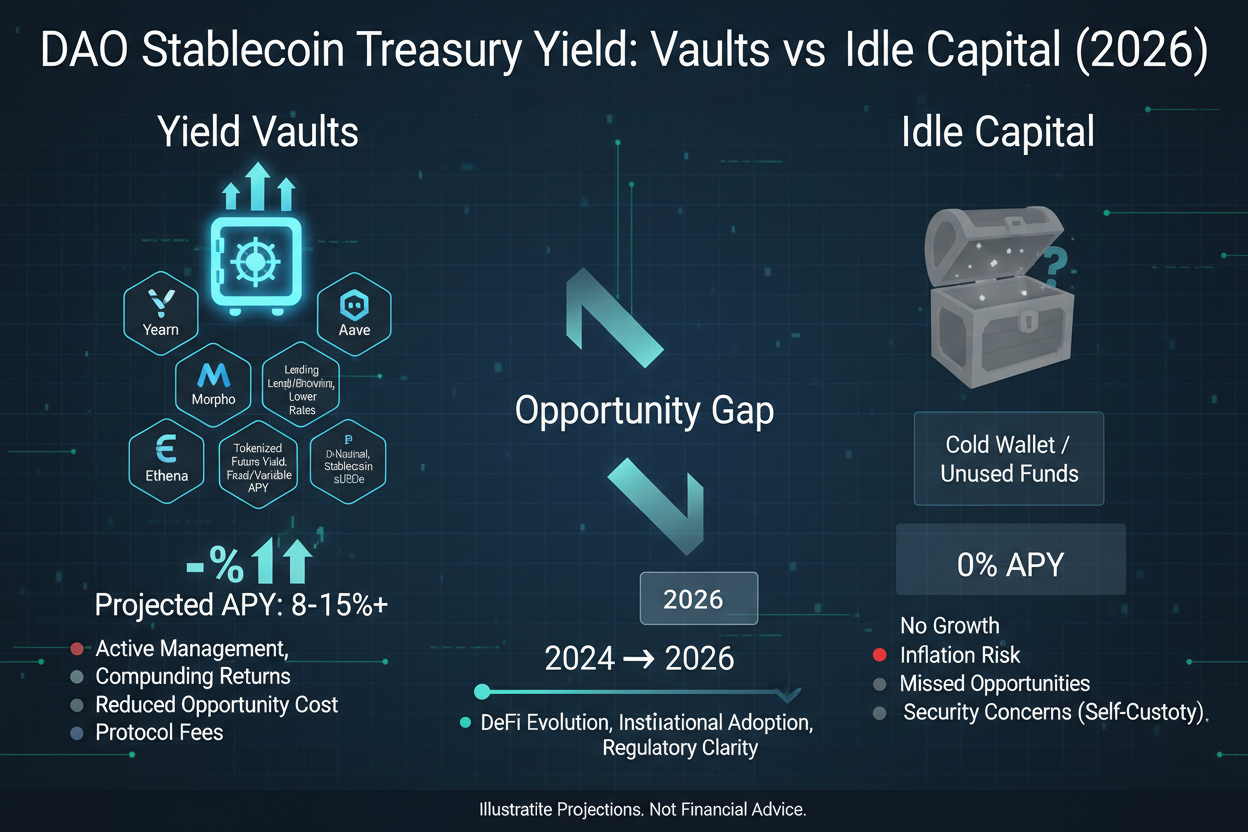

In 2026, DAOs manage over $20 billion in stablecoin treasuries, yet much of this capital sits idle, earning zero yield amid volatile markets. This inefficiency drains opportunity costs, as on-chain treasury vaults now offer risk-adjusted returns from 3% to 8% APY. Intent-based architectures and automated protocols have matured, transforming stablecoins from mere base assets into yield-generating engines. DAOs adopting these DAO stablecoin yield strategies not only combat idle capital but also align treasury operations with governance mandates for sustainable growth.

Recent DeFi evolution underscores stablecoins’ role as the monetary base in a layered financial system. Platforms like Aave, Yearn, and emerging solvers enable precise capital deployment, blending crypto-native mechanics with real-world asset exposure. Treasury managers must prioritize strategies that balance liquidity, security, and returns, especially as regulatory clarity bolsters stablecoin adoption.

Intent-Based Yield Optimization via Anoma Solvers

Anoma Solvers represent a paradigm shift in automated DAO treasury management, allowing DAOs to express intents like “maximize USDC yield under 2% volatility. ” Solvers then atomically execute across fragmented DeFi markets, sourcing optimal rates without manual intervention. For DAO treasuries, this means deploying millions into dynamic pools while maintaining composability.

Consider a mid-sized DAO with $10 million in USDC: Anoma routes funds to high-efficiency lending, liquidity provision, and restaking in one transaction. Historical data shows 5-7% APY with reduced gas costs via intent fulfillment. Risks include solver centralization, though decentralized networks mitigate this. Governance proposals can encode intents on-chain, ensuring alignment.

Ethena sUSDe Vaults for Delta-Neutral Yields

Ethena’s sUSDe vaults deliver delta-neutral yields by staking USDe against hedged futures positions, shielding DAOs from directional crypto bets. This strategy suits conservative treasuries seeking stable 4-6% APY, backed by transparent collateral in Treasuries and BTC derivatives. Unlike traditional lending, sUSDe accrues value passively, ideal for idle DAO treasury optimization.

