Securing DAO stablecoin vaults is no longer a theoretical exercise – it is a daily imperative for decentralized organizations managing millions in digital assets. As DAOs continue to grow in scope and influence, the sophistication of threats targeting on-chain treasuries has also escalated. Fortunately, the community has responded with a robust set of best practices. Below, we explore five essential strategies every DAO treasury manager should implement to ensure resilient, transparent, and secure operations.

1. Implement Multi-Signature Wallets for Vault Governance and Transactions

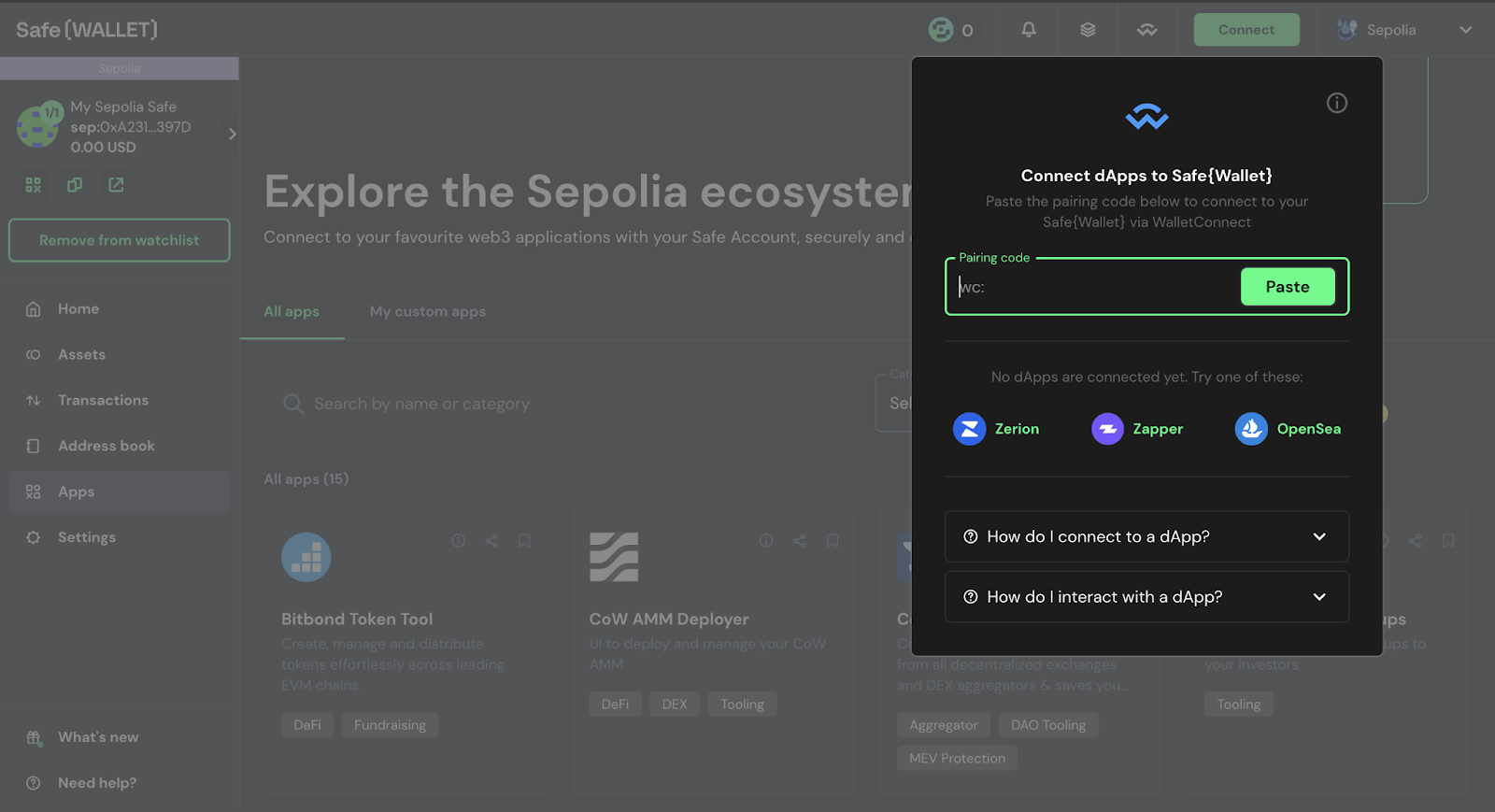

Relying on single-key wallets is an open invitation to risk. Multi-signature (multisig) wallets are now the gold standard for DAO stablecoin vault security. With multisig protocols like Safe or Gnosis Safe, every transaction requires approval from multiple authorized signers before execution. This approach dramatically reduces the likelihood of unauthorized withdrawals or unilateral decision-making by a rogue actor.

