In 2025, DAOs are redefining treasury management by leveraging sophisticated stablecoin vault strategies to maximize APY while preserving capital integrity. The landscape is dominated by protocols and tools that blend automation, risk controls, and cross-chain access, enabling DAOs to pursue yield at scale without sacrificing transparency or governance. Below, we dissect the top five strategies and platforms that are setting the benchmark for DAO stablecoin vaults this year.

1. Yearn Finance Stablecoin Vaults: Blue-Chip Auto-Compounding for Risk-Adjusted Yield

Yearn Finance continues to lead as the go-to platform for DAOs seeking blue-chip stablecoin strategies. Its vaults for USDC, DAI, and USDT automate yield harvesting through sophisticated auto-compounding mechanisms. This approach not only maximizes returns but also smooths out volatility by dynamically reallocating assets among vetted DeFi protocols based on risk-adjusted APY models. For DAO treasury managers, Yearn’s integration with governance frameworks ensures that all allocations remain auditable and under DAO control, a critical factor as regulatory scrutiny intensifies in 2025.

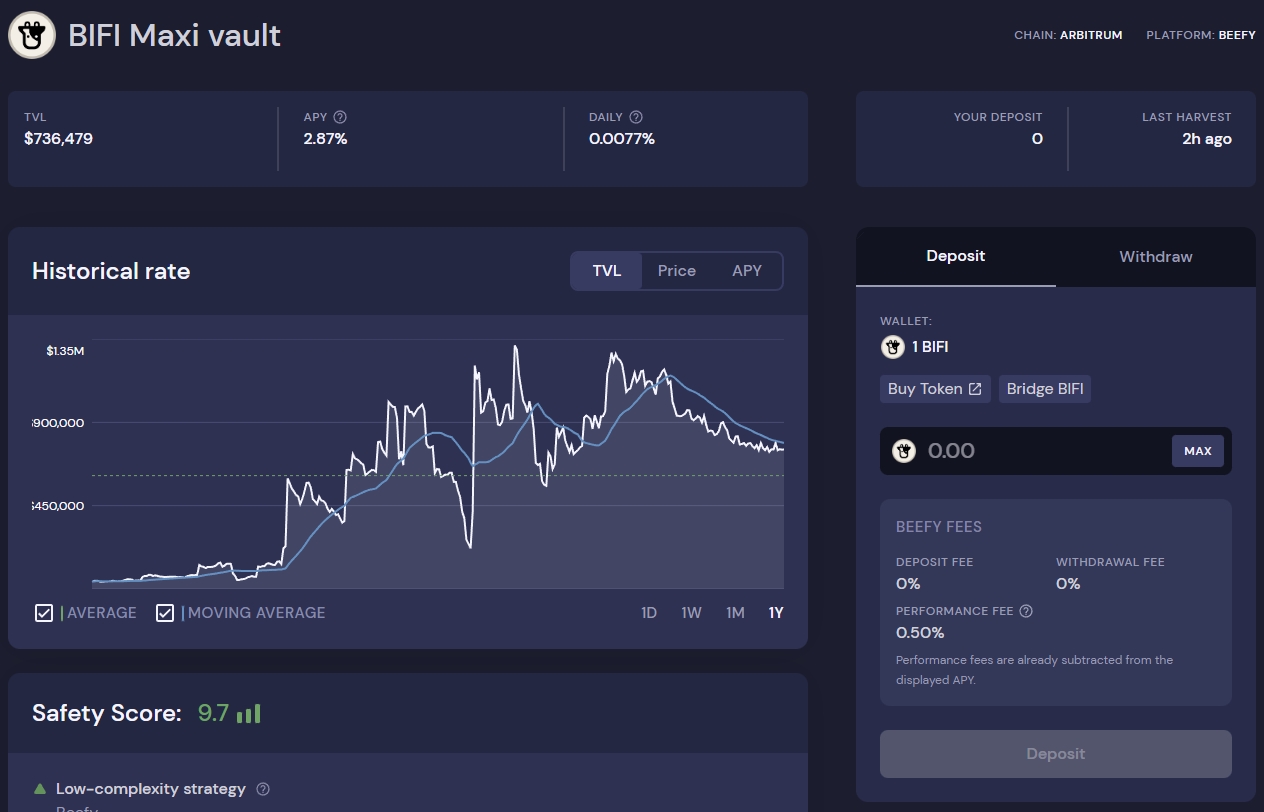

2. Beefy Finance: Multichain Auto-Compounding Across Ecosystems

The rise of multichain DeFi has made Beefy Finance a cornerstone for treasuries aiming to diversify yield sources beyond Ethereum Mainnet. Beefy’s auto-compounding vaults aggregate yields across major networks like Arbitrum, Base, and Polygon, enabling DAOs to tap into liquidity incentives wherever they arise. The protocol’s robust smart contract infrastructure minimizes manual intervention while providing real-time analytics on APY performance and underlying protocol risk. This makes it especially attractive for organizations managing large-scale reserves who demand both scalability and operational efficiency.

