In the current landscape of decentralized finance, multisig wallets have become the backbone of DAO treasury management. With treasuries often holding millions in digital assets, a robust approach to security and governance is non-negotiable. Recent discussions in the Safe Community Forum and insights from platforms like Request Finance and Colony reinforce that while multisig wallets such as Safe (formerly Gnosis Safe) are the gold standard, their effectiveness hinges on rigorous best practices tailored for on-chain treasury operations.

Why Multisig Wallets Remain Essential for DAO Treasuries

Multisignature wallets require multiple independent approvals to execute transactions, effectively eliminating single points of failure and distributing control among trusted participants. This design not only fortifies security but also aligns with the decentralized ethos of DAOs, ensuring no single actor can unilaterally move funds. As DAOs continue to scale, so does the need for standardized processes that balance operational agility with uncompromising safety.

The Five Pillars of Secure Multisig Treasury Management

Top 5 Best Practices for DAO Multisig Wallets

-

Implement a Robust Multisig Threshold (e.g., 3-of-5 or higher) to Prevent Single Point of Failure. Using a configuration like Safe (formerly Gnosis Safe) with a 3-of-5 threshold ensures that no single signer can unilaterally move funds, balancing security and operational efficiency.

-

Regularly Rotate and Audit Signers to Mitigate Insider Risk and Ensure Active Participation. Periodic review and rotation of signers helps prevent key person risk and ensures that only trusted, active members control treasury access.

