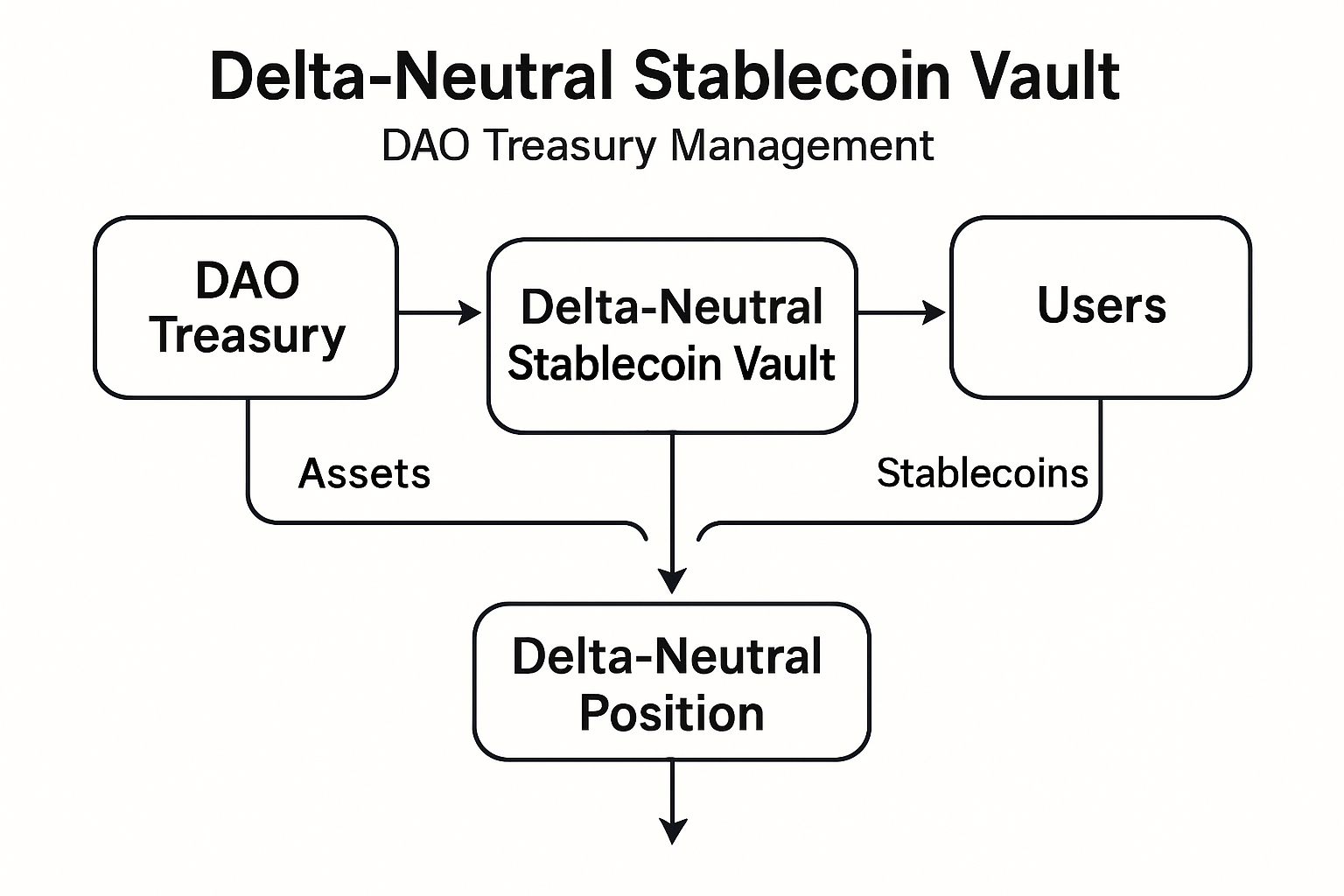

Decentralized Autonomous Organizations (DAOs) are under constant pressure to manage their treasuries with both prudence and innovation. With the rise of on-chain treasury management, delta-neutral stablecoin vaults have become a cornerstone for DAOs seeking consistent, risk-adjusted yield. These vaults offer a blend of capital efficiency and robust risk management, making them an increasingly popular choice for organizations aiming to weather market volatility without sacrificing returns.

What Are Delta-Neutral Stablecoin Vaults?

