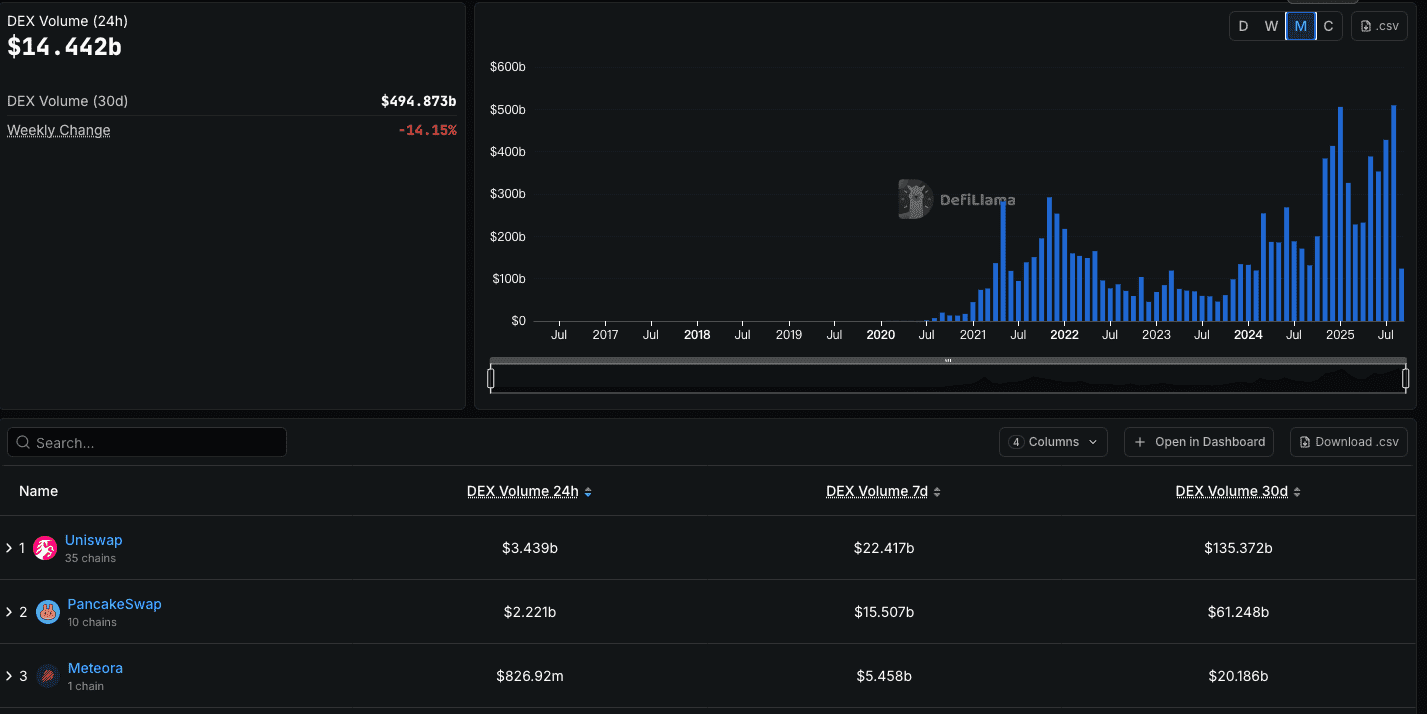

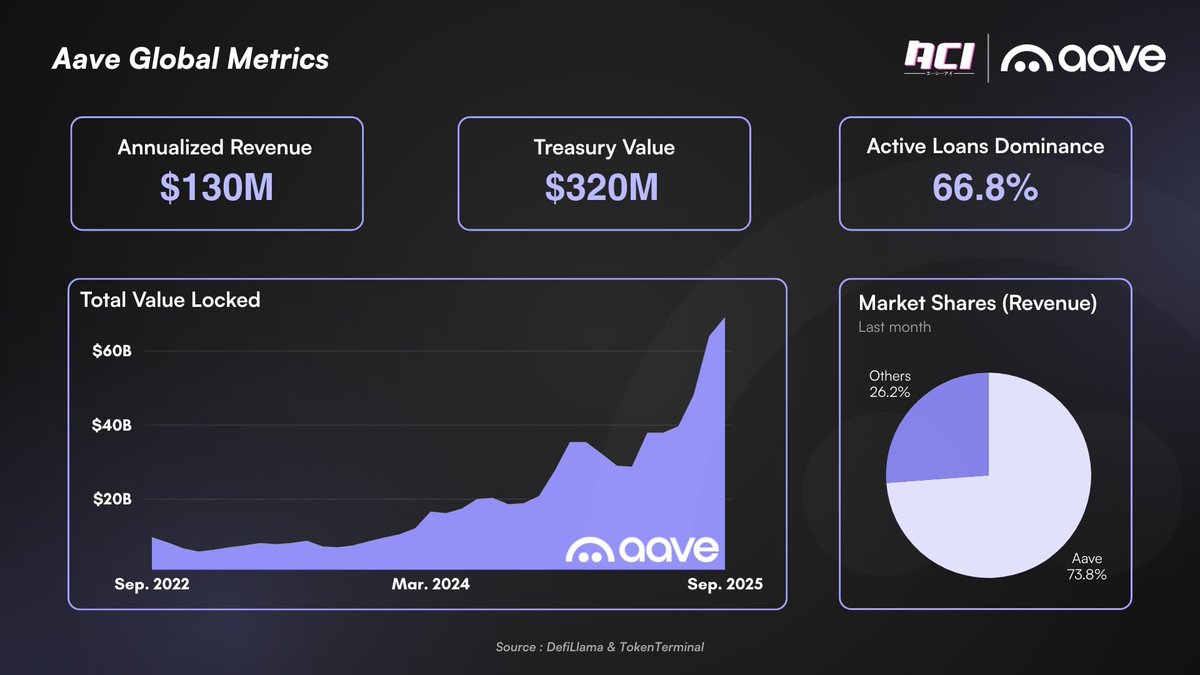

DAO treasuries now sit at the heart of decentralized finance, securing and deploying billions in digital assets. As DAOs scale, so do the risks: from smart contract exploits to sudden stablecoin depegs and governance attacks. The need for real-time, automated treasury risk management is no longer a theoretical best practice but a necessity for survival.

Why Real-Time Risk Management Is Critical for DAOs

Traditional treasury oversight, reliant on human intervention and periodic reviews, simply cannot keep pace with the velocity of DeFi markets. In 2025, DAOs face continuous threats:

- Depeg events: Stablecoins can lose their peg within minutes, threatening entire liquidity pools.

- Flash loan attacks: Automated arbitrageurs can exploit vulnerabilities faster than any manual response.

