Automated governance tools are transforming how DAOs and decentralized organizations manage their on-chain treasuries. In 2025, the landscape has matured rapidly, with a handful of standout platforms making it easier than ever to safeguard funds, streamline proposal voting, and enforce policy decisions. If you’re a DAO operator or treasury manager, understanding these tools is essential for staying ahead in the world of decentralized finance.

Why Automated Governance Matters for On-Chain Treasury Management

Managing a DAO treasury isn’t just about holding tokens securely. It’s about ensuring that every movement of capital is transparent, collectively governed, and aligned with the organization’s mission. Manual processes can introduce errors and delays – not to mention governance apathy. Automated governance tools solve these challenges by embedding rules directly into smart contracts or providing interfaces for seamless proposal review and execution.

In 2025, the best-in-class solutions combine robust security frameworks with intuitive user experiences. The result? Faster decision-making, improved auditability, and stronger community trust.

The Top 5 Automated Governance Tools Powering Decentralized Treasuries

Top 5 Automated Governance Tools for On-Chain Treasury Operations (2025)

-

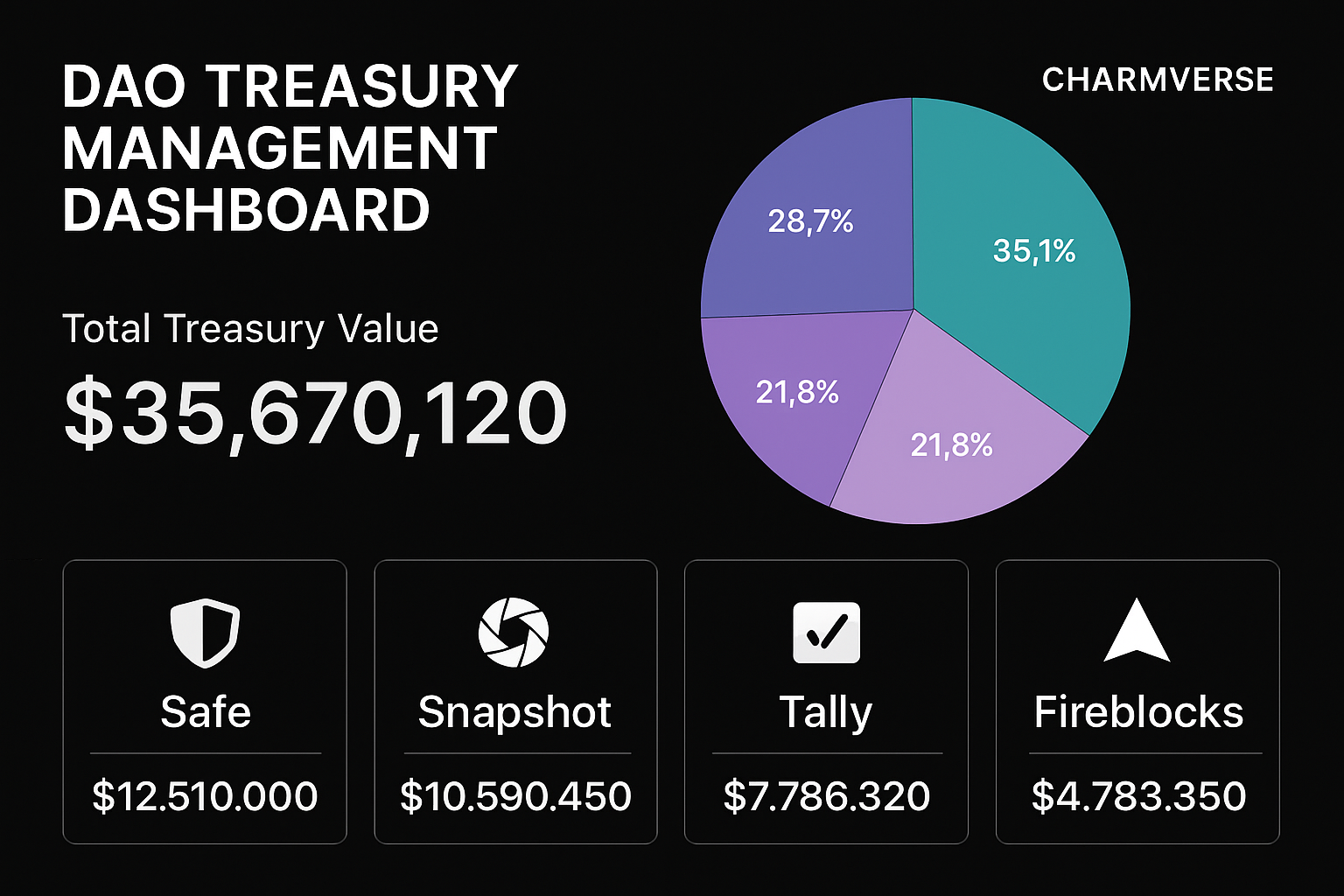

Safe (formerly Gnosis Safe): A leading smart contract wallet platform, Safe enables secure, multi-signature management of digital assets and on-chain treasuries. Its automation features support customizable transaction policies and seamless integration with DeFi protocols.

