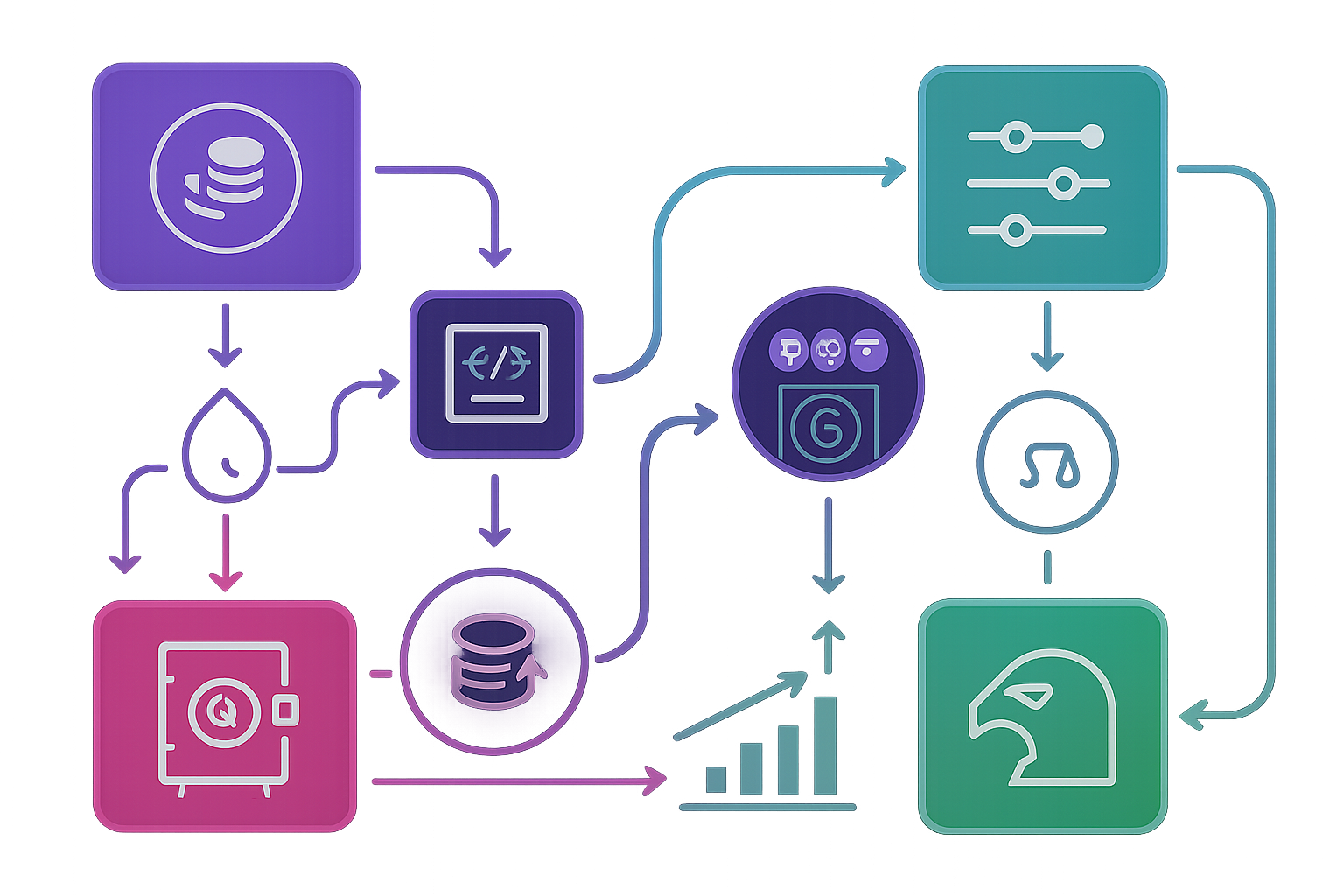

Stablecoin vaults have become the strategic backbone of DAO treasury management in 2025, offering a rare combination of capital efficiency, risk diversification, and airdrop opportunities. With USDC, DAI, and USDT now the bedrock of on-chain treasuries, the focus has shifted from simple storage to sophisticated yield optimization and automated risk controls. For DAO operators and treasury managers, choosing the right stablecoin vault is no longer just about chasing APY – it’s about building resilient portfolios that can weather volatility while capturing upside from ecosystem incentives.