At their core, delta-neutral vaults are automated financial instruments that deploy stablecoins into strategies designed to neutralize exposure to price swings. The “delta” in this context refers to a portfolio’s sensitivity to underlying asset price movements. By balancing long and short positions, often through derivatives or hedging mechanisms, these vaults bring the net delta close to zero. The result: DAOs can earn yield from funding rates, trading fees, or protocol incentives while minimizing the impact of bullish or bearish market moves.

This approach is particularly attractive for DAO treasuries that prioritize capital preservation and predictable cash flows. By focusing on stablecoins as the base asset, these vaults sidestep the notorious volatility of native tokens like ETH or BTC, instead generating steady returns through sophisticated DeFi strategies.

How Do Delta-Neutral Strategies Generate Yield?

The mechanics behind delta-neutral DeFi strategies might seem complex at first glance, but their core logic is straightforward:

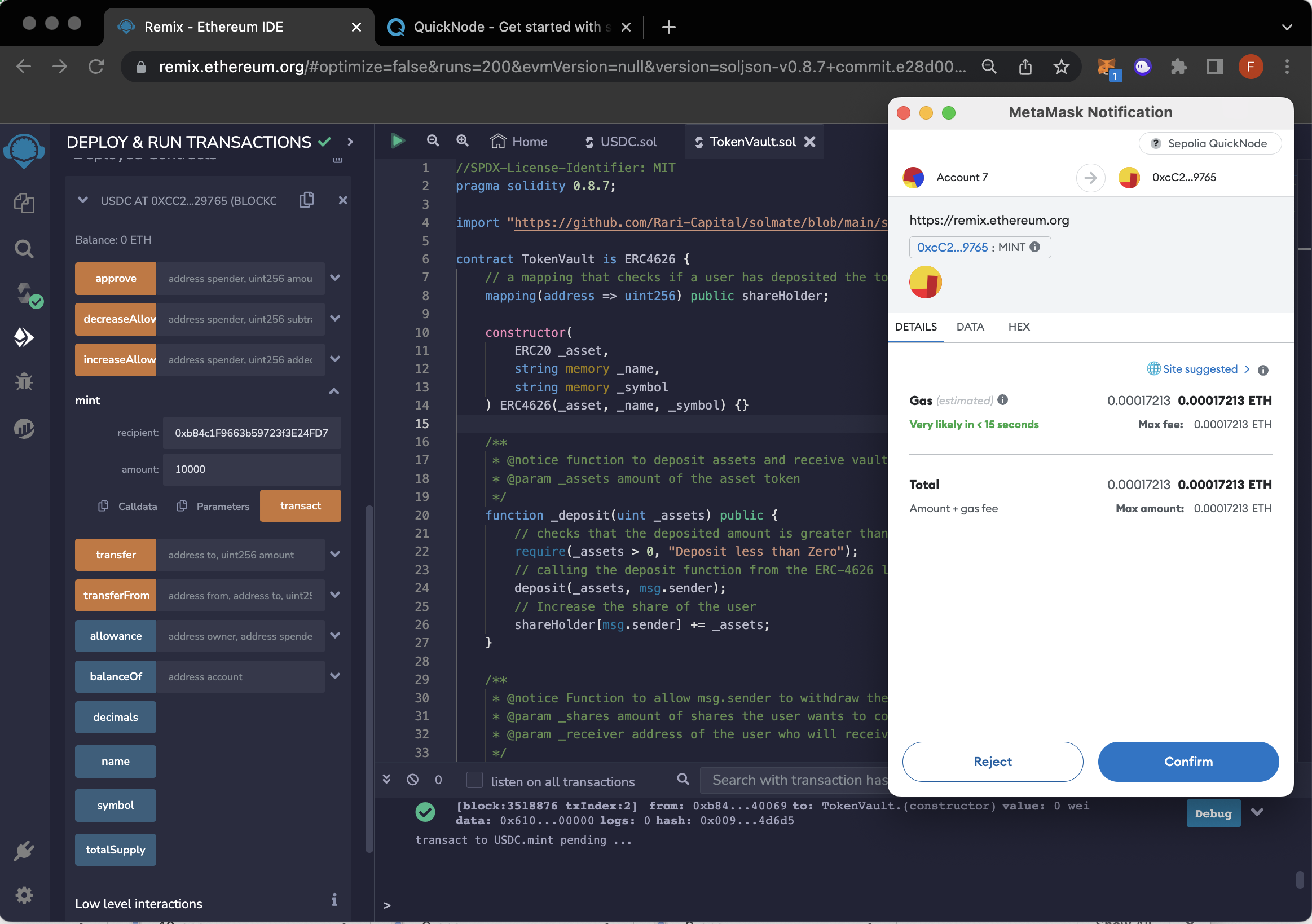

- Stablecoin Deposits: DAOs allocate idle USDC, DAI, or other stablecoins into specialized smart contracts (the vaults).

