Decentralized Autonomous Organizations (DAOs) have redefined how communities coordinate capital, but their treasury operations face a persistent challenge: balancing transparency with privacy. As DAOs mature and manage increasingly diverse portfolios, the need for confidential DAO treasury management becomes more urgent. Traditional on-chain accounting is public by design, exposing sensitive decisions and financial strategies to the world. Enter Fully Homomorphic Encryption (FHE), a cryptographic breakthrough that enables computation on encrypted data, promising a new era of private treasury management for DAOs.

Why Confidentiality Matters in DAO Treasury Operations

DAOs act as digital cooperatives, pooling funds for governance, contributor payments, and ecosystem growth. While transparency is foundational to trustless finance, there are legitimate reasons to keep certain operations private:

- Sensitive payroll data – Contributor salaries and grants often require discretion.

- Tactical asset allocations – Revealing rebalancing or diversification plans can be front-run by competitors or malicious actors.

- Private voting – Governance decisions around treasury allocations benefit from voter privacy to avoid coercion or retaliation.

This tension between openness and privacy has led many DAOs to adopt only partially confidential processes or off-chain workarounds, solutions that undermine the ethos of decentralized finance.

The FHE Revolution: Computing on Encrypted Data

Fully Homomorphic Encryption (FHE) flips the script by allowing computations, such as budget calculations or vote tallying, to occur directly on encrypted data. The raw inputs remain secret throughout the process; only the final result is revealed when decrypted. For DAOs, this means:

- Confidential voting: Members cast encrypted votes that are tallied without revealing individual choices.

- Private proposals: Funding requests and salary bids can be evaluated without exposing details to anyone but the proposer.

- Secure financial analysis: Sensitive treasury analytics can be performed without leaking underlying positions or strategies.

This approach not only enhances privacy but also reduces risks like collusion and front-running. As noted by industry experts, FHE-powered systems allow DAOs to execute trades, diversify holdings, and pay contributors privately, all while retaining verifiability for audits and compliance (source).

A New Standard for Secure DAO Finance

Top Benefits of FHE in DAO Treasury Management

-

Confidential Voting and Decision-Making: FHE enables encrypted voting in DAOs, so members can cast votes privately. Only the final tally is revealed, reducing the risk of voter coercion and enhancing governance privacy. (fhenix.io)

-

Secure Treasury Allocations: With FHE, DAOs can process encrypted funding proposals and salary bids, allowing budget decisions without exposing sensitive details. This keeps individual requests confidential throughout the allocation process. (tokentoolhub.com)

-

Enhanced Data Privacy: FHE allows DAOs to perform financial analysis and forecasting on encrypted data, protecting member privacy and organizational confidentiality during all treasury operations. (gate.io)

-

Reduced Risk of Data Leaks: By keeping all sensitive treasury data encrypted during processing, FHE minimizes the risk of internal or external data breaches that could expose DAO financial information.

