The world of decentralized finance is evolving at a breakneck pace, and nowhere is this more evident than in the transformation of on-chain treasury management. For DAOs and decentralized organizations, the challenge has always been to balance liquidity, yield generation, and risk management. The advent of yield-separated stablecoins like STBL’s USST marks a pivotal moment in this journey – one where capital efficiency and transparency finally converge.

Yield-Separated Stablecoins: A New Era for DAO Treasuries

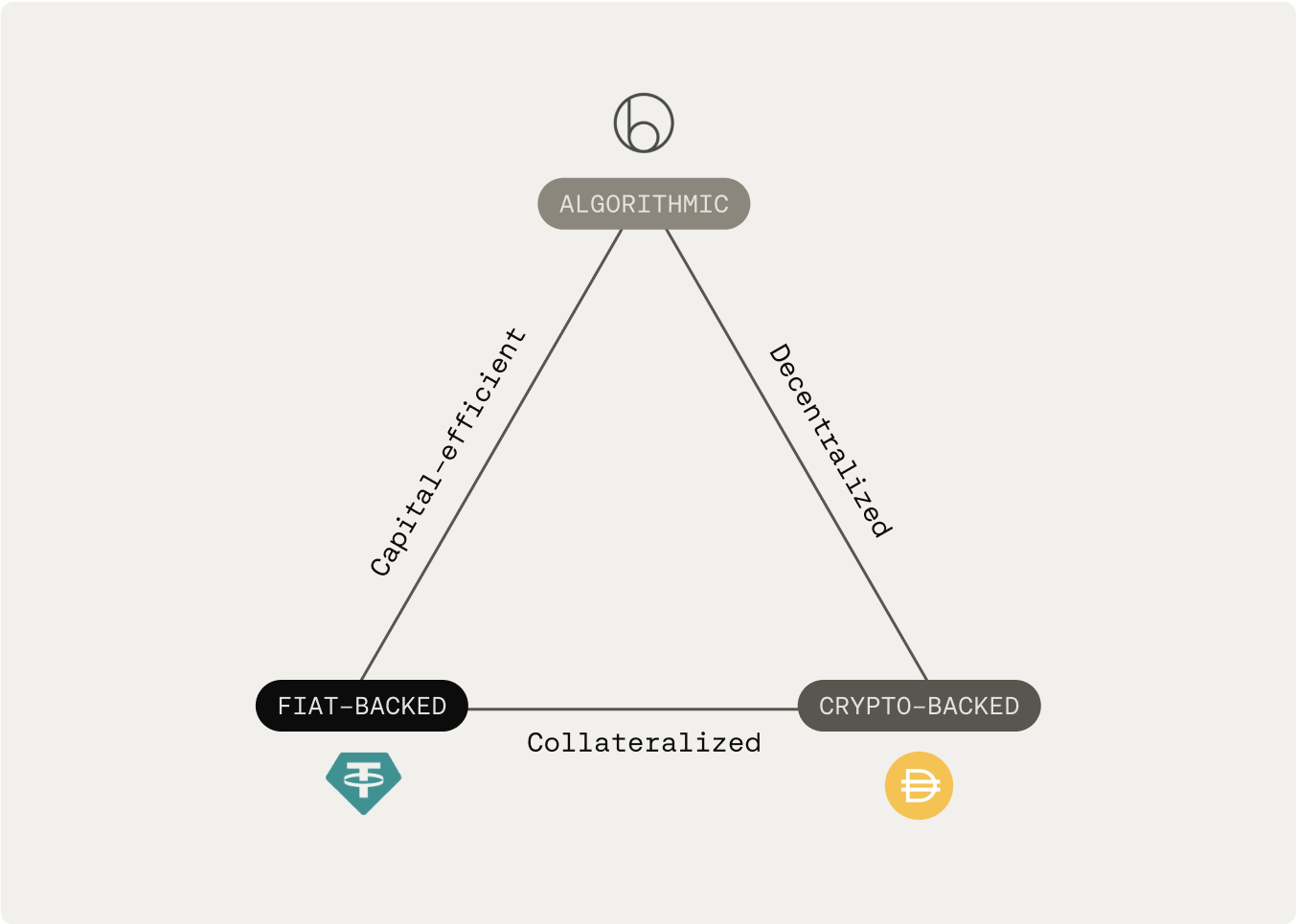

Traditional stablecoins such as USDT and USDC have long been the backbone of DeFi treasuries. They offer price stability but with a hidden cost: the yield generated from their underlying reserves is typically pocketed by issuers, not by the holders themselves. This model leaves DAO treasurers navigating trade-offs between liquidity and yield, often forcing them into complex DeFi strategies or riskier assets to meet operational needs.

