Stablecoin vaults are rapidly becoming the backbone of on-chain treasury management for DAOs in 2025. As decentralized organizations move away from manual, fragmented asset strategies, they’re embracing vault protocols that combine yield generation, risk mitigation, and capital efficiency, all while maintaining full transparency on-chain. This shift is not just a technical upgrade; it’s a fundamental evolution in how DAOs secure their financial future and navigate the unpredictable waters of DeFi.

Why Stablecoin Vaults Now Dominate DAO Treasury Best Practices

Historically, DAOs managed their treasuries using multisig wallets and basic asset allocation, an approach that left much to be desired in terms of automation, transparency, and yield. The rise of stablecoin vaults has changed this calculus. By deploying idle stablecoins into carefully engineered vaults, DAOs can now earn competitive yields (often around 10% annually as seen with Gitcoin DAO’s Avantgarde DeFi Yield Vault), automate rebalancing across strategies, and access advanced risk controls.

This isn’t theoretical. According to TradingStrategy. ai’s August 2025 report, out of over 10,800 DeFi vaults surveyed, more than one-third are now stablecoin-denominated, a testament to the surging demand for stability and predictable returns in DAO treasuries.

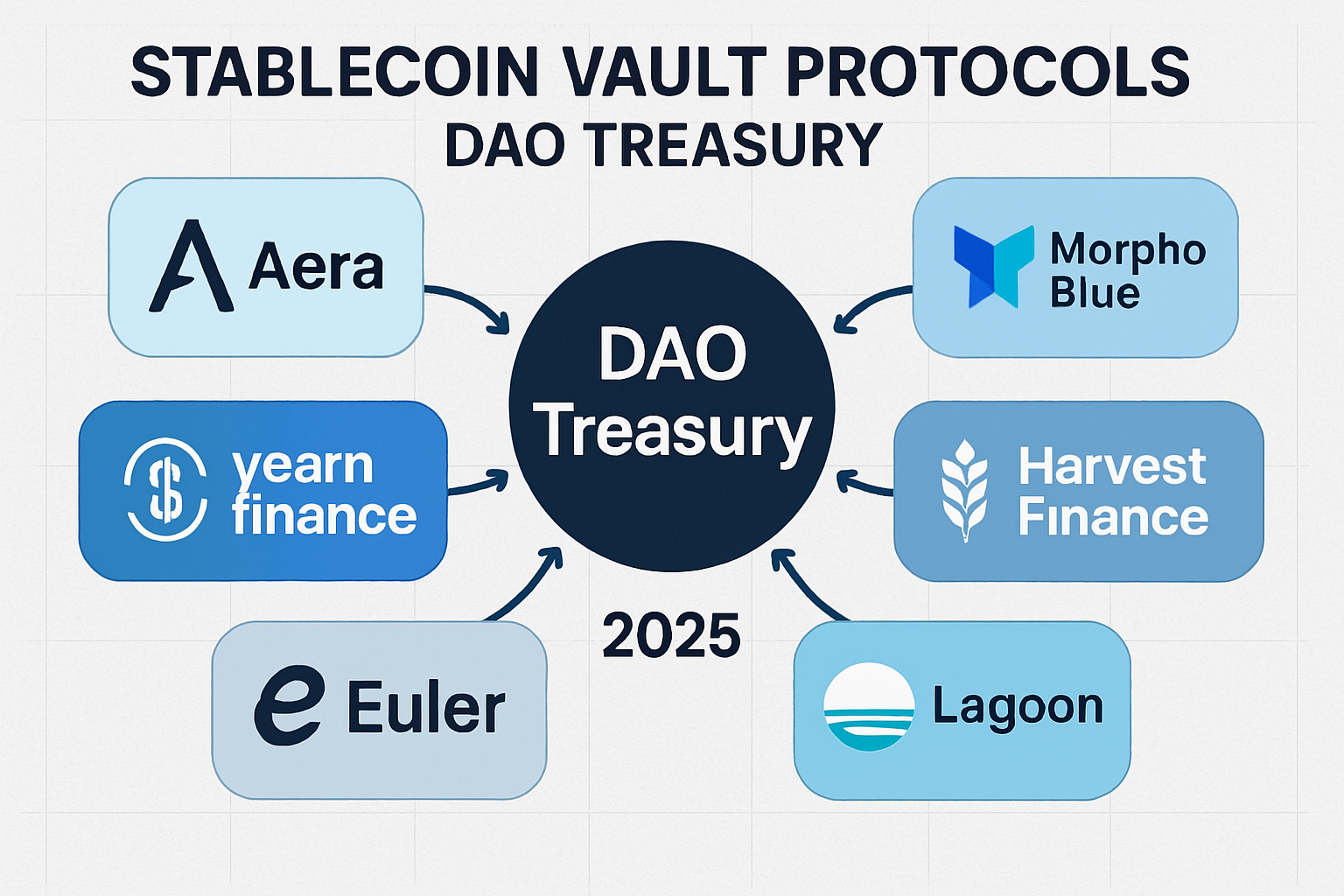

Meet the Six Protocols Leading the Stablecoin Vault Revolution

6 Leading Stablecoin Vault Protocols for DAOs in 2025

-

Aera: Aera offers autonomous, non-custodial vaults that dynamically rebalance DAO treasuries across DeFi strategies. Its protocol optimizes for yield and risk, providing transparency and automated management for stablecoin reserves.

-

Yearn Finance: Yearn Finance is a pioneering DeFi yield aggregator. Its stablecoin vaults automate yield generation by allocating assets across lending protocols, helping DAOs maximize returns with minimal manual intervention.

-

Morpho Blue: Morpho Blue is an innovative lending protocol that enhances capital efficiency for DAOs. Its vaults allow for flexible, peer-to-peer stablecoin lending, optimizing both returns and risk management.

-

Harvest Finance: Harvest Finance specializes in automated yield farming for stablecoins. Its vaults aggregate user funds and deploy them into high-yield DeFi strategies, offering DAOs streamlined access to diversified returns.

-

Lagoon: Lagoon is recognized for its robust stablecoin vault infrastructure, supporting a range of assets and yield strategies. It enables DAOs to manage liquidity, diversify holdings, and automate treasury operations.

-