-

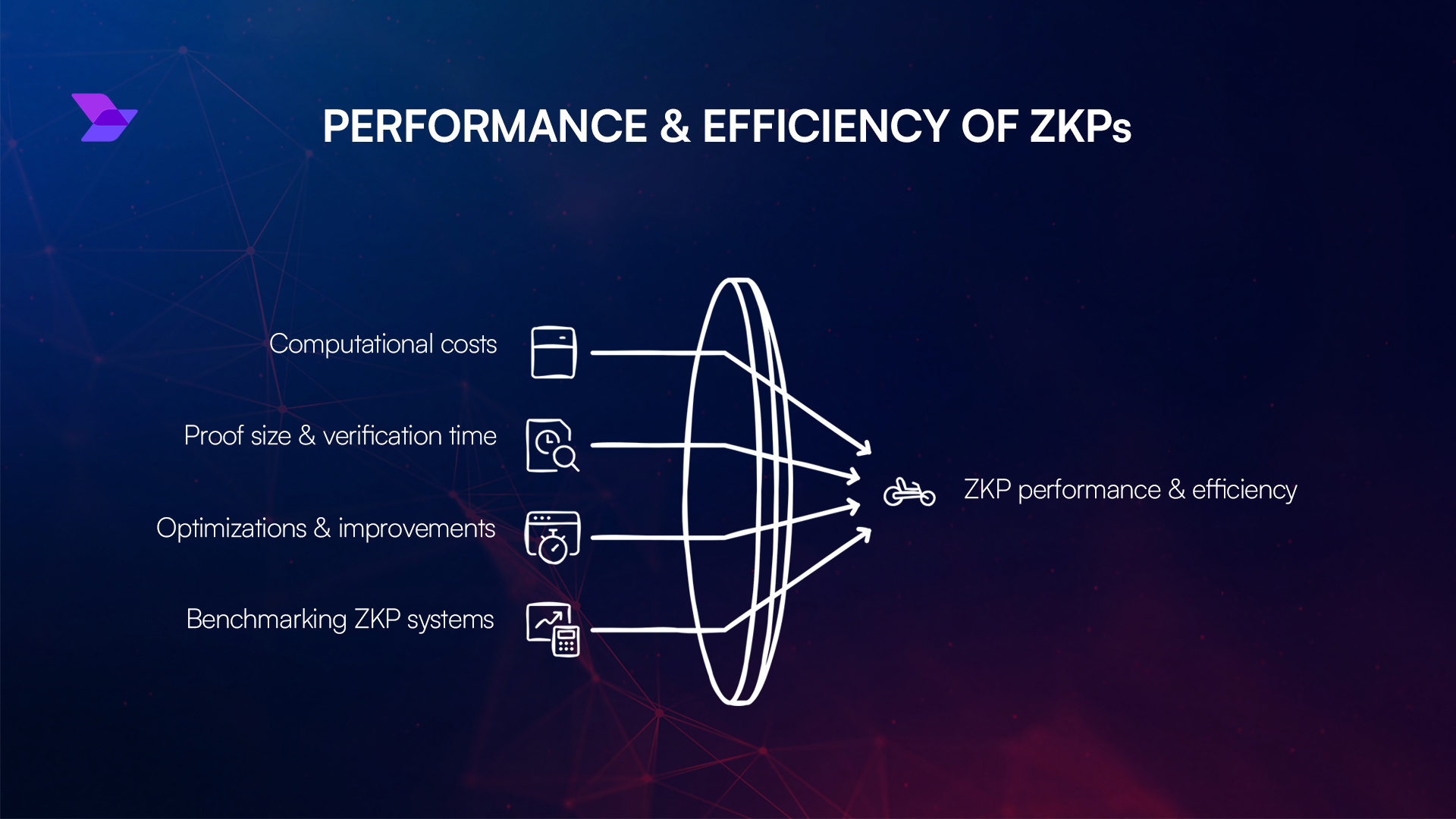

Composability with Other Cryptographic Tools: FHE can be combined with technologies like Zero-Knowledge Proofs (ZKPs) or Trusted Execution Environments (TEEs) to balance privacy and efficiency, providing robust and flexible security for DAOs. (tokentoolhub.com)

The adoption of FHE is setting a new standard for secure DAO operations. Consider these key advantages:

- No trade-off between privacy and decentralization: On-chain actions remain verifiable while details stay confidential.

- Simplified regulatory compliance: Auditors can verify aggregate outcomes without accessing sensitive member information.

- Ecosystem resilience: By shielding strategic moves from adversaries, DAOs reduce attack vectors and build long-term sustainability.

The technical overhead of FHE remains a consideration, computation times are higher compared to traditional methods, but hybrid approaches combining FHE with Zero-Knowledge Proofs (ZKPs) or Trusted Execution Environments (TEEs) are emerging as practical solutions (source). As these tools mature, expect more DAOs to embrace private treasury management as an operational best practice rather than an optional upgrade.