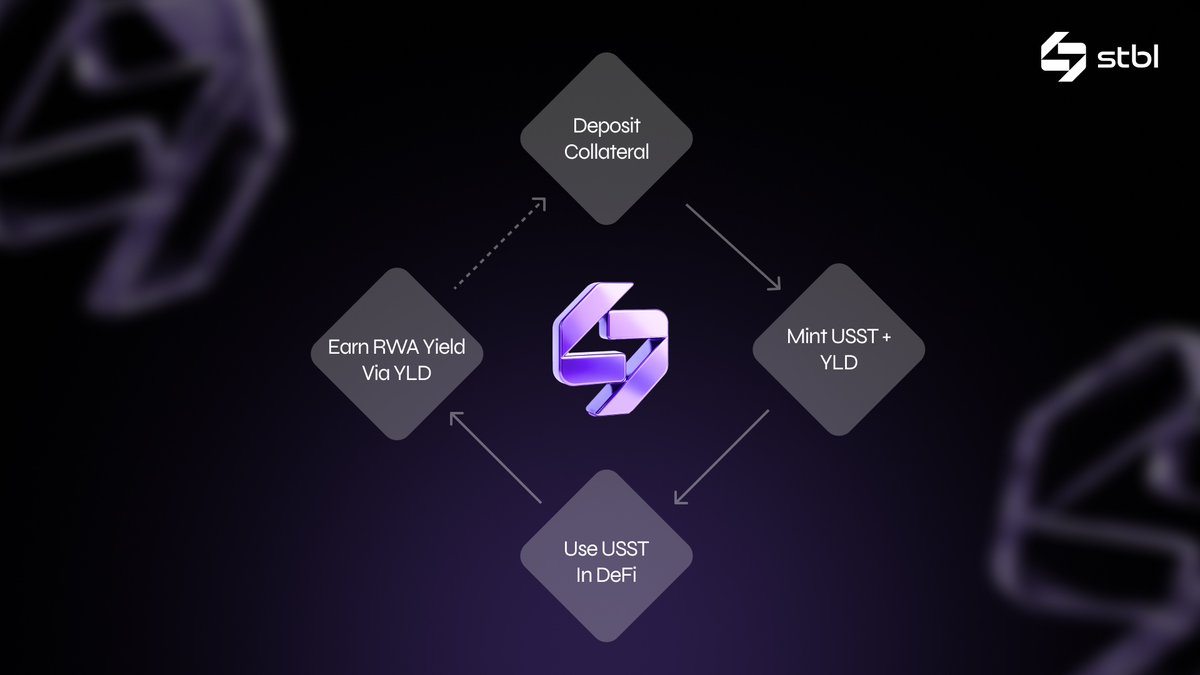

Enter STBL’s next-generation architecture: By decoupling principal from yield through a three-token system, STBL empowers organizations to optimize every dollar held on-chain. Here’s how it works:

- USST: A USD-pegged stablecoin backed by tokenized real-world assets (RWAs), fully liquid for spending or payments.

- YLD: An NFT representing the right to claim yield generated by those RWAs – tradeable and programmable for custom strategies.

- STBL: The protocol’s governance token, enabling community-driven decision-making.

This separation means an organization can hold USST for payroll or vendor payments while either selling YLD for instant yield or holding it to accrue income over time. It’s a leap forward in capital efficiency and a direct response to longstanding complaints about opaque issuer profits in legacy stablecoin models (docs.stbl.com).