-

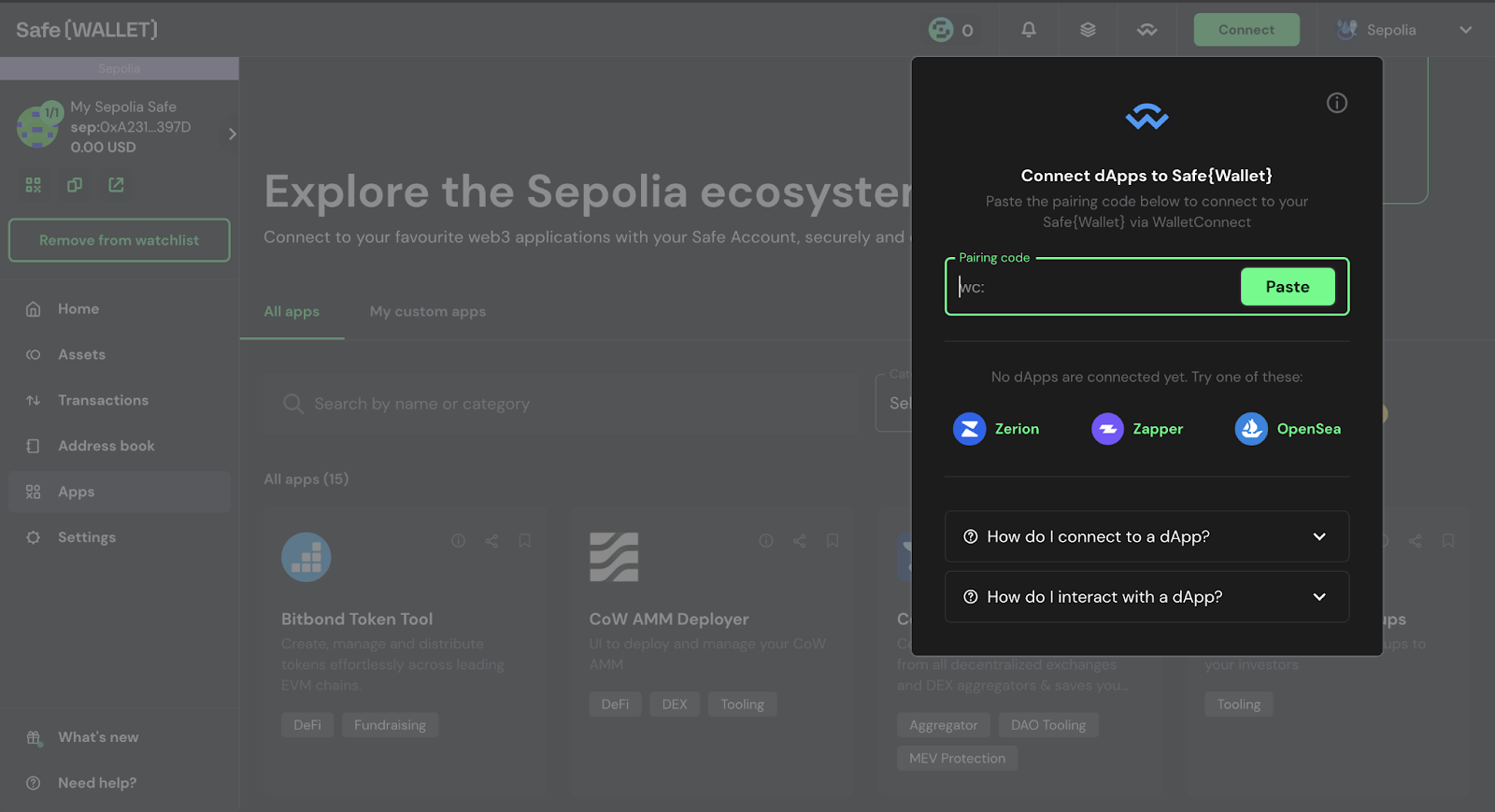

Integrate On-Chain Activity Monitoring and Real-Time Alerts for All Treasury Transactions. Use tools like Safe Transaction Service or Tenderly to monitor wallet activity and receive instant notifications of any transaction attempts.

-

Establish Clear, Transparent Governance Processes for Proposal Submission and Transaction Approval. Document and publicly share the steps for submitting proposals and approving transactions, leveraging on-chain voting platforms such as Snapshot for transparency.

-

Utilize Hardware Wallets or Dedicated Devices for All Signers to Enhance Key Security. Require signers to use hardware wallets like Ledger or Trezor to keep private keys offline and reduce exposure to online threats.

Below are the five most effective and up-to-date best practices every DAO should follow when deploying or managing multisig wallets:

1. Implement a Robust Multisig Threshold

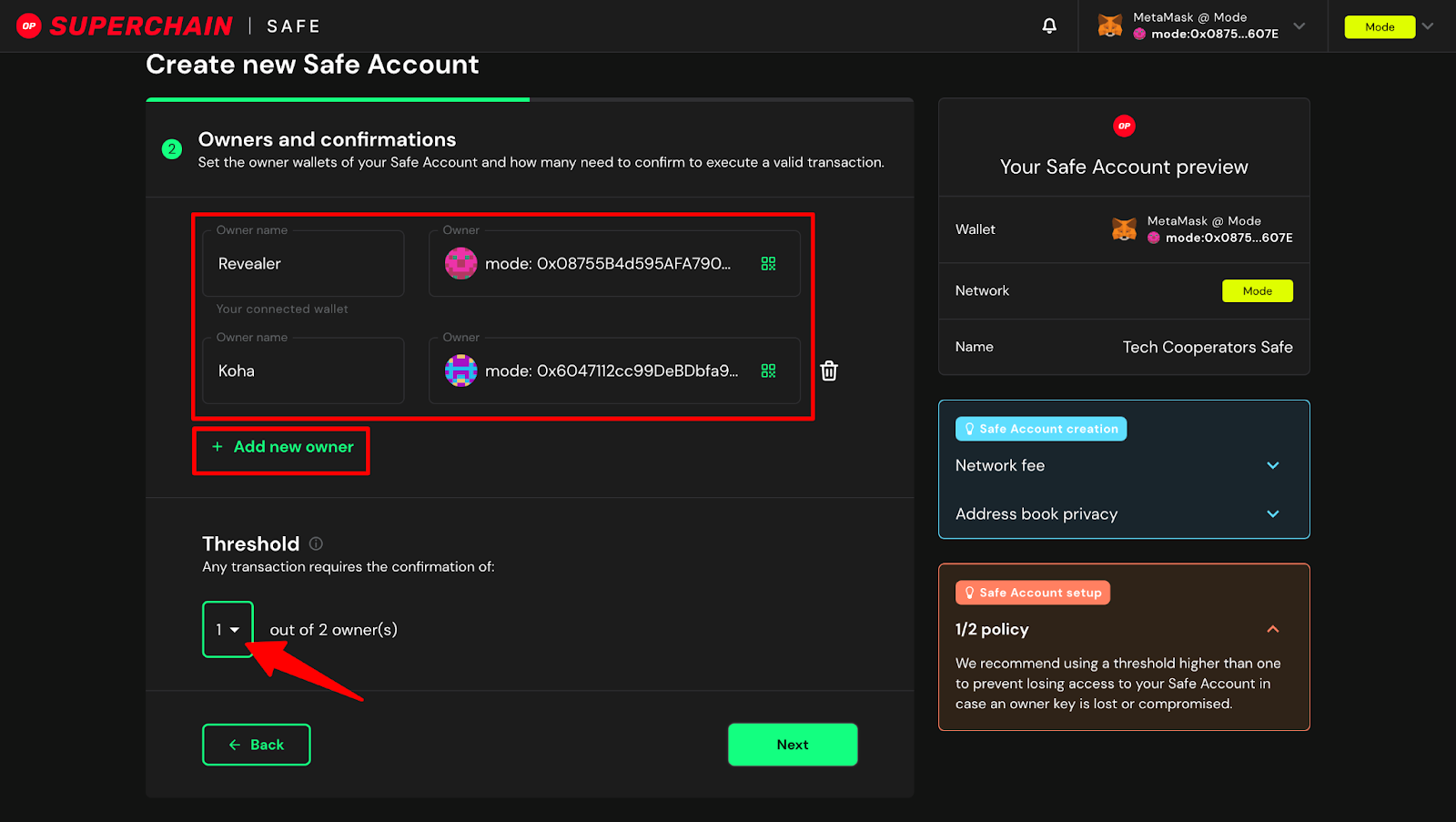

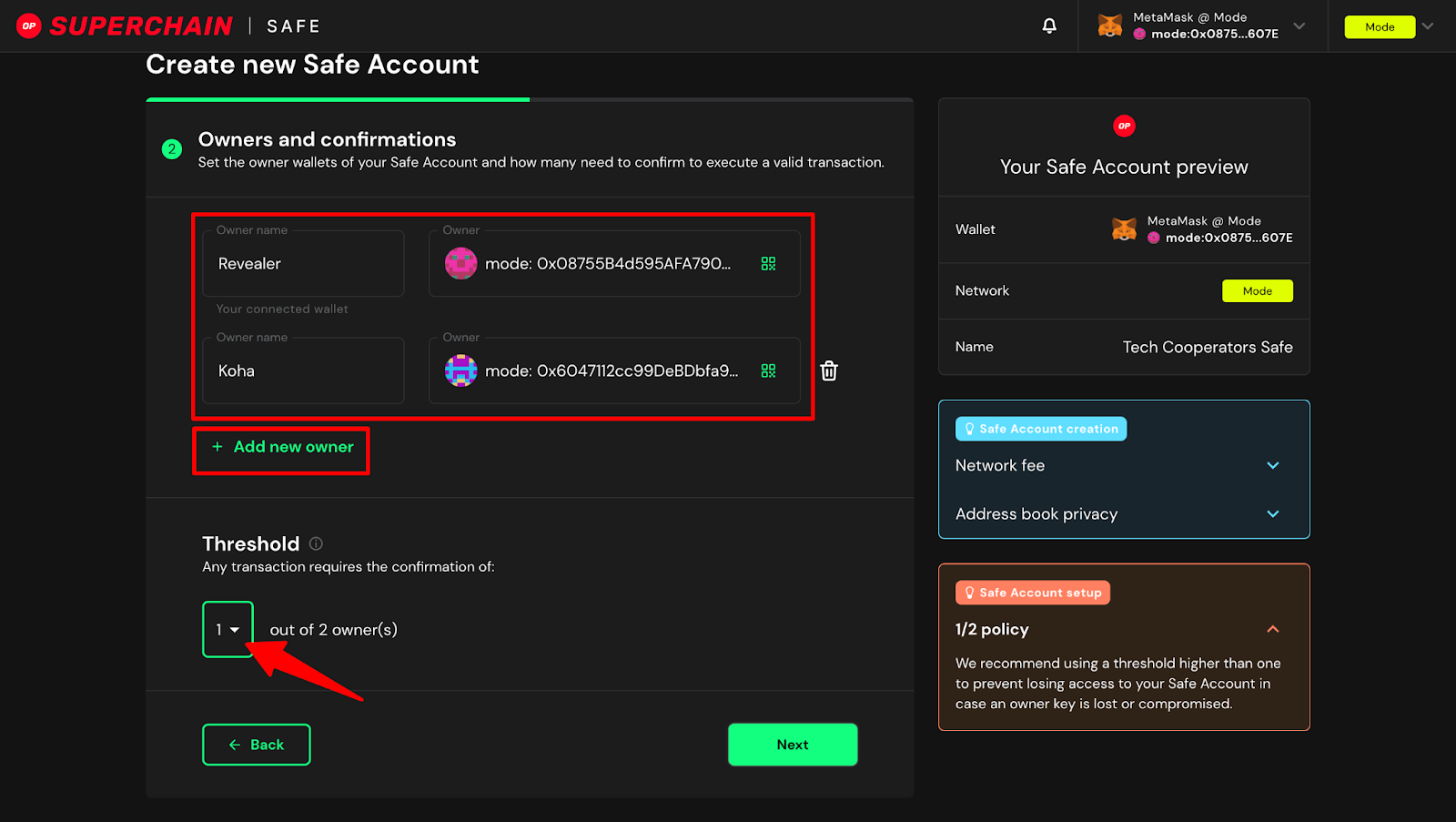

The foundation of any secure treasury starts with setting an appropriate signing threshold. For most medium to large DAOs, a 3-of-5 or higher configuration is recommended. This means that three out of five designated signers must approve any transaction before execution. Such setups prevent unilateral fund movements while maintaining workflow efficiency, critical for responsive treasury operations. The right threshold should consider both asset size and organizational complexity; too low invites risk, too high may cause bottlenecks.

2. Regularly Rotate and Audit Signers

Stagnant signer lists are a breeding ground for insider threats and operational drift. To mitigate these risks, DAOs must regularly rotate signers, verify their activity status, and conduct periodic audits. This ensures that only active, trusted members hold signing authority at any time, reducing exposure to compromised keys or disengaged contributors. Transparent audits further bolster community confidence in treasury stewardship.