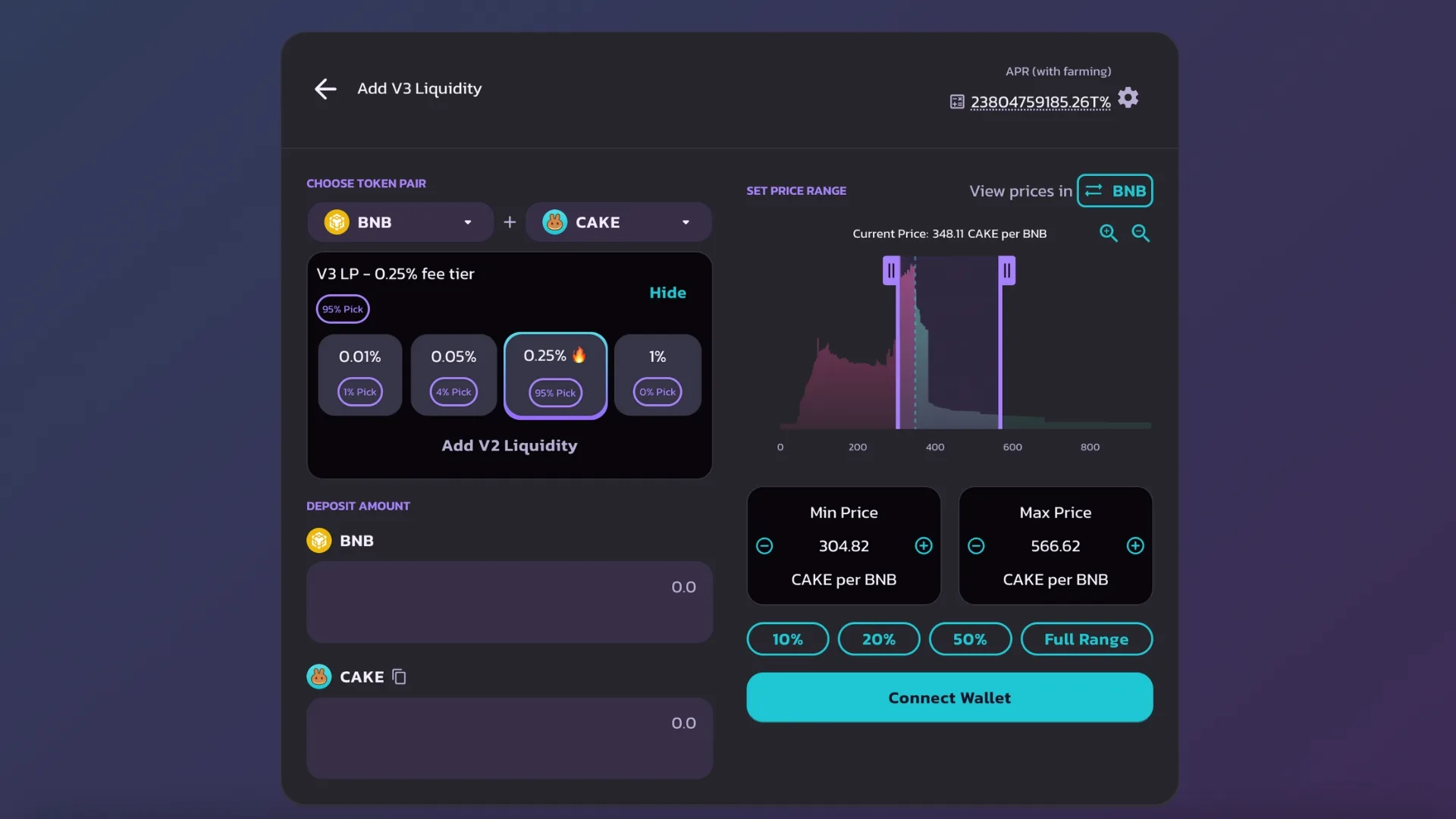

- Hedged Positions: The vault uses these deposits to take offsetting positions in perpetual swaps, lending protocols, or liquidity pools, carefully calibrated so that gains and losses from market moves cancel each other out.

