In 2025, DAO stablecoin vault management has become a sophisticated discipline, blending technical innovation with robust governance. As decentralized organizations steward billions in on-chain assets, the stakes for secure and efficient treasury operations have never been higher. The following best practices define the gold standard for DAOs seeking to optimize capital efficiency while minimizing systemic risk.

1. Adopt Multi-Signature and Smart Contract Wallets for Enhanced Vault Security

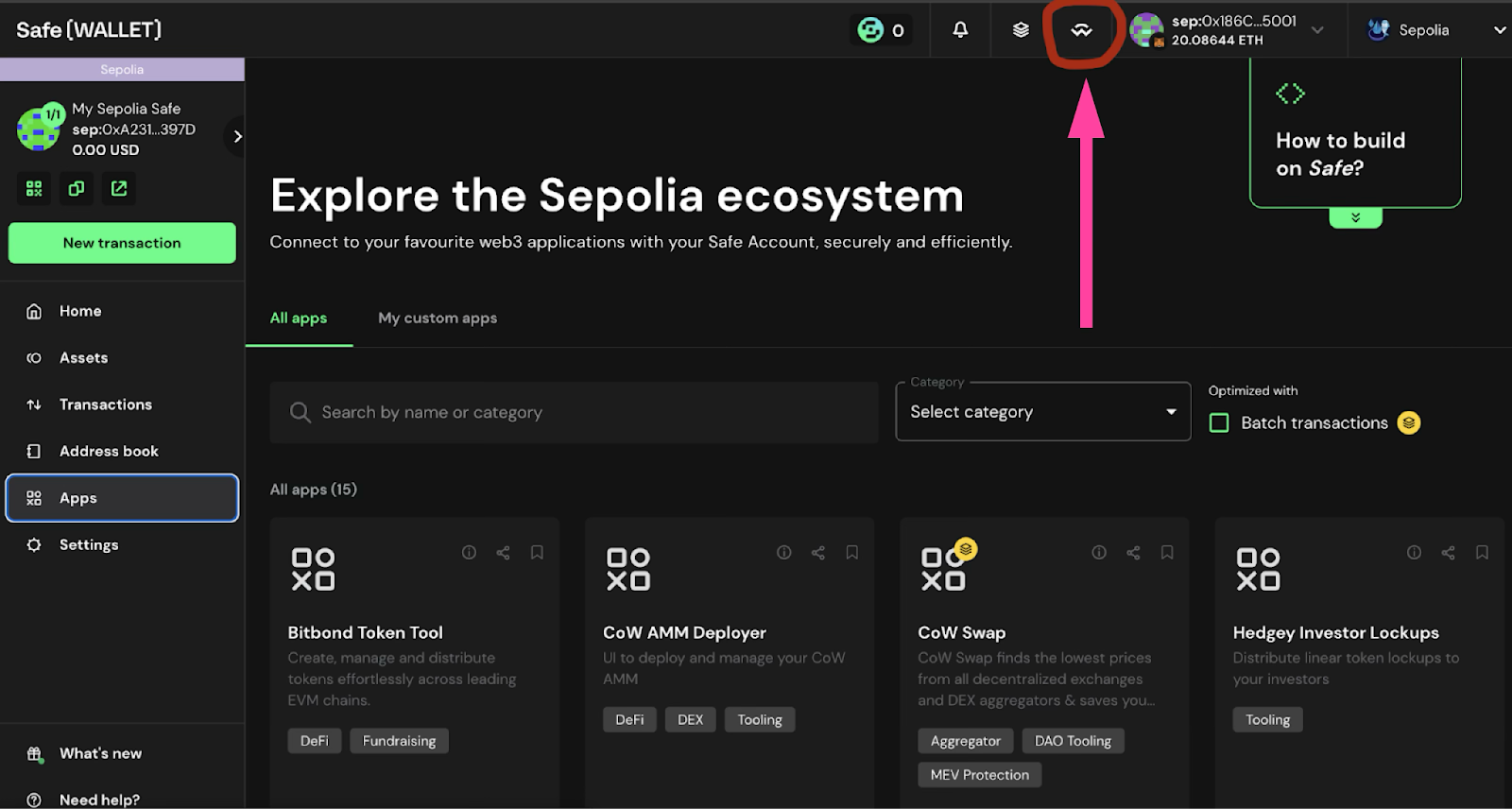

Multi-signature (multisig) wallets remain the cornerstone of decentralized treasury security in 2025. By requiring multiple independent approvals before any transaction is executed, multisig wallets like Gnosis Safe dramatically reduce single-point-of-failure risk. Forward-thinking DAOs are also integrating programmable smart contract wallets, enabling dynamic access controls and automated policy enforcement. This layered approach ensures that even if one key is compromised, malicious actors cannot drain vault funds without consensus.