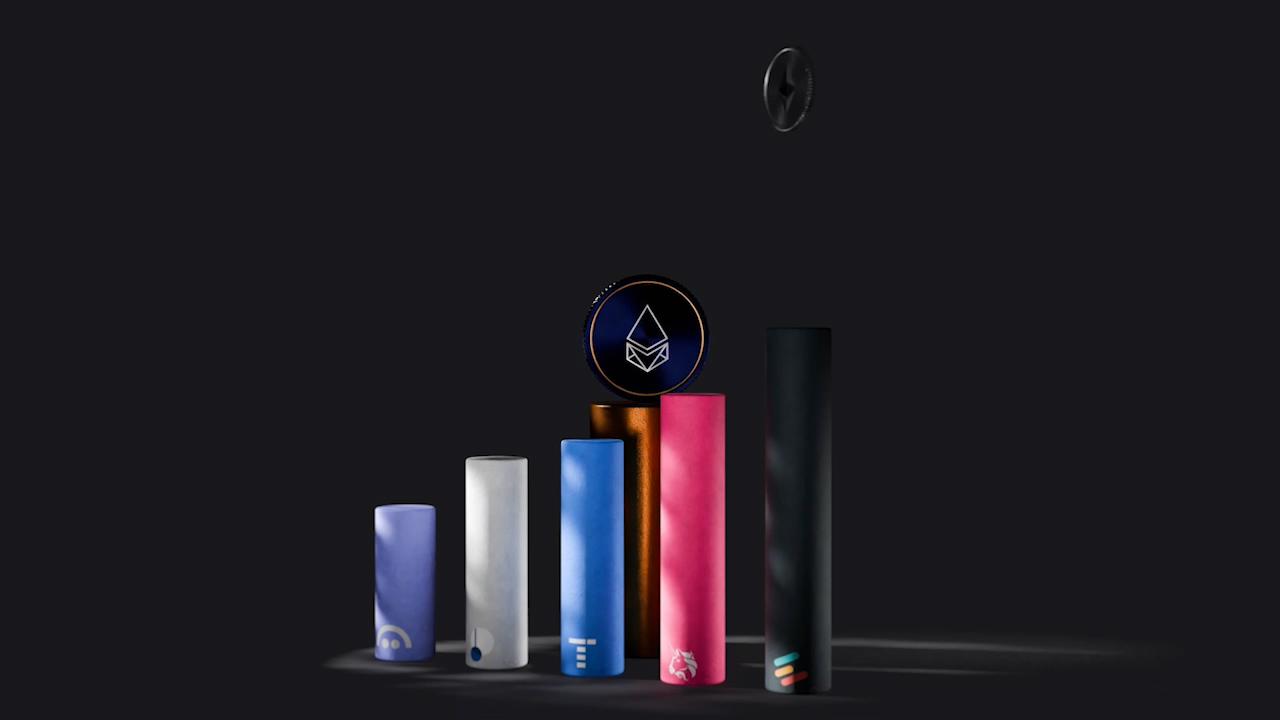

The current landscape features a competitive field of next-generation vaults. Each leverages unique mechanisms – from liquid staking to cross-chain lending – to maximize returns while minimizing operational complexity. Below, we dissect five standout stablecoin vaults that are setting the standard for DAO treasury yield strategies in 2025.

