Automated stablecoin vaults are rapidly becoming the backbone of modern DAO treasury management. In 2025, as DAOs evolve into more sophisticated organizations, the need for efficient, transparent, and risk-mitigated on-chain treasury solutions is greater than ever. If you’re a DAO operator or treasury manager, understanding how to implement these automated vaults can empower your community with robust capital preservation and yield generation, without sacrificing transparency or security.

Why Automated Stablecoin Vaults Are Essential for DAO Treasuries in 2025

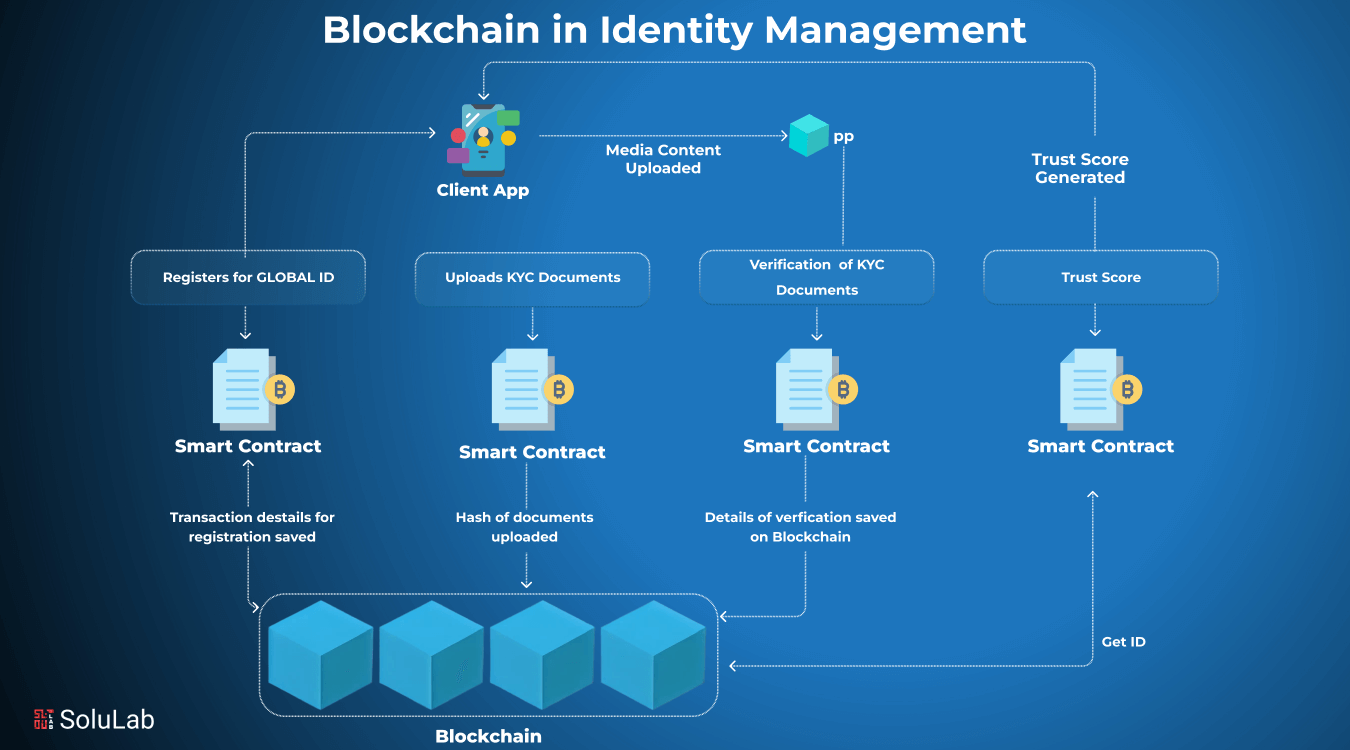

DAOs today are tasked with managing increasingly complex treasuries, often worth millions of dollars in stablecoins like USDC and DAI. Manual processes just can’t keep up with the pace of DeFi innovation, or the demands for accountability from token holders. Automated stablecoin vaults address these challenges by leveraging programmable smart contracts to handle asset allocation, yield optimization, and risk management autonomously.

What sets 2025’s leading vault platforms apart is their integration of advanced risk models and real-time market data feeds. This allows DAOs to dynamically adjust allocations across lending protocols (like Compound, Aave, Morpho) or liquidity pools based on predefined risk thresholds. The result: better capital efficiency and fewer sleepless nights worrying about market volatility or human error.