Integration is seamless: DAOs deposit USDC, receive sUSDe, and redeem anytime with minimal slippage. In 2026’s low-yield environment, sUSDe outperforms base rates by capturing funding premiums. Key metric: insurance fund coverage exceeds 200%, per protocol dashboards. DAOs like those in DeFi alliances report 15% treasury growth annually via this vault, underscoring its reliability.

Risk-Adjusted APY Comparison

| Strategy | APY Range | Risk Profile |

|---|---|---|

| Anoma Solvers | 5-7% | Low Volatility |

| Ethena sUSDe | 4-6% | Neutral |

| Morpho Blue | 6-8% | Custom |

Morpho Blue Custom Stablecoin Lending Pools

Morpho Blue empowers DAOs to curate bespoke lending pools, isolating USDC supply to preferred borrowers or collateral types. This granular control yields 6-8% APY on tailored risk profiles, surpassing generic markets. Vaults auto-rebalance via oracles, optimizing for supply-demand dynamics.

For example, a DAO focused on RWA collateral can set LTV ratios at 80%, borrowing against tokenized T-Bills for compounded returns. Morpho’s permissionless vaults reduce counterparty risk through on-chain verification. Analytics from 2025 show 20% higher efficiency than Aave V3 baselines. Treasury managers vote on pool parameters, embedding governance directly into yield generation. As stablecoin ecosystems mature, Morpho Blue stands out for scalability in DAO deployments.

Pendle Fixed-Yield PT-USDC Markets offer DAOs a way to lock in predictable returns by trading principal tokens (PT-USDC) separated from yield tokens (YT-USDC). This fixed-yield mechanism appeals to risk-averse treasuries, securing rates like 5% APY for six months amid fluctuating DeFi markets. DAOs buy PT-USDC at a discount, redeeming at par value plus accrued yield, effectively turning idle USDC into bonded income streams.

Precision matters here: market data from early 2026 shows PT-USDC trading at 98% of face value for 4.5-5.5% fixed yields, sourced from underlying lending protocols. Governance can approve batch purchases via on-chain votes, with liquidity sourced from Pendle’s AMM. Compared to floating rates, this shields against rate drops, as seen in late 2025 when base APYs fell below 3%. Drawbacks include opportunity costs if spot yields surge, but for stablecoin vaults for DAOs, Pendle provides contractual certainty.

Yearn V3 Automated Meta-Strategies for USDC

Yearn V3 elevates automated DAO treasury management with meta-strategies that dynamically allocate USDC across DeFi primitives, chasing 4-7% APY through algorithmic rebalancing. Unlike static vaults, V3 employs AI-like optimization, routing to Aave, Curve, or Convex based on real-time emissions and utilization. DAOs benefit from hands-off operations, as strategies compound harvests automatically.

A practical case: a DAO treasury of $5 million in yvUSDC-v3 captures slippage-minimized swaps and fee captures, outperforming manual farming by 15-20% per Yearn audits. Security audits cover 2026 upgrades, including shield mechanisms against exploits. Integration with governance tools like Safe allows snapshot-triggered deposits, aligning yields with community priorities. In a maturing DeFi landscape, Yearn V3 stands as the benchmark for set-it-and-forget-it DAO stablecoin yield.

Aave V3 High-Efficiency Stablecoin Supply Positions

Aave V3 refines stablecoin supply with efficiency modes, enabling DAOs to earn 3-6% APY on USDC while supplying to high-utilization markets. Features like e-mode bundle correlated assets, boosting capital efficiency up to 20% over V2. Risk isolation via isolated assets prevents cascade failures, crucial for large treasury deployments.

Deploying here involves supplying USDC to earn supplier rewards, often supplemented by safety module incentives. 2026 data indicates USDC supply APYs stabilizing at 4.2%, with peaks during borrowing surges. DAOs layer this with flash loans for leveraged positions, though conservative managers stick to unlevered supplies. Protocol health metrics, including $10 billion and TVL, affirm reliability. Voting on Aave Improvement Proposals lets DAOs influence supply incentives directly.

Yield and Risk Matrix

| Strategy | Yield (APY) | Primary Risk |

|---|---|---|

| Pendle PT-USDC | 5% fixed | Low liquidity risk |

| Yearn V3 | 4-7% dynamic | Smart contract risk |

| Aave V3 | 3-6% supply | Utilization risk |

These strategies collectively address idle DAO treasury optimization, transforming static holdings into productive assets. Anoma’s intents handle complexity, Ethena neutralizes volatility, Morpho customizes exposure, Pendle fixes rates, Yearn automates pursuit, and Aave provides foundational efficiency. DAOs implementing multisig controls and oracle monitoring achieve compounded growth, with historical blends yielding 5.5% net APY portfolio-wide.

Governance integration seals the deal: on-chain proposals execute vault shifts via Gelato or Defender, minimizing delays. As stablecoins underpin DeFi’s monetary base, per Galaxy Research, treasury managers prioritizing these protocols not only end idle capital but fortify against downturns. Early adopters report 12-18% annual treasury expansion, blending security with opportunistic gains in 2026’s ecosystem.