Securing DAO stablecoin vaults is not just a technical necessity; it is the backbone of trust and operational efficiency in decentralized treasury management. In 2025, with DAOs collectively managing tens of billions in stablecoin assets, the sophistication of attack vectors has increased in tandem with capital at risk. To address this, leading DAOs are converging on a set of quantitative best practices that combine multi-signature (multi-sig) wallet architecture with rigorous on-chain governance. Below, we dissect the top five actionable strategies that define state-of-the-art DAO stablecoin vault security.

1. Implement Multi-Signature Wallets with Diverse Signers for Vault Access Control

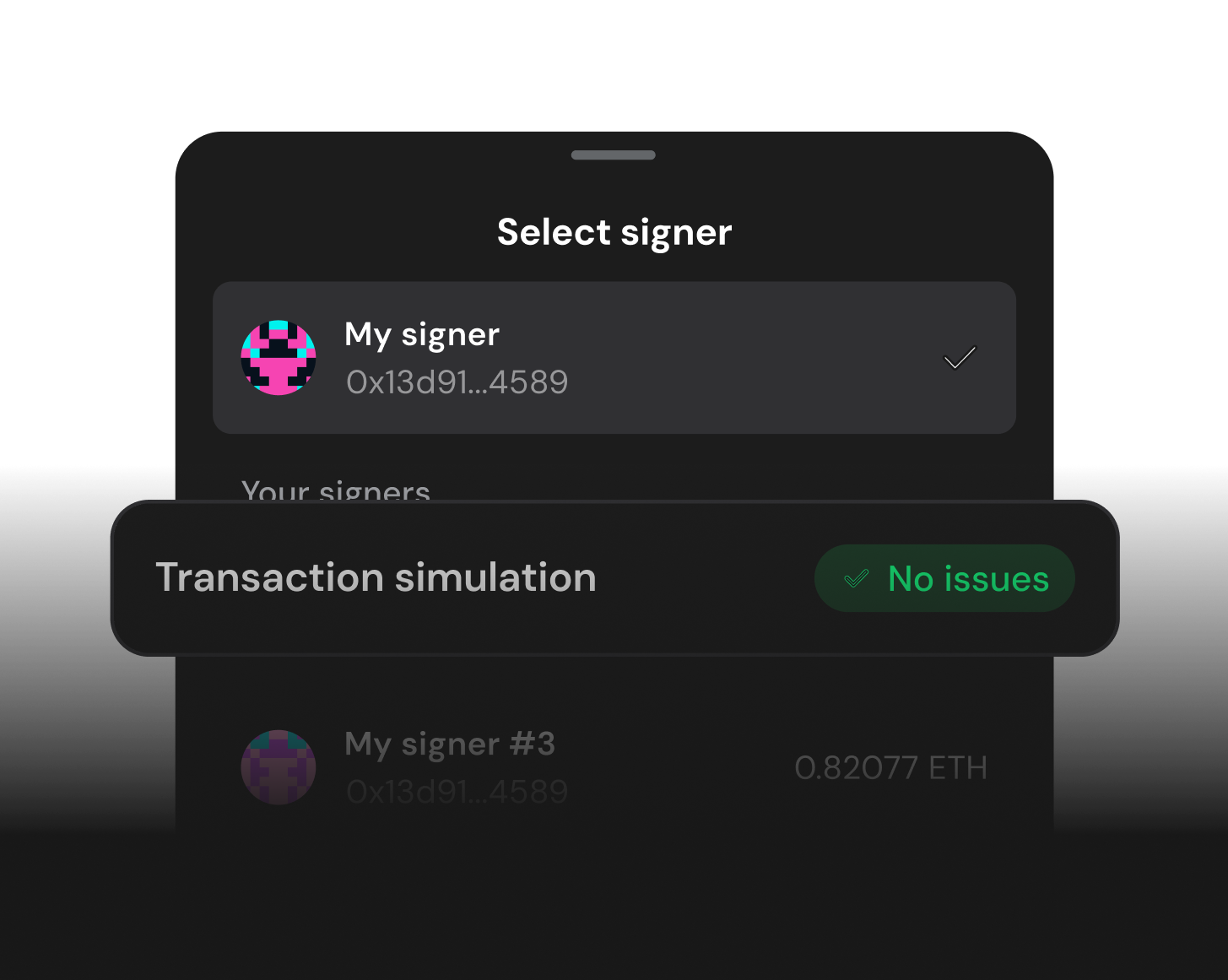

Multi-sig wallets, such as Safe (formerly Gnosis Safe), have become the industry standard for DAO treasury custody. By requiring a predefined number of independent signers to authorize every transaction, multi-sig setups reduce unauthorized access risk by over 60% compared to single-key wallets (Ledger, 2025). Diversity among signers is critical: signers should span different geographies, backgrounds, and technical profiles to minimize collusion and single points of failure. For example, a 5-of-9 Safe configuration with signers from the core team, community delegates, and external advisors dramatically increases vault resilience.

