In 2025, DAO treasury management is undergoing a rapid transformation as stablecoin vaults become the backbone of on-chain financial operations. The days of passive, set-and-forget treasury strategies are over. Leading DAOs now treat treasury management as an active discipline, leveraging automated stablecoin vaults to enhance capital efficiency, transparency, and risk control.

Automated Optimization: From Manual Allocation to Smart Vaults

The core advantage of modern stablecoin vaults lies in automation. Platforms like Aera and Factor. fi allow DAOs to program custom risk parameters and delegate asset allocation to decentralized networks of professional managers. This reduces governance overhead while ensuring treasuries are continuously optimized according to pre-defined mandates, whether that means maximizing operational reserves, seeking delta-neutral yield, or managing liquidity buffers.

For example, a DAO can set up a modular vault that automatically rebalances between USDC, USDT, and DAI based on market conditions or liquidity requirements. These non-custodial solutions remove human error from routine rebalancing and empower DAOs to respond dynamically to market volatility without sacrificing security or control. For a deeper dive into these mechanisms, see our analysis of on-chain treasury automation.

Yield Generation Without Directional Risk

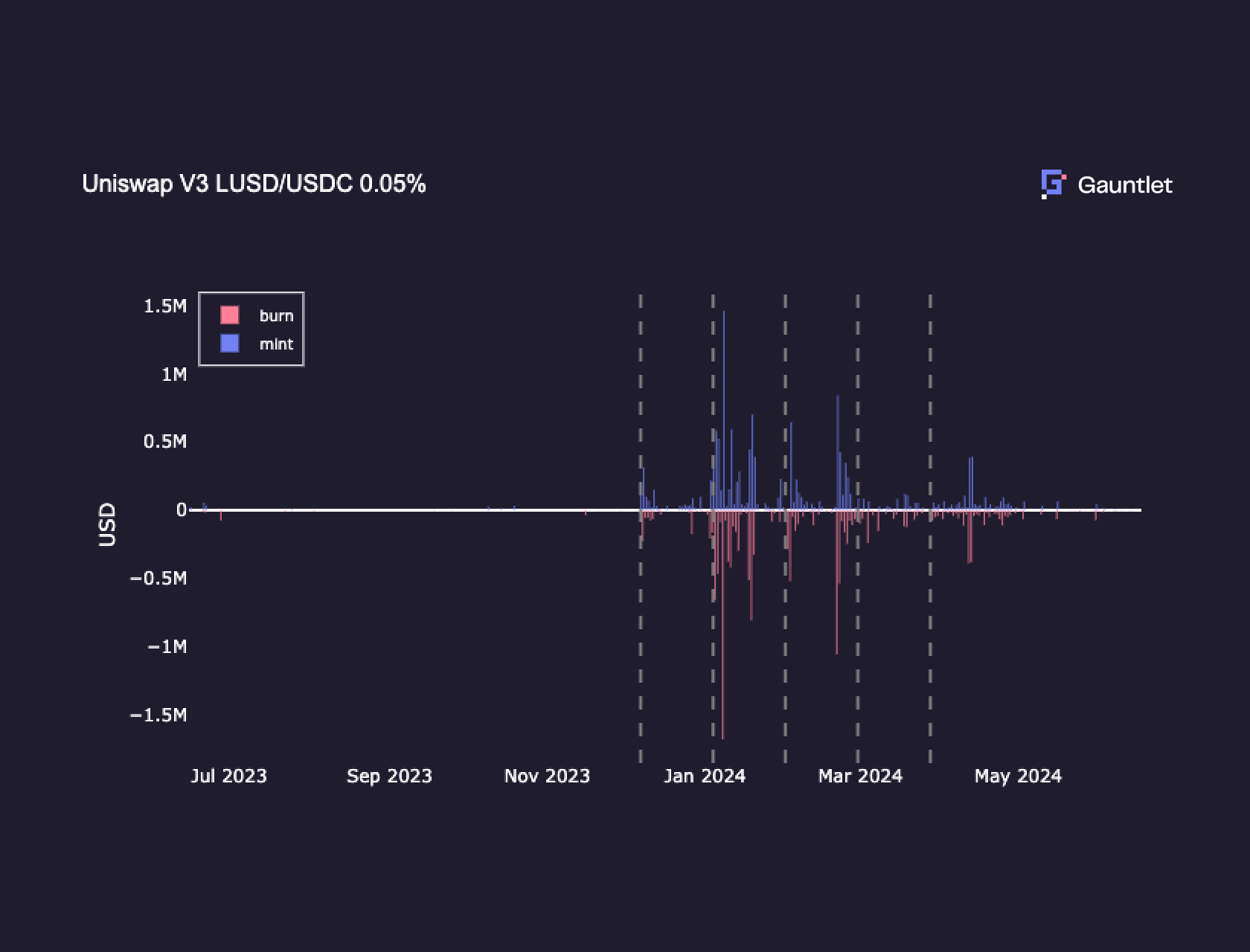

Stablecoin vaults are not just about safety, they are also powerful yield engines. In 2025, delta-neutral strategies have become the go-to for DAOs seeking predictable returns without exposure to crypto price swings. By hedging long and short positions across DeFi protocols, DAOs systematically capture yield from lending markets and liquidity pools while minimizing volatility risk.

