Decentralized Autonomous Organizations (DAOs) have rapidly matured into serious capital allocators, collectively managing treasuries valued at over $30 billion in 2024. This leap in scale has forced DAOs to move beyond the days of passively holding volatile governance tokens or stablecoins. Instead, they’re embracing a new era of productive DAO capital: deploying assets with purpose, transparency, and robust risk management to generate sustainable on-chain yield.

![]()

The Shift from Passive Holding to Strategic Yield Generation

The collapse of high-profile experiments like Nouns DAO’s treasury split in September 2024 was a wake-up call for the entire sector. It marked what many now call the death of passive yield: and the birth of sophisticated decentralized treasury strategies. DAOs are no longer content to let their assets sit idle; they’re exploring a diverse toolkit for yield generation while keeping community transparency and safety front and center.

Key drivers behind this shift include:

- Capital Efficiency: Idle tokens represent lost opportunity. Productive treasuries support ongoing development, grants, and ecosystem growth.

- Risk Mitigation: Diversification across stablecoins, ETH, BTC, and real-world assets reduces exposure to single-token volatility.

- Transparent On-Chain Governance: All allocations and strategy shifts occur on-chain, empowering token holders with oversight.

Diversification: The Bedrock of DAO Treasury Management

No modern DAO can afford to keep all its eggs in one basket. The first step toward productive on-chain yield is smart diversification. Most DAOs now allocate portions of their treasuries across:

Key Asset Types Held by DAO Treasuries

-

Stablecoins (USDC, DAI): DAOs frequently hold stablecoins like USDC and DAI to preserve capital and provide liquidity for operations and yield strategies. These assets help reduce volatility and are widely integrated across DeFi protocols.

-

Major Cryptocurrencies (ETH, BTC): Ethereum (ETH) and Bitcoin (BTC) are commonly held for their liquidity and long-term value potential. ETH, in particular, is essential for participating in staking and DeFi activities.

-

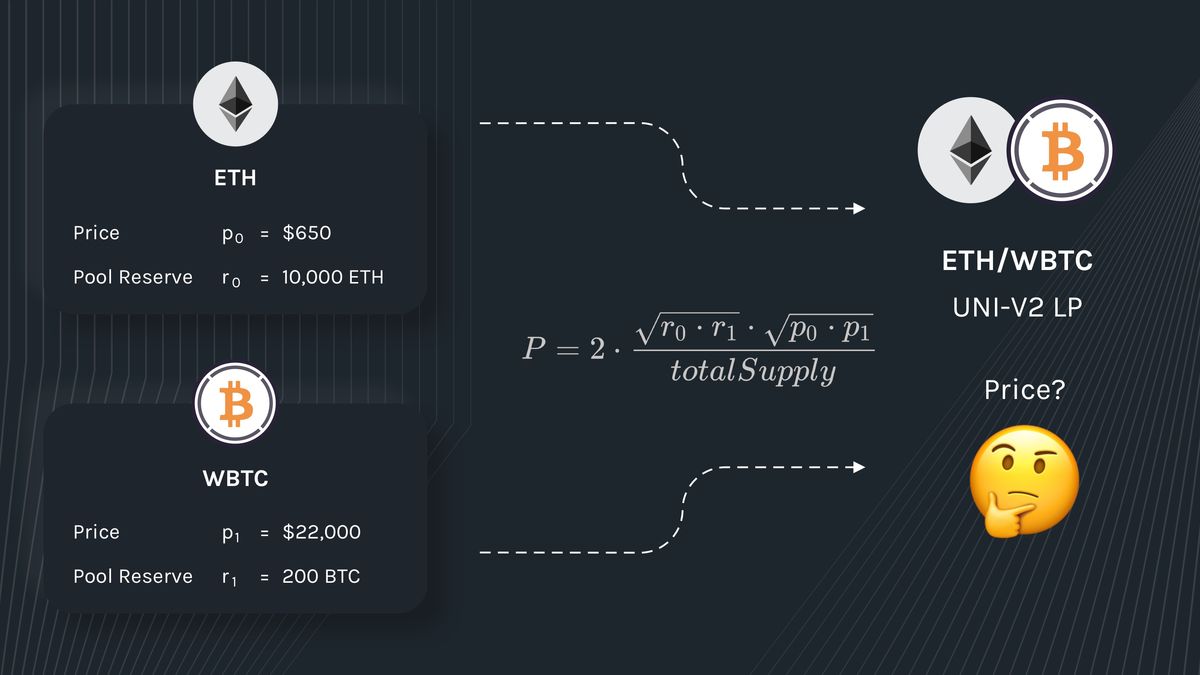

DeFi LP Tokens: By providing liquidity to decentralized exchanges like Uniswap or Balancer, DAOs receive liquidity provider (LP) tokens that represent their share of a pool and entitle them to trading fees and rewards.