The evolution of wallet security now includes support for modular upgrades, role-based permissions, and time-locked transactions, features that empower DAOs to respond quickly to governance decisions or emergencies without sacrificing safety. For an in-depth look at securing DAO stablecoin vaults with multisig and on-chain governance, see our dedicated guide.

2. Diversify Stablecoin Holdings Across Multiple Reputable Issuers

Concentration risk is a silent threat to DAO treasuries. In 2025, best-in-class DAOs diversify their stablecoin reserves across issuers like USDC, DAI, GHO, and sDAI. This not only hedges against the risk of depegging or regulatory action affecting a single asset but also improves liquidity access during periods of network congestion or market stress.

Diversification strategies now extend beyond crypto-native assets; some treasuries allocate portions to tokenized real-world assets (RWAs), such as short-term U. S. Treasuries wrapped on-chain via regulated protocols. The result: enhanced stability profiles and more resilient yield streams.

- USDC: Preferred for regulatory clarity and liquidity depth

- DAI/sDAI: Decentralized exposure with yield-bearing options

- GHO: Emerging as a composable native stablecoin within DeFi ecosystems

- sDAI: Allows treasuries to earn protocol-native yield passively

This multi-asset approach is essential for any DAO serious about long-term resilience. For practical frameworks on evaluating diversification strategies, explore our evaluation guide.

