Decentralized Autonomous Organizations have revolutionized collective decision-making, but their treasuries often mirror the fragility of traditional banks during a panic. A sudden exodus of liquidity providers or governance token holders can trigger a cascade of withdrawals, draining reserves and eroding trust. This phenomenon, akin to a bank run, threatens DAO treasury sustainability. As DAOs mature, innovative structures like child DAOs emerge to generate steady revenue, shielding parent treasuries from volatility.

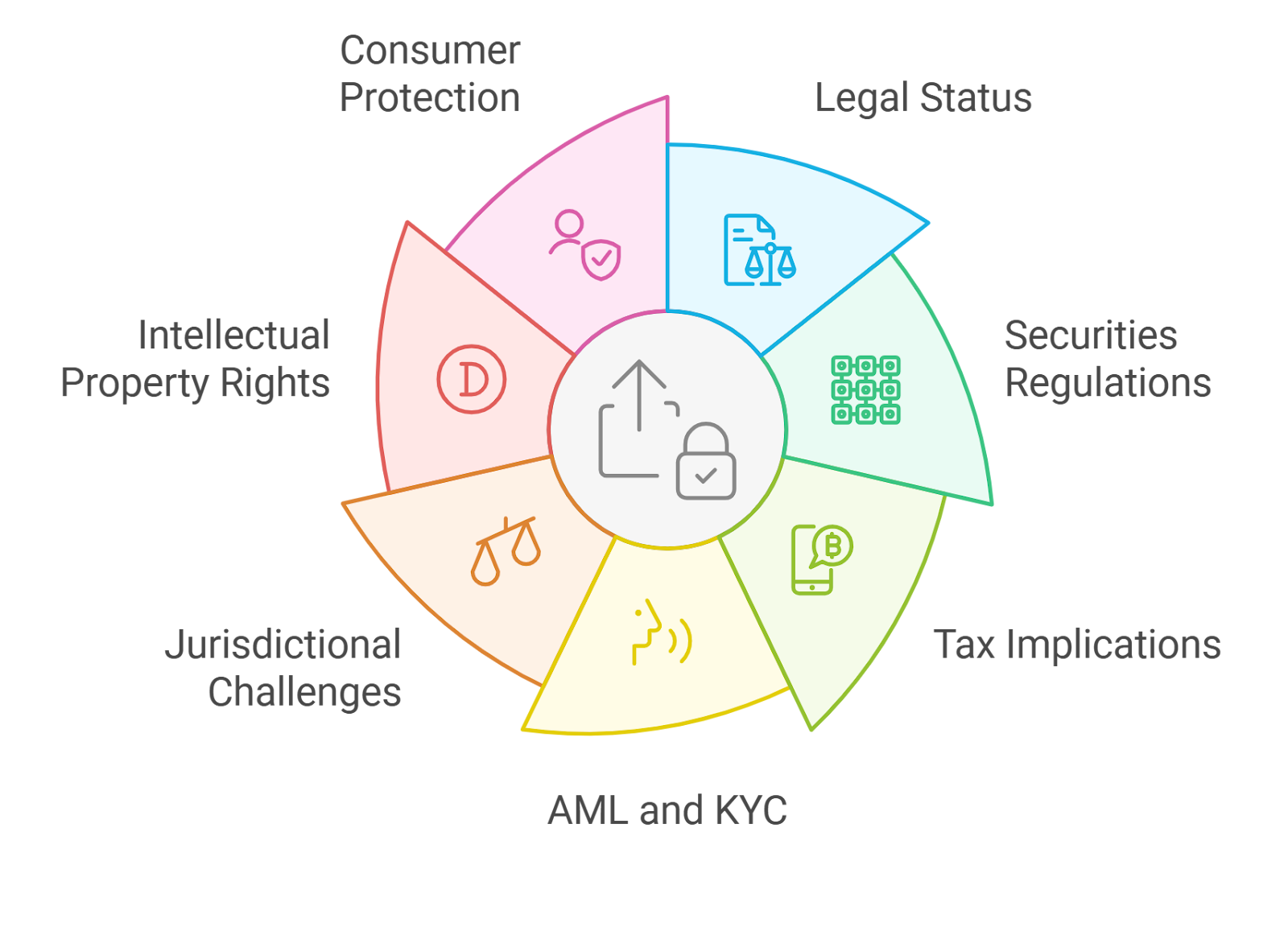

Recent analyses reveal that many DAOs rely heavily on governance tokens to incentivize participation, from liquidity provision to voting. While effective short-term, this model falters when token prices dip, prompting mass exits. Studies like those from Blockchain Research Lab highlight how opaque treasury management exacerbates these risks, leaving stakeholders uninformed about asset allocation or yield strategies.