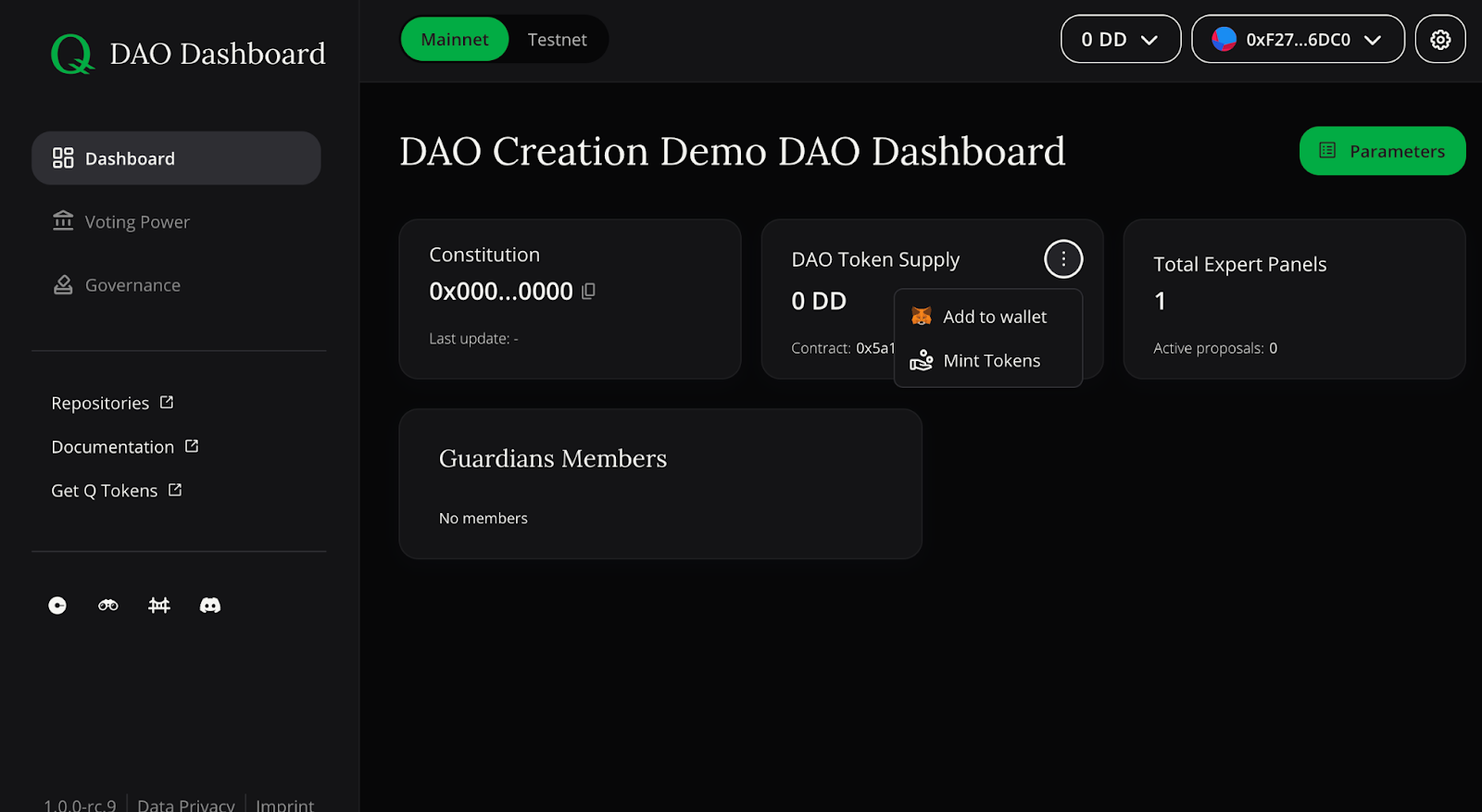

- Governance manipulation: Attackers may accumulate voting power to drain treasuries or change asset allocations.

This environment demands systems that can autonomously detect anomalies and execute pre-programmed protection strategies, what some call “treasury protection traps. ” These are not just theoretical constructs; they are live mechanisms actively defending protocol funds today.

