Stablecoin vaults have emerged as the cornerstone of modern on-chain treasury management for DAOs, delivering a blend of stability, yield generation, and risk mitigation that was previously unattainable in decentralized finance. As DAOs mature into capital allocators with multi-million dollar treasuries, the days of passively holding volatile governance tokens or single-asset wallets are fading fast. Instead, forward-thinking organizations are harnessing stablecoin vaults to optimize returns while preserving liquidity and transparency.

The Rise of Stablecoin Vaults: From Passive Holdings to Dynamic Yield Engines

Historically, DAOs relied on native tokens or basic multisig wallets to manage their treasuries. This approach left them vulnerable to market swings and limited their ability to generate sustainable yield. The advent of yield-bearing stablecoin vaults has fundamentally changed this equation. By depositing assets like USDC, USDT, or DAI into DeFi protocols such as Yearn, Beefy, or Morpho Blue, DAOs can now earn competitive yields while maintaining near-zero exposure to crypto volatility.

The Gitcoin DAO’s recent proposal to allocate $5 million USDC into the Avantgarde DeFi Yield Vault on Enzyme, targeting an annualized return of approximately 10%: exemplifies this shift toward active treasury management. Such strategies not only extend runway but also align with best practices for fiduciary responsibility in decentralized organizations.

Automated Rebalancing and Multi-Asset Diversification: Capital Efficiency Meets Risk Management

