Decentralized Autonomous Organizations (DAOs) are now at the center of on-chain capital allocation, actively managing treasuries that rival those of mid-sized financial institutions. With Ethereum (ETH) currently priced at $4,535.60, DAO treasuries are exposed to both the upside and downside of DeFi protocol risks in real time. The sheer velocity of innovation in decentralized finance means that risk management is no longer optional – it is existential.

Key Risks Facing DAO Treasuries in the DeFi Ecosystem

DAOs operate in a multidimensional risk landscape. Smart contract vulnerabilities, economic volatility, governance attacks, and regulatory scrutiny all converge on treasury operations. Recent guidance from Reed Smith LLP highlights that DAOs governing DeFi protocols may be directly targeted by regulators if their services cross into unregistered territory. Meanwhile, the U.S. Department of the Treasury warns of illicit actors exploiting DeFi for money laundering and sanctions evasion.

The most critical risks include:

- Smart Contract Exploits: Flaws can result in irreversible losses within seconds.

- Market Risk: Price swings in ETH (now at $4,535.60), BTC, or native tokens can rapidly erode capital.

- Governance Attacks: Malicious proposals or rushed upgrades can drain treasuries or introduce backdoors (Medium).

- Regulatory and Compliance Risk: Unclear jurisdictional boundaries create legal uncertainty for treasury managers.

Diversification: The First Line of Defense for On-Chain Treasury Exposure

A recurring theme among top-performing DAOs is robust diversification away from single-token exposure. Overconcentration in a DAO’s native token amplifies volatility and creates existential risk if sentiment sours or liquidity dries up. The ETHFI DAO recently proposed allocating up to 18 million ETHFI tokens into tokenized U. S. treasury notes, ETH, and BTC – a move designed to buffer against idiosyncratic shocks (governance.ether.fi). This mirrors best practices outlined by TRES Finance and CoW DAO’s own treasury management frameworks.

Diversification should not be static; it must adapt to changing market conditions and evolving protocol landscapes. For example, with ETH trading at $4,535.60 today – down $76.36 (-0.0166%) over 24 hours – DAOs must constantly reassess their asset allocations relative to risk-adjusted returns across stablecoins, blue-chip cryptoassets, and real-world asset integrations.

Top 5 DAO Treasury Diversification Strategies

-

Diversify Treasury Holdings Across Asset Classes: Allocate funds beyond the DAO’s native token into stablecoins, Ethereum (ETH) (currently priced at $4,535.60), Bitcoin (BTC), and tokenized real-world assets. For example, the ETHFI DAO proposed investing millions of tokens into ETH, BTC, and treasury notes to reduce volatility and protocol-specific risk.

-

Establish Robust Risk Management Frameworks: Implement comprehensive frameworks addressing smart contract vulnerabilities (with regular audits), economic risks (like asset price fluctuations), and governance risks (by ensuring transparent, decentralized processes). Use tools such as multi-signature approvals and time delays on major proposals.

