In 2026, DAO treasuries are no longer just digital piggy banks gathering dust on-chain. With stablecoin allocations jumping from 9.8% in 2022 to 18.2% in 2025, savvy operators are deploying stablecoin vaults to turn idle USDC and USDT into reliable yield machines. Imagine your DAO’s treasury working overtime, churning out 7-15% APY through diversified DeFi strategies, all while keeping risks in check. That’s the promise of DAO treasury vaults, and it’s reshaping on-chain treasury management right now.

These vaults aren’t some pie-in-the-sky tech; they’re battle-tested tools like Enzyme’s Avantgarde DeFi Yield Vault, where Gitcoin DAO just proposed parking $5 million USDC for those juicy annualized returns. It’s a smart move in a world where volatility can wipe out gains overnight, but stablecoins offer the ballast DAOs need.

Why Stablecoin Vaults Beat Holding Idle Assets

Let’s be real: leaving stablecoins idle is like letting money rot in a checking account earning 0%. Stablecoin yield strategies flip that script by automating deployments into low-risk, high-reward protocols. Platforms like Gauntlet deliver institutional-grade vaults with risk-adjusted yields, perfect for DAOs scaling up. And with AI-driven optimization from Aera, your treasury rebalances in real-time, sniffing out the best opportunities across chains.