This approach is especially attractive in today’s environment where dollar-backed stablecoins have significant influence over short-term U. S. Treasury yields (see Ahmed and Aldasoro 2025). As more DAOs adopt these sophisticated stablecoin yield strategies, the competitive edge shifts toward those who can automate risk management at scale while maintaining on-chain transparency.

Transparency and Real-Time Reporting Set New Standards

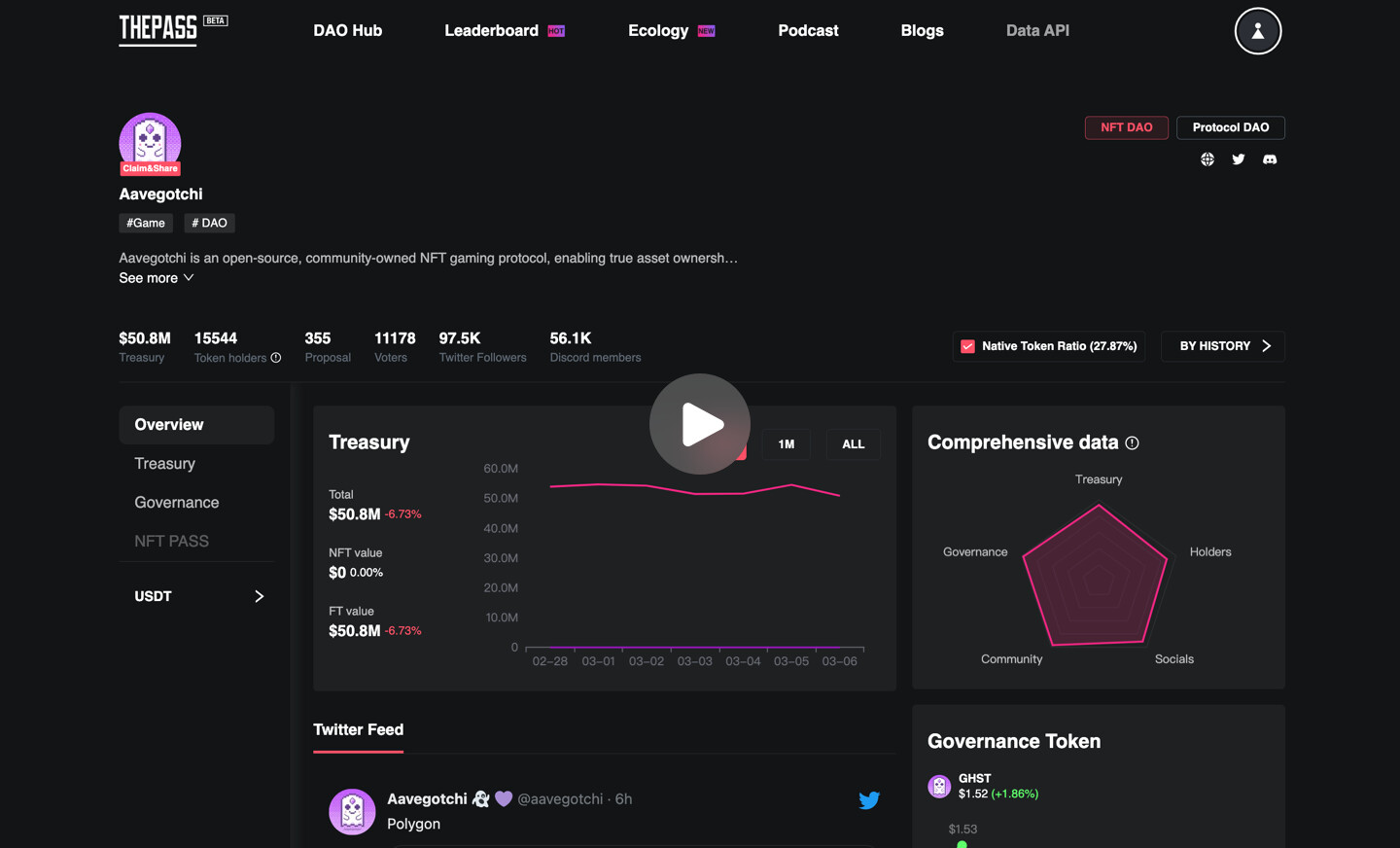

The maturation of DAO treasury management is tightly linked to advances in transparency tools. Leading vault protocols now provide real-time dashboards, on-chain audit trails, and open APIs, making every transaction verifiable by token holders or external auditors at any time. This level of visibility is critical not only for trust but also for regulatory compliance as DAOs expand globally.