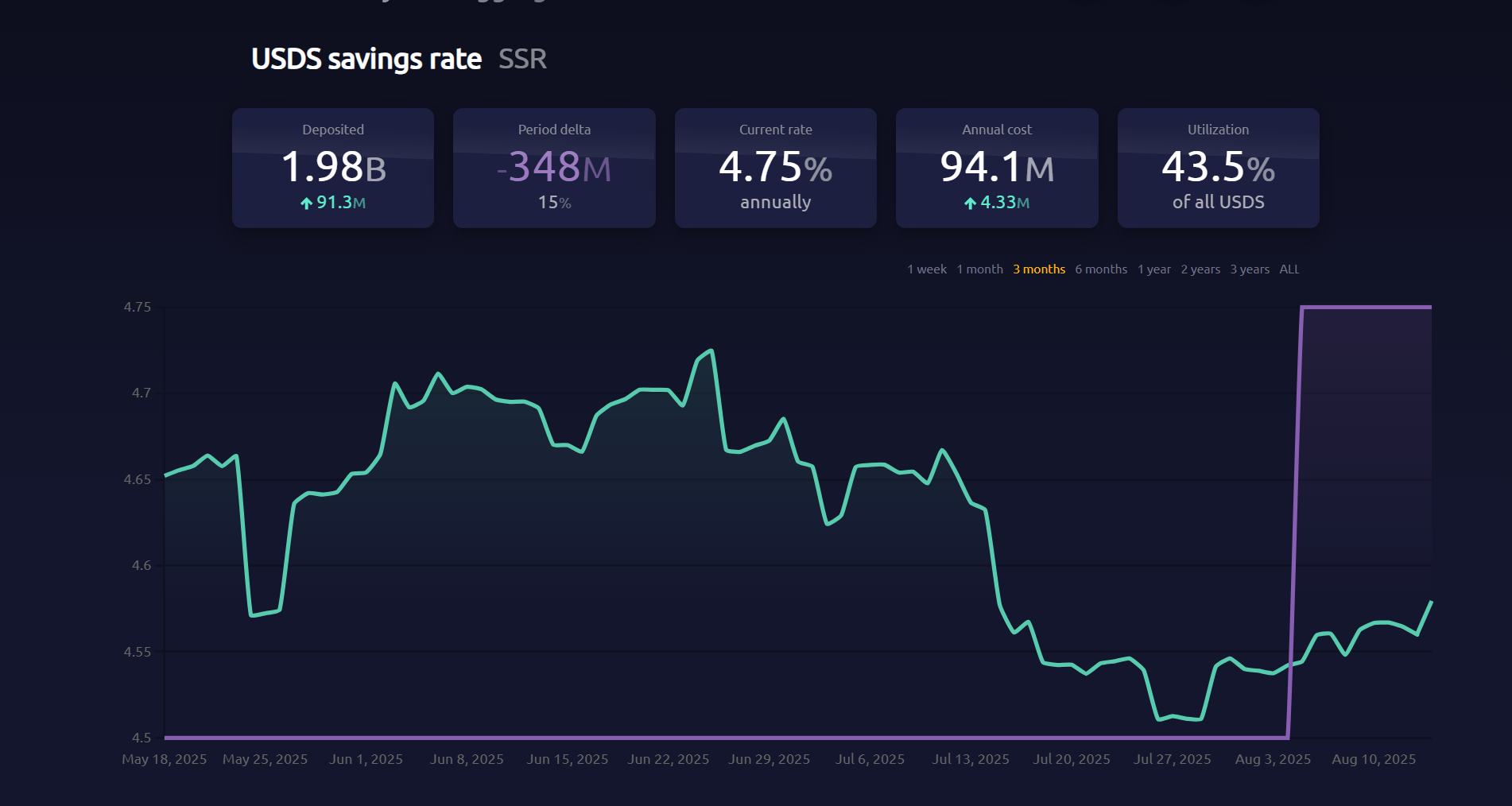

- Earning Yield: Returns are generated from funding rate arbitrage (earning when traders pay to maintain leveraged positions), trading fees collected from providing liquidity, or direct protocol rewards.

This structure allows DAOs to pursue yield without betting on price direction, a major advance over traditional staking or yield farming approaches prone to impermanent loss or liquidation risks.

