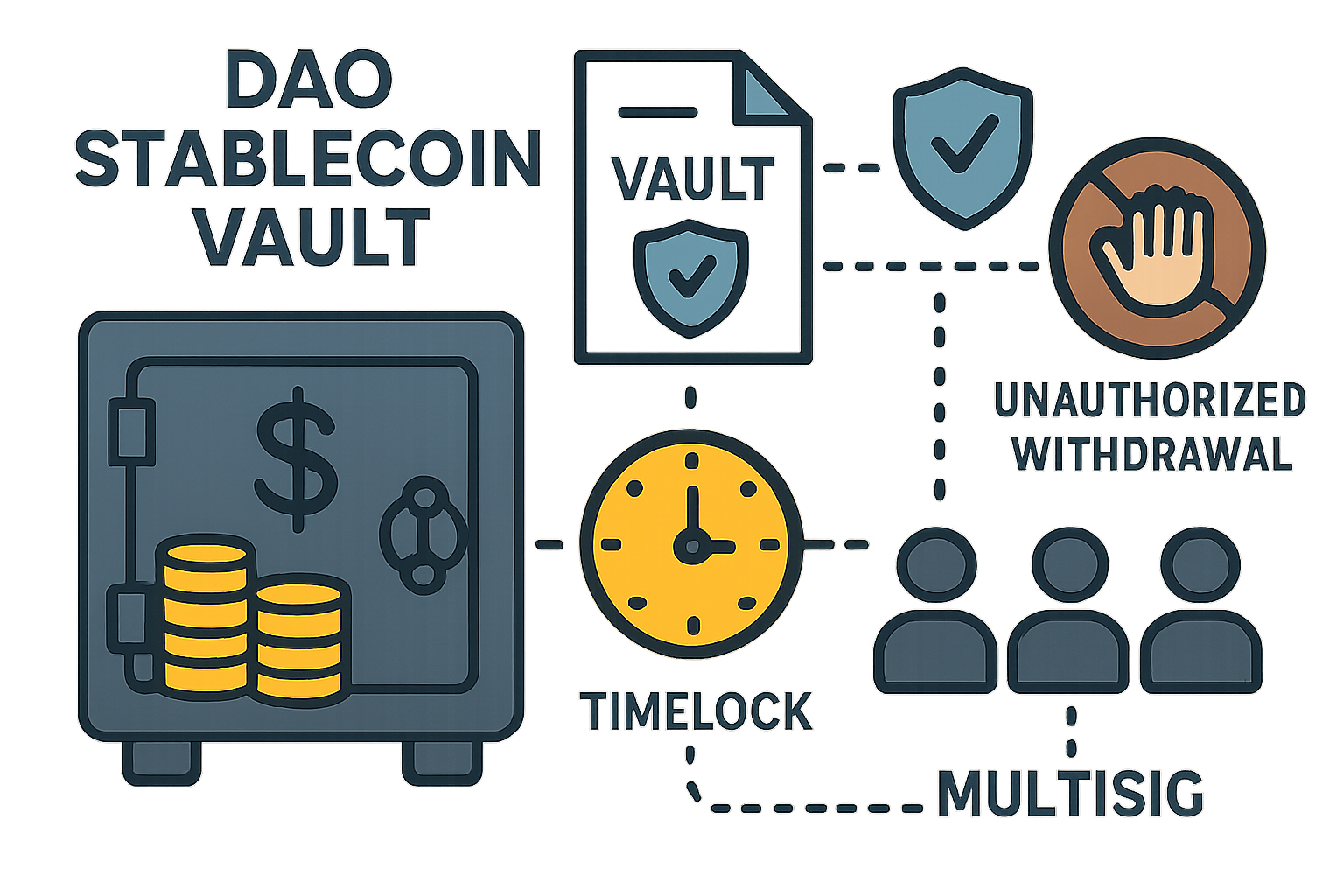

Securing DAO stablecoin vaults is the foundation for sustainable, trustless treasury management in decentralized organizations. As DAOs scale, the sophistication of threats and operational risks increases dramatically. Treasury managers must move beyond basic wallet hygiene and adopt a layered, automation-driven approach to vault security. Here’s how to implement the four most critical strategies for robust DAO stablecoin vault security, maximizing capital protection without sacrificing on-chain agility.

