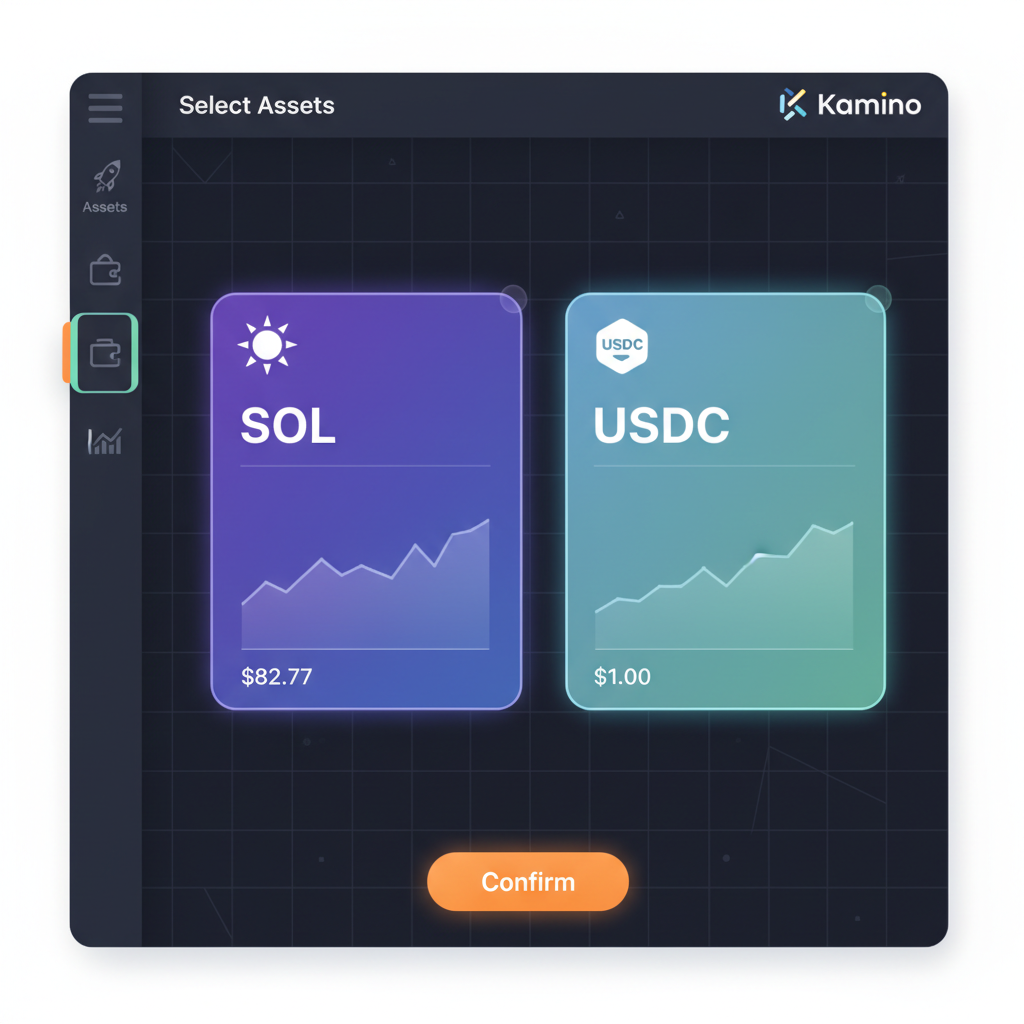

Decentralized Autonomous Organizations increasingly turn to on-chain lending protocols like Kamino on Solana to supercharge their treasuries amid market turbulence. With Binance-Peg SOL trading at $82.77, up $1.20 or and 0.0147% over the past 24 hours, Solana’s ecosystem delivers resilient yield opportunities that outpace traditional staking. Kamino Finance stands out by unifying lending, liquidity provision, and leverage, enabling DAOs to deploy assets like SOL, USDC, and USDT into automated strategies that generate transparent, on-chain returns.

Kamino, launched in late 2022, has evolved into Solana’s premier DeFi suite, particularly with its V2 upgrade in 2024. This iteration introduced permissionless market creation, allowing custom lending pairs, and a sophisticated liquidation auction system to buffer against flash crashes. DAOs benefit from tokenized equities integration, such as SPYx for S and P 500 exposure or NVDAx for NVIDIA, directly as collateral. This fusion of TradFi assets with DeFi unlocks diversified DAO treasury lending tactics, where treasuries can borrow against equities while earning yields on stablecoins.