Euler: Euler is a non-custodial lending protocol with advanced risk management features. Its stablecoin vaults allow DAOs to lend and borrow securely, optimizing capital allocation and protecting against volatility.

Let’s break down how each protocol is setting new standards for on-chain treasury management:

- Aera: Renowned for its autonomous rebalancing engine. Aera allows DAOs to delegate asset optimization to decentralized networks, no more manual intervention required. Its non-custodial vaults provide independent rebalancing and real-time visibility tools that maximize capital efficiency without sacrificing security.

- Yearn Finance: The original yield aggregator has evolved into a powerhouse for institutional-grade stablecoin strategies. Yearn’s smart contracts automatically allocate assets across vetted lending pools and liquidity farms, ensuring DAOs tap into best-in-class yields while minimizing exposure to single points of failure.

- Morpho Blue: This protocol stands out with its peer-to-peer lending model that dynamically matches borrowers and lenders at optimal rates. For DAOs seeking to deploy stablecoins with minimal slippage and robust risk controls, Morpho Blue offers an attractive blend of efficiency and transparency.

- Harvest Finance: Known for its auto-compounding features, Harvest aggregates yields from multiple DeFi sources. Its active risk management modules help DAOs capture upside while protecting against market shocks, a must-have in volatile conditions.

- Lagoon: Lagoon specializes in multi-strategy stablecoin vaults tailored for DAO treasuries. With configurable risk profiles and seamless integrations with other DeFi primitives, Lagoon empowers organizations to diversify holdings without operational complexity.

- Euler: Euler delivers advanced lending markets with modular risk parameters, allowing DAOs granular control over collateralization ratios and liquidation thresholds. Its innovative “permissionless markets” model means any DAO can launch custom lending pools backed by their preferred stablecoins.

The integration of these protocols isn’t just about chasing yield, it’s about building resilient systems that can weather bear markets while remaining agile enough to seize new opportunities as they arise.

The Mechanics: How Stablecoin Vaults Power Modern On-Chain Treasuries

The core advantage of these top-performing protocols lies in their ability to automate complex financial operations previously reserved for centralized institutions or hedge funds. For example:

- Aera‘s autonomous network continuously monitors market conditions and rebalances assets across supported strategies, ensuring optimal yield without manual overhead.