1. Implement Multisig and Role-Based Access Controls for Vault Transactions

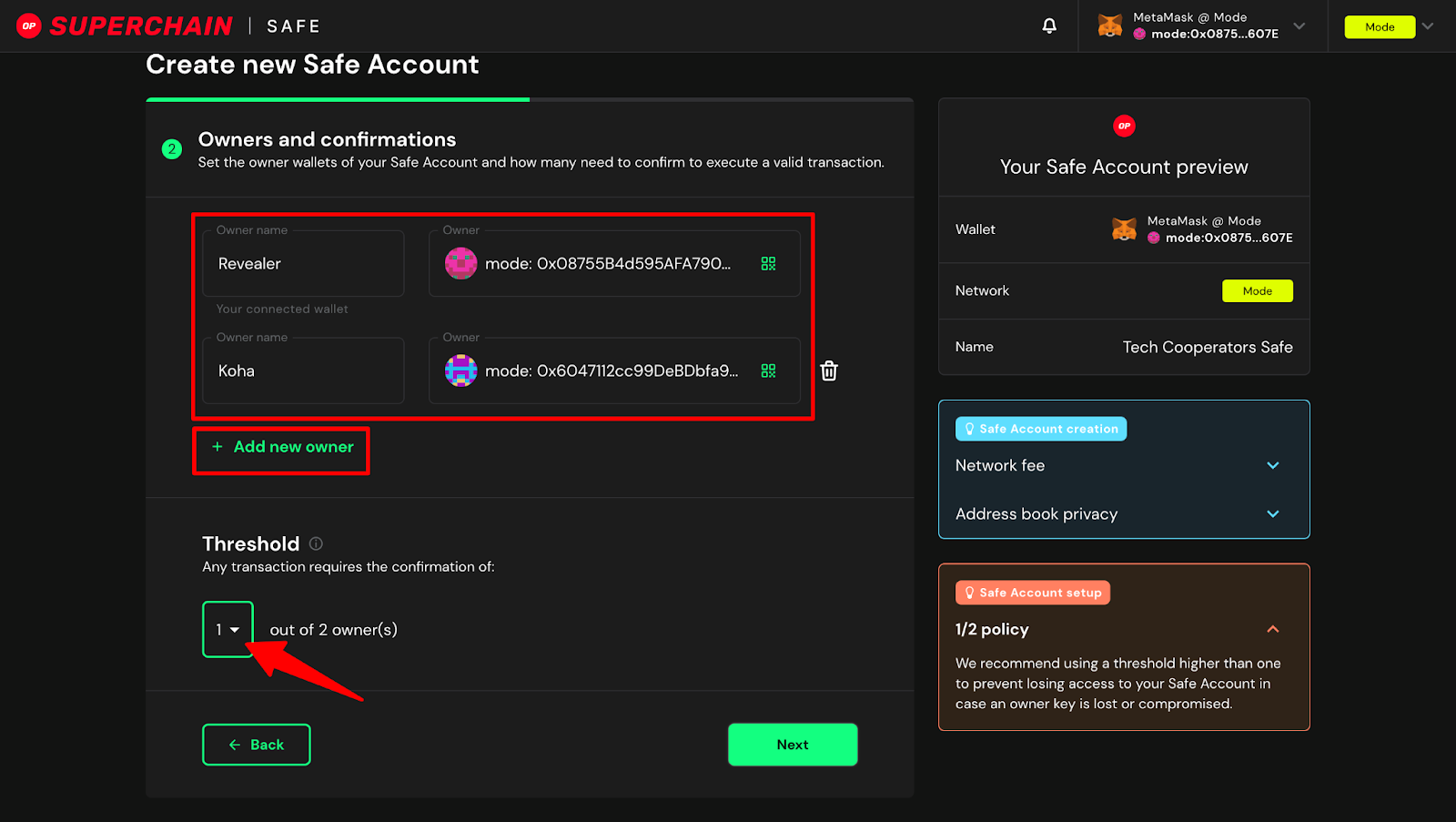

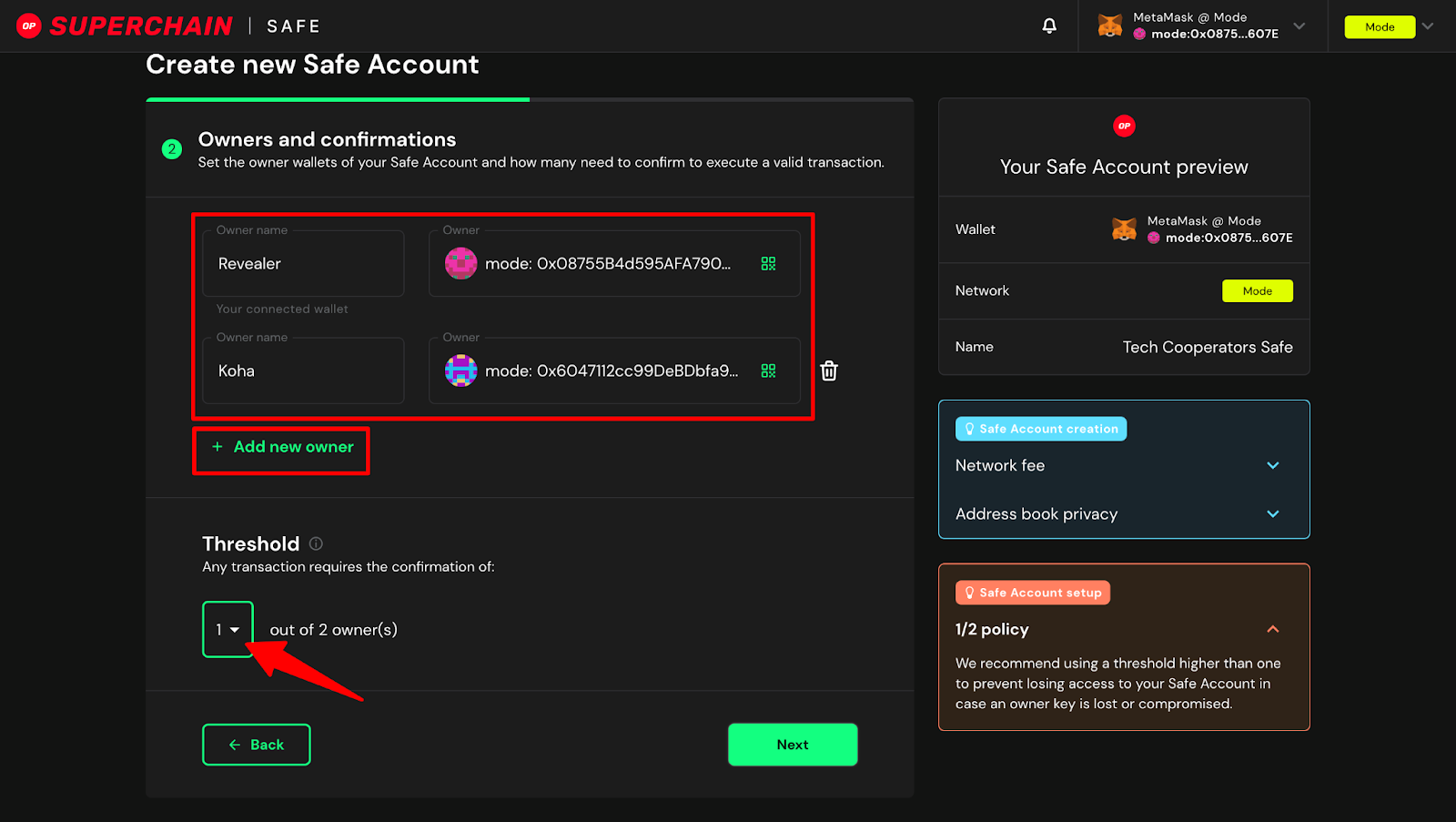

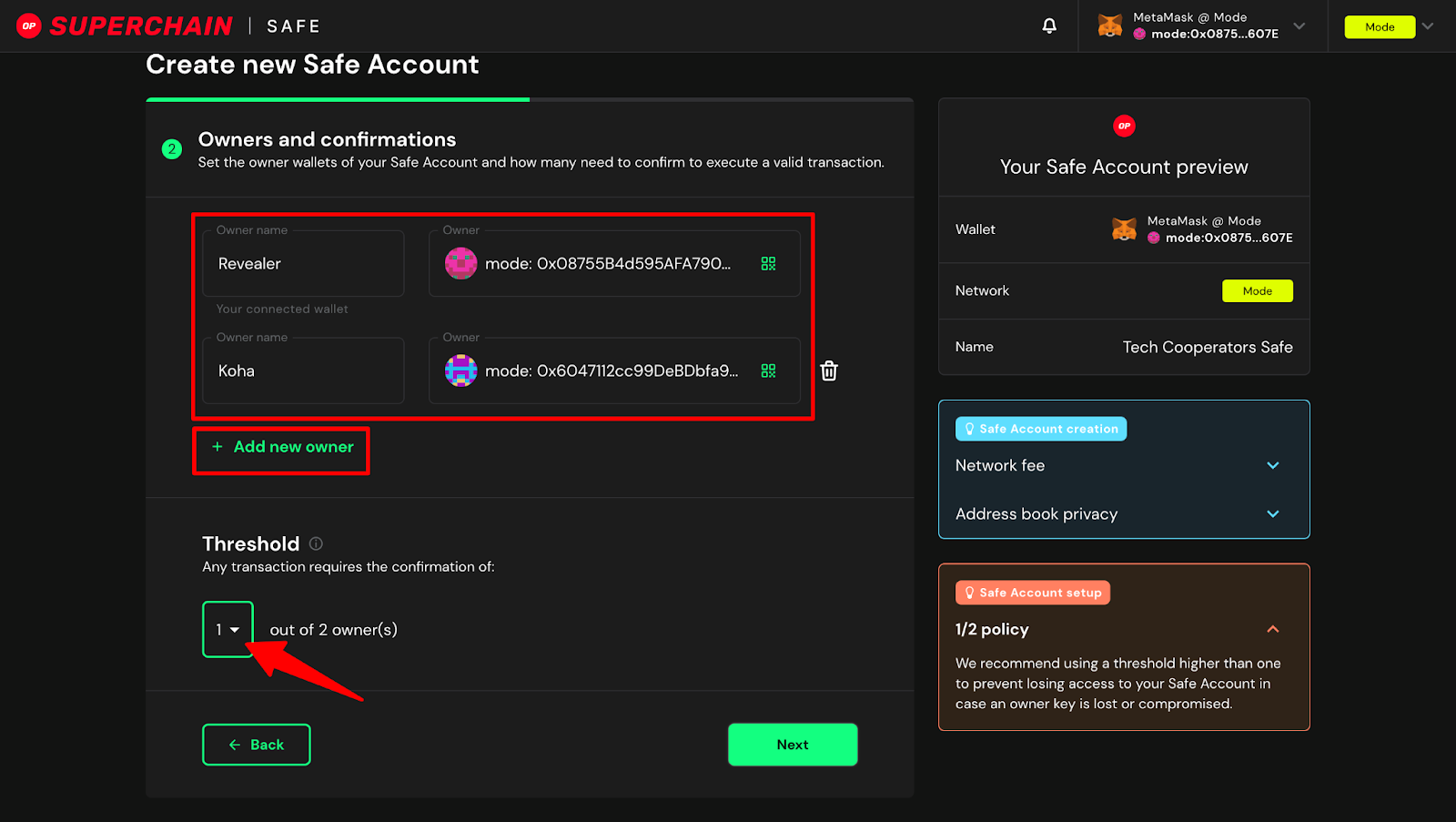

Single-key wallets are obsolete in DAO treasury operations. The gold standard is a combination of multisignature (multisig) wallets and granular role-based access controls (RBAC). Multisig requires multiple independent parties to approve any transaction, eliminating unilateral fund movement and drastically reducing internal collusion risk. Platforms like Gnosis Safe have become the default, letting DAOs set custom approval thresholds and delegate roles such as proposer, approver, or executor.

