In 2026, DAO treasury diversification stands as a cornerstone of on-chain treasury optimization, compelling organizations to shift from heavy reliance on native governance tokens toward balanced portfolios of ecosystem assets. With dozens of DAOs still parking over 80% of their treasuries in single tokens, as noted in recent Shift analyses, the risks of volatility and illiquidity loom large. Yet, forward-thinking treasurers are pioneering strategies that not only mitigate these pitfalls but also unlock yield potential across DeFi’s maturing landscape. By holding multiple ecosystem tokens, DAOs can fortify resilience, fuel operations, and position for growth in a multi-chain world.

This evolution aligns with broader trends: U. S. -based DAOs embracing multi-chain deployments despite cross-chain bottlenecks, per SUAS research, and protocols like Lido prioritizing buybacks alongside yield strategies. The imperative is clear: diversify into correlated yet complementary assets to weather market cycles while capturing upside from infrastructure plays and Layer 2 scaling solutions.

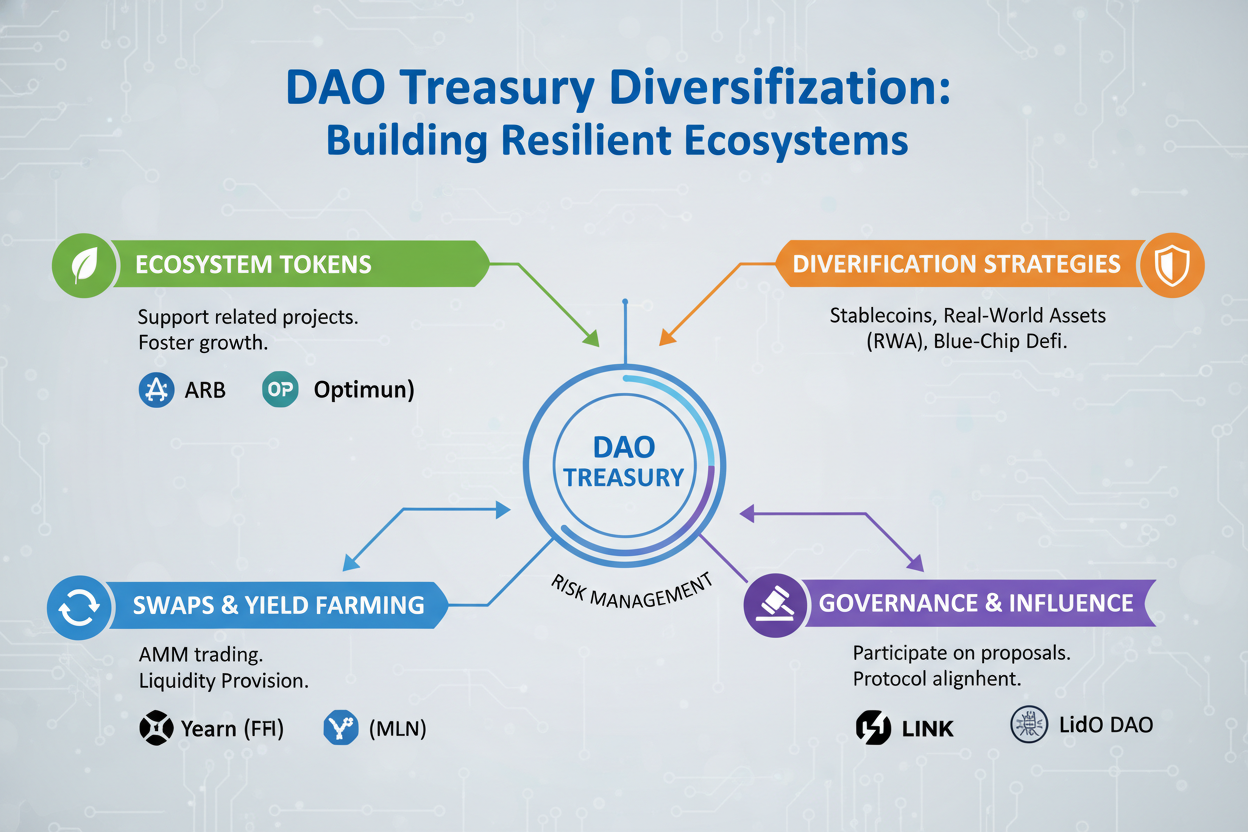

Governance Token Swaps with Partner Protocols

Pioneered as a collaborative powerhouse, governance token swaps enable DAOs to exchange portions of their native holdings for partner protocol tokens, instantly broadening exposure without outright sales that could signal distress. Two Sigma Ventures highlights this model’s treasury diversification benefits, fostering symbiotic relationships that enhance ecosystem interoperability. Imagine a gaming DAO swapping its tokens with a DeFi lender’s governance asset; both parties gain utility-aligned holdings, reducing single-token risk while amplifying network effects.

In practice, these swaps are executed via on-chain mechanisms, often with time-locked vesting to align incentives. For DAO operators, this strategy empowers treasury managers to negotiate value-accretive deals, turning potential liabilities into strategic assets. Early adopters report 15-25% portfolio stability gains, per onchaintreasury. org insights on DAO treasury diversification strategies.