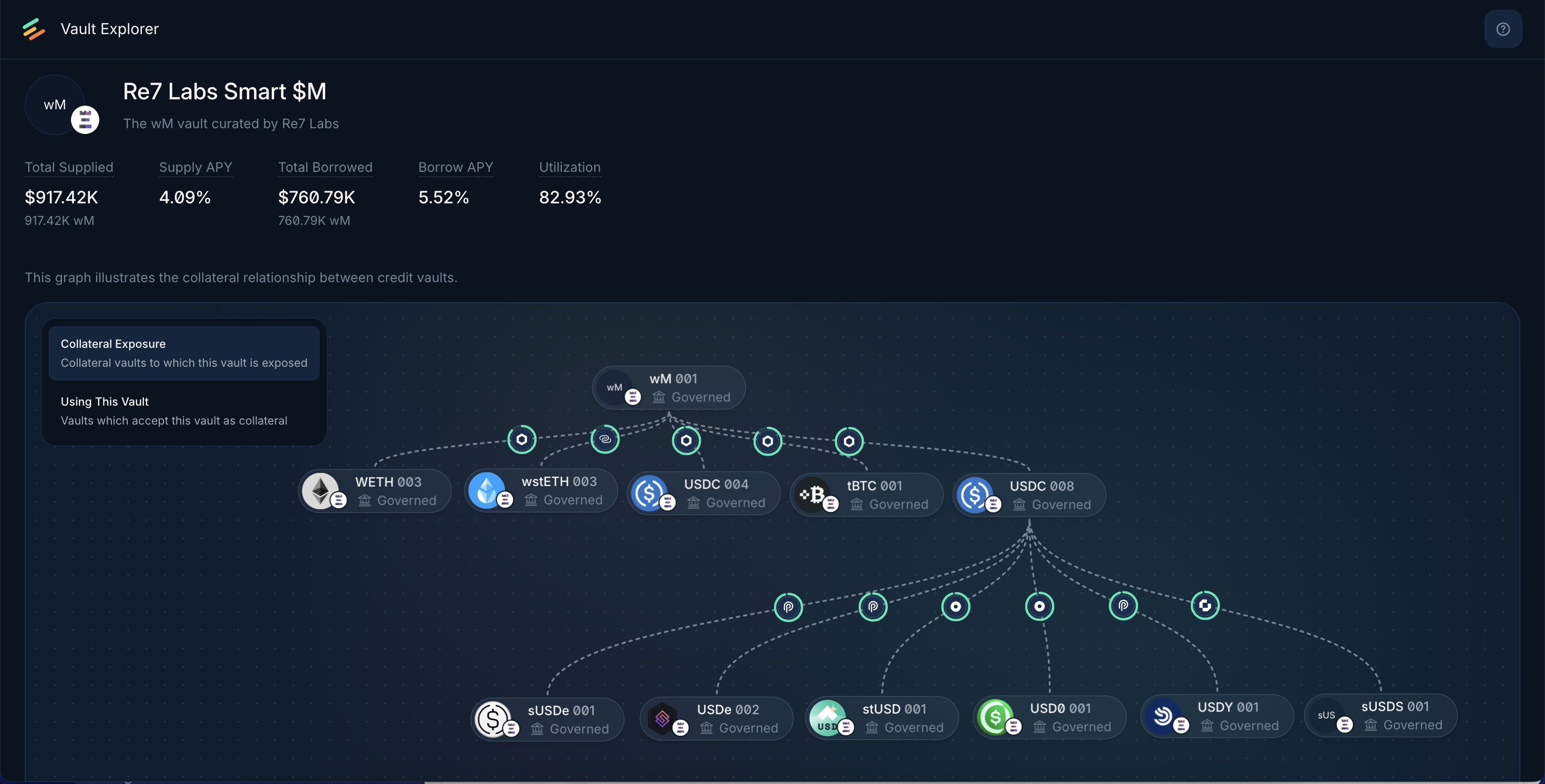

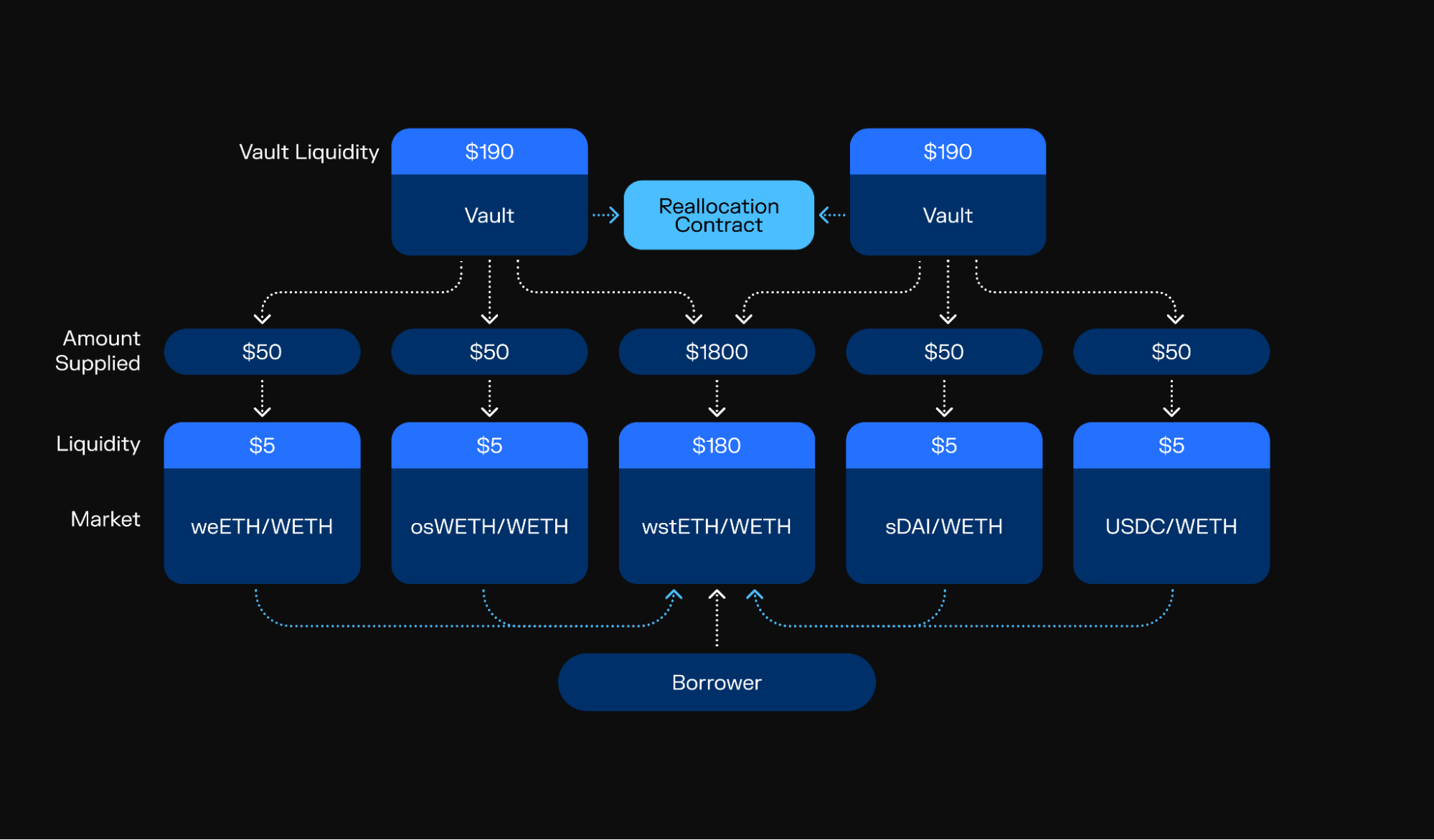

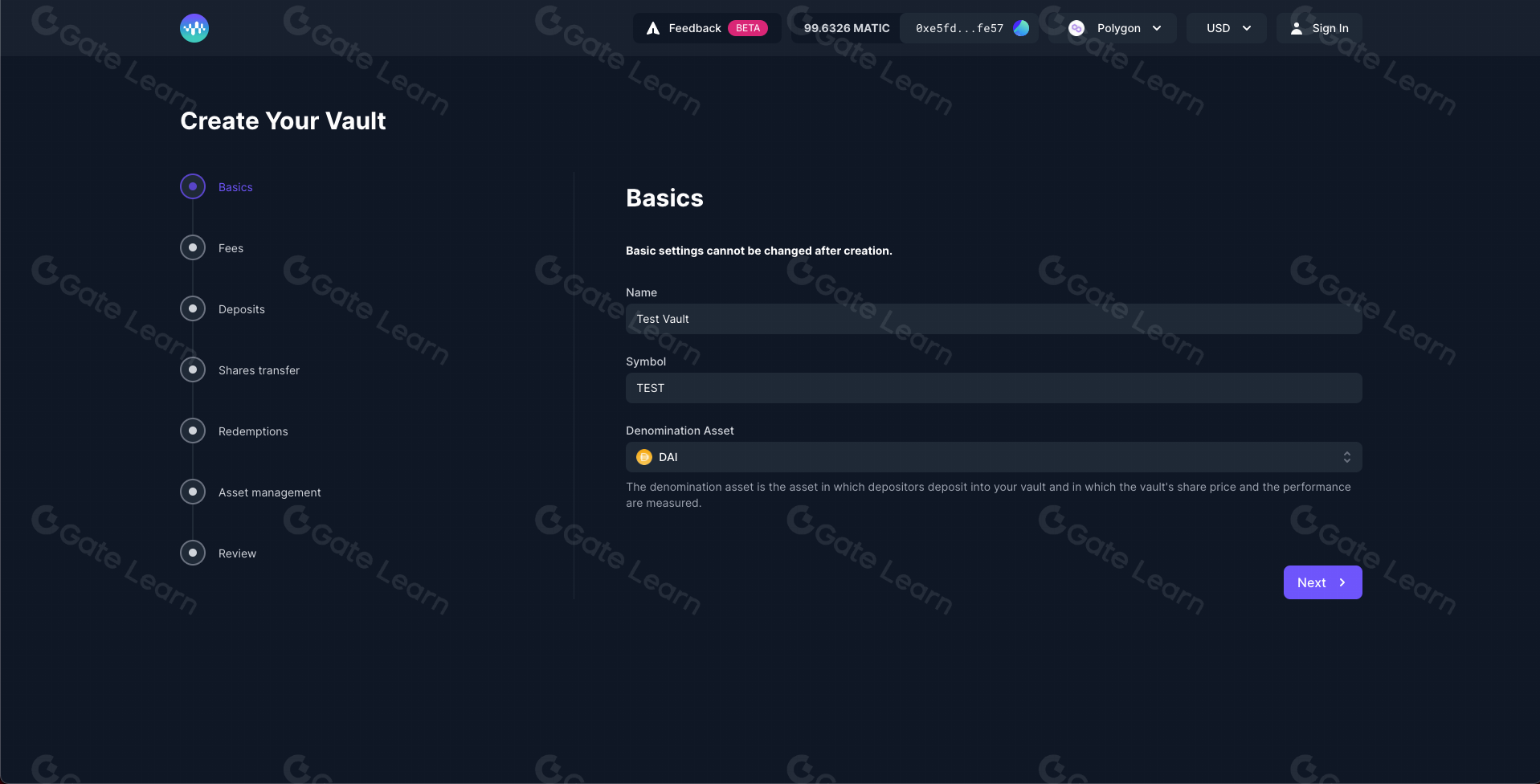

The complexity of managing a diversified treasury is no longer a barrier for DAOs thanks to automated rebalancing protocols. Platforms like Balancer Smart Vaults and Enzyme Finance allow treasury managers to set target allocations across multiple stablecoins or yield strategies. Smart contracts then execute ongoing rebalancing based on predefined parameters, removing human error and emotional bias from the equation.

This automation is crucial for sustaining capital efficiency in DAOs. For example, by utilizing Balancer’s programmable portfolio management features, a DAO can dynamically shift between high-yield stablecoin pools and tokenized U. S. Treasuries as market conditions evolve. This not only optimizes returns but also ensures liquidity is available when needed, a critical consideration for any decentralized organization facing unpredictable funding requirements.

