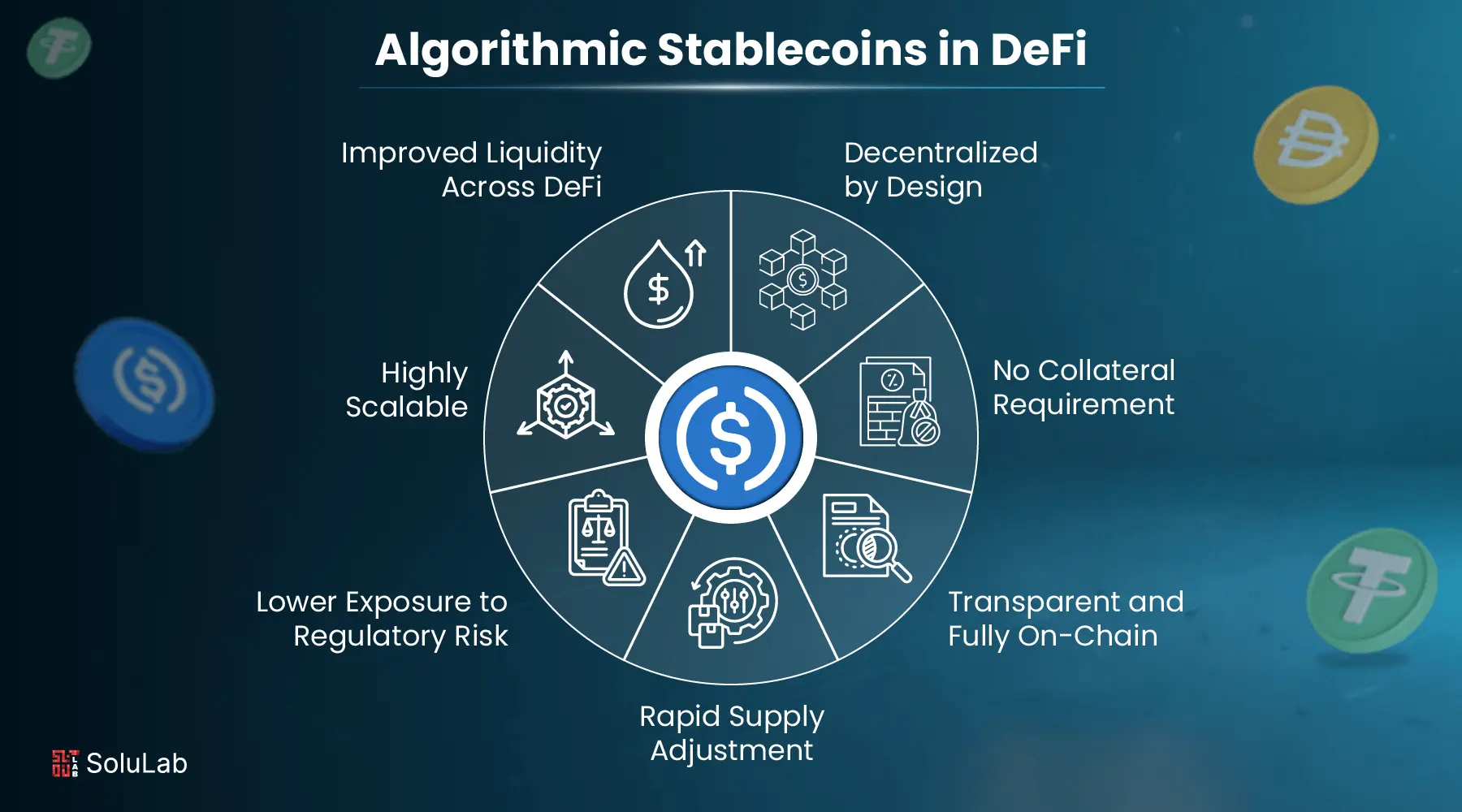

This is where automated stablecoin vaults come into play. These smart contract-powered vaults allow DAOs to programmatically manage assets – from automating portfolio rebalances to deploying idle funds into low-risk yield strategies. By integrating stablecoins such as USDC or DAI as reserve assets, DAOs can dramatically reduce exposure to native token volatility while unlocking new layers of capital efficiency.

Enhancing Stability with Stablecoins

The move toward stablecoins is more than just a hedge against price swings; it’s a strategic pivot. As highlighted by the Decentraland DAO’s recent proposal to convert part of its MANA holdings into stablecoins, the rationale is clear: stablecoins provide a reliable base layer for long-term planning and operational budgeting. This shift enables DAOs to insulate core funding from crypto market turbulence and focus on mission-driven initiatives.

The benefits don’t stop at stability. With programmable vaults, DAOs can automate dollar-cost averaging into stablecoins during periods of high volatility or set up rules-based triggers for liquidity deployment. The result? Treasuries become more resilient and responsive – less vulnerable to knee-jerk reactions or governance deadlock during market stress.