-

Snapshot: The most widely used off-chain voting platform for DAOs, Snapshot allows organizations to create, manage, and vote on proposals efficiently. It supports gasless voting and integrates with major DAO frameworks for transparent governance.

-

Tally: An on-chain governance tool that automates proposal submissions, voting, and execution directly on the blockchain. Tally ensures transparency, accountability, and real-time tracking of treasury decisions within DAOs.

-

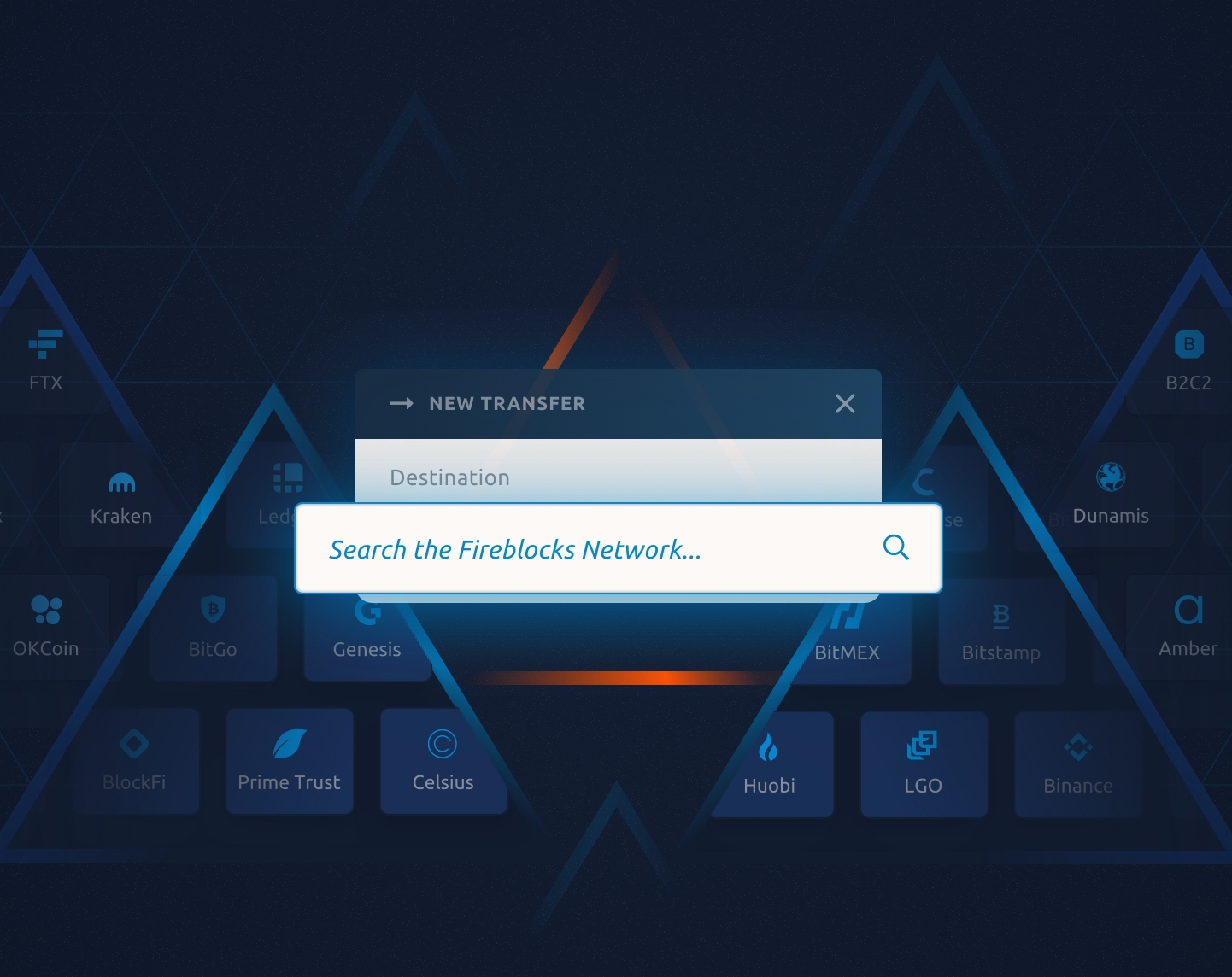

Fireblocks Policy Engine: A robust governance layer for digital asset treasuries, Fireblocks Policy Engine enables granular policy configuration, automated transaction approvals, and secure workflow management for institutional and DAO treasuries.

