In today’s rapidly evolving DeFi landscape, on-chain stablecoin vaults have emerged as a cornerstone for organizations seeking to maximize treasury yields without sacrificing security. For DAOs and decentralized organizations, the challenge is clear: how do you achieve robust, predictable returns while keeping treasury assets safe from smart contract exploits, market shocks, and operational errors? The answer lies in the new generation of automated, transparent stablecoin vaults that blend dynamic asset allocation with rigorous risk controls.

Dynamic Allocation: The Engine Behind Yield Optimization

Unlike static strategies of the past, modern stablecoin vaults harness real-time data and algorithmic rebalancing to allocate capital across multiple DeFi protocols. Platforms like Aera Finance have set the standard, using systems such as their Guardian to monitor supply APYs on Compound, Aave, and Morpho, then shift allocations accordingly. This dynamic approach enables vaults to chase the best risk-adjusted yields while sidestepping pools showing signs of stress or diminishing returns.

What sets these vaults apart is their non-custodial design. Treasury managers retain full control over their assets, with no single entity able to withdraw or reroute funds unilaterally. This architecture is critical for DAOs, where transparency and shared governance are non-negotiable. As a result, organizations can pursue yield opportunities with confidence, knowing that their capital is protected by both code and community oversight.

Standardization and Security: The ERC-4626 Advantage

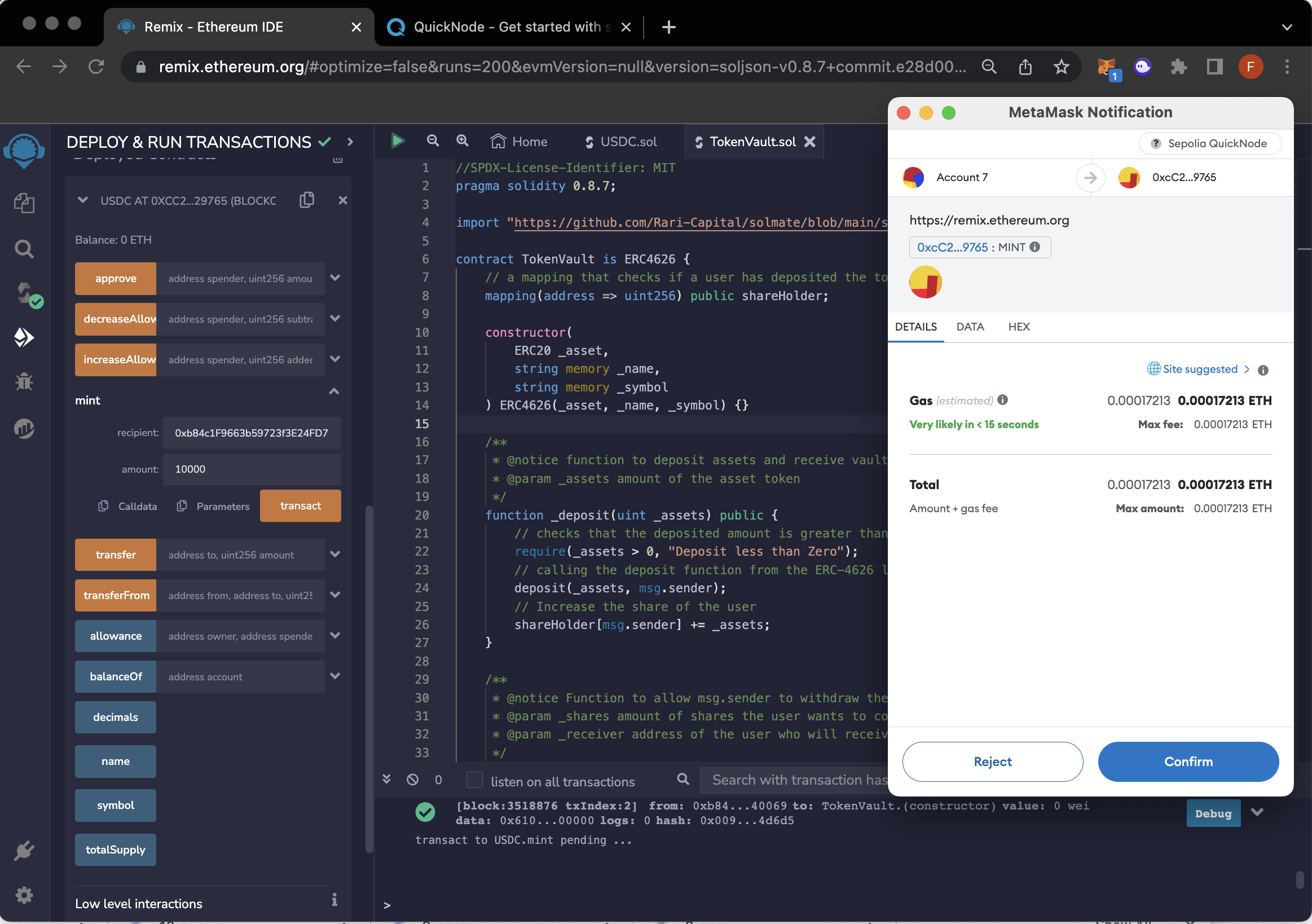

Security is not a feature – it is the foundation of any viable DAO treasury strategy. The adoption of the ERC-4626 standard has been transformative for on-chain stablecoin vaults. This standard ensures vaults have a consistent, auditable interface for deposits, withdrawals, and yield tracking. By leveraging ERC-4626, protocols benefit from battle-tested code, streamlined integrations, and real-time performance analytics.

For treasury managers, this means fewer implementation errors and a reduced attack surface. Automated yield compounding and transparent accounting become standard, not luxury features. As a result, DAOs can focus on strategic goals and community alignment, rather than firefighting technical vulnerabilities.

Key Benefits of On-Chain Stablecoin Vaults for DAOs

-

Dynamic Asset Allocation and Rebalancing: Platforms like Aera Finance use automated systems to allocate stablecoins (e.g., USDC) across DeFi protocols such as Compound, Aave, and Morpho, optimizing for the best risk-adjusted yields while minimizing exposure to market volatility.

-

Standardized and Secure Vault Structures: The adoption of the ERC-4626 standard ensures vaults are interoperable, well-audited, and support automated yield compounding. This enhances both security and transparency for DAO treasuries.