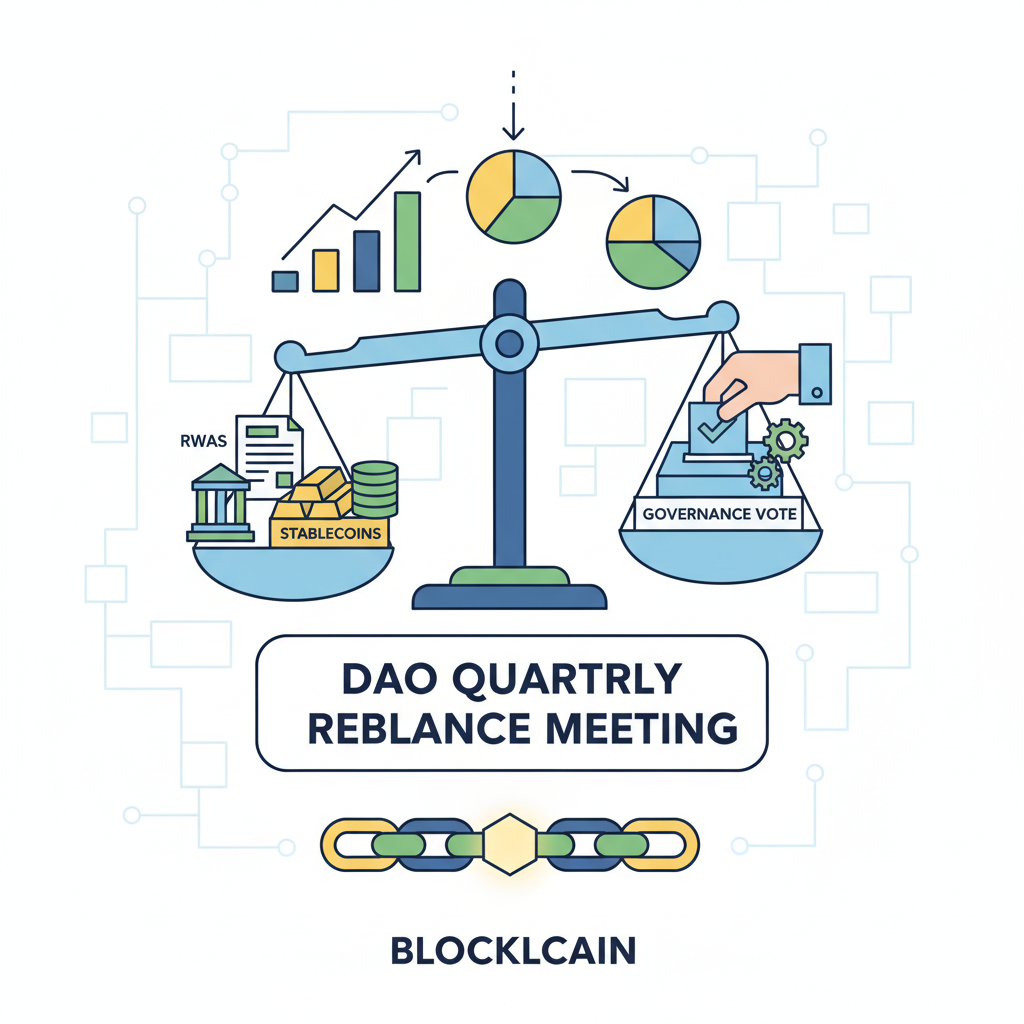

Diversification is key here. DAOs blending stablecoins with tokenized real-world assets (RWAs) like Ondo Finance’s U. S. Treasury Bills are accessing TradFi-level stability in DeFi. No more all-in on native tokens; this mix cushions against market dips while stacking yields. Check out how stablecoin vaults provide stability and yield in volatile DeFi markets for the full breakdown.

Proven Strategies for DAO Stablecoin Optimization

Ready to level up? Start with automated vaults like VaultLayer’s stablecoin strategies, which hunt high-yield spots across protocols without you lifting a finger. Multi-chain arbitrage via Beefy Finance or Harvest Finance exploits price gaps, boosting returns effortlessly. For 2026, I’d bet on AI agents like Binance’s upcoming “Sky Agents” for structured credit backed by stablecoin liquidity – game-changers for automated treasury yields 2026.

| Vault Platform | Key Features | Expected APY | Risk Level |

|---|---|---|---|

| Enzyme Avantgarde | Diversified DeFi strategies | 7-15% | Medium |

| Gauntlet Institutional | AI rebalancing, RWAs | 8-12% | Low |

| VaultLayer Auto | Multi-protocol optimization | 10-18% | Medium |

| Ondo Finance | Tokenized T-Bills | 4-6% | Very Low |

This table highlights top picks, but always DYOR – yields fluctuate, and smart contracts carry risks. Arbitrum DAO’s move to consolidate $2.54 million USDC into yield-optimized management shows the trend: even big players are prioritizing capital efficiency.

Real-World Wins: Gitcoin and Beyond

Gitcoin’s $5M vault proposal isn’t isolated. It’s part of a broader shift where DAOs treat treasuries as active engines for sustainability. By integrating yield-bearing stablecoins, they’re funding operations without diluting tokens. Platforms like Bitget Wallet add multi-chain custody and DAO coordination, making it seamless. Dive deeper into stablecoin vaults for DAO treasuries earning 7-23% APY.

