In 2025, DAOs are facing their most sophisticated treasury management landscape yet. The passage of the GENIUS Act has brought regulatory clarity, opening the door for compliant on-chain yield strategies. At the heart of this evolution are stablecoin vaults for DAOs, which now offer a blend of automated risk controls, transparent governance, and highly competitive yields. For DAO operators and treasury managers, selecting the right vault is critical to balancing capital efficiency with robust risk management.

Why Stablecoin Vaults Are Essential for DAO Treasury Management in 2025

Stablecoins like USDC, DAI, and USDT have become indispensable to DAOs seeking to preserve value and access liquidity without exposure to crypto market volatility. However, simply holding these assets is no longer enough. With on-chain yield optimization now a norm rather than an exception, DAOs must deploy their stablecoins into vetted DeFi vaults that maximize returns while maintaining rigorous stablecoin risk management.

The leading stablecoin vaults in 2025 are not just about yield – they incorporate automated rebalancing, multi-protocol routing, and advanced risk assessment tools. These features help DAOs stay agile in volatile conditions while satisfying both governance transparency and regulatory compliance.

The Top 5 Stablecoin Vaults for DAOs in 2025

This year’s best DeFi vaults are distinguished by their security frameworks, flexible support for major stablecoins, and proven track records in DAO treasury management. Let’s break down each one:

Top 5 Stablecoin Vaults for DAOs in 2025

-

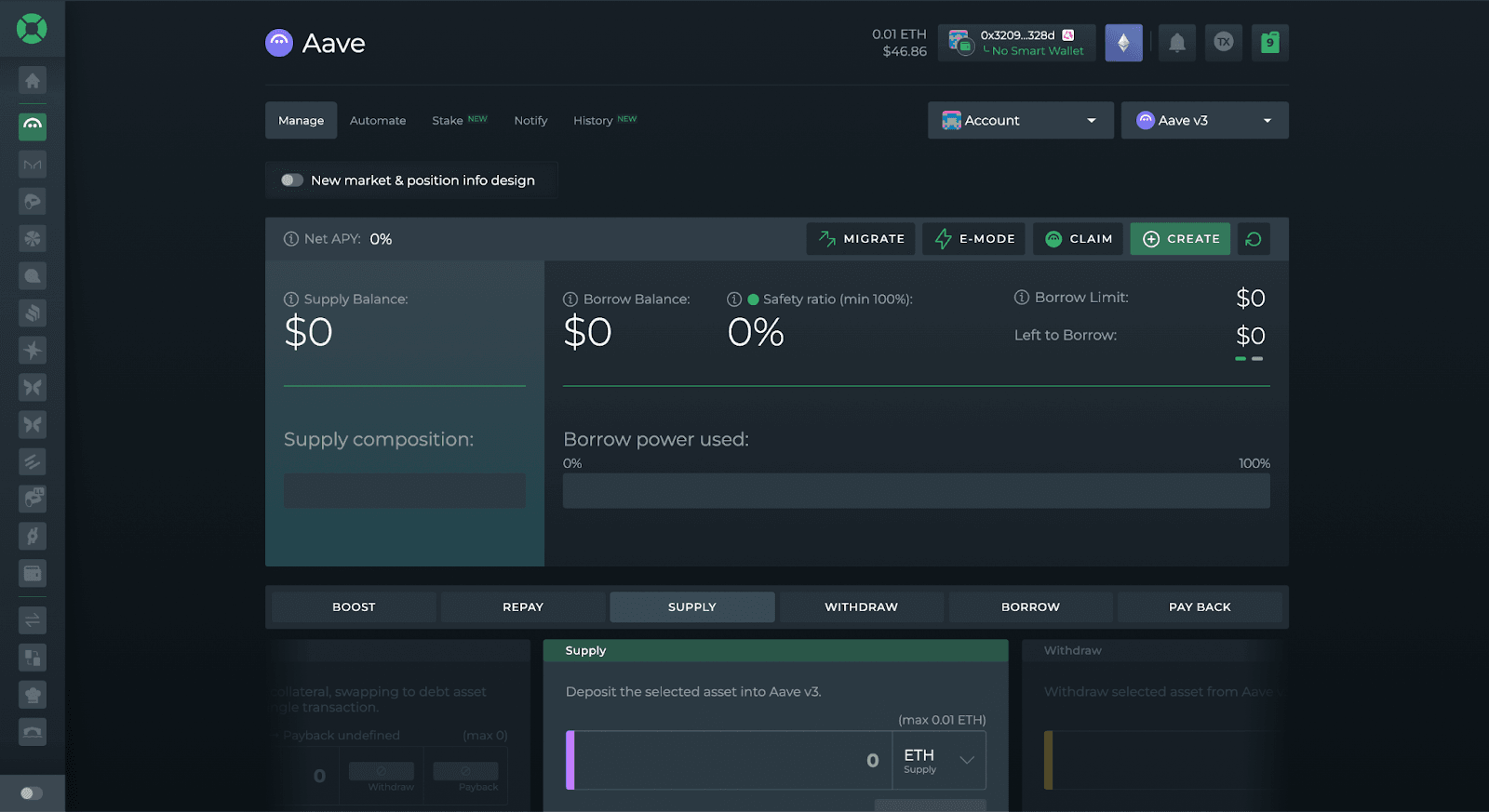

Aave V3 Stablecoin Lending Vault (USDC/DAI/USDT, Multi-Chain)Renowned for its multi-chain flexibility and automated risk management, Aave V3 supports leading stablecoins like USDC, DAI, and USDT. DAOs benefit from dynamic interest rates, robust liquidity, and advanced risk controls across major blockchains.

-

Yearn Finance yVaults (USDC/DAI, Ethereum Mainnet & L2s)Yearn Finance’s yVaults offer AI-driven strategy selection and automated yield optimization for stablecoins. Supporting USDC and DAI on Ethereum and Layer 2s, yVaults are a DAO favorite for their operational simplicity and capital efficiency.

-

Compound III USDC Vault (Ethereum Mainnet)Compound III’s USDC vault is a staple for DAOs seeking transparent, on-chain lending with algorithmic interest rates. Its single-asset design reduces risk exposure, while smart contract automation ensures security and efficiency.

-

Balancer Boosted Aave USD Pool (bb-a-USD, Ethereum Mainnet)This innovative pool combines Balancer’s liquidity provisioning with Aave’s yield strategies, allowing DAOs to earn boosted returns on bb-a-USD tokens. It’s prized for capital efficiency and deep on-chain liquidity.