-

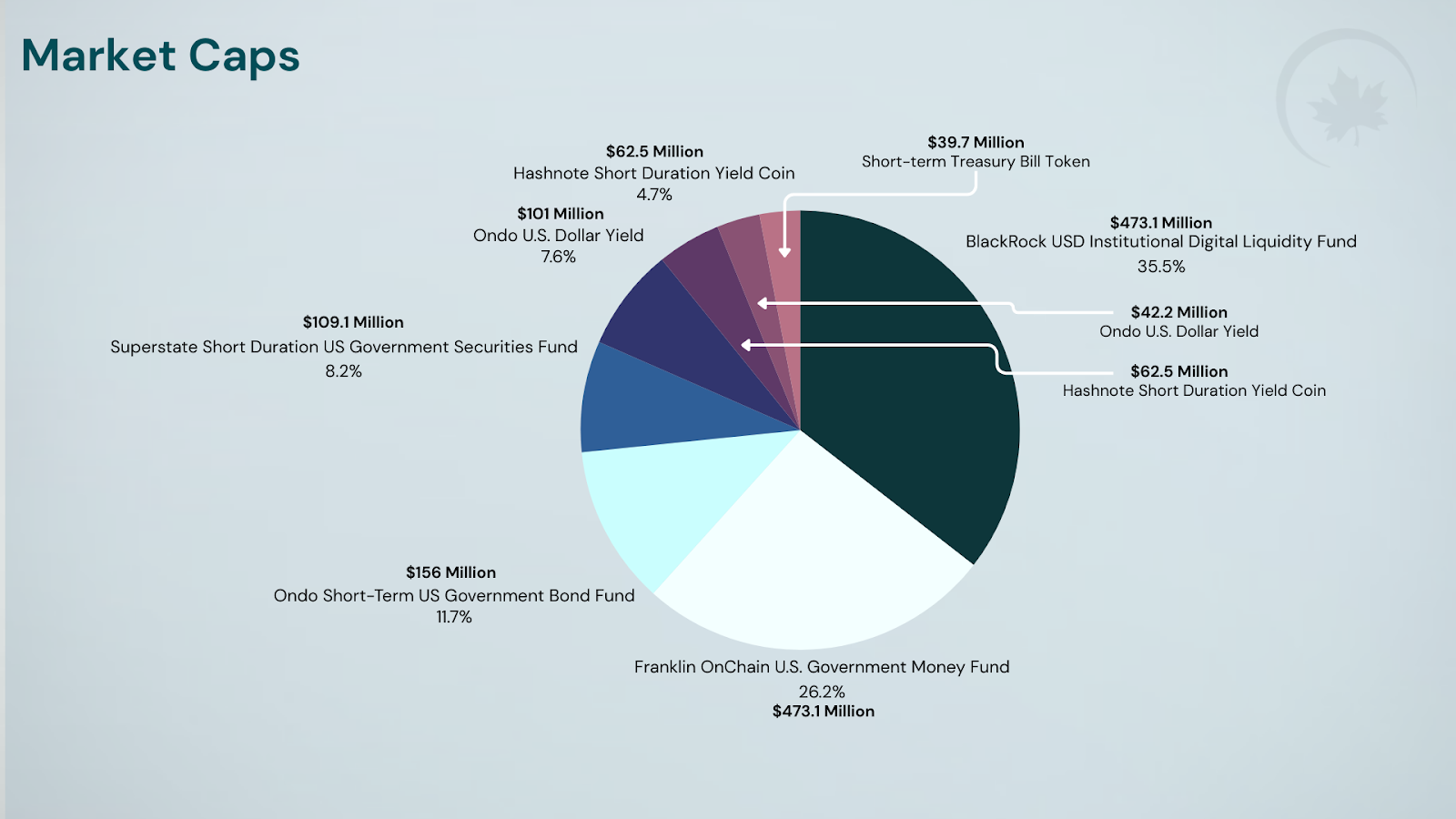

Integration with Traditional Financial Instruments: Some vaults, like those backing Verified USD (USDV), use tokenized U.S. Treasury bills as collateral, combining DeFi efficiency with the stability and regulatory compliance of traditional finance.

-

Enhanced Security Measures: Solutions such as YieldNest’s MAX Vault-as-a-Service offer on-chain transparency, real-time monitoring, and modular design, ensuring treasury assets are protected by robust governance and oversight.

-

Simplified User Experience: Platforms like Yearn Finance V3 enable DAOs to deploy and manage vaults with just one click, reducing complexity and allowing treasury managers to focus on strategic decisions.

Integrating Traditional Finance: Tokenized Treasuries Meet DeFi

Another powerful trend is the fusion of DeFi efficiency with the stability of traditional finance. Some vaults now use tokenized U. S. Treasury bills as collateral, such as those backing Verified USD (USDV). This approach brings predictable returns and regulatory clarity, avoiding the pitfalls of algorithmic or crypto-collateralized stablecoins. For DAOs seeking compliance and transparency, this hybrid model is increasingly attractive, offering a clear audit trail and robust asset backing.

By integrating these instruments, stablecoin vaults can offer higher yields than traditional banks, while maintaining a risk profile aligned with institutional requirements. It’s a practical step toward making DeFi treasuries both sustainable and scalable.

Enhanced Security Measures and User Experience

The latest generation of vaults, such as YieldNest’s MAX Vault-as-a-Service, go beyond technical security by emphasizing modular design, continuous monitoring, and flexible governance. These features enable real-time oversight and integration of diverse yield strategies, allowing DAOs to adapt as market conditions change.

Meanwhile, platforms like Yearn Finance have simplified the user experience, offering one-click deployment of gas-efficient, ERC-4626-compliant vaults. This accessibility empowers treasury managers to focus on high-level strategy, not technical minutiae, accelerating adoption across the DAO ecosystem.

