How did the Ethereum Name Service (ENS) DAO manage to build a resilient, sustainable treasury without compromising its core principle of decentralization? This question is top-of-mind for DAO operators and treasury managers seeking to balance capital efficiency with robust governance. The ENS DAO’s approach stands out as a model for on-chain treasury management, blending innovative financial strategies with transparent, community-driven oversight.

ENS Endowment: Building for Long-Term Viability

In March 2023, the ENS DAO took a pivotal step by establishing the ENS Endowment, designed to ensure ongoing funding for protocol development and operations regardless of market cycles. The endowment was initiated with a substantial transfer of 16,000 ETH from the DAO’s treasury, a bold move that signaled a shift toward more structured financial planning. By H1 2025, operational revenues reached $7.71M and expenses stood at $7.55M (excluding ENS tokens), demonstrating fiscal discipline and sustainability (source).

The endowment is managed by Karpatkey, a specialist in decentralized asset management chosen through an open community vote. This partnership ensures professional oversight while maintaining alignment with the DAO’s decentralized ethos, no single party can dictate investment decisions or allocations unilaterally.

Diversification: Stablecoins as a Treasury Safety Net

Relying solely on ETH exposes any treasury to significant volatility risk, a lesson not lost on the ENS DAO. To address this, the community approved a proposal to convert 25% of its holdings into stablecoins such as LUSD, RAI, USDC, and GUSD. The primary goal: cover at least 18 months of operational expenses irrespective of ETH price fluctuations (source). This move not only stabilizes cash flow but also sets a precedent for other DAOs seeking to de-risk their treasuries without offloading their native assets entirely.

The strategy demonstrates how DAO endowment strategies can leverage stablecoin vaults for predictable budgeting while retaining upside exposure from core assets like ETH.