The best practice? Design your signing policies so that no single individual can move funds independently. For example, requiring 5 out of 7 core members to approve large transfers ensures both agility and robust oversight. Multisig not only safeguards assets but also reinforces collective governance – a core value of any DAO.

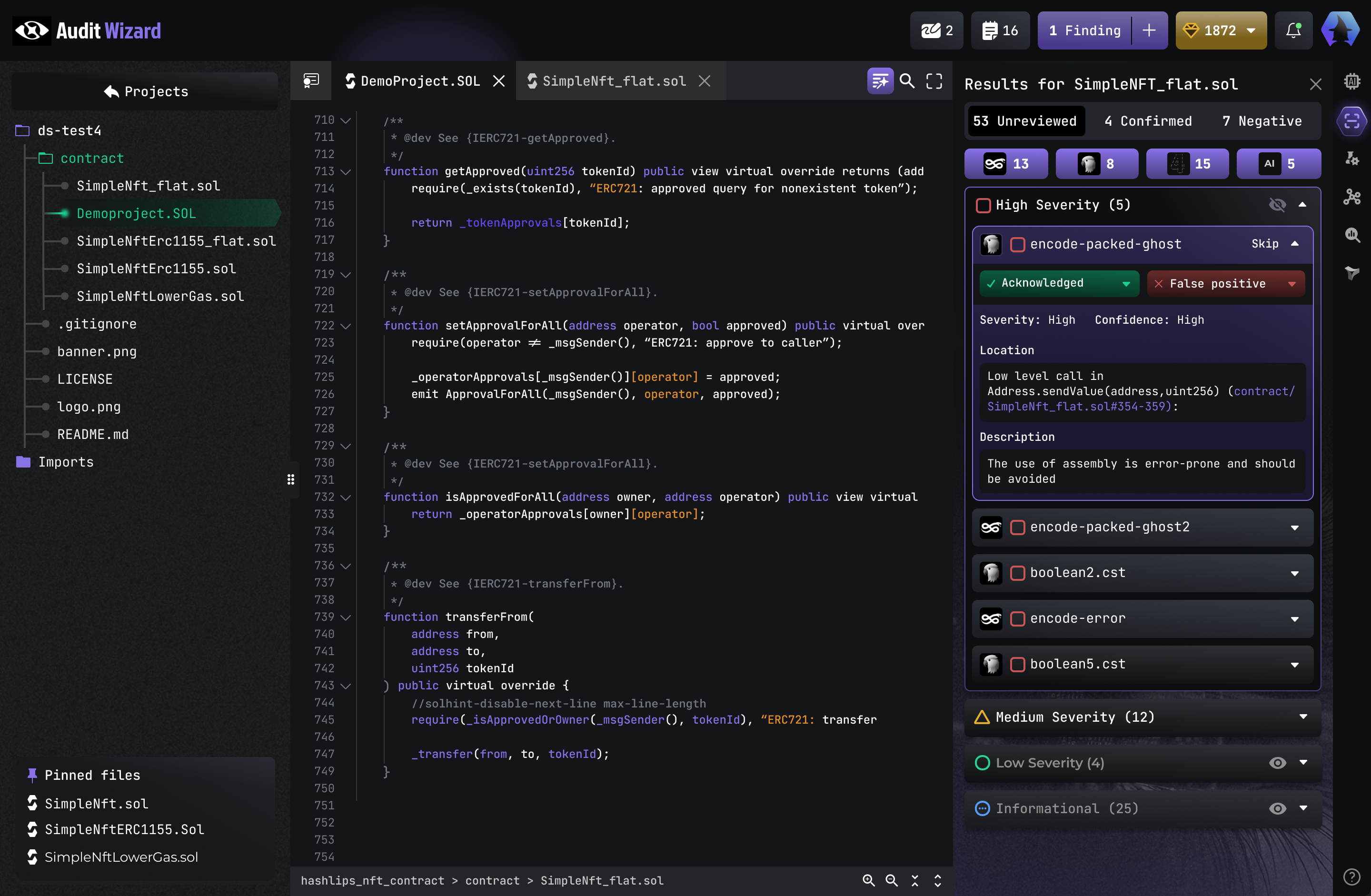

2. Conduct Regular Smart Contract Audits and Real-Time Monitoring

Even the most elegant smart contract can hide vulnerabilities that only emerge under real-world stress. That’s why routine code audits, performed by reputable third-party security firms, are non-negotiable for any DAO managing stablecoin vaults. These audits should cover not just initial deployments but also all future upgrades or integrations.