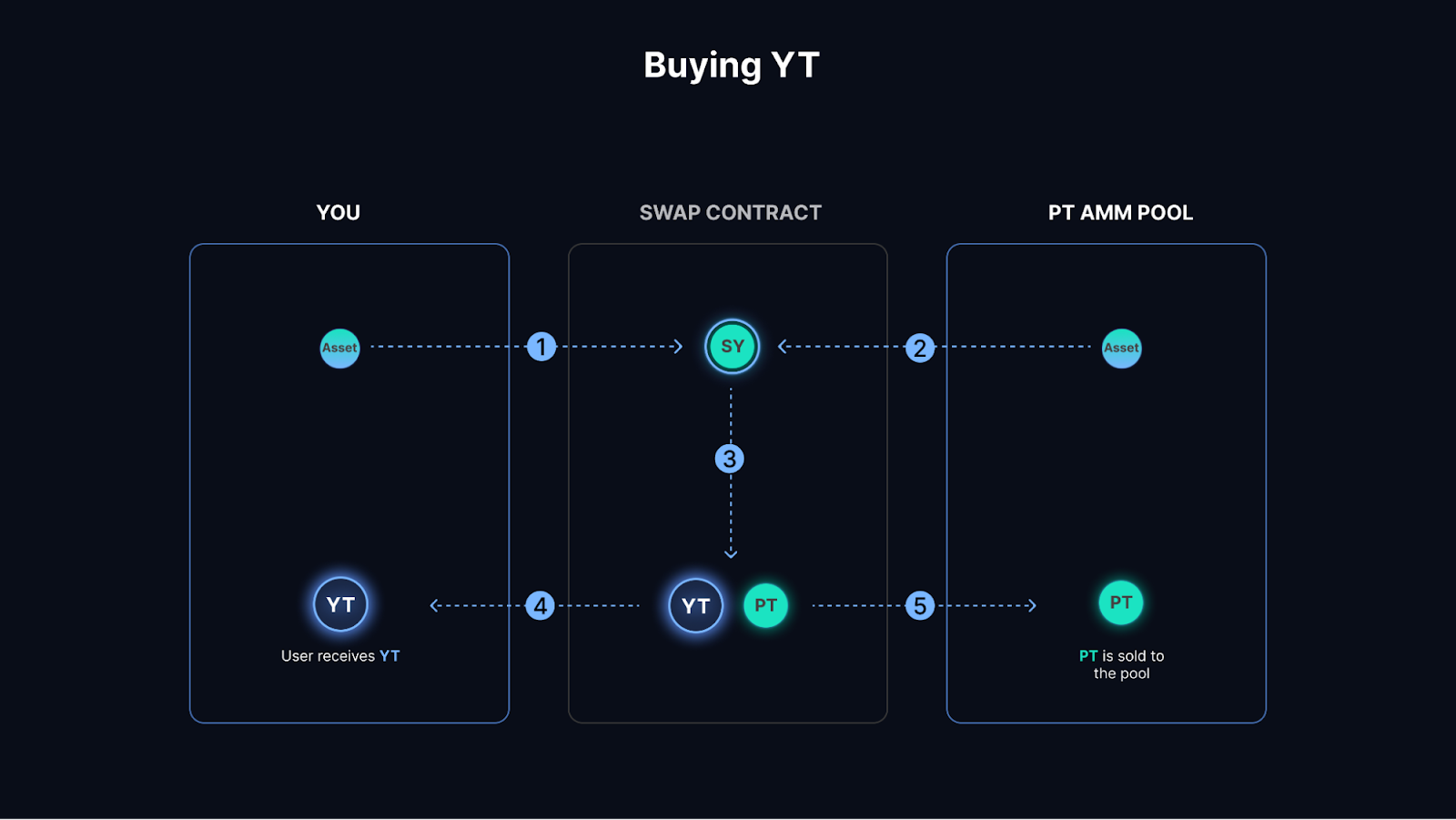

3. Pendle Finance: Yield Tokenization for Enhanced Predictability

Pendle introduces a unique paradigm by allowing DAOs to tokenize future yields into principal (PT) and yield (YT) tokens. This separation gives treasuries the flexibility to lock in fixed yields or actively trade their exposure based on market expectations, a powerful tool for budgeting and risk management in volatile macro environments. By integrating Pendle’s solutions, DAOs can build predictable revenue streams from their stablecoin reserves or opportunistically capture upside from fluctuating rates without exposing core capital to unnecessary risk.

The programmable nature of Pendle’s ERC-4626-based vaults also means that treasury policies can be codified directly into smart contracts, streamlining compliance with internal mandates and external audits alike.

4. Falcon Finance: Cross-Chain Vaults with Advanced Risk Controls

For DAOs aiming to maximize APY without compromising on security, Falcon Finance offers cross-chain stablecoin vaults engineered for institutional-grade treasury operations. With APYs reaching up to 18% on select vaults, Falcon stands out by embedding advanced risk management directly into the vault architecture. Automated rebalancing ensures that allocations stay within predefined risk corridors, dynamically shifting exposure in response to market volatility or evolving protocol risks. This is particularly crucial for DAOs with large, multi-chain treasuries that require both yield maximization and strict capital preservation.

Falcon’s on-chain governance modules allow DAOs to set custom risk parameters and automate compliance workflows, reducing operational friction while preserving transparency. As regulatory expectations grow more stringent, these features are quickly becoming non-negotiable for leading organizations.