1. Ether. fi Cash Vault (ETHFI): Liquid Staking Meets Stable Yield

Ether. fi Cash Vault is redefining stablecoin yield farming for DAOs with its non-custodial architecture and direct exposure to Ethereum’s liquid staking economy. Offering approximately 10% APY, this vault allows DAOs to deposit stablecoins and earn returns sourced from EtherFi’s staking rewards pipeline. What sets Ether. fi apart is its dual benefit: not only do treasuries access robust yields, but they also position themselves for potential airdrop opportunities within the rapidly growing EtherFi ecosystem. This makes it an ideal choice for DAOs seeking both income and strategic upside.

2. Aave V3 Stablecoin Lending Vault: Automated Treasury Optimization Across Chains

The Aave V3 Stablecoin Lending Vault remains a cornerstone for DAOs prioritizing multi-chain flexibility and automated risk management. Supporting major assets like USDC, DAI, and USDT across leading L2s, this vault dynamically reallocates funds to optimize yield while managing protocol-specific risks such as utilization rates or liquidity crunches. Its advanced rebalancing logic ensures that treasury allocations always chase optimal returns without manual intervention, a critical feature as DeFi markets move faster than ever before.

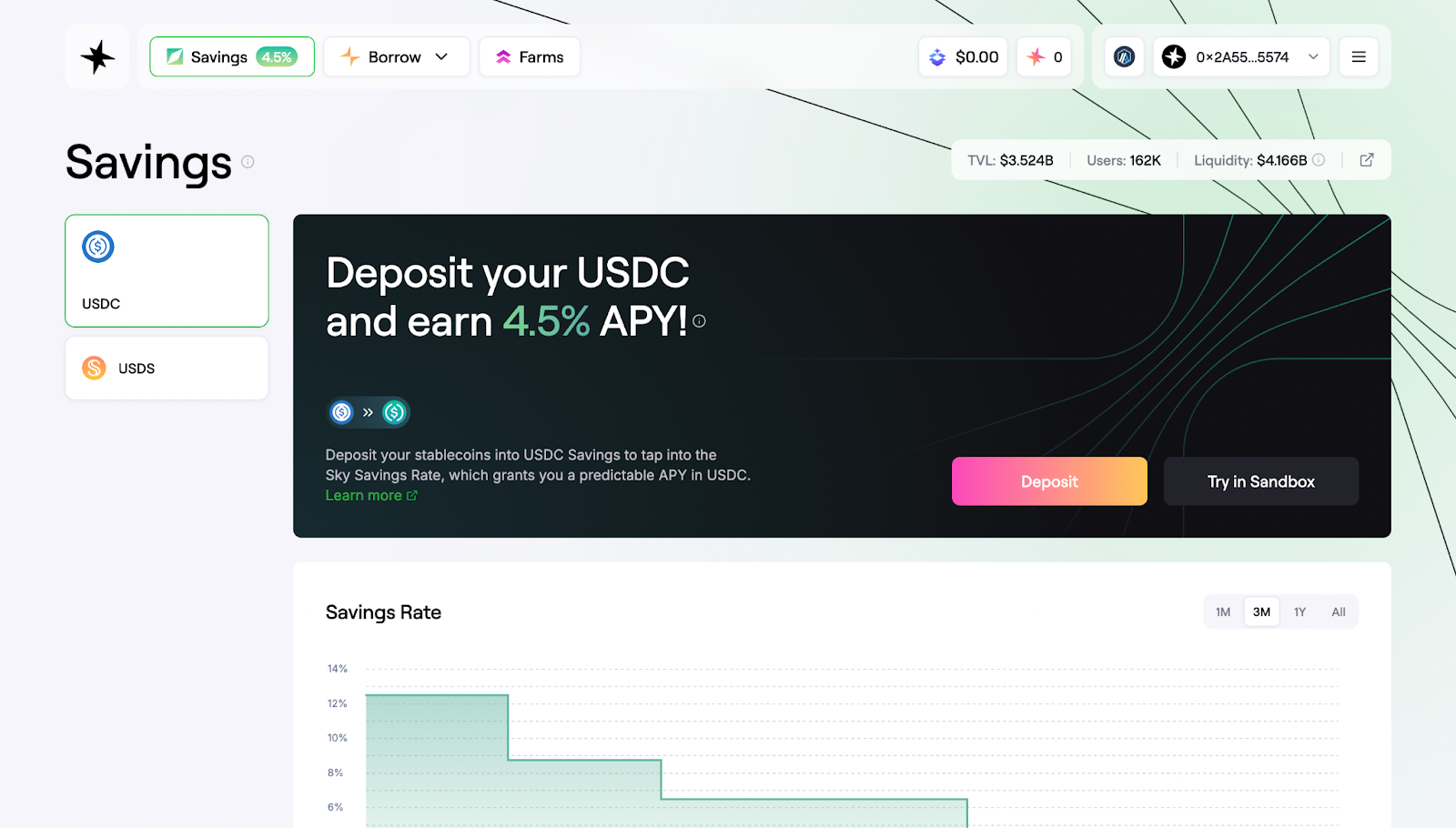

3. MakerDAO DAI Direct Deposit Module (D3M): Sustainable On-Chain Yield at Scale

The MakerDAO DAI Direct Deposit Module (D3M) is purpose-built for DAOs seeking decentralized stability without sacrificing yield potential. By integrating directly with protocols like Aave and Spark, D3M channels idle DAI into lending pools where it earns sustainable on-chain returns – all governed by Maker’s robust collateralization framework. This approach minimizes counterparty risk while allowing treasuries to participate in DeFi-native yield generation at scale.

Together, these first three vaults offer a spectrum of strategies: exposure to staking rewards with built-in airdrop potential (Ether. fi), automated cross-chain lending (Aave V3), and decentralized yield aggregation via protocol-native infrastructure (MakerDAO D3M). Each solution addresses distinct priorities around risk appetite, operational automation, and ecosystem alignment.