Top DeFi Platforms for DAO Stablecoin Vault Strategies

-

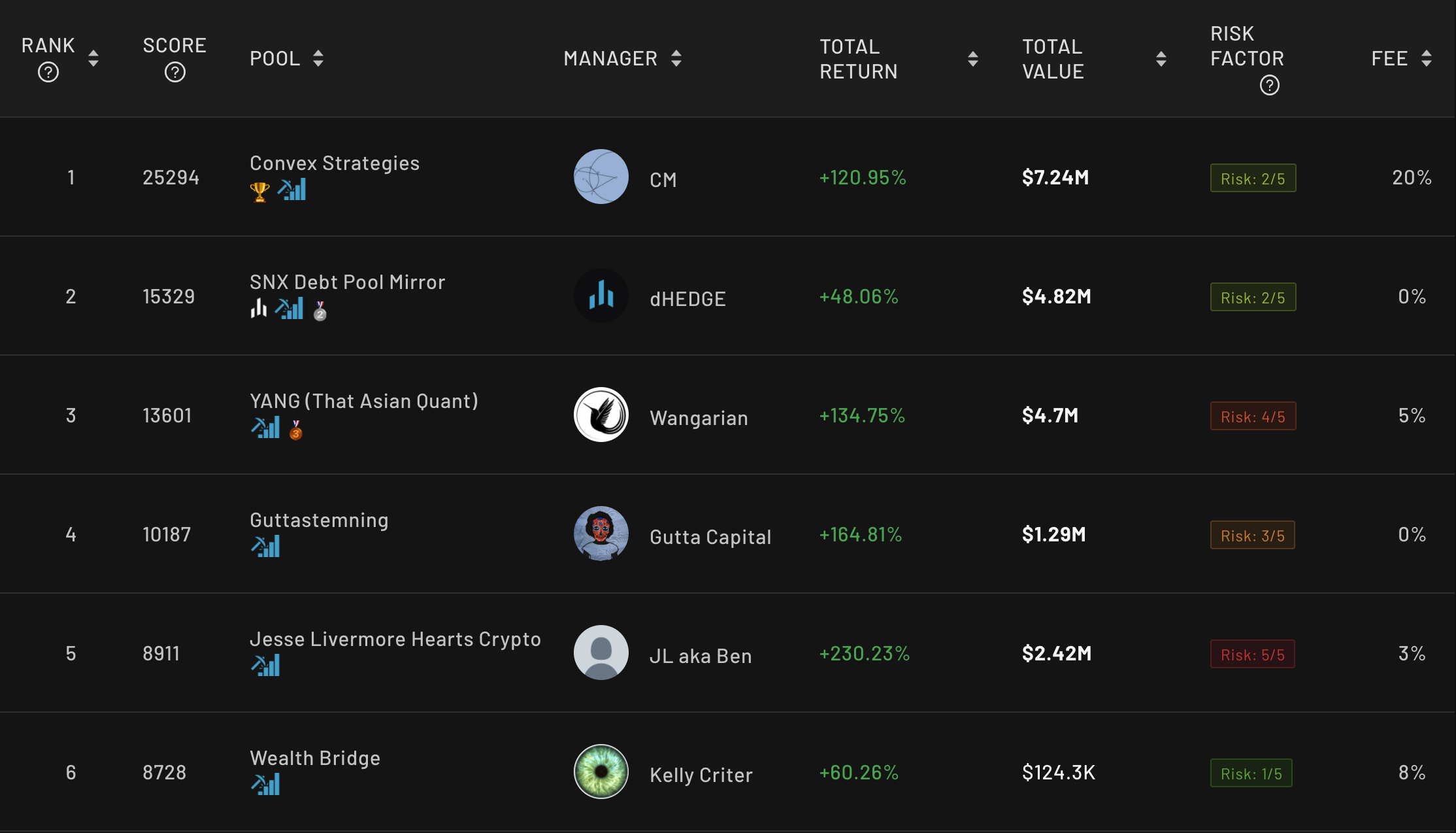

Enzyme Finance: Advanced on-chain asset management platform enabling DAOs to deploy stablecoin vaults with automated rebalancing, custom risk parameters, and transparent performance reporting.

-

Balancer Smart Vaults: Programmable liquidity protocol offering automated rebalancing and dynamic allocation for stablecoin portfolios, ideal for DAOs seeking efficient treasury management.

-

Yearn Finance: Leading yield aggregator with stablecoin vaults that automatically optimize returns across DeFi lending protocols, providing DAOs with passive, diversified yield.

-

Curve Finance: Specialized stablecoin AMM known for low slippage and high liquidity pools, allowing DAOs to earn swap fees and incentives on stablecoin holdings with minimal impermanent loss.

-

Aera: Risk-optimized DeFi vault platform designed for DAOs to diversify stablecoin allocations, maximize yield, and manage protocol risk through advanced vault strategies.

-

Morpho Blue: Efficient lending protocol enabling DAOs to lend stablecoins with optimized risk/reward profiles and enhanced capital efficiency, supporting diversified treasury strategies.

-

Ondo Finance: Pioneering real-world asset (RWA) integration for DAOs, allowing direct investment in tokenized U.S. Treasuries and money-market funds to access traditional yields on-chain.

Treasury Transparency on the Blockchain: Lessons from High-Profile Vault Events

Transparency remains non-negotiable in DAO treasury operations. The mid-2025 incident involving Stable, a blockchain designed for USDT transfers, brought this issue into sharp relief when its pre-deposit vault event hit an $825 million cap in just 22 minutes. Over 60% of deposits originated from a single entity, fueling community debate over fairness and process integrity.

This episode underscores why robust reporting standards and open audit trails are vital for maintaining trust in DAO governance structures. On-chain visibility allows all stakeholders to monitor flows into and out of stablecoin vaults in real time, reinforcing both accountability and decentralization principles.

Explore how transparency is reshaping DAO treasury management in 2025.

Integrating Real-World Assets: The Next Frontier for DAO Treasuries

The integration of tokenized real-world assets (RWAs) marks a new era for DAO treasury solutions. By mid-October 2025, the RWA market reached an all-time high of $33.91 billion, with tokenized U. S. Treasuries alone accounting for $8.3 billion in value. Forward-looking DAOs are allocating portions of their stables into these instruments via vetted DeFi platforms to tap low-risk yields that mirror traditional finance without abandoning on-chain transparency.

This trend not only diversifies income streams but also provides a hedge against systemic risks unique to crypto-native markets, further cementing stablecoin vaults as foundational tools for resilient on-chain treasuries.

Read more about how stablecoin vaults are revolutionizing on-chain treasury management for DAOs.

