In 2025, Decentralized Autonomous Organizations (DAOs) are rewriting the rules of capital efficiency by deploying sophisticated yield strategies that maximize returns while safeguarding against volatility. With the DeFi landscape evolving rapidly, DAOs must adopt advanced, actionable frameworks to extract optimal value from their on-chain treasuries. The following four strategies represent the cutting edge of DAO treasury yield optimization under current market conditions.

Automated Stablecoin Yield Farming via Protocol Aggregators

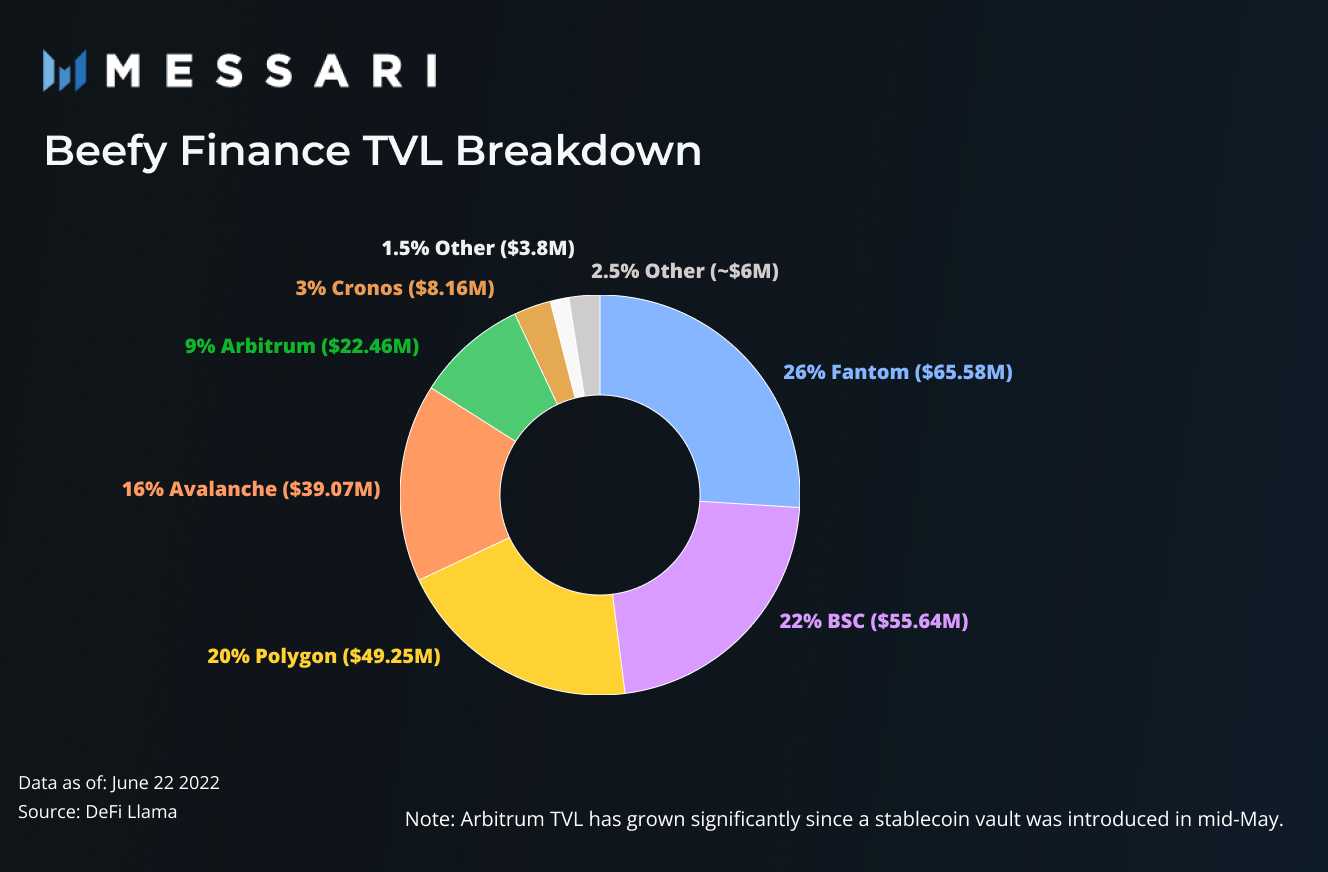

Stablecoins have become the backbone of DAO treasuries due to their price stability and deep liquidity across DeFi protocols. However, simply holding stablecoins is no longer sufficient for capital efficiency. By leveraging protocol aggregators like Brava, Yearn, or Beefy, DAOs can automate the process of seeking out the highest-yielding pools across multiple DeFi ecosystems. These platforms dynamically allocate stablecoin assets to top-performing lending markets, liquidity pools, and vaults, ensuring continuous optimization as yields fluctuate in real time.

This approach allows DAOs to capture annualized returns often ranging from 8% to 15% on stablecoin holdings, substantially outperforming idle assets, while minimizing manual intervention and transaction costs. For a deeper dive into how institutional-grade yield optimization is transforming treasury management, see insights from Brava.

