In the unpredictable terrain of decentralized finance, DAOs face a constant battle to preserve capital amid market swings and protocol risks. A DAO treasury three-layer strategy emerges as the disciplined approach to navigate this chaos, layering stablecoin holdings for stability, stablecoin vaults for DAOs for liquidity, and on-chain yield optimization for growth. This framework, rooted in real-world practices from Uniswap DAO’s consensus-driven allocations to emerging stablecoin ecosystems, transforms treasuries from reactive holdings into proactive engines of resilience.

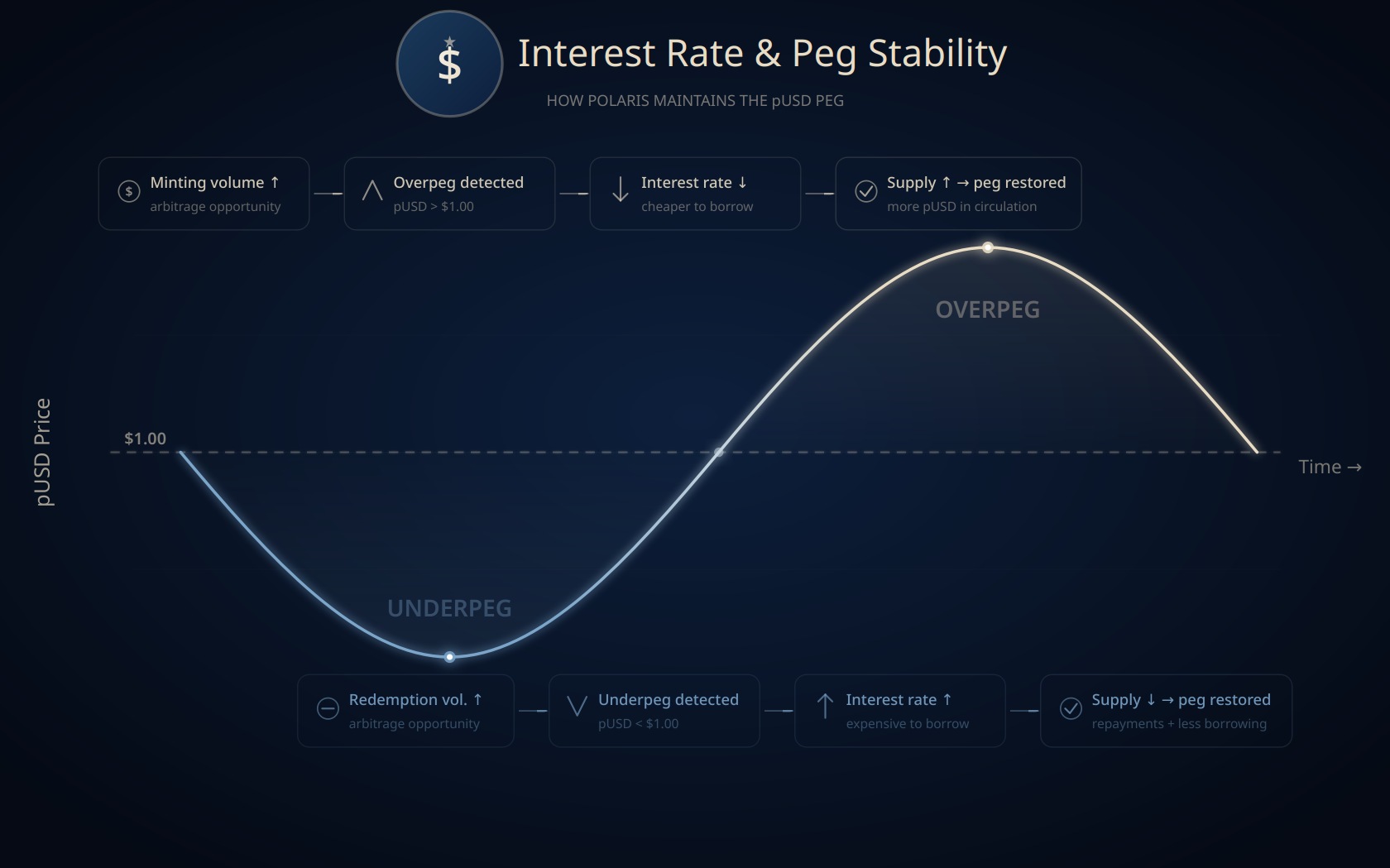

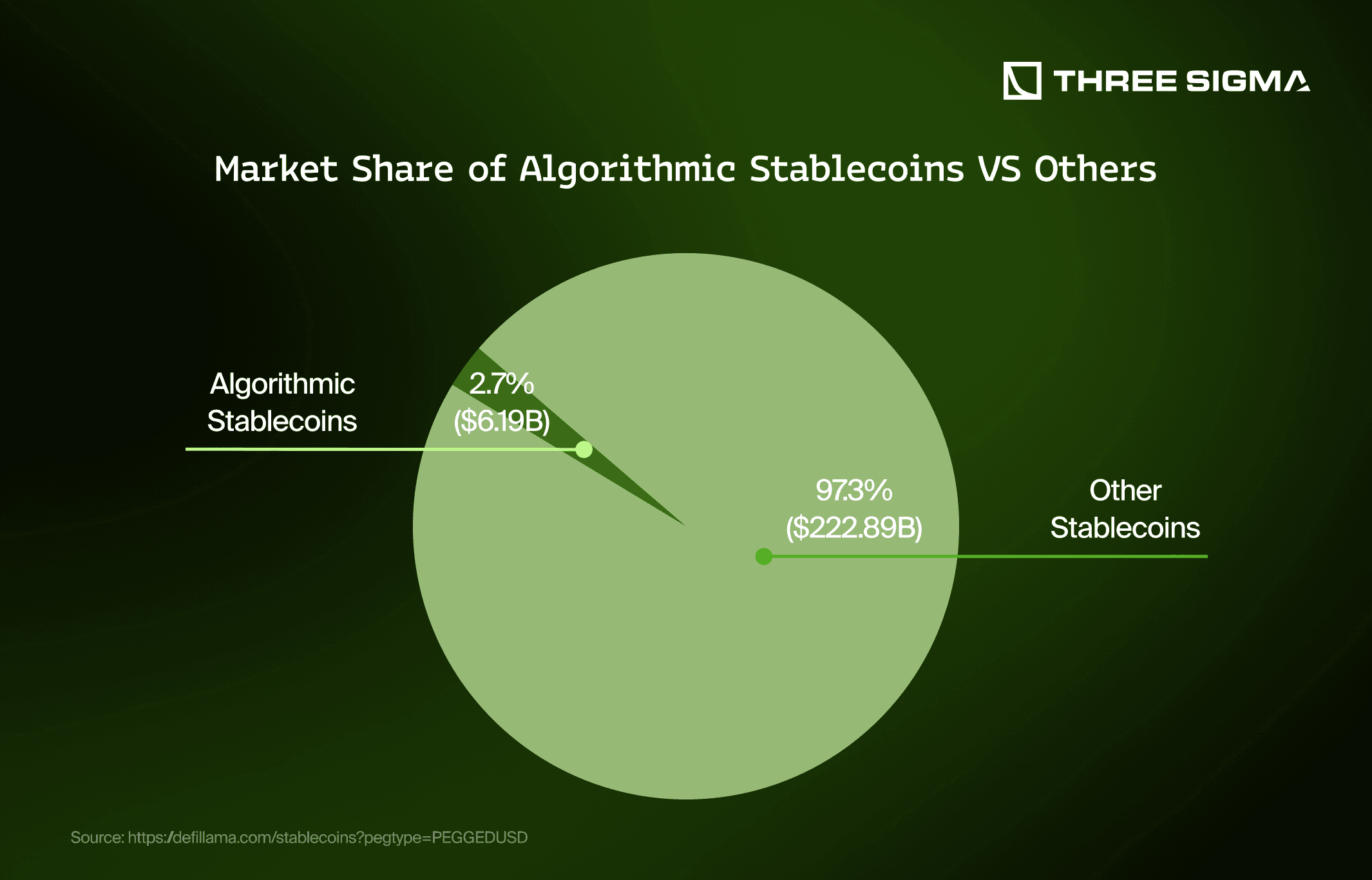