The Rise of Automated Treasury Protection Traps

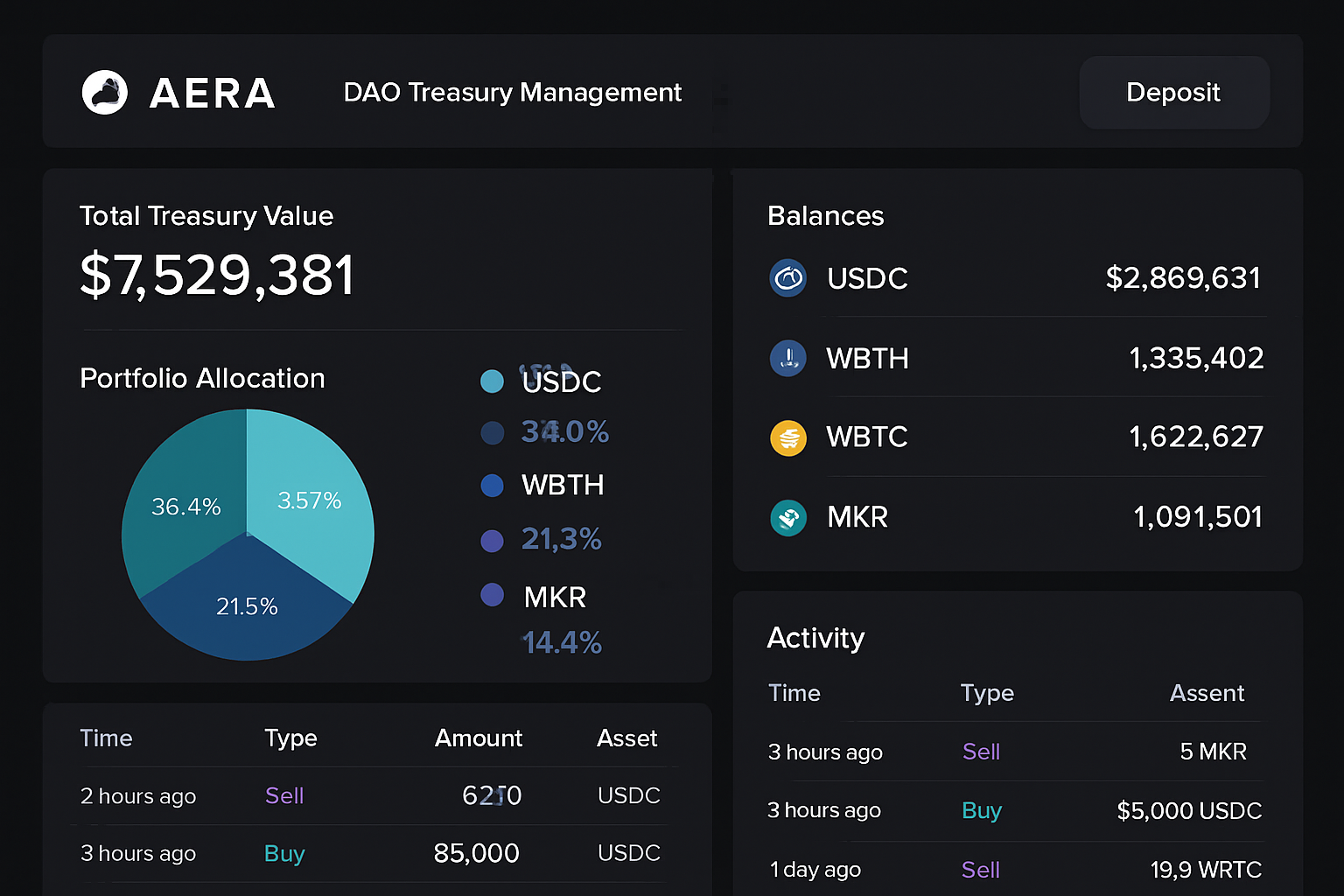

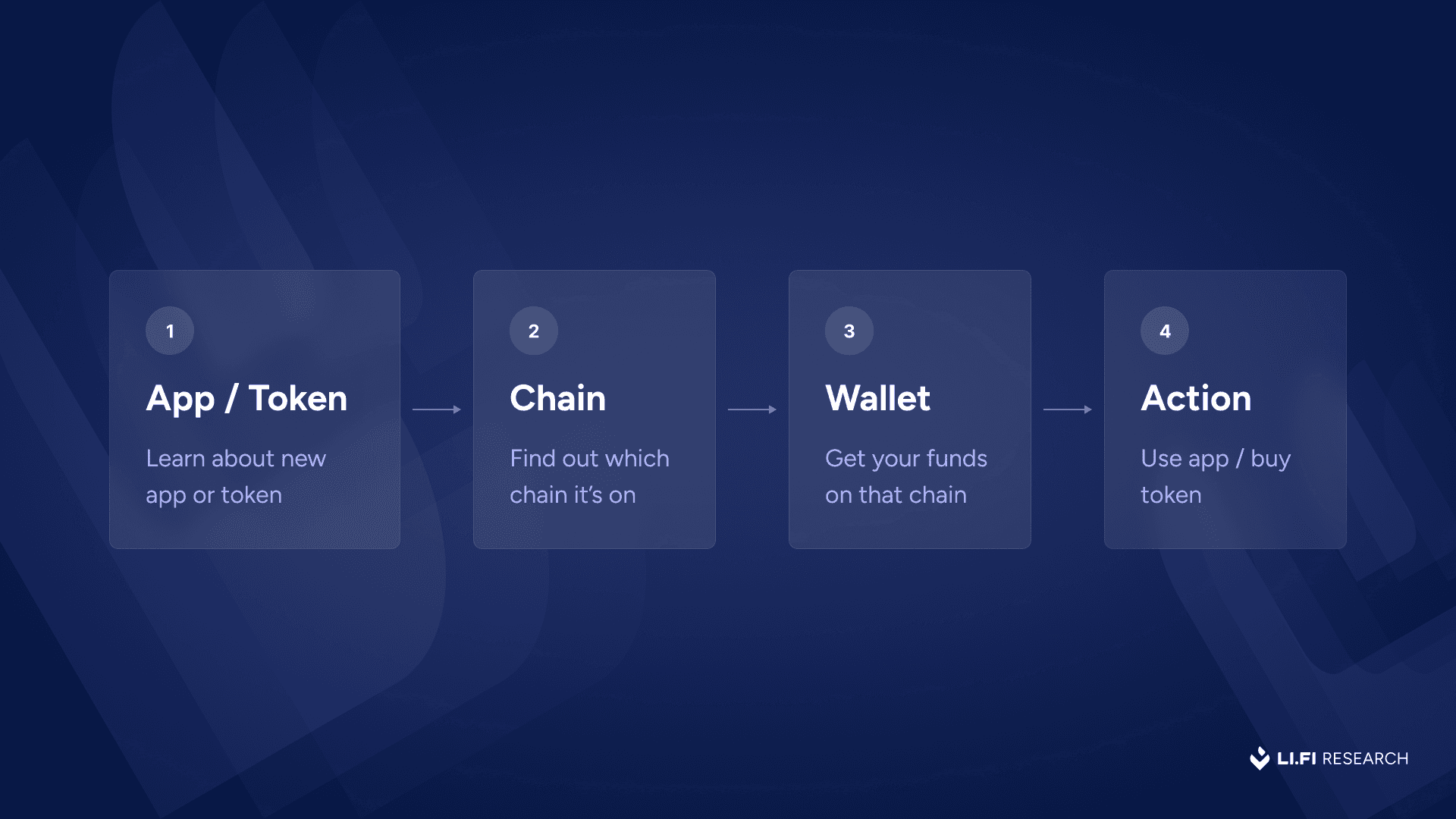

Modern DAOs are embracing solutions like Aera, which combines off-chain guardianship with on-chain execution. Here’s how such platforms are changing the game:

Key Features of Automated DAO Treasury Protection Traps

-

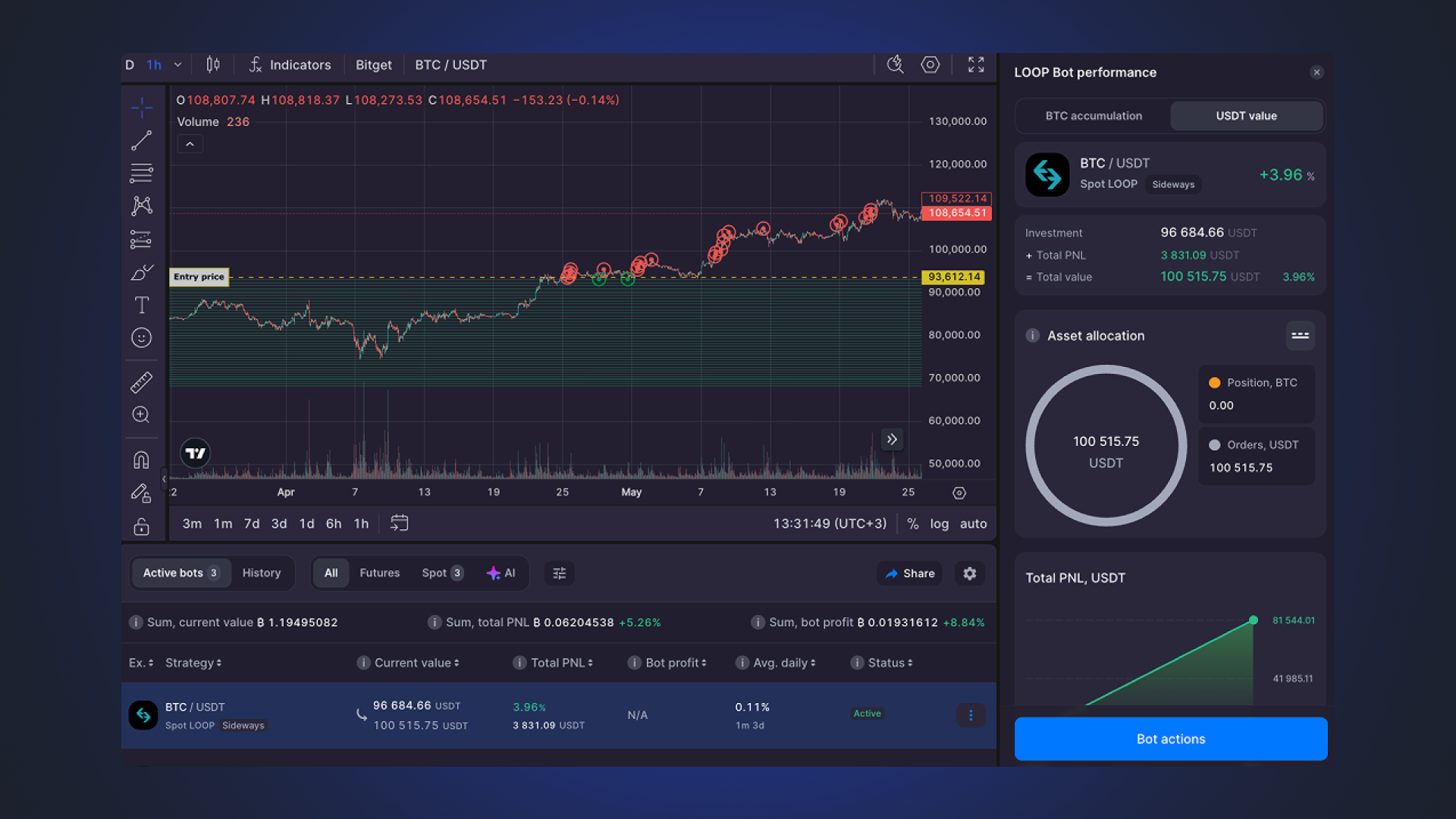

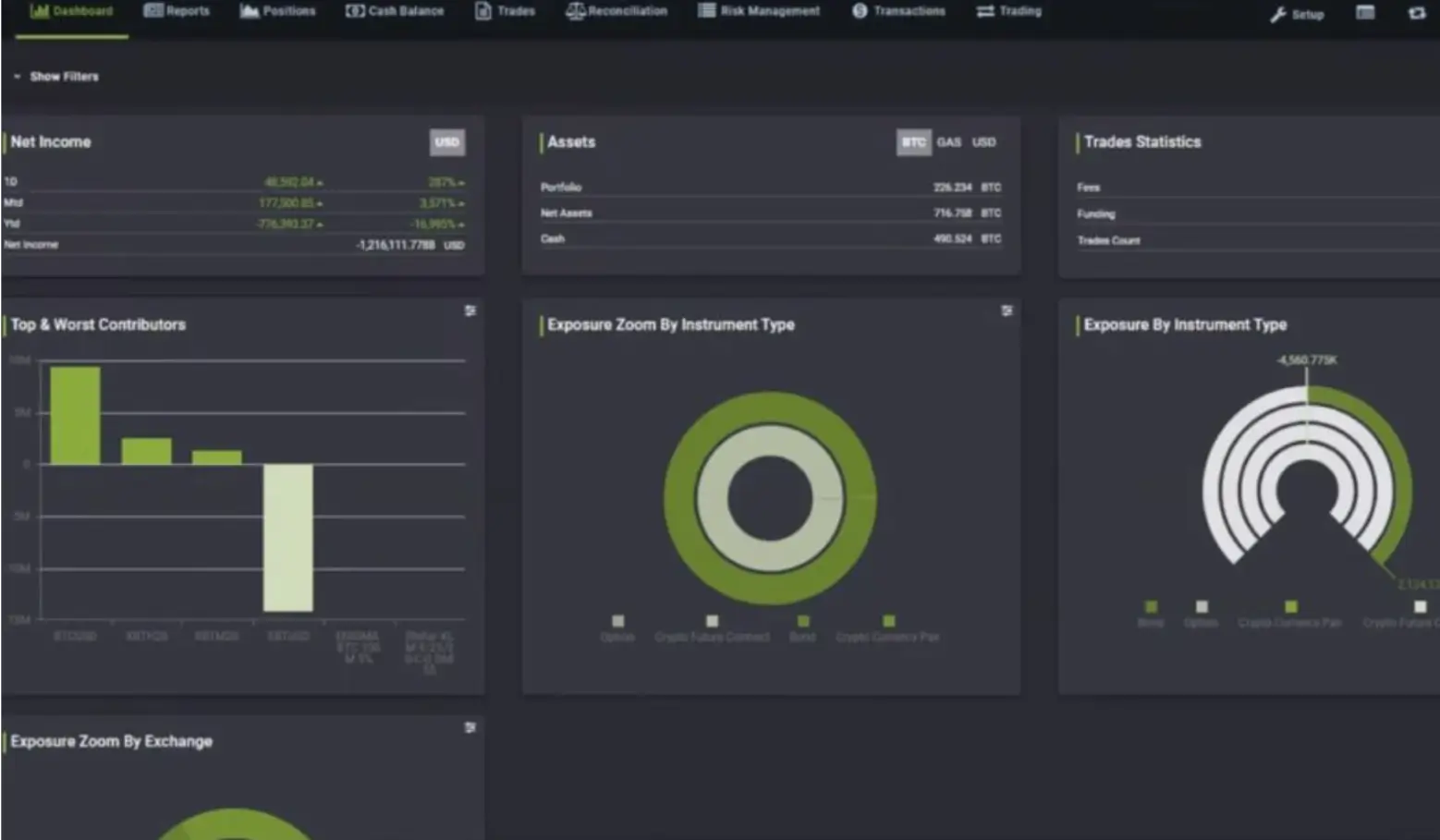

Real-Time Risk Assessment: Automated systems like Aera continuously monitor treasury exposures, enabling immediate detection of threats and rapid response to market changes.

-

On-Chain Guardrails and Permissions: Platforms such as dHEDGE implement strict controls that limit trading actions and prevent unauthorized withdrawals, ensuring assets remain secure within predefined boundaries.

-

Automated Diversification Strategies: Solutions like Factor.fi enable DAOs to automatically rebalance portfolios across multiple assets and protocols, reducing concentration risk and optimizing returns.

-

Transparent, Auditable Operations: Automated traps provide on-chain, publicly accessible records of all treasury activities, allowing DAO members and auditors to verify compliance and performance in real time.

-

Customizable Risk Profiles: Modular vault frameworks, such as those offered by Factor.fi, let DAOs tailor risk parameters and strategies to their specific governance and operational needs.

-

Non-Custodial Asset Management: Platforms like dHEDGE and Aera ensure that treasury assets remain under DAO control at all times, eliminating reliance on third-party custodians.

-

Automated Reporting and Alerts: Many automated treasury solutions generate real-time reports and send alerts for unusual activity or threshold breaches, keeping stakeholders informed and enabling swift action.

For example, Aera empowers DAOs to set risk parameters that trigger automatic rebalancing or asset migration when certain thresholds are breached, such as a stablecoin dropping below its peg or an asset price hitting a volatility limit. This approach dramatically reduces reliance on insider judgment and ensures that all actions align with predefined strategy and governance rules.

