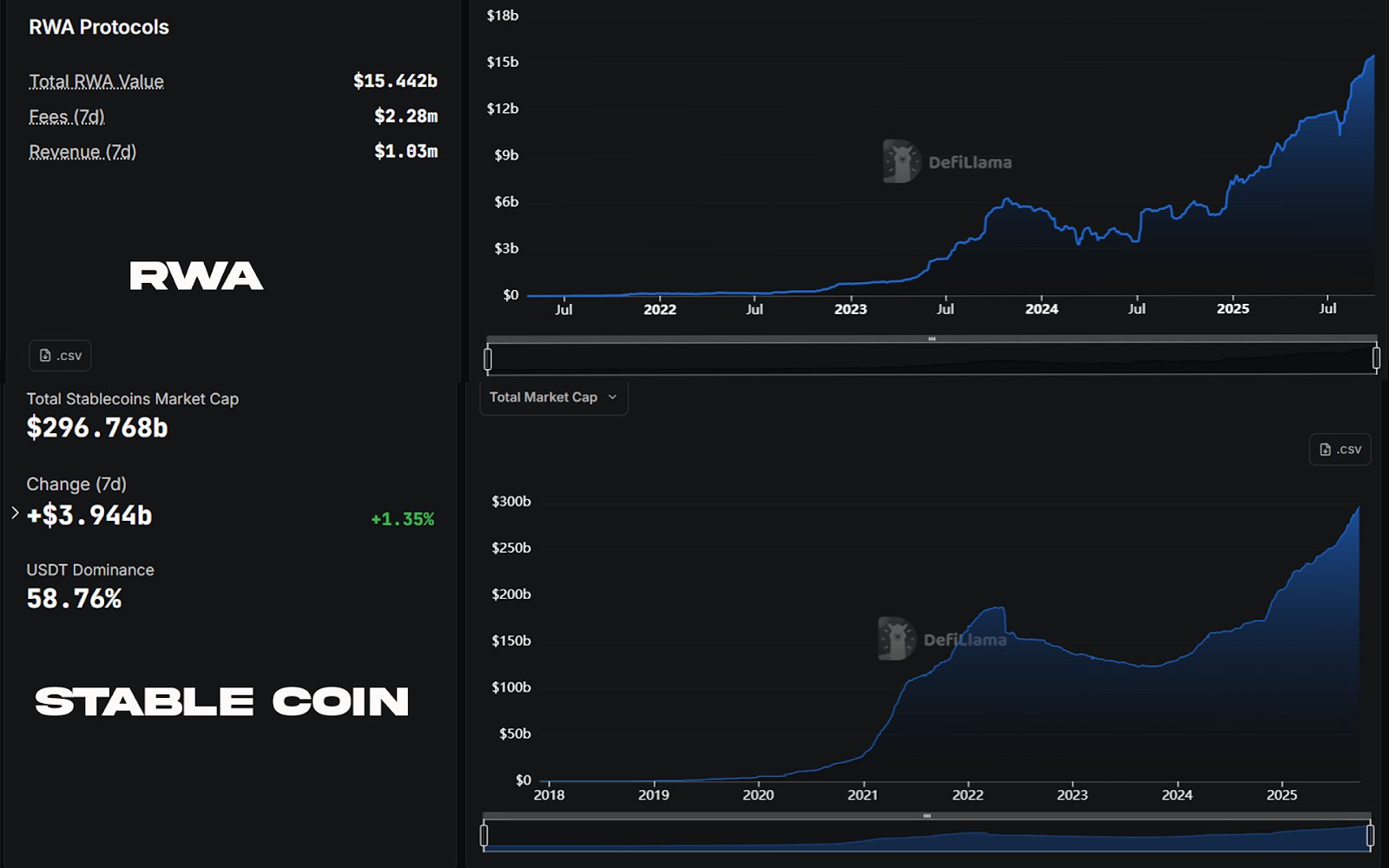

Stablecoin vaults are rapidly redefining DAO treasury management, delivering a new paradigm of yield optimization through real-world asset (RWA) backing. In 2025, as DAOs seek to maximize capital efficiency and minimize volatility, RWA-backed stablecoins like STBL and USST have become essential instruments. These protocols allow DAOs to anchor their treasuries in the predictable income streams of U. S. Treasuries and other regulated assets, transforming the risk-return profile of on-chain capital allocation.