The Competitive Edge: Falcon Finance and Yearn v3 Vaults

No list of best stablecoin vaults 2025 would be complete without examining high-octane innovators like Falcon Finance and Yearn Finance v3:

- Falcon Finance Stablecoin Vaults: These cross-chain vaults are designed for DAOs willing to balance higher APY potential, up to 18% APY: with smart contract automation and built-in risk controls. Falcon’s architecture also makes users eligible for future protocol airdrops, a key value-add as governance tokens remain a core part of DeFi economics.

- Yearn Finance Stablecoin v3 Vaults (yVaults): As one of DeFi’s original aggregators, Yearn’s latest iteration leverages AI-driven strategy selection across protocols to maximize yields on USDC, DAI, and USDT deposits. With multi-protocol routing under the hood, yVaults deliver both capital efficiency and operational simplicity, making them indispensable tools for modern DAO treasuries.

This evolving ecosystem gives DAO operators powerful new levers, from liquid staking hybrids to automated lending routers, to construct resilient portfolios that thrive across market cycles.

Key Considerations for DAO Treasury Managers in 2025

As DAOs navigate the increasingly sophisticated world of on-chain treasury management, selecting the right stablecoin vault is a matter of strategic alignment. The top-performing vaults of 2025 are not just about headline APY, they balance risk, liquidity, operational complexity, and ecosystem incentives. For example, Ether. fi Cash Vault (ETHFI) offers a unique blend of liquid staking rewards and airdrop eligibility, while Aave V3 Stablecoin Lending Vault excels at automated cross-chain optimization. MakerDAO’s D3M stands out for its protocol-native integration and decentralized governance, providing a robust foundation for DAOs that prioritize on-chain transparency.

Falcon Finance Stablecoin Vaults push the envelope further with high-yield opportunities (up to 18% APY) and cross-chain diversification, ideal for treasuries seeking aggressive growth paired with automated risk controls. Meanwhile, Yearn Finance v3 yVaults remain the gold standard for hands-off yield farming: their AI-driven strategies ensure optimal capital allocation across protocols with minimal manual oversight.