Diversification and Depeg Risk Mitigation in Practice

The best defense is diversification, both across assets and protocols. Platforms like Factor. fi allow DAOs to construct modular vaults tailored to unique risk appetites. These vaults automate:

- Asset rebalancing: Maintaining target allocations as market conditions shift.

- StablecoinTrap mechanisms: Instantly shifting funds out of depegging stablecoins into safer alternatives.

- Multi-vault frameworks: Spreading exposure across multiple yield strategies to reduce single-point-of-failure risk.

dHEDGE takes this further by providing transparent, non-custodial trading management with built-in guardrails, traders can act within preset parameters but never withdraw assets directly from the treasury. This blend of automation and constraint is key for on-chain risk management at scale (source).

The Role of Real-Time Monitoring and Reporting

No automated system is complete without robust reporting. Real-time dashboards provide DAO members with continuous visibility into asset flows, vault health, and triggered protection events. This transparency is fundamental, not just for trust but also for rapid collective response should new threats emerge that require governance intervention.

Automated reporting also supports regulatory compliance and auditability, crucial as DAOs operate with increasing scrutiny. Members can track every treasury action, from asset swaps to triggered StablecoinTrap events, in a fully on-chain, immutable record. This level of transparency, paired with the speed of automation, forms the backbone of modern decentralized treasury protection.