Real-World Examples: Solstice Finance and Umami Finance

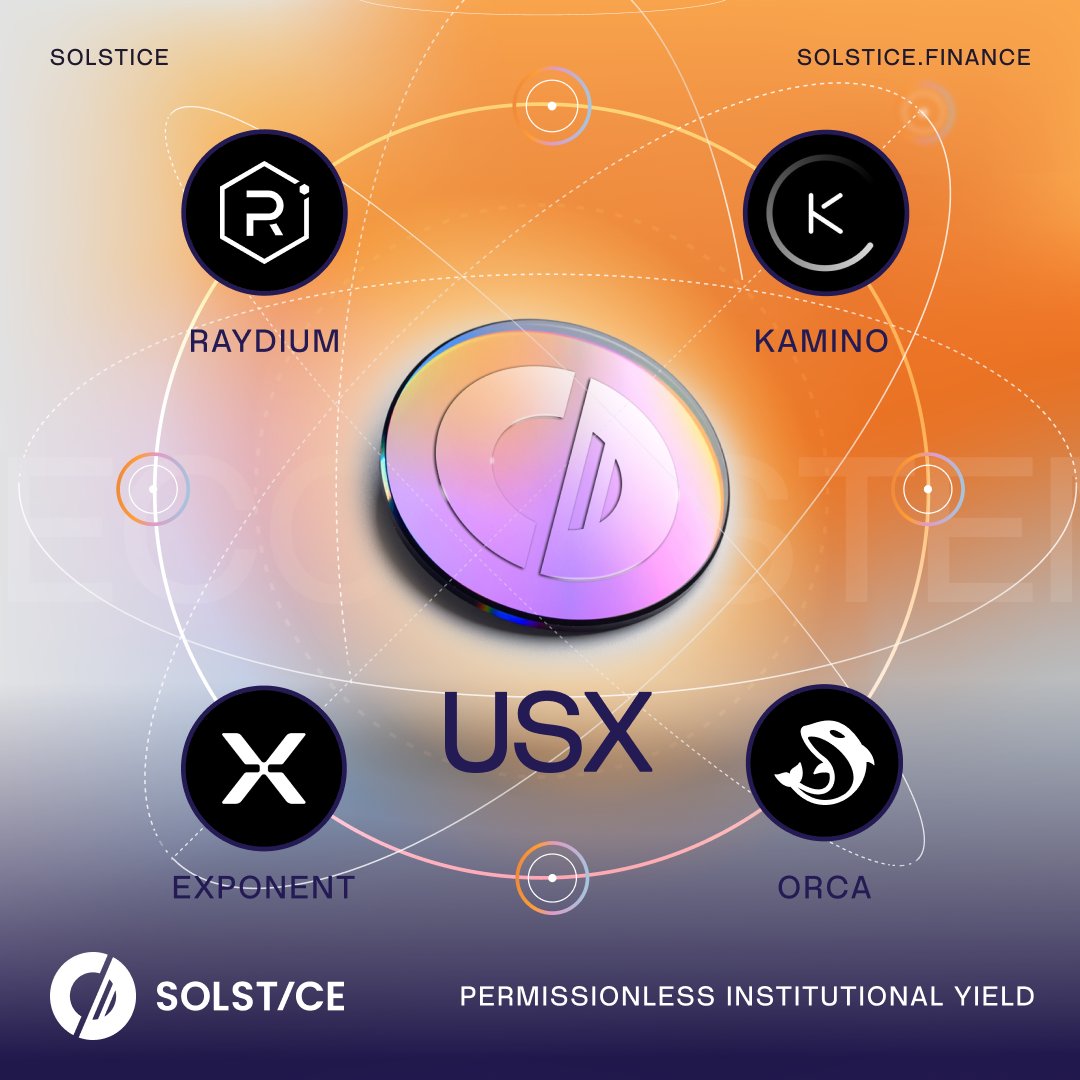

The practical application of delta-neutral vaults is already reshaping DAO treasury management across leading DeFi platforms. For instance, Solstice Finance‘s integration of eUSX as collateral on Kamino Finance enables users to deposit eUSX (a yield-bearing stablecoin) and borrow against it, unlocking advanced strategies like leveraged looping with reported APYs around 8%. This composability empowers DAOs to stack yields while maintaining risk controls tied directly to the underlying stablecoin peg.