RBAC further compartmentalizes authority by defining who can initiate proposals, execute trades, or adjust protocol parameters. This separation of duties not only strengthens internal checks but also streamlines governance workflows by automating permissions based on contributor roles.

Top Strategies for Securing DAO Stablecoin Vaults

-

Implement Multisig and Role-Based Access Controls for Vault TransactionsLeverage platforms like Gnosis Safe for multi-signature wallets, ensuring that all treasury transactions require approval from multiple DAO members. Combine this with robust role-based access control frameworks—such as Aragon or OpenZeppelin AccessControl—to define granular permissions and minimize risks from compromised accounts or internal collusion.

-

Utilize Audited, Upgradable Smart Contracts with TimelocksAdopt smart contract frameworks like OpenZeppelin Contracts for secure, upgradable contracts. Integrate timelock controllers to delay sensitive actions, giving the DAO community time to review and react to proposed changes. Always use contracts that have undergone professional security audits to mitigate vulnerabilities.

-

Regularly Rebalance Stablecoin Allocations Across Multiple Protocols and ChainsDiversify treasury assets by distributing stablecoins across reputable DeFi protocols such as Aave, Compound, and Curve, and consider multi-chain deployments via Chainlink CCIP or Polygon. Regular rebalancing reduces protocol-specific and chain-specific risks, ensuring liquidity and stability.

-

Establish Real-Time On-Chain Monitoring and Automated Incident AlertsImplement monitoring solutions like Forta or HAL to track treasury transactions and contract activity in real time. Set up automated alerts for suspicious events or anomalies, enabling rapid response to threats and improving overall treasury resilience.

2. Utilize Audited, Upgradable Smart Contracts with Timelocks

The contract code governing your stablecoin vault is both a fortress and a potential attack surface. Only deploy thoroughly audited smart contracts from reputable security firms – regular audits are non-negotiable as DeFi exploits evolve rapidly. Upgradability is essential too: using proxy patterns lets your DAO patch vulnerabilities or add features without migrating funds off-chain.

Timelocks add another critical layer: they enforce a mandatory delay between when a transaction is proposed and when it can be executed on-chain. This window gives the community time to scrutinize actions and intervene if malicious activity is detected – an essential defense against governance attacks or rogue admin proposals.

3. Regularly Rebalance Stablecoin Allocations Across Multiple Protocols and Chains

Diversification isn’t just about holding different assets; it’s about spreading risk across protocols and blockchains to avoid systemic failures. Relying on a single stablecoin issuer or DeFi protocol exposes your treasury to smart contract bugs, depegging events, or chain-specific outages.

Automated rebalancing strategies help maintain target allocations in response to market shifts or protocol health signals. For example, you might allocate USDC across Aave (Ethereum), Compound (Ethereum), and Stargate (LayerZero), periodically rebalancing based on liquidity conditions or yield opportunities.