Stablecoins, pegged 1: 1 to assets like the USD, serve as the unshakeable bedrock. As J. P. Morgan notes, they function as the “cash” equivalent for on-chain trading, with expanding roles in treasury management and cross-border flows. DAOs allocating here sidestep the pitfalls of volatile native tokens; a bear market that craters ETH spares those diversified into USDC or DAI. Yet, mere holding falls short; the core layer demands audited custody and multi-signature safeguards to mirror traditional reserves in cash and Treasuries.

Core Reserve Layer: Stablecoin Holdings

The Core Reserve Layer: Stablecoin Holdings anchors everything. Picture it as the DAO’s fortified vault of last resort: 40-60% of treasury in blue-chip stablecoins like USDC, USDT, and DAI, spread across custodians to dodge single points of failure. This isn’t passive parking; it’s strategic positioning. Federal Reserve analysis underscores how these assets maintain value against crypto tumult by tethering to real-world references, shielding DAOs from the “off-guard” losses Onchain Foundation warns about when treasuries lean too heavily on ETH.

Benefits of Stablecoin Core Reserves

-

Peg Stability: Stablecoins like USDC, USDT, and DAI maintain a 1:1 peg to USD via reserves in cash, bank deposits, and short-term Treasuries, per Federal Reserve analysis.

-

Diversification: Allocate across protocols like Aave, Compound, and Curve on networks including Ethereum and Polygon to mitigate protocol risks (onchaintreasury.org).

-

Low-Volatility Preservation: Shields treasury from crypto market swings, acting as ‘cash’ for on-chain trading and base asset (J.P. Morgan, Galaxy Research).

