Arbitrum DAO is rapidly redefining what sustainable treasury management looks like in the DeFi ecosystem. With the current Arbitrum (ARB) price at $0.4435, the DAO’s approach to on-chain treasury strategies is drawing attention from both institutional and community stakeholders. Their innovative Stable Treasury Endowment Program (STEP), launched in July 2024, stands out as a blueprint for how DAOs can leverage real-world assets (RWAs) to secure reliable yields and long-term resilience.

How STEP Transformed Arbitrum DAO’s Treasury Model

Traditionally, many DAOs have relied heavily on their native tokens for treasury reserves, exposing themselves to market volatility and risk. Arbitrum DAO recognized these challenges early and responded with a forward-thinking diversification strategy. By allocating over $30 million into tokenized U. S. Treasury products through partnerships with BlackRock, Ondo, and Mountain Protocol, the DAO generated nearly $700,000 in passive yield within just six months (source).

This move not only provided stable returns but also reduced reliance on ARB’s price movements for operational funding. As many DeFi protocols face funding shortfalls during bear markets, Arbitrum’s proactive diversification offers a compelling case study in DeFi treasury optimization.

Expanding RWA Exposure: The Next Phase of Sustainability

The success of STEP’s initial phase emboldened the community to approve an additional allocation of 35 million ARB tokens (about $11.6 million) to RWAs in May 2025. This expansion brought heavyweight partners like Franklin Templeton, Spiko, and WisdomTree into the fold, further cementing Arbitrum DAO’s reputation for responsible risk management best practices.

By integrating RWAs into its treasury mix, the DAO now enjoys more predictable yields while dampening exposure to crypto market swings, a critical factor given that ARB is holding steady at $0.4435. This strategic shift has inspired other DAOs to consider similar models for sustainable funding and capital preservation.

Arbitrum (ARB) Price Prediction 2026-2031

Professional outlook based on treasury management innovations and DeFi sustainability trends

| Year | Minimum Price | Average Price | Maximum Price | Estimated YoY Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.39 | $0.56 | $0.76 | +26% | Recovery phase; treasury yields stabilize, RWA adoption expands, but DeFi sector volatility persists. |

| 2027 | $0.45 | $0.69 | $0.98 | +23% | Bullish scenario: Broader RWA integration and increased DAO revenues; bearish: DeFi market correction. |

| 2028 | $0.58 | $0.85 | $1.22 | +23% | Mainstream DeFi adoption, regulatory clarity, and new protocol upgrades boost ARB demand. |

| 2029 | $0.71 | $1.04 | $1.58 | +22% | Mature DeFi ecosystem, robust treasury returns, but increased competition from other L2s. |

| 2030 | $0.88 | $1.28 | $2.03 | +23% | Sustained yield generation and on-chain governance lead to institutional interest; possible global DeFi expansion. |

| 2031 | $1.05 | $1.57 | $2.55 | +23% | Arbitrum DAO recognized as a benchmark for DeFi sustainability; RWA and institutional DeFi adoption at scale. |

Price Prediction Summary

Arbitrum (ARB) is positioned for steady growth through 2031, driven by innovative treasury management, diversification into real-world assets, and strong on-chain governance. While the minimum price projections account for potential market downturns, the average and maximum scenarios reflect the impact of DeFi market cycles, increasing adoption, and regulatory improvements. Overall, the outlook is positive, with progressive year-over-year gains and reduced volatility as treasury strategies mature.

Key Factors Affecting Arbitrum Price

- Expansion and success of Arbitrum DAO’s treasury management and RWA integration.

- Broader DeFi market cycles and global adoption trends.

- Regulatory developments, especially regarding RWAs and DAO governance.

- Technological upgrades to Arbitrum and competing L2 solutions.

- Macroeconomic factors affecting crypto and global risk assets.

- Institutional adoption of DeFi protocols leveraging Arbitrum’s sustainable yield models.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Power of On-Chain Governance and Community Trust

A key differentiator for Arbitrum DAO is its commitment to transparent DAO governance. Every major treasury decision undergoes thorough proposal evaluation and community voting via the Arbitrum Governance Forum. This process not only ensures broad stakeholder engagement but also strengthens trust, an asset as valuable as any tokenized yield instrument.

