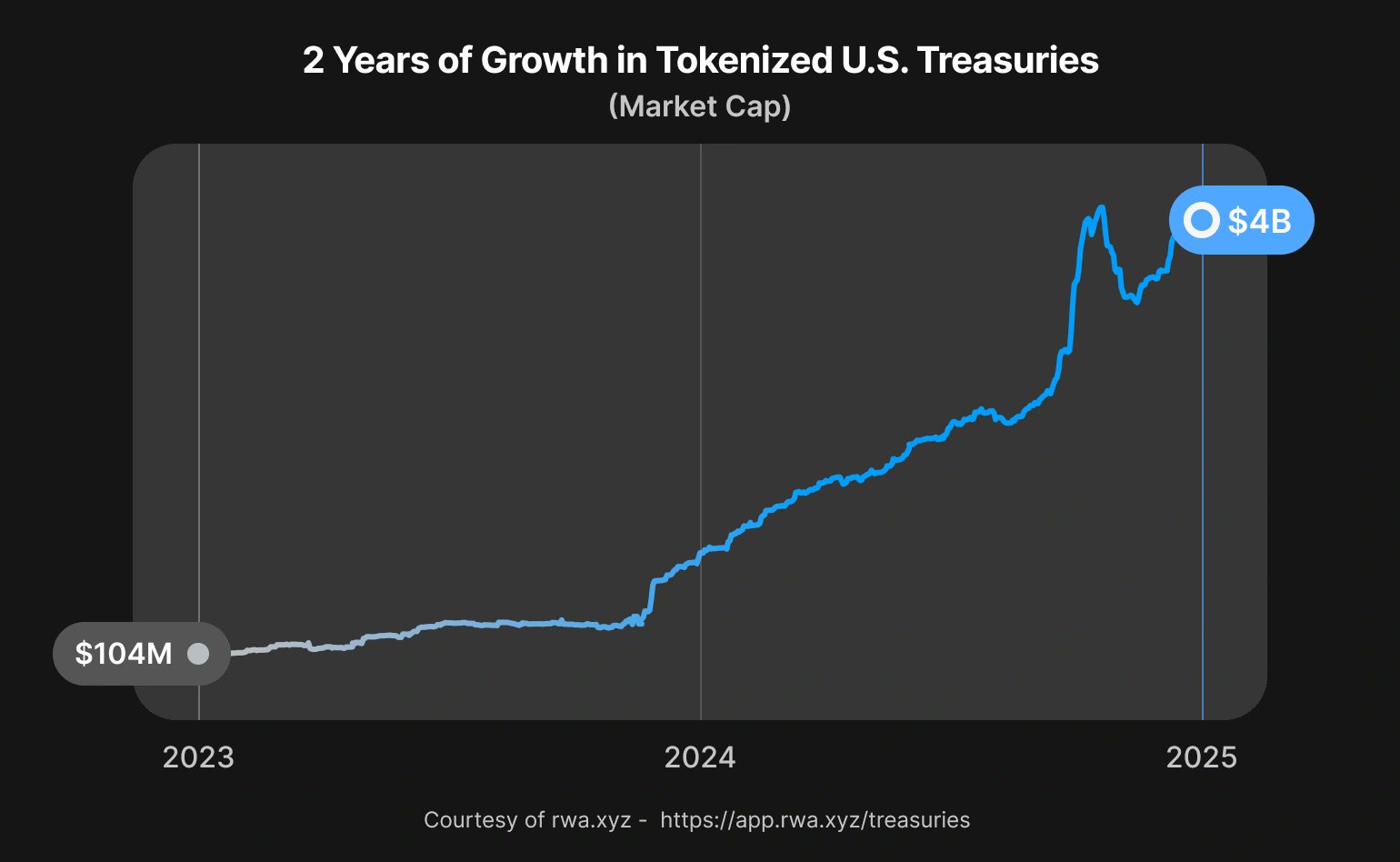

Real-world assets on-chain are no longer a theoretical ambition, they are rapidly becoming a cornerstone of sophisticated DAO treasury management. As of April 2025, the market capitalization for tokenized U. S. Treasuries alone has reached $5.6 billion, reflecting a surge in institutional and retail appetite for stable, yield-generating products within decentralized finance (DeFi). This transformation is not just about technology, but about reimagining the very architecture of capital allocation and risk in treasury operations.