The Rise of RWA-Backed Stablecoin Vaults in DAO Treasury Management

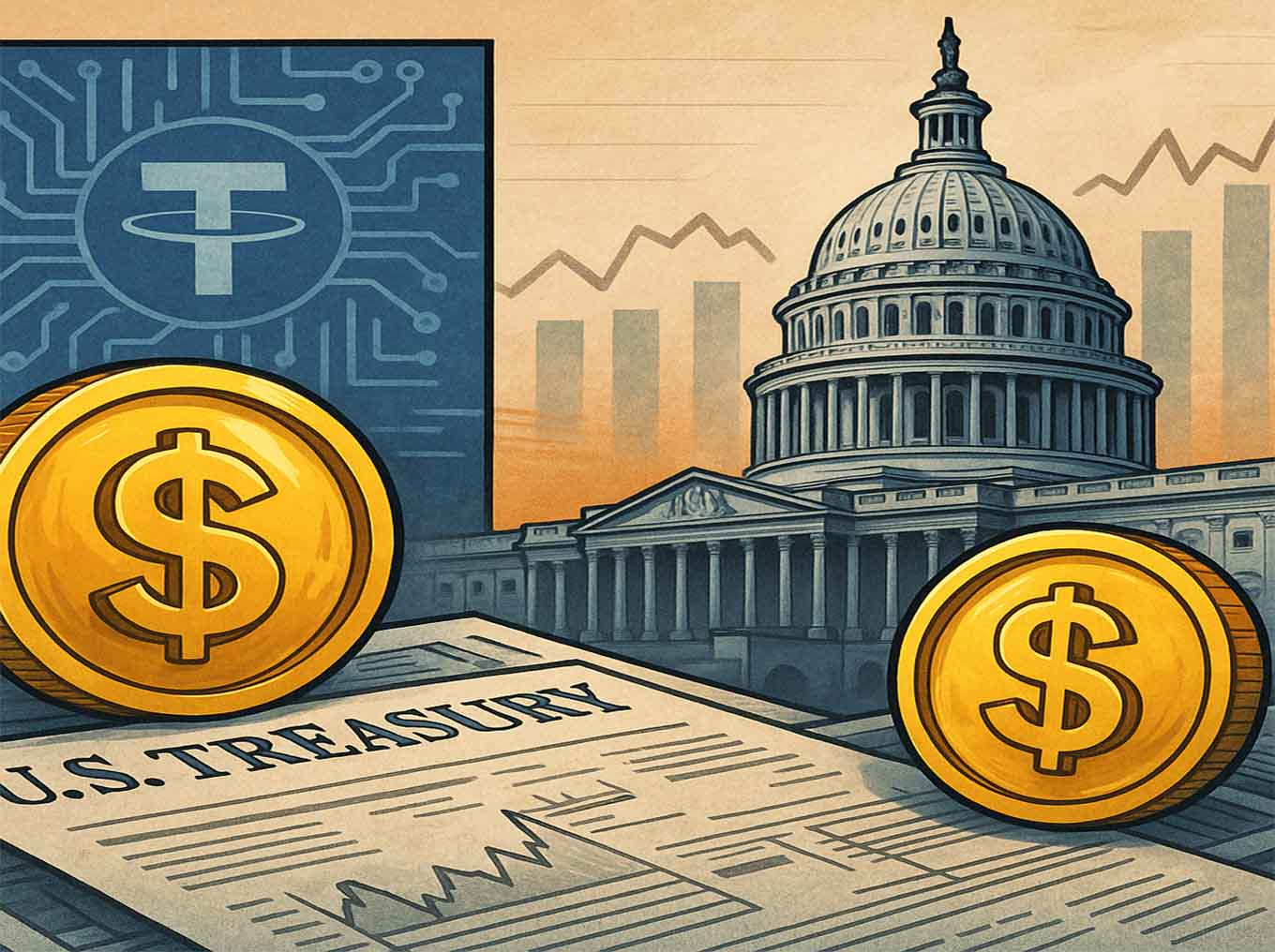

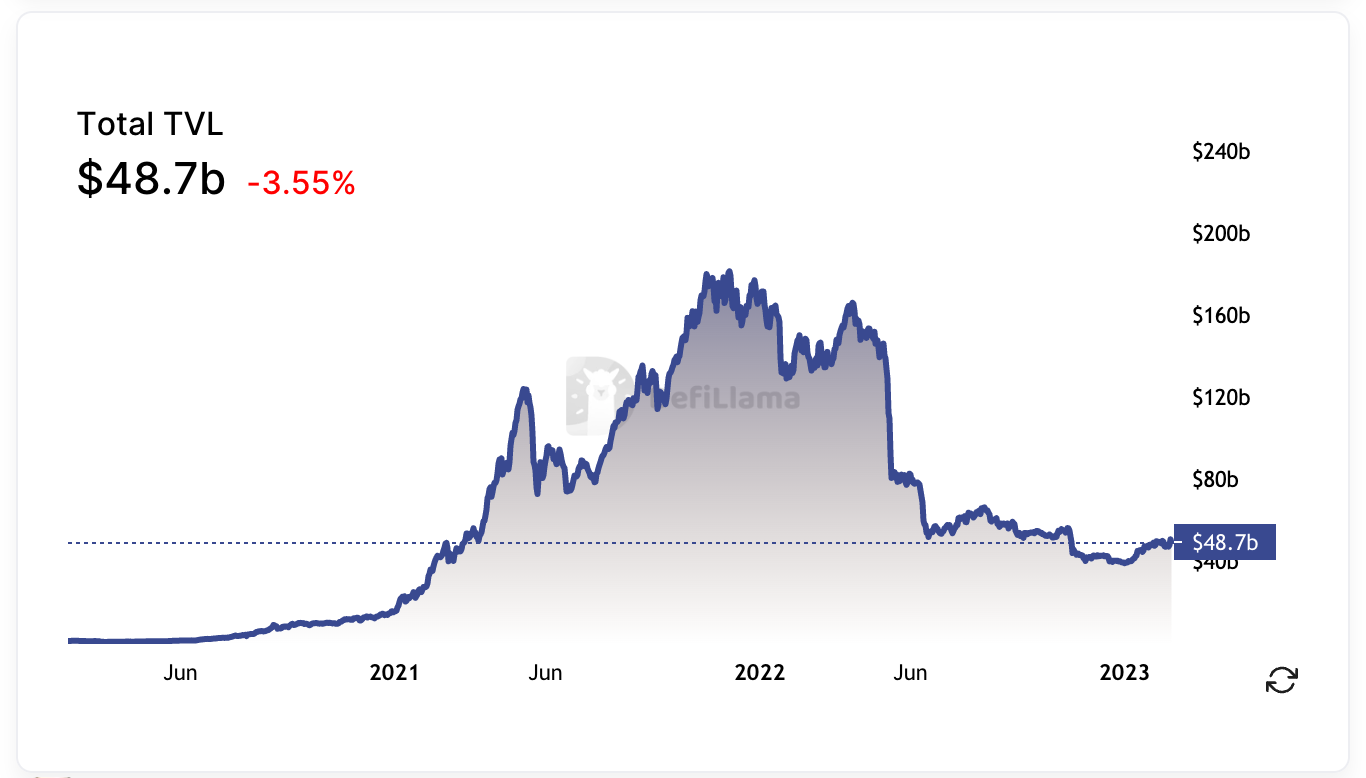

The integration of real-world assets into stablecoin vaults is not just a trend – it’s a structural shift in how DAOs approach yield generation and risk management. Unlike legacy crypto collateral (ETH, BTC), which is subject to sharp volatility swings, tokenized RWAs such as U. S. Treasury bills offer consistent yields and regulatory clarity. According to Q1 2025 data, MakerDAO now holds $1.29 billion in RWAs, with nearly 46% of DAI supply backed by off-chain assets like Treasuries, commercial paper, and receivables.

This diversification has enabled MakerDAO and similar protocols to capture nearly half their earnings from RWAs by late 2024 – a remarkable feat for on-chain treasuries previously reliant on DeFi-native yields alone. The result: DAOs can now achieve more stable returns while preserving transparency through smart contract automation.