Decentralized Oversight: Security Council and Community Governance

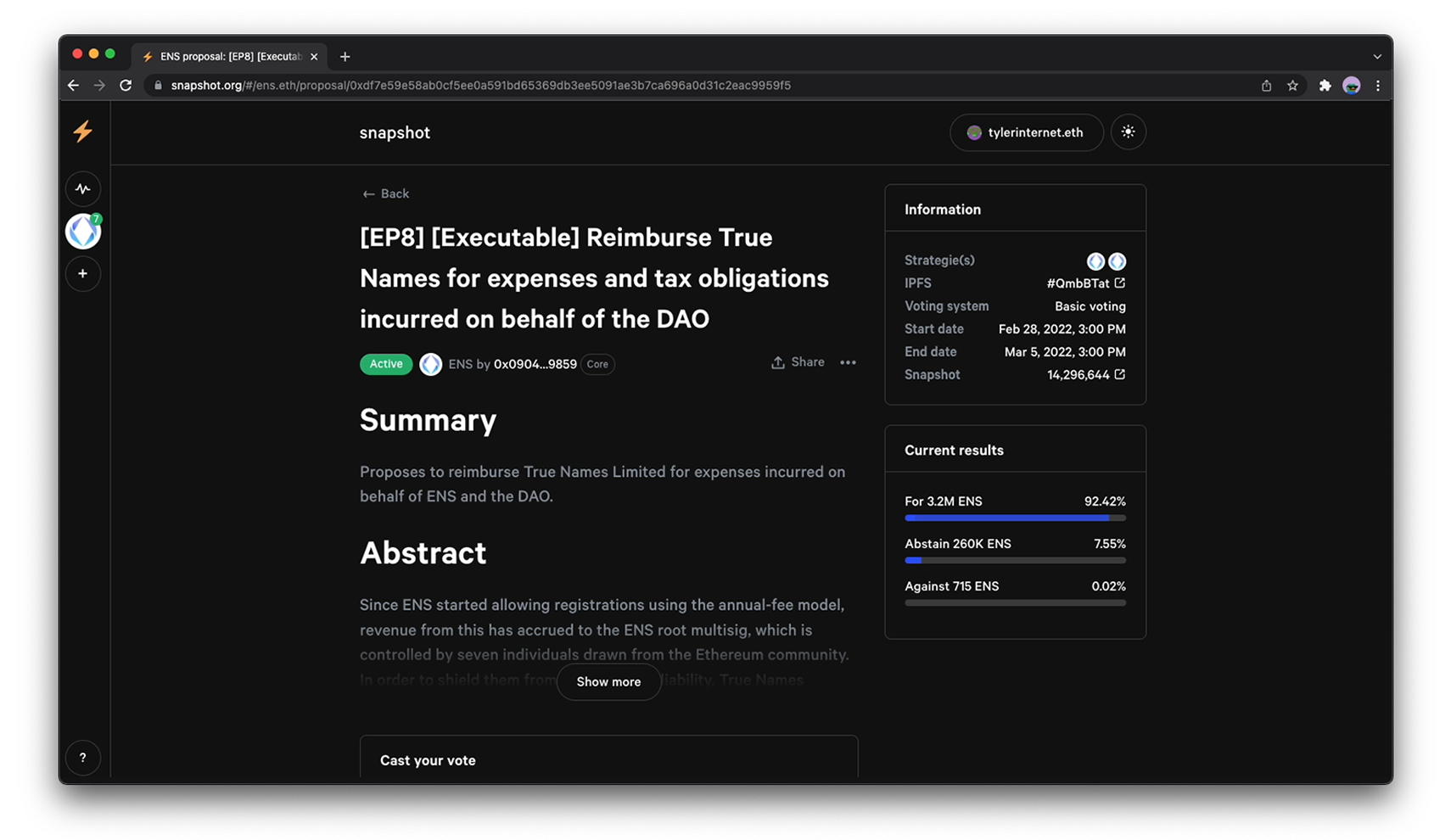

Sustainable treasury management is not just about smart investments, it’s about protecting those funds from malicious actors or rogue proposals. ENS DAO addressed this by establishing a Security Council, operating via a 4-of-8 multi-signature wallet. Its limited mandate allows it only to cancel proposals that threaten the DAO’s constitution or financial health (source). Crucially, the council cannot propose new actions or amend existing ones, preserving decentralized control while adding an essential layer of risk mitigation.

Ethereum Name Service (ENS) Price Prediction 2026-2031

Professional Forecast Table Based on Current Market Data, DAO Treasury Management, and Crypto Adoption Trends

| Year | Minimum Price (Bearish) | Average Price (Baseline) | Maximum Price (Bullish) | Estimated % Change (Avg) |

|---|---|---|---|---|

| 2026 | $18.50 | $25.00 | $33.00 | +16.5% |

| 2027 | $16.75 | $29.50 | $41.00 | +18.0% |

| 2028 | $20.00 | $34.00 | $52.00 | +15.3% |

| 2029 | $24.50 | $39.50 | $65.00 | +16.2% |

| 2030 | $28.00 | $45.00 | $80.00 | +14.0% |

| 2031 | $32.00 | $51.00 | $98.00 | +13.3% |

Price Prediction Summary

ENS price predictions from 2026 to 2031 show a progressive uptrend, reflecting ENS DAO’s sustainable treasury management, continued adoption of decentralized naming services, and prudent risk mitigation strategies. The minimum price projections account for bearish market conditions or regulatory headwinds, while the maximum prices reflect bullish scenarios with broader Web3 adoption and successful DAO governance. Average price estimates suggest steady long-term growth, with ENS potentially outperforming the broader crypto market if it maintains its position as the leading decentralized naming protocol.

Key Factors Affecting Ethereum Name Service Price

- Sustainable treasury and endowment management by ENS DAO, ensuring long-term funding for development and operations.

- Strategic diversification into stablecoins, reducing exposure to ETH volatility and operational risks.

- Robust DAO governance, including the Security Council, which enhances protocol security and community trust.

- Ongoing adoption of ENS for decentralized identity and naming services, especially as Web3 and blockchain domains gain traction.

- Potential regulatory clarity or challenges around DAO structures and crypto domain services.

- Competition from alternative blockchain naming protocols or centralized solutions.

- General crypto market cycles, including potential bull and bear markets from 2026 to 2031.

