Stablecoin vaults have become foundational to the capital structure of DAOs and DeFi protocols. Yet, recent events have exposed the fragility of trust when transparency is compromised. In mid-2025, Stable, a blockchain purpose-built for USDT transfers and backed by Bitfinex and Tether, ignited controversy after its pre-deposit vault event filled an $825 million cap in just 22 minutes. The velocity alone was headline-worthy, but what truly rattled the ecosystem was that over 60% of these deposits came from a single entity.

Whale Dominance and the Optics of Fair Access

For DAO treasury managers and DeFi operators, this event is a case study in the risks of opaque processes. The fact that one whale contributed $500 million before most participants even had a chance to react calls into question the very principles of decentralization and open access. While large capital inflows are often celebrated as signs of confidence, dominance by a single player can undermine community trust and introduce systemic risk.

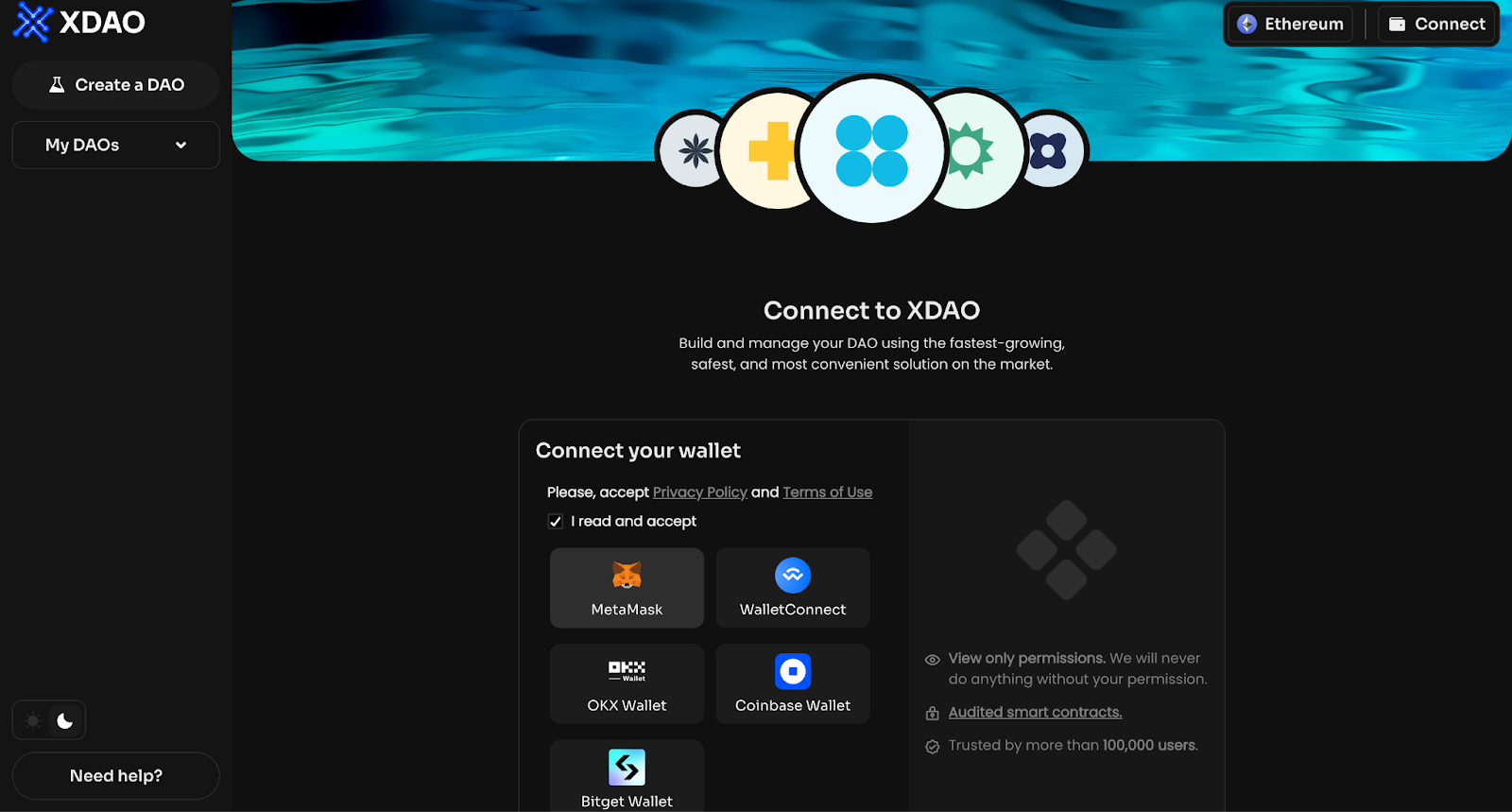

This isn’t just about optics – it’s about governance integrity. When only a handful of insiders or privileged entities gain early access to high-yield stablecoin vaults, smaller participants are left at a structural disadvantage. For DAOs aiming to build resilient treasury strategies, such concentration threatens both liquidity diversity and protocol legitimacy.

The Transparency Imperative in On-Chain Treasury Management

The Stable incident has reignited industry-wide debates on stablecoin vault transparency. Without clear disclosure around allocation rules and deposit timelines, even well-intentioned projects risk eroding user confidence. Automated on-chain governance can only be as robust as its underlying data flows; if deposit histories or allocation mechanisms are obfuscated or manipulated off-chain before launch, real-time monitoring loses efficacy.

Transparency isn’t simply about publishing addresses or transaction hashes after the fact. It requires proactive design: open whitelists, time-locked deposit windows, real-time proof-of-reserve dashboards, and clear communication channels for all stakeholders. As we saw with Stable’s campaign – which filled with 270 addresses but was heavily skewed by one Bitfinex-linked participant – lack of procedural clarity can quickly devolve into allegations of favoritism or insider advantage.

Emerging Alternatives: Proof-of-Reserve and Real-World Asset Vaults