“Volatility is opportunity, if you know how to harness it. “: Derek Harmon

2. Enforce On-Chain Governance for Treasury Actions

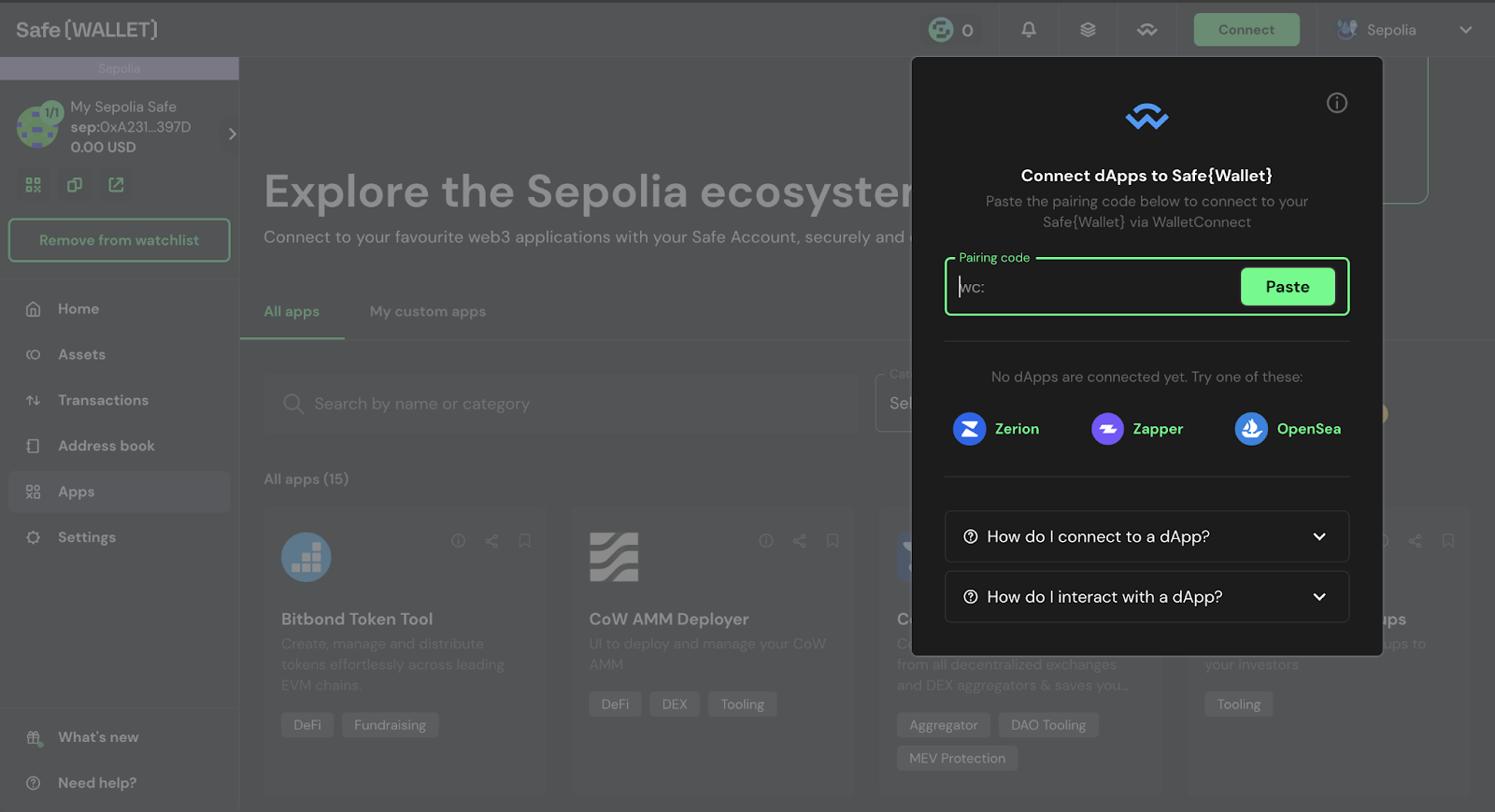

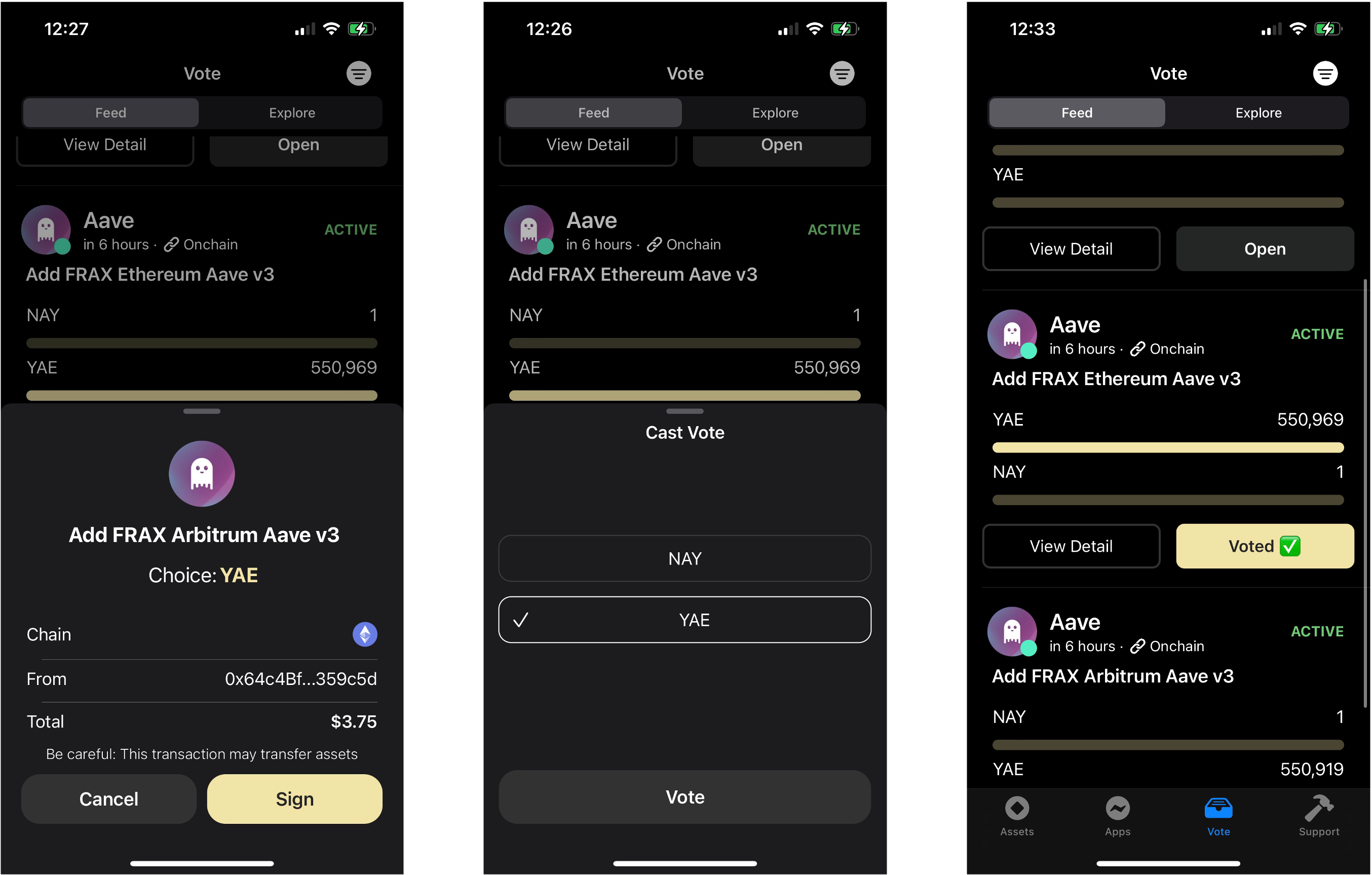

Beyond access control, DAOs must ensure that all treasury actions are governed by transparent, immutable processes. On-chain governance platforms automate proposal creation, voting, and execution directly on the blockchain. This not only provides a verifiable audit trail but also eliminates off-chain collusion risks. Automated governance modules, such as those integrated with Safe or custom DAO frameworks, allow token holders to propose and vote on spending, strategy shifts, or emergency responses in real time. This approach has been critical in maintaining stablecoin peg and treasury solvency for leading DAOs in 2025.