Why DAOs Are Embracing Real-World Assets

The strategic rationale for integrating real-world assets (RWAs) into DAO treasuries is clear: diversification, liquidity, and yield optimization. Tokenization enables fractional ownership of traditionally illiquid assets, think commercial real estate or private credit, making them accessible to a global investor base. The result? DAOs can construct portfolios that blend the volatility profile of crypto with the stability of traditional finance.

Consider these core opportunities:

Key Benefits of Integrating RWAs into DAO Treasuries

-

Enhanced Liquidity and Accessibility: Tokenizing real-world assets (RWAs) like U.S. Treasuries and real estate enables fractional ownership and 24/7 trading, making high-value assets accessible to a broader investor base. For example, platforms such as Centrifuge and Maple Finance facilitate on-chain RWA markets.

-

Diversification and Stable Yield Generation: Integrating RWAs allows DAOs to diversify their treasuries with stable, yield-generating assets like tokenized U.S. Treasuries, which reached a market capitalization of $5.6 billion as of April 2025. This attracts risk-averse investors and provides more predictable returns compared to volatile crypto assets.

-

Institutional Participation and Regulatory Alignment: Incorporating RWAs helps DAOs develop compliant financial products that meet regulatory standards, encouraging participation from institutions. Major networks like Canton Network have already enabled on-chain U.S. Treasury financing, demonstrating growing institutional interest.

-

Programmable Asset Management: Blockchain-based RWAs enable automated compliance, real-time settlement, and programmable asset transfers, reducing operational friction and settlement risk. Projects such as Chainlink provide secure data feeds and oracle solutions to support these features.

-

Democratized Global Investment Access: RWA tokenization breaks down traditional barriers, allowing individuals worldwide to invest in assets like private credit, real estate, and bonds that were previously limited to select participants. Platforms like Open Eden and Tangany offer regulated gateways for global RWA investments.

For example, tokenized U. S. Treasuries now offer DeFi participants reliable annual yields in the 4-5% range, a compelling alternative to volatile on-chain lending rates. Platforms like those mapped by Tokeny illustrate how distributors, custodians, and DeFi protocols are collaborating to bridge TradFi and DeFi at scale.

The Mechanics: How On-Chain Treasury RWA Integration Works

Integrating RWAs into an on-chain treasury involves several critical steps:

- Asset Selection and Due Diligence: Identifying suitable real-world assets that align with the DAO’s risk tolerance and investment horizon.

- Tokenization Process: Converting ownership rights into blockchain-based tokens via regulated providers.

- Custody and Compliance: Ensuring secure off-chain storage and legal enforceability through trusted custodians and service partners.

- Treasury Allocation and Governance: Using smart contracts to automate portfolio rebalancing, yield harvesting, and risk management.

This workflow allows DAOs to unlock new capital efficiency levers while maintaining transparency, a crucial factor for community trust and regulatory scrutiny alike. The recent on-chain US Treasury financing on Canton Network exemplifies this evolution (source).

Navigating Risks: What DAO Treasury Managers Must Watch For

No innovation comes without its own set of challenges, and RWA integration is no exception. The most pressing risks include:

- Regulatory Uncertainty: Jurisdictional differences can create compliance headaches and even jeopardize asset claims if not managed proactively (details here).

- Custody Vulnerabilities: Securely managing off-chain collateral requires robust legal agreements and trusted intermediaries, potentially introducing counterparty risk back into a space designed for disintermediation (more info).

- Tight Liquidity and Valuation Gaps: Many RWAs lack deep secondary markets; price discovery can be opaque during volatile periods, impacting both exit strategies and NAV calculations (see analysis).

- Smart Contract and Oracle Risks: Bugs or manipulation in code or data feeds could undermine asset integrity or expose treasuries to losses.

The Evolving RWA Ecosystem: From Bonds to Buildings

The spectrum of tokenizable assets is expanding fast, from government bonds to luxury real estate, private equity, fine art, and even intellectual property rights. According to Pantera Capital’s report on “The Great Onchain Migration, ” more than $24 billion in RWAs now reside on public blockchains, a threefold increase since early 2023 as nearly 200 issuers enter the fray.

As the RWA ecosystem matures, DAO treasury managers are moving beyond basic yield products and exploring more nuanced strategies. For instance, some DAOs are leveraging tokenized private credit and real estate to create uncorrelated revenue streams, while others are experimenting with programmable assets that unlock new governance and incentive models. This diversification is not just about risk mitigation, it’s about rethinking the capital stack for decentralized organizations.

Yet, this evolution comes with a mandate for operational excellence. The lack of standardized frameworks for valuation, reporting, and dispute resolution means DAO operators must be vigilant in partner selection and ongoing monitoring. Interoperability remains a sticking point: without seamless bridges between blockchains and off-chain registries, RWAs can become siloed or even illiquid when most needed.

