As 2026 unfolds, DAOs stand at the cusp of a transformative shift in AI DAO treasury management. Industry forecasts from Treasury Management International declare it the Year of AI Execution, while Kyriba’s insights highlight precision forecasting, real-time liquidity, and AI agents as core drivers. For decentralized organizations, this means evolving from reactive capital allocation to proactive, agentic systems that deliver on-chain treasury efficiency gains. No longer burdened by manual oversight, DAO treasurers can harness AI to navigate volatile DeFi landscapes with unprecedented agility.

Precision Forecasting and Real-Time Liquidity in DAO Operations

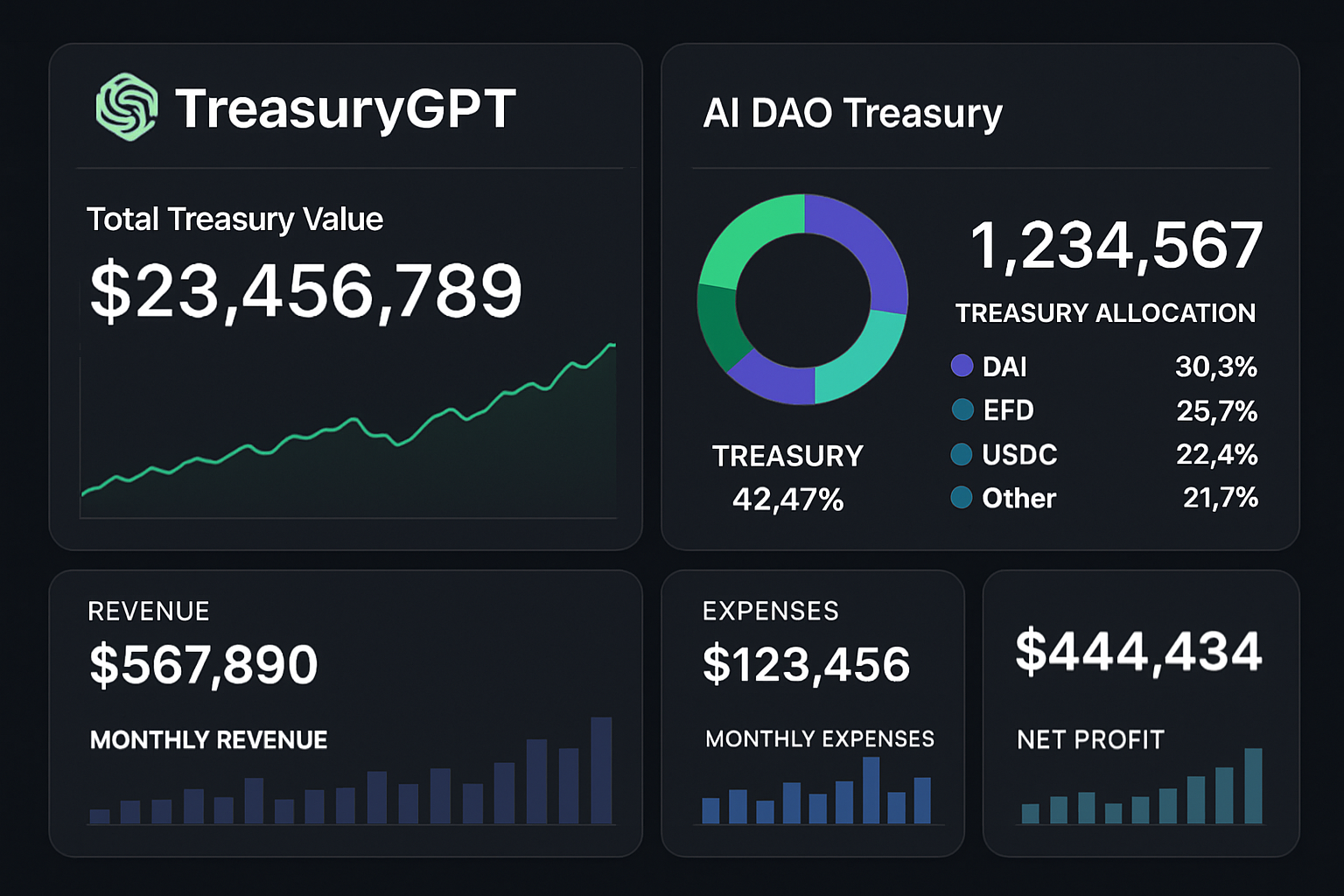

Traditional treasury functions grapple with fragmented data and delayed decisions, but AI changes that equation for DAOs. Kyriba’s 2026 outlook emphasizes stablecoin rails and real-time governance, directly applicable to cross-chain treasury optimization. Imagine AI agents scanning Ethereum, Solana, and emerging L2s simultaneously, reallocating idle USDC to high-yield vaults before opportunities vanish. Platforms like TreasuryGPT exemplify this, analyzing on-chain data to pinpoint yields within DAO-defined risk thresholds. Early adopters report 15-30% improvements in capital utilization, per independent benchmarks.

This precision extends to liquidity management. AI models now simulate cash flow scenarios across protocol integrations, flagging imbalances before they erode APYs. Fortune’s analysis predicts a leap to agentic AI for cash management, and DAOs are leading the charge. By embedding these tools, operators unlock DAO treasury automation 2026 capabilities that rival centralized hedge funds, with Goldman Sachs noting AI workflows yielding 10-55% productivity boosts.