-

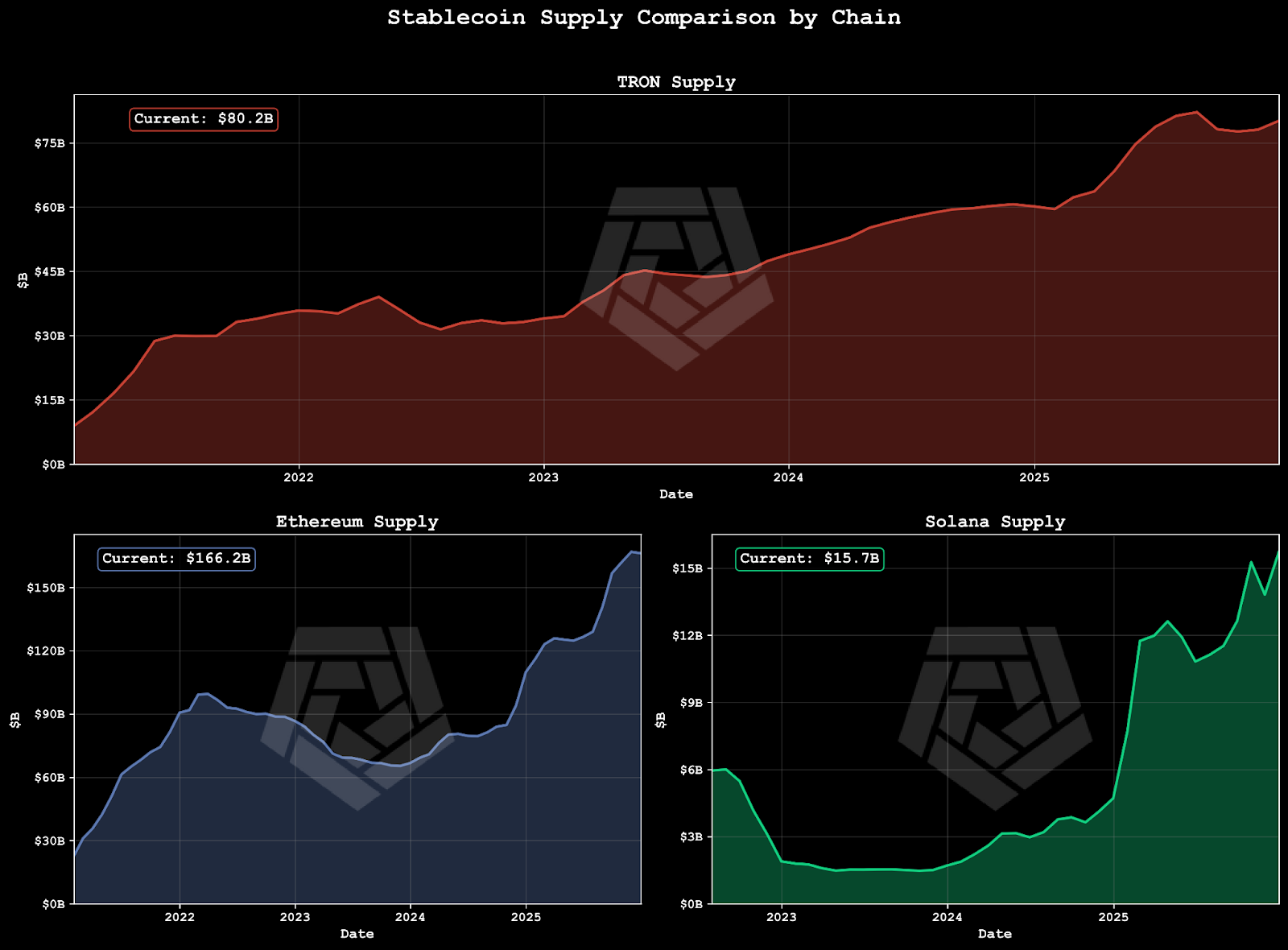

High On-Chain Liquidity: Programmable for seamless trading, payments, and treasury ops, primarily on Ethereum and Tron (Chainalysis).

-

Secure Vault Integration: Held in audited smart contracts with timelocks for DAO governance and flexibility (onchaintreasury.org).

Wharton’s Stablecoin Toolkit highlights the parallel to DAO-managed reserves for on-chain backed assets, insisting on rigorous treasury oversight. In practice, this layer funds operations without liquidation pressure, enabling DAOs like BitDAO to deliberate allocations via governance votes. Diversify issuers and chains, Ethereum, Tron, to mitigate peg risks, always prioritizing transparency via on-chain proofs.

Liquidity Layer: Stablecoin Vaults

Elevating from mere reserves, the Liquidity Layer: Stablecoin Vaults injects accessibility and security. Here, stablecoins flow into audited smart contracts on protocols like Aave or Compound, featuring timelocks that enforce review periods between proposals and execution. This setup, as detailed in onchaintreasury. org best practices, balances yield with caution; upgradability allows patches against exploits, while diversification across Ethereum and Polygon curtails protocol concentration.

Stablecoin vaults have emerged as the strategic backbone of on-chain treasury management.

Request Finance observes Uniswap DAO’s treasury controls, but vaults supercharge this with automated rebalancing. Allocate 30-40% here for DAO liquidity management, earning 2-5% APY on idle funds without impermanent loss traps. Timelocks prove invaluable during flash crashes, giving communities veto power. I’ve seen DAOs weather 2022’s liquidity crunch unscathed, their vaults yielding steadily while others liquidated.

Read more on securing these vaults. Multi-chain deployment slashes gas costs and risks; Polygon vaults, for instance, offer Ethereum-grade security at fractionally lower fees. Governance integration lets token holders tweak parameters, fostering decentralized treasury optimization without central bottlenecks.