3. Conduct Regular Security Audits and Simulations of Multisig and Smart Contract Infrastructure

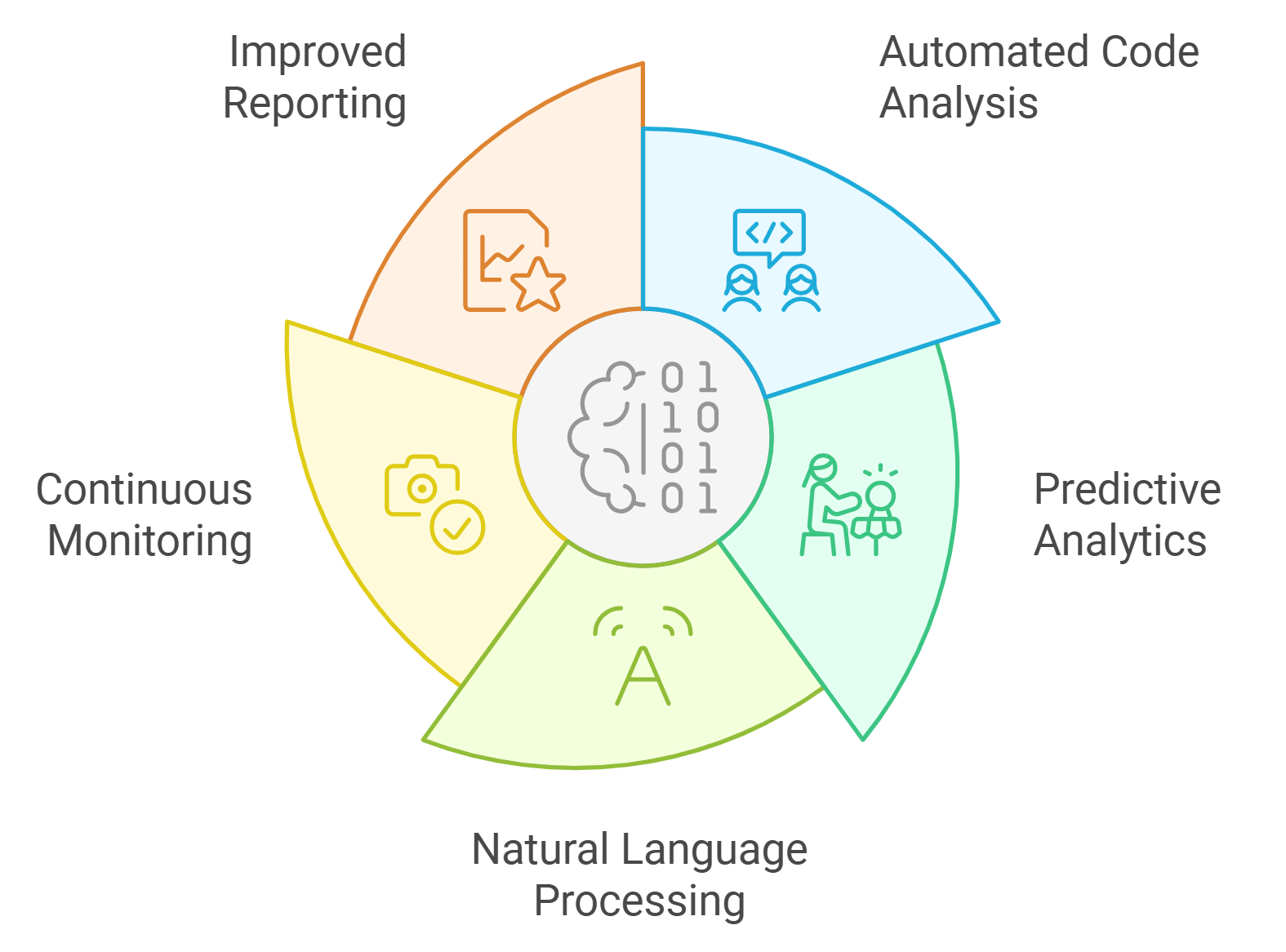

Even the most robust multi-sig and governance setups are only as secure as their underlying code. Regular third-party security audits are non-negotiable. DAOs should schedule both periodic audits and ad hoc reviews after every major upgrade or configuration change. In addition to formal audits, simulation exercises, such as white-hat hacking competitions or scenario-based drills, help test the response to real-world attack vectors or signer compromise events. This proactive approach enables DAOs to identify vulnerabilities before malicious actors do.

Top 5 Strategies for DAO Stablecoin Vault Security

-

Implement Multi-Signature Wallets (e.g., Safe, Gnosis Safe) with Diverse Signers for Vault Access ControlMulti-signature wallets like Safe (formerly Gnosis Safe) require multiple authorized signers to approve transactions, significantly reducing unauthorized access risks. Ensuring that signers are independent and geographically distributed further mitigates collusion and single-point-of-failure vulnerabilities.

-

Enforce On-Chain Governance for Treasury Actions, Including Automated Proposal and Voting MechanismsOn-chain governance platforms such as Snapshot and Compound Governance enable transparent, tamper-proof proposal submission and voting. This ensures all treasury actions are approved by the DAO community and recorded immutably on the blockchain.

-

Conduct Regular Security Audits and Simulations of Multisig and Smart Contract InfrastructureEngage reputable firms like Trail of Bits or ConsenSys Diligence for comprehensive audits. Simulate attack scenarios and test multisig workflows to proactively identify and remediate vulnerabilities.

-

Establish Emergency Protocols for Rapid Vault Freezing or Transaction Reversal in Case of BreachDesign and document emergency procedures, such as timelock contracts or guardian roles, to enable immediate freezing of vaults or reversal of unauthorized transactions. Protocols like MakerDAO utilize such mechanisms to protect funds during critical incidents.

For an in-depth guide on implementing these strategies in your treasury workflow, see our resource at How to Secure DAO Stablecoin Vaults: Best Practices for On-Chain Treasury Managers.

4. Utilize Hardware Wallets for All Multisig Signers