- Technical upgrades to the ENS protocol or Ethereum network (e.g., scalability, L2 adoption) that could impact utility and demand.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This structure is complemented by ENS’s delegate model: $ENS token holders can assign voting power to trusted representatives who deliberate and execute treasury decisions transparently on-chain. This ensures that all major moves, from asset allocation to endowment expansion, are subject to open debate and direct community approval.

The Road So Far: A Case Study in On-Chain Treasury Best Practices

The combination of professional asset management via Karpatkey, prudent diversification into stablecoins, and robust decentralized oversight has positioned ENS DAO as an exemplar in on-chain treasury governance. As the current price of Ethereum Name Service (ENS) sits at $21.45, these measures have helped shield the organization from short-term volatility while ensuring it remains accountable to its stakeholders every step of the way.

While many DAOs struggle to strike a balance between financial sustainability and decentralized oversight, ENS DAO’s evolving treasury model offers practical lessons for the broader ecosystem. The introduction of an endowment managed through a transparent, community-driven process has enabled ENS DAO to weather market turbulence and plan for multi-year operational continuity. With operational revenues closely matched to expenses in H1 2025, the DAO demonstrates not just fiscal prudence but also the ability to adapt its strategy as conditions change.

Karpatkey’s role as an asset manager is particularly noteworthy. By acting as a professional steward, yet remaining accountable to on-chain votes, the partnership avoids the pitfalls of centralization that often accompany traditional fund management. This collaborative approach is further reinforced by periodic reviews, open reporting, and ongoing dialogue between Karpatkey, Steakhouse Financial, and the wider ENS community (source).

Lessons Learned: DAO Treasury Management in Practice

The ENS DAO’s journey highlights several actionable takeaways for other decentralized organizations:

Key Takeaways from ENS DAO’s Treasury Management

-

Creation of the ENS Endowment: In March 2023, the ENS DAO established the ENS Endowment by transferring 16,000 ETH to a dedicated SAFE managed by Karpatkey. This move provides a sustainable funding source to support ENS’s long-term development and operations, regardless of market volatility.

-

Diversification into Stablecoins: To reduce exposure to ETH price swings, the DAO proposed converting 25% of its treasury into stablecoins such as LUSD, RAI, USDC, and GUSD. This strategy aims to ensure at least 18 months of operational expenses are covered, enhancing financial stability for the DAO.