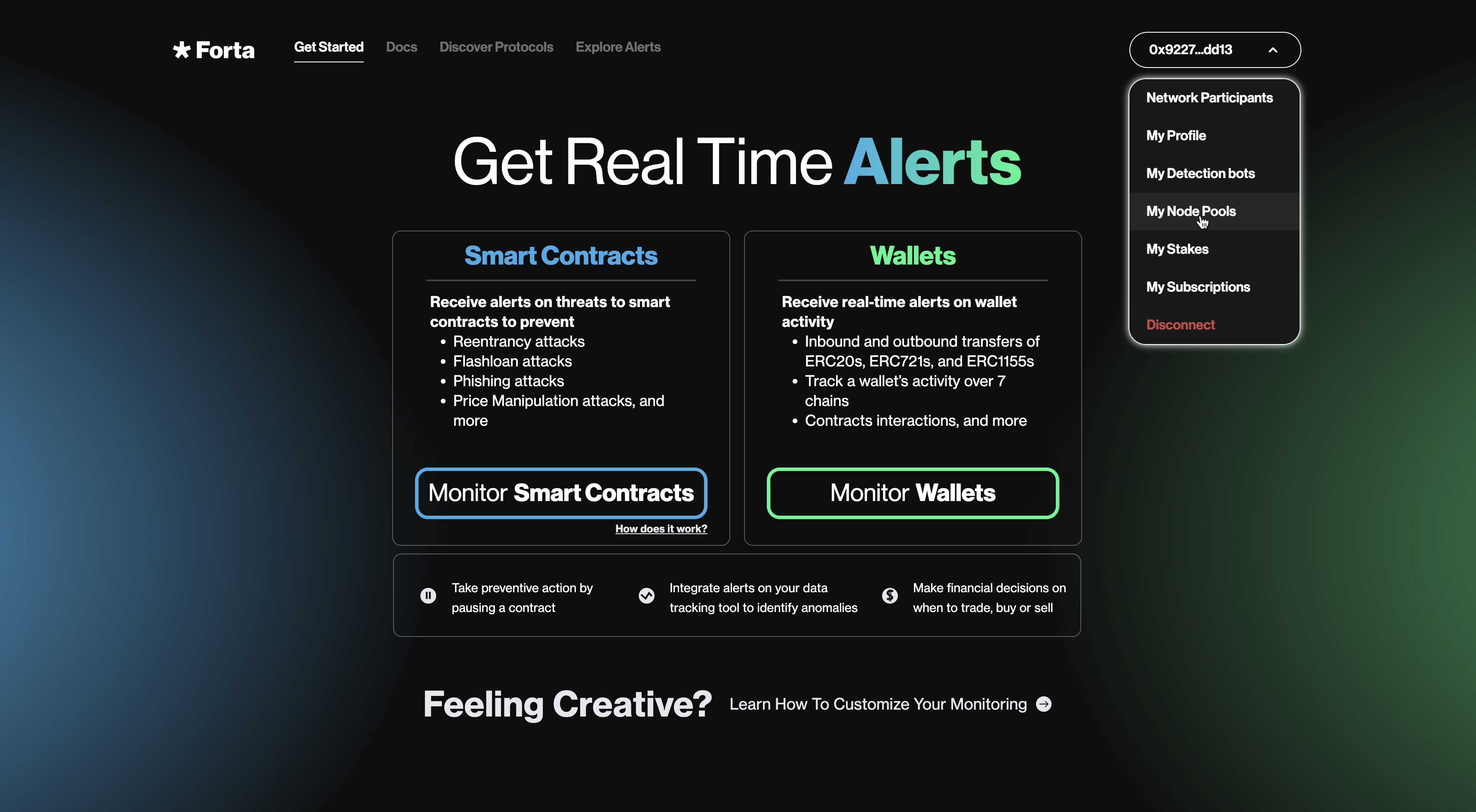

3. Automate Real-Time Risk Monitoring and On-Chain Alerts for Depegging or Protocol Vulnerabilities

The speed at which market conditions can shift makes automated risk monitoring indispensable. Leading DAOs deploy smart monitoring tools that track price feeds, protocol health metrics, and network anomalies in real time. These systems trigger on-chain alerts if a stablecoin’s price deviates from its peg or if underlying protocols show signs of stress.

This proactive posture allows treasury managers to execute contingency plans, such as reallocating funds or pausing transactions, before risks materialize into losses. Integration with open-source monitoring frameworks ensures transparency: all alert triggers and responses are logged on-chain for auditability by token holders.

Top Automation Tools for DAO Treasury Risk Monitoring

-

Adopt Multi-Signature and Smart Contract Wallets for Enhanced Vault Security: Platforms like Safe (formerly Gnosis Safe) and Multisig.org enable DAOs to require multiple approvals for transactions, distributing access control and minimizing single points of failure. These wallets support programmable automation via smart contracts for added security.

