Governance tokens have become the linchpin of DAO treasury management, transforming how decentralized organizations coordinate capital allocation and strategic direction. As DAOs proliferate across DeFi and Web3, these specialized digital assets are redefining the balance between transparency, efficiency, and collective control. In a market where every treasury decision can shape protocol longevity or expose it to existential risk, understanding the mechanics of governance tokens is essential for any DAO operator or treasury manager.

How Governance Tokens Shape Treasury Management

At their core, governance tokens DAO treasury systems empower token holders to propose and vote on initiatives that directly impact an organization’s financial health. This can include everything from authorizing stablecoin diversification to approving grants or funding new protocol features. The process is inherently democratic yet technologically sophisticated: each on-chain vote is recorded immutably, providing an auditable trail that traditional organizations struggle to match.

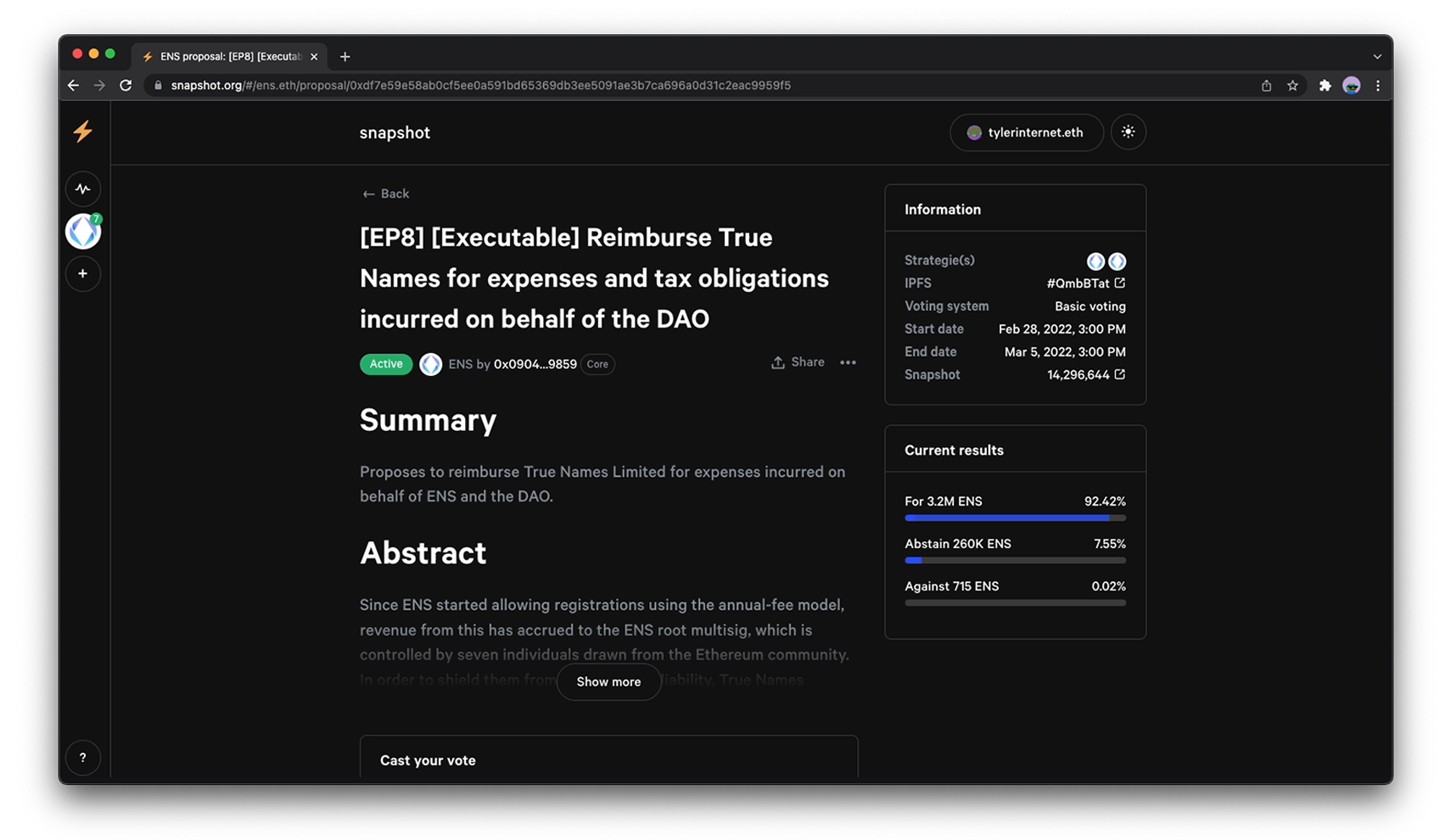

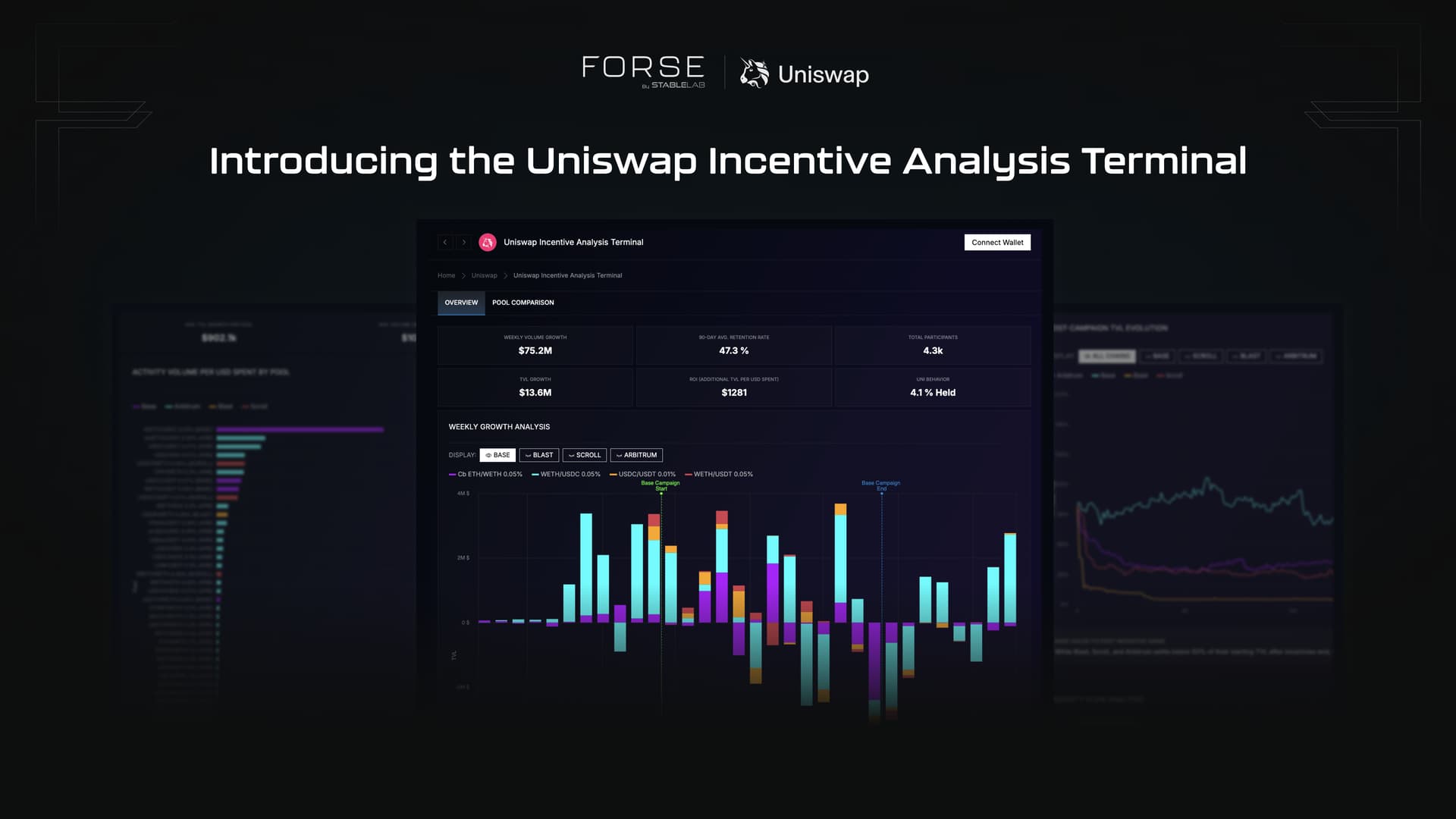

For example, leading DAOs such as Uniswap and Aave regularly put major treasury decisions to token-holder votes, with outcomes visible on public ledgers. This not only ensures accountability but also incentivizes members to actively participate in shaping the future of their organization. The ability to directly allocate millions in digital assets through transparent voting is one of the most powerful innovations in decentralized finance.

Voting Mechanisms: From Token-Weighted Power to Quadratic Fairness

The influence that governance token holders wield depends heavily on the voting mechanism chosen by each DAO. The most common model is token-based voting, where each token equals one vote. While this system is simple and effective for scaling decisions across thousands of participants, it introduces centralization risks if large holders dominate outcomes.

To counterbalance this, some DAOs are experimenting with quadratic voting. In this system, casting multiple votes becomes exponentially more expensive for each additional vote cast by a single holder. This design amplifies minority voices and makes it harder for whales to single-handedly dictate treasury policy. Others employ delegated voting models – allowing less active members to assign their votes to trusted representatives who specialize in governance.

