Decentralized Autonomous Organizations (DAOs) have entered a new era of treasury management, propelled by the rapid integration of AI-driven stablecoin vaults. In 2025, these automated systems are fundamentally changing how DAOs optimize yields and mitigate risks, blending blockchain transparency with the predictive power of artificial intelligence. As DAOs seek to maximize capital efficiency while safeguarding against market volatility, AI-powered vault protocols are fast becoming the gold standard for on-chain treasury optimization.

Why Stablecoin Vaults Are the Backbone of Modern DAO Treasuries

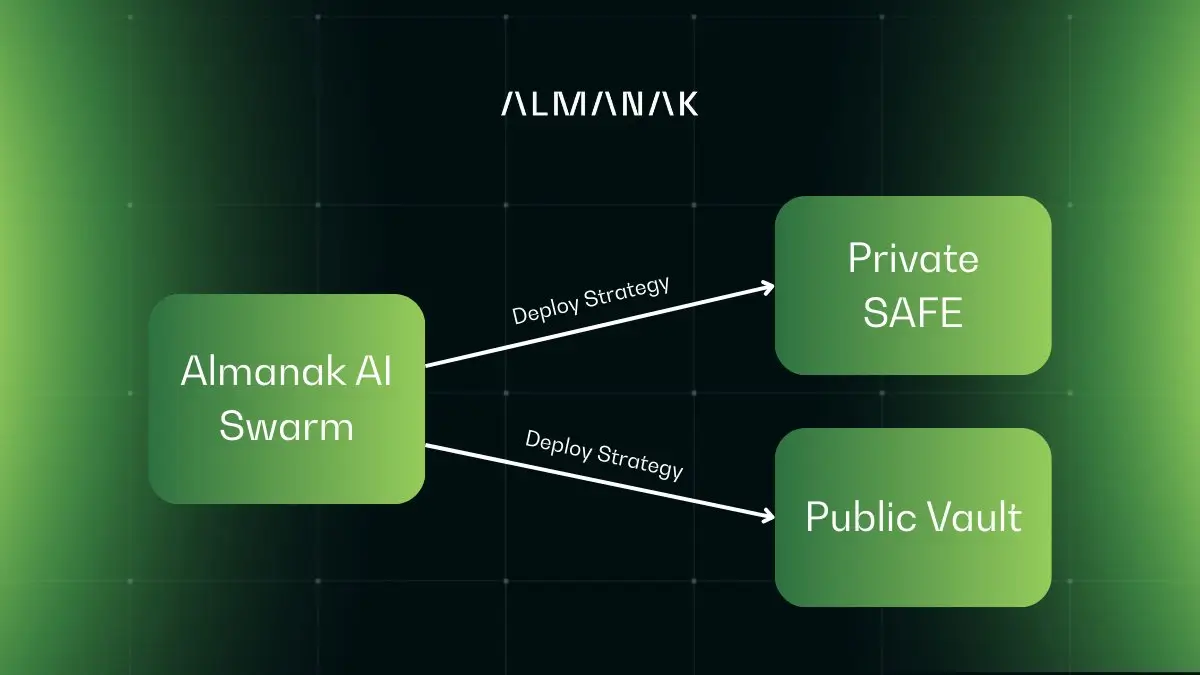

Stablecoins have already transformed treasury operations by enabling near-instant transfers, reducing float risk, and providing a reliable store of value for DAOs. However, the next leap forward is the deployment of AI stablecoin vaults that actively manage allocations across lending, staking, and liquidity protocols. Platforms like Aera and Gauntlet exemplify this trend, offering vaults that autonomously rebalance assets to capture the best available risk-adjusted yields in real time.

Unlike static strategies, AI-powered vaults ingest and analyze vast streams of on-chain and off-chain data. They continuously monitor protocol yields, liquidity conditions, and macroeconomic signals, then execute trades or shift allocations without human intervention. This dynamic approach allows DAOs to outperform manual strategies, especially in fast-moving or volatile markets.

Key Benefits of AI-Driven Stablecoin Vaults for DAOs

-

Automated Yield Optimization: AI-powered vaults like Fyde Treasury leverage real-time data analysis to identify and execute high-yield strategies across DeFi protocols, maximizing returns with minimal manual oversight.

-

Proactive Risk Management: Platforms such as Mitosis Matrix Vaults use AI agents to monitor market volatility and liquidity, enabling DAOs to dynamically rebalance portfolios and reduce exposure to adverse market events.