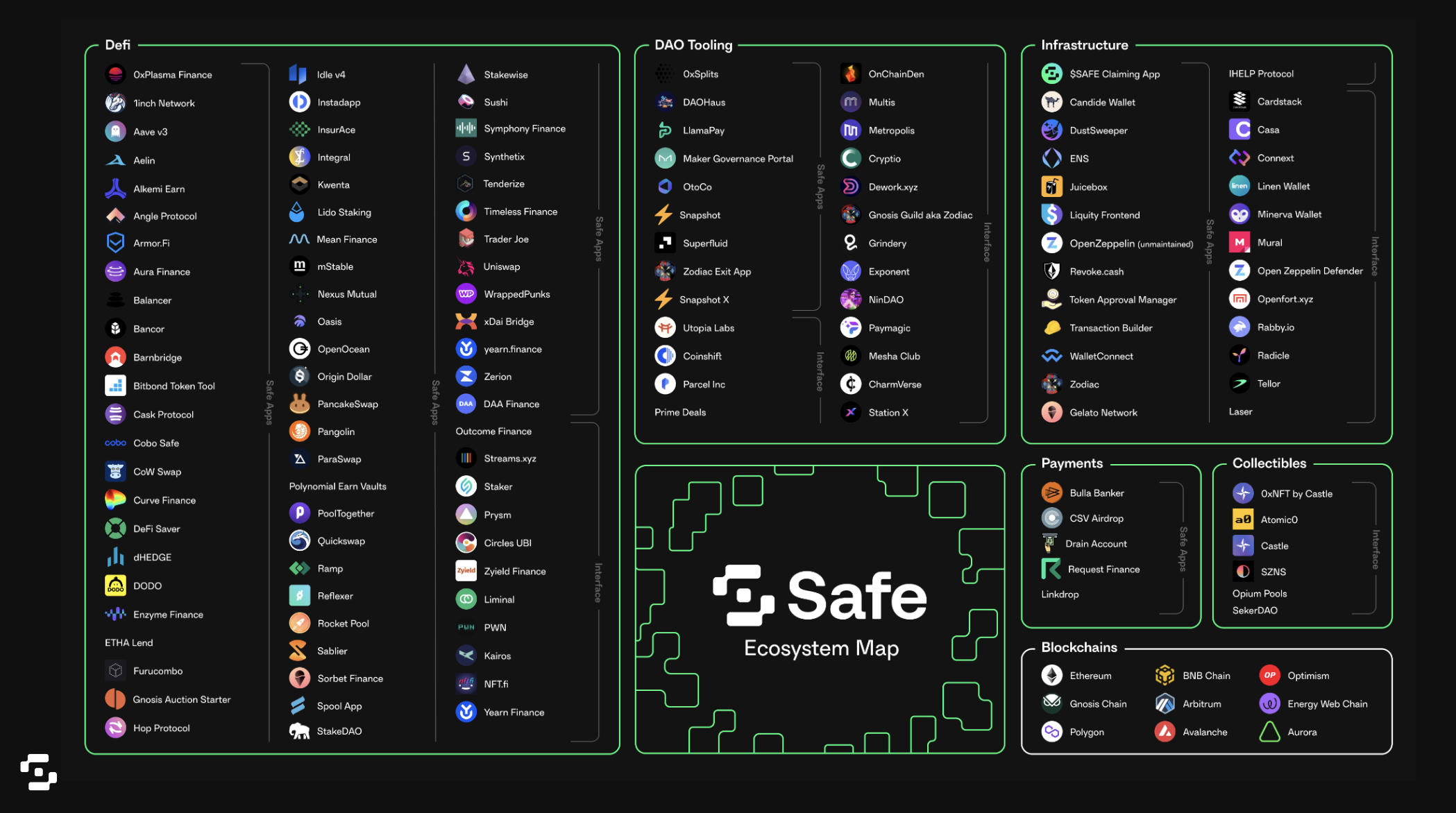

5. Automated Treasury Rebalancing via Safe Integrations: Dynamic Allocation for Real-Time Optimization

Integrating automated allocation strategies through Safe (formerly Gnosis Safe) marks a pivotal evolution in DAO treasury management. By leveraging Safe’s modular smart contract infrastructure, DAOs can seamlessly connect with top-performing vaults and aggregators, including Yearn, Beefy, and Falcon, to execute dynamic rebalancing in response to real-time market data.

This approach eliminates manual bottlenecks and human error from the reallocation process while ensuring that stablecoin positions are continuously optimized for both yield and risk exposure. For example, a DAO might configure its treasury to shift capital from USDC vaults on Beefy to DAI vaults on Yearn if APY differentials surpass a certain threshold or if underlying protocol risks change materially.