-

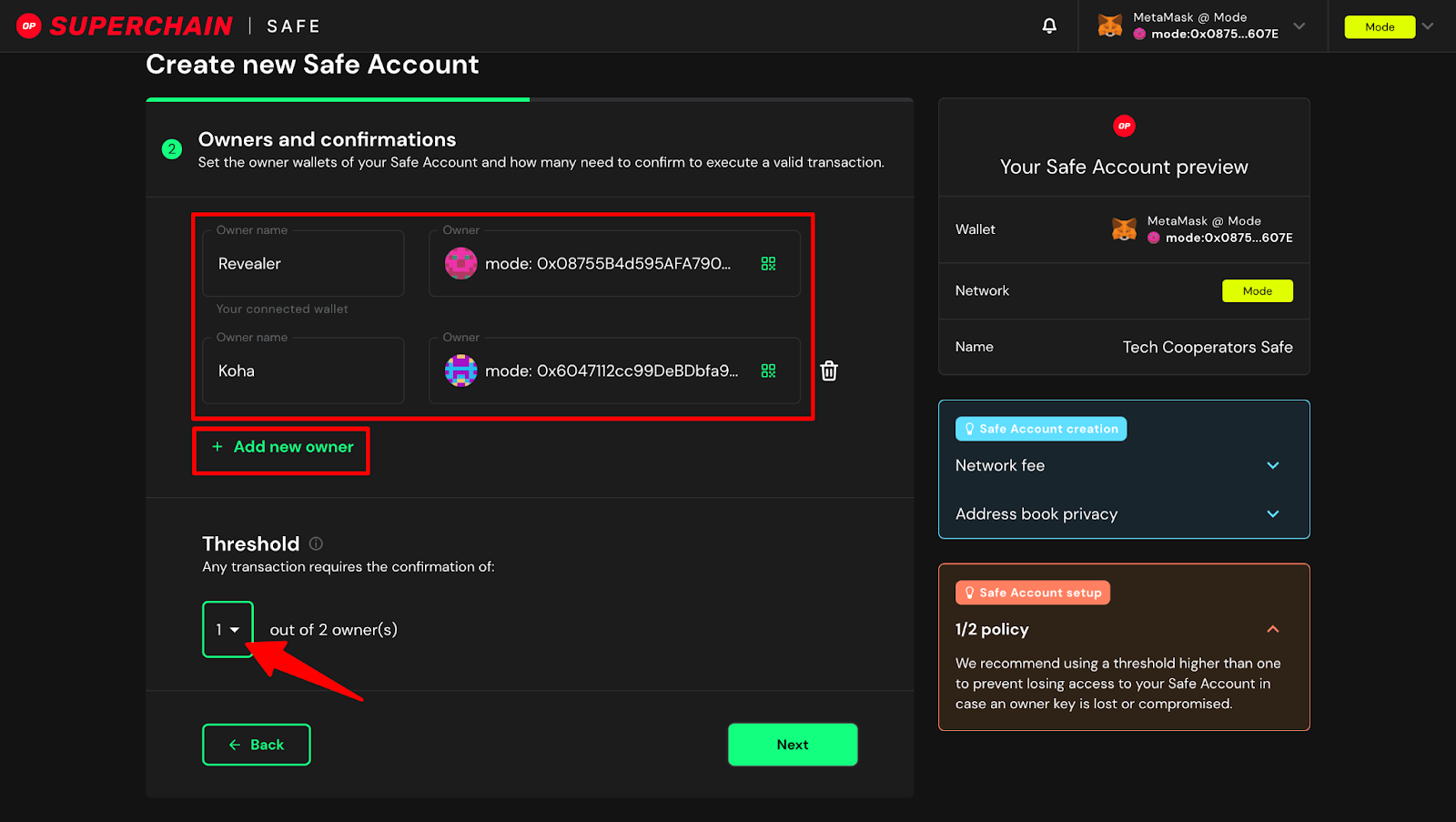

Utilize Multisignature (Multisig) Wallets: Store treasury assets in multisig wallets (e.g., Gnosis Safe), requiring multiple signers for transactions. This setup reduces the risk of unauthorized access and single points of failure, ensuring greater security for DAO funds.

-

Engage in Yield-Generating DeFi Protocols Cautiously: Participate in reputable, audited DeFi protocols (such as Aave or Compound) to generate yield, but prioritize passive and automated strategies. Carefully assess risks like impermanent loss, protocol exploits, and market volatility before allocating treasury funds.

-

Continuously Monitor and Adapt Treasury Strategies: Regularly review treasury performance, risk exposure, and protocol developments. Use analytics tools and dashboards (e.g., DAOhaus) to track assets and adjust strategies in response to evolving market and regulatory conditions.