Comparing DAO Voting Mechanisms

-

Token-Based Voting: In this straightforward mechanism, each governance token equals one vote. Voting power is directly proportional to the number of tokens held, making it simple to implement and understand. However, this can lead to centralization risks if a small group accumulates a large share of tokens, potentially undermining decentralization. This model is widely used in major DAOs like Uniswap and Compound.

-

Quadratic Voting: To address the dominance of large holders, quadratic voting assigns a non-linear cost to each additional vote. This means the cost of casting multiple votes increases quadratically, helping to amplify minority voices and reduce the influence of whales. Gitcoin DAO is a notable adopter, using this method to fund public goods and community initiatives.

-

Delegated Voting: Also known as liquid democracy, this mechanism allows token holders to delegate their voting power to trusted representatives. Delegates vote on behalf of others, enabling more informed and efficient decision-making. This system is prominent in DAOs like Aragon and ENS DAO, where active delegates play a key role in governance.

The choice of mechanism has profound implications for capital efficiency and risk management within DAO treasuries. Well-designed systems can align incentives across diverse stakeholders while minimizing the risk of capture by a small group.

Incentivizing Participation and Aligning Community Interests

Treasury management voting doesn’t just determine how funds are spent – it also shapes member engagement over time. Governance tokens are often paired with incentives such as staking rewards or access to exclusive features for active participants. By rewarding meaningful participation, DAOs foster a sense of ownership that goes beyond passive speculation.

This alignment is critical when navigating volatile markets or making controversial allocation decisions. When community members feel invested both financially and emotionally through governance rights, they’re more likely to support resilient strategies rather than short-term gains. As highlighted by Bitbond’s analysis, robust incentive structures are key drivers behind successful decentralized decision-making frameworks.

However, even the most elegant on-chain governance tokens systems face persistent challenges. Chief among them is participation fatigue. As DAOs scale, the volume and complexity of treasury proposals can overwhelm average members, resulting in low voter turnout and, at times, decision-making by an unrepresentative minority. This dynamic threatens both legitimacy and operational effectiveness, especially when high-stakes capital allocations are at play. Addressing this requires ongoing experimentation with delegation models and user experience improvements that lower the barrier to informed participation.

Navigating Centralization Risks and Legal Uncertainties

Another critical tension lies in the risk of centralization. If a handful of actors accumulate significant governance tokens, they could steer treasury outcomes for personal gain rather than collective benefit. Some protocols have responded by introducing quadratic or time-weighted voting, while others cap voting power or implement vesting schedules to slow accumulation. Still, these solutions are not foolproof; vigilance is required to monitor token distribution and ensure governance remains genuinely decentralized.

Complicating matters further are emerging legal risks. Recent court decisions have suggested that governance token holders may be seen as partners in unincorporated associations, potentially exposing them to liability for DAO actions. While legal frameworks remain fluid across jurisdictions, prudent operators should pay close attention to compliance practices and transparency standards. For a deeper dive into these evolving issues, see the analysis at Reuters.

Best Practices for DAO Treasury Governance

The most resilient DAOs treat their governance tokens not just as tools for voting but as levers for continuous improvement in treasury stewardship. Here are actionable best practices for DAO operators and treasury managers:

Best Practices for DAO Treasury Governance with Governance Tokens

-

Implement Transparent On-Chain Voting: Ensure all treasury decisions are made through verifiable on-chain governance processes, allowing members to audit proposals, voting outcomes, and fund allocations in real time.

-

Adopt Robust Voting Mechanisms: Utilize advanced systems like quadratic voting (as seen in Gitcoin Grants) or delegated voting (used by Uniswap and Aave), to balance influence and mitigate centralization risks.

-

Regularly Review and Update Governance Frameworks: Periodically assess and refine governance token rules, quorum thresholds, and proposal requirements to adapt to evolving community needs and maintain effective treasury oversight.

-

Encourage Broad Participation and Education: Proactively incentivize token holders to engage in treasury governance through rewards, educational resources, and clear communication, as practiced by DAOs like MakerDAO.

-

Enhance Treasury Transparency and Reporting: Publish detailed, accessible reports on treasury assets, expenditures, and decision rationales, following the example of DAOs like ENS DAO and CoW DAO.

-

Mitigate Centralization and Sybil Risks: Monitor token distribution, implement anti-Sybil mechanisms, and consider vesting or lock-up periods to prevent undue influence by large holders or malicious actors.

-

Address Legal and Compliance Considerations: Stay informed about evolving legal frameworks and potential liabilities for governance token holders, referencing guidance from organizations like The LAO and recent legal analyses.