Practical Steps: Building Resilient On-Chain Treasury RWA Programs

To capitalize on the opportunities while mitigating risks, DAOs should adopt a disciplined approach to RWA integration:

Best Practices for DAO Treasury Managers Integrating RWAs

-

Conduct Rigorous Due Diligence on RWA Tokenization Providers: Partner only with established platforms such as Centrifuge, Maple Finance, or Tangible that have a proven track record in real-world asset tokenization, robust compliance frameworks, and transparent asset backing.

-

Ensure Regulatory Compliance and Legal Clarity: Engage legal counsel familiar with digital assets to navigate jurisdictional complexities. Utilize platforms like OpenEden or Ondo Finance that emphasize regulatory adherence and provide clear documentation of asset rights and investor protections.

-

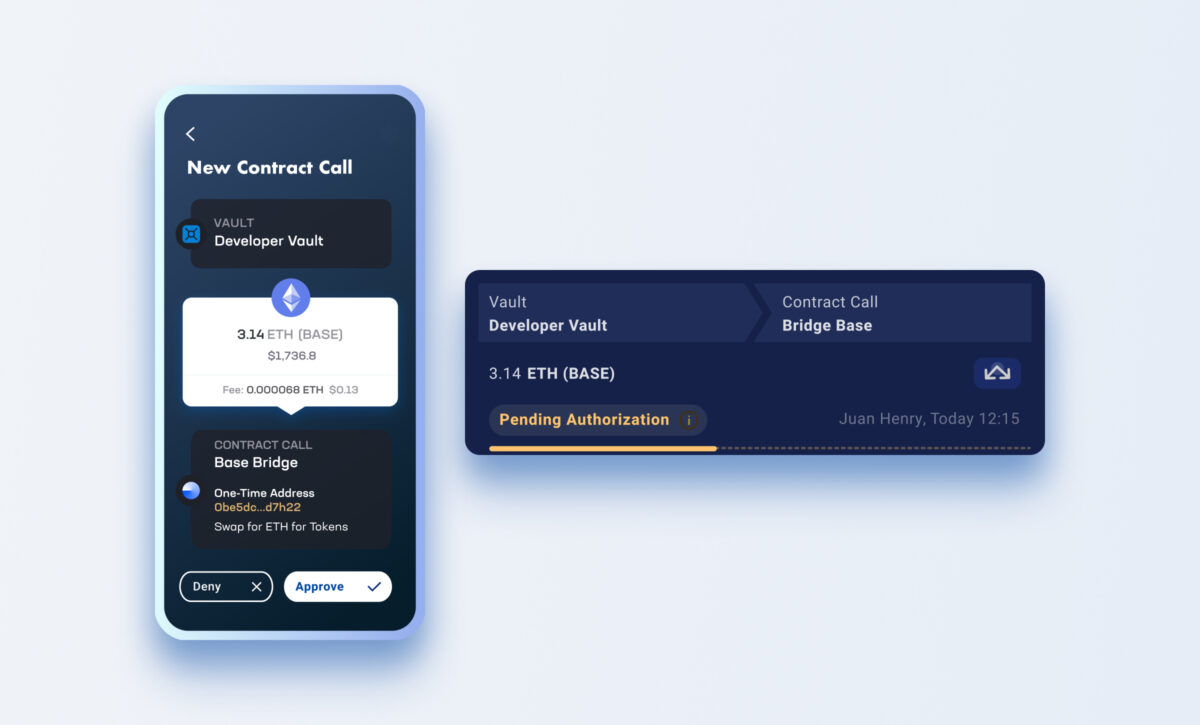

Prioritize Secure Custody Solutions: Use reputable custodians such as Fireblocks or BitGo for safeguarding tokenized assets and their underlying physical or financial instruments, ensuring robust asset management and minimizing counterparty risk.

-

Leverage On-Chain Transparency and Real-Time Auditing: Integrate services from data providers like Chainlink or RedStone Oracles to access reliable, real-time asset data and enable transparent on-chain reporting for DAO stakeholders.