DAO Treasury Vulnerabilities Exposed

Bank runs in DAOs manifest differently than in centralized finance: instead of physical queues, it’s on-chain token redemptions or proposal spam demanding immediate payouts. Treasury-driven DAOs, which strategically deploy capital into investments or lending, face amplified pressure if revenue streams dry up. For instance, grant-focused DAOs often exhaust funds on one-off allocations, neglecting recurring income. Diversification across stablecoins and DeFi protocols offers partial mitigation, as noted in Riseworks’ guidance, but without internal revenue engines, external market shocks prevail.

In my experience managing digital asset portfolios, the core issue lies in over-dependence on speculative inflows. Governance tokens incentivize behavior but rarely sustain operations long-term. Black Flag DAO’s state-of-the-DAOs report underscores this: protocols burn through treasuries to bootstrap activity, only to face insolvency when hype fades. Preventing DAO treasury bank runs demands a shift to self-reinforcing models.

Child DAOs as Revenue Powerhouses

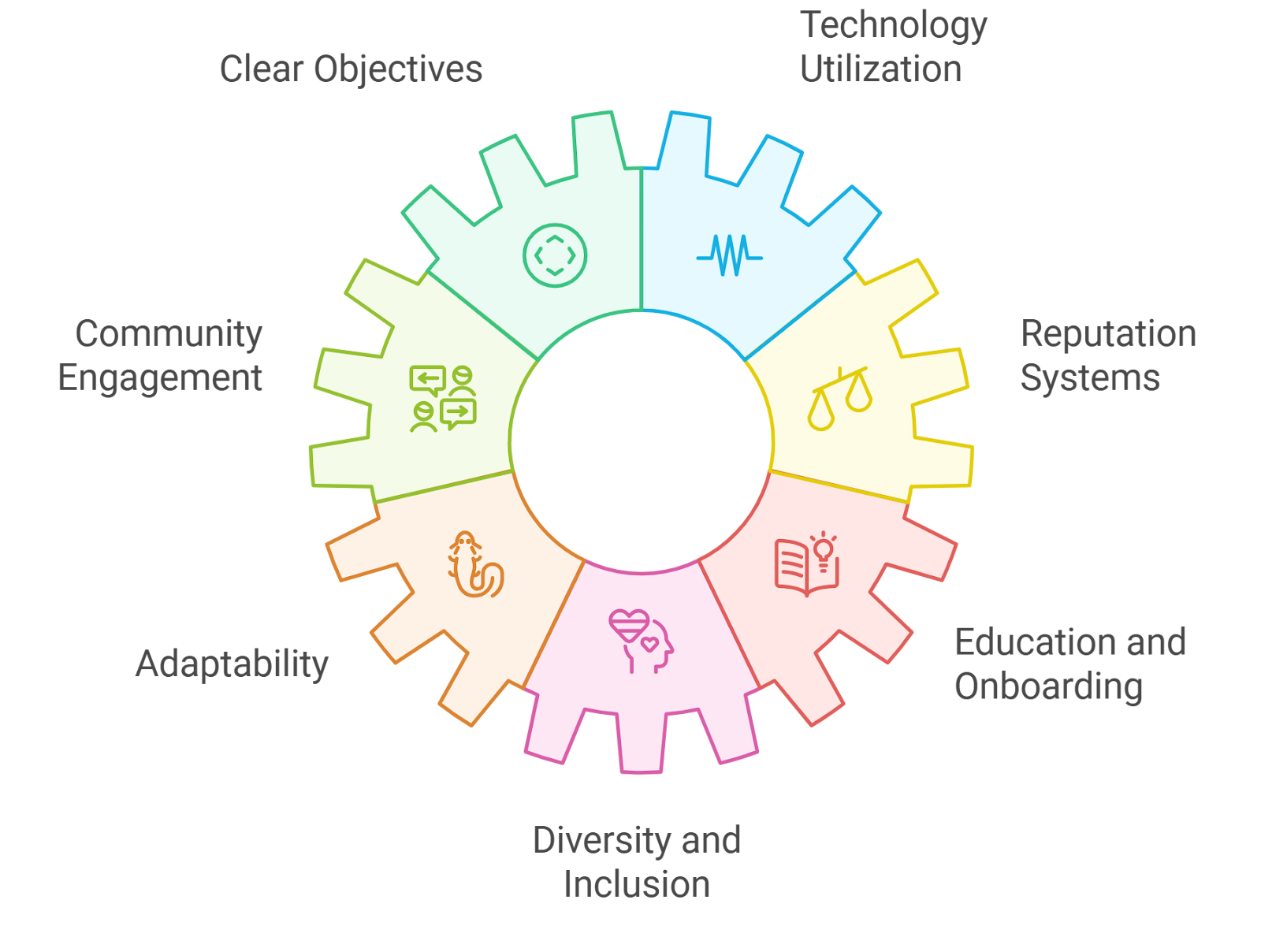

Child DAOs represent sub-entities spun off from a parent DAO, each tailored to niche revenue activities like service fees or protocol operations. Revenue from these children flows upward through predefined sharing mechanisms, bolstering the parent’s reserves. This child DAO revenue sharing creates a layered defense: isolated risks in subsidiaries prevent contagion to the core treasury.