Key Components of Automated Stablecoin Vault Solutions

Let’s break down what makes a modern automated stablecoin vault tick:

Key Components of Automated Stablecoin Vaults for DAOs

-

Smart Contract Infrastructure: Automated stablecoin vaults are powered by smart contracts that autonomously manage asset allocation, rebalancing, and yield optimization for DAO treasuries. This reduces manual intervention and ensures consistent, rules-based management.

-

On-Chain Audit Trails: Every transaction and performance metric is recorded on-chain, creating an immutable audit trail. This transparency allows all DAO members to review vault activity and ensures accountability.

-

Governance Integration: Vaults can be configured to integrate with DAO governance tools like Snapshot or Safe, enabling treasury decisions and risk parameters to be managed through transparent, on-chain voting.

- Smart Contract Infrastructure: At their core, these vaults use audited smart contracts to automate everything from deposits to rebalancing strategies.

- Risk Management Protocols: Advanced logic ensures assets are deployed only within parameters approved by the DAO, think maximum drawdown limits or exposure caps per protocol.

- On-Chain Audit Trails: Every transaction is logged immutably on-chain for full transparency. This means stakeholders can verify performance metrics anytime without relying on third parties.

- Governance Integration: Vault operations are often linked directly to DAO voting mechanisms, enabling members to approve strategy changes or emergency actions in real time.

The best-in-class platforms in 2025 include Factor. fi, which offers modular programmable vaults; Aera, known for dynamic rebalancing across DeFi protocols; and dHEDGE for managed liquidity strategies. Each brings unique features but shares a commitment to automation and transparency.

A Step-by-Step Approach: From Objective Setting to Ongoing Optimization

If you’re considering implementing automated stablecoin vaults for your DAO treasury this year, here’s a proven framework that aligns with industry best practices:

- Define Treasury Objectives: Start by clarifying your goals, is it capital preservation during volatility? Maximizing yield? Diversifying exposure?

- Select Vault Platforms: Choose solutions that match your risk appetite and technical requirements. Look for platforms with strong audit histories and customizable strategies.

- Configure Vault Parameters: Set your allocation rules (e. g. , max % per protocol), preferred yield sources, and required governance approvals for changes.

- Integrate Governance Workflows: Ensure any major parameter updates or withdrawals require on-chain voting or multisig confirmations according to your DAO’s policies.

- Monitor and Adjust Regularly: Use real-time dashboards and on-chain reports to track performance, and be ready to adapt as market conditions change or new opportunities arise.

This approach not only streamlines operations but also fosters greater trust among stakeholders, because every action is visible and verifiable on-chain. For more tactical guidance on specific implementation steps, see our dedicated guide here.

One of the biggest advantages of automated stablecoin vaults is their ability to enforce continuous risk mitigation. With real-time data feeds and programmable guardrails, DAOs can sleep easier knowing that their treasury isn’t overexposed to any single protocol or market event. For example, if a lending platform’s risk profile deteriorates, the vault can automatically rebalance assets to safer venues, no need for frantic governance votes or manual interventions.

Transparency is also dramatically improved. Every deposit, withdrawal, and strategy update is recorded on-chain. This immutable audit trail not only satisfies internal DAO reporting requirements but also reassures token holders and external auditors that the treasury is managed responsibly. As regulatory scrutiny around digital assets grows in 2025, this level of transparency isn’t just a nice-to-have, it’s essential for long-term sustainability and trust.

Practical Tips for Seamless Vault Automation

To get the most out of stablecoin vault automation, keep these practical tips in mind:

- Prioritize Security: Only deploy capital into vaults with recent third-party audits and active bug bounty programs.

- Automate Reporting: Set up automated reporting dashboards so your community can monitor performance without technical barriers.

- Diversify Strategies: Don’t rely solely on one protocol or yield source, spread risk across multiple DeFi platforms and stablecoins.

- Engage Your Community: Use transparent governance tools to let members propose or vote on major treasury moves.

If you’re interested in how leading DAOs are leveraging these best practices for robust risk management, check out our deep dive on real-world case studies: How DAOs Use Stablecoin Vaults for Treasury Risk Management.

Looking Ahead: The Future of On-Chain Treasury Solutions

The evolution of automated stablecoin vaults is far from over. In the coming years, expect even tighter integrations with DAO governance frameworks, smarter AI-driven allocation models, and seamless interoperability between chains. As these tools mature, they’ll empower DAOs to operate more like professional asset managers, without sacrificing their core values of decentralization and transparency.

The bottom line? Automated stablecoin vaults are no longer an experimental edge case, they’re quickly becoming a best practice for any DAO serious about safeguarding its financial future. By embracing automation today, you’re not just keeping up with industry trends; you’re laying the groundwork for sustainable growth and resilient treasury operations well into 2025 and beyond.