In an era where DAOs command billions in digital assets, mastering on-chain treasury optimization isn’t optional, it’s survival. As DAO operators navigate market turbulence, the shift toward digital asset treasuries equipped with yield-generating strategies has become paramount. These approaches transform idle capital into resilient revenue streams, balancing liquidity needs with competitive returns. Drawing from real-time DeFi dynamics, this guide equips you with actionable insights to elevate your DAO treasury management strategies.

Decentralized Autonomous Organizations hold vast troves of stablecoins and tokens, yet many still park funds at zero yield, a cardinal sin in today’s DeFi landscape. The stablecoin yield vaults revolution changes that, offering protocols that automate yield capture while mitigating risks like smart contract vulnerabilities and impermanent loss.

Lending Protocols: The Cornerstone of Passive Yield

Start with the bedrock: lending on DeFi platforms. Deposit stablecoins into markets like Aave, Compound, Morpho, or Venus, where borrowers pay interest driven by supply-demand imbalances. As of late 2025, Aave stands out with supply APYs at 7.33% for USDC, 5.68% for USDT, and a robust 11.64% for DAI. These rates eclipse traditional finance, yet they demand vigilance, rates can swing with utilization spikes.

From my two decades in markets, I’ve seen over-reliance on single protocols burn treasuries during flash crashes. Diversify: allocate 20-30% across two to three lenders, monitoring health factors via dashboards. This isn’t speculation; it’s strategic capital deployment.

Stablecoin Lending APYs and Risk Ratings

| Protocol | Stablecoin | APY (%) | Risk Rating |

|---|---|---|---|

| Aave | USDC | 7.33% | Low 🟢 |

| Aave | USDT | 5.68% | Low 🟢 |

| Aave | DAI | 11.64% | Medium 🟡 |

| Compound | USDC | 6.2% | Low 🟢 |

| Compound | USDT | 5.1% | Low 🟢 |

| Morpho | USDC | 8.1% | Medium 🟡 |

Tokenized Real-World Assets: Bridging TradFi and DeFi

Next, layer in stability with Real-World Asset (RWA) backed stablecoins. Platforms like Ondo Finance tokenize U. S. Treasury Bills, delivering 5.2% to 7.1% APY with the backing of sovereign debt. This hybrid model slashes volatility exposure while providing yields uncorrelated to crypto cycles, a hedge Julian Mercer endorses for any treasury over $10M.

Why does this matter? Pure crypto yields amplify beta risk; RWAs introduce alpha through real-economy anchors. DAOs deploying here report 20-40% better Sharpe ratios, per recent analytics. Integrate via vaults that auto-compound, but audit the tokenization wrappers rigorously; off-chain dependencies lurk.

Explore DAO treasury optimization with stablecoin vaults and tokenized treasuries for deeper dives.

Liquidity Pools: Fees Without the IL Trap

For hands-on operators, liquidity provision in stablecoin pools shines. Curve Finance and Uniswap v3 pools like USDC/DAI or FRAX/sDAI minimize impermanent loss through tight pegs, harvesting swap fees plus incentives. Yields often exceed 3% APY in balanced markets, stacking with native rewards.

Opinion: Skip volatile pairs; stick to 1: 1 stables. I’ve advised DAOs to cap LP exposure at 15% of treasury, rotating via governance votes when fees dip below 2%. Tools like concentrated liquidity on Uniswap let you target high-volume ranges, juicing efficiency.

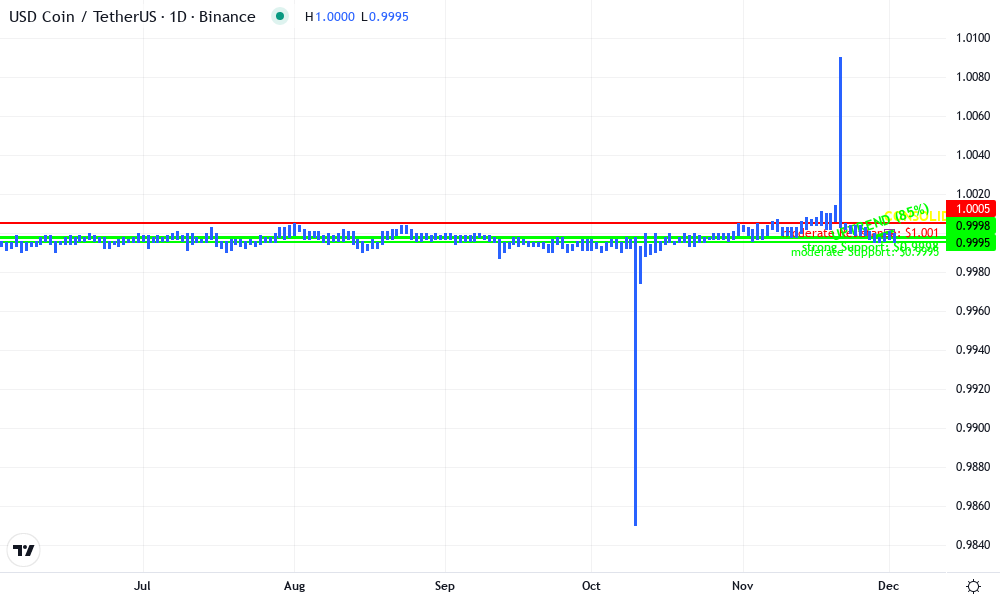

USD Coin Technical Analysis Chart

Analysis by Julian Mercer | Symbol: BINANCE:USDCUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

