DAO stablecoin vaults are at the core of on-chain treasury management, acting as programmable financial engines that balance risk and reward for decentralized organizations. As DAOs mature, the imperative has shifted from simple asset storage to dynamic capital efficiency – deploying capital intelligently to generate sustainable yield while safeguarding operational resilience. This nuanced approach is shaping the future of decentralized treasury management.

Why Capital Efficiency in DAO Treasuries Matters

Capital efficiency is not just a buzzword; it’s a critical metric for DAOs striving to maximize their runway, fund innovation, and weather market volatility. In today’s landscape of higher market liquidity and permissionless protocols, DAOs have unprecedented access to yield opportunities, but also face new complexities in risk segmentation and automation. Modern vault designs empower DAOs to:

- Minimize idle capital by deploying stablecoins into diversified yield strategies

- Automate rebalancing based on pre-set governance parameters

- Enhance transparency via on-chain reporting and auditability

- Dynamically manage risk with modular vault structures and automated triggers

Diversified Treasury Management: Beyond Passive Holdings

The era of monolithic treasury reserves is over. Leading DAOs now blend stablecoins for operational security with volatile assets like ETH for growth exposure, plus deploy assets into yield-generating DeFi protocols. This diversified approach enables:

Key Benefits of Diversified DAO Treasury Management

-

Enhanced Risk Mitigation: By allocating assets across stablecoins, native tokens, and yield-bearing strategies, DAOs reduce exposure to single-asset volatility and systemic risks. This diversification helps safeguard the treasury against market downturns and protocol-specific failures.

-

Improved Capital Efficiency: Diversified treasuries can leverage automated protocols like Aera to optimize asset allocation and rebalance portfolios. This enables DAOs to maximize returns from idle assets while maintaining liquidity for operational needs.

-

Operational Flexibility: Maintaining a mix of liquid stablecoins and staked assets (e.g., through Lido) allows DAOs to quickly respond to funding needs or market opportunities without sacrificing yield generation.

-

Stronger Governance and Transparency: Utilizing on-chain, permissionless management tools ensures that treasury strategies are transparent and auditable, fostering trust among DAO members and external stakeholders.

A structured allocation allows for automated rebalancing between buckets – operational reserves, growth assets, and yield strategies – optimizing both safety and upside potential. For an in-depth look at how factor-based vaults empower custom risk profiles within DAO treasuries, see this analysis on Medium.

Automated Vault Protocols: The New Standard for On-Chain Optimization

Manual treasury management can be slow and error-prone, especially when every move requires governance approval. Enter automated protocols like Aera, which enable DAOs to delegate asset optimization to smart contracts governed by decentralized networks. These platforms offer independent rebalancing logic and real-time treasury visibility, transforming capital efficiency by reducing bottlenecks.

This shift toward autonomous optimization not only streamlines operations but also unlocks advanced strategies such as dynamic collateral adjustment and cross-protocol integrations. For more on how these systems are being implemented in real-world DAO treasuries, check out this overview of Aera’s launch on Polygon.

Hybrid Stablecoin Models: Security Meets Yield Generation

The next evolution in stablecoin vault optimization involves hybrid models that combine overcollateralization (for robust security) with synthetic yield generation (for enhanced returns). Falcon Finance’s USDf is a prime example – blending overcollateralized volatile assets with 1: 1 minted stablecoins to strike a balance between safety and capital efficiency. You can dive deeper into these hybrid frameworks at Falcon Finance’s insights page.