Top 5 DAO Stablecoin Vault Optimization Strategies in 2025

| Strategy / Platform | Core Approach | Key Features | Typical APY (2025) | Risk Management Highlights |

|---|---|---|---|---|

| Yearn Finance Stablecoin Vaults | Auto-compounding blue-chip stablecoin yields | Automated yield optimization, robust DAO governance, supports USDC, DAI, USDT | Variable, typically 4-8% | Proven security, active governance, diversified strategies |

| Beefy Finance Multichain Auto-Compounding | Cross-chain yield aggregation with auto-compounding | Access to multiple DeFi protocols across chains, maximized APY, automated rewards | Variable, up to 10%+ | Multichain diversification, smart contract audits |

| Pendle Finance Yield Tokenization | Split stablecoin yields into principal & yield tokens | Lock in fixed yields, trade yield exposure, enhanced predictability | Fixed or variable, up to 12% | Customizable risk via tokenization, transparent smart contracts |

| Falcon Finance Cross-Chain Stablecoin Vaults | DAO-focused vaults with high APY and automation | Advanced on-chain risk controls, up to 18% APY, tailored for large treasuries | Up to 18% | Automated rebalancing, real-time risk controls |

| Automated Treasury Rebalancing via Safe Integrations | Smart contract-based dynamic allocation | Integrates with leading vaults/aggregators, real-time market optimization, modular infrastructure | Depends on integrated vaults, typically 5-12% | Automated rules, customizable risk parameters, non-custodial security |

Best Practices for DAO Stablecoin Vault Optimization in 2025

- Diversify across protocols: Avoid concentration risk by spreading assets among multiple platforms, Yearn for blue-chip stability, Beefy for multichain access, Pendle for yield predictability, Falcon for high-yield cross-chain exposure.

- Automate wherever possible: Use Safe integrations and ERC-4626-compliant vault frameworks to minimize manual intervention and operational overhead.

- Codify risk parameters: Leverage programmable smart contracts (as seen with Pendle and Falcon) to enforce treasury mandates at the protocol level.

- Monitor real-time analytics: Stay ahead of market shifts by relying on platforms that provide transparent APY tracking and robust reporting tools.

- Prioritize security audits: Engage only with platforms that undergo regular third-party audits and offer transparent disclosures of smart contract risks.

The Road Ahead: Capital Efficiency Meets Security

The convergence of automation, cross-chain liquidity access, and programmable compliance is redefining how DAOs approach stablecoin treasury management in 2025. By strategically combining auto-compounding blue-chip solutions like Yearn Finance with multichain aggregators such as Beefy Finance, and layering advanced tools like Pendle’s yield tokenization or Falcon’s cross-chain risk controls, DAOs can unlock new levels of capital efficiency without sacrificing transparency or security.

The integration of automated rebalancing via Safe further ensures that treasuries remain agile amid rapidly changing DeFi markets. Ultimately, the most successful DAOs will be those that treat their stablecoin reserves not as static holdings but as programmable assets, continuously optimized through secure, auditable protocols tailored to organizational goals.

Top 5 Strategies & Platforms for DAO Stablecoin Vault Optimization (2025)

-

Yearn Finance Stablecoin Vaults: Leverage Yearn’s blue-chip stablecoin vaults (USDC, DAI, USDT) for auto-compounding yields and risk-adjusted APY optimization, with robust security and DAO governance integration.

-

Beefy Finance Multichain Auto-Compounding: Utilize Beefy Finance’s multichain stablecoin vaults for cross-chain yield aggregation, maximizing APY by accessing diverse DeFi protocols and auto-compounding rewards across major networks.

-

Pendle Finance Yield Tokenization: Employ Pendle to split stablecoin yields into principal and yield tokens, enabling DAOs to lock in fixed yields or trade yield exposure for enhanced treasury predictability and risk management.

-

Falcon Finance Cross-Chain Stablecoin Vaults: Adopt Falcon’s DAO-focused vaults offering up to 18% APY, with advanced on-chain risk controls and automated rebalancing tailored for large-scale treasury operations.

-

Automated Treasury Rebalancing via Safe (formerly Gnosis Safe) Integrations: Implement automated allocation strategies using Safe’s modular smart contract infrastructure, integrating with leading vaults and aggregators to dynamically optimize stablecoin positions based on real-time market conditions.