For DAOs intent on long-term sustainability, the practical implementation of stablecoin vault strategies requires more than just technical integration. It demands a disciplined approach to risk, governance, and operational security. This is where best practices come into play, offering a blueprint for both established and emerging organizations navigating the evolving landscape of on-chain treasury management.

Securing Stablecoin Vaults: Best Practices for DAO Operators

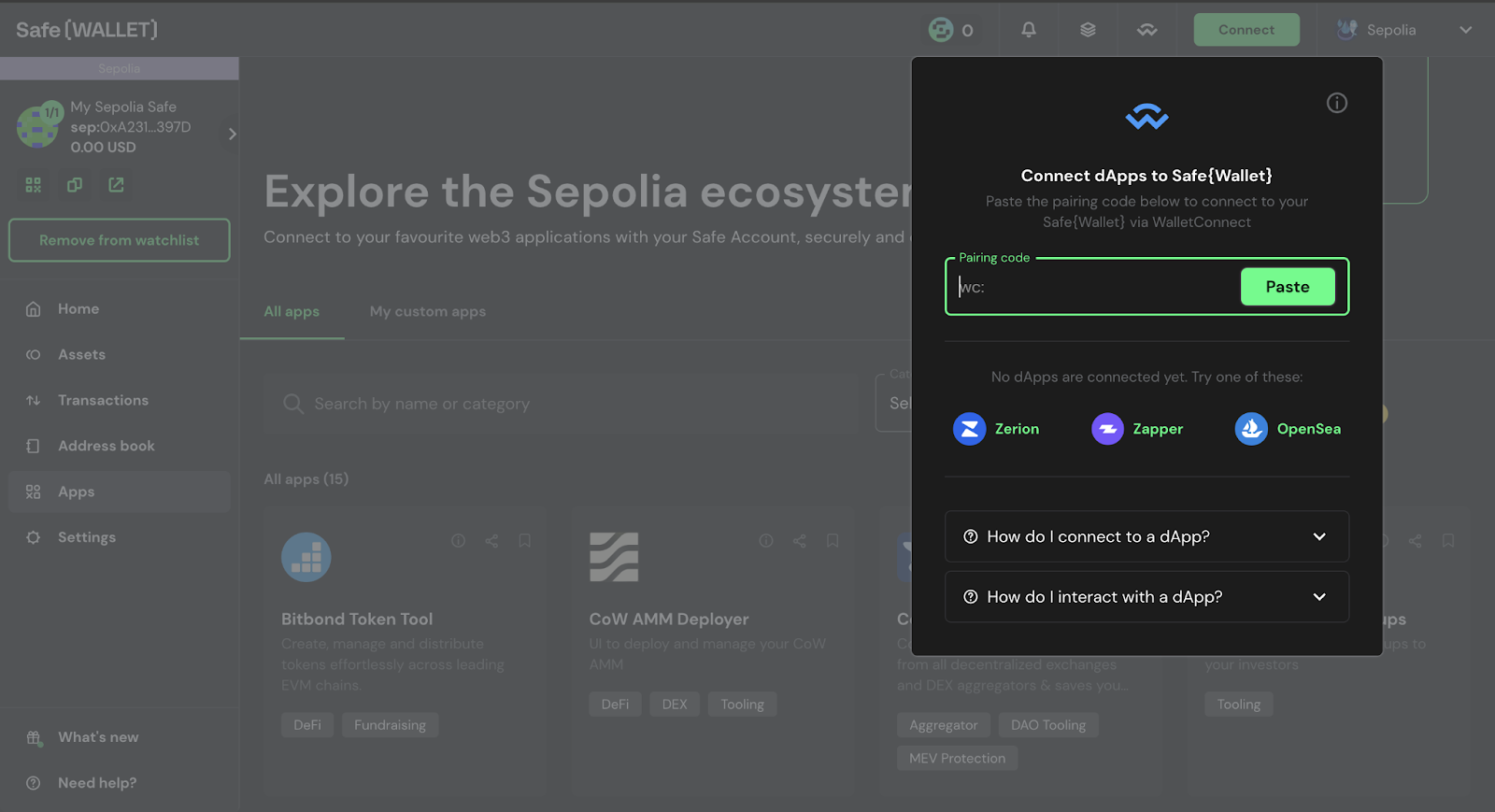

The foundation of any secure DAO treasury lies in robust access controls. Single-key wallets are obsolete; the gold standard is now multisig wallets combined with role-based permissions. This ensures that no single actor can unilaterally move funds, dramatically reducing internal risk and aligning with decentralized governance principles. Platforms like Safe (formerly Gnosis Safe) and standardized governor contracts have become industry staples for this reason.