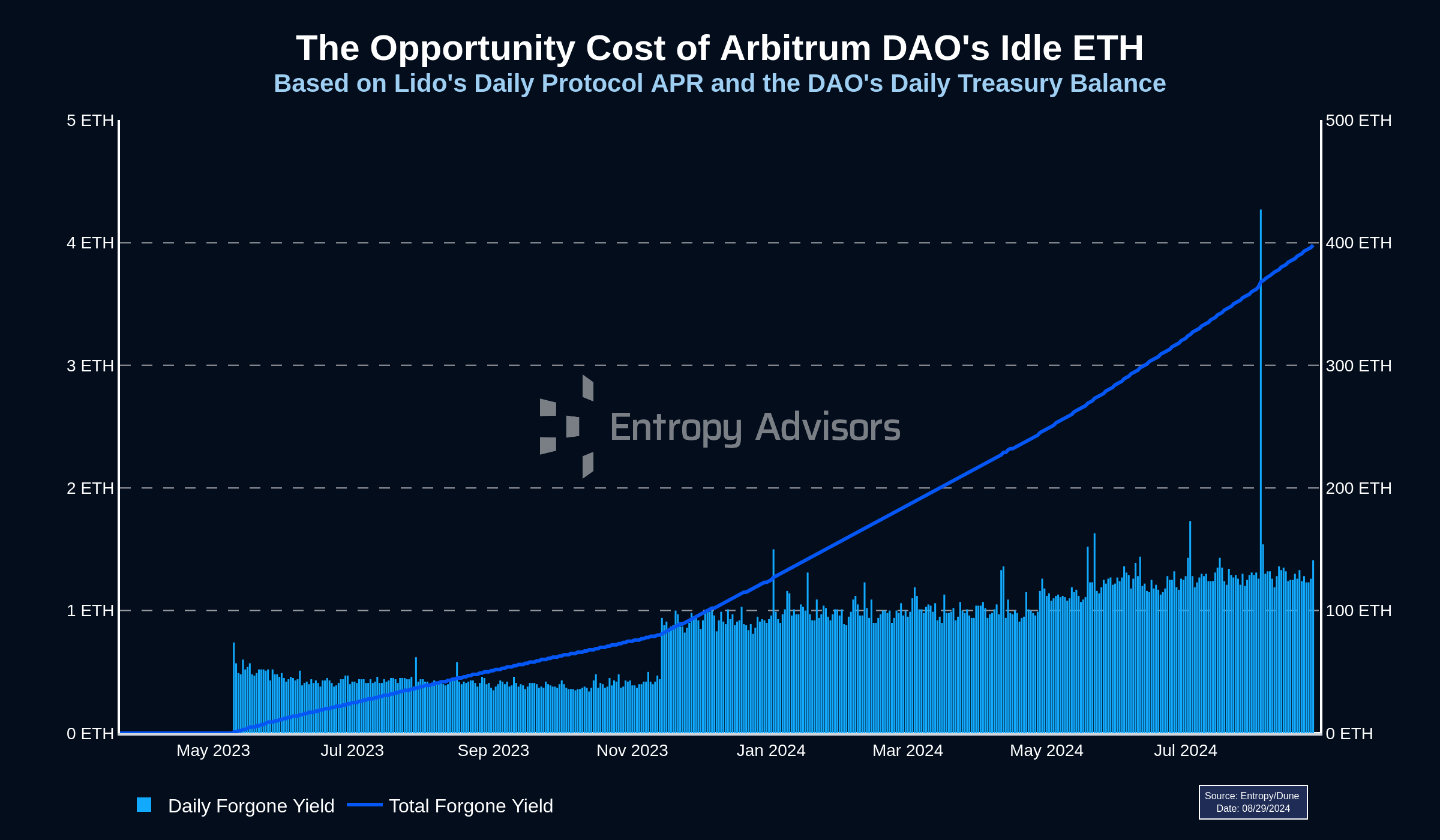

The Treasury and Sustainability Working Group continues to drive innovation by exploring new DeFi lending protocols (like Aave, Lido, Fluid) and advanced liquidity provisioning mechanisms that align with both risk management best practices and long-term growth goals.

- Diversification: Reduces dependency on native ARB token value fluctuations

- Sustainable Yield: Generates passive income from real-world assets like U. S. Treasuries

- Community-Driven Decisions: All allocations are transparently governed by ARB holders through open proposals and votes

- Institutional Partnerships: Engages with trusted asset managers such as BlackRock and Franklin Templeton for RWA exposure

A Model for Other DAOs Seeking Resilience

The combination of on-chain transparency, diversified asset allocation, and robust community input positions Arbitrum DAO as a leader in DeFi treasury optimization. As more decentralized organizations look beyond speculative token holdings toward sustainable funding models, Arbitrum’s playbook offers practical lessons, and measurable results, for building resilient treasuries in an ever-evolving market landscape.