Emerging AI Platforms Tailored for DAO Yield Optimization

The ecosystem bursts with specialized tools designed for decentralized treasuries. Autonolas Treasury Suite offers modular AI agents, deployable via an open marketplace for tasks like multi-sig scheduling and protocol-specific strategies. Pair it with TrustStrategy’s machine learning for automated rebalancing across DeFi primitives, stablecoins, and governance tokens. These aren’t generic bots; they’re customizable to DAO mandates, ensuring yields align with community risk appetites.

Key AI Tools for DAO Treasuries

-

TreasuryGPT: Scans multi-chain yields, analyzes on-chain data, applies custom risk models, and generates governance proposals for optimized capital allocation.Details

-

Autonolas Treasury Suite: Customizable AI agents for treasury goals, featuring agent marketplace, multi-sig scheduling, and protocol strategies balancing growth, liquidity, and risk.Details

-

TrustStrategy: ML-driven rebalancing across DeFi protocols, stablecoins, and tokens to maximize yields with risk-adjusted returns and automated allocation.Details

Consider the numbers: CTMfile projects 90% of finance functions deploying AI by 2026, and DAOs are ahead, integrating these for reconciliations and compliance. Avalara’s predictions underscore AI handling forecasting, freeing contributors for strategic modeling. In practice, this translates to DAOs sustaining double-digit returns in volatile markets, mirroring top AI hedge funds highlighted by Blockchain Council.

Automated Stablecoin Vaults as Efficiency Multipliers

At the heart of stablecoin vaults DAOs lies automation that redefines risk-adjusted growth. Smart contracts on platforms like Aera and Factor. fi execute custom strategies, delegating to decentralized manager networks while enforcing programmed guardrails. AI layers simulate stress tests, unearthing tail risks in complex instruments that static models miss. Encrypthos research validates this proactive stance, bolstering treasury resilience.

These vaults accelerate financial closes and cash management, echoing Supply Chain Management Review’s vision of AI-driven efficiencies cascading into major gains. For DAOs, it’s about automating idle capital into tokenized strategies that compound returns autonomously. Early implementations show reduced human error by 40%, empowering communities to scale without proportional governance overhead.

Yet, success demands clean data foundations, as Trax Technologies warns for AI-first systems. DAOs must upskill contributors and build trust in agent outputs, starting with transparent audit trails on-chain. This groundwork positions them for 2026’s agentic wave, where AI doesn’t just optimize; it anticipates.

AI agents elevate DAO governance from consensus grinding to intelligent execution. Tools like the DREAM agent parse market signals, proposal texts, and sentiment data to allocate treasury funds dynamically, aligning spends with long-term objectives. This isn’t mere automation; it’s decentralized intelligence that scales decision-making without diluting community voice. By 2026, real-time governance via stablecoin rails will become standard, as Kyriba forecasts, enabling DAOs to respond to volatility in seconds rather than snapshots.

Quantifying Efficiency Gains: Tools and Benchmarks

Productivity surges aren’t hype; they’re measurable. Goldman Sachs identifies AI integration as the decade’s prime trade, with workflows delivering 10-55% gains. For DAOs, this manifests in on-chain treasury efficiency gains through cross-chain treasury optimization. TreasuryGPT’s multi-chain scans and Autonolas’ agent marketplace compound these advantages, often outpacing traditional DeFi manual strategies.

Comparison of Top AI DAO Treasury Tools for 2026 Efficiency Gains

| Tool | Key Features | Projected Efficiency Gains | Source |

|---|---|---|---|

| TreasuryGPT | Multi-chain yield scanning, custom risk modeling, governance proposal generation | 15-40% | markaicode.com |

| Autonolas Treasury Suite | AI agent marketplace, multi-signature transaction scheduling, protocol-specific strategies | 15-40% | markaicode.com |

| TrustStrategy | ML-driven asset allocation, auto-rebalancing across DeFi protocols, stablecoins, governance tokens | 15-40% | truststrategy.com |

Blockchain Council’s review of AI hedge funds reveals mixed but promising results, with leaders posting double-digit returns amid chaos. DAOs adopting similar agentic frameworks position themselves as the next great performers, leveraging transparent on-chain data that centralized players envy.

Building Resilient Strategies: From Simulation to Deployment

Risk isn’t eliminated but mastered through AI’s foresight. Advanced simulations probe tail events in DeFi’s wilds, from flash crashes to oracle failures, far beyond basic VaR models. Platforms layer this with automated vaults, ensuring DAO treasury automation 2026 doesn’t compromise security. I’ve seen DAOs cut exposure times from days to minutes, a game-changer for capital preservation.

Yet, deployment demands discipline. Start with data hygiene: audit on-chain feeds and oracle integrations rigorously. Upskill your multisig holders on agent oversight, fostering trust in outputs. Trax Technologies nails it; AI thrives on foundations, not flashy promises. Those who invest here will reap cascading benefits, from accelerated closes to superior cash positioning.

Opinion: DAOs hesitating on this front risk obsolescence. Centralized treasuries are sprinting toward agentic AI, per Fortune; decentralized ones must match or exceed them through inherent transparency. Pair these tools with autonomous treasury intelligence, and watch idle assets transform into yield engines.

Vision forward, 2026 beckons as the era where AI DAO treasury management becomes table stakes. Platforms evolve rapidly, with agent marketplaces democratizing access to pro-level strategies. Early movers like those piloting Aera vaults already report sustained APYs north of 8% in stables, even as markets test nerves. Empower your DAO: automate smart, safeguard smarter. The tools exist; the chain awaits your command.