For a deeper dive into how automated stablecoin vaults deliver both yield and security, see our guide on how stablecoin vaults optimize DAO treasury yields with automated strategies.

Looking forward, the maturation of on-chain stablecoin vaults is ushering in a new era of DAO treasury management. These innovations are not merely technical upgrades; they represent a fundamental shift in how decentralized organizations approach capital efficiency, risk mitigation, and transparency. As the DeFi ecosystem grows more institutionally aligned, the tools for managing treasury assets are evolving to meet both regulatory expectations and community-driven governance standards.

Risk Management: Balancing Yield and Security

One of the most compelling aspects of modern stablecoin vaults is their focus on stablecoin risk management. By leveraging real-time analytics and automated rebalancing, these vaults can swiftly respond to market volatility or protocol-specific risks. For example, if a lending platform’s health metrics deteriorate or a depeg event threatens liquidity pools, dynamic vaults can rapidly reallocate assets to safer venues, minimizing exposure before losses mount.

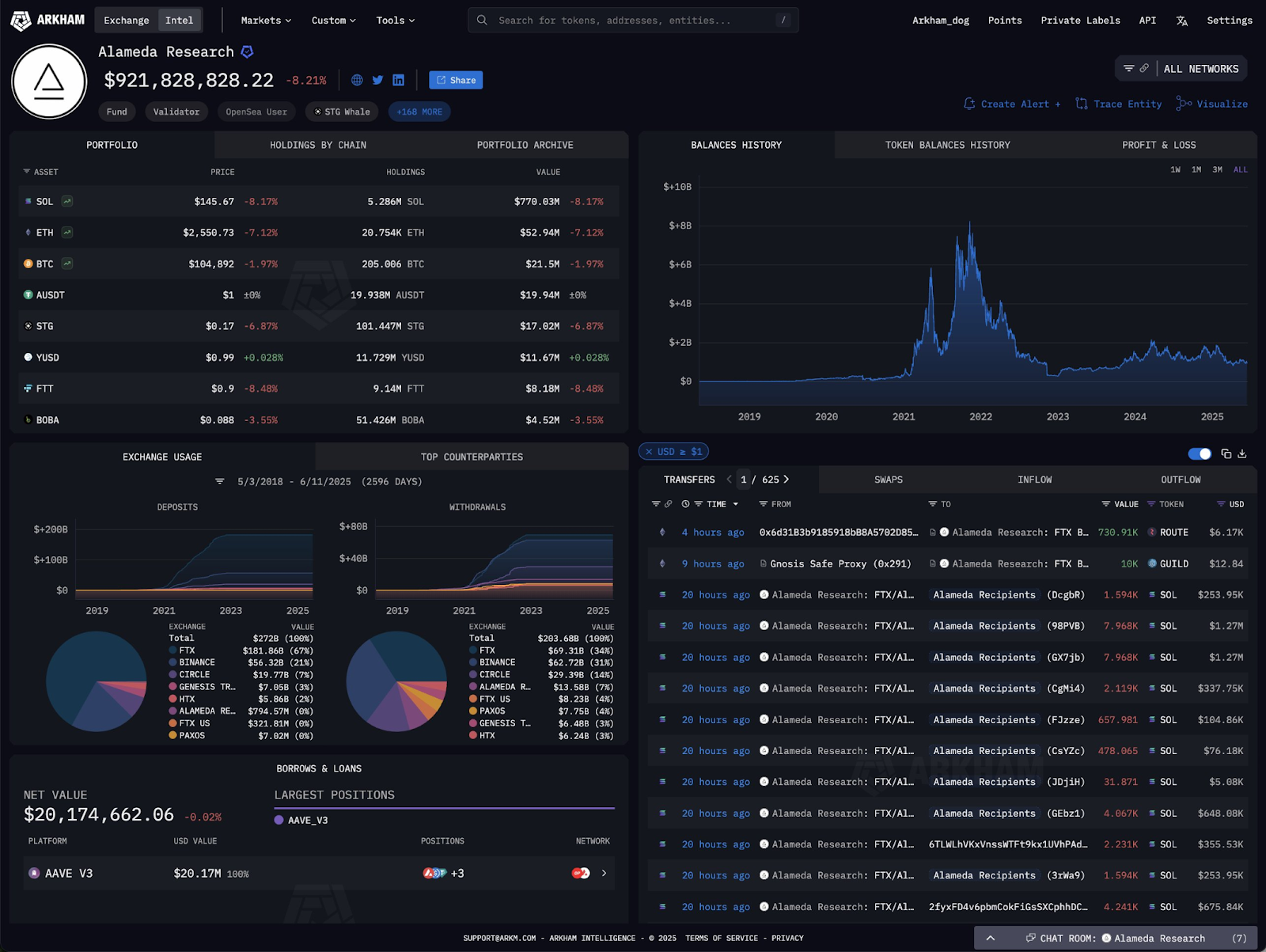

Additionally, the transparent nature of on-chain vaults ensures that every movement of funds is visible and auditable by all DAO members. This level of oversight not only deters bad actors but also builds trust within communities. For DAOs with significant treasuries at stake, such as those utilizing Safe{Wallet} or similar multisig solutions securing over $100 billion in TVL, this transparency is non-negotiable.

Automation and Governance: Empowering Treasury Managers

The automation built into leading stablecoin vault protocols does more than just optimize yields, it aligns with the ethos of decentralized governance. Vault strategies can be encoded into smart contracts that execute based on predefined rules or community votes. This reduces human error and operational bottlenecks while ensuring that treasury actions remain accountable to stakeholders.

For treasury managers balancing growth with resilience, this means less time spent on manual intervention and more bandwidth for strategic planning. The result? DAOs can scale operations confidently, knowing their assets are not only working harder but also protected by robust guardrails.