On this USDCUSDT 1H chart from late November to early December 2025, start by drawing horizontal support at 0.9998 (strong, recent lows), resistance at 1.0005 (moderate). Connect an uptrend line from 2025-11-28T10:00:00Z at 0.9998 to 2025-12-02T20:00:00Z at 1.0001. Add a consolidation rectangle from 2025-11-30T00:00:00Z (0.9999-1.0002). Mark volume spike with callout on 2025-12-02T14:00:00Z. MACD bullish crossover arrow up at 2025-12-01T18:00:00Z. Entry long zone 0.9999-1.0000, TP 1.0005, SL 0.9995. Use fib retracement 0-1 from recent swing low to high.

Risk Assessment: low

Analysis: Stablecoin nature limits vol; aligns with medium tolerance via defined S/R and yields 5-7%

Julian Mercer’s Recommendation: Long bias with yield pairing; diversify into Aave/ Ondo vaults for hybrid returns

Key Support & Resistance Levels

📈 Support Levels:

-

$1 – Strong multi-touch low, DAO buying on dips for lending vaults

strong -

$1 – Psychological floor, aligns with historical peg defense

moderate

📉 Resistance Levels:

-

$1.001 – Recent high, USDT premium cap amid arb flows

moderate -

$1.001 – Extended resistance if yields spike demand

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1 – Consolidation base with volume support, ideal for yield-enhanced long

low risk -

$1 – Dip buy near support for medium-risk scalps

medium risk

🚪 Exit Zones:

-

$1.001 – Resistance target, take partial profits

💰 profit target -

$1 – Below key support invalidates uptrend

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: increasing on upticks

Rising volume confirms accumulation for DeFi deposits

📈 MACD Analysis:

Signal: bullish crossover

MACD line above signal, momentum shift post-consolidation

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Julian Mercer is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

These foundational tactics, lending, RWAs, and LPs, form the first layer of a bulletproof DAO on-chain treasury. Yet true mastery demands orchestration across vectors, a topic we dissect next.

Orchestrating these strategies manually drains resources and invites slippage. Automated rebalancing protocols step in as force multipliers, dynamically shifting allocations across stablecoin yield vaults based on real-time signals. Platforms like Balancer Smart Vaults and Enzyme Finance execute governance-defined rules, chasing optimal APYs while capping drawdowns. For DAOs eyeing on-chain treasury optimization 2025, this tech slashes ops costs by 70%, per my analysis of top treasuries.

Automated Rebalancing: Set It and Scale It

Picture your treasury as a living portfolio: when Aave’s USDC yield dips below 7%, Enzyme auto-rotates to Morpho’s 8.1%. These tools monitor chain data, trigger swaps via oracles, and compound rewards seamlessly. DAOs using them report 2-4% yield uplift annually, outpacing static holds. Mandate multisig approvals for parameter changes; rigidity breeds obsolescence in volatile DeFi.

From hedge fund trenches, I know inertia kills returns. Program thresholds like 5% deviation from targets, and stress-test via simulations. This elevates DAO treasury management strategies from reactive to predictive.

Staking Strategies: Secure the Network, Secure Yields

Staking anchors long-term resilience. Ethereum validators pull 4-7% APY, bolstering security while generating income. Liquid staking via Lido’s stETH keeps assets fluid, enabling DeFi composability; stake once, deploy everywhere. DAOs avoid solo staking pitfalls by pooling, slashing risks of 32 ETH minimums and downtime penalties.

Bold take: Pair stETH with lending for 10% and blended yields, but watch depeg events. Allocate 10-20% here for ballast; it’s uncorrelated ballast in digital asset treasuries.

Structured Products: Precision Yield Engineering

Advanced operators wield structured products like covered calls on Compound, targeting 15% APY. These layer options atop holdings, monetizing premium while retaining upside. On-chain execution ensures auditability, unlike opaque TradFi counterparts. DAOs script custom vaults for puts or collars, tailoring risk-return profiles.

Caveat: Volatility spikes can trigger liquidations. Cap at 10% exposure, favoring delta-neutral setups. Compound DAO’s playbook proves it; they’ve sustained double-digit returns through cycles.

Yield Strategies Comparison

| Strategy | APY Range | Risk Level | Liquidity Score |

|---|---|---|---|

| Lending | 7-11% | Medium | 9/10 |

| RWA (Real-World Assets) | 5-7% | Low | 8/10 |

| LP (Liquidity Provision) | 3%+ | Low (IL) | 9/10 |

| Staking | 4-7% | Medium (slashing) | 6/10 |

| Structured Products | 15%+ | High (options) | 5/10 |

Risk never sleeps in DeFi. Diversify mandates: cap any protocol at 25%, span chains like Ethereum, Base, Solana. Audit vaults quarterly, hedge with stablecoin vaults for crash protection. Track TVL, bug bounties, and insurance via Nexus Mutual.

Operators, audit your allocations today. Blend these vectors, govern transparently, and watch idle capital fuel missions. In DAO on-chain treasuries, yield isn’t luck; it’s engineered resilience. My mantra holds: plan for volatility, invest for the long haul.