The landscape doesn’t stand still after deployment either. Real-time monitoring solutions such as Chainalysis Hexagate now allow DAOs to track their stablecoin balances, transactional flows, and contract interactions in real time. This continuous vigilance helps spot anomalies early – whether it’s suspicious activity or an unexpected contract behavior – empowering teams to respond before minor issues become major crises.

Top 5 Strategies to Secure DAO Stablecoin Vaults

-

Implement Multi-Signature Wallets for Vault Governance and TransactionsAdopt multisig wallets like Safe (formerly Gnosis Safe) to require multiple approvals for every vault transaction. This dramatically reduces the risk of unauthorized access and single points of failure, ensuring that no single party can move funds unilaterally.

-

Conduct Regular Smart Contract Audits and Real-Time MonitoringPartner with reputable audit firms such as Halborn or Trail of Bits for comprehensive code reviews. Enhance security with real-time monitoring tools like Chainalysis Hexagate to detect vulnerabilities and suspicious activity instantly.

-

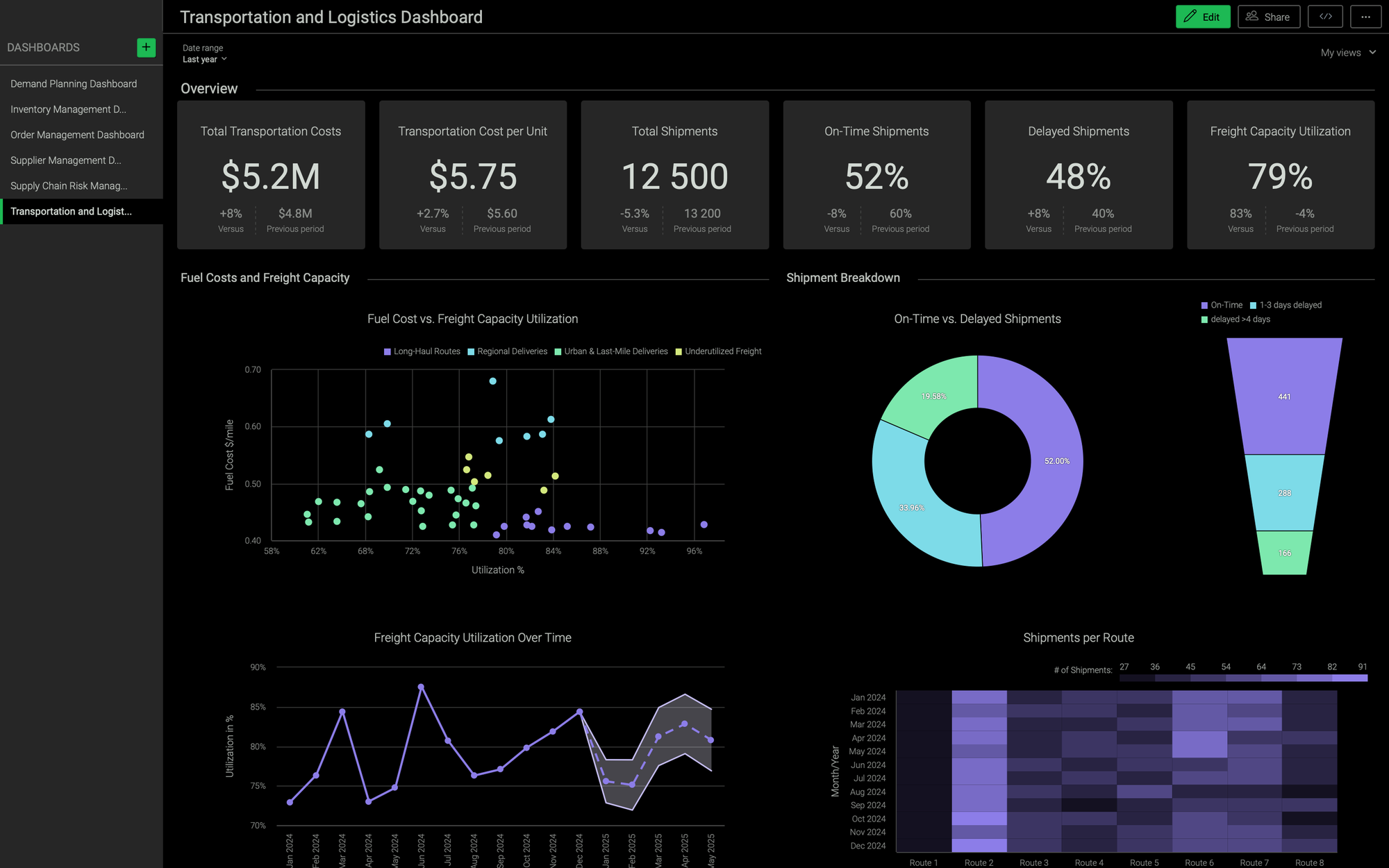

Utilize Automated Risk Management Tools and On-Chain AnalyticsLeverage analytics platforms like Dune Analytics and risk engines such as Gauntlet to monitor treasury health, flag anomalies, and optimize asset allocation. Automated tools provide actionable insights for proactive risk mitigation.

-

Establish Emergency Pause Mechanisms and Incident Response ProtocolsIncorporate emergency pause features in smart contracts, as seen in protocols like Compound and Aave. Develop clear incident response plans to act swiftly during security breaches, minimizing potential losses and maintaining community trust.

3. Enforce Role-Based Access Controls and Segregation of Duties

No treasury should operate on trust alone; structure matters as much as intent. Role-based access controls (RBAC) empower DAOs to define who can initiate proposals, approve transactions, or manage settings within their vault infrastructure. By segregating duties across different roles (e. g. , proposer vs approver), DAOs minimize internal risks such as accidental errors or collusion.

This principle extends beyond mere technical controls – it’s about fostering a culture where accountability is embedded at every level of treasury management. Coupled with transparent reporting and regular community updates, RBAC fortifies both security and trust within your organization.

Why Best Practices Matter More Than Ever

The rapid evolution of DeFi means yesterday’s playbook is already outdated today. As highlighted by recent research from Halborn and RootstockLabs, institutional-grade risk management is now table stakes even for grassroots DAOs.

If you’re serious about optimizing capital efficiency while protecting your treasury from emerging threats, mastering these foundational strategies isn’t optional – it’s existential.

For deeper dives into how DAOs use stablecoin vaults for risk management frameworks tailored to your unique needs, see our detailed guide at How DAOs Use Stablecoin Vaults for Treasury Risk Management.