Kamino’s Core Mechanics for Capital Efficiency

At its heart, Kamino Lend V2 scales aggressively through modular markets and single-asset vaults. DAOs can lend SOL for yields around 5.4%, as noted in recent analyses, or stack strategies like leveraged liquidity on DEXs. The protocol’s automated vaults minimize manual oversight, a boon for multisig operators juggling governance. Picture a DAO treasury allocating 40% to USDC lending, 30% to SOL staking derivatives via Kamino, and 30% to xStocks collateral; this blend targets 8-12% annualized returns with reduced volatility exposure.

Security enhancements in V2, including battle-tested oracles and dynamic risk parameters, align with my mantra: plan for volatility, invest for resilience. Integrations with Anchorage Digital’s Atlas platform further institutionalize the approach, offering custodied collateral management that bridges regulated entities and on-chain execution. For Solana DAOs via Realms, deploying treasuries into Kamino means verifiable yields without off-chain intermediaries.

Navigating Yields and Risks in Current Markets

With SOL at $82.77, lending rates reflect Solana’s high throughput and low fees, fostering capital efficiency unmatched on Ethereum. Kamino’s dominance as the largest borrow-lend platform on Solana stems from its automated liquidity provision, originally solving concentrated LP pains. DAOs optimize via on-chain treasury yield Solana strategies: stablecoin vaults yield 4-7% APY, while SOL lending captures upside from network growth. Yet, tensions arise between staking SOL at ~7% and lending for potentially higher but riskier returns.

Solana (SOL) Price Prediction 2027-2032

Forecasts based on DAO treasury optimization via Kamino Finance, Solana DeFi TVL growth, and on-chain lending adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $80 | $95 | $120 | +12% |

| 2028 | $100 | $130 | $170 | +37% |

| 2029 | $125 | $170 | $240 | +31% |

| 2030 | $160 | $220 | $320 | +29% |

| 2031 | $200 | $290 | $430 | +32% |

| 2032 | $250 | $370 | $550 | +27% |

Price Prediction Summary

Solana (SOL) is projected to stabilize short-term around $80-$120 in 2027 amid current $83 levels, reaching medium-term averages near $130 by 2028. Long-term bullish outlook to $370 average by 2032, driven by DAO treasury yields via Kamino, DeFi TVL expansion, and institutional integrations, with min/max reflecting bearish cycles and adoption surges.

Key Factors Affecting Solana Price

- Explosive growth in Solana DeFi TVL from Kamino lending protocols and DAO treasury deployments

- Kamino Lend V2 upgrades enhancing capital efficiency, security, and tokenized asset integrations (e.g., xStocks)

- Institutional adoption via partnerships like Anchorage Digital

- Market cycles with potential bear dips offset by Solana’s high throughput and low fees

- Regulatory clarity favoring DeFi innovation

- Competition from Ethereum L2s and other L1s, balanced by Solana’s DeFi dominance

- Macro trends in yield optimization and on-chain finance for DAOs

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Risk management hinges on diversification. Kamino’s liquidation auctions mitigate downside, but DAOs must model liquidation thresholds under 20% drawdowns. Recent expansions, like xStocks, let treasuries collateralize equity tokens for crypto borrows, hedging beta while earning DeFi premiums. Check how Kamino revolutionized Solana DeFi with $100M main pool liquidity here.