Key Advantages of Automated Stablecoin Vaults for DAOs

-

Enhanced Financial Stability: By integrating stablecoins like USDC and DAI into treasury operations, DAOs can significantly reduce exposure to volatile native tokens and ensure a more predictable financial runway. For example, the Decentraland DAO has proposed converting portions of its treasury to stablecoins to safeguard against market swings.

-

Automated Treasury Operations: Platforms such as Factor.fi empower DAOs to automate complex financial workflows, including portfolio rebalancing and liquidity management, through programmable vaults. This minimizes manual intervention and increases operational efficiency.

-

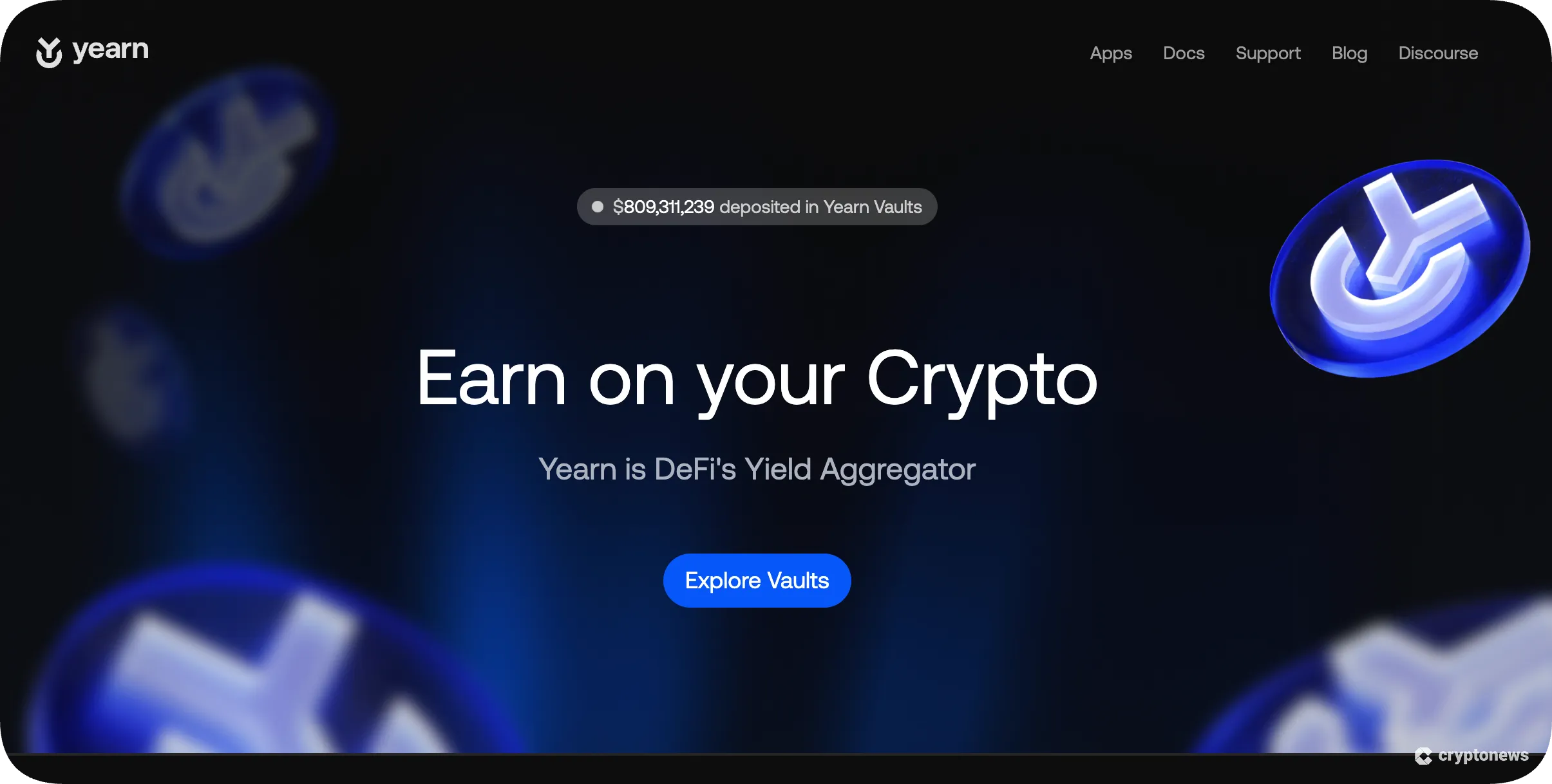

Yield Generation & Asset Optimization: Automated vaults allow DAOs to deploy idle stablecoin reserves into DeFi protocols like Avantgarde or lending platforms, generating yield while maintaining low risk. The Gitcoin DAO utilizes such strategies to support its ongoing sustainability.