-

Charmverse: A collaborative platform designed for DAOs, Charmverse streamlines proposal management, automates governance workflows, and enhances member engagement with integrated task tracking and documentation tools.

Let’s break down what makes each of these platforms unique in today’s on-chain treasury ecosystem:

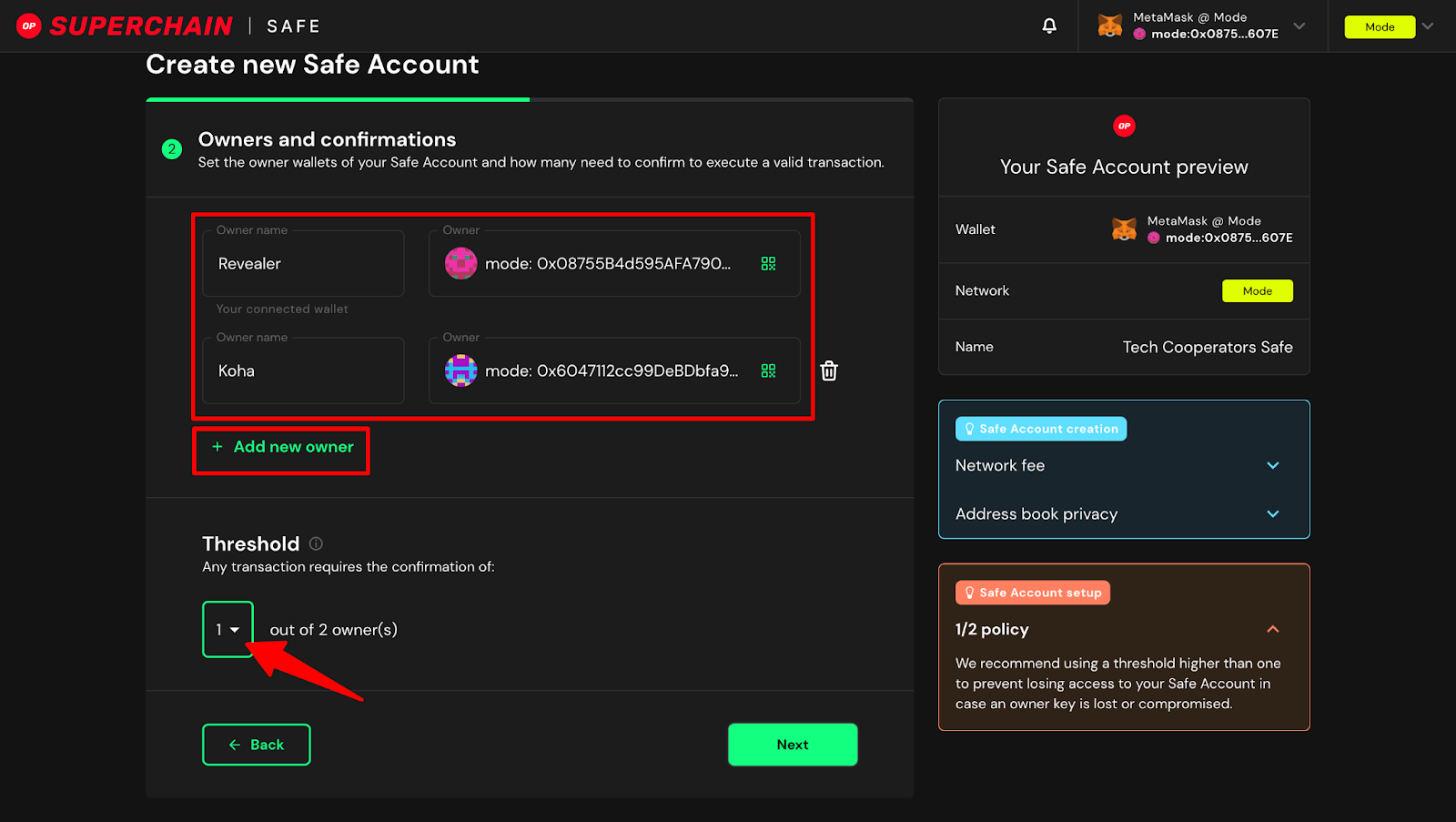

Safe (formerly Gnosis Safe): The Gold Standard for Multi-Sig Security

Safe remains the industry leader for secure on-chain asset custody. As a multi-signature wallet designed specifically for DAOs and organizations handling large treasuries, Safe enables teams to require multiple approvals before funds can be moved. This drastically reduces the risk of single-point failures or rogue actors draining assets.