Tokenomics. net reports that many DAOs now allocate between 20-40% of their treasuries to stablecoins; the rest is diversified across blue-chip crypto assets or tokenized real-world assets like U. S. Treasuries and short-term bonds for additional stability (source). This robust reporting infrastructure supports both internal governance and external oversight, a must-have in today’s regulatory climate.

Diversification and Risk Mitigation in Practice

One of the most actionable trends for DAOs in 2025 is the strategic diversification of stablecoin holdings. By allocating treasury assets across multiple trusted issuers, such as USDC, USDT, and DAI, DAOs are actively mitigating risks tied to any single protocol or counterparty. This approach limits exposure to black swan events, regulatory shocks, or technical failures that could impact a single stablecoin. Many treasuries now also allocate a portion to tokenized real-world assets (RWAs), such as short-term U. S. Treasuries, further stabilizing their reserves while capturing additional yield.

Arbitrum DAO’s Secure Treasury Endowment Program (STEP 2.0) is a leading example: by partnering with professional managers like Karpatkey, Arbitrum has rebalanced its treasury toward stablecoins and deployed capital into lending protocols and RWA vaults. The result is a more resilient financial base for ecosystem growth, a model other DAOs are quickly emulating.

Operational Playbook: Best Practices for DAO Treasury Teams

Best Practices for DAO Treasury Teams Using Stablecoin Vaults

-

Automate Asset Allocation with Aera Vaults: Delegate treasury management to Aera’s non-custodial vaults, allowing professional managers to optimize allocations according to DAO-defined risk parameters. This reduces manual overhead and ensures continuous, data-driven optimization.

-

Customize Strategies via Factor.fi: Use Factor.fi’s modular vaults to program risk profiles—whether for operational reserves, directional exposure, or delta-neutral yield. This enhances transparency and aligns vault performance with DAO governance objectives.

-

Implement Delta-Neutral Yield Farming: Adopt delta-neutral stablecoin strategies to generate passive income while minimizing market volatility. Leading DAOs hedge positions across decentralized exchanges to systematically capture yield without directional risk.

-

Leverage Real-Time Transparency Tools: Choose vault platforms offering real-time dashboards, on-chain audit trails, and open APIs. These features ensure every transaction is verifiable by token holders and external auditors, supporting regulatory compliance and trust.

-

Diversify Across Multiple Stablecoins and RWAs: Allocate treasury funds across trusted stablecoins (e.g., USDT, USDC, DAI) and tokenized real-world assets like U.S. Treasuries. This multi-asset approach mitigates protocol risk and boosts capital efficiency.

-

Study Leading Examples Like Arbitrum DAO: Analyze case studies such as Arbitrum DAO’s Secure Treasury Endowment Program (STEP 2.0), which partners with Karpatkey to reallocate assets into stablecoins and on-chain yield vaults for ecosystem stability.

For DAOs looking to optimize their on-chain treasury solutions, several best practices have emerged:

- Automate rebalancing: Use programmable vaults to remove manual intervention and reduce operational risk.

- Diversify across issuers and asset types: Split allocations among leading stablecoins and consider RWAs for added stability.

- Implement real-time reporting: Adopt protocols that offer transparent dashboards and on-chain auditability.

- Set clear risk parameters: Define thresholds for liquidity buffers, yield targets, and drawdown limits within vault strategies.

- Engage professional managers: Leverage decentralized asset management networks when internal governance bandwidth is limited.

The actionable takeaway: treat treasury management as an ongoing discipline rather than an afterthought. The most successful DAOs in 2025 are those that iterate continuously, reviewing performance data, adjusting allocations based on market conditions, and updating risk parameters proactively.

What’s Next? Toward Full Automation and Global Scale

The next wave of innovation is likely to center on even greater automation, think autonomous vaults capable of responding instantly to market events or governance signals without human intervention. As regulatory frameworks mature globally, expect increased demand for standardized reporting interfaces and composable compliance modules built directly into vault infrastructure.

This evolution will further lower barriers for new DAOs entering the space while raising standards for transparency, efficiency, and security across the board. For deeper analysis on how these trends are shaping DAO financial operations this year, see our guide here.

The bottom line: Stablecoin vaults have become indispensable tools for modern DAO treasury management, powering active risk mitigation, predictable yield generation, and transparent governance at scale. Operators who master these systems will lead the next era of decentralized finance.