Strategy Layer: On-Chain Yield Optimization

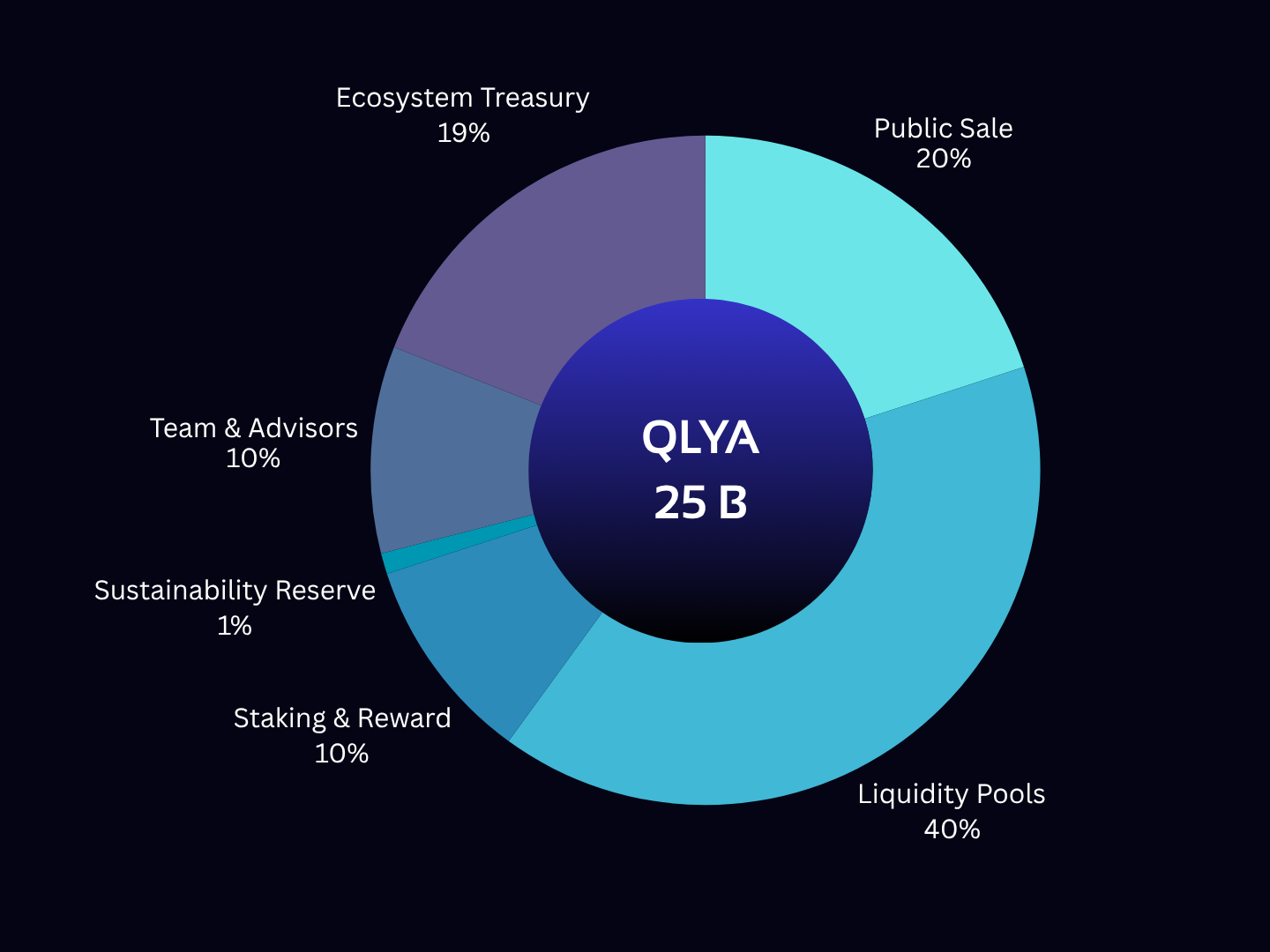

The pinnacle, Strategy Layer: On-Chain Yield Optimization, deploys the remaining 10-20% into dynamic DeFi plays. Galaxy’s on-chain yield report maps paths from stablecoin lending to curated liquidity pools, demanding nuanced risk assessment. DAOs blend restaking, lending, and LPs, targeting 5-15% returns while capping drawdowns.