-

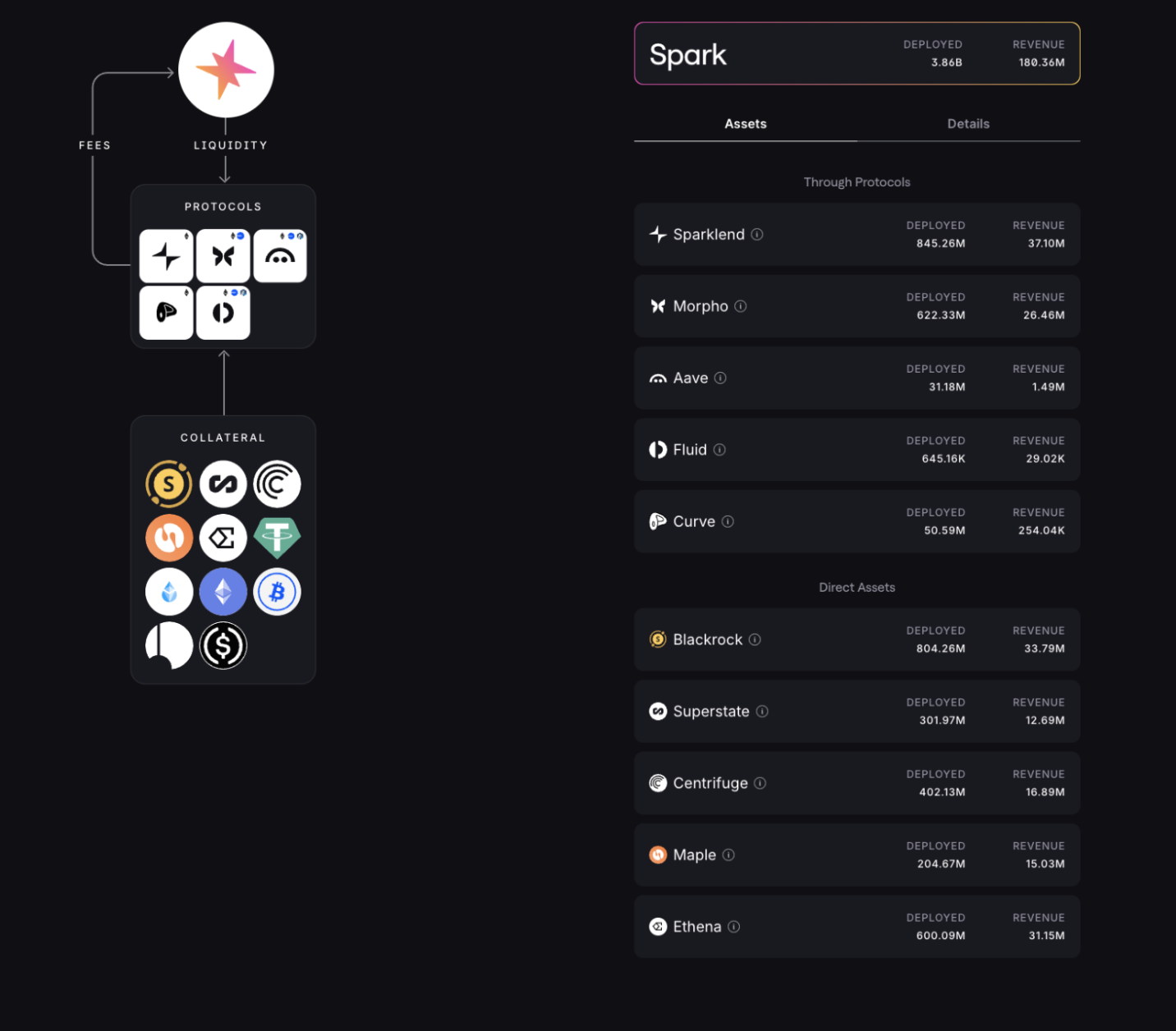

Spark Protocol DAI Savings Rate Vault (Ethereum Mainnet)The Spark Protocol vault offers DAOs direct access to the DAI Savings Rate on Ethereum, with protocol-native integration and decentralized governance. It’s a reliable choice for stable, on-chain yield and robust risk management.

Aave V3 Stablecoin Lending Vault (USDC/DAI/USDT, Multi-Chain)

Aave V3 remains a cornerstone protocol for DAOs prioritizing flexibility across multiple chains. Its lending vault supports USDC, DAI, and USDT – offering deep liquidity pools with dynamic interest rates based on real-time market demand. The protocol’s automated risk parameters adjust collateral factors and liquidation thresholds regularly to protect against systemic shocks.

Aave’s robust governance structure ensures that any parameter changes or upgrades are transparently proposed and voted on by token holders. For DAOs needing cross-chain exposure with battle-tested security mechanisms, Aave V3 is often the first stop.

Read more about Aave V3’s role in DAO treasuries here.

Yearn Finance yVaults (USDC/DAI, Ethereum Mainnet and L2s)

Yearn Finance yVaults have evolved into highly automated yield engines powered by AI-driven strategy selection. Supporting both USDC and DAI across Ethereum mainnet as well as Layer 2 networks, yVaults continuously route funds to the highest-yielding protocols – including Compound, Morpho, and Aave – based on up-to-the-minute analytics.

The operational simplicity of Yearn means that treasury managers can deploy capital with minimal oversight while benefiting from regular rebalancing and transparent performance reporting. This makes Yearn ideal for DAOs seeking hands-off yield generation without sacrificing oversight or security.

Learn how Yearn’s automation optimizes DAO yields.