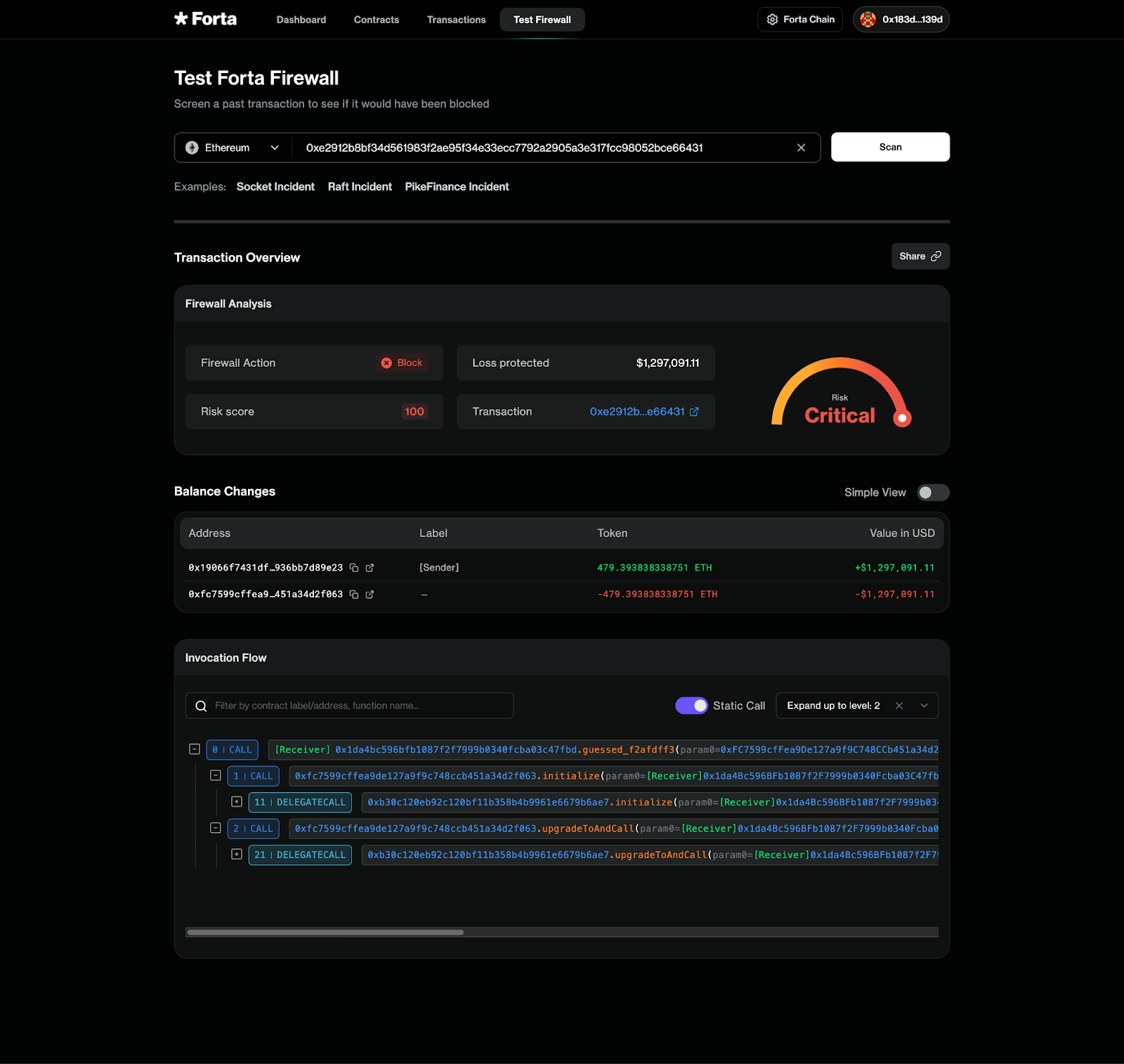

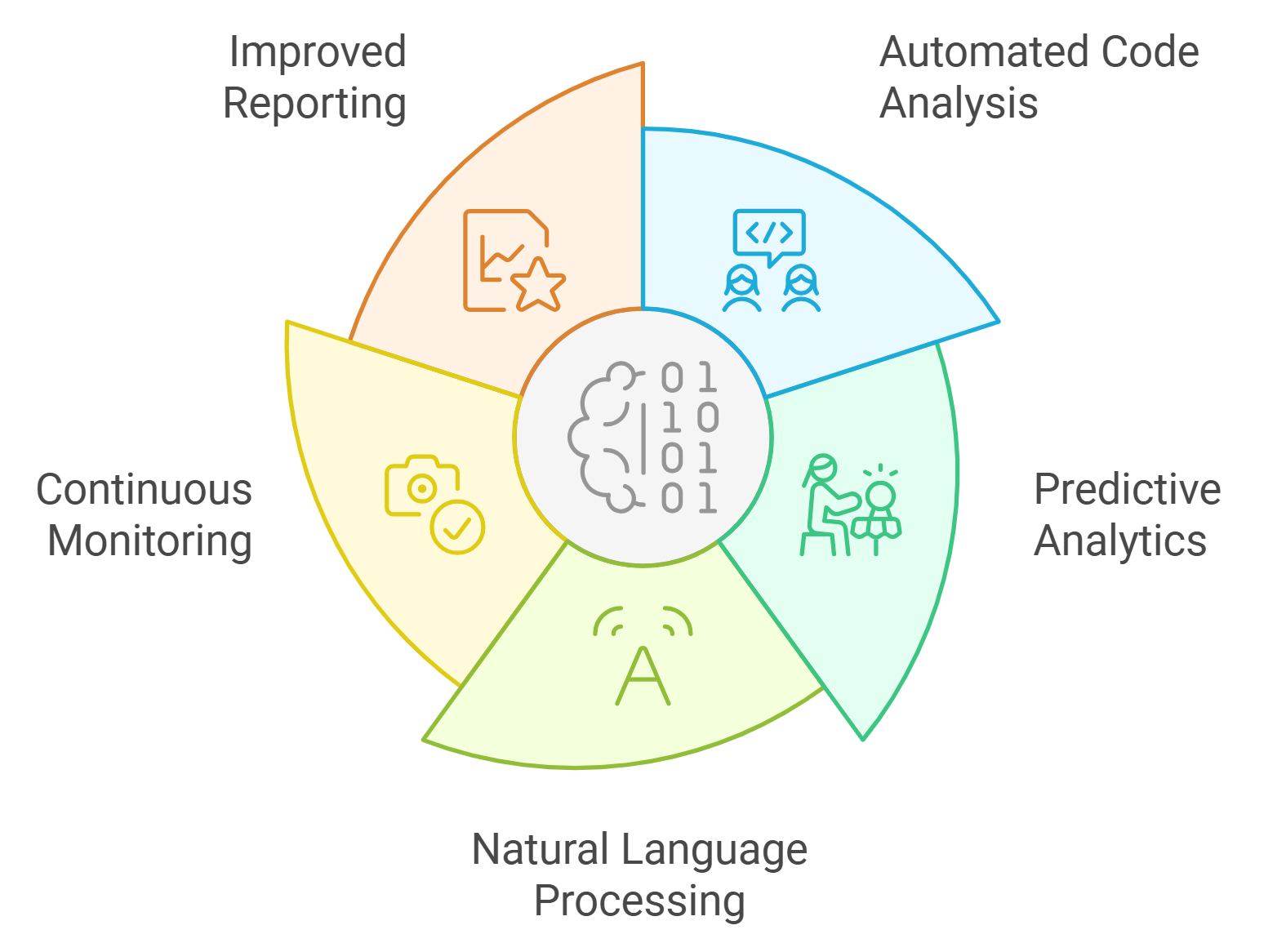

4. Establish Real-Time On-Chain Monitoring and Automated Incident Alerts

No amount of preventive control can guarantee absolute safety; proactive monitoring closes the loop by enabling rapid detection of anomalies. Integrate real-time analytics tools that track wallet balances, transaction flows, contract upgrades, oracle price feeds, and governance actions 24/7.

Automated incident alerts, delivered via Discord bots or encrypted messaging apps like Telegram Signal Bridge, instantly notify stakeholders of suspicious activity – such as unauthorized withdrawals or sudden changes in vault ownership structure.

4 Essential Strategies for DAO Stablecoin Vault Security

-

Implement Multisig and Role-Based Access Controls for Vault Transactions: Leverage established platforms like Gnosis Safe to require multiple approvals for any vault transaction. Combine multisig with role-based permissions—using tools such as Aragon or Snapshot—to ensure only authorized DAO members can propose or execute actions, minimizing risks of unauthorized transfers or internal collusion.

-

Utilize Audited, Upgradable Smart Contracts with Timelocks: Deploy stablecoin vaults using thoroughly audited and upgradable smart contracts on trusted platforms like OpenZeppelin Contracts. Integrate timelock mechanisms (e.g., Compound Timelock) to introduce delays before critical changes take effect, providing time for DAO members to review and veto suspicious actions.

-

Regularly Rebalance Stablecoin Allocations Across Multiple Protocols and Chains: Diversify risk by distributing stablecoin holdings across reputable protocols such as Aave, Compound, and Curve, and across different blockchains (e.g., Ethereum, Polygon). Use tools like Enzyme Finance to automate and monitor rebalancing, reducing exposure to protocol-specific or chain-specific risks.