Beyond access controls, DAOs must layer in additional security mechanisms such as governance timelocks and off-chain signaling tools. These features allow communities to review and contest major transactions before execution, adding a crucial buffer against both internal mistakes and external attacks. Regular audits, both internal and by reputable third parties, are equally vital to identify vulnerabilities before they can be exploited.

Yield-Bearing Strategies: Balancing Return With Liquidity

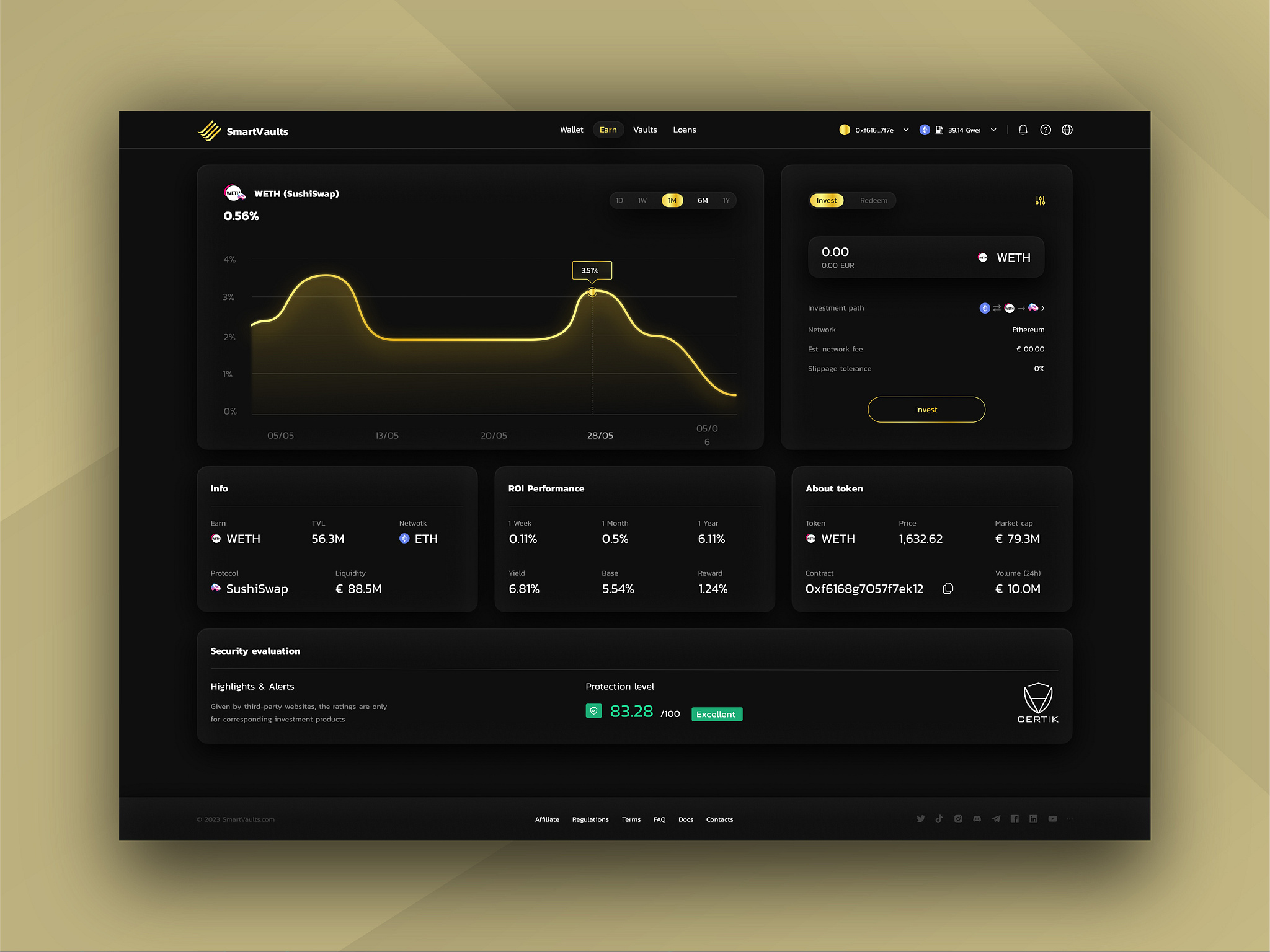

Yield optimization is at the heart of modern DAO treasury solutions, but it must never come at the expense of liquidity or safety. The most effective DAOs diversify their lending exposure across platforms, using Aera, Morpho Blue, Yearn, Beefy, among others, to minimize protocol-specific risks while capturing attractive yields on stablecoins.

Integrating RWAs further enhances this balance. By allocating a portion of assets to tokenized U. S. Treasuries or money-market funds via platforms like Ondo or Matrixdock, DAOs can access risk-adjusted yields that are less correlated with crypto market volatility. Meanwhile, providing liquidity in low-impermanent-loss pools on Curve or Uniswap v3 allows treasuries to earn swap fees without excessive exposure to price swings.

Automation and Reporting: Scaling Governance Without Sacrificing Oversight

As treasuries scale past eight or nine figures, manual oversight becomes impractical. Automated rebalancing via smart contracts, like those found in Balancer Smart Vaults or Enzyme Finance, frees up human capital while enforcing policy discipline around allocation targets and risk limits.

The importance of real-time reporting cannot be overstated. On-chain dashboards that visualize vault performance, yield streams, and historical allocations empower DAO participants to make informed decisions and hold leadership accountable. Transparent reporting also eases external audits, a key requirement as DAOs attract institutional partners or pursue regulatory compliance.

Top Security & Reporting Tools for DAO Stablecoin Vaults

-