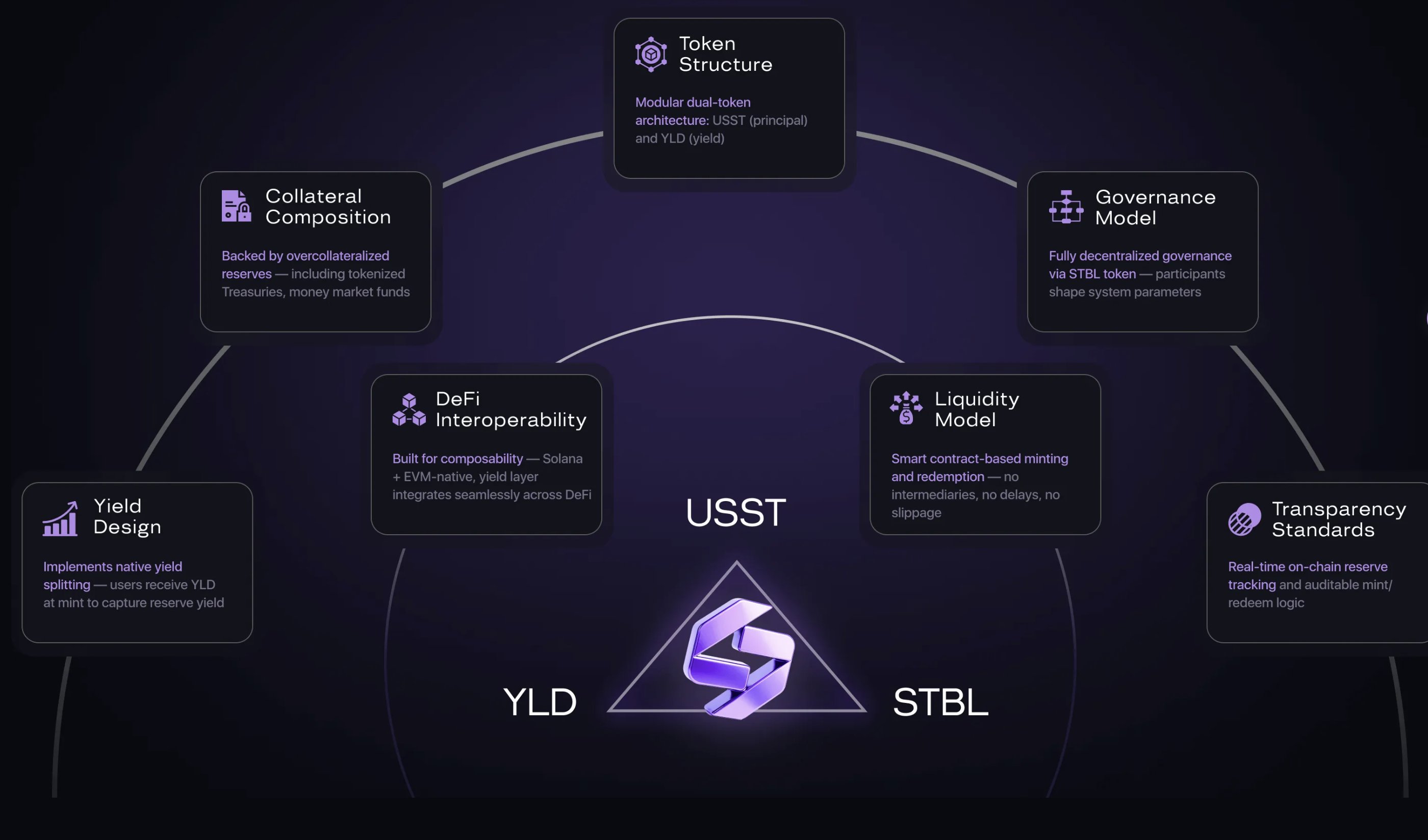

How Yield-Splitting Architectures Unlock Capital Efficiency

Protocols like STBL are pioneering yield-splitting models where the principal (stablecoin) is separated from the yield component via smart contracts. For example, when users mint USST stablecoins against tokenized U. S. Treasuries, they receive both a dollar-pegged asset (USST) and an NFT or token representing future yield (YLD). This enables DAOs to:

Key Benefits of Yield-Splitting Stablecoin Vaults for DAOs

-

Consistent, Enhanced Yield Generation: By allocating treasury assets to RWA-backed stablecoin vaults—such as those using USST or USDV—DAOs can access yields comparable to U.S. Treasury bills, offering more stable and predictable returns than typical DeFi lending protocols.

-

Risk Diversification via Real-World Assets: Integrating tokenized assets like U.S. Treasury bonds and commercial paper into DAO treasuries, as seen with MakerDAO and Noble, reduces exposure to crypto market volatility and creates a more resilient treasury structure.

-

Yield-Splitting for Flexible Treasury Management: Protocols such as STBL enable DAOs to separate stablecoin principal (e.g., USST) from yield (e.g., YLD NFTs), allowing for tailored distribution of earnings between operational needs and growth initiatives.

-

Improved Transparency and Regulatory Alignment: RWA-backed stablecoins like USDV and STBL are subject to established regulatory frameworks and regular reporting, enhancing compliance and trust for DAOs managing large treasuries.

-

Automated, On-Chain Yield Distribution: Smart contract-driven vaults, exemplified by MakerDAO and STBL, automate the minting, reserve checks, and yield distribution processes, reducing manual intervention and operational risk.

The implications are profound: DAOs can use USST for payments or liquidity provision while simultaneously earning yield through YLD tokens – all transparently tracked on-chain. This dual-token architecture aligns incentives for both liquidity providers and long-term treasury managers.

Quantitative Benefits: Yield Enhancement and Risk Mitigation

Stablecoin vaults backed by RWAs deliver two quantifiable advantages:

- Enhanced Yield Generation: Tokenized T-bills currently offer yields that consistently outpace most crypto-native lending markets without exposing treasuries to DeFi protocol risk.