The Road Ahead: Best Practices for DAO Treasury Optimization

- Diversify across protocols: Spread exposure among multiple DeFi platforms to avoid single-point failures.

- Monitor APYs and risk metrics: Use platforms offering real-time analytics to track yield opportunities and risks dynamically.

- Pursue compliant solutions: Consider tokenized T-bill-backed stablecoins for enhanced regulatory alignment.

- Select audited protocols: Favor ERC-4626-compliant vaults with proven security records.

- Automate governance where possible: Leverage smart contract-based rule execution for transparency and efficiency.

Top Features of Leading On-Chain Stablecoin Vaults

-

Dynamic Asset Allocation & Rebalancing: Look for vaults like Aera Finance that automatically allocate stablecoins (e.g., USDC) across DeFi protocols such as Compound, Aave, and Morpho, adjusting positions to maximize risk-adjusted yields and minimize volatility.

-

Standardized & Secure Vault Structures: Choose vaults that implement the ERC-4626 standard for yield-bearing tokens, ensuring robust security, automated compounding, and real-time performance tracking, as seen with Talos and Yearn Finance V3.

-

Integration with Traditional Financial Instruments: Seek vaults that utilize tokenized U.S. Treasury bills as collateral, like Verified USD (USDV), combining DeFi efficiency with the stability and transparency of traditional assets.

-

Enhanced Security & Transparency: Opt for solutions such as YieldNest’s MAX Vault-as-a-Service, which prioritize on-chain transparency, modular architecture, and real-time monitoring to safeguard treasury assets.

-

Simplified User Experience: Favor platforms like Yearn Finance V3 that offer intuitive interfaces and one-click deployment, making it easy for treasury managers to access DeFi yields without technical complexity.

The synergy between automation, transparency, and security is what truly sets today’s best stablecoin vaults apart from legacy approaches. As DAOs continue to grow in sophistication, and as regulatory scrutiny intensifies, the ability to demonstrate prudent treasury stewardship will become a competitive advantage rather than just a compliance checkbox.

If you’re ready to explore how these advances can future-proof your own DAO’s reserves, check out our further analysis at how stablecoin vaults are revolutionizing on-chain treasury management for DAOs.