The Mechanics Behind Yield Separation

The innovation isn’t just theoretical – it’s already reshaping market dynamics. When users deposit RWAs such as U. S. Treasury Bills into the protocol, they mint USST (the liquid stablecoin) and receive YLD tokens (the yield claim). This dual-token structure creates new opportunities for treasury managers:

- Enhanced Liquidity: No need to lock up funds or sacrifice operational flexibility. USST remains spendable at all times.

- Bespoke Yield Strategies: YLD tokens can be sold, staked, or integrated into automated vaults based on an organization’s risk profile.

- Sustainable Yield Sources: Because USST is backed by regulated RWAs rather than volatile crypto collateral, yields are more predictable and compliant with emerging regulations (docs.stbl.com).

This approach also enhances transparency – every step of collateralization, yield generation, and distribution is recorded on-chain. That means no more black-box reserve management; DAOs can audit their treasury health in real time.

$STBL Market Performance: Navigating Volatility with Confidence

This year has seen explosive growth in RWA-backed stablecoins as organizations seek compliant alternatives that don’t compromise on returns. As of October 10,2025, the $STBL governance token trades at $0.200379, reflecting both its utility within protocol governance and growing adoption among DAO treasuries. The latest market data shows a 24-hour change of -0.07635 (-0.27591%), with an intraday high of $0.28527 and low of $0.200106.

STBL Price Prediction 2026-2031

Forecast based on RWA adoption, DeFi growth, and evolving stablecoin landscape

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.17 | $0.26 | $0.35 | +30% | Adoption of RWA-backed stablecoins accelerates; STBL benefits from increased on-chain treasury integration |

| 2027 | $0.21 | $0.32 | $0.47 | +23% | Regulatory clarity in US/EU boosts institutional use; competition from other protocols tempers upside |

| 2028 | $0.25 | $0.39 | $0.60 | +22% | Yield optimization features mature, attracting DeFi and TradFi treasuries; bullish scenario if RWAs scale rapidly |

| 2029 | $0.30 | $0.48 | $0.75 | +23% | Global DeFi adoption peaks, STBL’s governance role increases; bear case if regulatory restrictions tighten |

| 2030 | $0.36 | $0.59 | $0.93 | +23% | On-chain treasury management mainstream; STBL sees strong demand as stablecoin 2.0 leader |

| 2031 | $0.43 | $0.73 | $1.15 | +24% | If RWA tokenization and yield-splitting become standard, STBL could outperform peers; volatility remains due to market cycles |

Price Prediction Summary

STBL is positioned for robust long-term growth as the stablecoin 2.0 narrative and RWA adoption reshape DeFi and on-chain treasury management. While price appreciation may be gradual due to its governance-focused utility, significant upside exists if regulatory and technological tailwinds persist. Volatility is expected, but the trend favors progressive gains through 2031.