PowerDAO exemplifies this with its governance reconfiguration per child DAO, empowering consistent actors while generating yields. Every child DAO handles its voting power dynamics, fostering accountability. Meanwhile, Gitcoin’s evolution provides a benchmark: through Passport Identity Service and Grants-as-a-Service, it now covers about 53% of operational costs from ongoing revenue, drastically reducing treasury burn as of 2025.

Benefits of Child DAOs

-

Diversified Income Streams: Child DAOs create multiple revenue sources, e.g., Gitcoin’s Passport Identity Service and Grants-as-a-Service cover 53% of operational costs.

-

Risk Isolation: Limits parent treasury exposure by containing failures within child DAOs, aligning with Riseworks diversification strategies.

-

Scalable Growth: Enables modular expansion via new child DAOs for ventures without disrupting core operations.

-

Enhanced Governance: Child DAOs tailor voting mechanisms, like PowerDAO’s user-empowering reconfiguration.

-

On-Chain Transparency: All child DAO revenues and transactions verifiable on blockchain for stakeholder trust.

Building Resilient Structures On-Chain

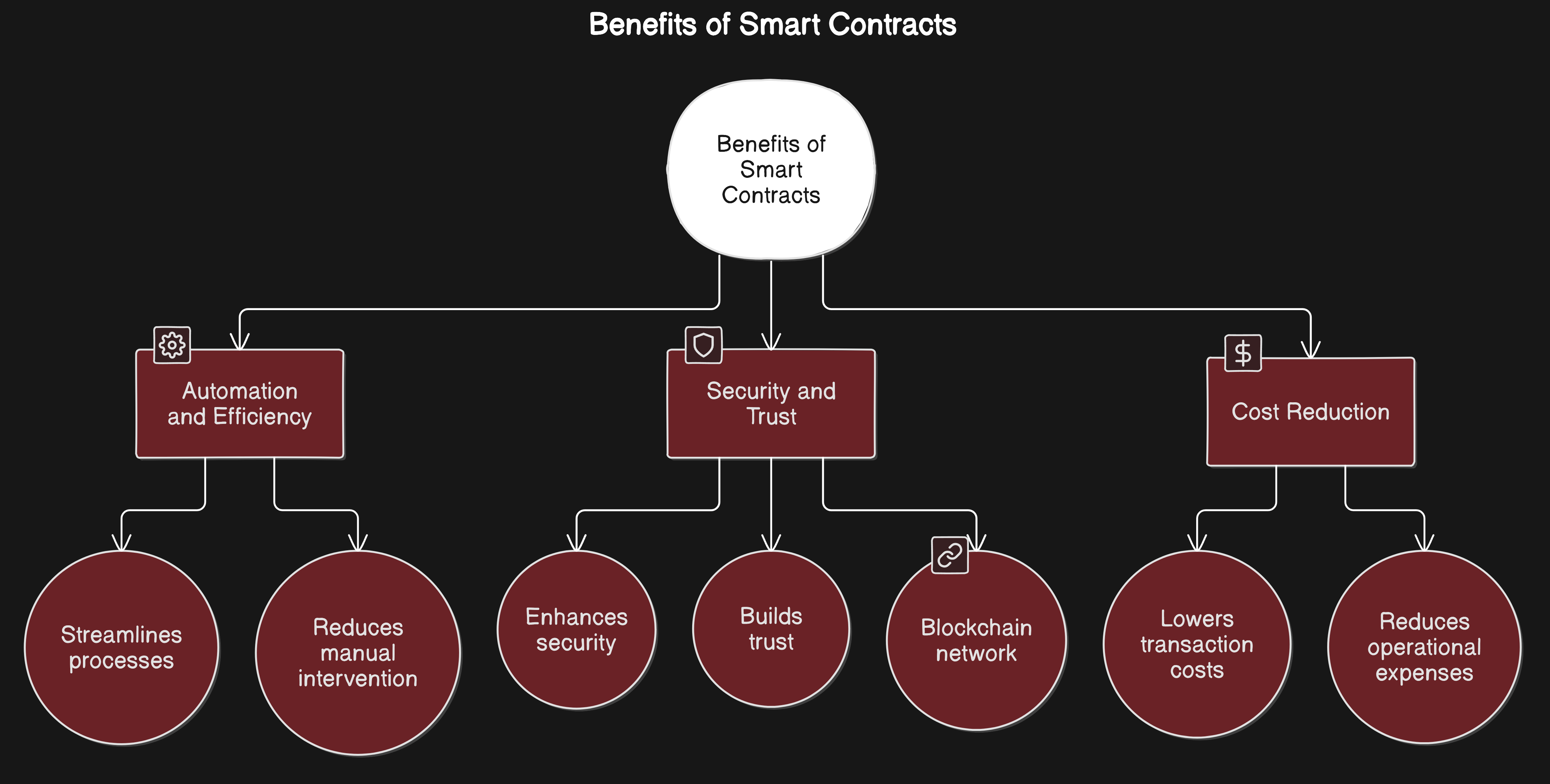

To implement PowerDAO treasury model variants, start with clear legal and technical blueprints. Migrate treasuries to smart-contract wallets for transparency, following checklists from seasoned operators. Allocate child DAO mandates precisely: one for yield farming, another for premium services. Coinmetro’s deep dive advocates regular audits and financial statements, essential for tracking child contributions.

On-chain treasury optimization amplifies this: deploy excess funds into vetted DeFi vaults while reserving buffers for volatility. GitHub tools like BobTheBuidler’s dao-treasury enable real-time reporting, demystifying flows. Treasury-driven DAOs that lend or invest via children achieve compounding effects, turning potential runs into opportunities for reinvestment. Yet success hinges on disciplined governance; unchecked expansion risks diluting focus.

Measuring the impact of child DAOs requires precise metrics beyond mere treasury size. Track revenue attribution from subsidiaries, burn rates pre- and post-implementation, and liquidity ratios during stress tests. Gitcoin’s milestone, where child initiatives like Passport and Grants-as-a-Service offset 53% of operations, sets a quantifiable standard. DAOs achieving similar thresholds demonstrate true DAO treasury sustainability, insulating against token depegs or proposal floods that mimic bank runs.