- Diversification and Volatility Dampening: By allocating capital into regulated securities rather than volatile tokens, DAOs reduce drawdown risk during market turbulence.

This capital-efficient model is already being adopted by protocols like Noble (offering Treasury-backed stablecoins), Verified USD Foundation (USDV), and KernelDAO’s KUSD – each providing DAOs with access to on-chain T-bill yields.

The strategic use of RWA-backed stablecoin vaults is fast becoming a best practice in DAO treasury operations. For an in-depth exploration of strategies, risks, and top protocols leading this space, see this comprehensive guide.

As the on-chain treasury landscape matures, DAOs are increasingly prioritizing mechanisms that maximize sustainable yield while maintaining robust risk controls. The combination of RWA-backed stablecoin vaults and yield separation is reshaping capital allocation decisions for decentralized organizations. By leveraging tokenized T-bills, commercial paper, and other high-grade RWAs, treasuries can now access yield streams previously limited to traditional finance, all while retaining the composability and transparency inherent to DeFi.

Real-World Asset Backing: A New Benchmark for DAO Resilience

Integrating RWAs into stablecoin vaults does more than just optimize yield; it fundamentally enhances the resilience of DAO treasuries. Assets like U. S. Treasuries are not only less volatile but also benefit from established regulatory oversight and reporting standards. This dual advantage, stable returns and compliance, has made protocols such as STBL and Noble attractive choices for DAOs seeking predictable cash flows.

The practical upshot: DAOs can lock in yields comparable to those found in TradFi money markets while remaining fully on-chain. For example, the over-collateralized design of STBL ensures that USST minters retain claim to their principal value, with additional upside captured via YLD tokens. Automated smart contracts handle reserve checks and yield distribution, reducing operational overhead and human error.

Best Practices for On-Chain Treasury Managers

To harness the full potential of RWA-backed stablecoin vaults, DAO treasury managers should adopt a systematic approach to allocation and risk assessment:

Best Practices for Deploying DAO Capital into RWA-Backed Stablecoin Vaults

-

Conduct Thorough Due Diligence on RWA Providers: Evaluate the credibility, regulatory compliance, and transparency of platforms like MakerDAO, Noble, and Verified USD Foundation before allocating treasury funds. Prioritize protocols with audited smart contracts, clear collateralization structures, and robust reporting.

-

Diversify Across Multiple RWA-Backed Stablecoins: Reduce concentration risk by deploying capital into a mix of established stablecoins such as DAI (backed by MakerDAO’s RWA portfolio), USST (from STBL Protocol, backed by U.S. Treasuries), and USDV (collateralized by tokenized T-bills via Verified USD Foundation).

-

Implement Automated Rebalancing Strategies: Leverage DAO governance and smart contract tools to periodically rebalance treasury allocations between different RWA-backed stablecoin vaults, optimizing for yield, liquidity, and risk exposure.

-

Prioritize Regulatory Compliance and Transparency: Select vaults and stablecoins with clear legal frameworks and regular third-party attestations. For example, Noble and Verified USD Foundation provide on-chain proof of reserves and regulatory disclosures, enhancing trust and auditability.

Quantitative rigor is essential, treasury teams should monitor collateralization ratios, regularly audit smart contract reserves, and dynamically rebalance between crypto-native and RWA-backed assets as market conditions evolve.

Emerging Trends: Composability and Governance Innovation

The next frontier lies in composability: integrating RWA-backed stablecoins seamlessly with DeFi primitives such as automated market makers (AMMs), lending protocols, and structured products. Already, we see DAOs combining USST or USDV with liquidity pools or options vaults to further enhance returns while managing downside risk through real-world collateral.

Governance models are also evolving. With yield-splitting architectures like STBL’s, DAOs can programmatically direct yields toward specific initiatives, be it protocol development, grants programs, or buybacks, without manual intervention. This level of automation brings a new layer of capital efficiency and transparency to treasury operations.

The Road Ahead: Data-Driven Capital Allocation

Ultimately, the adoption of RWA-backed stablecoin vaults signals a paradigm shift toward data-driven capital allocation within DAOs. As more protocols embrace transparent reporting and real-time analytics on asset backing and yield flows, treasury teams will be empowered to make informed decisions that balance growth objectives with prudent risk management.

This evolution not only bridges DeFi with institutional-grade financial infrastructure but also sets a new benchmark for transparency and efficiency in decentralized treasury management. For DAO operators ready to lead in this new era of on-chain finance, embracing RWA-backed stablecoin strategies is no longer optional, it’s imperative.