The fallout from Stable’s vault event has catalyzed innovation across the stablecoin landscape. In response to mounting scrutiny over centralized practices, new entrants like Verified USD (USDV) are taking transparency to another level by anchoring their stablecoins to tokenized U. S. Treasury Bills with real-time verification through proof-of-reserve mechanisms. This approach not only enhances visibility but also aligns on-chain assets more closely with traditional financial safeguards.

Similarly, dForce’s Vault now connects stablecoin depositors directly with compliant real-world asset markets, ensuring that every deposit is traceable and allocated exclusively to pre-approved venues. These initiatives signal an industry pivot toward radical openness – where trust is not assumed but continuously verified through auditable smart contracts and transparent allocation policies.

For DAOs and DeFi protocols seeking to future-proof their treasuries, these innovations offer a blueprint for sustainable growth. Real-time proof-of-reserve dashboards, as pioneered by USDV, provide stakeholders with on-demand visibility into exactly how stablecoins are collateralized. This continuous auditability is not just a technical feat but a strategic lever for building long-term confidence among depositors, governance participants, and external auditors alike.

Yet, the lessons from Stable’s $825 million pre-filled vault extend beyond technical transparency. They underscore the necessity of designing processes that actively prevent concentration risk from undermining protocol health. Time-locked deposit windows, randomized access lotteries, and tiered allocation models are all tools that can be deployed to ensure equitable participation, especially when vault yields are at stake.

Best Practices for DAO Stablecoin Vault Transparency

-

Real-Time Proof-of-Reserves — Platforms like Verified USD (USDV) set a gold standard by offering real-time, on-chain verification of reserves, ensuring that every stablecoin is fully backed and auditable at any moment.

-

Transparent Whitelisting & Access Controls — dForce Vault exemplifies transparency by only allocating deposits to pre-approved, compliant real-world asset markets, with clear, public criteria for participation.

-

Public Audit Trails & Open-Source Code — Leading DAOs like MakerDAO publish open-source smart contracts and regular, independent audit reports, allowing anyone to verify vault operations and risk exposures.