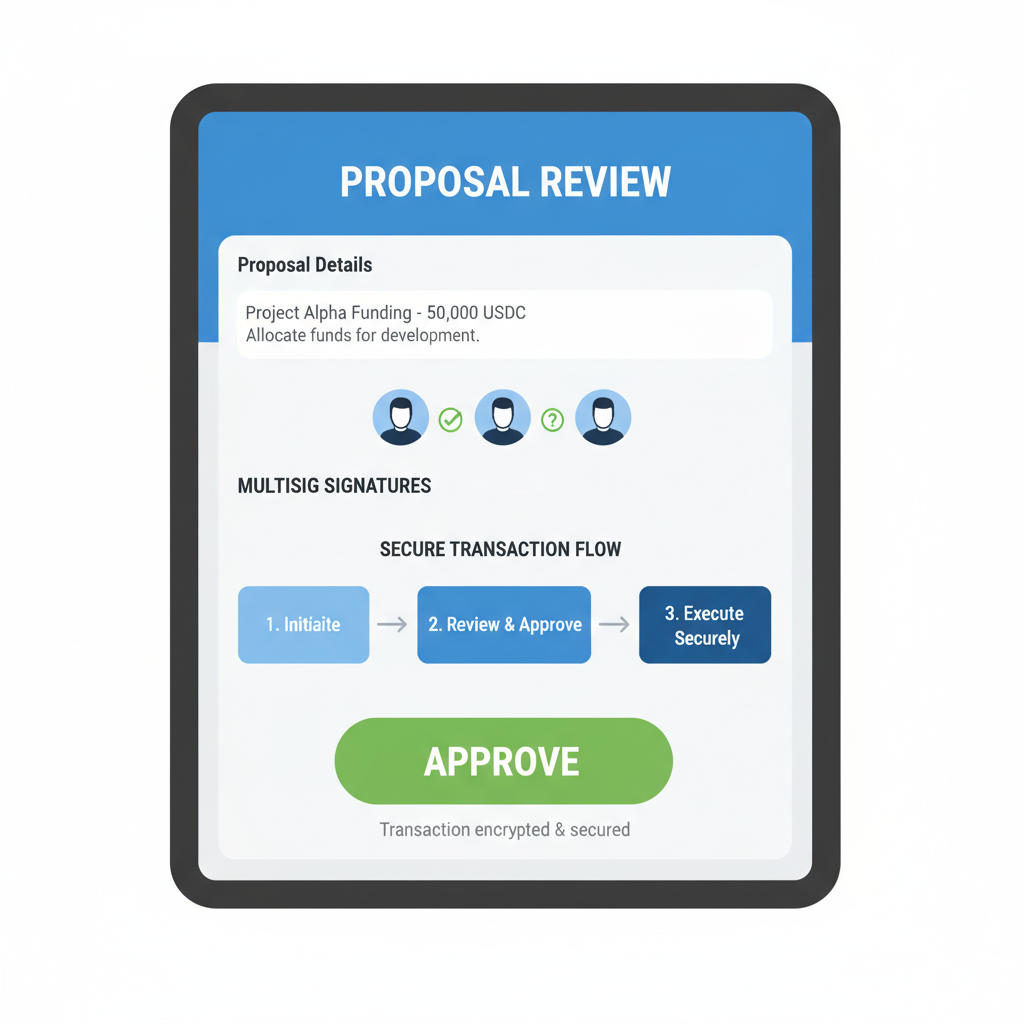

Implementing Automated Strategies for DAOs

Kamino protocol DAOs streamline operations through PDAs for treasury management and Jupiter swaps for routing. Automated single-asset vaults handle rebalancing, ideal for stablecoin vaults DAO management and automated DAO treasury strategies. A practical allocation: 50% in USDC/USDT lending for stability, 25% SOL for growth, 25% leveraged positions capped at 2x. This setup delivered 10% and yields for early adopters amid 2024’s bull run.