-

Increased Operational Efficiency: The AI16z DAO demonstrated a 60% reduction in inefficiencies by deploying AI agents for autonomous investment analysis, streamlining decision-making and execution processes.

-

Enhanced Transparency and Auditability: AI-driven vaults maintain detailed on-chain records of all transactions and strategy changes, supporting robust auditing and governance practices for DAOs.

-

Continuous Adaptation to Market Conditions: AI systems continuously learn from evolving DeFi market trends, ensuring that vault strategies remain aligned with the DAO’s risk tolerance and yield objectives over time.

AI-Powered Yield Optimization: Data-Driven Alpha for DAOs

The core advantage of automated DeFi yield strategies lies in their ability to synthesize real-time data and act without delay. For example, Fyde Treasury’s AI-managed smart contracts scan hundreds of protocols, identifying high-yield opportunities and executing complex strategies like recursive lending or cross-chain staking. This not only enhances returns but also reduces the operational burden on DAO treasury managers.

Consider the AI16z DAO, which implemented an autonomous AI agent named “AI Marc” in late 2024. According to industry reports, this system reduced inefficiencies by 60%, eliminating manual lag and emotional bias from treasury decisions. As more DAOs adopt similar approaches, the competitive edge is shifting toward those who can leverage AI for continuous portfolio optimization.