As DAOs scale, attackers become more creative, and internal governance grows more complex, it’s vital to layer your security posture. Let’s examine two final best practices that round out a modern defense-in-depth approach for DAO stablecoin vaults.

4. Utilize Automated Risk Management Tools and On-Chain Analytics

Gone are the days when static controls were enough. Today’s leading DAOs leverage automated risk management tools alongside sophisticated on-chain analytics to proactively identify threats and optimize capital deployment. Solutions like Chainalysis Hexagate or Coinshift provide real-time dashboards that flag suspicious activity, monitor unusual contract interactions, and surface potential vulnerabilities as they arise.

This data-driven vigilance is more than a technical upgrade, it’s the difference between reactive firefighting and anticipatory governance. By integrating these tools into daily treasury workflows, DAOs can set automated alerts for large withdrawals, unexpected contract calls, or deviations from normal spending patterns. This not only helps prevent catastrophic losses but also enables dynamic risk-adjusted strategies for yield generation and liquidity management.

5. Establish Emergency Pause Mechanisms and Incident Response Protocols

No matter how robust your systems are, black swan events can, and do, occur. That’s why every DAO treasury should implement emergency pause mechanisms, often referred to as “circuit breakers, ” within their vault architecture. These allow authorized parties to temporarily halt all transactions if an exploit or critical bug is detected.

But technology alone isn’t enough; clear incident response protocols must also be defined in advance. Who gets notified? How are decisions made under duress? What steps should be taken to communicate transparently with the community? Documenting these procedures ensures that when seconds count, your team isn’t scrambling in confusion.

Bringing It All Together: A Checklist for Secure DAO Treasury Management

The most resilient DAOs do not treat security as a one-off project, they embed it into every layer of their operations. Implementing multi-signature wallets, conducting regular audits with real-time monitoring, enforcing role-based access controls, leveraging automated risk management tools, and preparing robust emergency protocols form a holistic shield against today’s evolving threats.

The path forward is clear: prioritize transparency, automation, and collective responsibility at every step of treasury management. As the DeFi landscape continues to mature, and institutional capital flows into on-chain treasuries, these best practices will define which DAOs thrive and which fall victim to avoidable risks.

If you’re ready to take your organization’s treasury safeguards to the next level or want deeper insights on capital-efficient strategies for stablecoin vaults, explore our comprehensive resources at How to Secure DAO Stablecoin Vaults: Best Practices for On-Chain Treasury Managers.