-

Equitable Participation Mechanisms — To avoid centralization risks, best-in-class vaults implement fair allocation models (e.g., per-wallet caps, transparent whitelists, or randomized draws) to ensure broad community access and prevent whale dominance, as seen in the Stable $825M vault controversy.

-

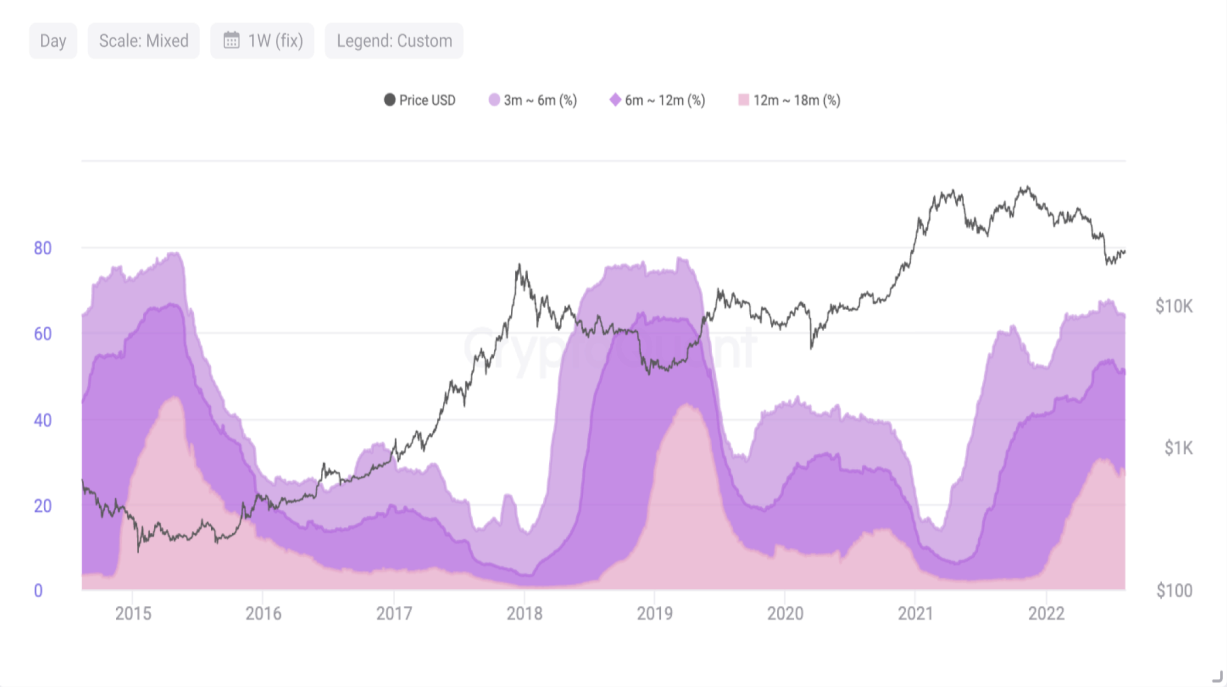

Comprehensive On-Chain Analytics — Integrations with platforms like Dune Analytics empower communities to track vault inflows, outflows, and participant distribution in real time, enhancing accountability and trust.

On-chain treasury managers must also recognize that transparency is an ongoing process, not a one-off event at launch. Periodic disclosure of vault inflows and outflows, regular updates on portfolio composition, and open forums for community feedback all contribute to a culture of accountability. When protocols treat transparency as a living practice rather than a marketing checkbox, they position themselves to weather both market volatility and regulatory scrutiny.

Building Trust in the Age of Algorithmic Capital

The velocity and scale of Stable’s vault event have become a cautionary tale for the entire decentralized finance sector. As capital flows become increasingly algorithmic, and as whales continue to wield outsize influence, robust transparency measures are no longer optional. They are existential requirements for any DAO or protocol aiming to attract sustainable liquidity and foster genuine community engagement.

Ultimately, the path forward lies in embracing radical openness at every layer: from smart contract code to governance documentation to real-time asset attestations. The protocols that internalize these lessons will not only sidestep the reputational pitfalls seen in Stable’s campaign but will also set new standards for trust in on-chain treasury management.