The platform integrates policy automation features such as spending limits and role-based permissions. Combined with seamless compatibility across major blockchains and DeFi protocols, Safe is often the backbone of DAO treasury infrastructure.

Snapshot: Off-Chain Voting That Drives On-Chain Action

Snapshot has become synonymous with decentralized voting – powering over 96% of major DAO votes according to recent market research. Its off-chain voting mechanism means that members can participate in governance without paying gas fees, lowering barriers to engagement while maintaining transparency through cryptographically signed ballots.

Snapshot’s modular approach allows DAOs to define custom voting strategies (like quadratic voting or weighted voting), making it flexible enough for everything from simple polls to complex multi-stage proposals. Once a vote passes off-chain, execution can be triggered on-chain via integrations with platforms like Safe or Tally.

Tally: On-Chain Governance Automation With Full Transparency

Tally takes things one step further by recording every vote and proposal directly on-chain. This ensures that all decisions are immutable and fully auditable – a must-have feature for larger DAOs managing significant assets. Tally automates much of the governance workflow: from proposal creation to vote tallying and execution once quorum is reached.

The platform also offers analytics dashboards so communities can track participation rates and monitor treasury activity in real time. For organizations seeking maximum transparency combined with automation, Tally is an indispensable tool in their arsenal.

Fireblocks Policy Engine: Granular Controls for Institutional-Grade Treasury Management

Fireblocks Policy Engine stands out for DAOs and decentralized organizations that require enterprise-level security and compliance. The Policy Engine acts as a governance layer, enabling treasury managers to configure granular transaction policies, think whitelisting counterparties, setting approval thresholds, and automating risk controls. This means you can enforce who is allowed to move funds, how much can be transferred at a time, and under what conditions, all without manual intervention.

What makes Fireblocks especially compelling is its seamless integration with both on-chain and off-chain systems. Whether you’re managing assets across multiple wallets or interacting with DeFi protocols, Fireblocks brings unified oversight and auditability to your treasury operations. For teams balancing efficiency with robust internal controls, it’s a game-changer. Learn more about the platform’s capabilities at Fireblocks Treasury Management.

Charmverse: AI-Powered Governance Assistance for DAOs

Charmverse represents the next evolution in DAO tooling by combining governance automation with advanced AI-driven proposal management. Charmverse helps communities cut through noise by filtering proposals, summarizing discussions, and surfacing actionable insights through natural language processing. This not only reduces governance fatigue but also ensures that high-quality proposals get the attention they deserve.

The platform’s engagement analytics let treasury managers see which members are most active and which proposals drive the most participation. By automating repetitive tasks, like proposal formatting or notification reminders, Charmverse frees up contributors to focus on strategic decisions rather than administrative overhead.

Best Practices for Integrating Automated Governance Tools

Implementing these tools isn’t just about picking the right software, it’s about aligning technology with your organization’s culture of transparency and collective stewardship. Here are a few tips to maximize value from automated governance:

- Layer security: Use Safe for multi-signature custody alongside Fireblocks’ policy controls for added protection against both internal and external threats.

- Engage your community: Leverage Snapshot’s off-chain voting to encourage broad participation before moving critical decisions on-chain with Tally.

- Automate routine workflows: Let Charmverse handle proposal sorting and notifications so human contributors can focus on strategy.

- Audit regularly: Take advantage of analytics dashboards in Tally and Fireblocks to monitor activity, spot anomalies, and ensure compliance.

Which automated governance tool does your DAO rely on most for treasury operations?

Automated governance tools are transforming how DAOs manage their treasuries, from secure asset management to transparent on-chain voting. Let us know which tool is most essential for your DAO in 2025!

The Future of On-Chain Treasury Management Is Automated, and Accountable

The days of spreadsheet-based treasury tracking are over. In their place stands a new generation of automated governance tools that make decentralized finance more secure, participatory, and transparent than ever before. Whether you’re safeguarding millions in protocol reserves or coordinating community grants, platforms like Safe, Snapshot, Tally, Fireblocks Policy Engine, and Charmverse provide the foundation for resilient treasury operations in 2025.

If you’re aiming to future-proof your DAO or decentralized organization, now is the time to invest in these best-in-class solutions, and empower your community with trustless automation at every step.