-

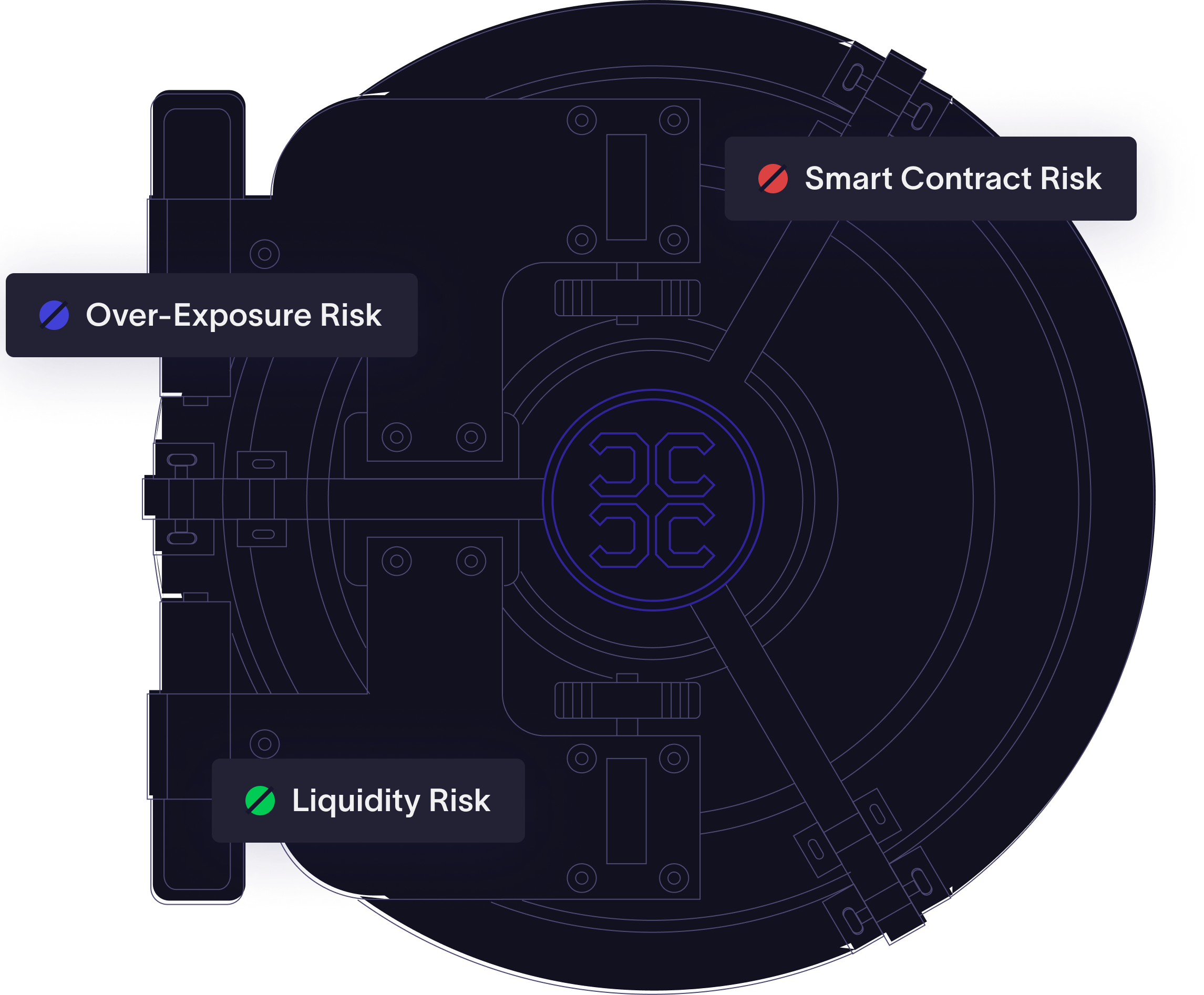

Risk Management & Transparency: Solutions like Castle Finance offer risk-optimized vaults that help DAOs manage DeFi risks. All transactions are transparently recorded on-chain, ensuring full auditability and stakeholder trust.

-

Increased Accountability & Governance: Automated stablecoin vaults enforce governance rules via smart contracts, ensuring that treasury actions align with DAO mandates and are visible to all members, thereby strengthening decentralized decision-making.

Automation Unleashed: Smarter Workflows and Yield Generation

The real magic happens when automation meets composability. Platforms like Factor. fi empower DAOs with modular vault architectures that support custom risk profiles and dynamic asset allocations. Instead of manually chasing yield or rebalancing portfolios via governance votes, DAOs can now:

- Automate liquidity management: Instantly deploy reserves into lending protocols or liquidity pools based on pre-set parameters.