-

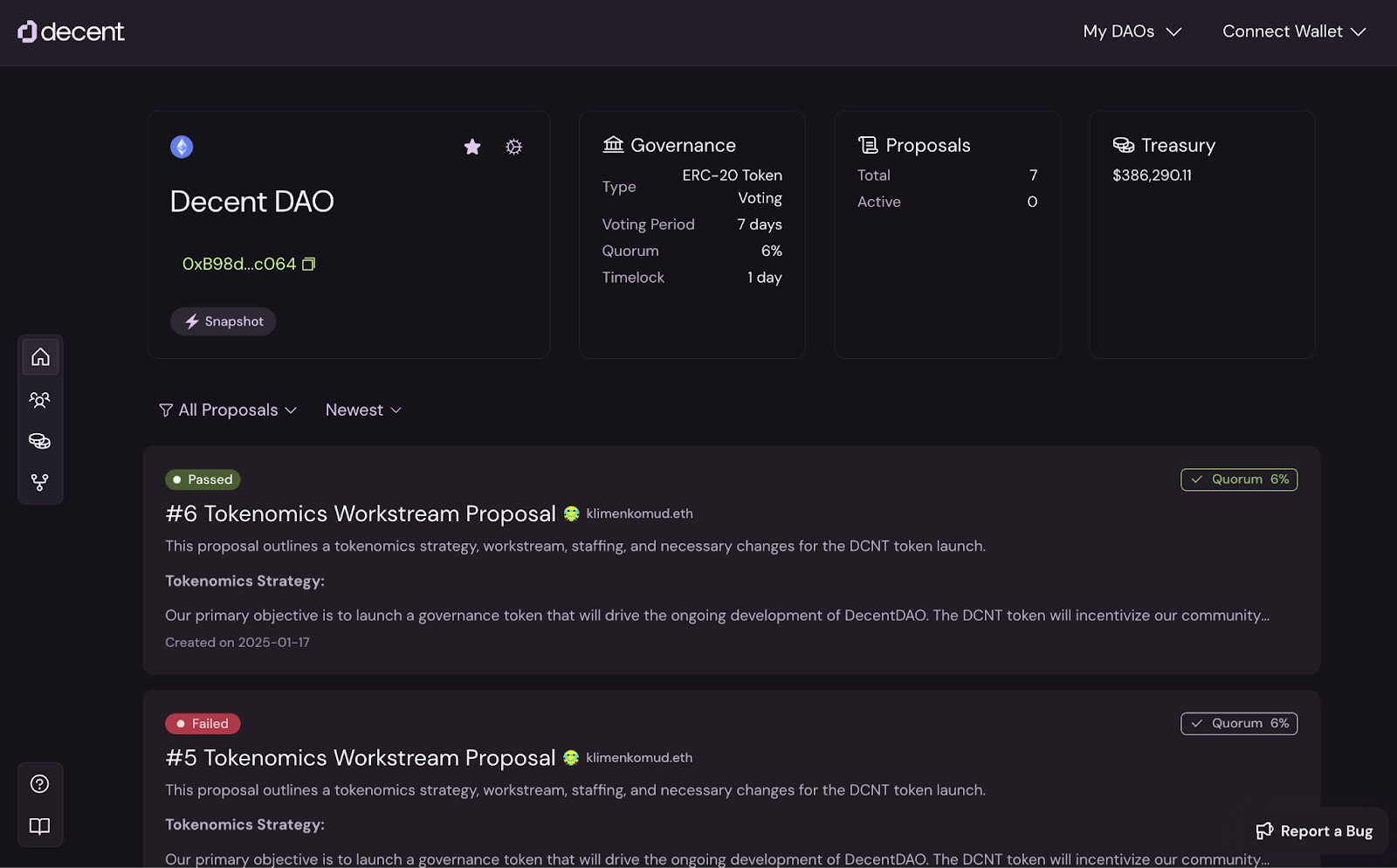

Implementation of a Security Council: The DAO established a Security Council operating as a 4-of-8 multi-signature wallet. Its limited mandate is to cancel proposals that threaten the DAO’s integrity or finances, adding an extra layer of protection without undermining decentralization.

-

Community-Driven Governance Model: ENS DAO uses a delegate system where $ENS token holders can delegate voting power to representatives. All major treasury decisions, including endowment management and diversification, are made through open proposals and community-approved votes, ensuring transparency and broad participation.

- Formalize your investment policy. A clear investment policy statement (IPS) ensures all stakeholders understand risk tolerance, diversification targets, and governance thresholds.

- Diversify early with stablecoins. Stablecoin vaults act as a buffer against market swings while providing liquidity for ongoing operations.

- Implement layered governance controls. Multi-sig security councils can provide necessary guardrails without undermining community sovereignty or slowing innovation.

- Prioritize transparency in reporting. Frequent updates on treasury performance and risk exposures build trust among token holders and delegates alike.

The importance of these principles is underscored by recent moves to expand the ENS Endowment, such as Karpatkey’s proposal to add another 5,000 ETH, demonstrating the DAO’s commitment to iterative improvement and long-term resilience (source).

Looking Ahead: Scaling Sustainable Decentralization

The evolution of ENS DAO’s treasury management, from initial ETH-heavy reserves to a diversified endowment with robust oversight, serves as a blueprint for other DAOs facing similar challenges. As regulatory scrutiny increases and market cycles grow more unpredictable, the need for resilient on-chain treasuries will only intensify. By prioritizing decentralization at every juncture, while still embracing professional expertise where needed, ENS DAO proves that financial sustainability doesn’t have to come at the expense of community control.

If you’re building or managing a decentralized treasury today, consider how these strategies might apply within your own organization. Whether it’s adopting stablecoin vaults or establishing a security council with limited powers, small steps toward structured oversight can make all the difference when volatility strikes, or opportunity knocks.