Other DAOs are already taking notice. The Arbitrum DAO’s approach is sparking conversations across governance forums and X (formerly Twitter) about how to adapt STEP-like structures to their own treasuries. The focus on on-chain treasury strategies and direct community involvement is shifting the narrative from speculative risk to proactive, sustainable growth.

What sets Arbitrum apart isn’t just the size of its $1.3 billion treasury or its headline partnerships; it’s the methodical way the DAO has built a system where sustainable yield and transparent governance reinforce each other. The Treasury and Sustainability Working Group’s ongoing exploration of DeFi protocols like Aave, Lido, and Fluid demonstrates a willingness to iterate and optimize, not just rest on early successes.

Practical Takeaways for DAO Operators

Key Lessons from Arbitrum DAO’s Treasury Management

-

Diversify Treasury Assets with Tokenized Real-World Assets (RWAs): Arbitrum DAO’s Stable Treasury Endowment Program (STEP) demonstrates the value of allocating treasury funds into tokenized U.S. Treasury products via partnerships with established issuers like BlackRock, Ondo, and Mountain Protocol. This reduces reliance on native tokens and provides more stable, predictable yields.

-

Leverage Institutional Partnerships for Credibility and Security: Collaborating with major financial institutions such as Franklin Templeton, Spiko, and WisdomTree in STEP’s second phase has enabled Arbitrum DAO to access secure, compliant RWA products and diversify its treasury exposure.

-

Prioritize Transparent, On-Chain Governance: Arbitrum DAO’s treasury management process involves public proposal evaluations and community voting, ensuring that all major allocation decisions are made transparently and with broad stakeholder input.

-

Focus on Sustainable Yield Generation: By generating nearly $700,000 in passive yield within six months from its initial $30 million allocation, Arbitrum DAO shows that DAOs can create sustainable income streams through carefully selected DeFi and RWA strategies.

-

Mitigate Volatility by Reducing Native Token Exposure: Integrating RWAs into the treasury helps reduce the risks of price swings associated with holding large amounts of ARB (currently $0.4435), enhancing the DAO’s financial resilience.

-

Set a Precedent for DeFi Sustainability: Arbitrum DAO’s approach provides a scalable model for other decentralized organizations aiming to achieve long-term sustainability by blending DeFi innovation with real-world assets.

If you’re managing a DAO treasury or advising on DeFi capital allocation, here are some actionable insights from Arbitrum’s journey:

- Embrace Diversification: Don’t let your treasury ride solely on native token price. Tokenized RWAs can anchor your reserves with predictable returns.

- Pursue Transparent Governance: Open proposal processes and community voting build trust, reduce risk of mismanagement, and keep stakeholders engaged.

- Partner Strategically: Collaborate with reputable asset managers who understand both traditional finance and DeFi nuances.

- Iterate Continuously: Treasury management isn’t set-and-forget. Regularly review allocations, yields, and risk exposures as markets evolve.

The result? Even as ARB holds steady at $0.4435, the DAO is less vulnerable to market shocks and better prepared for long-term ecosystem growth. This resilience is exactly what many DAOs are missing in today’s volatile landscape, and why Arbitrum’s model is so compelling.

Looking Ahead: Raising the Bar for DeFi Treasury Optimization

The success of STEP has energized both institutional players and grassroots participants within Arbitrum’s ecosystem. As new AIPs propose further diversification into stablecoins and advanced lending protocols, expect continued innovation in how decentralized treasuries generate value while safeguarding their communities’ future.

This isn’t just an isolated win for one DAO, it’s a signal that sustainable funding models are possible in Web3 when technology, governance, and financial strategy align. By setting such a high bar for transparency, diversification, and community-driven oversight, Arbitrum DAO has created a living blueprint for others seeking robust DeFi treasury optimization.

If you’re ready to future-proof your organization’s capital base or simply want to learn more about how on-chain treasuries can drive sustainable growth, keep an eye on what happens next in the Arbitrum ecosystem. Their journey proves that with the right mix of innovation and discipline, DAOs can thrive, no matter what the broader market brings.