Top 5 Stablecoin Vaults for DAO Treasury Yield (2025)

-

Ether.fi Cash Vault (ETHFI) — A non-custodial, liquid staking stablecoin vault delivering approximately 10% APY. DAOs benefit from exposure to EtherFi’s robust airdrop ecosystem while maintaining on-chain transparency and liquidity.

-

Aave V3 Stablecoin Lending Vault (USDC/DAI/USDT) — A multi-chain lending vault designed for optimized DAO treasury yield and risk management. Features automated rebalancing across USDC, DAI, and USDT, ensuring capital efficiency and robust risk controls.

-

MakerDAO DAI Direct Deposit Module (D3M) — A decentralized DAI vault that integrates directly with protocols like Aave and Spark, providing DAOs with sustainable on-chain yield and seamless protocol interoperability.

-

Falcon Finance Stablecoin Vaults — High-yield, cross-chain stablecoin vaults offering up to 18% APY. These vaults feature automated risk controls and airdrop eligibility, making them highly attractive for DAO treasuries seeking aggressive yield.

-

Yearn Finance Stablecoin v3 Vaults (yVaults) — Automated DeFi yield aggregator for USDC, DAI, and USDT, leveraging multi-protocol strategies for capital efficiency. Yearn’s v3 vaults offer DAOs passive, diversified yield with advanced risk management.

Risk Management and Diversification: The New Standard

The lessons of previous DeFi cycles are clear: Diversification is non-negotiable. Leading DAOs now distribute stablecoin allocations across multiple vaults to mitigate protocol-specific risks such as smart contract vulnerabilities or liquidity shocks. By blending exposure, combining, say, Ether. fi’s liquid staking with Falcon’s high-yield vaults and Yearn’s multi-protocol aggregation, treasury managers can smooth returns while remaining agile in volatile markets.

This multi-vault approach also opens doors to layered yield streams and airdrop opportunities across ecosystems. It’s not uncommon for sophisticated treasuries to rotate capital seasonally or tactically rebalance based on evolving APYs and governance incentives. Automated tools offered by Aave V3 or Yearn v3 make such dynamic strategies both feasible and cost-effective at scale.

Airdrops and Ecosystem Incentives: Hidden Alpha in 2025

A key trend this year is the rise of airdrop-centric yield strategies. Protocols like Ether. fi and Falcon Finance explicitly reward early adopters and active participants with governance tokens or ecosystem incentives, sometimes rivaling or even exceeding direct APY returns. For DAOs keen on maximizing total return (not just passive income), these airdrop opportunities represent hidden alpha that can materially impact treasury performance over time.

Tactical Playbook: How to Deploy These Vaults Effectively

The most effective DAO treasuries in 2025 follow a tactical playbook:

- Diversify: Allocate across multiple vault types (staking, lending, aggregators) to smooth risk-adjusted returns.

- Automate: Leverage platforms like Yearn v3 or Aave V3 for auto-rebalancing based on real-time market conditions.

- Pursue Incentives: Actively monitor new protocol launches (e. g. , Falcon Finance) for early adopter benefits and potential token drops.

- Monitor Risk: Regularly review smart contract audits, platform health metrics, and governance changes, especially when deploying into newer protocols or cross-chain environments.

- Stay Agile: Use transparent dashboards to track yields, manage liquidity needs, and pivot allocations as market conditions evolve.

The Bottom Line: Building Resilient On-Chain Treasuries

The best stablecoin vaults of 2025 empower DAOs to move beyond passive holding into active capital stewardship, balancing yield maximization with rigorous risk controls. By leveraging tools like Ether. fi Cash Vault, Aave V3 Lending Vaults, MakerDAO DAI D3M, Falcon Finance Stablecoin Vaults, and Yearn Finance v3 yVaults, treasury managers can construct portfolios that thrive across market cycles while capturing upside from DeFi’s most innovative incentive structures.

If you’re ready to take your DAO treasury strategy to the next level, or want deeper insights into these protocols, explore our full guide on best stablecoin vault strategies for DAO treasuries.