-

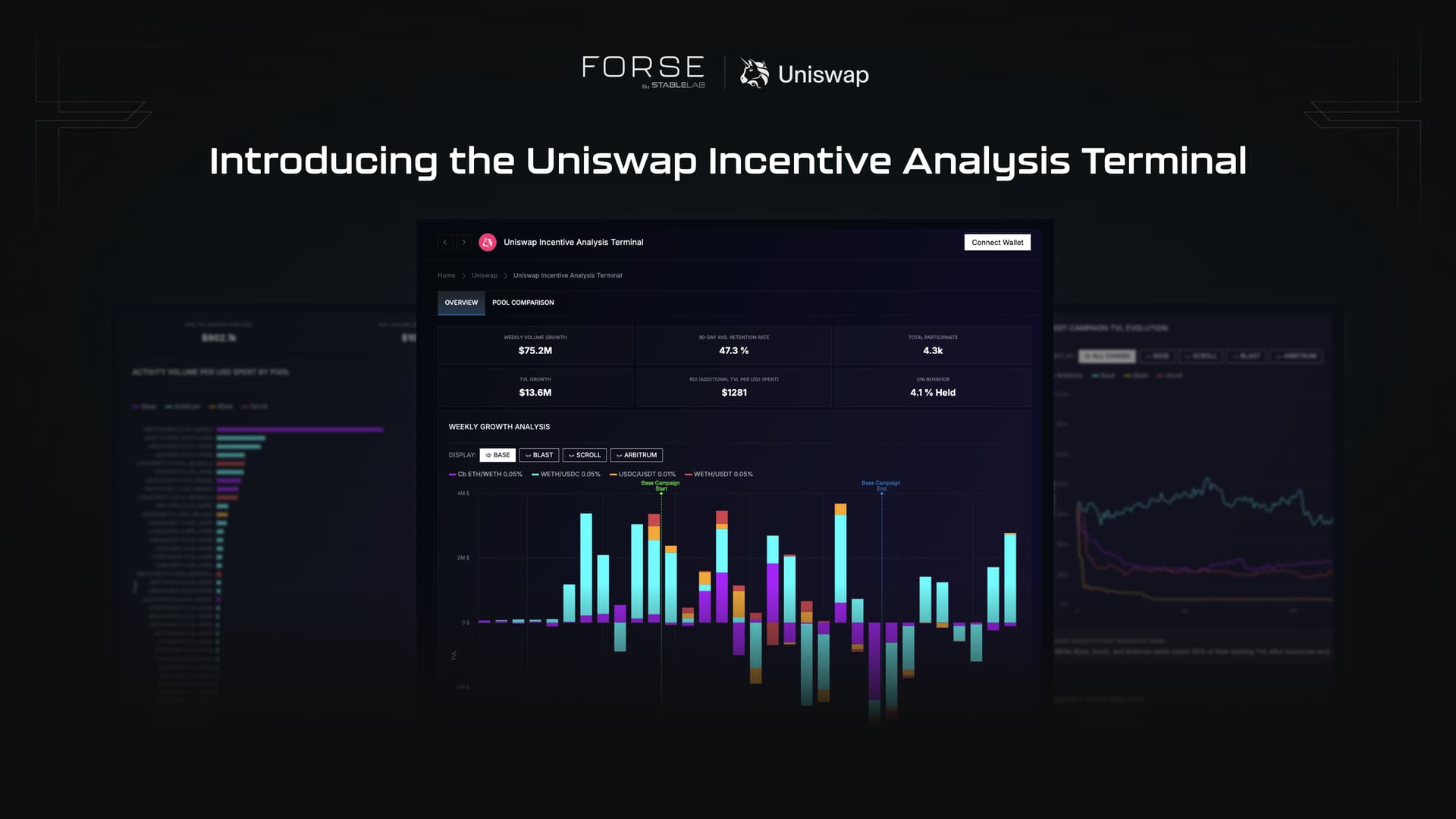

Assess and Monitor Liquidity and Market Depth: Favor tokenized assets with active secondary markets on platforms such as Uniswap, Curve Finance, or Tradeweb to facilitate efficient entry and exit, and regularly monitor liquidity metrics to mitigate exit risk.