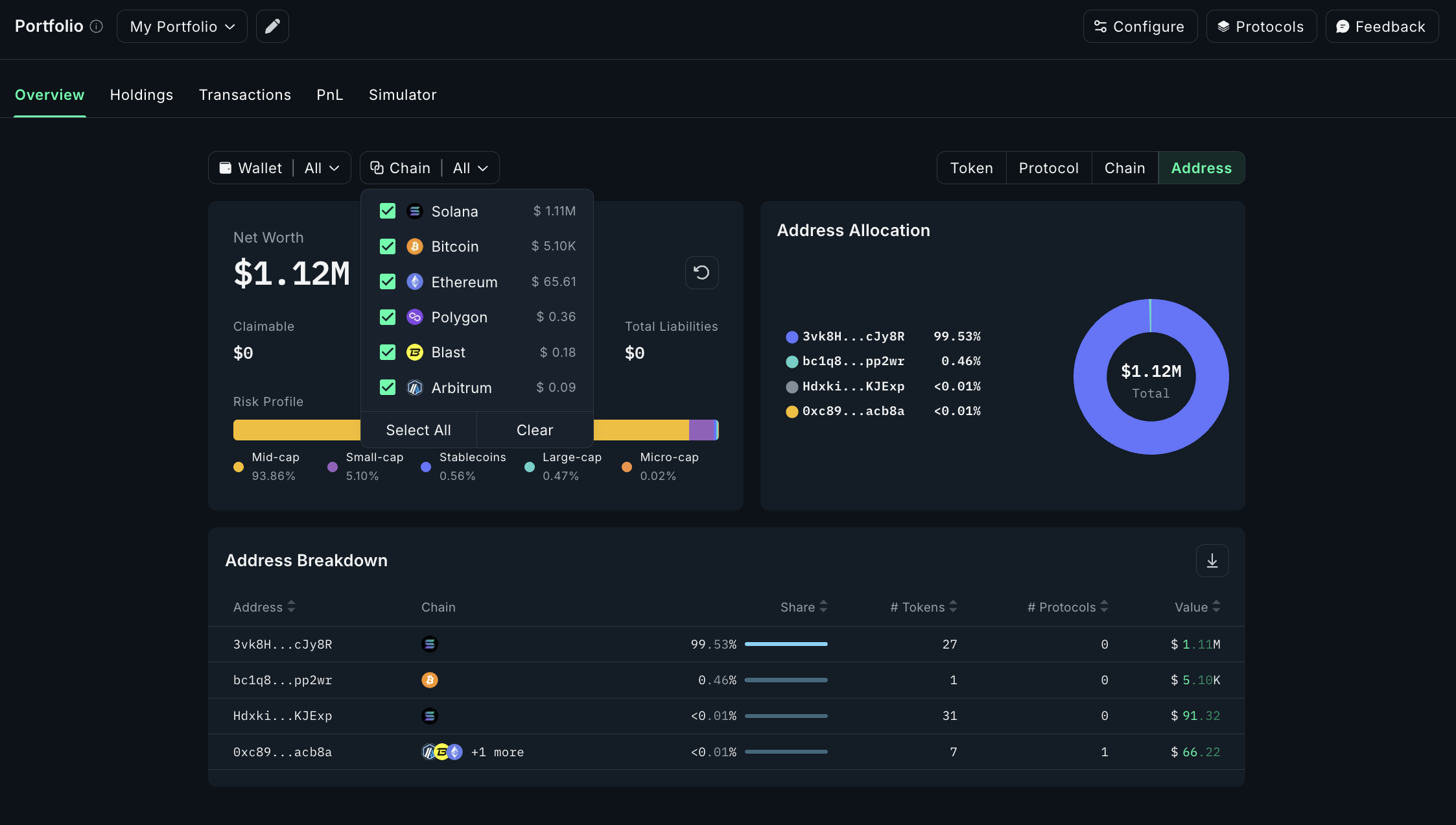

Dynamic Portfolio Rebalancing with Real-Time On-Chain Analytics

Market volatility and shifting risk profiles demand that DAOs maintain agile portfolio allocations. Dynamic rebalancing leverages real-time on-chain analytics to monitor asset distribution and trigger automated adjustments when allocations drift beyond predefined thresholds. For example, if a DAO targets 50% stablecoins but rising ETH prices skew its allocation toward volatile assets, an automated rebalancing bot can swap excess ETH back into stablecoins or other strategic assets instantly.

This strategy not only minimizes drawdowns but also ensures that treasuries remain aligned with governance mandates and risk appetites at all times. Modern tools integrate seamlessly with multi-signature wallets like Gnosis Safe for secure execution and transparent reporting.

Top DAO Treasury Yield Optimization Strategies

-

Automated Stablecoin Yield Farming via Protocol Aggregators (e.g., Brava, Yearn, Beefy)Leverage advanced aggregators to automatically allocate stablecoins across top DeFi pools, maximizing risk-adjusted returns while minimizing manual intervention. These platforms optimize yield by continuously scanning for the best opportunities across protocols.

-

Dynamic Portfolio Rebalancing with Real-Time On-Chain AnalyticsUtilize analytics tools to monitor treasury allocations and market conditions in real time, enabling automated or governance-driven rebalancing. This approach helps DAOs maintain target asset mixes, reduce volatility, and minimize drawdowns.

-

Deployment of Risk-Adjusted Lending Strategies on Decentralized Money Markets (e.g., Aave, Compound, Morpho)Earn passive income by lending assets on reputable DeFi money markets, with risk parameters tailored to DAO risk appetites. These platforms provide transparent, non-custodial environments and competitive yields.

-

Integrating Permissionless Structured Products for Enhanced Yield and Downside Protection (e.g., MYSO v2 Vaults)Access innovative DeFi vaults and structured products that offer tailored risk-return profiles, enabling DAOs to capture additional yield while mitigating downside risk through permissionless, on-chain instruments.

Deployment of Risk-Adjusted Lending Strategies on Decentralized Money Markets

Lending protocols such as Aave, Compound, and emerging platforms like Morpho allow DAOs to generate passive income by supplying assets for overcollateralized loans. The key is deploying risk-adjusted strategies, allocating capital based on protocol security audits, historical default rates, utilization ratios, and variable APYs.

This enables DAOs to earn steady yields (often ranging from 3% to 8% annually) while maintaining flexibility in asset withdrawal during periods of market stress. By diversifying across multiple money markets and implementing withdrawal automation triggers based on real-time risk metrics, treasuries can further reduce exposure to protocol-specific risks without sacrificing returns.