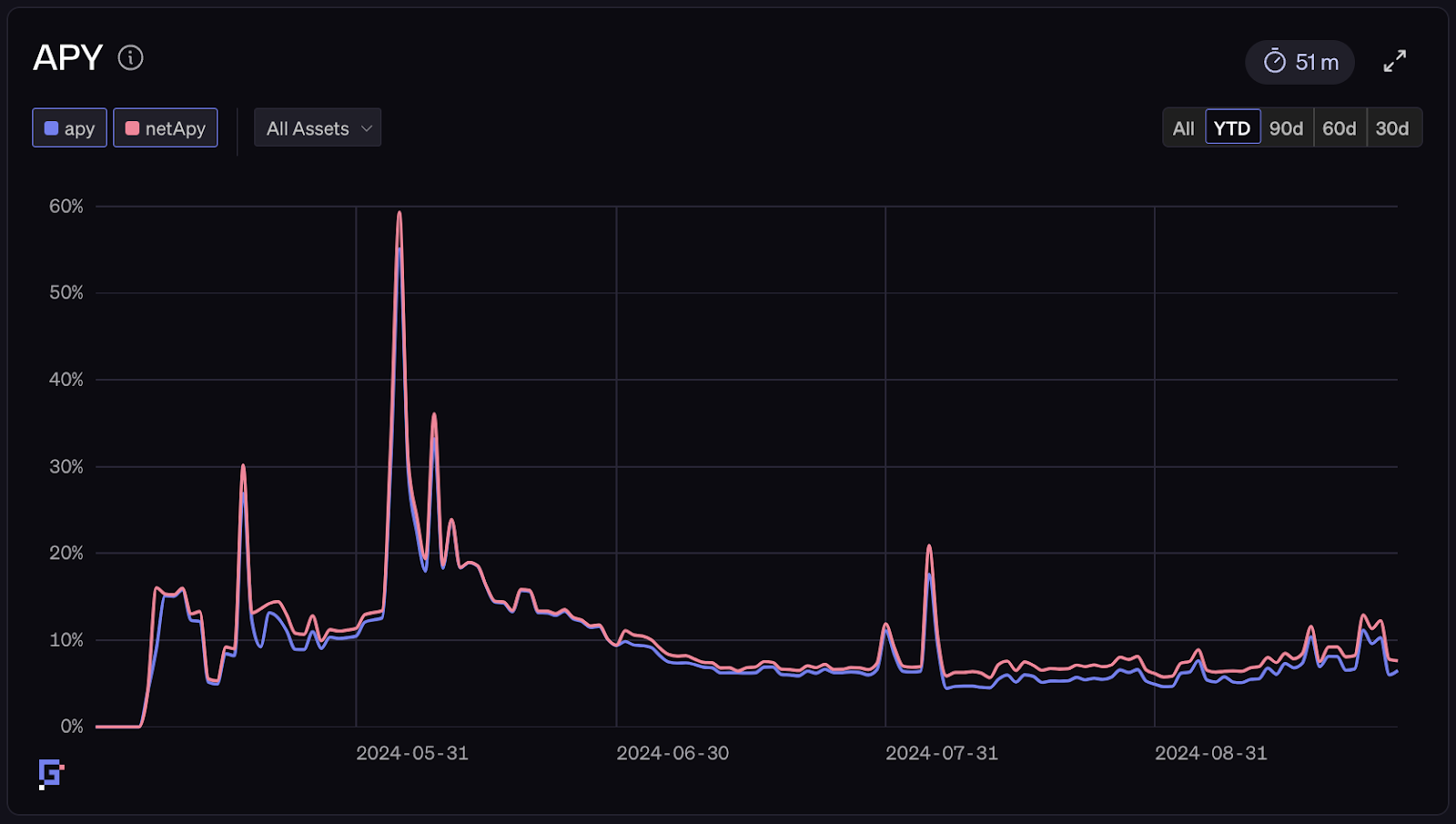

Umami Finance, another pioneer in this space, offers a USDC-based delta-neutral vault that mints GLP and hedging tokens in tandem. By dynamically rebalancing these assets within the vault, Umami has achieved reported yields near 20% APR, all while shielding participants from directional market risks. These protocols exemplify how automated hedging and smart contract infrastructure can deliver sustainable returns for DAO treasuries even amid turbulent market conditions.

If you want a deeper dive into how these mechanisms power modern yield-generating stablecoins, and why they matter for DAO treasury managers, consider reading this detailed guide: How Delta-Neutral Strategies Power Modern Yield-Generating Stablecoins.

The Benefits for DAO Treasury Management

The adoption of stablecoin vaults for DAOs is not just about chasing high APY numbers; it’s about building resilient financial infrastructure:

- Consistent Yield: With volatility neutralized by design, these strategies provide reliable returns that make budgeting and planning far easier for decentralized organizations.

- Capital Efficiency: Idle assets earn yield rather than sitting dormant, a crucial advantage for treasuries tasked with maximizing every dollar’s productivity.