-

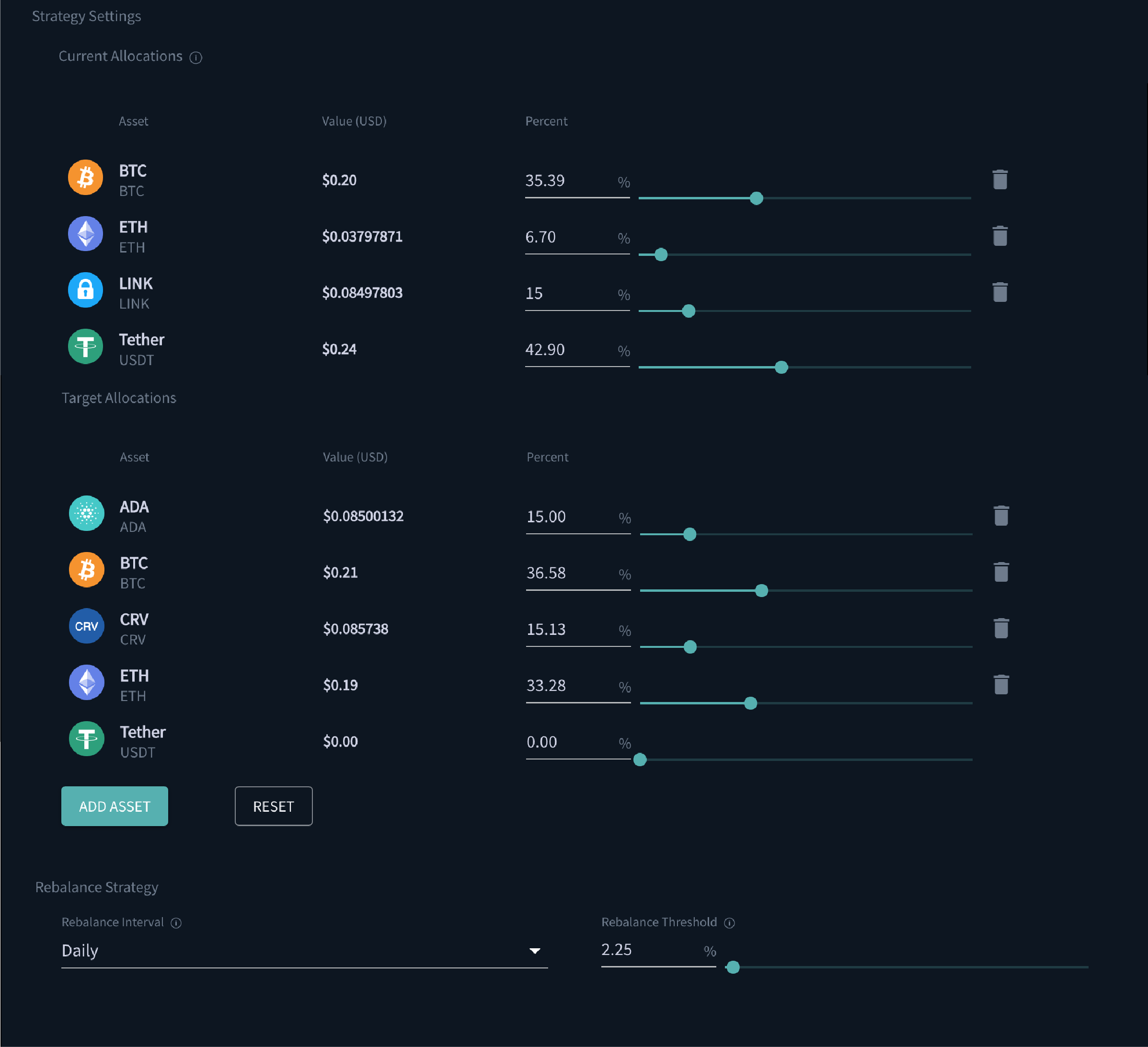

Diversify Stablecoin Holdings Across Multiple Reputable Issuers (e.g., USDC, DAI, GHO, sDAI): Tools like Enzyme and Balancer automate portfolio rebalancing and risk monitoring, helping DAOs allocate assets across trusted stablecoins such as USDC, DAI, GHO, and sDAI to mitigate issuer and protocol risk.

-

Automate Real-Time Risk Monitoring and On-Chain Alerts for Depegging or Protocol Vulnerabilities: Solutions like Hal (by 1inch) and Forta provide automated, customizable alerts for on-chain events, including stablecoin depegs and protocol exploits, enabling DAOs to react instantly to emerging risks.

The next sections will explore how automated yield strategies and transparent governance frameworks further elevate decentralized treasury management in 2025.

4. Integrate Automated Yield Strategies Using Audited DeFi Protocols for Idle Stablecoin Reserves

Leaving stablecoins idle is a missed opportunity in today’s capital-efficient DeFi landscape. The most advanced DAOs in 2025 integrate automated yield strategies, deploying idle reserves into audited protocols that offer transparent risk profiles and on-chain performance metrics. By leveraging platforms like Aera and integrating with yield aggregators, treasuries can earn passive income while maintaining strict risk controls.

The key to sustainable yield optimization lies in automation: smart contracts execute predefined allocation rules, seamlessly moving funds between protocols based on real-time APY, liquidity, and risk signals. Automated rebalancing ensures that exposure to any one protocol or asset never exceeds governance-set thresholds. Critically, only audited and battle-tested DeFi protocols should be whitelisted to minimize smart contract risk.

- Delta-neutral vaults: Capture yield while hedging away market volatility.

- sDAI and GHO staking: Earn protocol-native rewards with minimal manual intervention.

- Automated withdrawals: Instantly pull funds back to the treasury if a protocol triggers a risk alert.

This approach not only maximizes returns but also aligns with DAO mandates for transparency and security. For hands-on guides to optimizing stablecoin vault yields, see our practical resources on optimizing DAO vaults.

5. Establish Transparent, On-Chain Governance for Treasury Actions and Emergency Response

No treasury management system is complete without robust governance. In 2025, leading DAOs implement transparent, on-chain governance frameworks that give token holders visibility into every action, whether it’s reallocating assets, upgrading smart contracts, or executing emergency withdrawals. This transparency is not just best practice; it’s an essential pillar of trust for decentralized communities.

Modern governance platforms empower members to propose, debate, and vote on treasury actions directly from their wallets. Emergency response mechanisms, such as time-locked withdrawals or automated circuit breakers, are encoded in smart contracts and can be triggered by community consensus or pre-defined conditions detected by risk monitoring systems.

- Snapshot voting: Off-chain proposals with on-chain execution ensure both scalability and auditability.

- Multi-stage approvals: Critical actions require multiple governance checkpoints before execution.

- Audit trails: Every action is publicly logged for external review and regulatory compliance.

This level of transparency not only deters malicious actors but also empowers token holders to actively steward their collective capital. For detailed frameworks on implementing transparent DAO governance, visit our deep dive at DAO stablecoin vault best practices.

Building Resilient DAO Treasuries: The Road Ahead

The convergence of multi-signature security, diversified stablecoin allocation, automated risk monitoring, yield optimization through audited DeFi protocols, and transparent on-chain governance forms the backbone of resilient DAO treasury management in 2025. As regulatory expectations evolve and the ecosystem matures, these practices are no longer optional, they are the baseline for any decentralized organization aiming to safeguard its assets while delivering value to its community.

The future belongs to DAOs that continuously iterate on these pillars: automate smart, safeguard smarter, and always keep your community empowered through radical transparency.