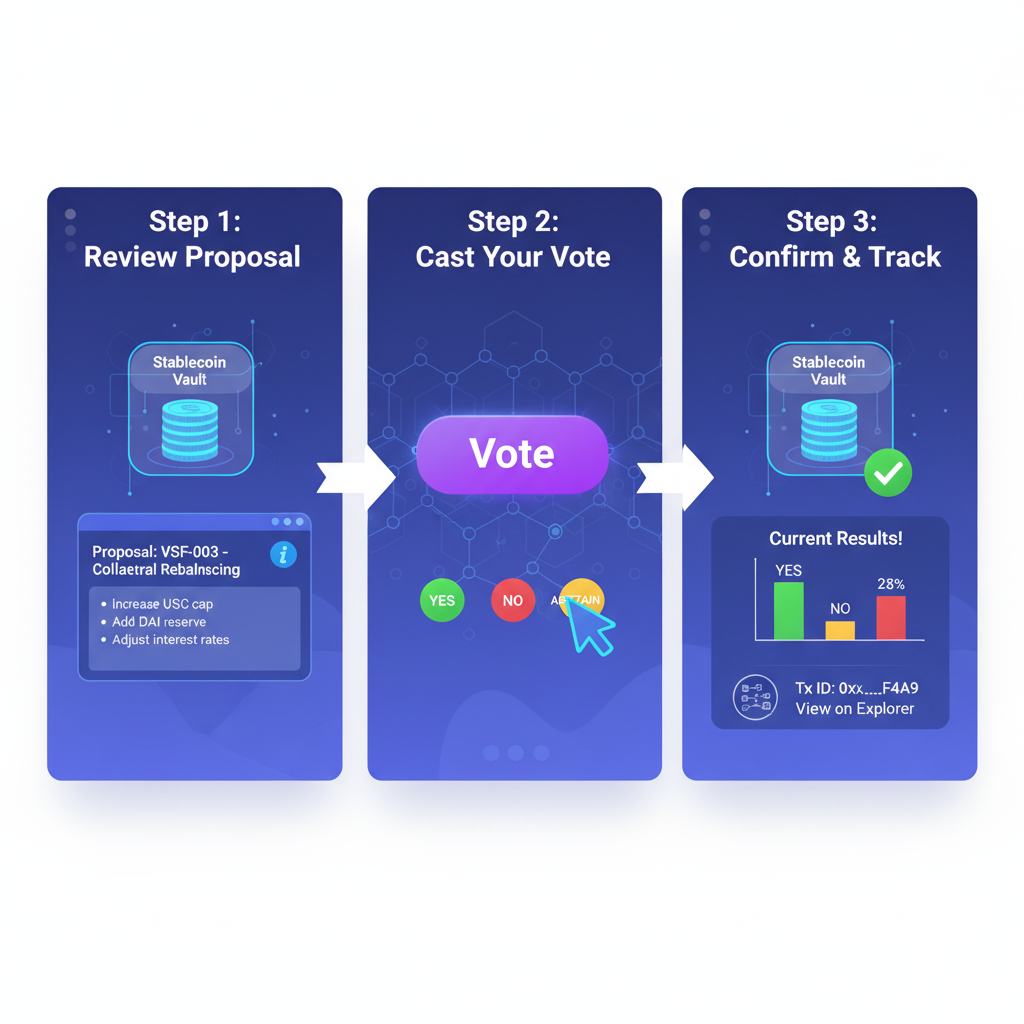

Institutions are noticing too. Banks grappling with stablecoins as 24/7 settlement layers, per Finextra, underscore the convergence. For DAOs, this means more liquidity pools and better yields ahead. But success hinges on governance: propose, vote, deploy – with transparency baked in.

Getting that governance loop right sets the stage for real DAO stablecoin optimization. But how do you actually deploy these vaults without tripping over smart contract pitfalls or governance drama? It’s simpler than you think, especially with tools maturing in 2026.

Step-by-Step: Launching Your First Stablecoin Vault

I’ve walked DAOs through this process, and it boils down to a few deliberate steps. First, assess your treasury: how much USDC or USDT is sitting idle? Gitcoin’s $5 million play shows scale doesn’t matter as much as strategy. Next, pick a vault aligned with your risk tolerance – low-drama T-Bills via Ondo or aggressive multi-protocol hunts with VaultLayer.

Once live, automation takes over. Beefy Finance’s multi-chain arbitrage snags extra basis points by zapping funds where yields peak, like from Ethereum to Arbitrum. Harvest Finance complements this with proven auto-compounding. The result? Your treasury evolves from static to dynamic, funding grants or ops without selling tokens.

Don’t sleep on RWAs either. Tokenized U. S. Treasury Bills from Ondo deliver 4-6% with near-zero volatility, a hedge when DeFi TVL swings wild. Pair that with Gauntlet’s AI vaults, and you’re golden – real-time adjustments based on on-chain signals keep impermanent loss and liquidation risks minimal.

Vault Risks and Mitigations

| Platform | Risk | Mitigation |

|---|---|---|

| Enzyme | Smart contract bugs | Audits and insurance |

| Gauntlet | Market volatility | AI dynamic allocation |

| VaultLayer | Chain congestion | Multi-chain support |

| Ondo | Regulatory shifts | Fully collateralized RWAs |

This setup isn’t risk-free, mind you. Smart contract exploits loom, but audited protocols and treasury diversification slash those odds. Stablecoin allocations hitting 18.2% average reflect DAOs learning this lesson: spread bets across chains and assets.

2026 Outlook: AI Agents and Sovereign Balance Sheets

Looking ahead, Binance’s Sky Agents could launch up to 10 new ones, kickstarting structured credit with stablecoin backing – think predictable yields from on-chain lending. Meanwhile, the crypto-TradFi mashup BobbyGiggz nails as the “portable on-chain balance sheet” means DAOs get institutional tools without the suits.

Platforms like Bitget Wallet streamline multi-chain management, letting even small DAOs coordinate yields across ecosystems. Banks eyeing stablecoins for 24/7 settlements? That’s tailwind for deeper liquidity and tighter spreads. For treasury managers, it’s prime time to act: consolidate idle assets, propose vaults, and watch APYs compound.

Arbitrum DAO’s $2.54 million USDC consolidation proves it works at scale. Explore DAO treasury optimization with stablecoin vaults and tokenized treasuries for more case studies. With these moves, your DAO isn’t just surviving DeFi’s ups and downs – it’s thriving, funding the future one yield at a time.