- Tight Risk Controls: Automated rebalancing ensures exposures remain within predefined parameters. This aligns with the inherently cautious posture many DAOs must adopt when stewarding community funds.

This evolution in on-chain treasury management signals a shift toward greater professionalism and sustainability in DeFi governance. As more protocols adopt these models, and as reporting standards around real-time APY and risk metrics improve, the case for integrating delta-neutral strategies into DAO operational playbooks will only strengthen further.

However, as with any innovative yield strategy in DeFi, delta-neutral vaults require ongoing diligence. While the promise of stable, market-neutral returns is attractive, the underlying smart contracts and hedging mechanisms are only as robust as their implementation and oversight. DAOs must be vigilant in their selection of vault providers and should favor those with transparent reporting, rigorous audits, and proven track records in risk management.

Key Considerations for DAO Operators

Before deploying significant treasury assets into delta-neutral stablecoin vaults, DAO operators should weigh several critical factors:

DAO Checklist Before Allocating to Delta-Neutral Stablecoin Vaults

-

Assess Vault Provider Reputation: Choose established platforms like Solstice Finance or Umami Finance with transparent track records and audited smart contracts.

-

Review Strategy Transparency: Ensure the vault clearly discloses its delta-neutral mechanisms, such as hedging methods, collateral types, and risk parameters.

-

Evaluate Smart Contract Security: Confirm the vault has undergone recent, reputable audits and check for active bug bounty programs to mitigate smart contract vulnerabilities.

-

Monitor Yield Sources and Sustainability: Analyze how the vault generates yield (e.g., trading fees, funding rates), and assess if returns like the reported ~8% APY (Solstice) or ~20% APR (Umami) are sustainable.

-

Check Collateral Liquidity and Risk: Verify that underlying stablecoins and collateral assets are highly liquid and reputable to minimize slippage and liquidation risk.

-

Understand Withdrawal Terms and Fees: Review lock-up periods, withdrawal restrictions, and all associated fees to ensure alignment with DAO treasury needs.

-

Review Ongoing Monitoring and Reporting: Ensure the vault provides real-time performance data and risk analytics for continuous oversight by DAO treasury managers.

Liquidity and Collateralization: Ensure that the vault’s underlying assets are liquid enough to handle large inflows or outflows without slippage or unexpected price impact. Overcollateralization can further protect against sudden market shocks.

Smart Contract Security: The complexity of automated hedging strategies increases potential attack surfaces. Only interact with protocols that undergo regular security audits and maintain an active bug bounty program.

Strategy Transparency: Vaults should provide clear documentation of how positions are balanced and rebalanced. Opaque strategies may mask hidden risks or misaligned incentives.

If you’re interested in a technical breakdown of how these strategies optimize DAO treasury yields without compromising security, see this resource.

Risks Unique to Delta-Neutral Vaults

No strategy is entirely risk-free. Even with delta-neutral positioning, DAOs face unique challenges:

- Depeg Events: Stablecoins themselves are not immune to risk. A sudden depeg event can disrupt both yield generation and the safety of principal.

- Execution Slippage: Automated rebalancing relies on timely trades; high network congestion or low liquidity can cause slippage, undermining neutrality.

- Cumulative Fees: Frequent trading for hedging purposes may erode net returns if not managed efficiently.

The prudent approach is to diversify across multiple vetted protocols and continuously monitor on-chain metrics such as APY fluctuations, collateral ratios, and audit outcomes. This layered defense helps DAOs withstand both known and emergent threats in the DeFi landscape.