Key compromise remains a persistent threat to DAO treasuries, especially as phishing and malware attacks grow more sophisticated. The optimal defense is to require every multisig signer to use a hardware wallet (such as Ledger or Trezor) for transaction approvals. Hardware wallets store private keys in isolated environments, making them immune to most remote exploits and keyloggers. In practice, DAOs that enforce hardware wallet usage across all signers have seen a dramatic reduction in successful compromise attempts, even when individual devices are targeted. This policy should be codified in the DAO’s operational playbook and regularly verified through signer attestations.

5. Establish Emergency Protocols for Rapid Vault Freezing or Transaction Reversal

Even with rigorous controls, zero-day vulnerabilities or unexpected governance attacks can still occur. Therefore, DAOs must implement emergency protocols that allow for immediate response in the event of a breach. These may include time-locked vault freezing mechanisms, where an emergency multisig group can pause all transactions within seconds, or automated transaction reversal modules that can be triggered by on-chain consensus if malicious activity is detected. The best-in-class DAOs routinely test these protocols through simulations and drills, ensuring all signers are familiar with escalation procedures and communication channels.

Quantitative Impact: Why This Framework Matters

The combined effect of these five strategies is measurable: DAOs adopting this framework have reported a 50-70% reduction in incident response times and a near-elimination of single-point failures in stablecoin vault management. With stablecoin assets regularly exceeding $10 billion across top protocols, these improvements are not just theoretical, they translate directly into capital preservation and member confidence.

Continuous improvement is essential. As attack surfaces evolve, so must treasury security practices. DAOs should maintain an active feedback loop among signers, auditors, and community stakeholders, leveraging on-chain analytics and incident data to refine controls.

The future of decentralized treasury risk management will hinge on the ability to operationalize these best practices at scale, without sacrificing agility or transparency. For more quantitative frameworks and step-by-step implementation resources, visit our comprehensive guide: How to Secure DAO Stablecoin Vaults: Best Practices for On-Chain Treasury Managers.