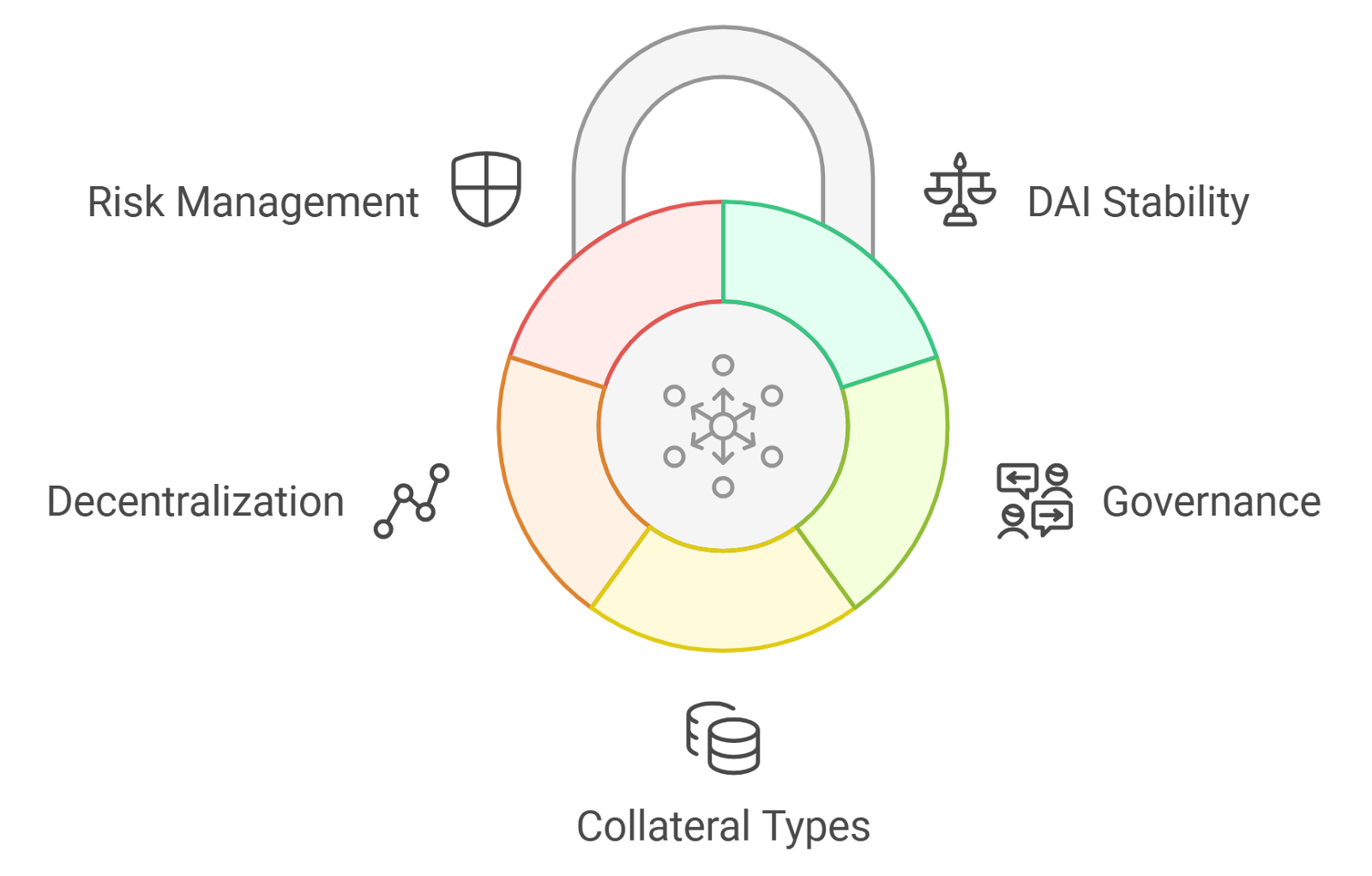

Risk Management Frameworks: From Theory to Automated Practice

The shift from ad hoc decision-making toward institutional-grade risk frameworks marks a watershed moment for on-chain treasury exposure management (Galaxy’s SeC FiT PrO framework). Effective frameworks address:

- Smart Contract Audits: Routine code reviews and third-party audits are non-negotiable (Gate.io analysis). Automated tools now flag vulnerabilities before funds are deployed.

- Economic Stress Testing: Scenario modeling across price shocks (e. g. , sudden drop below $4,500 ETH) ensures capital buffers are adequate.

- Governance Safeguards: Time delays on major proposals and multi-signature requirements reduce attack vectors (solscoop.com).

The sophistication of these frameworks increasingly determines which DAOs survive market stress events versus those who become cautionary tales.

Quantitative rigor is now the standard for DAOs seeking to optimize treasury yield without sacrificing safety. Automated monitoring tools, such as real-time risk dashboards and on-chain analytics, allow treasury managers to track portfolio exposures with precision. These systems can trigger alerts if asset allocations drift beyond set parameters or if protocol risk factors spike unexpectedly. The key is not just having a framework on paper, but embedding it directly into DAO operations through smart contracts and governance automation.

Multisignature wallets remain a foundational security layer, but leading DAOs are moving toward advanced access controls, such as threshold schemes and programmable spending limits, to further reduce single points of failure. When combined with continuous audit trails and transparent reporting, these measures create a robust defense against both internal malfeasance and external threats.

Yield Generation: Navigating the Trade-Off Between Opportunity and Risk

Generating yield from idle assets is essential for capital efficiency, yet it is also where many DAOs have suffered catastrophic losses. The temptation to chase double-digit APYs must be balanced against protocol risk profiles and market volatility. Passive strategies, such as staking blue-chip assets or providing liquidity in audited stablecoin pools, offer lower but more predictable returns compared to high-risk farming or leverage-based protocols.

For example, with ETH at $4,535.60, allocating a portion of the treasury into well-audited ETH staking protocols can provide sustainable yield while minimizing exposure to smart contract exploits. Meanwhile, real-world asset integrations, like tokenized U. S. Treasuries, are gaining traction as DAOs seek to anchor returns in less correlated markets (governance.ether.fi).

Risk-adjusted performance metrics should drive all allocation decisions. Treasury managers must evaluate not only historical returns but also the underlying protocol’s audit history, liquidity depth, and governance transparency.

Continuous Adaptation: Surviving in a Dynamic DeFi Environment

The pace of change in decentralized finance demands constant vigilance. Market conditions shift rapidly, as evidenced by ETH’s recent 24-hour move from $4,636.48 down to $4,510.55, and new threats emerge as protocols evolve or regulatory scrutiny intensifies (Reed Smith LLP). Regular scenario analysis and stress tests are critical for identifying vulnerabilities before they become existential risks.

DAOs that thrive are those that institutionalize learning loops: reviewing past incidents (such as smart contract hacks), updating internal controls based on lessons learned, and iteratively refining their risk models to account for new data points.

Best Practices for DAO Treasury DeFi Risk Management

- Diversify continuously: Rebalance portfolios based on quantitative thresholds, not gut instinct, to reflect evolving market realities.

- Pursue verified yield: Prioritize audited protocols with transparent governance over untested high-yield opportunities.

- Automate oversight: Integrate monitoring tools that can flag anomalous activity or excessive concentration in real time.

- Enforce governance safeguards: Require multi-signature approvals and implement proposal time-locks for significant transactions (solscoop.com).

- Document everything: Maintain detailed records of all treasury actions to support transparency and facilitate post-incident reviews.

The future of DAO treasury management belongs to those who treat risk as a quantitative discipline, not an afterthought, and who build adaptive systems capable of thriving amid volatility.