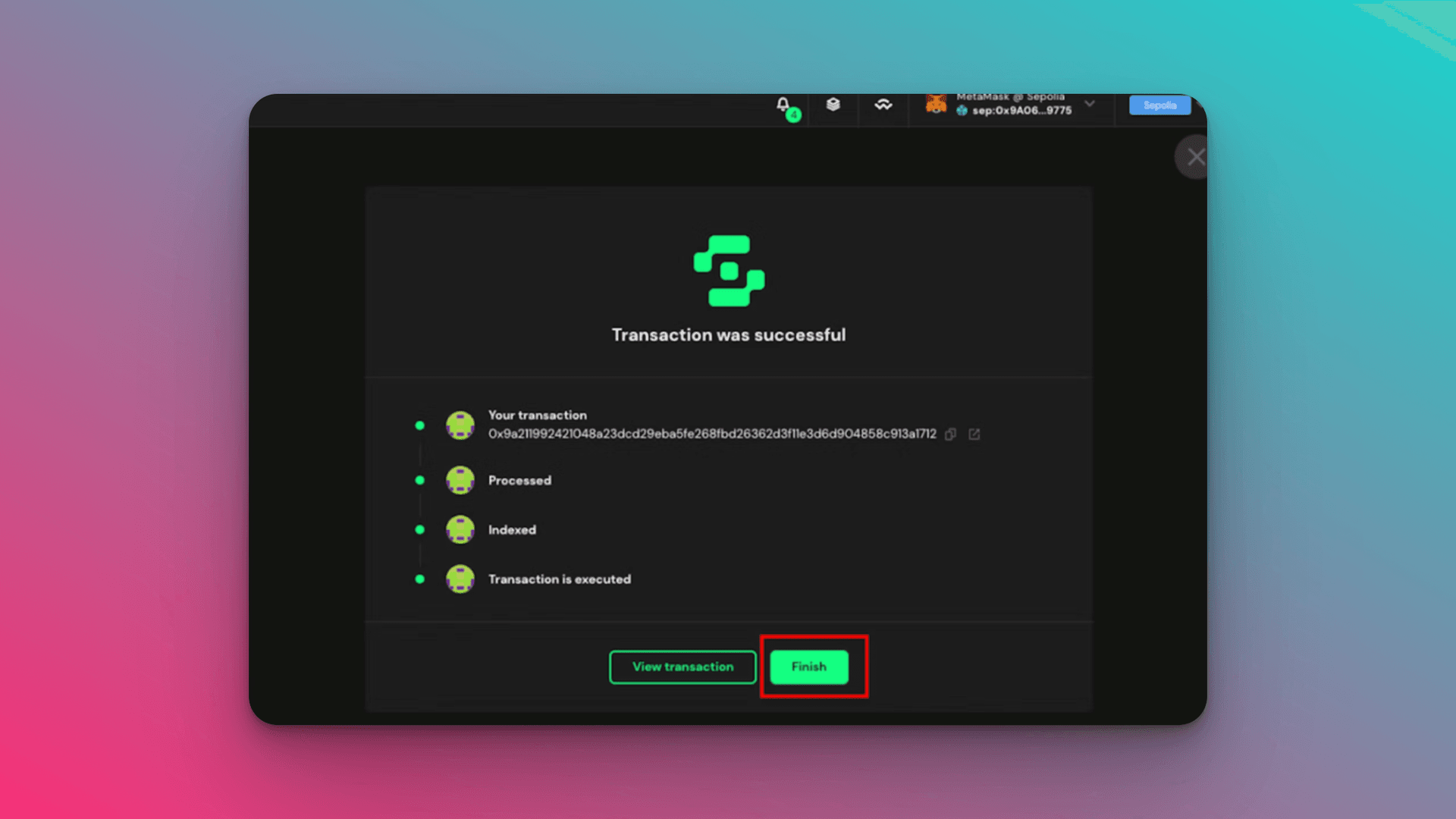

3. Integrate On-Chain Activity Monitoring and Real-Time Alerts

No matter how robust your signer setup is, real-time visibility into on-chain activity is essential for proactive risk management. Integrating monitoring tools that provide instant alerts on all treasury transactions allows teams to detect unauthorized actions or anomalies early, before they escalate into larger incidents. This practice not only protects assets but also reinforces transparency within the community.

The importance of these first three pillars cannot be overstated, they form the frontline defense against both external attacks and internal mishaps in DAO treasury management.

4. Establish Clear, Transparent Governance Processes

Even the most secure multisig setup can fall short if governance is opaque or ad hoc. DAOs should codify processes for proposal submission, deliberation, and transaction approval. This includes documenting how proposals are initiated, who can sponsor them, and what information must be disclosed before a vote. Every step of the decision-making process should be accessible to the community, ideally on-chain or via public repositories. Transparent workflows not only deter collusion but also empower token holders and contributors to participate meaningfully in treasury oversight.

Time-locked transactions are another powerful tool here. By introducing mandatory waiting periods for large or sensitive transfers, DAOs provide an additional window for community review and challenge, further strengthening accountability.

5. Utilize Hardware Wallets or Dedicated Devices for All Signers

Key security is non-negotiable. All signers must use hardware wallets or air-gapped devices to store their private keys offline. This dramatically reduces exposure to phishing attacks, malware, and other online threats that have historically led to catastrophic DAO losses. Key backups should be encrypted and stored in geographically separate locations, never on cloud drives or shared digital notes.

Furthermore, DAOs should regularly review their key management policies as part of broader operational audits. If a signer’s device is lost or compromised, protocols for rapid revocation and replacement must be in place to maintain treasury integrity.

Checklist: Secure Hardware Wallet Practices for DAO Multisig Signers

-

Implement a Robust Multisig Threshold (e.g., 3-of-5 or higher) to Prevent Single Point of Failure: Ensure your Safe (formerly Gnosis Safe) multisig wallet requires multiple independent approvals—such as a 3-of-5 setup—to authorize transactions. This setup significantly reduces the risk of compromise from any single signer.

-

Regularly Rotate and Audit Signers to Mitigate Insider Risk and Ensure Active Participation: Schedule periodic reviews of signer activity and replace inactive or compromised signers. Use Safe’s built-in features to manage and update signer lists securely, minimizing the risk of insider threats.

-

Establish Clear, Transparent Governance Processes for Proposal Submission and Transaction Approval: Document and publicly share the steps for submitting proposals, voting, and approving transactions. Leverage platforms like Snapshot for off-chain voting and ensure all decisions are visible to the DAO community.