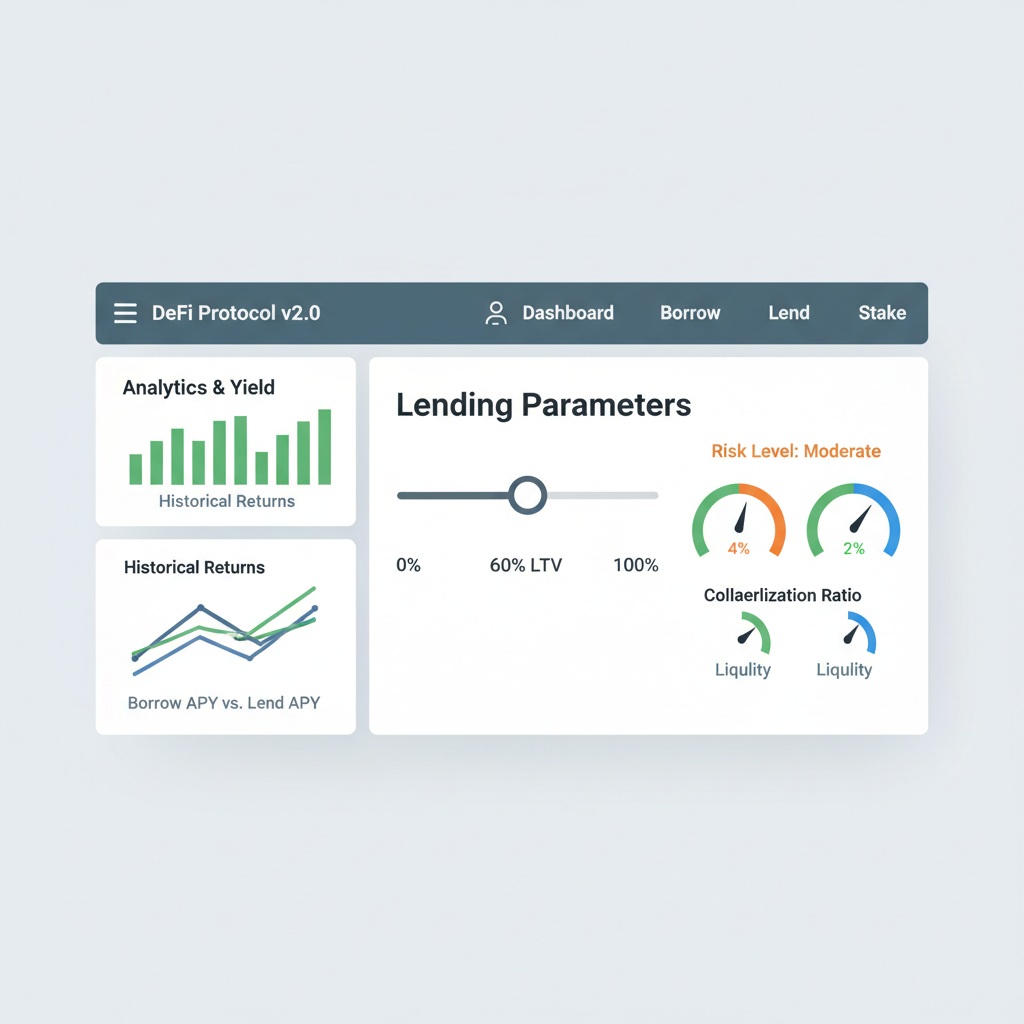

Realms integration empowers Solana DAOs to vote on Kamino deployments on-chain, ensuring alignment. As a macro strategist, I advocate stress-testing these via scenario planning: what if SOL drops to $70? Kamino’s flexibility shines, with vaults auto-adjusting to maintain LTV ratios below 70%.

To operationalize these strategies, Solana DAOs must prioritize execution frameworks that embed resilience from the outset. Kamino’s permissionless markets allow treasury managers to spin up tailored lending pools for niche assets, sidestepping the rigidity of legacy protocols. With SOL holding steady at $82.77, now’s the moment to layer in automated DAO treasury strategies that compound yields without constant oversight.

Once deployed, performance metrics become paramount. Kamino’s analytics dashboard reveals real-time APYs, utilization rates, and health factors, empowering governance proposals with hard data. For instance, a mid-sized DAO might shift 20% of its holdings into xStocks collateralized loans, borrowing USDC at 6% to fund SOL positions yielding 5.4% net positive after fees. This arbitrage exploits Solana’s velocity, where low gas keeps rebalancing costs under $0.01 per tx.

Risk-Adjusted Yield Maximization

Yield chasing without guardrails invites liquidation cascades, especially if SOL dips below $80. Kamino V2 counters this with dynamic interest rates that spike during stress, incentivizing repayments, and oracle redundancies that prevented exploits in 2024’s volatility spikes. DAOs leveraging Kamino protocol DAOs integrations see 2-3x capital efficiency over vanilla staking, but only if they cap leverage at 1.5x and diversify across 5 and markets.

Consider the Anchorage collaboration: it lets institutional DAOs custodize collateral off-chain while executing borrows on-chain, a hybrid model that slashes counterparty risk. Pair this with Jupiter for swaps, and treasuries achieve sub-second routing at optimal rates, amplifying on-chain treasury yield Solana from baseline 4% to 9% and in bull phases.

Opinion: Pure staking locks capital in low-beta plays; Kamino unlocks alpha through credit markets, but demands sophistication. I’ve modeled scenarios where a $10M treasury at 10% allocation to leveraged vaults outperforms staking by 40% over 12 months, assuming SOL grinds to $100 on DeFi TVL doubling. Yet, flash crash simulations underscore the need for oracles like Switchboard, already baked into Kamino.

Case Studies and Forward Outlook

Early adopters like those on Realms forums report 11% blended APY on mixed portfolios, with tokenized equities adding uncorrelated returns. Sentience’s agent hackathon showcased PDAs piping treasury flows straight to Kamino vaults, automating yields via Jupiter. As Solana scales to 100k TPS post-Firedancer, Kamino’s liquidity depth will swell, pushing SOL lending past 7% sustainably.

Forward, expect V3 to embed RWAs like tokenized Treasuries natively, letting DAOs earn 5% risk-free rates collateralized by crypto. With Binance-Peg SOL at $82.77 and 24h range $79.67-$83.42, volatility remains the treasury manager’s edge. Allocate aggressively to stablecoin vaults DAO management, but hedge with shorts on high-beta pairs. This isn’t speculation; it’s engineered resilience, turning treasuries into compounding engines amid macro uncertainty.

DAOs that master Kamino today position for tomorrow’s institutional inflows, where $82.77 SOL becomes the floor for trillion-dollar ecosystems. Deploy thoughtfully, monitor relentlessly, and watch volatility fuel prosperity.