Key Factors Affecting STBL Price

- Growth and adoption rate of RWA-backed stablecoins in DeFi and TradFi sectors

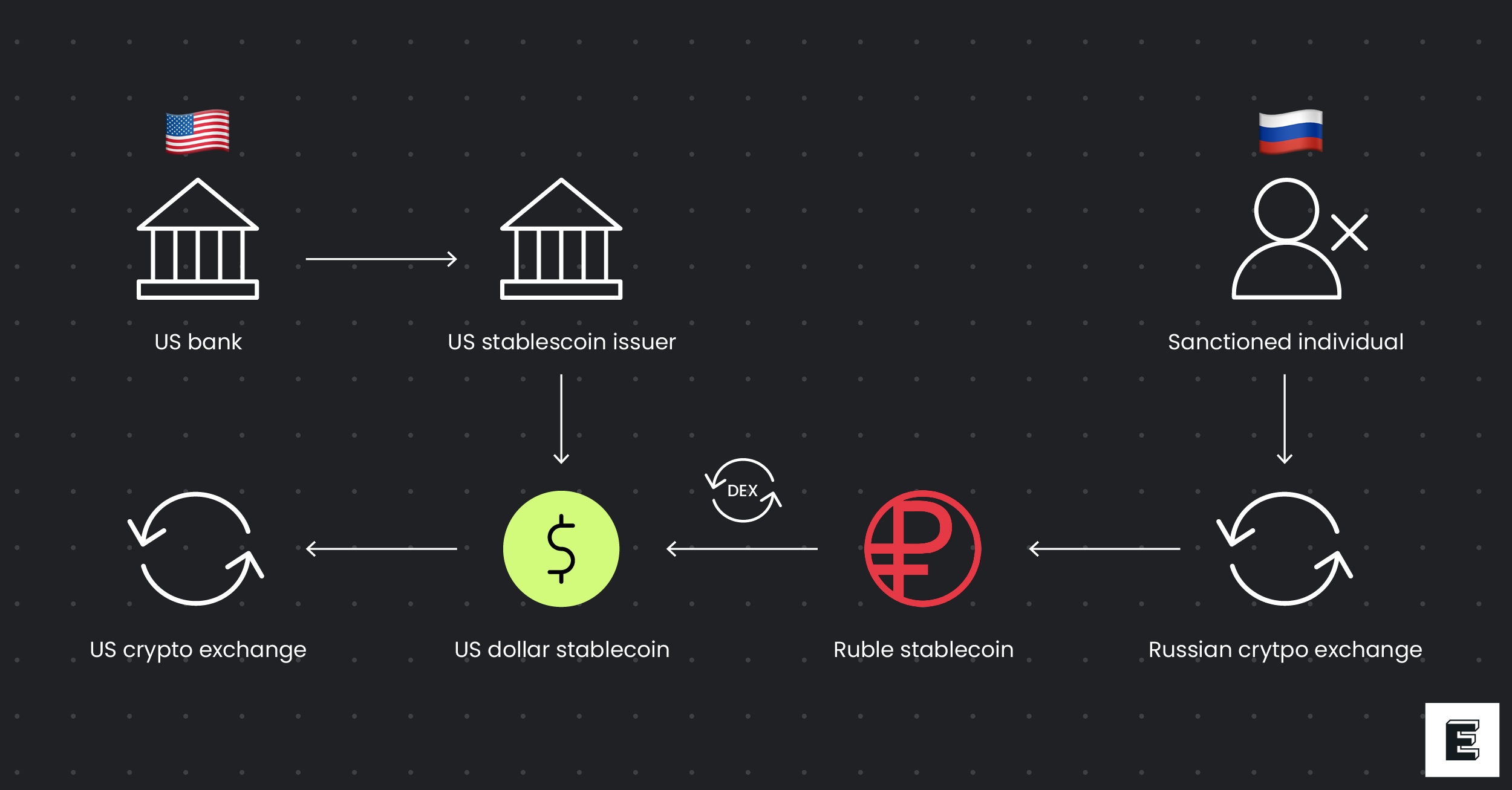

- Regulatory clarity and global compliance for stablecoins and tokenized assets

- Competition from other yield-generating or governance tokens in the stablecoin sector

- Technological improvements and security of the STBL protocol

- Macro market cycles impacting crypto asset valuations

- Institutional adoption of on-chain treasury solutions

- Utility and governance relevance of the STBL token versus passive holding

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This price resilience underscores growing confidence in models that prioritize both stability and regulatory alignment – especially as MiCA-compliant frameworks become central to institutional DeFi participation (coindesk.com). For treasury managers who once had to choose between safety and performance, STBL offers the best of both worlds.

The Road Ahead: Operational Excellence Meets Innovation

The implications go far beyond simple asset allocation decisions. With yield-separated stablecoins now gaining traction among major DAOs and institutional players alike, we’re witnessing a fundamental redefinition of what it means to manage digital capital responsibly.

By leveraging yield-separated stablecoins, DAOs can now design treasury strategies that are both agile and robust. This flexibility is particularly vital in a regulatory landscape that is evolving rapidly, with compliance and auditability at the forefront of every responsible treasury manager’s mind. The transparency baked into STBL’s architecture means that every transaction, yield claim, and governance vote can be scrutinized in real time, empowering communities to hold themselves and their protocols to higher standards.