Deep Dive: Compound III USDC Vault and Balancer Boosted Aave USD Pool

The next two vaults bring unique strengths to a diversified DAO portfolio:

- Compound III USDC Vault (Ethereum Mainnet): This iteration of Compound focuses exclusively on blue-chip collateral like USDC. By narrowing its asset base and introducing isolated markets per asset type, Compound III enhances risk containment while delivering attractive yields through algorithmic interest rate models.

- Balancer Boosted Aave USD Pool (bb-a-USD): On Ethereum mainnet, this hybrid pool integrates Balancer’s programmable liquidity with Aave’s lending engine. The result? Enhanced capital efficiency as idle assets earn extra yield via underlying lending protocols before being used for swaps or liquidity provision.

Together with Spark Protocol’s DAI Savings Rate Vault (covered later), these platforms form the backbone of modern DAO treasury management strategies, allowing organizations to tailor their approach based on risk tolerance and operational needs.

For treasury managers, the Compound III USDC Vault stands out for its focused risk profile. By restricting collateral types and isolating markets, Compound III minimizes systemic exposure, a critical consideration in today’s regulatory environment. Its algorithmic rate-setting ensures that DAOs can access competitive yields without overextending leverage or complexity. Regular audits and transparent governance further bolster trust in this protocol, making it a favorite among organizations emphasizing capital preservation.

The Balancer Boosted Aave USD Pool (bb-a-USD) is a sophisticated solution for DAOs looking to maximize every dollar of liquidity. Here, stablecoins deposited into Balancer are automatically routed to Aave’s lending pools, where they accrue interest before being made available for swaps or liquidity provision within Balancer itself. This dual utility not only improves yield but also enhances liquidity depth for DAO treasuries that require frequent on-chain transactions. The modular nature of Balancer allows for fine-tuned exposure and integration with automated risk management tools.

Spark Protocol DAI Savings Rate Vault (Ethereum Mainnet)

The Spark Protocol DAI Savings Rate Vault is the go-to choice for DAOs seeking sustainable, protocol-native yield on their DAI holdings. By leveraging MakerDAO’s DSR mechanism within Spark Protocol’s interface, this vault offers predictable returns with minimal operational overhead. The system is governed by decentralized proposals and rigorous risk assessments, ensuring that changes to savings rates or collateral requirements are both transparent and accountable.

Spark’s integration with Ethereum mainnet guarantees deep liquidity and seamless interoperability with other DeFi applications, key advantages as DAOs increasingly rely on composable financial primitives to manage complex treasury needs.

Best Practices: Maximizing Yield While Managing Risk

Deploying assets across these top stablecoin vaults enables DAOs to balance yield generation with prudent risk controls. Here are several actionable strategies:

- Diversify across protocols: Allocating funds between Aave V3, Yearn yVaults, Compound III, Balancer bb-a-USD Pool, and Spark Protocol mitigates idiosyncratic risks while capturing a spectrum of yield opportunities.

- Automate rebalancing: Leverage vaults offering AI-driven or rules-based rebalancing to respond dynamically to market changes without manual intervention.

- Monitor regulatory developments: Stay informed about compliance requirements post-GENIUS Act; prioritize vaults with transparent governance and regular audit histories.

- Assess liquidity needs: Match your DAO’s operational cadence with the withdrawal terms and on-chain liquidity profiles of each vault, especially important if you anticipate large disbursements or rapid market shifts.

The right mix will depend on your DAO’s size, mission, and risk appetite. For more detailed frameworks on evaluating these options, see our guide: How to Evaluate Stablecoin Vaults for DAO Treasuries.

Looking Ahead: The Future of Stablecoin Yield Strategies

The landscape for automated DeFi vaults is evolving rapidly as protocols race to integrate smarter risk engines and more robust cross-chain capabilities. As stablecoins continue their ascent as the backbone of DAO treasuries, expect further innovation around permissionless access controls, real-time compliance checks, and even insurance-backed yield products.

Treasury managers who stay abreast of these developments, and who methodically diversify across the proven leaders like Aave V3, Yearn yVaults, Compound III USDC Vault, Balancer bb-a-USD Pool, and Spark Protocol’s DAI Savings Rate Vault, will be best positioned to maximize returns while safeguarding their communities’ capital well into 2026.