If you want deeper insight into how DAOs use these practices for risk management with stablecoins specifically, check out our guide at How DAOs Use Stablecoin Vaults for Treasury Risk Management.

Integrating these four strategies creates a robust, multi-layered defense system that empowers DAOs to operate securely in an increasingly complex DeFi landscape. The interplay between access controls, contract security, diversification, and real-time oversight is not just best practice, it’s essential for long-term capital preservation and operational resilience.

Optimizing Security Without Sacrificing Agility

DAO treasury managers often face the challenge of balancing security with operational flexibility. Multisig and RBAC frameworks are highly configurable, approval thresholds and roles can be dynamically adjusted as your DAO grows or governance structures evolve. Upgradable smart contracts mean you’re not locked into outdated logic, while timelocks ensure every upgrade is subject to community review before going live. This dynamic approach lets DAOs adapt quickly to changing market conditions or regulatory requirements without exposing the treasury to unnecessary risk.

Meanwhile, automated rebalancing across protocols and chains keeps your stablecoin reserves insulated from single points of failure. By leveraging cross-chain bridges and composable DeFi primitives, you can optimize yields while minimizing exposure to any one protocol’s risks. Real-time monitoring tools close the feedback loop, alerting contributors within seconds if something goes wrong so you can execute emergency procedures before losses mount.

Culture of Security: Training, Drills, and Transparency

Technical controls are only as effective as the people who operate them. Regular training sessions for signers and protocol contributors are crucial, everyone should understand how multisig approvals work, what a suspicious transaction looks like, and how to respond in a crisis. Running simulated incident response drills will surface gaps in your playbooks before they’re stress-tested by a real attack.

Transparency is another pillar of robust on-chain treasury management. Make security policies public; share audit reports and rebalance logs with your community; publish post-mortems if incidents occur. This openness builds trust with token holders and attracts skilled contributors invested in the DAO’s success.

Continuous Improvement: Keeping Pace With DeFi Risks

The threat landscape for secure DAO treasuries evolves constantly, new attack vectors emerge as protocols innovate. Schedule periodic reviews of your vault architecture: update RBAC permissions when leadership changes; commission fresh smart contract audits after major upgrades; rotate signing keys regularly; expand monitoring coverage as new assets or chains are added.

The most resilient DAOs treat security as an ongoing process rather than a one-time setup. By embedding these four best practices into your operational DNA, and fostering a culture of vigilance, you’ll not only protect your stablecoin vaults but also set a standard for responsible decentralized governance.

Essential Strategies for Securing DAO Stablecoin Vaults

-

Implement Multisig and Role-Based Access Controls for Vault TransactionsAdopt robust access management by using multi-signature (multisig) wallets like Gnosis Safe, which require multiple approvals for transactions. Combine this with role-based governance protocols (e.g., OpenEden’s TBILL Vault) to ensure only authorized members can initiate or approve vault operations, reducing single points of failure and internal risk.

-

Utilize Audited, Upgradable Smart Contracts with TimelocksDeploy audited smart contracts (using firms like ConsenSys Diligence or Trail of Bits) that support upgradeability for rapid security improvements. Integrate timelock mechanisms (as seen in OpenEden’s TBILL Vault) to introduce delays before executing critical changes, allowing for community review and intervention if needed.

-

Regularly Rebalance Stablecoin Allocations Across Multiple Protocols and ChainsMitigate risk by diversifying stablecoin holdings (such as USDC, DAI, and USDT) across reputable DeFi platforms like Aave, Compound, and Curve, and across different blockchains (Ethereum, Polygon, etc.). Regular rebalancing ensures optimal yield, liquidity, and reduces exposure to protocol-specific vulnerabilities.

-

Establish Real-Time On-Chain Monitoring and Automated Incident AlertsImplement real-time monitoring tools like Forta and Hal to track on-chain activity, vault movements, and governance actions. Set up automated alerts for suspicious transactions or abnormal patterns, enabling immediate response to potential threats and strengthening operational resilience.

If you’re ready to take action or want more tactical examples on implementing these approaches at scale, explore our deep dive at How DAOs Use Stablecoin Vaults for Treasury Risk Management.