Let’s break down the operational advantages driving adoption:

Top 5 Reasons DAOs Are Embracing Yield-Separated Stablecoins

-

1. Liquidity Without Sacrificing Yield: Yield-separated stablecoins like STBL’s USST allow DAOs to keep their treasury liquid for operational spending, while the yield component (YLD tokens) accrues interest separately. This empowers organizations to spend or deploy stablecoins as needed, without missing out on potential returns.

-

2. Transparent, RWA-Backed Stability: USST is fully backed by tokenized real-world assets (RWAs), such as U.S. Treasury Bills, ensuring both transparency and robust collateralization. This over-collateralized model reduces exposure to volatile crypto assets and enhances trust in treasury reserves.

-

3. Flexible Yield Optimization Strategies: By holding or trading YLD tokens, DAOs can tailor their yield strategies to match risk tolerance and market conditions. The separation of principal and yield enables more sophisticated treasury management and risk-adjusted returns.

-

4. Enhanced Regulatory Alignment: The principal-yield separation architecture of STBL aligns with emerging regulatory expectations, potentially simplifying compliance for DAOs and institutional treasuries. This design helps organizations navigate the evolving legal landscape with greater confidence.

-

5. Community-Driven Governance: The STBL governance token allows DAOs and stakeholders to actively participate in protocol decisions, fostering a transparent and decentralized approach to treasury management. As of October 10, 2025, STBL is trading at $0.2004 (24h change: -0.0764), reflecting ongoing community engagement and market activity.

1. Dynamic Capital Allocation: Separate principal and yield streams enable DAOs to allocate funds precisely where needed, whether for immediate expenses or long-term growth. 2. Automated Risk Controls: Smart contracts enforce over-collateralization, reducing manual oversight and human error. 3. Regulatory Readiness: By isolating yield as a distinct asset (YLD), DAOs can more easily comply with global reporting standards. 4. Community-Driven Governance: The STBL token ensures that protocol upgrades, risk parameters, and strategic decisions remain in the hands of stakeholders. 5. Ecosystem Interoperability: USST’s liquidity and YLD’s programmability open doors for integrations with DeFi lending, staking, and automated portfolio tools.

This ecosystem approach is already inspiring new best practices among DAO treasurers. For example, progressive organizations are setting up automated vaults where YLD tokens are reinvested or diversified across multiple yield sources, maximizing returns without sacrificing daily operational liquidity.

Best Practices for DAO Treasuries: Building Sustainable Reserves

The rise of compliant, transparent RWA-backed stablecoins is setting new benchmarks for what on-chain capital stewardship should look like. Treasury managers should consider these actionable steps as they embrace this next evolution:

- Regularly audit both USST holdings (for liquidity) and YLD positions (for yield exposure) using on-chain analytics tools.

- Diversify between different classes of RWAs backing USST to mitigate concentration risk.

- Engage with governance via STBL tokens to influence protocol parameters, such as collateral types or risk limits, that impact your treasury directly.

- Create transparent reporting dashboards for your community to foster trust and accountability.

The result? A more resilient treasury that aligns financial outcomes with community values, a core tenet of decentralized governance.

Looking Forward: Purposeful Growth in DeFi Treasuries

The momentum behind yield-separated stablecoins like STBL is not just a passing trend, it marks a shift toward sustainable digital asset management where transparency, compliance, and capital efficiency coexist by design. As regulatory frameworks like MiCA shape the future of DeFi participation, those who adopt these innovations early will be best positioned to thrive in an increasingly competitive landscape.

If you’re managing a DAO or decentralized organization’s reserves today, it’s time to rethink legacy models. Embrace solutions that let you invest with purpose while managing with foresight, aligning operational agility with long-term security.

The era of passive stablecoin holding is over; active stewardship powered by tools like STBL’s USST/YLD system is how tomorrow’s treasuries will lead.