-

Tokenized U.S. Treasury Bills: Some DAOs diversify into tokenized T-bills via platforms like Ondo Finance or Maple Finance, accessing real-world yield and reducing crypto market risk.

This approach stabilizes overall treasury value while unlocking various sources of yield. For example, allocating to stablecoins like USDC or DAI allows access to DeFi lending protocols or fixed-rate vaults, critical for funding predictable expenses such as grants or operational costs.

The Modern DAO Yield Toolkit: Staking, Lending and Automated Strategies

The most effective DAOs employ a blend of proven DeFi primitives and emerging tools for on-chain yield generation. Here’s how leading projects are putting their capital to work:

- Staking and Liquid Staking: Participating in proof-of-stake networks earns rewards while liquid staking (e. g. , Lido’s stETH) adds flexibility by enabling further DeFi integrations.

- Lending Protocols: Platforms like Aave and Compound allow DAOs to lend stablecoins or blue-chip assets for variable interest rates, generating income from otherwise idle funds.

- Automated Vaults and Risk-Managed Strategies: Solutions such as Castle Finance offer programmatic rebalancing based on a DAO’s risk profile, minimizing manual intervention while maximizing returns within set parameters.

If you want a deeper dive into optimizing capital efficiency using these strategies, check out our comprehensive guide: Optimizing Capital Efficiency in DAO Treasuries With Yield Strategies.

Beyond Crypto-Native Assets: Embracing Tokenized Traditional Instruments

A significant trend among large DAOs is the inclusion of tokenized real-world assets (RWAs), such as U. S. Treasury bonds. By allocating part of their reserves here, as MakerDAO famously did, they earn predictable yields while reducing correlation with crypto market swings. This hybrid approach is helping DAOs weather bear markets and fund long-term roadmaps without constant fundraising pressure.

With these strategies in play, the landscape of DAO treasury management is evolving rapidly. DAOs are no longer passive holders but active participants in both DeFi and traditional finance, leveraging the best of both worlds to generate yield and secure their missions for the long term.

Risk Management and Transparent On-Chain Governance

The pursuit of on-chain yield generation brings new risks, smart contract exploits, protocol insolvency, or market shocks. Forward-thinking DAOs are responding by building robust internal frameworks for risk assessment and automated monitoring. They’re also leveraging cutting-edge analytics tools to track real-time portfolio exposures, stress test allocations, and set automated triggers for rebalancing.

Transparency is non-negotiable. Every treasury move, from staking to swapping stablecoins or entering a new yield vault, is executed on-chain with open records. This not only protects token holders but strengthens community trust and engagement. DAOs are increasingly adopting governance models where proposals for treasury allocation must pass public votes, ensuring that capital deployment aligns with community values.

Stablecoins and Programmable Money: The New Power Tools

Stablecoin adoption is at the heart of productive DAO capital strategies. By holding USDC or DAI, treasuries can tap into a wealth of DeFi protocols offering competitive yields, often with lower risk than volatile assets. More advanced DAOs are exploring programmable stablecoins, automating payrolls, grant disbursements, and recurring payments while simultaneously earning interest through integrated DeFi rails.

This move toward automation is especially powerful for decentralized teams spread across time zones. It reduces operational overhead and ensures that every dollar works harder without sacrificing transparency or security. For a closer look at how programmable stablecoins are reshaping DAO operations, see this deep dive: Yield-Bearing Stablecoins: Building the Next Layer of On-Chain Treasury Yield.

What’s Next? Automation, Composability and Community Control

The future of on-chain treasury management lies in greater automation and composability. Expect to see more DAOs using smart contracts that automatically route idle funds into the highest-yielding protocols based on real-time data, or even split allocations dynamically based on governance-set parameters.

This isn’t just about squeezing out extra basis points; it’s about empowering communities to govern capital at scale without bottlenecks or bureaucratic delays. As DeFi infrastructure matures and risk tooling advances (with platforms like Euler v2 leading the way), expect even more creative yield strategies tailored to each DAO’s unique mission.

Key Takeaways for DAO Operators

- Diversification across asset types is essential for stability and opportunity.

- Combining staking, lending, automated vaults, and tokenized RWAs creates a resilient yield stack.

- Transparent governance builds trust, and keeps your community engaged in every capital decision.

- Leveraging programmable stablecoins streamlines operations while unlocking additional revenue streams.

- The most successful DAOs treat their treasuries as dynamic engines, not static reserves.

If you’re ready to take your treasury strategy further, whether you’re a DAO founder or just passionate about decentralized finance, explore our practical guides on maximizing capital efficiency: How DAOs Can Optimize Treasury Fees and Reinvest for Sustainable Growth.