Targeted deployments demand precision: lend USDC on Aave for baseline yields, pivot to Curve pools during stablecoin arbitrage spikes, or restake via EigenLayer for compounded returns. The key lies in parameterized strategies governed by DAO votes, with circuit breakers halting operations if yields dip below risk-adjusted hurdles. I’ve advised DAOs where this layer turned idle capital into a 12% annualized buffer, outpacing inflation without chasing unicorns.

Comparison of On-Chain Yield Strategies for Stablecoins

| Protocol | Typical APY Range (%) | Key Risks | Key Features & Networks |

|---|---|---|---|

| Aave | 2-6 | Smart contract vulnerabilities, liquidation risk, interest rate volatility | Lending markets with high liquidity; Ethereum, Polygon |

| Compound | 1-5 | Smart contract risk, governance changes, lower liquidity | cToken lending; primarily Ethereum |

| Curve | 0.5-8 | Impermanent loss (low for stables), bribe/gauge risks, pool complexity | Stablecoin LP pools with low slippage; Ethereum |

Yet optimization isn’t set-it-and-forget-it. Protocols evolve; Galaxy emphasizes understanding restaking multipliers against smart contract hazards. Allocate judiciously: cap any single strategy at 5% of treasury to contain black swan events. Uniswap’s voting model shines here, channeling proposals through Snapshot to on-chain execution, ensuring community buy-in for tweaks.

Real-world proof abounds. DAOs embracing this trio sidestepped Terra’s collapse; their stablecoin cores absorbed shocks, vaults provided liquidity without fire sales, and yield layers churned returns amid chaos. Mondaq positions stablecoin vaults as the backbone, but layering elevates them to a symphony of on-chain treasury reserves.

Integrating the Layers for Resilient Operations

Siloed layers falter; synergy fortifies. The DAO treasury three-layer strategy thrives on orchestration: core holdings seed vaults, vault liquidity fuels yield plays, and automated rebalancers cycle gains back to reserves. Tools like onchaintreasury. org advocate timelocks across vaults, multi-chain spreads via Polygon and Ethereum, and incident alerts for anomalies.

Picture a dashboard fusing Dune Analytics for balances, Tenderly for simulations, and Aragon for governance. Triggers auto-adjust: if core stablecoins exceed 60%, shunt to vaults; if yields spike, amplify strategy layer. This decentralized treasury optimization marries automation with oversight, slashing response times from days to blocks.

Risks persist, of course. Peg breaks, though rare for USDC, warrant contingency swaps to DAI. Protocol hacks? Diversification and insurance via Nexus Mutual cap losses. Governance apathy? Incentivize via veToken models, rewarding vigilant stewards. Chainalysis pegs stablecoins as programmable cash, but DAOs must program defensively.

Blockchain App Factory’s guide to stablecoin DAOs underscores governance-treasury alignment, a pillar here. Regular audits, from PeckShield or Quantstamp, plus upgradability proxies, fortify contracts. Multi-sig wallets, thresholded at 3-of-5, gate high-value moves.

Forward-thinking DAOs benchmark against peers: Uniswap’s $5B treasury allocates conservatively, BitDAO ventures boldly under votes. Your DAO’s mix hinges on risk appetite; conservative ops tilt core-heavy, growth chasers amp yields. Track metrics like yield-to-volatility ratios and drawdown recovery, reporting transparently via on-chain dashboards.

Read deeper on vault protection in volatility and management best practices. Ultimately, this framework turns treasuries into fortresses that yield, adapt, and endure, positioning DAOs not just to survive DeFi’s tempests but to harness them for enduring prosperity.