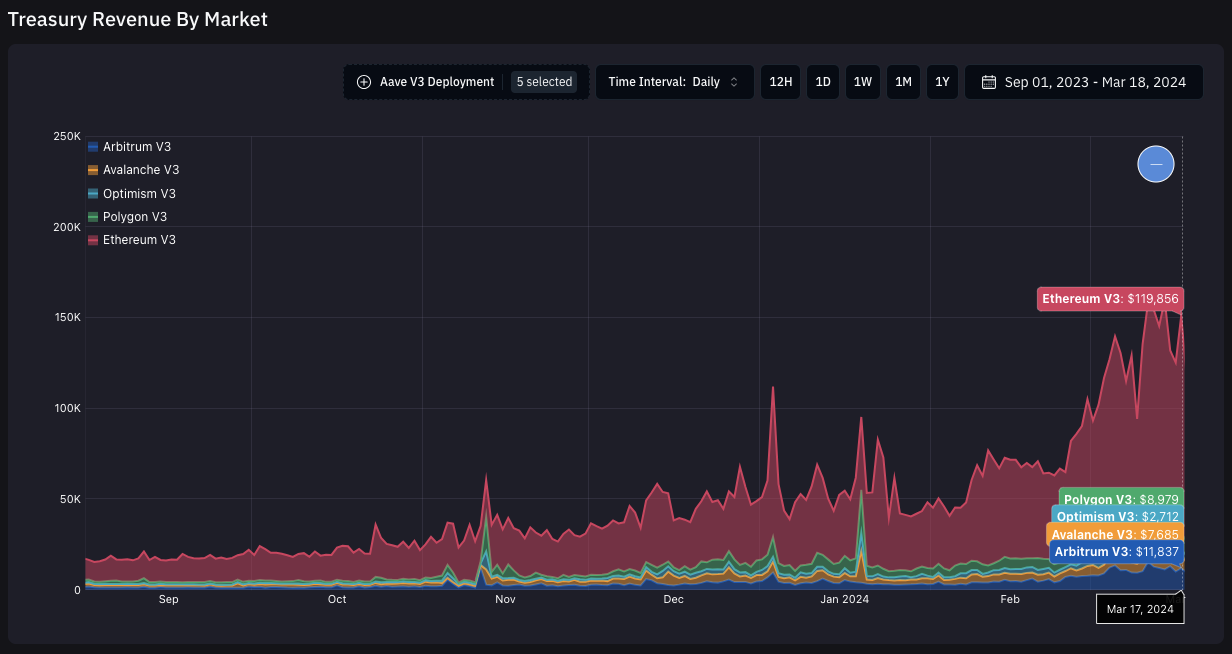

Beyond hybrid models, DAOs are actively leveraging a spectrum of yield optimization strategies to squeeze more value from every stablecoin held. The most progressive treasuries don’t just lend on established protocols like Aave or Compound, they deploy capital across liquidity pools, automated market makers, and even structured products such as options vaults. This multifaceted approach allows for both steady base yields and opportunistic alpha, all while maintaining strict parameters for risk exposure.

Yield Optimization Strategies: Balancing Return and Risk

Effective stablecoin vault optimization means more than chasing headline APRs. DAOs must conduct rigorous due diligence on protocol security, liquidity depth, and historical performance before allocating funds. Advanced strategies include:

Top Yield Optimization Tactics for DAO Stablecoin Vaults

-

Diversify Treasury Holdings Across Multiple Assets: DAOs are enhancing capital efficiency by allocating stablecoins, ETH, and other assets across distinct strategies—balancing operational reserves, growth exposure, and yield generation. This structured diversification enables automated rebalancing and better risk segmentation. (Source)

-

Utilize Automated Treasury Management Protocols: Platforms like Aera provide autonomous, permissionless treasury management, allowing DAOs to delegate optimization and rebalancing to decentralized networks. This reduces governance overhead and ensures responsive capital allocation. (Source)

-

Adopt Capital-Efficient Stablecoin Models: Hybrid stablecoin frameworks—such as Falcon Finance’s USDf—combine overcollateralization with synthetic yield generation. This approach enhances capital efficiency while maintaining robust security for DAO treasuries. (Source)

-

Deploy Stablecoins into DeFi Yield Protocols: DAOs maximize returns by lending stablecoins on Aave or Compound, providing liquidity to DEXs, and utilizing options or futures for hedging. These strategies require ongoing risk assessment and diversification to optimize yield and mitigate downside. (Source)

-

Leverage Liquid Staking Solutions: By staking assets like ETH via Lido, DAOs earn staking yields while receiving liquid derivative tokens. These tokens can be redeployed in DeFi protocols, compounding yield and maintaining liquidity. (Source)

For example, lending on Aave or Compound can provide predictable returns with high liquidity, while providing liquidity to decentralized exchanges like Uniswap offers exposure to trading fees, albeit with impermanent loss risk. Some DAOs are also exploring structured DeFi products such as options vaults that automate premium generation through dynamic collateral adjustments. These layered strategies demand robust analytics and continuous monitoring to prevent overexposure or protocol-specific risks.

Liquid Staking and Cross-Protocol Leverage: Unlocking New Layers of Capital Efficiency

To further amplify capital efficiency, DAOs are integrating liquid staking into their treasury playbooks. By staking assets on platforms like Lido and receiving derivative tokens (e. g. , stETH), treasuries maintain exposure to staking rewards while unlocking the ability to redeploy those derivatives into other yield-generating opportunities across DeFi. This creates a flywheel effect, capital is never idle and always working in multiple layers simultaneously.

However, this complexity introduces new considerations around smart contract risk, cross-protocol dependencies, and potential slippage during extreme market events. Prudent DAOs implement real-time monitoring tools and automated risk triggers to safeguard against cascading failures.

Automated Governance: Scaling Secure On-Chain Decisions

The final lever for maximizing DAO stablecoin vault efficiency is automating governance itself. Automated governance frameworks allow pre-approved parameters, such as rebalancing thresholds or risk limits, to be executed by smart contracts without waiting for manual proposals or votes. This approach not only accelerates response times but also enforces discipline in sticking to predefined treasury mandates.

Autonomous governance is particularly powerful during periods of volatility when rapid action is required to protect reserves or seize fleeting yield opportunities. By codifying risk management rules directly into the vault logic, DAOs can achieve a level of operational resilience that matches (or exceeds) traditional finance, all while remaining fully transparent and auditable on-chain.

The Future of On-Chain Treasury Management

The next wave of DAO treasury innovation will likely blend advanced automation with even greater composability, enabling seamless movement between protocols and asset classes based on real-time market data. As permissionless infrastructure continues to evolve, expect new primitives that further collapse the distinction between security and efficiency.

For now, the blueprint is clear: diversify intelligently, automate relentlessly, monitor continuously, and always align your capital deployment with the community’s long-term mission. The organizations that master these principles will set the standard for resilient decentralized finance in the years ahead.