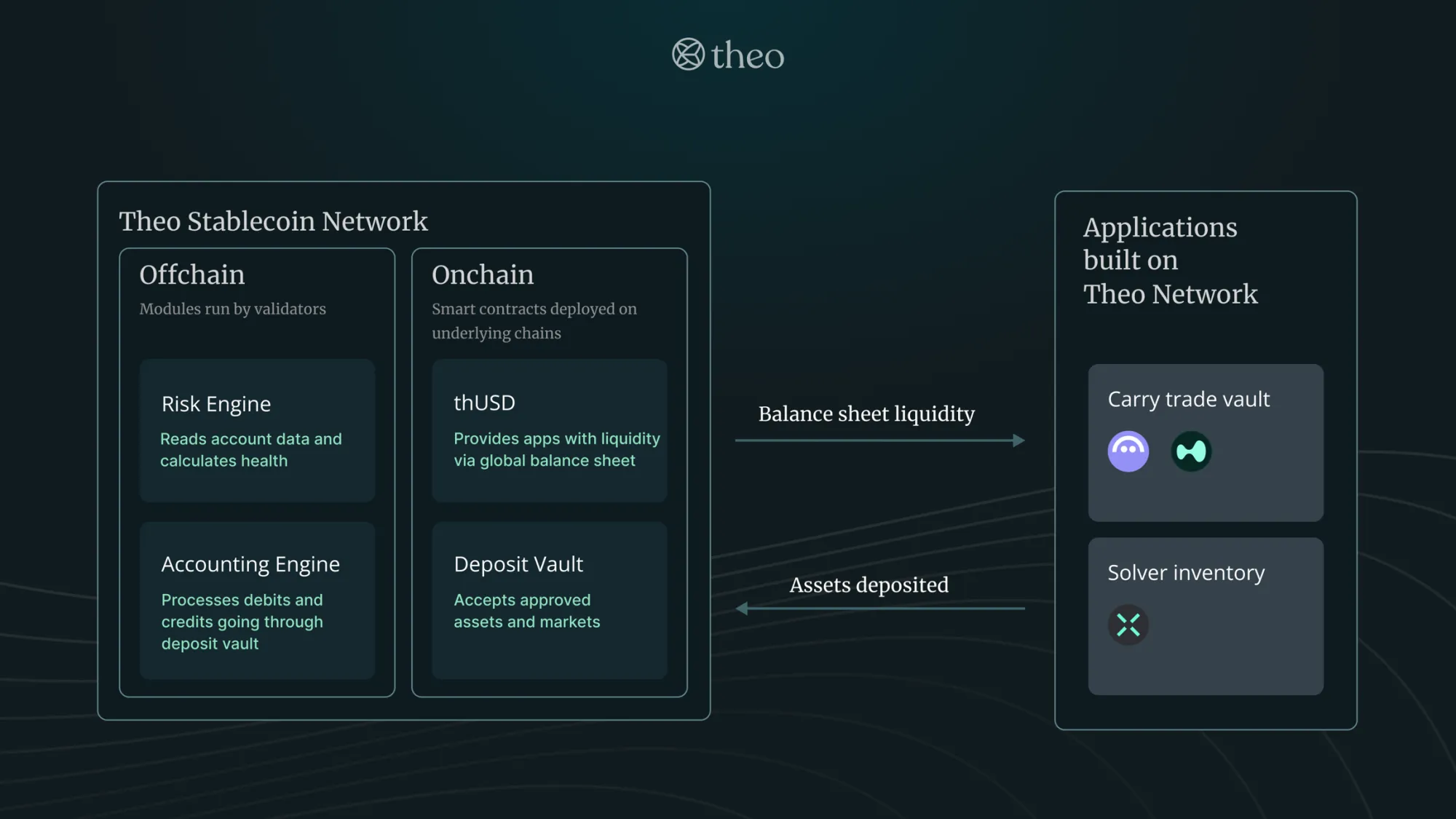

The Future: Automation and Composability

The next frontier for stablecoin vaults for DAOs lies in deeper automation and composability. As on-chain infrastructure matures, we’re seeing vault strategies that integrate seamlessly with lending markets, perpetual swaps, and even real-world asset tokenization platforms. This not only unlocks new sources of uncorrelated yield but also allows treasuries to respond dynamically to changing market conditions without manual intervention.

The data-driven approach, tracking cross-chain APY deltas, liquidity depths, and capital stickiness, is becoming standard practice among leading treasury managers. Platforms like Factor Vaults now offer customizable objective functions tailored to each DAO’s unique mandate, while tools like Aera enable real-time monitoring across diverse asset classes.

Best Practices Moving Forward

- Diversify Providers: Spread exposure across several reputable protocols rather than concentrating risk in one vault.

- Automate Monitoring: Use dashboard tools to track APY shifts and contract health metrics continuously.

- Pilot Before Scaling Up: Start with smaller allocations before committing a large percentage of treasury assets; review performance over multiple market cycles.

- Stay Educated: Regularly review new research from trusted sources on evolving DeFi risk management practices (see this guide for more insights).

The rise of delta-neutral stablecoin vaults marks a turning point in decentralized treasury management, one where sustainable yield does not have to come at the expense of prudent risk controls. For DAOs looking to build resilient financial infrastructure amid ever-changing markets, these instruments offer a compelling blend of consistency, flexibility, and security when implemented thoughtfully.