Safe (formerly Gnosis Safe): A leading multisig wallet platform, Safe enables DAOs to implement robust role-based access controls and secure treasury transactions, protecting vaults from single-point-of-failure risks.

-

Enzyme Finance: A programmable asset management protocol, Enzyme Finance empowers DAOs to automate portfolio rebalancing and risk management, offering transparent on-chain reporting for all vault activities.

-

Balancer Smart Vaults: Balancer provides automated vault rebalancing and dynamic allocation tools, allowing DAOs to maintain target stablecoin allocations and optimize yield with real-time reporting.

-

Yearn Vaults: Yearn offers automated stablecoin yield aggregation, with built-in reporting dashboards that track vault performance and risk metrics for DAO treasuries.

-

OpenZeppelin Defender: OpenZeppelin Defender delivers continuous smart contract monitoring, automated alerting, and transaction relays, enhancing security oversight and auditability for DAO vault operations.

-

Dune Analytics: Dune Analytics enables DAOs to build custom dashboards for real-time treasury tracking, transaction transparency, and compliance reporting using on-chain data.

Key Takeaways for DAO Treasury Leaders

- Diversify: Spread stablecoin holdings across multiple protocols and asset types, including RWAs, to mitigate concentration risk.

- Automate: Use smart contracts for rebalancing and yield harvesting to minimize operational errors.

- Secure: Implement multisig wallets with clear role assignments; regularly audit your vault infrastructure.

- Report: Maintain transparent dashboards so all stakeholders have visibility into treasury health at all times.

- Evolve: Stay abreast of new DeFi integrations, especially RWA products, as this sector continues its rapid maturation.

The strategic use of stablecoin vaults marks a paradigm shift in how decentralized organizations approach capital efficiency, risk management, and transparency on the blockchain. As competition intensifies, and as regulatory scrutiny grows, the DAOs that master these disciplines will not only survive but set the standard for digital-native financial stewardship going forward.