Strategic Allocation to Layer 2 Ecosystem Tokens like ARB, OP, and MATIC

Layer 2 tokens represent the scaling vanguard, and allocating 10-20% of treasuries to ARB, OP, or MATIC tokens equips DAOs for the blockchain rails maturing into credible infrastructure, as Galaxy’s 2026 M and A insights forecast. These assets correlate with Ethereum’s growth but offer discounted entry to high-throughput ecosystems, ideal for DAOs with dApp deployments or user bases demanding low fees.

Consider Optimism’s OP token: its governance utility ties directly to sequencer revenue sharing, providing yields that outpace many L1 alternatives. ARB’s ecosystem grants further incentivize holdings, while MATIC’s Polygon evolution ensures liquidity. This allocation strategy, rooted in DAO ecosystem token holdings, demands rigorous due diligence on sequencer risks and upgrade paths, yet it transforms treasuries into active participants in DeFi’s efficiency revolution.

Infrastructure Token Holdings for Long-Term Utility with LINK and LDO

Betting on primitives like Chainlink’s LINK and Lido’s LDO anchors DAO treasuries in indispensable infrastructure, tokens that underpin oracles and liquid staking across chains. LINK’s role in secure data feeds makes it a bulwark against manipulation, while LDO captures restaking yields amid 2025’s tokenholder updates emphasizing growth priorities. Holding these for utility, not speculation, aligns with DAO risk management 2026 tenets, offering deflationary mechanics and protocol fees as tailwinds.

DAOs like those leveraging Lido’s staking pools have seen compounded returns from buybacks and LST integrations, per their November 2025 recaps. Pairing 5-15% allocations here with stablecoin buffers creates a hybrid fortress: volatile upside buffered by proven utility. This approach, echoed in Request Finance’s structuring guides, centralizes flows while diversifying into tokens with real economic capture.

Transitioning to these holdings requires governance proposals that model worst-case drawdowns, yet the empowerment is profound: treasuries evolve from passive vaults to yield-optimizing engines.

On-chain index funds and baskets democratize diversification, allowing DAOs to assemble passive portfolios of ecosystem tokens without the overhead of manual selection. Platforms like Set Protocol or Index Coop enable customizable baskets weighted toward blue-chip DeFi assets, Layer 2 scalers, and infrastructure plays, mirroring traditional ETFs but fully programmable on-chain. This strategy sidesteps the pitfalls of over-concentration, as evidenced by Tally’s 2025 wrap-up where voters greenlit idle asset deployments into liquid staking and yield pools with near-unanimous support.

On-Chain Index Funds and Baskets for Broad Exposure

By pooling tokens such as ARB, LINK, and OP into a single vault, DAOs achieve DAO ecosystem token holdings that track sector indices, capturing broad upside while diluting idiosyncratic risks. Take a DeFi index basket: 30% LSTs like LDO, 25% L2s, 20% oracles via LINK, balanced with lending governance tokens. Governance sets reweighting thresholds, executed atomically via smart contracts, ensuring treasuries remain aligned with market rotations.

This approach shines in 2026’s transitional crypto landscape, per Galaxy’s M and A outlook, where evolving rails demand exposure beyond native tokens. Early implementations, like those in LimeChain’s treasury guides, report 8-12% annualized yields from fee accruals alone, plus alpha from composability. For risk-averse operators, starting with 15% treasury allocation to these baskets builds conviction gradually, transforming treasuries into set-it-and-forget-it growth engines.

Automated Rebalancing Vaults via DeFi Protocols like Yearn or Enzyme

The pinnacle of on-chain treasury optimization arrives with automated rebalancing vaults, where protocols like Yearn Finance or Enzyme execute dynamic adjustments based on predefined rules. These vaults ingest diverse ecosystem tokens – from OP and MATIC to LINK and partner swaps – continuously optimizing for yield while enforcing drift limits, such as no more than 10% deviation from target weights. In a volatile 2026, this automation proves indispensable, adapting to L2 sequencer shifts or oracle upgrades without quorum delays.

Enzyme’s modular vaults, for instance, support custom strategies with on-chain accounting, ideal for DAOs centralizing flows as Request Finance advocates. Yearn’s vaults layer meta-strategies atop baselayers, harvesting yields from lending, LSTs, and even tokenized RWAs for compounded returns. Pair this with stablecoin allocations – converting 20-30% native tokens to USDC vaults yielding 5% and via MakerDAO’s DSR – and treasuries become antifragile. Recent adopters, inspired by Decentraland’s liquidity builds, have slashed operational drag by 40%, redirecting focus to grants and innovation.

Implementing these demands upfront governance: model scenarios with cross-chain frictions highlighted in SUAS reports, integrate privacy layers for competitive edges as Garima Singh’s sovereign treasury vision outlines, and audit vaults rigorously. Yet the payoff empowers DAO stewards to orchestrate treasuries like conductors, blending swaps, L2 bets, infrastructure anchors, indices, and auto-vaults into a symphony of resilience.

Forward DAOs blending these strategies – fortified by stablecoin buffers and RWA yields hitting $33B mid-2025 – not only survive cycles but thrive, funding visions from multi-chain expansions to community bounties. As blockchain infrastructure solidifies, treasury diversification evolves from defensive play to offensive weapon, securing decentralized futures one balanced allocation at a time.