Integrating Permissionless Structured Products for Enhanced Yield and Protection

The next frontier in capital efficiency lies in permissionless structured products such as MYSO v2 Vaults. These vaults package options-like payoff structures directly on-chain, enabling DAOs to access enhanced yield opportunities alongside built-in downside protection mechanisms. For instance, a DAO might deposit USDC into a MYSO vault that offers boosted yield if ETH remains within a certain price band, but with principal protection if volatility spikes unexpectedly.

This approach empowers treasuries to pursue higher risk-adjusted returns without exposing core funds to catastrophic losses, a crucial consideration in today’s unpredictable markets. To explore how these products are democratizing access to institutional-grade strategies for DAOs and protocols alike, check out this analysis on Medium by Denis.

Adopting these advanced strategies requires not just technical infrastructure but also a robust governance process and a culture of data-driven decision making. As DAOs scale, automation becomes essential for managing complexity and minimizing human error. By integrating protocol aggregators, real-time analytics, risk-adjusted lending, and permissionless structured products, DAOs can systematically unlock new levels of capital efficiency.

It is important to note that yield optimization is not a set-and-forget operation. Protocol incentives, APYs, and risk factors are in constant flux. Automated stablecoin yield farming via aggregators like Brava or Yearn ensures that DAOs can capture the best available rates without needing to chase yields manually across dozens of protocols. However, ongoing monitoring is critical: smart contract exploits or sudden liquidity shifts can rapidly change the risk calculus. Implementing automated alerts and withdrawal triggers based on on-chain analytics gives treasury managers the agility needed to act decisively in fast-moving markets.

Dynamic portfolio rebalancing stands out as a cornerstone for sustainable growth. By continuously aligning allocations with DAO mandates, such as maintaining a 50% stablecoin buffer, treasuries avoid overexposure to single assets or market cycles. This discipline is especially vital during periods of extreme volatility when emotional decision-making can erode treasury value.

Deploying capital into decentralized money markets like Aave, Compound, or Morpho further diversifies income streams while supporting DeFi’s broader liquidity infrastructure. Risk-adjusted lending means not just chasing the highest APY but weighing protocol health scores, utilization rates, and withdrawal friction against yield opportunities. Automation platforms now allow DAOs to set conditional logic, such as exiting positions if utilization spikes above 90% or if protocol reserves drop below safe thresholds, adding an extra layer of protection for community funds.

Permissionless structured products such as MYSO v2 Vaults are rapidly gaining traction among sophisticated DAOs seeking asymmetric return profiles with built-in hedges against tail risks. These instruments democratize access to complex strategies previously reserved for institutional desks, allowing even smaller treasuries to participate in advanced yield generation while capping downside exposure.

Building a Culture of Transparent On-Chain Treasury Management

Ultimately, optimizing DAO treasury yields is as much about governance and transparency as it is about technical execution. Community-driven frameworks ensure that key decisions, like adjusting target allocations or approving new yield strategies, are vetted through open discussion and on-chain voting. This participatory approach builds trust among stakeholders while enabling rapid adaptation as DeFi evolves.

DAOs willing to invest in automation tools, rigorous analytics, and permissionless innovation will be best positioned to weather volatility and compound capital over the long term. With platforms like Brava delivering institutional-grade aggregation and protocols such as MYSO v2 unlocking novel structured products for all participants, there has never been a better time for DAO treasuries to embrace on-chain yield optimization at scale.

- Automated Stablecoin Yield Farming via Protocol Aggregators: Maximizes stablecoin returns with minimal manual oversight

- Dynamic Portfolio Rebalancing: Maintains strategic allocations with real-time data

- Risk-Adjusted Lending Strategies: Generates passive income while managing exposure

- Permissionless Structured Products: Unlocks enhanced yields with downside protection

The future belongs to DAOs that automate smart, and safeguard smarter, by leveraging these four actionable strategies tailored to today’s DeFi landscape.