Comparison of Treasury Models: Traditional DAO vs. Child DAO

| Model | Revenue Streams | Risk Exposure | Resilience Score (1-10) |

|---|---|---|---|

| Traditional DAO | Governance token incentives, liquidity provision, volatile grants | High volatility, concentrated treasury holdings, prone to bank runs | 3 |

| Child DAO (e.g., Gitcoin) | Diversified ongoing revenue (Passport Identity Service, Grants-as-a-Service covering 53% of operational costs), DeFi yields, risk-isolated sub-treasuries | Low – revenue diversification, asset allocation across stablecoins and reputable DeFi protocols, sub-DAO isolation | 9 |

Key Metrics and Benchmarks

Adopt a dashboard mindset: monitor child DAO contributions as a percentage of total inflows, ideally targeting 40-60% for balance. Blockchain Research Lab’s studies reveal that treasuries with diversified on-chain deployments outperform peers by 2-3x in drawdown recovery. Opinionated take: ignore vanity metrics like TVL; focus on net revenue after expenses. Tools from GitHub, such as dao-treasury, automate this, providing on-chain proofs that build stakeholder confidence and deter panic withdrawals.

To prevent DAO treasury bank runs, simulate scenarios via governance proposals. Stress-test by assuming 30% token value drop; resilient structures maintain 80% liquidity. PowerDAO’s model shines here, with child-specific voting recalibrations ensuring aligned incentives. Zeeve’s DAO typology underscores grant DAOs’ pivot potential to revenue subs, transforming philanthropy into perpetuity.

Yet pitfalls lurk. Over-proliferation fragments governance; cap at 5-7 children initially. Misaligned incentives in subs can siphon value, necessitating parent veto rights. Bobsguide notes DAOs’ transparency edge over TradFi, but only if reporting is relentless. Enforce monthly statements per Coinmetro, correlating child outputs to parent health.

Forward-thinking DAOs layer in advanced tactics: oracle-fed risk engines pause distributions during anomalies, or quadratic funding in children amplifies aligned contributions. On-Chain Treasuries platforms excel here, offering vaults that auto-allocate based on volatility indexes. In blending portfolio theory with blockchain, child DAOs evolve treasuries from static pools to dynamic engines. The result? Organizations that weather storms, rewarding steadfast participants while scaling impact. This isn’t mere survival; it’s strategic dominance in DeFi’s next phase.