Case Studies: DAO Treasury Automation in Action

Several protocols now serve as live examples of how automated risk management transforms DAO security and capital efficiency:

DAOs Using Automated On-Chain Treasury Management

-

Aera – DAOs like Fei Protocol and Tribe DAO have leveraged Aera for trustless, automated treasury management. Aera employs off-chain guardians who execute complex strategies within on-chain constraints, ensuring real-time risk mitigation and alignment with DAO goals.

-

Factor.fi – Platforms such as Balancer DAO have integrated Factor.fi to construct modular, programmable vaults. This enables automated diversification, passive yield strategies, and custom risk profiles tailored to each DAO’s governance framework.

-

dHEDGE – DAOs including Perpetual Protocol DAO utilize dHEDGE for transparent, non-custodial treasury management. dHEDGE provides on-chain, auditable trading activity with guardrails, allowing designated traders to execute within strict limits and protecting DAO assets from unauthorized withdrawals.

-

Avantgarde Finance – GnosisDAO and others have adopted Avantgarde Finance for secure, automated treasury management. Avantgarde combines real-time reporting, capital-efficient strategies, and programmable asset allocation to support DAO governance and risk management.

For instance, DAOs utilizing Factor. fi’s programmable vaults have successfully weathered sudden depeg events by automatically reallocating funds away from at-risk stablecoins. Meanwhile, protocols using Aera’s off-chain guardianship have demonstrated resilience during flash loan-induced volatility spikes, executing pre-approved rebalancing strategies within seconds of detection.

These case studies highlight a new norm: DAO treasury automation is not just about efficiency, it is about survival in an environment where attackers move at machine speed. By codifying risk parameters and automating responses, DAOs can neutralize entire categories of threat before they become existential crises.

Best Practices for Implementing Automated Treasury Protection

To maximize the benefits of on-chain risk management, DAO operators should follow these best practices:

DAO Treasury Protection: Best Practices Checklist

-

Define Clear Risk Parameters and Triggers: Establish precise, transparent risk thresholds (e.g., asset allocation limits, drawdown percentages) that automatically activate treasury protection mechanisms. This ensures objective, non-insider risk assessment and response.

-

Implement On-Chain Guardrails and Access Controls: Set up smart contract-based restrictions that prevent unauthorized withdrawals and limit trading actions. Ensure only designated roles can execute trades within pre-approved parameters, as practiced by dHEDGE and similar platforms.

-

Automate Diversification and Yield Strategies: Use programmable vaults (e.g., Factor.fi) to automate asset diversification and passive yield farming, reducing concentration risk and optimizing returns in real time.

-

Enable Real-Time Monitoring and Transparent Reporting: Deploy tools that provide continuous, auditable visibility into treasury balances, allocations, and risk exposures. Real-time dashboards and on-chain reporting help DAO members monitor and respond to threats quickly.

-

Regularly Audit and Update Protection Mechanisms: Schedule periodic reviews of smart contracts, risk parameters, and platform integrations to adapt to evolving threats and market conditions. Utilize both internal and external security audits for maximum resilience.

1. Define clear risk parameters: Document thresholds for depeg risk, asset volatility, and liquidity needs.

2. Choose modular vault architectures: Opt for solutions that allow flexible strategy updates as market conditions evolve.

3. Enable real-time monitoring: Integrate dashboards that alert members to any triggered protection mechanisms.

4. Audit smart contracts regularly: Ensure code is up-to-date and resilient against emerging attack vectors.

5. Foster community oversight: Involve token holders in reviewing and updating automated protection logic.

The Road Ahead: Toward Proactive DeFi Treasury Security

The landscape for DeFi treasury security is evolving rapidly. With billions at stake and adversaries growing more sophisticated by the day, DAOs must continue innovating their approach to automated asset rebalancing, treasury protection traps, and depeg risk mitigation. The integration of trustless platforms like Aera, modular vaults from Factor. fi, and transparent trading guardrails from dHEDGE sets a new standard for decentralized treasury management (Aera documentation).

The future belongs to those who treat automation not as a luxury but as a foundational layer, one that enables both security and agility in the face of constant change. As DAOs mature, expect to see further advances in cross-protocol integrations, predictive analytics for threat detection, and community-driven upgrades to on-chain governance frameworks.