Risk Management: Proactive Defense with On-Chain Intelligence

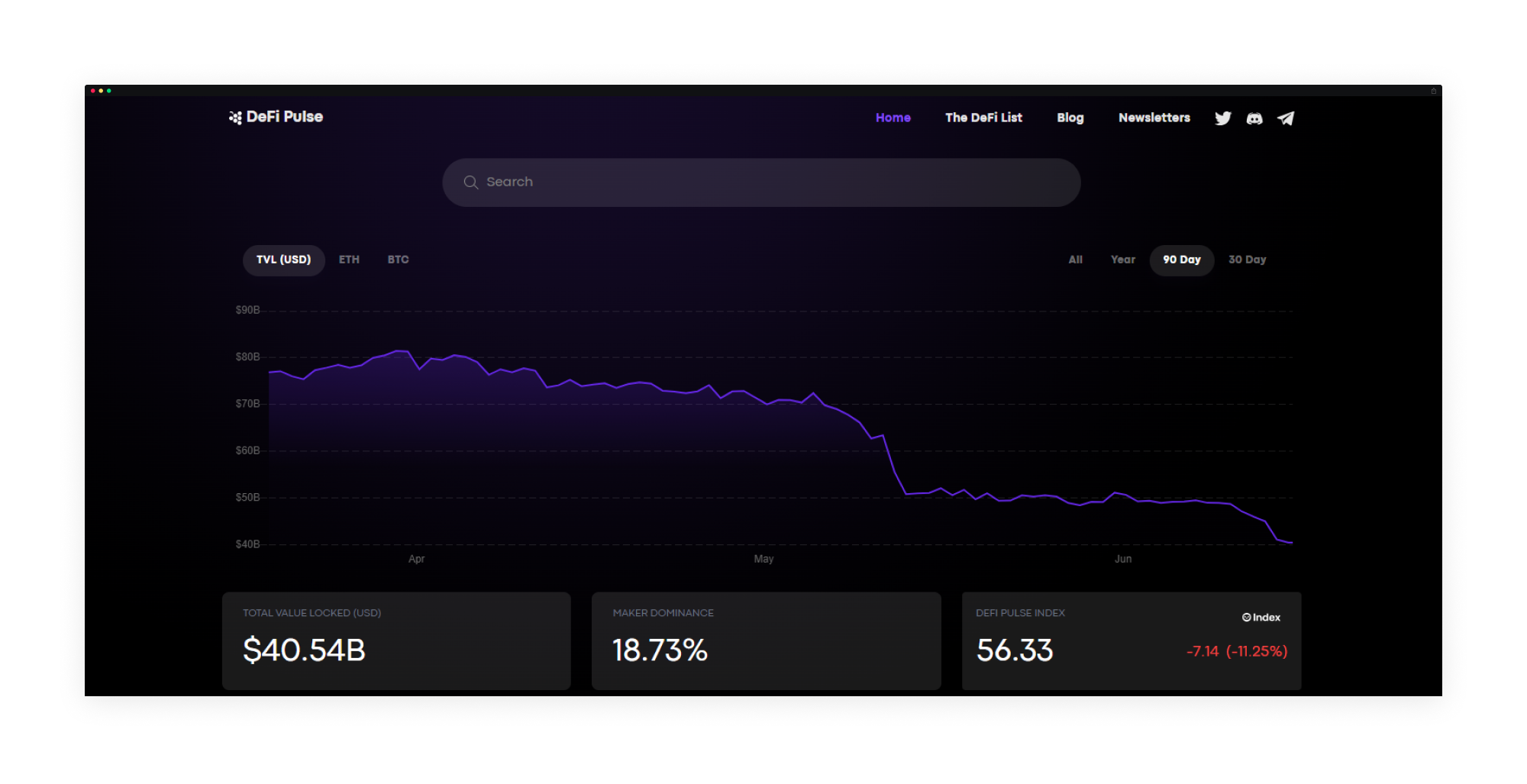

Yield optimization is only half the story. Robust on-chain treasury risk management is equally critical for DAOs entrusted with millions in assets. AI-driven vaults excel here by constantly assessing risk factors such as protocol insolvency, smart contract exploits, and sudden market drawdowns. Mitosis’s Matrix Vaults, for instance, use AI agents to monitor vault health and rebalance assets across chains at the first sign of stress.

These systems can also enforce DAO-defined risk parameters in real time. If market volatility spikes or a lending protocol’s risk profile deteriorates, the AI can swiftly reduce exposure or migrate funds to safer venues. This proactive defense mechanism is vital as DAOs increasingly deploy capital across diverse ecosystems and real-world asset (RWA) backed stablecoins.

For a deeper dive into how stablecoin vaults protect DAOs during periods of heightened market uncertainty, see this resource.

Despite the clear advantages, DAOs must carefully consider the challenges of implementing AI stablecoin vaults. The performance of these systems hinges on the quality and integrity of the data fed into the AI models. Poor data hygiene or reliance on unverified oracles can introduce systemic vulnerabilities, undermining both yield and risk controls. Moreover, the complexity of AI-driven automation raises new questions around transparency and explainability, especially when vault decisions impact large, community-governed treasuries.

To address these challenges, leading DAOs are instituting rigorous governance frameworks and third-party audits of both smart contracts and AI logic. On-chain transparency remains paramount: every vault allocation and risk adjustment is logged, enabling members to scrutinize decisions and hold operators accountable. Some protocols, such as those built on Steer and SingularityDAO, have pioneered modular vault structures where AI logic is open source and auditable by the DAO itself.

Case Studies: Real-World Impact and Lessons Learned

The rapid adoption of stablecoin vault protocols is best illustrated by recent case studies. VisionSys AI’s $2 billion Solana treasury initiative demonstrates how large-scale DAOs can deploy AI-powered vaults to unlock new yield streams while maintaining strict risk controls. Similarly, the Mitosis Matrix Vaults have shown resilience in cross-chain environments, automatically shifting assets in response to changing risk signals and liquidity conditions.

These examples highlight a crucial lesson: DeFi treasury automation is not just about maximizing returns, but also about building antifragile systems that can adapt to market shocks. DAOs leveraging AI-driven vaults report not only improved yields but also reduced drawdowns during periods of volatility. As a result, DAO treasuries are becoming more sophisticated, using AI not as a black box, but as a transparent, programmable co-pilot.

For DAOs seeking to implement or upgrade their treasury stack, it is essential to evaluate both the technical and governance layers of AI vault solutions. Considerations should include:

- Auditability: Are the AI models and smart contracts regularly audited by reputable third parties?

- Governance Alignment: How does the vault’s automation logic align with DAO governance processes and community values?

- Data Integrity: What measures are in place to ensure the reliability of data inputs and oracles?

- Resilience: How does the protocol respond to black swan events or cross-chain disruptions?

For an in-depth breakdown of stablecoin vault strategies and risks, explore this comprehensive guide.

The Future: AI as a DAO Treasury Standard

The trajectory is clear: as DeFi matures, AI-driven stablecoin vaults will become a foundational layer of DAO treasury management. Their ability to synthesize real-time data, automate complex strategies, and enforce risk controls at machine speed is setting a new benchmark for capital efficiency and security. However, the ultimate success of these systems depends on transparent governance, robust audits, and ongoing education for DAO members.

As the ecosystem evolves, expect to see further integration of predictive analytics, cross-chain automation, and real-world asset collateralization within AI vault protocols. DAOs that embrace these innovations early will be best positioned to thrive in an increasingly competitive and dynamic DeFi landscape.