Implementing these principles can help DAOs foster a culture where transparency meets agility, where every capital allocation is scrutinized yet responsive to changing market dynamics.

The Road Ahead: Evolving Models for On-Chain Treasury Management

The future of on-chain treasury management will likely see more sophisticated blends of automated safeguards and human oversight. Smart contracts can enforce spending limits or require multi-stage approvals for major disbursements, while real-time analytics dashboards keep stakeholders informed about asset flows and risk exposures.

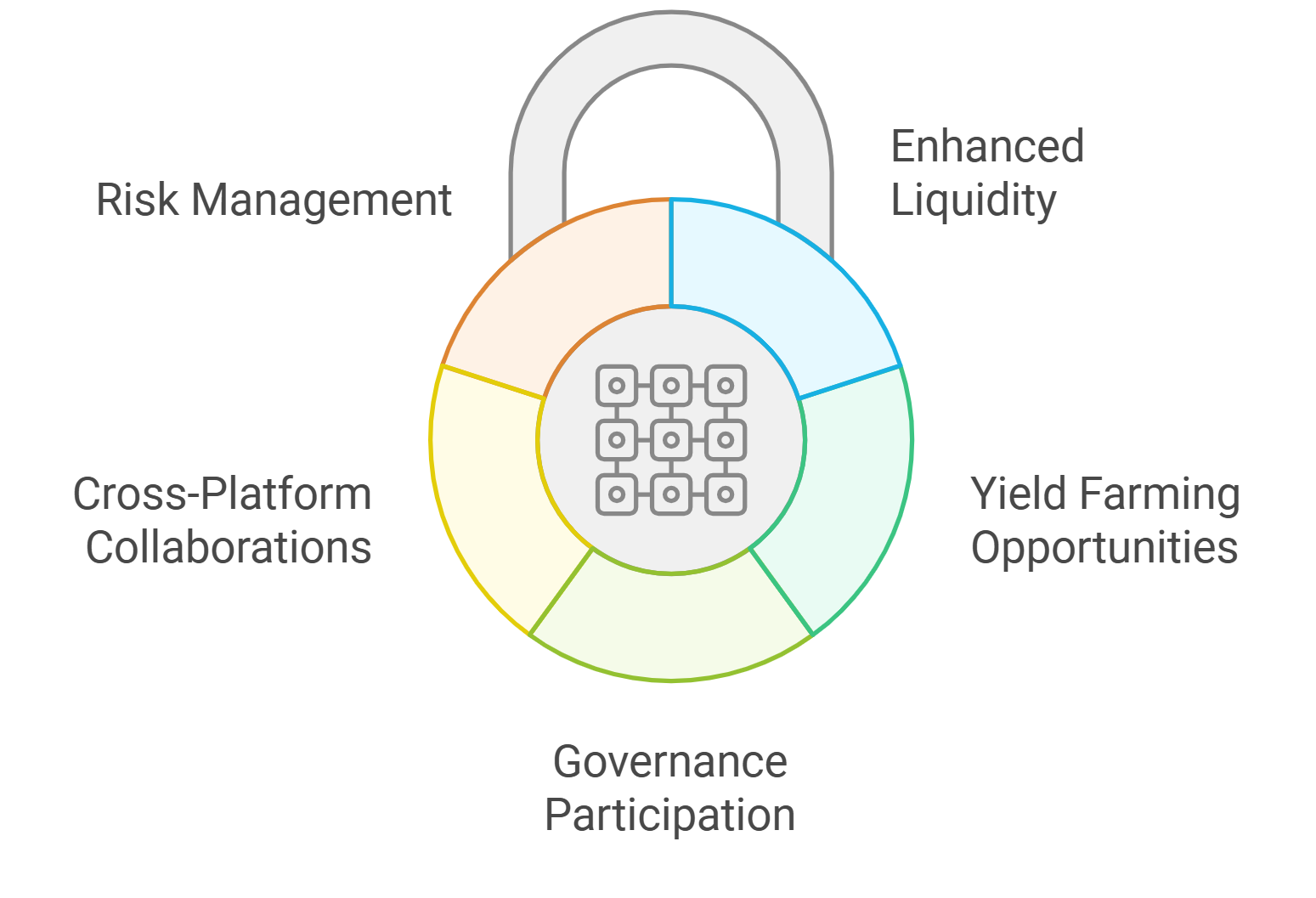

Ultimately, the role of governance tokens DAO treasury systems is poised to expand as DAOs tackle larger treasuries and more complex mandates. The emergence of cross-DAO collaboration, where multiple communities coordinate joint investments or insurance pools, will further test existing models’ scalability and resilience.

Effective DAO treasury management isn’t about eliminating risk; it’s about empowering communities to manage uncertainty transparently, and with conviction.