- Simplify compliance: Embed access controls and audit trails directly in smart contracts for transparent oversight.

- Diversify revenue streams: Generate sustainable yields from DeFi integrations while maintaining low-volatility exposure through stablecoins.

This paradigm shift isn’t just theoretical; it’s playing out in real time as leading projects like Gitcoin deploy idle USDC into managed DeFi yield vaults – bolstering runway without compromising principal security. For a deeper dive into how these mechanisms work in practice, see our guide on setting up automated stablecoin vaults for DAO treasuries.

Transparency and Risk Management at Scale

One persistent challenge for decentralized treasuries is balancing transparency with operational agility. Automated vault platforms address this head-on: every transaction – from rebalancing events to yield harvests – is immutably recorded on-chain, creating an auditable trail accessible by all stakeholders. This not only strengthens accountability but also streamlines reporting for compliance-conscious DAOs seeking institutional partnerships.

Risk is not eliminated, but risk management becomes proactive rather than reactive. Advanced vaults such as those offered by Castle Finance or Gauntlet employ risk models that dynamically adjust allocations and withdrawal permissions based on real-time market data. This means DAOs can set guardrails, like maximum drawdowns or liquidity thresholds, and trust that smart contracts will enforce these limits without manual intervention.

What’s more, the transparency of on-chain automation provides a foundation for trust in DAO governance. Stakeholders no longer have to rely on post-hoc explanations for fund movements, every action is visible, verifiable, and governed by code. This is especially critical as DAOs increasingly seek external audits and institutional capital, both of which demand robust controls over treasury operations.

Why Automated Stablecoin Vaults Are Becoming the Gold Standard

The momentum behind automated stablecoin vaults is unmistakable. They address the core challenges DAOs face, volatility, inefficiency, and opacity, while unlocking new opportunities for capital growth and resilience. As stablecoins become the base layer for on-chain treasuries, their programmable nature enables continuous improvement in treasury strategy without sacrificing security or compliance.

Top DAO Use Cases for Automated Stablecoin Vaults in 2025

-

Enhancing Financial Stability with Stablecoin Reserves: DAOs like Decentraland DAO are converting volatile native tokens into stablecoins (e.g., USDC, DAI) to reduce treasury risk and support long-term initiatives. Automated vaults ensure these reserves are managed efficiently and transparently.

-

Automating Treasury Operations via Programmable Vaults: Platforms such as Factor.fi empower DAOs to automate portfolio rebalancing, liquidity management, and custom risk strategies using smart contract-based vaults, minimizing manual intervention and operational overhead.

-

Yield Generation and Asset Optimization: DAOs like Gitcoin DAO deploy idle stablecoins into DeFi yield vaults (e.g., managed by Avantgarde) to earn interest, supporting operational sustainability while maintaining low volatility exposure.

-

Risk Management and Transparency with Institutional-Grade Vaults: Solutions such as Castle Finance offer risk-managed vaults that help DAOs mitigate DeFi risks. Automated vaults also provide on-chain transparency, allowing members to audit every treasury action.

-

Streamlining DAO Governance and Compliance: Automated stablecoin vaults, integrated with multisig wallets like Safe (formerly Gnosis Safe), enable secure, rule-based treasury operations, enforce governance decisions, and embed compliance controls for decentralized organizations.

For DAO operators weighing the transition from legacy multisig wallets to automated vaults, the calculus is shifting fast. The ability to automate routine tasks like rebalancing or yield harvesting frees up governance bandwidth to focus on strategic decisions rather than operational minutiae. At the same time, modular vault frameworks allow DAOs to tailor strategies as their needs evolve, whether that means prioritizing runway extension, grant funding, or liquidity provisioning during periods of market stress.

As we look ahead, expect increased adoption of risk-optimized DeFi vaults and programmable stablecoin solutions across the DAO ecosystem. These tools will not only help DAOs weather volatility but also position them for sustainable growth in an increasingly competitive landscape. For practical steps on implementation and best practices in automation, explore our resource: How DAOs Use Stablecoin Vaults for Treasury Risk Management.

The Strategic Edge: Capital Efficiency Meets Community Trust

The most forward-thinking DAOs are already leveraging automated stablecoin vaults not just as a defensive play but as a source of strategic advantage. By combining programmable asset allocation with real-time reporting and embedded compliance features, these organizations are setting new standards for transparency and capital efficiency in decentralized finance.

Ultimately, the future of on-chain treasury management lies at the intersection of automation, stability, and transparency. Automated stablecoin vaults deliver all three, empowering DAOs to plan for volatility while investing for resilience. The organizations that master this toolkit will be best positioned to thrive as DeFi matures and regulatory scrutiny intensifies.