- Morpho Blue‘s peer-to-peer matching engine enables efficient use of treasury capital by directly connecting surplus funds with vetted borrowers at algorithmically determined rates.

- Yearn Finance, Harvest Finance, Lagoon, and Euler each offer unique approaches to diversification, whether through automated compounding (Harvest), bespoke portfolio construction (Lagoon), or customizable lending pools (Euler).

This new era of on-chain treasury management means DAOs can focus less on day-to-day asset juggling, and more on advancing their core missions with confidence that their reserves are working efficiently behind the scenes.

With stablecoin vaults at the core, DAOs are rewriting the rules for treasury oversight and capital deployment. The protocols leading this movement, Aera, Yearn Finance, Morpho Blue, Harvest Finance, Lagoon, and Euler, are not just competing on yield. They’re setting new benchmarks for risk management, transparency, and operational simplicity.

Risk Management: Beyond Just Yield

One of the most significant advantages of these vaults is their robust approach to stablecoin risk management. For example, Euler and Morpho Blue enable DAOs to set custom collateralization ratios and liquidation thresholds. This means treasuries can tailor their exposure to market volatility while still accessing competitive returns. Meanwhile, protocols like Aera and Lagoon provide automated rebalancing that dynamically shifts allocations based on real-time market data, helping DAOs avoid concentration risk and maintain liquidity even during black swan events.

Harvest Finance‘s auto-compounding mechanism ensures that yields aren’t just earned, they’re maximized through continuous reinvestment. And with Yearn Finance’s institutional-grade vaults, DAOs benefit from a diversified approach that spreads assets across multiple platforms and strategies, further minimizing single-point-of-failure risks.

Transparency and Real-Time Oversight

A key reason why these protocols are favored by DAO operators is their commitment to transparency. Every transaction within a vault is recorded on-chain, auditable by anyone at any time. Platforms like Aera, Lagoon, and Euler offer dashboards with granular insights into asset allocations, performance metrics, and risk parameters. This level of visibility builds trust among community stakeholders and makes it easier to report on treasury health during governance calls or public audits.

Capital Efficiency and Strategic Flexibility

The best-performing stablecoin vaults in 2025 don’t just park assets, they actively put them to work. For instance:

- Morpho Blue: Connects idle DAO reserves with vetted borrowers for peer-to-peer lending at optimal rates.

- Aera and Lagoon: Rebalance between lending markets, liquidity pools, or yield farms based on real-time returns.

- Harvest Finance and Yearn Finance: Aggregate yields from diverse DeFi sources while minimizing gas costs through batch transactions.

- Euler: Allows DAOs to launch permissionless lending pools tailored to their unique governance needs or risk appetite.

This flexibility enables DAOs to respond quickly as market conditions shift, allocating more capital to high-yield opportunities or retreating into safer strategies when volatility spikes. The result? Enhanced capital efficiency without sacrificing the security or stability essential for long-term sustainability.

Practical Outcomes: What Top Protocol Adoption Means for DAOs

The impact of adopting these six protocols is already visible across leading decentralized organizations:

- Smoother operational funding cycles during bear markets thanks to predictable yield streams from stablecoin vaults.

- Easier reporting and compliance with community-driven audits due to transparent on-chain activity logs.

- Diversified revenue streams that support grants programs or protocol development without selling core governance tokens at a discount.

- An improved ability to participate in ecosystem alliances or liquidity bootstrapping events using liquid stablecoins instead of volatile assets.

If you’re new to DeFi treasury tools or looking for advanced strategies, explore our deep dive on the subject: How DAOs Use Stablecoin Vaults for Treasury Risk Management.

The future of DAO treasuries will be defined by those who embrace automation without compromising transparency, and these six protocols offer exactly that balance.

What Comes Next?

The landscape will only get more competitive as new entrants seek to match the sophistication of Aera, Yearn Finance, Morpho Blue, Harvest Finance, Lagoon, and Euler. For now though, these six stand as the gold standard in stablecoin-denominated treasury management, offering powerful tools for any DAO serious about resilience and growth in an unpredictable world.