For DAO operators and treasury managers, the implications of private treasury management powered by FHE are profound. Not only does it protect the sensitive details of contributor payments and strategic allocations, but it also strengthens internal governance by ensuring decisions are made free from external pressure or manipulation.

Practical Use Cases: FHE in Action for DAO Treasuries

Imagine a scenario where a DAO needs to rebalance its stablecoin vaults or allocate funds to new protocol integrations. With FHE, these operations can be conducted confidentially, preventing market participants from front-running asset movements or speculating on internal strategy shifts. Contributor compensation can be handled with privacy, preserving morale while maintaining auditability at the aggregate level.

Another major advantage is in verifiable proofs in DAO finance. FHE enables DAOs to provide cryptographic assurance that rules have been followed, such as budget caps or compliance requirements, without exposing transaction-level data. This is critical not only for internal trust but also for engaging with external partners and regulators who may require evidence of sound financial controls.

Implementation Considerations and Best Practices

While the promise of decentralized finance privacy is compelling, integrating FHE into live on-chain systems does require careful planning:

Best Practices for Deploying FHE in DAO Treasuries

-

Leverage Established FHE Libraries and PlatformsUtilize reputable FHE frameworks such as Zama’s Concrete or Fhenix to ensure robust, well-audited cryptographic implementations for DAO treasury operations.

-

Integrate Confidential Voting MechanismsImplement FHE-powered voting tools like Fhenix DAO Governance to allow members to cast encrypted votes, ensuring privacy while maintaining transparent and verifiable outcomes.

-

Combine FHE with Zero-Knowledge Proofs (ZKPs)Enhance privacy and efficiency by integrating FHE with established ZKP protocols such as Aztec Network or zkSync, balancing computational overhead and confidentiality in treasury management.

-

Conduct Regular Security AuditsEngage trusted blockchain security firms like Trail of Bits or OpenZeppelin to audit FHE smart contracts and treasury workflows, identifying vulnerabilities and ensuring compliance with best practices.

-

Monitor Performance and Optimize WorkflowsContinuously assess the computational impact of FHE on DAO treasury operations using analytics tools such as Dune Analytics or Nansen, and optimize processes to maintain a balance between privacy and efficiency.

- Assess computational resources: FHE operations are more resource-intensive than standard cryptography. DAOs should benchmark performance impacts and consider hybrid models where appropriate.

- Select proven libraries and partners: The FHE ecosystem is evolving rapidly. Work with reputable providers who keep pace with security standards and optimizations.

- Pilot before scaling: Start with non-critical treasury functions, such as encrypted voting or proposal review, before extending to full-scale financial operations.

- Combine with other privacy tech: Leverage Zero-Knowledge Proofs (ZKPs) or Trusted Execution Environments (TEEs) alongside FHE for layered security and efficiency (learn more here).

The end goal is to enable secure DAO operations: protecting sensitive data without sacrificing transparency, auditability, or decentralization. As more DAOs adopt these tools, expect a wave of innovation in governance design and capital allocation strategies.

The Road Ahead: Confidentiality as a Competitive Edge

The next generation of DAOs will treat confidentiality not as an afterthought but as a core design principle. By leveraging advanced cryptography like FHE, organizations gain flexibility to experiment with novel incentive structures, forge new partnerships, and shield their communities from adversarial actors, all while maintaining verifiable integrity on-chain.

The shift toward private treasury management is already underway among leading DeFi communities who recognize that true decentralization includes the right to keep certain decisions confidential. As technology matures, expect best practices to emerge around balancing openness with privacy, empowering DAOs to act strategically without losing sight of transparency’s foundational role.

If you’re building or managing a DAO treasury today, now’s the time to start exploring confidential workflows powered by homomorphic encryption. The organizations that master this balance will set the standards, and reap the rewards, in tomorrow’s decentralized economy.