-

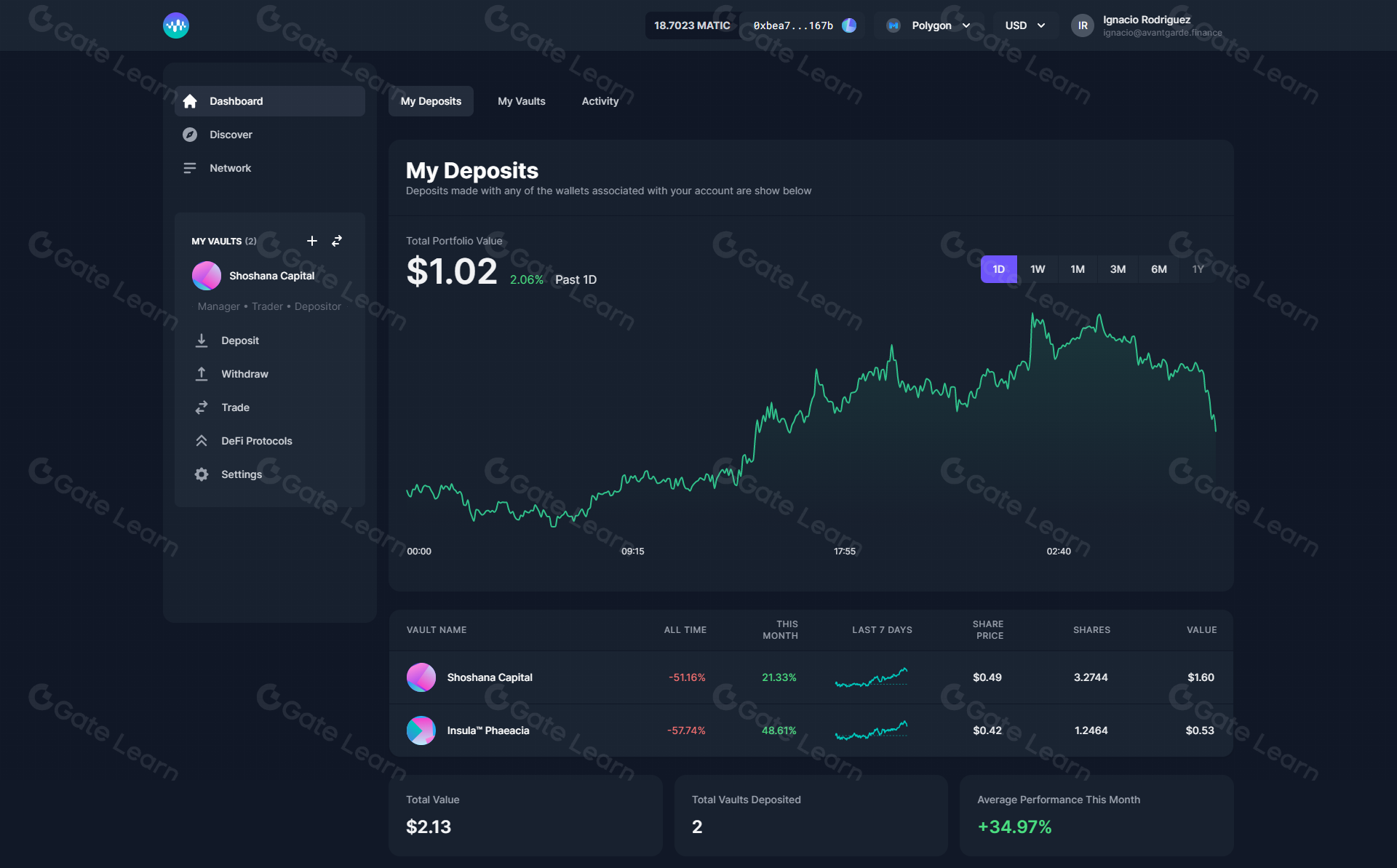

Implement Robust Risk Management and Diversification: Construct diversified portfolios by allocating across multiple RWA types (e.g., tokenized U.S. Treasuries, real estate, private credit) and platforms, using tools like Enzyme Finance for on-chain portfolio management and risk analytics.

Key recommendations include establishing clear investment mandates that define acceptable asset types and risk thresholds; conducting rigorous due diligence on tokenization providers; implementing automated monitoring tools for smart contracts; and maintaining transparent communication with stakeholders around performance and governance changes.

It’s also crucial to stress-test portfolios under various market scenarios. As highlighted in research from Team1, valuation transparency is essential, especially given the potential for rapid shifts in secondary market liquidity. DAOs that maintain robust scenario planning frameworks will be best positioned to weather volatility without compromising long-term objectives.

What’s Next? The Road Ahead for DAO Asset Integration

The next phase of growth will likely see greater collaboration between DeFi protocols, traditional custodians, and regulatory bodies. With tokenized U. S. Treasuries now at $5.6 billion in market capitalization, institutional adoption is no longer a distant goal but an unfolding reality. Expect new protocols focused on composability and cross-chain settlement to drive further innovation, and regulatory clarity to unlock even broader participation.

Ultimately, integrating real-world assets on-chain is about more than portfolio construction, it’s about building resilient digital economies that can withstand shocks while delivering sustainable value to all stakeholders.