Bringing It All Together: Multisig Wallets as the Backbone of On-Chain Treasury Security

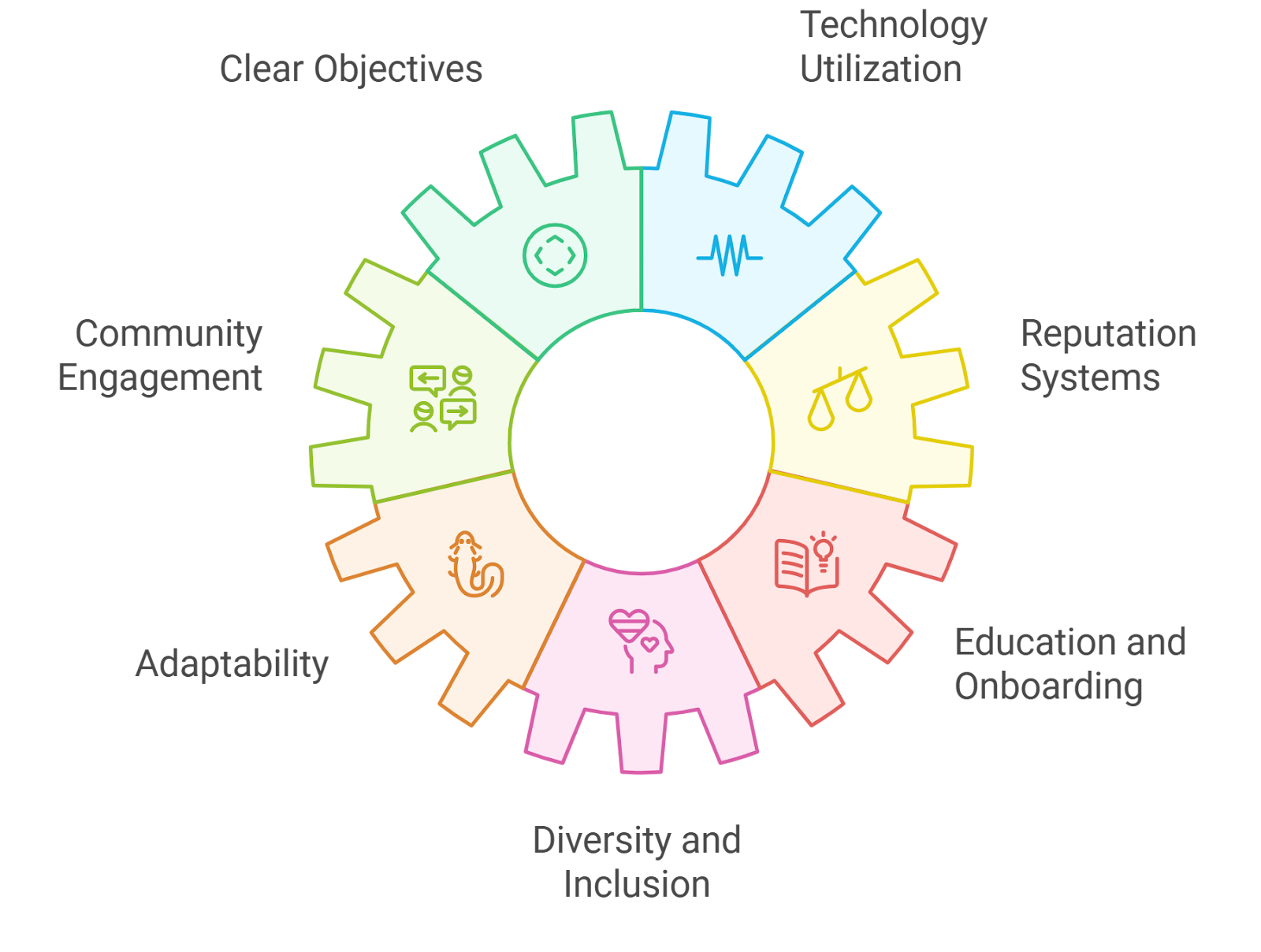

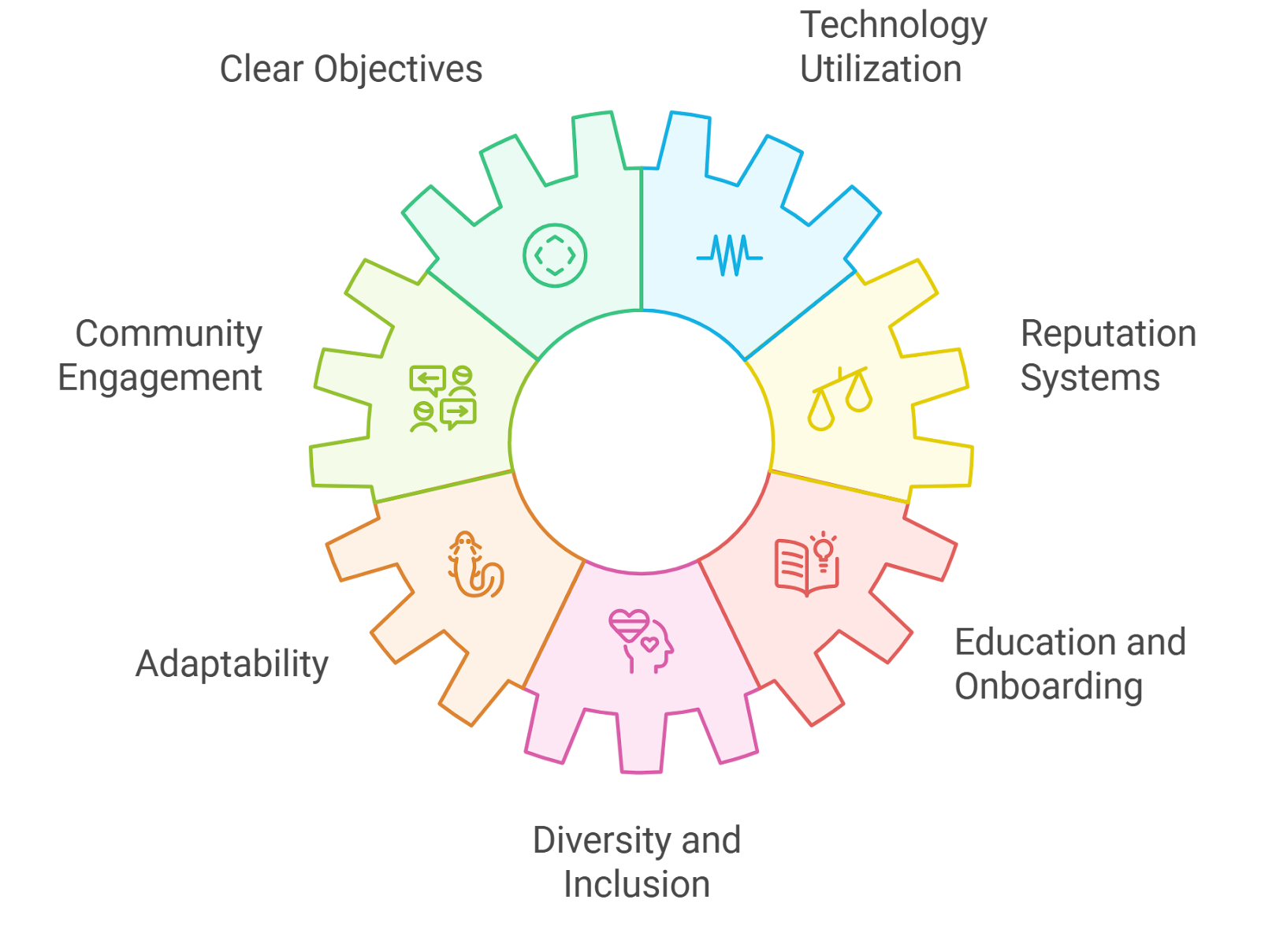

The intersection of these five best practices, robust thresholds, active signer management, real-time monitoring, transparent governance, and uncompromising key security, creates a resilient framework for DAO treasuries in 2025 and beyond. As recent cases have shown on platforms like Safe Community Forum and Colony Blog, lapses in any one area can undermine even the most sophisticated setups.

For DAOs seeking both operational agility and ironclad security, multisig wallets remain indispensable. But technology alone is not enough; it’s the disciplined application of these practices that transforms a wallet from just another smart contract into a trusted vault for collective assets.

As decentralized organizations grow more complex, and as treasuries swell with new capital inflows, the importance of standardized multisig management will only intensify. By adhering to these proven strategies, DAOs can safeguard their assets while building lasting trust within their communities.